Get Personal Loans Online Approval fast! Compare 15 trusted lenders in the US, UK, Canada & Australia offering flexible terms, low rates, and quick funding.

In today’s fast-paced world, waiting weeks for a loan decision is no longer a viable option. Are you searching for “personal loans online approval” because you need immediate access to funds? Whether you’re in the US, UK, Canada, or Australia, you might be facing an emergency, a time-sensitive investment opportunity, or the pressing need to consolidate high-interest debt.

The traditional loan application process, with its mountains of paperwork and lengthy waits, can be a major source of stress and anxiety. Many borrowers worry about complex eligibility requirements, the impact of a credit check, and whether their application will be approved at all. This uncertainty can stand in the way of solving your financial challenges.

This guide is your roadmap to securing fast, secure, and flexible funding through the online approval process. We promise to demystify the world of online personal loans, showing you how to navigate the application process with ease and confidence. Imagine completing a simple application from the comfort of your home and receiving an approval decision in minutes, with funds deposited into your account in as little as one business day. We will explore the best options available in Tier One markets, helping you compare rates, understand the requirements, and choose a loan that empowers your financial freedom. Your solution to quick, hassle-free financing is just a few clicks away.

Benefits of Personal Loans: Online Approval for Instant Funding

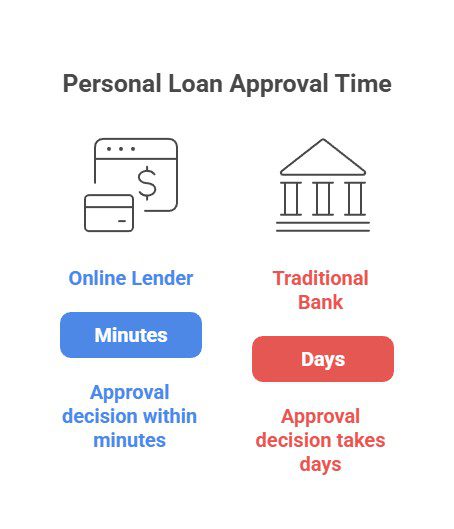

The rise of personal loans with online approval has fundamentally transformed the borrowing experience, offering a level of speed and convenience that was once unimaginable. For borrowers in the US, UK, Canada, and Australia, the primary benefit is the rapid access to funds. When you’re facing an emergency, like an urgent car repair or a sudden medical bill, time is of the essence. The streamlined digital process offered by online lenders means you can go from application to funding in a fraction of the time it takes with a traditional bank. Many lenders can provide an approval decision within minutes and deposit the cash into your account by the next business day, and in some cases, even the same day.

Beyond speed, convenience is a major advantage. You can apply for a personal loan online 24/7 from any device, eliminating the need to take time off work or schedule an appointment at a physical branch. The application forms are typically user-friendly and intuitive, guiding you through each step. Another significant benefit is the increased accessibility. Online lenders often use advanced algorithms that consider a wider range of data points beyond just your credit score, which can improve approval odds for individuals with non-traditional income streams or less-than-perfect credit. This creates more opportunities for more people to access the financing they need.

Mini Case Study: Chloe’s Urgent Travel

Chloe, a marketing professional in London, UK, received news that her sister in Canada was having a medical emergency. She needed to book a last-minute flight and cover accommodation costs, which totaled around £3,000. She didn’t have enough in her savings to cover the immediate expense. On a Tuesday evening, she applied for a personal loan with an online lender known for its fast approval process. She completed the application in 15 minutes, was approved almost instantly, and the funds were in her bank account when she woke up on Wednesday morning.

Result: The instant online approval process allowed Chloe to book her travel without delay and be with her family when they needed her most, turning a stressful financial situation into a manageable one.

| Features of Online Approval | Benefit to the Borrower | Who It Helps Most |

| Speed | Receive funds in as little as 24 hours. | Anyone facing an emergency or time-sensitive opportunity. |

| Convenience | Apply anytime, anywhere, from any device. | Busy professionals, parents, and those in remote areas. |

| Accessibility | Broader eligibility criteria than some traditional banks. | Self-employed individuals, gig workers, and those with fair credit. |

| Comparison Shopping | Easily pre-qualify with multiple lenders without a credit impact. | Savvy borrowers are looking to secure the best possible rate and terms. |

| Transparency | Clear presentation of rates and terms upfront. | Everyone who values making an informed financial decision. |

