Personal Loan vs Credit Card: Compare options in US, UK, Canada & Australia. Find best rates and flexible offers for your financial needs.

You need money. Maybe you’re eyeing a long-overdue kitchen renovation, facing a sudden emergency repair, or are stuck under a mountain of high-interest credit card debt from the holidays. You log into your banking app to find two choices: you can either get a “personal loan” or apply for a “credit card.” Both are good for quick cash, whether you’re taking money out at the ATM or using the card to pay for transactions directly.

Things are even worse in the most expensive, Tier One markets like the USA, the United Kingdom, Canada, and Australia. You may like a certain credit card for its travel rewards, but get burned by the average annual percentage rate (APR) of 22% if you carry a balance. A personal loan provides a fixed interest rate and a set payoff timeline, but could it be the right weapon for an even smaller short-term expense?

Picking the wrong product could be the difference between paying $1,500 in interest or $5,000 on that same $10,000 borrowed. That’s not the case with credit card rates, which are nearly always variable: When central banks such as the U.S. Federal Reserve or the Bank of England raise interest rates, they can spike. A personal loan, typically a fixed-rate one, provides predictability, and that’s valuable in maintaining a household budget.

This guide will help demystify the financial jargon. We’ll be comparing personal loans and credit cards side by side as we look for the interest rates, fees, and rules that matter to you. Let’s take a look back at when taking out a fixed-rate loan is your best financial play, and when the smarter choice could be to use a flexible credit card (in a responsible way). And by the end, you’ll have a template on which to make a decision around whether it saves you more money, helps or hurts your credit score, and gets you closer to your financial goals sooner.

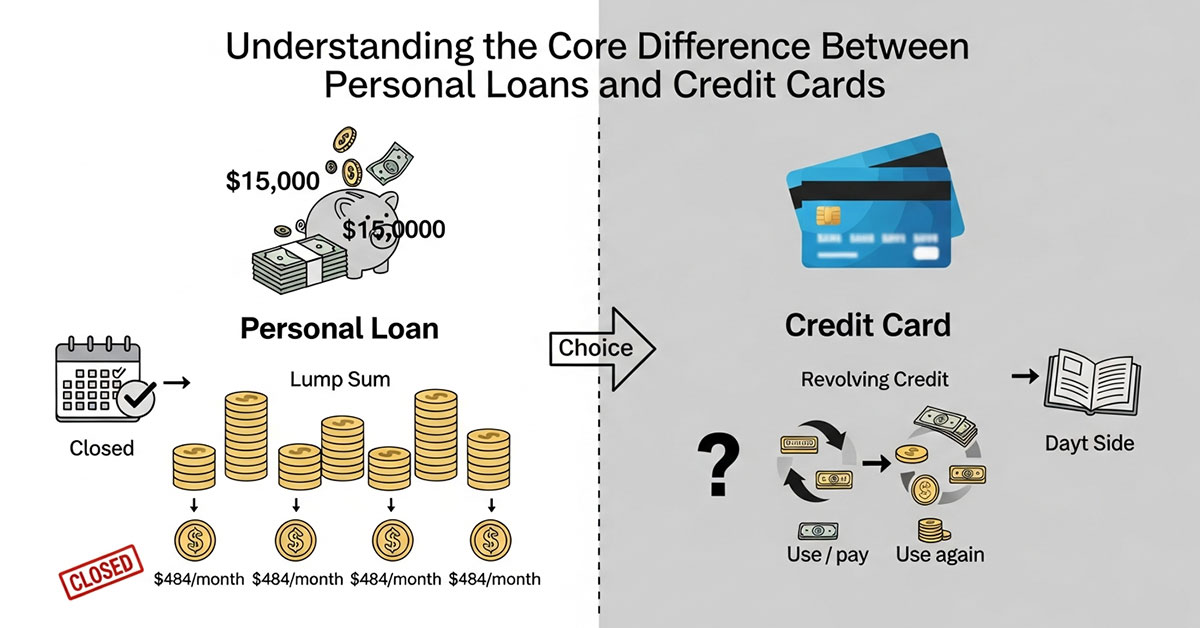

Understanding the Core Difference Between Personal Loans and Credit Cards

Before you can choose the right tool, you have to know what that tool was made for. At their heart, personal loans and credit cards are two very different borrowing philosophies: installment credit and revolving credit.

A personal loan. Nowadays, you can also apply for a personal loan online and get the money deposited into your bank account. You take out one big pile of money — a “lump sum” — upfront, say $15,000. You then repay it through a series of fixed, equal monthly payments (let’s say 6 months @$484/month). Interest is usually set at a fixed rate; once you sign on the dotted line, your payments are for good. It’s because you know the exact date when you will be debt-free. When you pay it off, the account is shut down.

A credit card is revolving debt. You are approved for a credit limit — say, $15,000 — that becomes a pool of money from which you can draw as needed. You can spend $1,000 today and then another $500 the next week and pay back currency with an interest-based promise of only $800. It’s a revolving door. All you have to do is make a modest “minimum payment” each month. You are only charged interest on the balance that you carry beyond the due date. The interest rate is invariably variable and typically much higher than that of a loan.

Case Study: The $5,000 Purchase

Let’s see how this plays out for two different borrowers in Tier One markets.

· Sarah (United States): Sarah needs $5,000 for an urgent dental procedure. She takes out a 3-year personal loan at a 9% fixed APR. Her monthly payment is $159.00. She budgets for this payment, and in 36 months, she is done.

o Total Interest Paid: $724

· Mark (United Kingdom): Mark needs £5,000 for the same procedure. He puts it on his credit card, which has a 21.9% variable APR. He decides to pay the same £159.00 per month, trying to match Sarah.

o Total Interest Paid: £2,311 (and it takes him 48 months, a full year longer, to pay it off).

Result: By choosing the personal loan for this large, one-time expense, Sarah saved over $1,500 in interest and got out of debt 12 months faster.

Comparison Table: Installment vs. Revolving Credit

| Feature | Personal Loan (Installment Credit) | Credit Card (Revolving Credit) |

| How You Get Funds | A single lump sum, deposited at once. | A line of credit you can draw from as needed. |

| Interest Rate | Typically fixed (e.g., 7%–18%). | Typically variable (e.g., 18%–30%+). |

| Repayment | Fixed monthly payments over a set term (2-7 years). | A minimum payment is required; you can carry a balance indefinitely. |

| Best For | Large, one-time expenses (debt consolidation, renovations). | Small, everyday purchases; managing cash flow; earning rewards. |

| Key Benefit | Predictability and lower interest rates. | Flexibility and perks (if paid in full). |

| Key Danger | Fees (origination) or prepayment penalties. | The “minimum payment trap” and compounding interest. |

The loan forces discipline with its fixed payment, while the credit card offers flexibility that demands your own discipline.

When a Personal Loan Might Be the Smarter Financial Choice for You

A personal loan is a strategic financial tool. It shines when you have a specific, large expense and your primary goal is to pay the lowest possible amount of interest. You should strongly consider a personal loan when your situation matches one of these scenarios.

A loan is designed for a clearly defined purpose. Think of it as a financial “project” with a start, a middle, and a definite end.

Top Reasons to Choose a Personal Loan:

1. Debt Consolidation: This is the most powerful use. If you have $20,000 in credit card debt across three cards, all charging you 22% APR, you are paying a fortune in interest. You can take out $20,000 personal loan at 11% APR. You use the loan to pay off all three cards, leaving you with one single, lower-interest payment. This move can save you thousands and get you out of debt years faster.

2. Home Improvement: You need $25,000 for a new roof or a kitchen remodel. You know the exact cost. A personal loan gives you the $25,000 lump sum to pay your contractor. You then have a predictable 5-year plan to pay it back. Using a credit card for this is extremely risky, as a 25% APR on a $25,000 balance is crippling.

