Personal Loan Offers made simple — compare 25+ lenders with low rates, quick approval, and flexible terms in the US, UK, Canada & Australia.

Are you searching for the best personal loan offers of 2025? Navigating the vast sea of lenders across the US, UK, Canada, and Australia can be a daunting task. You might be feeling the pressure of unexpected bills, dreaming of a much-needed home renovation, or struggling under the weight of high-interest credit card debt. The core of the problem is finding a loan that balances a low interest rate with a fast, hassle-free approval process. Many borrowers worry about being locked into unfavorable terms, facing hidden fees, or having their credit score negatively impacted by simply applying. The stress of making the wrong financial decision can feel paralyzing.

This guide promises to cut through the confusion and illuminate the path to the best personal loan for your unique situation. We will unveil the top offers from leading lenders, focusing on transparent terms, competitive rates, and quick access to funds. Imagine securing the capital you need in as little as one business day, with a clear repayment plan that fits seamlessly into your budget. We will empower you with the knowledge to compare online personal loans, understand eligibility requirements, and choose a solution that aligns with your financial goals. Your journey to financial flexibility and peace of mind starts now. Explore more details here →

Top Personal Loan Offers and Competitive Rates from Leading Lenders

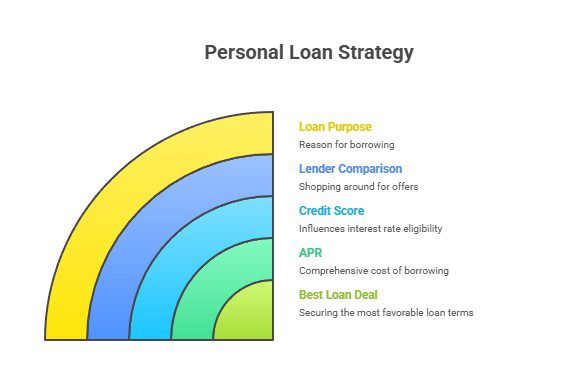

In 2025, the personal loan market is more competitive than ever, which is great news for borrowers in Tier One countries. Leading lenders, from established banks to agile online fintech companies, are vying for your business by offering attractive interest rates and flexible terms. The key to securing the best deal is to shop around and compare what different providers have to offer. Lenders determine your interest rate based on several factors, primarily your credit score, income, and debt-to-income ratio. Those with excellent credit will qualify for the lowest rates, but even borrowers with fair credit can find competitive offers.

When comparing lenders, look beyond the advertised headline rate. Pay close attention to the Annual Percentage Rate (APR), as this figure includes both the interest rate and any mandatory fees, giving you a more accurate picture of the total cost of borrowing. Many of the best personal loans in 2025 come from online lenders who, due to their lower overhead costs, can often pass those savings on to consumers. However, don’t discount traditional banks and credit unions, especially if you have an existing relationship with them, as they may offer loyalty discounts or more personalized service.

Mini Case Study: Liam’s Car Purchase

Liam, a graphic designer in Melbourne, Australia, needed to buy a reliable car for his commute. Instead of opting for dealer financing, which often comes with high interest rates, he decided to explore personal loan offers. He had a good credit score and spent an afternoon comparing online lenders. He pre-qualified with three different companies to see the actual rates they would offer him. He found an online lender that offered him a 5-year loan for AUD $20,000 with a fixed APR of 7.99%, which was significantly lower than the 11% APR offered by the car dealership.

Result: By taking the time to compare personal loan offers, Liam saved over AUD $1,800 in interest payments over the life of his loan.

| Lender | Typical APR Range (Good Credit) | Loan Amounts | Loan Term (Years) | Best For |

| SoFi (US) | 8.99% – 25.81% | $5,000 – $100,000 | 2-7 | Excellent credit, no-fee loans |

| HSBC (UK) | 5.0% – 21.9% | £1,000 – £25,000 | 1-8 | Existing customers, low rates |

| CIBC (Canada) | 6.99% – 19.99% | $2,000 – $50,000 | 1-5 | Flexible payment options |

| NAB (Australia) | 6.99% – 18.99% | $5,000 – $55,000 | 1-7 | Competitive fixed rates |