Low Rates and Flexible Terms for Tier One Borrowers

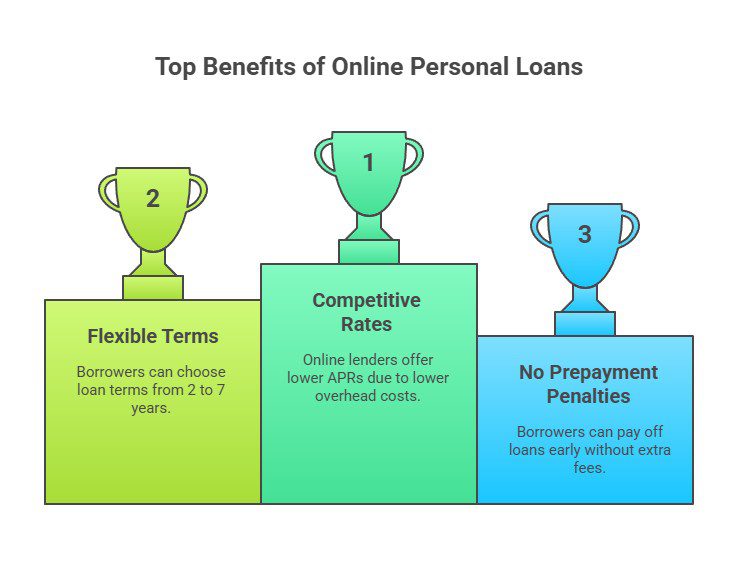

The competitive online lending market across the US, UK, Canada, and Australia has driven lenders to offer increasingly attractive rates and flexible terms to win over qualified borrowers. If you have a good to excellent credit score, you are in a prime position to secure a personal loan with a low, fixed Annual Percentage Rate (APR). Because online lenders have lower overhead costs than brick-and-mortar banks, they can often pass these savings on to you in the form of more competitive interest rates. Securing a low APR is the most effective way to reduce the total cost of your loan, saving you potentially thousands of dollars over the repayment period.

Flexibility is another key area where online lenders excel. Most platforms allow you to choose from a wide range of loan terms, typically from two to seven years (24 to 84 months). This enables you to customize your loan to fit your budget. You can opt for a shorter term with a higher monthly payment to pay off the loan quickly and minimize interest costs, or a longer term with a lower monthly payment to ensure it fits comfortably within your monthly cash flow. Furthermore, many of the best online lenders offer loans with no prepayment penalties, giving you the freedom to pay off your loan ahead of schedule without any extra fees if your financial situation improves.

Mini Case Study: Liam’s Debt Consolidation Strategy

Liam, from Toronto, Canada, had $15,000 in credit card debt with an average APR of 19.9%. He had a good credit score and used an online comparison tool to find a personal loan. He was approved for a 3-year loan with a fixed APR of 8.9%. He also chose a lender that allowed bi-weekly payments.

Takeaway: By switching to the low-rate personal loan, Liam saved over $3,500 in interest. The bi-weekly payment schedule helped him pay off the loan even faster, aligning with his paycheque and keeping him on track.

| Credit Profile | Typical APR Range (US) | Typical APR Range (UK) | Typical APR Range (Canada) | Typical APR Range (Australia) |

| Excellent Credit | 7% – 13% | 5% – 10% | 8% – 14% | 8% – 15% |

| Good Credit | 12% – 19% | 9% – 16% | 13% – 20% | 14% – 21% |

| Fair Credit | 18% – 28% | 15% – 25% | 19% – 30% | 20% – 32% |

| Note: These are estimates for unsecured personal loans as of late 2025 and can vary widely by lender. |

Fast and Easy Online Application Process in the US, UK, Canada, and Australia

The defining feature of applying for personal loans online is the remarkably fast and easy application process. Lenders in Tier One markets have invested heavily in technology to create a seamless and user-friendly experience from start to finish. The entire process, from getting a rate quote to receiving your funds, can often be completed without ever speaking to a person or leaving your home. This efficiency is a stark contrast to the often paper-intensive and time-consuming process at some traditional financial institutions.

The journey typically begins with pre-qualification. You’ll fill out a short form with basic personal and financial information, such as your name, address, and income. The lender then performs a soft credit inquiry, which does not affect your credit score, to provide you with a preliminary loan offer. This entire step usually takes less than five minutes. If you like the offer and decide to proceed, you’ll move on to the full application. Here, you’ll provide more detailed information and upload necessary documents, such as a government-issued ID and proof of income, directly to the lender’s secure portal. Sophisticated verification technology allows the lender to review your documents and make a final decision quickly, often within hours.

Mini Case Study: Sarah’s First-Time Application

Sarah, a recent graduate in a US city, needed a loan to cover moving expenses for her first job. She was nervous about applying for a loan, fearing a complicated process. She chose an online lender with a highly rated mobile app. She was able to complete the entire application on her phone during her lunch break. The app prompted her for each piece of information and allowed her to take pictures of her driver’s license and recent payslip for verification. She received a final approval notice via email just two hours later.

Result: The easy-to-navigate online process removed the intimidation factor for Sarah, making her first borrowing experience positive, efficient, and stress-free.

| Application Stage | What You Do | Typical Time | Credit Score Impact |

| 1. Pre-qualification | Enter basic personal & financial info. | 2-5 minutes | None (Soft Inquiry) |

| 2. Select Offer | Review preliminary offers and choose a lender. | 5-10 minutes | None |

| 3. Full Application | Provide detailed info and upload documents. | 10-20 minutes | Yes (Hard Inquiry) |

| 4. Final Approval & Funding | E-sign the loan agreement and receive funds. | 1-2 Business Days | None |

Compare Rates for Personal Loans Online Approval Across Trusted Lenders

One of the most powerful advantages of the online lending ecosystem is the ability to easily compare rates from multiple trusted lenders. Engaging in this comparison is the single most important action you can take to ensure you get the best possible deal on your personal loan. Accepting the first offer you receive could mean leaving hundreds or even thousands of dollars on the table over the life of your loan. Thanks to the pre-qualification process offered by most online lenders, you can shop for rates without any negative impact on your credit score.

Start by identifying three to five reputable lenders. These can include well-known online platforms, your primary bank if it has a strong online presence, and a local credit union. Navigate to their personal loan page and complete the pre-qualification form for each. This will provide you with a personalized rate estimate based on your credit profile. When you have your offers, compare them based on the Annual Percentage Rate (APR), which is the most accurate measure of the total cost of borrowing. Also, look at the offered loan terms and any potential fees. Online loan comparison tools can further streamline this process by allowing you to fill out one form and receive multiple offers at once.