3. Major Life Events: Funding a large wedding, paying for significant moving expenses, or financing a major purchase (like a used car from a private seller) are all excellent uses for a loan.

4. Emergency Expenses: When a $10,000 emergency medical bill or car transmission repair lands in your lap, a personal loan provides a structured way to pay it off without falling into the variable-rate trap of a credit card.

Case Study: The Miller Family (Australia)

The Miller family in Sydney had A$22,000 in credit card debt spread across two bank cards and one store card. The average APR was 20.5%. Their minimum payments totaled A$650, but the balance barely seemed to move.

They applied for a 3-year debt consolidation loan for A$22,000 at an 11% APR comparison rate.

· Old Credit Card Payment: A$650 (mostly interest, 10+ years to repay)

· New Loan Payment: A$718 (fixed for 3 years)

Result: Although their monthly payment was slightly higher, they committed to it. In exactly 36 months, they were completely debt-free. The personal loan saved them over A$9,000 in future interest payments and gave them the psychological win of a clear end date.

Personal Loan Use-Case Table

| Loan Purpose | Why a Personal Loan Wins | Tier One Market Example |

| Debt Consolidation | Drastically cuts interest (e.g., 21% card to 11% loan). | A borrower in the UK uses a loan to clear high-interest store card and credit card balances. |

| Home Improvement | A large, fixed amount for a project with a clear budget. | A Canadian family funds a C$30,000 basement renovation. |

| Major Life Event | Covers a large, one-time cost (wedding, moving). | A US couple pays for $15,000 in cross-country moving and setup expenses. |

| Emergency | Covers a large medical or dental bill without variable interest. | An Australian covers A$8,000 in emergency dental surgery. |

Key Takeaway: A personal loan is your best choice when you are borrowing thousands, not hundreds, and want a clear, fixed plan to pay it back.

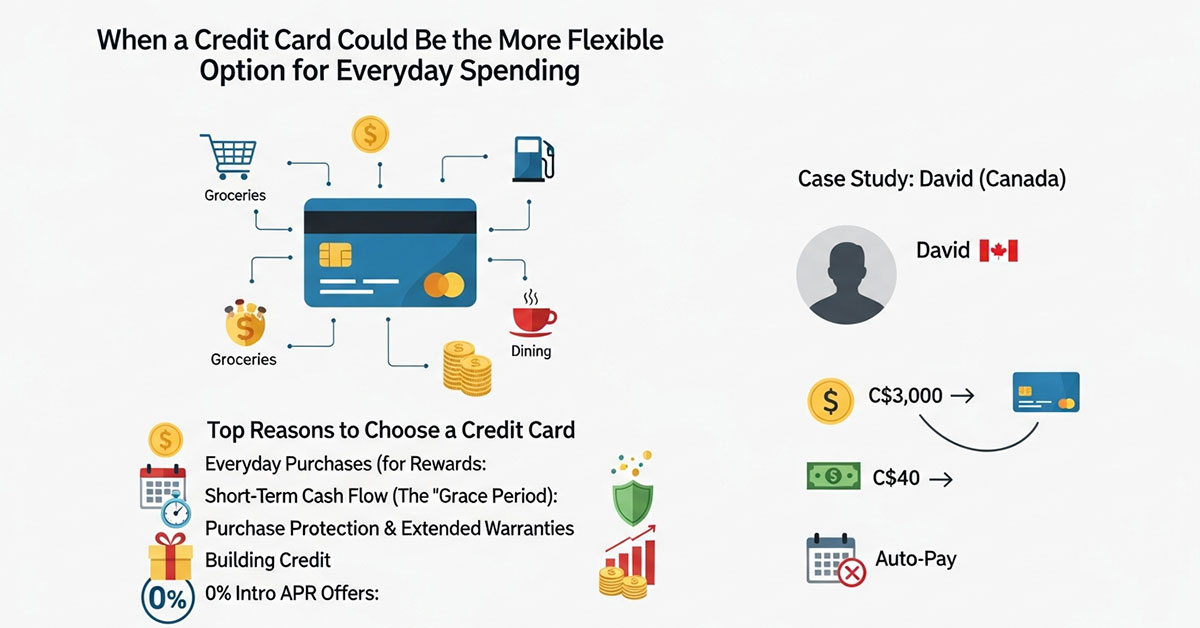

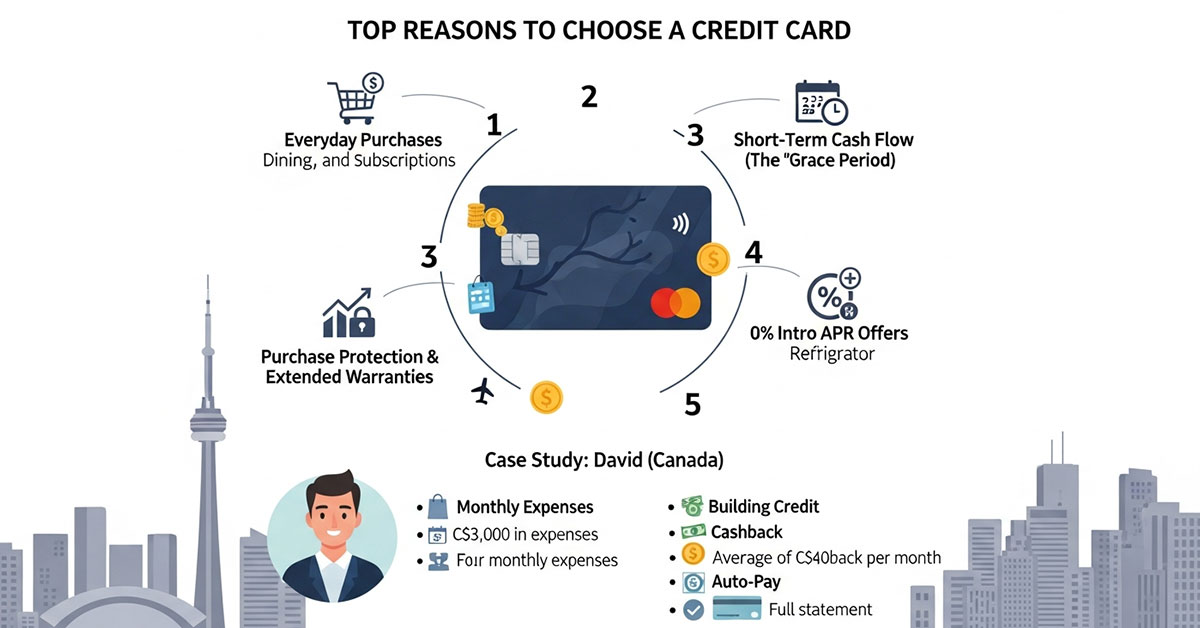

When a Credit Card Could Be the More Flexible Option for Everyday Spending

A credit card is not a good tool for long-term debt, but it’s a great one for managing short-term cash flow. At its best, a credit card is flexible, it offers better consumer protection features , and — believe it or not — can even pay you to use it.

The golden rule of credit card usage is pretty straightforward: Never use a credit card to buy something you can’t afford in full when the bill arrives. Follow this rule, and the high APR on a card (e.g., 22%) is irrelevant. You will pay not one cent of interest.

Top Reasons to Choose a Credit Card:

1. Everyday Purchases (for Rewards): Paying for groceries, gas, dining, and subscriptions. Why use a debit card, which offers $0 in rewards, when a credit card gives you 1%–5% cashback or valuable travel points?