Flexible Terms and Repayment Options Tailored for Tier One Borrowers

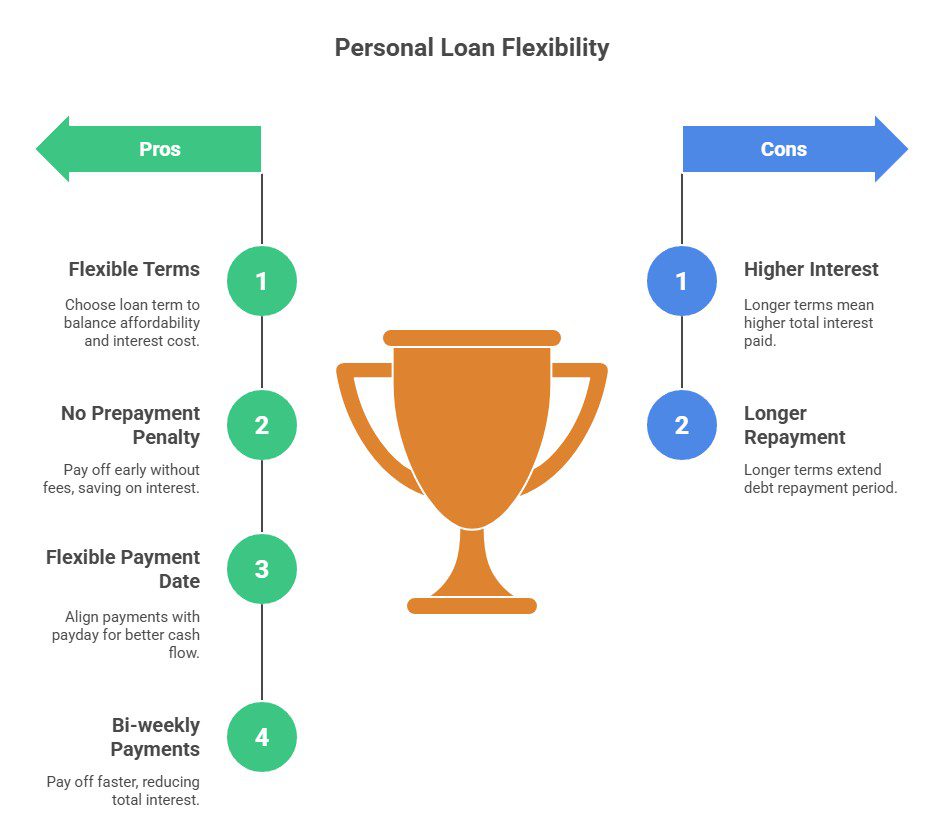

One of the most significant advantages of modern personal loans is the flexibility they offer. Lenders in the US, UK, Canada, and Australia understand that borrowers have diverse financial situations and need repayment plans that fit their unique budgets. This has led to a wide range of loan terms and repayment options designed to provide maximum flexibility and affordability. The loan term, or the length of time you have to repay the loan, is a critical component. A shorter term means higher monthly payments but less interest paid overall, while a longer term provides lower, more manageable monthly payments but a higher total interest cost.

Many top lenders now allow you to choose a term that works for you, typically ranging from one to seven years. In addition to choosing your loan term, many lenders offer flexible repayment schedules. For instance, some allow you to choose your monthly payment date to align with your payday. Others offer the option of bi-weekly payments, which can help you pay off your loan faster and save on interest. Another key feature to look for is the absence of a prepayment penalty. This allows you to pay off your loan ahead of schedule without incurring any extra fees, giving you the freedom to become debt-free sooner if your financial situation improves.

Mini Case Study: Chloe’s Budget-Friendly Repayment Plan

Chloe, a teacher in a suburb of London, UK, took out a personal loan to cover the cost of a professional development course. She was on a tight budget and was concerned about her ability to manage the monthly payments. She chose a lender that allowed her to select a longer loan term of five years, which brought her monthly payment down to a very manageable amount. A year later, she received a pay raise and was able to start making extra payments on her loan. Because her lender did not charge a prepayment penalty, she was able to pay off her loan two years early, saving her hundreds of pounds in interest.