Mini Case Study: Mark’s Due Diligence

Mark, from Manchester, UK, wanted a £10,000 loan. He pre-qualified with his high-street bank, an online lender, and a credit union.

· Bank Offer: 9.5% APR

· Online Lender Offer: 7.9% APR

· Credit Union Offer: 8.2% APR

By spending just 30 minutes comparing his options, Mark was able to see a clear winner.

Takeaway: Mark chose the online lender and saved over £500 in interest compared to his bank’s offer. This demonstrates the significant financial benefit of comparison shopping.

| Lender | Sample APR (Good Credit) | Origination Fee | Prepayment Penalty | Best For |

| SoFi (US) | 8.99% – 25.81% | None | None | No-fee loans, member benefits |

| Marcus by Goldman Sachs | 6.99% – 24.99% | None | None | Flexible payment options |

| LendingClub (US) | 8.98% – 35.99% | 3% – 8% | None | Peer-to-peer lending, fair credit |

| Zopa (UK) | As low as 5.6% | None | None | Competitive UK rates |

| Fairstone (Canada) | 19.99% – 39.99% | Varies | None | Options for fair to good credit |

Eligibility Criteria and Requirements for Online Loan Approval

To successfully secure personal loans with online approval, you need to meet the lender’s eligibility criteria. While these can vary slightly between lenders and countries, the core requirements in the US, UK, Canada, and Australia are quite similar. The primary factor lenders assess is your ability to repay the loan, which they gauge through your credit history and income. A good credit score is your most valuable asset, as it signals to lenders that you are a reliable borrower. Most online lenders look for a score in the “good” range (typically 670+ in the US) to qualify for the best rates, although many have options for those with “fair” credit.

Beyond your credit score, lenders will require proof of a steady and sufficient income. You will need to provide recent payslips, bank statements, or tax returns to verify your earnings. Lenders use this to calculate your debt-to-income (DTI) ratio, which is the percentage of your monthly income that goes toward debt payments. A lower DTI is always better. Other standard requirements include being of legal age (18+ in most regions), being a citizen or permanent resident of the country you’re applying in, and having an active bank account where the funds can be deposited and payments can be withdrawn.

Mini Case Study: David the Freelancer

David, a freelance web developer in Australia, needed a loan to purchase new equipment. He was worried that his fluctuating monthly income would be a barrier to approval. He chose an online lender that was known for working with self-employed individuals. In addition to his recent bank statements, he provided his last two years of tax returns to show a consistent annual income.

Result: The lender was able to approve David’s loan based on his average annual earnings, demonstrating that online platforms can be more flexible with non-traditional income verification compared to some stricter traditional banks.

| Requirement | Why It’s Needed | What You’ll Provide |

| Good Credit Score | To assess your creditworthiness and risk. | Your personal details for a credit check. |

| Steady Income | To ensure you can afford the monthly payments. | Payslips, bank statements, or tax returns. |

| Low Debt-to-Income Ratio | To confirm you aren’t overextended financially. | Your income details and a list of existing debts. |

| Legal Age & Residency | To meet legal and regulatory requirements. | Government-issued ID (e.g., driver’s license, passport). |

| Valid Bank Account | To disburse the loan funds and collect payments. | Your bank account and routing/sort code numbers. |

Funding Options and Approval Speed for Tier One Applicants

For applicants in Tier One countries, the speed of funding following online loan approval is a major competitive differentiator among lenders. The timeline from final approval to having cash in your bank account can range from a few hours to a few business days. The fastest options are typically offered by dedicated online lenders (fintech companies) who have built their entire infrastructure around efficiency. Many of these lenders offer next-business-day funding as a standard feature. This means if you are approved on a Monday, you can expect the funds to be available in your account on Tuesday.

Some of the most aggressive online lenders even offer same-day funding. To qualify for this, you typically need to complete and have your application approved before a specific cut-off time (e.g., 11:00 AM) on a business day. The funds are then sent via a faster payment system or wire transfer, which can make them available within hours. Traditional banks with online application portals may be slightly slower, often taking between two to five business days to fund a loan after approval. The exact funding time can also depend on your own bank’s processing speed for incoming transfers.

Mini Case Study: Maria’s Quick Turnaround

Maria, a small business owner in a US city, needed $10,000 to purchase inventory for a surprise sales event. She needed the money within 48 hours. On Wednesday morning, she applied with an online lender that advertised same-day funding. She completed her application by 10:00 AM and was approved by 11:30 AM.

Takeaway: By choosing a lender specifically known for its funding speed, Maria received the funds in her bank account by 5:00 PM the same day, allowing her to secure the inventory and capitalize on the sales opportunity.

| Funding Speed | How It Works | Common Lenders | Best For |

| Same-Day Funding | Approval and transfer are completed on the same business day. | Some online lenders like LightStream. | True emergencies and urgent opportunities. |

| Next-Business-Day Funding | Funds are available on the business day after approval. | Most major online lenders (SoFi, Marcus). | The most common and reliable fast-funding option. |

| Standard Funding (2-5 Days) | Funds are transferred via standard electronic transfer (ACH). | Many traditional banks and some online lenders. | Non-urgent needs where speed is less critical. |

Steps to Get Personal Loans Online Approval Without Hassle

Getting a personal loan online can be a smooth and hassle-free experience if you follow a few simple steps. The key is preparation. Before you even start an application, take the time to check your credit score and review your credit report for any errors. Knowing your score will help you target lenders that are a good fit for your credit profile. Next, gather all your necessary financial documents, such as your last two payslips, recent bank statements, and a form of government-issued ID. Having these in a digital format will make the application process much faster. Once you’re prepared, the next step is to get pre-qualified with several lenders to compare rates without impacting your credit score.