2. Short-Term Cash Flow (The “Grace Period”): This is the magic. When you buy a $500 item, your card issuer gives you a “grace period” (usually 21-25 days after your statement closes) to pay the bill. This means you can use the bank’s money for free for 3-4 weeks, letting your own $500 sit in your savings account.

3. Purchase Protection & Extended Warranties: This is a major benefit in Tier One markets. If you buy a new laptop with your card and it’s stolen or damaged within 90 days, the card issuer may refund you. They also frequently add an extra year to the manufacturer’s warranty for free.

4. Building Credit: For a young person in Canada, the US, UK, or Australia, responsibly using a “starter” credit card (and paying it in full) is the fastest way to build a strong credit history.

5. 0% Intro APR Offers: These are a special exception. If you need to buy a $2,000 refrigerator, you can use a card with a “0% APR for 15 months” offer. This gives you 15 months to pay it off, interest-free. This is a strategic use, but dangerous if you don’t pay it off before the 25% APR kicks in.

Case Study: David (Canada)

David is a young professional in Toronto. He uses his cashback credit card for all his monthly expenses, which total about C$3,000. This includes his groceries, transit pass, phone bill, and entertainment.

· His card gives him 2% cashback on groceries and 1% on everything else.

· He earns, on average, C$40 in cashback every month.

· The Key: David has his card set to auto-pay the full statement balance from his checking account each month.

Result: David pays $0 in interest. He builds an excellent credit history. He gets free travel medical insurance and extended warranties on his electronics. And the bank pays him nearly C$500 per year just for using their card.

Credit Card Benefit Table

| Credit Card Benefit | How It Works | Tier One Example |

| Rewards (Cashback/Points) | Earn a percentage back (e.g., 1%-5%) on your spending. | An Australian family uses a points card to earn Qantas miles for a future holiday. |

| Grace Period | Pay $0 interest if you pay your full statement balance by the due date. | A UK user buys a £400 TV and pays the bill 28 days later, interest-free. |

| Purchase Protection | The card issuer (e.g., Visa, Amex) may insure new items against theft or damage. | A US cardholder gets a refund for a $300 item that was stolen from their porch. |

| Credit Building | Shows lenders you can responsibly manage revolving debt. | A student in Canada gets a “starter” card with a $1,000 limit to build a credit file. |

Key Takeaway: A credit card is the superior choice for spending you can pay off quickly. A personal loan is for borrowing that you need time to pay off.

Interest Rates, Fees, and Repayment Terms Compared Across Tier One Markets

Cost is the single largest driver of your decision. A lower interest rate, or APR (annual percentage rate), means you pay less to borrow the same amount of money.

Personal loan interest rates Personal loan interest rates are based on your credit score (for example, your FICO score in the US or your Equifax score in Canada/Australia, etc).

· Excellent Credit (760+): You can find rates from 7% to 12%.

· Good Credit (680-759): Expect rates from 12% to 18%.

· Fair/Poor Credit (<680): Rates can be 18% to 36%, which is as high as a credit card.

Credit card interest rates (Purchase APR) are almost always high and variable. They are not as dependent on your credit score, though a better score gets you a better card.

· Standard Rates: 19% to 25%

· Rewards/Travel Cards: 21% to 28%

· Store Cards: 25% to 30%+

Case Study: The True Cost of Borrowing $10,000 for 3 Years

Let’s say you have a good credit score.

· Scenario 1: Personal Loan. You get a 3-year loan for $10,000 at a 10% fixed APR.

o Your monthly payment is $322.67.

o Total Interest Paid: $1,616.12

· Scenario 2: Credit Card. You put $10,000 on a card with a 22% variable APR. You try to pay it off in 3 years.

o You must pay $381.93 per month to hit that goal.

o Total Interest Paid: $3,749.48

Result: The personal loan saves you $2,133.36 in interest. The loan’s fixed payment is also $59 lower each month, making it easier on your budget.

Average Borrowing Costs Table (Tier One Markets)

| Market | Avg. Personal Loan Rate (Good Credit) | Avg. Credit Card Purchase APR | Key Regulatory Note |

| United States (US) | 8% – 13% | 21.6% | APR (Annual Percentage Rate) must be disclosed (Truth in Lending Act). |

| United Kingdom (UK) | 6% – 10% | 23.0% | “Representative APR” is shown (must be offered to 51% of applicants). |

| Canada (CA) | 9% – 14% | 20.99% | Interest is capped federally; provinces regulate other fees. |

| Australia (AU) | 9% – 15% | 20.7% | “Comparison Rate” must be shown, which includes most fees. |

| Note: Rates are illustrative and change constantly with central bank policies. |

Don’t Forget the Fees!

· Personal Loan Fees:

o Origination Fee: Common in the US. This is a fee of 1%–6% taken from the loan proceeds. (A $10,000 loan with a 5% fee means you only get $9,500).

o Prepayment Penalty: Rare, but check. A fee for paying the loan off early.

· Credit Card Fees:

o Annual Fee: Common on rewards cards ($95 to $695).

o Balance Transfer Fee: 3%–5% of the amount transferred.

o Cash Advance Fee: A 5% fee plus a high APR (~29%) that starts accruing instant interest with no grace period. Never do this.

o Late Payment Fee: A significant fee ($30-$50) if you miss your due date.

Key Takeaway: For any planned borrowing over $2,000, a personal loan will almost always be cheaper than a credit card, saving you thousands.

H2: Impact on Credit Score, Borrowing Power, and Long-Term Financial Goals

How you borrow affects your credit score, which in turn affects your ability to achieve long-term goals like buying a car or a home. Lenders in all Tier One markets look at five key factors:

1. Payment History (35%): Do you pay on time? (Both loans and cards impact this.)

2. Credit Utilization (30%): How much of your revolving credit limit are you using? (This is mostly a credit card metric.)

3. Length of History (15%): How old are your accounts?

4. Credit Mix (10%): Do you have a healthy mix of installment (loan) and revolving (card) debt?

5. New Credit (10%): Have you applied for a lot of credit recently?

The “Credit Utilization” Trap

This is the most important difference. Credit utilization is the #1 reason high credit card balances hurt your score.

Imagine your score is 750. You have one credit card with a $10,000 limit.

· Scenario A (Loan): You take a $9,000 personal loan. Your credit utilization remains 0%. Your score takes a small, temporary dip from the “hard inquiry” but quickly recovers. Your DTI (Debt-to-Income) ratio is affected, but your score is safe.

· Scenario B (Card): You put $9,000 on your credit card. Your credit utilization is now 90%. ($9,000 / $10,000).

o Result: Your credit score will plummet, potentially by 50-100 points. Why? Lenders see a 90% utilization and assume you are in financial distress. This single metric can block you from getting a car loan or a mortgage.

Case Study: The Mortgage Application (Canada)

· Applicant 1 (Liam): Liam has C$15,000 in personal loan debt. His monthly payment (C$450) is factored into his Debt-to-Income (DTI) ratio. His credit cards are all paid off, so his credit utilization is 0%. His credit score is 780.

· Applicant 2 (Emma): Emma has C$15,000 in credit card debt on C$18,000 in combined limits. Her utilization is ~83%. Her minimum payments (C$400) are factored into her DTI. Her credit score is 660.

Result: Liam is easily approved for the mortgage at a great rate. Emma is rejected. Even though their debt amount and monthly payments are similar, Emma’s type of debt (revolving and maxed out) signals high risk. Liam’s type of debt (installment) is seen as manageable and structured.