Takeaway: Choosing a lender with flexible terms and no prepayment penalties can provide you with both affordability in the short term and the opportunity for significant savings in the long term.

| Repayment Feature | Benefit for the Borrower | Common Availability |

| Choice of Loan Term | Allows you to balance monthly affordability with total interest cost. | Widespread among most lenders. |

| No Prepayment Penalty | Freedom to pay off the loan early and save on interest. | Standard with most reputable online lenders and many banks. |

| Flexible Payment Date | Align payments with your payday for better cash flow management. | Offered by many leading online lenders and some banks. |

| Bi-weekly Payments | Pay off the loan faster and reduce total interest paid. | More common with credit unions and some Canadian banks. |

Quick Funding and Streamlined Application Process for Fast Cash

When you need money for an urgent expense, the last thing you want is a long, complicated loan application process. Recognizing this need, many lenders, especially online personal loan providers, have developed highly streamlined application processes that can be completed in minutes. This focus on speed and convenience means you can often go from application to funding in as little as 24 to 48 hours. This efficiency is a game-changer for those facing emergencies like unexpected medical bills or urgent home repairs.

The process typically begins with pre-qualification, where you provide some basic financial information to see the rates and terms you might be eligible for. This step usually involves a soft credit check, which does not impact your credit score. If you decide to proceed, you’ll complete a more detailed online application and may need to upload supporting documents like pay stubs or bank statements. Lenders use technology to quickly verify your information and make a credit decision, often within hours or even minutes. Once you are approved and have signed your loan agreement electronically, the funds are typically transferred directly to your bank account via an electronic funds transfer.

Mini Case Study: Mark’s Emergency Home Repair

Mark, a homeowner in a rural part of the US, had his water heater break down in the middle of winter. He needed $3,000 for a replacement but didn’t have the cash on hand. He turned to an online lender and was able to complete the entire application on his smartphone in about 15 minutes. He was approved almost instantly, and the funds were in his bank account the next morning. He was able to hire a plumber and get his new water heater installed without having to endure days without hot water.

Result: The speed of the online loan process allowed Mark to resolve a stressful emergency situation quickly and efficiently, minimizing the disruption to his family’s life.

| Lender Type | Typical Application Time | Typical Funding Time | Document Requirements |

| Online Lenders | 10-20 minutes | 1-3 business days (some same-day) | Digital upload of pay stubs, bank statements, and ID |

| Traditional Banks | 30-60 minutes (online or in-person) | 2-7 business days | May require in-person submission of documents |

| Credit Unions | 20-40 minutes (online or in-person) | 1-5 business days | Similar to banks, they may have options for members |

Eligibility and Credit Requirements for Personal Loan Offers

Understanding the eligibility and credit requirements for personal loans is the first step toward a successful application. While specific criteria vary between lenders, there are several common factors that all providers in the US, UK, Canada, and Australia will assess. The most significant of these is your credit score. A strong credit score demonstrates a history of responsible borrowing and significantly increases your chances of approval, while also qualifying you for the most favorable interest rates. Lenders will also look at your income and employment status to ensure you have a stable and sufficient source of funds to repay the loan.

Your debt-to-income (DTI) ratio is another crucial metric. This is the percentage of your gross monthly income that goes toward paying your monthly debt obligations. A lower DTI ratio is preferred, as it indicates that you are not overextended financially. Other common requirements include being of legal age in your country or province, having a valid bank account, and being a citizen or permanent resident. If your credit score is on the lower end, don’t be discouraged. Some lenders specialize in loans for borrowers with fair or bad credit, though you should expect to pay a higher interest rate.

Mini Case Study: Maria’s Credit Improvement Journey

Maria, a recent graduate in Toronto, Canada, wanted to take out a small personal loan to furnish her new apartment. Her credit score was only fair due to a limited credit history. She was initially offered a loan with a high interest rate. Instead of accepting it, she decided to spend six months focused on building her credit. She made sure to pay her student loan and credit card bills on time every month and kept her credit card balance low. After six months, her credit score had improved by 50 points. She reapplied for a personal loan and was approved at an interest rate that was 4% lower than the initial offer.