Pros and Cons of the Online Process

| Pros | Cons |

| Speed and Convenience: Apply in minutes, get funded quickly. | Less In-Person Support: Primarily digital communication. |

| Easy to Compare: Pre-qualification makes rate shopping simple. | Requires Basic Tech-Savviness: You must be comfortable with online forms and uploading documents. |

| Wider Accessibility: More options for various credit profiles. | Risk of Scams: You must verify that the lender is legitimate. |

Expert Insight: “The single most important step for a hassle-free process is getting pre-qualified,” says a financial tech blogger. “It’s like test-driving a car. It gives you a clear picture of what you can expect in terms of rates and payments from different lenders, all without any commitment or negative impact on your credit. This step alone can save you both time and money.”

Requirements for Loan Approval in Tier One Markets

While specific underwriting criteria can differ, the fundamental requirements for personal loan approval are consistent across the major Tier One markets of the US, UK, Canada, and Australia. Lenders are primarily assessing your ability and likelihood to repay the loan.

1. Creditworthiness: A solid credit history and a good credit score are paramount. In the US, a FICO score of 670 or higher is generally considered good. In the UK, Canada, and Australia, similar “good” ratings from their respective credit bureaus (e.g., Experian, Equifax, TransUnion) are required for the best rates.

2. Verifiable Income: Lenders need to see that you have a stable and sufficient source of income to cover the loan payments. This is usually verified with payslips, bank statements, or tax returns for the self-employed.

3. Debt-to-Income (DTI) Ratio: This ratio measures how much of your monthly income goes to existing debt. Lenders prefer a DTI ratio below 43% to ensure you can comfortably afford the new loan.

4. Basic Personal Information: You must be of legal age, be a citizen or permanent resident, and have a valid personal bank account.

| Requirement | Why it Matters | How to Meet It |

| Good Credit Score | Shows you are a reliable borrower. | Pay bills on time; keep credit card balances low. |

| Steady Income | Proves you can afford the payments. | Maintain stable employment or have consistent self-employment income. |

| Low DTI Ratio | Ensures you are not over-leveraged. | Pay down existing debts before applying for a new loan. |

Expert Insight: “Your DTI ratio is becoming an increasingly important factor for lenders,” notes a senior loan underwriter. “It’s a direct measure of affordability. The best application shows not just a good credit score, but also a healthy gap between what you earn and what you owe. This gives lenders the confidence to approve your loan quickly.”

How to Use Personal Loans Online Approval to Boost Your Financial Freedom

A personal loan, when used strategically, can be a powerful tool to enhance your financial freedom rather than just another monthly bill. The instant online approval process allows you to act quickly on opportunities that can improve your financial standing. One of the most effective ways to do this is through debt consolidation. By using a personal loan to pay off high-interest credit card debt, you can lower your overall interest rate, simplify your payments, and create a clear timeline to become debt-free, which is a cornerstone of financial freedom.

Another way a personal loan can boost your freedom is by enabling you to make strategic investments. This could be an investment in yourself, such as paying for a professional certification or course that can significantly increase your earning potential. It could also be an investment in an asset, like a home improvement project that adds more value to your property than the cost of the loan. The key is to use the borrowed funds for purposes that provide a positive financial return, either through savings on interest or an increase in your income or assets.

| Loan Use | How It Boosts Financial Freedom | Example |

| Debt Consolidation | Frees up cash flow by lowering interest payments; creates a path out of debt. | Swapping 20% APR credit card debt for a 9% APR personal loan. |

| Career Development | Increases your earning potential for long-term financial growth. | Paying for a coding bootcamp that leads to a higher-paying job. |

| Home Improvement | Builds equity in your home, which is a major financial asset. | A kitchen remodel that increases your home’s value. |

Expert Insight: “Financial freedom is about having choices,” says a certified financial planner. “A strategically used personal loan can create those choices. It can free you from the trap of high-interest debt or unlock an opportunity for growth. The rule is simple: the loan should be a stepping stone, not a stumbling block. It should solve a problem or build value.”

Debt Consolidation and Balance Transfers with Online Loan Approval

Debt consolidation is one of the most common and beneficial reasons for seeking a personal loan with online approval. The process is straightforward: you apply for a new, single personal loan and use the lump-sum funds to pay off multiple existing debts, such as credit cards, store cards, or other high-interest loans. This leaves you with just one monthly payment to manage, which simplifies your finances and reduces the risk of missing a payment. The primary financial benefit comes from securing a personal loan with a lower fixed interest rate than the average variable rate of your credit cards.