Credit Score Impact Comparison Table

| Action | Impact of Personal Loan | Impact of Credit Card |

| Applying | 1 hard inquiry. (Minor, temporary dip) | 1 hard inquiry. (Minor, temporary dip) |

| Carrying a Balance | No utilization impact. Affects the DTI ratio. | Major negative impact via Credit Utilization Ratio. |

| Making Payments | Builds a strong payment history (installment). | Builds strong payment history (revolving). |

| Paying Off | Account closes. (Can slightly lower avg. Age of accounts. | Lowers utilization to 0%. Keep the card open to help credit age. |

| Credit Mix | Improves the mix by adding an installment loan. | Adds a revolving account, which is standard. |

Key Takeaway: A personal loan (paid on time) is far better for your credit score than carrying a high balance on a credit card.

How to Decide Between a Personal Loan and a Credit Card for Maximum Savings

You’ve seen the data, the case studies, and the credit score impacts. Now, let’s create a simple framework. To make the best choice, ask yourself these four questions.

1. What is the

Purpose?

o Is this a large, one-time, planned expense (e.g., roof, debt consolidation)?

o Or is this a small, everyday, or emergency expense (e.g., groceries, $300 car repair)?

2. How Much Do You Need?

o Is it over $2,000?

o Or is it under $2,000?

3. How Long Will It Take to Repay?

o Will it take you more than 60 days (two billing cycles)?

o Or can you realistically pay it off in full within 30-60 days?

4. What is Your Financial Discipline?

o (Be honest). Do you need a fixed payment to force you to stay on track?

o Or are you hyper-disciplined, pay your balance in full, and just want rewards?

Case Study: Maria (US) Makes the Wrong Choice

Maria wanted to remodel her kitchen for $15,000. She had excellent credit.

· Option 1: A 5-year personal loan at 9% APR. Payment: $311/month.

· Option 2: A new credit card with a $20,000 limit and a 0% intro APR for 12 months.

Maria chose Option 2. She thought, “I’ll get 0% interest!”

· The Mistake: The project took 3 months. Life got busy. After 12 months, she had only managed to pay back $4,000.

· The Result: On day 366, her remaining $11,000 balance jumped to the card’s standard 24.99% APR. Her new minimum payment was $300, but $229 of that was just interest. She was trapped, paying thousands more than if she had just taken the predictable personal loan.

Your Decision-Making Guide

Use this table to find your answer.

| Your Situation | Best Option | Why? (To Maximize Savings) |

| “I’m consolidating $15,000 in debt.” | Personal Loan | You will cut your APR in half (e.g., 22% to 11%), saving thousands. |

| “I’m buying an $800 laptop.” | Credit Card | You get purchase protection, an extended warranty, and rewards. Pay it in full next month. |

| “I’m paying for a $25,000 wedding.” | Personal Loan | This is a large, one-time cost. A fixed 3- or 5-year repayment plan is predictable and safe. |

| “I need to cover a $400 car repair.” | Credit Card | This is a perfect short-term cash flow tool. It’s too small for a loan. Pay it off on your next payday. |

| “I’m remodeling my bathroom ($10k).” | Personal Loan | You need a lump sum and a fixed plan. Do not risk a 25% APR if the project is delayed. |

| “I want to earn travel points.” | Credit Card | Use the card for all spending, but treat it like a debit card. Pay the balance to zero every week. |

Key Takeaway: Use a credit card for spending you can pay off this month. Use a personal loan to borrow what you need to pay off.

Advantages and Drawbacks of Personal Loans for Tier One Borrowers

A personal loan is a powerful and predictable financial product, but it is not the right tool for every situation. Understanding its specific pros and cons in markets like the US, UK, Canada, and Australia is key.

Advantages

· Lower, Fixed Interest Rates: This is the #1 advantage. For a borrower with good credit, a 9% fixed APR on a loan is vastly cheaper than a 22% variable APR on a credit card. This saves you thousands.

· Predictable Budgeting: You get a fixed monthly payment (e.g., $300/month) for a fixed term (e.g., 36 months). This “set it and forget it” payment is easy to build into your household budget, just like a car payment.

· A Clear End Date: Knowing you will be debt-free on a specific date is incredibly motivating and provides psychological relief. This structure prevents the “debt treadmill” where you only pay minimums.

· Improves Credit Mix: Having an installment loan that you pay on time looks very good to credit bureaus (Equifax, TransUnion, Experian). It shows lenders you can responsibly manage different types of credit.

Drawbacks

· Less Flexible: A loan is a one-time lump sum. If you borrow $10,000 for a project and it ends up costing $12,000, you cannot simply tap the loan for more. You would have to apply for a new loan.

· Origination Fees: This is especially common in the US. A lender might charge a 1% to 6% “origination fee” that comes out of the loan proceeds. A $10,000 loan with a 5% fee means you only receive $9,500.

· Interest Starts Immediately: Unlike a credit card’s grace period, a loan starts accruing interest from day one. It is designed for borrowing, not for short-term (30-day) cash flow.

· Slower Funding: While “fintech” lenders are fast (1-3 days), it’s not instant like a credit card swipe.

Table: Personal Loan Pros vs. Cons

| Advantages (The “Pro”) | Drawbacks (The “Con”) |

| ✅ Lower, Fixed APR: (e.g., 8%) Saves thousands vs. variable card rates. | ❌ Origination Fees: (e.g., 1-6%) Can reduce your total loan amount upfront. |

| ✅ Budget Certainty: Fixed payment (e.g., $250/mo) never changes. | ❌ Less Flexible: Can’t tap funds again. Need more? New loan. |

| ✅ Clear End Date: A 3-year loan is paid in 3 years. Highly motivating. | ❌ Slower Funding: Takes 1-5 business days (vs. instant card). |

| ✅ Good for Credit Mix: Shows lenders you can manage different debt types. | ❌ Interest Starts Immediately: No 30-day interest-free grace period. |

Expert Insight: A financial planner in London often notes, “A personal loan is a commitment. It’s you telling your future self how much to save each month. A credit card is a temptation. It’s you asking your future self to figure it out. Choose the loan when you have a plan.”

Advantages and Drawbacks of Credit Cards for High-Income Consumers

For high-income or high-net-worth consumers in Tier One markets, the “personal loan vs. credit card” debate changes. These consumers typically do not need to borrow for expenses. Instead, the credit card becomes a powerful tool for maximizing rewards and convenience. The high APR is irrelevant because they never carry a balance.

Advantages

· Exceptional Rewards: Premium cards (like the Amex Platinum or Chase Sapphire Reserve) offer massive sign-up bonuses (often worth $1,000+) and high earning rates (3x-5x points) on travel, dining, and other categories.

· Premium Perks & Access: This is a major driver. These cards provide access to airport lounges (e.g., Centurion, Priority Pass), elite hotel status (e.g., Hilton Gold, Marriott Gold), and dedicated concierge services.

· Superior Consumer Protections: Premium cards offer the best travel insurance (trip cancellation, lost baggage), purchase protection (theft/damage), and extended warranties.

· Cash Flow Management: A high-income earner or business owner can put $50,000 in expenses on a card, earn rewards on that $50k, and then pay the bill 30 days later. This allows their cash to remain in a high-yield savings account earning interest for an extra month.

Drawbacks

· Extremely High Annual Fees: These cards are not cheap. Annual fees in the US, UK, Canada, and Australia can range from $450 to $700 (£400-£600, C$500-C$700). You must spend enough to justify this fee.

· Risk of Complacency: Even a wealthy individual can get distracted and forget to pay a bill in full. Carrying a $20,000 balance “just for one month” at 25% APR is an expensive $400+ mistake.

· Complexity: Managing “points ecosystems” (e.g., transferring Amex points to Aeroplan in Canada or Avios in the UK) can be complicated and time-consuming.

· Temptation for Lifestyle Creep: Access to a $50,000 “limit” can subtly encourage overspending, even for those with high incomes.