Key Tip: Taking the time to improve your credit score before applying for a loan can result in significant savings.

| Credit Score Range (US FICO Score) | Credit Rating | Likelihood of Approval | Typical APR Range |

| 800-850 | Exceptional | Very High | 8% – 12% |

| 740-799 | Very Good | High | 10% – 15% |

| 670-739 | Good | Good | 14% – 20% |

| 580-669 | Fair | Moderate | 18% – 30% |

| 300-579 | Poor | Low | 28% – 36%+ |

Check your eligibility and see what rates you could qualify for today. →

Popular Uses for Personal Loans: Debt, Home Projects, and More

Personal loans are one of the most versatile financial products available, offering a lump sum of cash that can be used for a wide range of purposes. This flexibility is a key reason for their popularity among borrowers in Tier One countries. Unlike a mortgage or an auto loan, a personal loan is not tied to a specific purchase, giving you the freedom to use the funds where you need them most. One of the most common and financially savvy uses is debt consolidation. By taking out a personal loan to pay off multiple high-interest credit cards, you can simplify your finances into a single monthly payment and often secure a lower interest rate, helping you get out of debt faster.

Home improvement projects are another popular use for personal loans. Whether you’re remodeling your kitchen, finishing a basement, or adding a new deck, a personal loan can provide the necessary funds to increase the value and enjoyment of your home. Other common uses include financing major life events like a wedding or a large vacation, covering unexpected medical expenses, making a large purchase like furniture or an appliance, or even helping to fund a small business venture. The key is to have a clear plan for the funds and to ensure that the loan will help you achieve a specific financial goal.

Mini Case Study: The Smith Family’s Home Office

The Smith family, living in a suburb of Manchester, UK, needed a dedicated home office space after both parents started working remotely. They decided to convert their unused attic into a functional office. They took out a £10,000 personal loan to cover the cost of the renovation. The project not only improved their work-life balance but also added an estimated £15,000 to the value of their home. The monthly loan payment was manageable, and they viewed it as a smart investment in their property.

Takeaway: Using a personal loan for a home improvement project can provide a significant return on investment by increasing your home’s equity.

| Common Loan Use | Average Loan Amount | Potential Benefit | Key Consideration |

| Debt Consolidation | $15,000 / £12,000 | Lower interest rate, simplified payments | Avoid running up new credit card debt after consolidation. |

| Home Improvement | $20,000 / £15,000 | Increased home value, improved living space | Ensure the project cost is in line with the value it adds. |

| Medical Expenses | $5,000 / £4,000 | Covers unexpected costs without draining savings | Compare loan costs to other financing options like medical payment plans. |

| Major Purchases | $7,500 / £6,000 | Can be cheaper than retailer financing | Avoid impulse purchases; ensure the item is a necessity. |

| Life Events (e.g., Wedding) | $10,000 / £8,000 | Spreads the cost of a large event over time | Create a strict budget to avoid over-borrowing. |

Online Personal Loan Options with Instant Approval and No Hidden Fees

The rise of online personal loans has revolutionized the lending industry, offering borrowers unprecedented speed, convenience, and transparency. In 2025, the best online lenders provide a user-friendly experience from start to finish, often with “instant approval” decisions, meaning you can find out if you’re approved within minutes of submitting your application. This is made possible by sophisticated algorithms that can quickly assess your creditworthiness based on the information you provide. While the final approval is subject to verification, this initial decision provides a high degree of certainty for borrowers who need to act fast.

A key feature of top-tier online personal loan offers is a commitment to transparency, particularly when it comes to fees. Many of the most reputable online lenders now offer personal loans with no hidden fees. This means no origination fees (a fee charged for processing the loan), no late payment fees (though interest will still accrue), and, most importantly, no prepayment penalties. This “no-fee” structure simplifies the borrowing process and ensures that the APR you are quoted is a true reflection of the loan’s cost. This transparency empowers borrowers to make more informed financial decisions and builds trust between the lender and the customer.

Mini Case Study: Sarah’s Transparent Loan Experience

Sarah, from a city in the US, needed a loan to consolidate some credit card debt. She was wary of hidden fees after a bad experience with a previous loan. She chose an online lender that explicitly advertised “no fees, ever.” The application process was entirely online, and she received an instant decision. The loan offer she received clearly showed her interest rate, her APR (which was the same as her interest rate because there were no fees), and her total repayment amount. She appreciated the transparency and felt confident in her decision.