This strategy is often compared to a credit card balance transfer, but they work differently. A balance transfer involves moving debt from one credit card to another, usually one with a 0% introductory APR offer. This can be effective, but the 0% rate is temporary, and there is often a balance transfer fee of 3-5%. A personal loan, on the other hand, gives you a fixed rate for the entire term of the loan, providing a more structured and predictable path to becoming debt-free.

| Feature | Personal Loan for Consolidation | Credit Card Balance Transfer |

| Interest Rate | Fixed rate for the entire loan term. | 0% introductory rate, then a higher variable rate. |

| Fees | May have an origination fee, but many have none. | Almost always has a balance transfer fee (3-5%). |

| Repayment Plan | Structured, with a clear end date. | Less structured; requires discipline to pay off before the 0% period ends. |

| Best For | Larger debt amounts and a clear, predictable payoff plan. | Smaller debt amounts that can be paid off within the introductory period. |

Expert Insight: “A personal loan is generally a more robust solution for significant debt consolidation,” explains a credit counseling expert. “It enforces discipline with its fixed payments. A balance transfer can be a great tool, but it can also be a temporary fix if the borrower doesn’t address the spending habits that led to the debt in the first place.”

Emergency and Major Purchase Loans with Instant Online Approval

Life is full of unexpected events and major purchases that can strain your budget. An emergency loan, which is simply a personal loan used for an urgent, unforeseen expense, is a vital financial safety net. Whether it’s a critical home repair like a broken furnace, a large vet bill, or a sudden medical expense, the “instant online approval” aspect of modern personal loans provides the speed needed to handle these situations without delay. This quick access to cash can prevent a stressful situation from turning into a financial catastrophe and is a much more affordable option than high-cost alternatives like payday loans.

Similarly, for planned major purchases, a personal loan can be a smart financing choice. This could include buying new furniture, upgrading home appliances, or even financing a wedding. By securing a personal loan in advance, you can effectively become a “cash buyer,” which can give you more negotiating power. A personal loan often comes with a lower, fixed interest rate compared to the financing options offered by retailers, which can sometimes have deferred interest clauses that can be costly if the balance isn’t paid in full during the promotional period.

| Loan Purpose | Key Advantage of Online Approval | Best Practice |

| Emergency Fund | Speed – get cash in as little as 24 hours to cover urgent costs. | Even in a hurry, take 10 minutes to compare at least two lenders. |

| Major Purchase | Can secure a lower fixed rate than store financing. | Get pre-approved for your loan before you start shopping. |

| Medical Bills | Structured repayment plan for large, unexpected health costs. | Ask the medical provider about no-interest payment plans first. |

Expert Insight: “The key to using a personal loan for a major purchase is to treat it as a planned expense,” advises a personal finance coach. “This means creating a budget for the purchase, getting pre-approved for a loan amount that fits that budget, and sticking to it. The loan is a tool to make the purchase affordable, not an excuse to overspend.”

Customer Experiences and Reviews from the US, UK, Canada, and Australia Borrowers

In the digital age, customer reviews are a crucial resource for evaluating online loan providers. Experiences shared by other borrowers in the US, UK, Canada, and Australia can offer candid insights into a lender’s process, customer service, and overall reliability. When you’re comparing lenders, it’s wise to look at reputable third-party review sites like Trustpilot, the Better Business Bureau (for North America), and Feefo. Look for patterns in the feedback. Are borrowers consistently praising a lender’s fast funding and transparent terms? Or are there recurring complaints about surprise fees, poor communication, or a difficult application process?

Common Themes in Positive Reviews:

· “The online application was so simple and took less than 10 minutes.”

· “I was approved in minutes and had the money the next day, just as they promised.”

· “Their customer service was really helpful in answering my questions.”

· “No hidden fees! The rate I was quoted was the rate I got.”

Common Themes in Negative Reviews:

· “The verification process took much longer than they advertised.”

· “I was surprised by an origination fee that was deducted from my loan.”

· “It was impossible to get a real person on the phone to help me.”

| Country | Popular Review Platform | What Borrowers Value Most (Based on Reviews) |

| US | Better Business Bureau, Credit Karma | Speed of funding, transparency on fees. |

| UK | Trustpilot, MoneySavingExpert | Low APR, good customer service. |

| Canada | Google Reviews, Ratehub.ca | Ease of application, clear communication. |

| Australia | ProductReview.com.au, Canstar | Competitive rates, reliable platform. |

Expert Insight: “When reading reviews, pay more attention to the substance of the comments than the star rating alone,” suggests a consumer rights advocate. “A detailed review explaining a specific problem is much more informative than a generic one-star rating. Also, look to see if the lender actively responds to reviews, as this shows a commitment to customer satisfaction.”

How Credit Checks Affect Your Personal Loans Online Approval Score

When you apply for a personal loan online, lenders will perform a credit check to assess your creditworthiness. There are two types: a soft inquiry and a hard inquiry. During the initial pre-qualification stage, lenders use a soft inquiry. This allows them to see your credit profile and provide a rate estimate, but it is not visible to other lenders and has zero impact on your credit score. This is why you can and should shop around for rates. Once you choose a lender and submit a full application, the lender will perform a hard inquiry. A single hard inquiry may cause a small, temporary dip in your credit score, usually less than five points. Multiple hard inquiries for different types of credit in a short period can have a greater negative impact.

A Checklist for Managing Credit Checks:

· Use Prequalification: Compare offers using soft inquiries to avoid credit score damage.

· Limit Formal Applications: Only submit a full application to the one lender you intend to use.

· Rate Shop Within a Window: Most credit scoring models treat multiple inquiries for the same type of loan within a 14-45 day period as a single event.

· Monitor Your Credit: Check your credit report regularly to ensure all inquiries are legitimate.