Table: Premium Credit Card Pros vs. Cons (High-Income)

| Advantages (The “Pro”) | Drawbacks (The “Con”) |

| ✅ Exceptional Rewards: (e.g., 5x points on travel, massive sign-up bonuses). | ❌ High Annual Fees: (e.g., $695 in the US, £575 in the UK). |

| ✅ Premium Perks: Airport lounge access, hotel elite status, concierge. | ❌ Complexity: Requires high spending to justify the fee; complex reward rules. |

| ✅ Cash Flow Tool: Pay large expenses; pay in full 30 days later. | ❌ Risk of Complacency: Easy to let a large balance “ride,” incurring massive interest. |

| ✅ Strong Consumer Protections: Top-tier travel insurance, purchase protection. | ❌ High APR: The interest rate (20%+) is still dangerously high if a balance is carried. |

Expert Insight: A wealth manager in Sydney advises: “For my clients, a premium credit card is a tool for maximizing their (already high) spending, not a line of credit. They treat the due date as a hard-zero deadline. The moment they can’t pay it in full, we switch them back to a debit card.”

Fixed Payments vs Revolving Credit: What Works Best for Your Budget

Your budgeting style and financial psychology play a huge role in which product will work for you. This is a battle between structure and flexibility.

Fixed Payments (Personal Loans)

A fixed-payment structure is ideal for the “set it and forget it” budgeter.

· How it works: You know that on the 15th of every month, $350 is automatically withdrawn for your loan payment. You build your entire monthly budget (groceries, rent, savings) around this fixed, non-negotiable cost.

· Pros: This forces discipline. There is no temptation to “just pay the minimum.” You see your principal balance decrease every month, which is highly motivating. It’s the perfect tool for aggressively paying down a large, specific debt.

· Cons: It’s inflexible. If you have a tough month (e.g., your car breaks down), you cannot “pay less” on your loan. You must make the full payment, or you risk a default and a major hit to your credit.

Revolving Credit (Credit Cards)

A revolving-credit structure offers flexibility, which is both its greatest strength and its most dangerous weakness.

· How it works: Your “payment due” changes every month based on your balance. The bank only requires you to pay a small minimum (e.g., $50 on a $5,000 balance).

· Pros: This flexibility can be a lifeline in a true emergency. If you have a bad month, you can just pay the minimum to stay in good standing.

· Cons: This is the “Minimum Payment Trap.” Paying the minimum is a financial disaster. On that $5,000 balance at 22% APR, a $50 minimum payment means ~$90 in new interest is added, while you only paid $50. Your balance goes up! This trap keeps people in debt for decades.

What Works Best?

· Choose fixed payments (Personal Loan) if: You are trying to get out of debt. You need structure, you have a clear financial goal, and you want a predictable budget. This is for debt elimination.

· Choose revolving credit (Credit Card) if: You are managing your monthly spending. You are disciplined, you pay your balance in full every month, and you are using the card as a transaction tool, not a debt tool.

Expert Insight: A Canadian credit counselor states, “The most dangerous phrase in finance is ‘minimum payment.’ A fixed personal loan payment removes that danger. It replaces a vague ‘suggestion’ with a concrete ‘plan.’ For 9 out of 10 people trying to get out of debt, a fixed plan is the only path to success.”

Using a Personal Loan for Debt Consolidation and Interest Reduction

This is the single most powerful and effective use of a personal loan. Millions of consumers in Tier One nations fall into the trap of high-interest revolving debt. A debt consolidation loan is a structured plan to get out.

How It Works: A 3-Step Process

1. Assess the Damage: You add up all your high-interest debts.

o Card 1: $7,000 at 21.99%

o Card 2: $4,000 at 19.99%

o Store Card: $2,000 at 24.99%

o Total: $13,000 at an average 21.5% APR.

2. Get the Tool: You apply for a $13,000 personal loan. With a good credit score, you are approved for a 3-year term at an 11% fixed APR.

3. Execute the Plan: The $13,000 is deposited into your bank account. You immediately use it to pay off all three cards. (Some lenders will even do this for you.)

The Result (The “Why”)

· Massive Interest Savings: You just cut your interest rate in half. This saves you thousands. On this $13,000, you will save over $3,500 in interest payments.

· Simplicity: You no longer have three due dates and three payments. You have one fixed payment. This reduces stress and the risk of a late fee.

· A Clear Finish Line: You will be 100% debt-free in 36 months. With the credit cards, paying the minimums would have taken you over 15 years.

· Credit Score Boost: After an initial small dip, your score will likely increase significantly. Why? Your “Credit Utilization” on your (now empty) credit cards drops from 90%+ to 0%. This signals a massive decrease in risk to lenders.

Key Takeaway: Using a loan for debt consolidation is not “creating new debt.” It is restructuring your existing debt into a cheaper, smarter, and faster-to-repay product. It is an active step toward financial health.

Short-Term Spending Flexibility and Cashback Perks with Credit Cards

A credit card, when used responsibly, is the ultimate tool for short-term financial flexibility. Its power lies not in its credit limit, but in its grace period and rewards.

The grace period is the time between when your statement closes and when your payment is due (usually 21-25 days). If you pay your entire statement balance in full during this time, you are charged 0% interest.

This allows you to:

· Manage Cash Flow: You get paid on the 30th. Your car needs a $400 repair on the 10th. You can put it on your credit card, pay $0 in interest, and then pay the bill in full when you get your paycheck. This is a perfect, free, short-term loan.

· Earn Rewards on Every Dollar: Why use a debit card? It’s connected directly to your cash and offers no perks. A good cashback card in the US, Canada, Australia, or the UK will give you 1% to 2% back on everything you buy. If you spend $2,000 a month on the card (and pay it in full), you are earning $240 to $480 per year for free.

The Best Perks

Beyond cash, credit cards offer perks that have real-dollar value:

· Travel Rewards: Premium cards let you earn points (like Avios, Aeroplan, Qantas) that you can redeem for flights and hotels, often saving you thousands.

· Purchase Protection: Many cards will insure a new item against theft or accidental damage for 90-120 days.

· Extended Warranties: A common perk that adds an extra year to the manufacturer’s warranty on electronics, appliances, and more.

· Travel Insurance: Many cards provide rental car insurance (CDW), trip delay reimbursement, and lost luggage coverage, saving you from buying separate policies.

Key Takeaway: A credit card should be used like a debit card. Use it for your planned, budgeted daily spending. Pay the bill in full every month (or even every week). By doing this, you pay $0 in interest, build your credit, and earn valuable rewards and protections.

Choosing the Right Option Based on Your Financial Habits and Goals

Ultimately, this choice is a reflection of your personal financial habits and what you are trying to accomplish. There is no single “best” answer, only the “best” tool for the job at hand.

What is Your Goal?

· Goal: Get Out of Debt.

o Your Habit: You feel overwhelmed by multiple high-interest card payments and are stuck in the “minimum payment” trap.

o Your Best Option: Personal Loan. You need the structure. A debt consolidation loan will give you one payment, a lower rate, and a clear end date. This is your path to freedom.

· Goal: Make a Large, Planned Purchase.

o Your Habit: You are planning a $15,000 wedding or a $20,000 home renovation. You need funding up front.

o Your Best Option: Personal Loan. You need a lump sum. A loan’s fixed rate and fixed term are built for a large “project” like this. It gives you budget predictability.

· Goal: Maximize Rewards & Manage Daily Spending.

o Your Habit: You are a disciplined budgeter. You never carry a balance and treat your credit card like a debit card.

o Your Best Option: Credit Card. You are the ideal user. You will pay $0 in interest while racking up hundreds of dollars in cashback, travel points, and consumer protections.