What Loan Amounts and Term Options Are Available for Tier One Applicants

Applicants in the US, UK, Canada, and Australia have access to a wide range of loan amounts and terms. Typically, unsecured personal loans range from as little as $1,000 (or the local equivalent) up to $100,000. The amount you can qualify for depends heavily on your credit score and income. Lenders need to be confident you can repay the loan, so higher incomes and credit scores unlock larger loan amounts. The loan term, or repayment period, is also flexible. Most lenders offer terms ranging from 24 to 84 months (two to seven years). A shorter term will have higher monthly payments but lower total interest costs, while a longer term will have more affordable monthly payments but a higher total interest cost.

A Checklist for Choosing Your Loan Amount and Term:

· Borrow Only What You Need: Create a precise budget for your loan purpose.

· Use a Loan Calculator: See how different terms affect your monthly payment and total cost.

· Choose the Shortest Term You Can Afford: This is the best way to save money on interest.

· Confirm There’s No Prepayment Penalty: This allows you to pay it off even faster if you can.

Why Fixed and Variable Interest Rates Matter in Online Loan Approval

The vast majority of online personal loans come with a fixed interest rate. This is a significant advantage for borrowers, as it means your interest rate—and therefore your monthly payment—will remain the same for the entire life of the loan. This predictability makes it much easier to budget and manage your finances. A variable interest rate, which is much less common for personal loans but can be found with some lines of credit, can fluctuate over time based on market conditions. While a variable rate might start lower than a fixed rate, it carries the risk that your payments could increase in the future, which can be difficult to manage. For most borrowers, a fixed rate is the safer and more desirable option.

A Checklist for Understanding Rates:

· Prioritize Fixed-Rate Loans: They offer stability and predictability.

· Understand the APR: This is the most accurate measure of your loan’s cost.

· Know What Influences Your Rate: Your credit score is the most important factor.

· Look for Autopay Discounts: Many lenders offer a rate reduction for setting up automatic payments.

How to Plan Repayments and Manage Strategies for Online Loans

Effectively managing your personal loan repayments is key to improving your financial health. The best strategy starts before you even take out the loan: create a detailed monthly budget to ensure you can comfortably afford the payment. The single most important rule is to make every payment on time. Late payments can incur fees and damage your credit score. The easiest way to ensure this is to set up automatic payments with the lender. If your financial situation allows, a great strategy is to pay more than the minimum amount. You can do this by rounding up your payment each month or by making an extra payment whenever you receive a windfall, like a bonus or tax refund.

A Repayment Strategy Checklist:

· Create a Budget: Know you can afford the payment before you apply.

· Set Up Autopay: This is the best way to avoid late payments.

· Pay More Than the Minimum (If Possible): This saves you money on interest and gets you out of debt faster.

· Confirm No Prepayment Penalty: Ensure you won’t be charged a fee for paying the loan off early.

Security Measures and Fraud Protection in Online Loan Applications

Reputable online lenders take security and fraud protection very seriously. When you are applying for a personal loan online, you are sharing sensitive personal and financial information, so it’s crucial to ensure the lender has robust security measures in place. Look for clear indicators of a secure website, such as “https://” in the URL and a padlock icon in the address bar. This signifies that the data you transmit is encrypted. Legitimate lenders will also have a clear privacy policy that explains how they collect, use, and protect your data. Be wary of any unsolicited loan offers you receive via email or text message, as these can be phishing scams.

A Security Checklist for Online Applications:

· Verify the Website is Secure: Look for “https://” and the padlock icon.

· Check for a Clear Privacy Policy: Understand how your data will be used.

· Use Strong, Unique Passwords: Protect your account on the lender’s portal.

· Be Wary of Unsolicited Offers: Never click on suspicious links or provide information to unverified sources.

· Confirm the Lender is Legitimate: Do a quick search for reviews to ensure they are a registered business.

What Fees and Prepayment Policies You Should Know Before Applying

While the interest rate is the main cost of a loan, various fees can add to the expense. It’s vital to understand these before you apply. The most common fee is an origination fee, which is a one-time charge for processing your loan. It’s typically a percentage of the loan amount (1-8%) and is deducted from the funds you receive. Many top-tier online lenders have eliminated origination fees, which is a major advantage. Another critical policy to check is the prepayment policy. A borrower-friendly loan will have no prepayment penalty, meaning you can pay off your loan ahead of schedule without incurring any extra charges. Always read the loan agreement carefully to identify any potential late payment fees or insufficient funds fees.

A Fees and Policies Checklist:

· Check for an Origination Fee: Aim for a lender with a 0% fee if possible.

· Confirm There is No Prepayment Penalty: This is a non-negotiable for flexible borrowing.

· Understand the Late Fee Policy: Know the cost and grace period for a late payment.

· Read the Fine Print: The loan agreement will detail all potential costs.

Tips for Securing Personal Loans Online Approval with Top Lenders

To increase your chances of approval with top lenders, focus on presenting yourself as a low-risk borrower. First, know your credit score and take steps to improve it if necessary. This includes paying down credit card balances to lower your credit utilization. Second, have all your income verification documents organized and ready. Third, when you apply, be honest and accurate with all the information you provide; discrepancies are a major red flag. Finally, only apply for the amount you truly need. Requesting a smaller, more manageable loan amount can improve your approval odds.

Common Mistakes to Avoid During the Online Loan Application Process

The most common mistake is not comparing offers. Always pre-qualify with several lenders. Another error is not reading the fine print and being surprised by fees later on. A third mistake is providing inaccurate information, whether intentionally or by accident, which can lead to an immediate denial. Also, avoid applying for multiple types of credit at the same time, as this can signal financial distress to lenders. Finally, don’t fall for “guaranteed approval” scams; legitimate lenders will always review your credit and finances.