· Goal: Cover a Small Emergency.

o Your Habit: Your $500 emergency fund isn’t quite $500. You need to cover a $600 car repair and can pay it back on your next paycheck.

o Your Best Option: Credit Card. This is a cash flow problem, not a debt problem. A loan is too slow and too large. Use the card’s grace period to give yourself a 30-day, interest-free float.

Final Thought: If you need to borrow for more than 60 days, a personal loan is almost always the cheapest, safest, and most responsible choice.

How to Compare Total Borrowing Costs, APRs, and Repayment Schedules

When you compare loans or cards, don’t just look at the monthly payment. You must look at the total cost of borrowing.

The Annual Percentage Rate (APR) is the most important number. It represents the true annual cost of borrowing, including the interest rate plus certain fees. In Tier One markets, lenders are required by law to show you this (e.g., TILA in the US, “Comparison Rate” in Australia).

Checklist for Comparing Costs:

· Check the APR, not the “Interest Rate.” The APR is the more complete number.

· Look for Origination Fees (Loans): A 10% APR loan with a 5% origination fee is more expensive than an 11% APR loan with no fee. Always ask for the “no-fee” option.

· Check for Annual Fees (Cards): A 19% APR card with a $95 annual fee is worse than a 19% APR card with no fee (unless the rewards clearly outweigh the cost).

· Compare Total Interest Paid: Use an online calculator.

o Loan A: $10,000 at 9% for 3 years. Total Interest: $1,427.

o Loan B: $10,000 at 11% for 5 years. Total Interest: $2,994.

o Even though Loan B has a lower monthly payment ($217 vs. $318), it costs you twice as much in the long run.

Key Takeaway: Always choose the shortest loan term you can comfortably afford. A 3-year loan is always cheaper than a 5-year loan.

Understanding Repayment Flexibility and Loan Duration Differences

Personal loans are inflexible by design.

· Duration: 2 to 7 years (36 or 60 months are most common).

· Flexibility: Very little. You must pay the fixed amount. Paying more (to pay it off early) is great, but you should check for “prepayment penalties” (these are rare in the US/UK but exist). Paying less is not an option.

Credit cards are extremely flexible.

· Duration: Indefinite. As long as you pay the minimum, you can stay in debt forever (this is the trap).

· Flexibility: Total flexibility. You can pay the minimum ($50), the full balance ($5,000), or any amount in between. This flexibility is a benefit for cash flow but a danger for debt reduction.

Which is Better?

· For debt reduction, the loan’s inflexible structure is far superior. It forces you to get the debt paid.

· For cash flow management, the card’s flexibility is superior.

Key Tip: If you take a personal loan, always set up auto-pay. This ensures you never miss a payment, which is critical for your payment history (the biggest part of your credit score).

What Fees, Charges, and Penalties You Should Watch Out For

“The big print giveth, and the fine print taketh away.” Always read the agreement.

Personal Loan Fees

· Origination Fee: (US, some fintechs) A fee (1-6%) to “process” the loan, taken from the proceeds.

· Prepayment Penalty: (Rare, but check) A fee for paying the loan off early. Avoid loans with this.

· Late Payment Fee: ($25-$50 or a percentage) A standard fee if your payment is late.

Credit Card Fees

· Annual Fee: ($0 to $700) A yearly fee to have the card. Only pay this if the rewards are worth more.

· Late Payment Fee: ($30-$50)

· Balance Transfer Fee: (3-5%) A fee to move debt from one card to another.

· Cash Advance Fee: (5% + 29% APR + No Grace Period) The most expensive way to get cash. Never, ever do this.

· Foreign Transaction Fee: (1-3%) A fee for making purchases outside your home country (e.g., a US card used in the UK). Look for cards with “no foreign transaction fees.”

Key Takeaway: The “best” product can be the “worst” if it’s loaded with fees. A “no-fee” credit card and a “no-origination-fee” loan are often the best starting points.

How Credit Utilization Impacts Your Credit Score Over Time

This is the most critical, yet least understood, part of your credit score.

Credit Utilization Ratio (CUR) = (Total Revolving Balances) / (Total Credit Limits)

This only applies to your revolving credit (credit cards). Installment loans (personal loans, mortgages) do not count toward this 30% of your score.

Example

You have two credit cards, each with a $5,000 limit. Your total limit is $10,000.

· Scenario 1: You carry a $1,000 balance.

o Your CUR is 10% ($1,000 / $10,000).

o Result: This is excellent. Your credit score is high. Lenders see you as responsible.

· Scenario 2: You carry an $8,000 balance.

o Your CUR is 80% ($8,000 / $10,000).

o Result: This is terrible. Your credit score will drop significantly. Lenders see you as “maxed out” and high-risk, even if you never miss a payment.

The Golden Rule: Always keep your total credit utilization below 30% ($3,000 in this example). For the best scores, keep it below 10% ($1,000).

How a Personal Loan Helps: If you have an $8,000 credit card balance (80% CUR), taking a personal loan to pay it off instantly drops your CUR to 0%. This one move can boost your credit score by 30-60 points in a single month.

Evaluating Rewards, Cashback, and Promotional Offers by Major Banks

Rewards are the main benefit of spending on a credit card. In all Tier One markets, you will find:

· Cashback Cards: (e.g., 1.5% – 2% back on everything, or 5% on rotating categories). Best for simplicity.

· Travel Cards: (e.g., Amex, Chase, BMO, Qantas). Earn points/miles. Best for frequent travelers who can “play the game” to get maximum value.

Promotional Offers:

· 0% Intro APR on Purchases: (e.g., “0% APR for 15 months”). This lets you buy a $2,000 item and pay it off over 15 months, interest-free. This is a strategic use.

· 0% Intro APR on Balance Transfers: (e.g., “0% APR for 18 months, 3% fee”). This is a temporary debt consolidation tool. You pay a 3% fee ($300 on $10,000) to get 18 months of 0% interest. This can be good, but a personal loan is often simpler and has a clear end date.

Warning: Do not be tempted only by a 75,000-point sign-up bonus. These offers require you to spend $4,000-$6,000 in 3 months. If this causes you to overspend and carry a balance, the 25% APR you pay will wipe out the value of the bonus instantly.

How to Make a Data-Driven Decision Between a Loan and a Credit Card

Stop guessing. Use this checklist.

The 60-Day-Rule Checklist

1. What is the total amount I need to borrow?

o (e.g., $8,000)

2. What is the purpose?

o (e.g., Consolidate two credit cards)

3. Can I realistically pay this entire amount back in 60 days?

o (e.g., No, $8,000 is too much).

4. If the answer to #3 is “No,” choose a Personal Loan.

o Reason: It will be cheaper, protect your credit score, and give you a fixed end date.

The <60-Day-Rule Checklist

1. What is the total amount I need to spend?

o (e.g., $700)

2. What is the purpose?

o (e.g., A new set of tires)

3. Can I realistically pay this entire amount back in 60 days?

o (e.g., Yes, I get paid twice).

4. If the answer to #3 is “Yes,” choose a Credit Card.

o Reason: You will pay $0 interest, get any rewards (cashback), and benefit from purchase protection.

This simple, data-driven framework removes the emotion and points you to the mathematically correct product for your situation.

Case Study: Using a Personal Loan to Pay Off High-Interest Credit Card Debt

Let’s look at James (US).

· Debt: $14,000 on a credit card at 22.9% APR.

· Payment: He was struggling to pay $400/month.

· The Problem: Of his $400 payment, $267 was going straight to interest. Only $133 was paid down on the debt. He was on a debt treadmill, and it would take him 51 months (over 4 years) to pay it off.

· Total Interest Paid: $6,470

The Solution:

James took a 3-year (36-month) personal loan for $14,000 at 10.9% APR.

· His new fixed payment: $458/month.

· The Result: His payment was $58 higher, but he committed to it. He was 100% debt-free in 36 months.

· Total Interest Paid: $2,490

Takeaway: By swapping his debt from a high-cost credit card to a lower-cost personal loan, James saved $3,980 and got out of debt 15 months faster.

Insight: Managing Monthly Payments Efficiently to Boost Credit Health

Your payment history is the most important factor in your credit score (35%). The single best way to manage your payments is automation.

1. For your personal loan: Set up automatic payments from your checking account for the full fixed amount. This ensures you are never late.

2. For your credit card: Set up automatic payments for the full statement balance. This ensures you never pay interest, and your utilization is reported as low.

If you cannot afford to auto-pay the full balance on your card, do not auto-pay the minimum. This is dangerous complacency. Instead, set a calendar reminder and manually pay as much as you possibly can before the due date.

FAQ: Should You Choose Fixed or Variable Interest for Better Stability?

This is an easy answer: Always choose a fixed interest rate for stability.

· Fixed Rate (Personal Loans): The rate (e.g., 9%) is locked in for the life of your loan. If the central bank raises interest rates, your payment does not change. This gives you budget certainty.

· Variable Rate (Credit Cards): The rate (e.g., 22%) is tied to a benchmark (like the Prime Rate in the US/Canada). When central banks raise rates, your credit card APR automatically goes up. This means your debt becomes more expensive.

Key Insight: The only time to consider a variable rate is in a high-interest-rate environment where you are expecting rates to fall dramatically, which is a gamble. For stability, fixed is always king.

Exploring Refinancing and Balance Transfer Options for Lower Costs

If you already have debt, you are not stuck.

· Balance Transfer (Credit Card): This is a temporary fix. You move your $5,000 balance from a 22% APR card to a new card offering “0% for 18 months.” You will pay a 3-5% fee ($150-$250). This “buys you time” to pay off the debt interest-free. It’s a great tool if you have the discipline to pay it off in 18 months.

· Personal Loan (Refinancing): This is a permanent solution. You use a loan to pay off the cards. This is not 0%, but it’s a low fixed rate (e.g., 9%) that is stable and predictable.

Which is better?

· If you can 100% pay off the debt within the 0% intro period, a balance transfer is cheaper.

· If you need more time (2-5 years), a personal loan is safer and more structured.

How to Minimize Debt Risk Through Smart Borrowing and Planning

Smart borrowing means having a plan before you apply.

1. Borrow for Assets, Not Consumables: Borrowing for a (modest) car, home repair, or education (assets) is smarter than borrowing for a vacation, clothes, or a fancy dinner (consumables).

2. The 24-Hour Rule: For any non-emergency purchase, wait 24 hours. This kills impulse spending.

3. Know Your “Why”: Why are you borrowing? If it’s to “keep up with the Joneses,” stop.

4. Match the Term to the Asset: Don’t take a 7-year loan for a car you’ll only keep for 3. Don’t take a 5-year loan to pay for a vacation that lasts one week.

5. Build an Emergency Fund: The best way to minimize debt risk is to not need debt. Having 3-6 months of living expenses in a high-yield savings account means a $1,000 car repair is an inconvenience, not a crisis.

Aligning Your Borrowing Choices with Long-Term Financial Stability

Your long-term goal is financial freedom. Every borrowing decision either moves you closer to or further from that goal.

· Credit Cards (Used Poorly): Carrying a balance is a drag on your goals. The $3,000 you pay in credit card interest could have been $3,000 in your retirement account.

· Credit Cards (Used Wisely): Paying in full every month is a boost. It builds your credit score, making your future mortgage cheaper.

· Personal Loans (Used Wisely): Using a loan to consolidate 22% APR debt into 9% APR is an accelerant. You are actively saving money and speeding up your debt-free date.

Final Takeaway: Use personal loans to eliminate old, expensive debt. Use credit cards to transact new, daily purchases (and pay them off immediately).

Expert Insight: Understanding Revolving vs Installment Credit Structures

A credit specialist in the US explains it this way: “Think of your finances as a house. An installment loan (like a mortgage or personal loan) is part of the foundation. It’s stable, predictable, and has a defined size. Lenders see this as strong.”

“Revolving credit (a credit card) is the wiring. It’s flexible, and you need it to make things work. But if you overload the circuits (high utilization), the whole house is at risk of burning down. Lenders get very nervous when they see overloaded wiring.”

Your “credit mix” (10% of your score) is best when you show you can manage both—a stable foundation and wiring that isn’t overloaded.

Financial Advisor View: Balancing Short-Term and Long-Term Borrowing Needs

A financial advisor in the UK often tells clients, “We must separate spending from borrowing.”

“A credit card is a spending tool. The goal is to pay $0 in interest. Use it for your monthly budgeted items (groceries, petrol) to get rewards, then pay it to zero.

“A personal loan is a borrowing tool. The goal is to pay the least interest possible. Use it for large, planned items (a car, a new boiler) where you need time.

“The crisis comes when people mix them up: they borrow long-term on a credit card, and they spend on a personal loan (e.g., taking a $5,000 loan for a holiday). Use the right tool for the job.”

Credit Specialist Tips: What to Know About the Application and Approval Process

· Credit Card Approval: Often instant, online. Requires a “hard inquiry” on your credit report. You can often get pre-approved without a score impact.

· Personal Loan Approval:

1. Pre-qualification: Many lenders (especially online) let you “check your rate” using a “soft inquiry,” which does not impact your credit score. This is the best way to shop around.

2. Application: Once you choose a lender, you formally apply. This requires a “hard inquiry,” which dings your score by a few points (temporarily).

3. Verification: You’ll need to provide proof of income (pay stubs) and identity (driver’s license).

4. Funding: Once approved, the money is usually in your account in 1-5 business days.

Responsible Borrowing 101: Expert Advice on Repayment Discipline

The single best piece of advice is to pay yourself first, and pay your debt second.

1. Set up an automatic savings deposit for your emergency fund (even $50 a month).

2. Set up automatic payments for all your debts (loan, card minimums).

3. Live on what is left.

The “Avalanche” vs. “Snowball” Method:

· Avalanche (Best Math): Pay the minimum on all debts. Put all extra money toward the debt with the highest interest rate (your credit card). This saves the most money.

· Snowball (Best Psychology): Pay the minimum on all debts. Put all extra money toward the debt with the smallest balance. When it’s paid off, you get a quick win, and “roll” that payment into the next smallest.

Both work. The best plan is the one you will stick to.

Statistic Highlight: How Borrowing Choices Affect Credit Scores in Tier One Markets

In all four Tier One markets (US, UK, CA, AU), the credit scoring models (FICO, VantageScore, Equifax) are heavily weighted toward Credit Utilization.

Statistic: A borrower with a 750 score who “maxes out” their credit cards (90%+ utilization) can see their score drop to 650 or lower, even if they never miss a payment.

Statistic: A borrower who consolidates $10,000 in card debt with a $10,000 personal loan can see their score increase by 20-50 points within 1-2 months, as their utilization drops from 90% to 0%.

This shows that lenders view revolving debt as far more dangerous than installment debt.

Industry Insight: Selecting the Right Financial Product for Your Unique Situation

There is no “bad” product, only the “wrong” use.

· Ask: “Am I financing a purchase or a problem?”

· A Purchase: (e.g., $1,500 laptop you’ll pay off in 45 days) -> Credit Card (for rewards and 0% interest).

· A Problem: (e.g., $1,500 car repair you can’t pay off in 45 days) -> This is a trick. The best solution is your Emergency Fund.

If you don’t have an emergency fund, you must choose the “least bad” option. A credit card is fine if you can pay it off in 2-3 months. If it will take a year, a small personal loan from a credit union is the better, cheaper choice.