Alternatives to Personal Loans Online Approval in Tier One Countries

If an online personal loan isn’t the right fit, there are several alternatives. A Home Equity Line of Credit (HELOC) can be a great option for homeowners, offering a revolving line of credit with a low interest rate. A 0% introductory APR credit card can be ideal for smaller expenses that you can pay off within the promotional period (typically 12-21 months). For smaller amounts, peer-to-peer (P2P) lending platforms can be an option. Finally, for those who value in-person service, a traditional loan from a local credit union is always a solid alternative.

Step-by-Step Application Process for Fast Online Loan Approval

The process is designed for speed:

1. Prequalify: Take 5 minutes to submit basic information for a soft credit check and receive a rate estimate.

2. Compare: Review offers from 3-5 lenders.

3. Apply: Choose the best offer and complete the full application, uploading documents like payslips and ID.

4. Verify: The lender performs a hard credit check and verifies your information.

5. Sign & Fund: E-sign the final loan agreement and receive your funds via direct deposit, often by the next business day.

| Step | Time Estimate | Credit Impact |

| Prequalify | 5 mins | None |

| Apply | 15 mins | Small, temporary dip |

| Fund | 1-2 days | None |

Customer Support and Assistance Options for Online Loan Platforms

Reputable online lenders provide robust customer support. Most offer multiple channels for assistance, including a comprehensive FAQ section on their website, email support, a customer service phone number, and often a live chat feature. Before committing to a lender, it’s a good idea to test their support by asking a question via phone or chat. The quality and speed of their response can be a good indicator of the service you’ll receive once you become a customer.

Comparison Tools and Financial Resources for Finding the Best Personal Loans

Leverage online tools to simplify your search. Loan comparison websites like NerdWallet, Credit Karma, or Bankrate allow you to see pre-qualified offers from multiple lenders by filling out a single form. These sites often feature reviews, calculators, and educational articles. Most top lenders also provide free resources on their own websites, including loan payment calculators and blog posts about financial wellness, which can help you make a more informed borrowing decision.

Approval Guidelines and Lender Requirements from Financial Experts

Financial experts consistently advise that lenders in 2025 are focused on two primary approval factors: a demonstrated history of creditworthiness (your credit score) and a proven ability to afford the new debt (your debt-to-income ratio). A FICO score above 670 and a DTI ratio below 43% are the most common benchmarks for a smooth approval process. Experts also note that lenders are increasingly using automated systems to verify income by securely linking to your bank account, which can expedite the approval process significantly for applicants who are comfortable with this technology.

Funding Speed and Same-Day Access Insights from Tier One Banks

While online fintech lenders are the leaders in funding speed, some major Tier One banks are catching up. Insights from the banking sector show that existing customers often have the fastest funding experience. If you apply for a personal loan with the bank where you have your primary checking account, they can often verify your information and deposit the funds more quickly, sometimes within one to two business days. However, for true same-day access to funds, dedicated online lenders who specialize in expedited processing still hold the edge over most traditional banks.

Interest Calculations and Rate Details from Industry Specialists

Industry specialists emphasize that borrowers must understand that the advertised “as low as” rate is reserved for applicants with pristine credit. Your personal rate will be higher. The rate is calculated based on your risk profile. The largest component is your credit score, but factors like your income, the loan amount, and the loan term also play a role. A longer term may sometimes carry a slightly higher interest rate because it represents a longer period of risk for the lender. Always focus on the APR (Annual Percentage Rate), as it includes fees and is the true measure of the loan’s cost.

Repayment Options and Flexibility Insights for Online Loan Borrowers

Repayment flexibility is a key feature valued by online loan borrowers. Insights show that the most sought-after features are the ability to choose from a wide range of loan terms and the absence of a prepayment penalty. The latter is crucial, as it allows borrowers to pay off their debt ahead of schedule without any extra cost, saving them money on interest. Some innovative lenders are also offering features like the ability to change your payment date once a year or to skip a payment after a certain number of consecutive on-time payments, providing an extra layer of flexibility for managing life’s unexpected events.

Privacy and Security Policies Recommended by Leading Financial Institutions

Leading financial institutions recommend a multi-layered approach to privacy and security for online loan applications. They advise borrowers to only use lenders that have clear, comprehensive privacy policies and use high-level encryption (look for “https://” in the site’s URL). They also recommend that consumers use strong, unique passwords for any online loan portals and enable two-factor authentication if it is offered. Furthermore, they caution against sharing sensitive personal information in response to unsolicited emails or text messages, as these are common tactics used in phishing scams.

User Feedback and Experiences from Verified Online Loan Applicants

An analysis of recent user feedback from verified online loan applicants highlights a high level of satisfaction with the speed and convenience of the process. Many users express surprise at how quickly they can go from application to funding compared to their past experiences with traditional lending. The most positive feedback is reserved for lenders who are transparent about rates and fees throughout the process. Conversely, the most common complaints arise when the final approved rate is significantly higher than the pre-qualified estimate or when the document verification process becomes slow and cumbersome.

FAQ

What’s the easiest loan to get approved for?

Generally, the easiest loans to get approved for are secured loans or loans from lenders specializing in bad credit. A secured loan requires you to provide collateral, such as a car or a savings account, which significantly reduces the lender’s risk and makes approval easier, even with a low credit score. Among unsecured loans, those from lenders like Avant or OneMain Financial are often more accessible for borrowers with fair or poor credit, though they will come with higher interest rates. The absolute easiest loans, like payday or pawn shop loans, should be avoided due to their extremely high costs.