The ultimate goal is to build your savings so you never have to “borrow” for an emergency again.

❓ Frequently Asked Questions (FAQ)

Is It Better to Have a Personal Loan Than a Credit Card?

It is not better to have one than the other; it is best to have both and use them correctly.

A credit card is superior for daily spending. When you use it for groceries and gas and pay the bill in full, you build credit, get rewards, and pay $0 in interest.

A personal loan is superior for large, long-term borrowing. It offers a much lower, fixed interest rate and a clear repayment plan, making it the best tool for debt consolidation or a $10,000 home project.

A healthy credit profile in the US, UK, Canada, or Australia typically shows a mix of both: revolving credit (credit cards) with low utilization and installment credit (like a loan) with a history of on-time payments.

Is It Better to Take a Loan or a Credit Card for Big Purchases?

A personal loan is almost always better for a big purchase, which we’ll define as any purchase you cannot pay off in 60 days.

If you buy a $5,000 entertainment system, putting it on a credit card at 22% APR is a costly mistake. You will pay thousands in interest if you only make minimum payments.

Taking a 3-year personal loan at 9% APR is far smarter. You get a fixed, manageable payment, and you will save over $1,500 in interest. The loan’s structure forces a responsible repayment plan.

The only exception is if you can use a “0% Intro APR” credit card and are 100% certain you can pay off the entire $5,000 before the promotional period ends.

Is It Better to Apply for a Credit Card or Personal Loan First?

If you are young and have no credit (a “thin file”), apply for a credit card first. A simple “starter” card or a secured card is the easiest way to establish a credit history. Use it for a small, recurring bill (like a streaming service), pay it in full every month, and your credit score will begin to grow.

If you have an established credit history but are trying to consolidate existing high-interest debt, apply for the personal loan first. This is your most important move. Securing the loan allows you to pay off your cards, which will dramatically lower your credit utilization and boost your credit score.

How Much Would a $5,000 Personal Loan Cost Per Month?

The cost depends on the interest rate (APR) and the loan term (length). Let’s assume you have a “good” credit score.

· On a 3-year (36-month) term:

o At 8% APR, your payment would be ~$156.68/month.

o At 11% APR, your payment would be ~$163.70/month.

· On a 5-year (60-month) term:

o At 8% APR, your payment would be ~$101.38/month.

o At 11% APR, your payment would be ~$108.71/month.

Key Tip: The 5-year loan has a lower monthly payment, but you will pay significantly more interest in total. Always choose the shortest term you can comfortably afford.

Which Is Better for a Credit Score: a Personal Loan or a Credit Card?

This depends entirely on how you use them.

· A personal loan is generally better for your score if you are carrying large balances. It improves your “credit mix” and, when used to pay off cards, it dramatically lowers your “credit utilization,” which provides a huge boost to your score.

· A credit card can be worse for your score if you carry a high balance (over 30% utilization), as this signals risk to lenders.

· However, a credit card, when used lightly (under 10% utilization) and paid in full every month, is a fantastic tool for building a strong payment history and boosting your score over the long term.

A high-balance credit card is the worst for your score. A paid-on-time loan is good. A low-balance credit card is great.

Personal Loan vs Credit Card for Debt Consolidation — Which Saves More?

A personal loan almost always saves you more money and is the superior tool for debt consolidation.

Here’s why: A credit card charges a high, variable interest rate (e.g., 22%). A personal loan offers a lower, fixed interest rate (e.g., 11%). By moving your 22% debt to an 11% loan, you are cutting your interest costs in half. This means more of your payment goes to the principal, and you get out of debt years faster.

The “balance transfer card” (0% for 18 months) is an alternative, but it is a temporary fix. The personal loan is a permanent solution with a structured repayment plan.

Personal Loan vs Credit Card Balance Transfer — Which Reduces Interest Faster?

A credit card balance transfer technically reduces interest faster… but only during the 0% introductory period (e.g., 18 months). During that time, 100% of your payment (minus the 3-5% transfer fee) goes to the principal, as there is no new interest.

However, a personal loan is often the safer and more reliable way to reduce interest. You get a low, fixed rate (e.g., 9% vs. 0%) for a long term (e.g., 3-5 years).

The Risk: If you fail to pay off the balance transfer card before the 0% period ends, the 22%+ “go-to” rate kicks in, and you are right back in high-interest debt. The personal loan is the more predictable and structured path.

Personal Loan vs Credit Card Calculator for Tier One Borrowers

The best calculator is a simple loan amortization calculator. To see the cost:

1. For a Personal Loan: Enter the Loan Amount (e.g., $10,000), a fixed APR (e.g., 9%), and a Term (e.g., 36 months). It will show you a fixed monthly payment and the total interest paid.

2. For a Credit Card: Enter the “Loan” Amount ($10,000), a variable APR (e.g., 22%), and a target monthly payment. You will be shocked to see that paying the minimum will have you in debt for over a decade and cost you more than the loan itself.

💳 Smart Loan & Credit Card Calculator

Compare how fast you can pay off your loan or credit card balance.

· Result: A $10,000 loan at 9% for 3 years costs $1,427 in interest.

· A $10,000 card at 22% (paying the same $318/month) costs $3,864 in interest.

Personal Loan vs Credit Card Pros and Cons Explained

Personal Loan Pros:

· Lower, fixed interest rate

· Fixed monthly payment (easy to budget)

· Clear end date (you will be debt-free)

· Good for credit mix

Personal Loan Cons:

· Less flexible (a one-time lump sum)

· Origination fees (sometimes)

· Interest starts immediately (no grace period)

Credit Card Pros:

· Flexible (revolving line of credit)

· Rewards (cashback, travel points)

· Grace period (0% interest if paid in full)

· Purchase protection

Credit Card Cons:

· Very high, variable interest rates

· The “minimum payment trap”

· Can damage credit score via high utilization

· Annual fees and late fees

Personal Loan vs Credit Card Cost Comparison for US, UK, Canada & Australia

Across all four Tier One markets, the math is the same: carrying a balance on a credit card is the most expensive way to borrow money.

· Average Credit Card APR: ~20% – 23%

· Average Personal Loan APR (Good Credit): ~8% – 13%

The Cost of $10,000 (Paid over 3 Years):

· Personal Loan (11% APR):

o Monthly Payment: ~$327

o Total Interest Paid: ~$1,780

· Credit Card (22% APR):

o Monthly Payment: ~$382

o Total Interest Paid: ~$3,750

Conclusion: For any planned debt that will take more than a couple of months to pay off, choosing the personal loan saves you $1,970 in interest.

❓ Frequently Asked Questions

1️⃣ What is a personal loan and how is it different from a credit card?

A personal loan gives you a lump sum with a fixed APR and fixed monthly payments for a set term. A credit card offers revolving credit with variable interest and flexible repayment — but high APRs can make debt expensive over time.

2️⃣ When is a personal loan a better option than a credit card?

A personal loan is ideal if you need a large one-time amount, prefer fixed monthly payments, or want to consolidate high-interest credit card debt into a lower-rate loan.

3️⃣ When might a credit card be better instead of a personal loan?

If you need quick access to funds, plan to repay quickly, and want benefits like cash-back or rewards, a credit card may be the better choice — provided you avoid carrying balances long-term.

4️⃣ Why does paying only the minimum on a credit card keep you in debt?

Minimum payments mostly cover interest, not principal. That means your balance reduces very slowly — keeping you in debt for years and costing you more than you originally borrowed.

5️⃣ What should I compare between a personal loan and a credit card?

Compare APRs, repayment terms, total interest cost, fees, and repayment flexibility. A personal loan suits long-term structured repayment, while a credit card suits short-term or revolving needs.