How to get $3000 today through personal loans online approval?

Getting a $3,000 loan on the same day is challenging but possible with the right online lender. Your best bet is to apply with a lender that specifically advertises same-day funding, such as LightStream. To maximize your chances, you must have a good credit score and a straightforward financial profile. You need to apply early on a business day (usually before 11 AM) and have all your required documents, like proof of income and ID, ready for immediate upload. If your application is approved quickly and without any complications, the lender may be able to wire the funds to your account for same-day access.

Can I get a $5000 personal loan online with instant approval?

Yes, you can get a $5,000 personal loan online with an “instant approval” decision. Many online lenders use automated systems to review your application and provide a conditional approval decision within minutes. This approval is contingent upon the successful verification of your information. For a $5,000 loan, you will typically need a fair to good credit score (640 or higher) and sufficient income to show you can afford the monthly payments. Once you receive the instant decision and upload your documents, final approval and funding usually follow within one to three business days.

How to get a $5000 loan quickly in the US or UK?

To get a $5,000 loan quickly in the US or UK, your best option is an online lender. In the US, companies like SoFi, Marcus, and Discover are known for their fast processing times. In the UK, lenders like Zopa and Kroo offer a similar speedy service. The key to getting your funds quickly is preparation. Check your credit score beforehand, gather your digital documents (payslips, bank statements), and choose a lender known for next-day funding. Completing the online application accurately and promptly will help ensure there are no delays in the verification process.

Personal loans online approval, instant approval – Is it really instant?

The term “instant approval” is mostly a marketing term for an instant decision. When you apply, an algorithm instantly assesses your initial application and credit data to give you a pre-approval decision in minutes. However, this is not the final approval. You will still need to provide documents to verify your identity, income, and other information. The final approval only comes after a human underwriter or an automated system has verified these documents. While the initial decision is instant, the entire process from application to funding typically takes at least one to two business days.

Instant personal loans online approval with same-day deposit

Securing an instant personal loan with a same-day deposit is the fastest funding available, but it is not guaranteed and has strict requirements. You must apply with a lender that explicitly offers this service, like LightStream in the US. You will need to have a strong credit profile and a straightforward application that doesn’t raise any red flags for underwriters. The most critical factor is timing: you must complete the entire application and be approved before the lender’s daily cut-off time, which is often before noon on a business day. Missing this window will push your deposit to the next business day.

Personal loans online approval bad credit – What are your options?

If you have bad credit, your options for online personal loans are more limited and will come with higher interest rates, but they do exist. Lenders like Avant, OneMain Financial, and OppLoans in the US specialize in providing loans to individuals with less-than-perfect credit. In the UK, options might include lenders like Fair for You or Oakam. These lenders often look at factors beyond just your credit score, such as your income and employment stability. Another strong option is to apply with a local credit union, which may be more flexible with its lending criteria for members.

Best online loans with instant approval with no hidden fees

The best online loans with an instant approval decision and no hidden fees come from top-tier lenders who prioritize transparency. In the US, SoFi and Marcus by Goldman Sachs are excellent examples. They offer competitive rates and are well-known for having no origination fees, no late fees, and no prepayment penalties. This means the APR you are quoted is a true reflection of the loan’s cost. To qualify for these premium, no-fee loans, you will generally need a good to excellent credit score (typically 680 or higher). Always read the loan agreement to confirm the fee structure before signing.

Best personal loans for Tier One countries

The “best” personal loan varies by individual needs, but top contenders in Tier One countries share common traits: competitive rates, transparent fees, and a smooth online experience.

· US: SoFi, LightStream, and Marcus are excellent for good credit. Avant is a strong option for fair credit.

· UK: Zopa, Kroo, and major banks like HSBC offer very competitive rates.

· Canada: Major banks like RBC and CIBC have strong online offerings, alongside fintech lenders.

· Australia: Lenders like NAB, Commonwealth Bank, and online players like SocietyOne are popular choices.

The best approach is always to compare rates from a few of these top providers.

Capital One personal loan – How to qualify online

As of late 2025, Capital One is not accepting applications for new personal loans. The company has discontinued this product to focus on its other lines of business, such as credit cards and auto financing. If you see information about applying for a Capital One personal loan, it is likely outdated. For those seeking a loan, it’s recommended to explore other leading financial institutions. Many reputable online lenders, national banks, and credit unions offer excellent personal loan products with easy online applications.

Personal loans for bad credit guaranteed approval—What to know

You should be extremely wary of any lender that advertises “guaranteed approval” for personal loans, especially for bad credit. This is a major red flag and often indicates a predatory lender. Legitimate lenders will always need to review your credit and financial information to assess your ability to repay the loan; they cannot guarantee approval beforehand. Lenders that make such claims often have exorbitant interest rates and fees that can trap borrowers in a cycle of debt. Instead of seeking “guaranteed” loans, look for reputable lenders that specialize in bad credit.

Discover personal loans—compare rates and apply online.

Discover is a highly rated option for personal loans, known for its excellent customer service and transparent terms. They offer fixed-rate personal loans from $2,500 to $40,000 with no origination fees. To qualify, you will generally need a good credit score (typically 660 or higher) and a minimum household income of $25,000. Their online application process is straightforward. You can check your rate on their website with a soft credit inquiry that won’t affect your score. This allows you to easily compare their offer with other lenders before committing to a full application.