Result: By choosing a no-fee online lender, Sarah knew the exact cost of her loan upfront and avoided any surprise charges, making her debt consolidation journey much less stressful.

| Feature | Description | Why It’s a Major Plus |

| Instant Decision | An automated, preliminary approval decision is provided within minutes. | Provides immediate feedback and allows for quick planning. |

| No Origination Fees | The lender does not charge a fee for processing and disbursing the loan. | You receive the full loan amount you applied for, maximizing your funds. |

| No Prepayment Penalties | You can pay off your loan early without any financial penalty. | Offers the flexibility to save on interest and become debt-free faster. |

| Fully Online Process | Application, document submission, and signing are all done digitally. | Maximum convenience, can be done from anywhere at any time. |

Compare the Best Personal Loan Offers from Trusted Financial Institutions

When you’re in the market for a personal loan, it’s crucial to compare offers from several trusted financial institutions to ensure you get the best possible terms. Don’t just accept the first offer you receive. By taking the time to compare, you could save hundreds or even thousands of dollars in interest over the life of your loan. The main factors to compare are the Annual Percentage Rate (APR), the loan term, and any associated fees. A lower APR is always better, as it represents a lower total cost of borrowing. Also, consider the lender’s reputation for customer service by reading online reviews from other borrowers.

Pros and Cons of Comparing Lenders

| Pros | Cons |

| Find the Lowest Interest Rate: Comparison shopping is the best way to secure a competitive rate. | Time-Consuming: It can take some time to pre-qualify with multiple lenders. |

| Identify Hidden Fees: You can spot lenders who charge high origination or prepayment fees. | Risk of Multiple Hard Inquiries: Only submit full applications after pre-qualifying to avoid this. |

| Better Loan Terms: You may find a lender offering more flexible repayment options. | Information Overload: Comparing multiple offers can sometimes feel overwhelming. |

Expert Insight: “Using an online loan marketplace can be a very efficient way to compare the best personal loan offers,” says a financial journalist. “These platforms allow you to fill out one simple form and receive pre-qualified offers from multiple lenders at once. This makes it easy to see your options side-by-side and choose the best loan for your needs, all without impacting your credit score.”

Fixed Rate and Low APR Personal Loans That Save You Money

One of the most attractive features of a personal loan is the option to secure a fixed interest rate. With a fixed-rate loan, your interest rate and your monthly payment will remain the same for the entire duration of the loan. This provides predictability and makes it much easier to budget, as you’ll never have to worry about your payment suddenly increasing. In contrast, a variable-rate loan can have a lower introductory rate, but it can fluctuate over time with market conditions, which can be risky. For most borrowers, a fixed-rate loan is the safer and more prudent choice.

Securing a low APR is the key to saving money on a personal loan. The APR is a broader measure of the cost of borrowing than the interest rate alone, as it includes any mandatory fees. To get the lowest possible APR, you’ll need a strong credit score. Before you apply for a loan, take steps to improve your credit, such as paying down credit card balances and ensuring you have a history of on-time payments.

| Loan Feature | What It Is | Why It’s Beneficial |

| Fixed Interest Rate | The interest rate is locked in for the life of the loan. | Provides predictable monthly payments and protects you from rising rates. |

| Low APR | A low Annual Percentage Rate, representing the total cost of borrowing. | Directly reduces the amount of interest you pay, saving you money. |

| No Fees | The lender does not charge origination, late, or prepayment fees. | Simplifies the loan and ensures the APR is as low as possible. |

Expert Insight: “A fixed-rate personal loan is a powerful tool for taking control of your finances,” notes a certified financial planner. “It allows you to turn unpredictable, high-interest debt into a single, manageable payment with a clear end date. This structure and predictability can be a huge psychological boost for anyone on a journey to become debt-free.”

No Fees and No Prepayment Penalties for Flexible Borrowers

In the competitive 2025 lending market, many of the best personal loan offers come with borrower-friendly features like no fees and no prepayment penalties. These features provide a level of flexibility and transparency that can make a significant difference in your overall borrowing experience. A “no-fee” loan means the lender does not charge an origination fee, which is a percentage of the loan amount that some lenders deduct from your funds before you even receive them. This means you get the full amount you applied for.

A “no prepayment penalty” clause is equally important. This gives you the freedom to pay off your loan ahead of schedule without incurring any extra charges. If you receive a bonus at work, a tax refund, or simply find yourself in a better financial position, you can put that extra money toward your loan principal, which will save you money on interest and help you become debt-free faster. Always confirm with a lender that their loans do not have these penalties before you sign any agreement.

| Fee Type | What It Is | Impact on Borrower |

| Origination Fee | A one-time fee for processing the loan, deducted from the loan proceeds. | Reduces the amount of money you actually receive from the loan. |

| Prepayment Penalty | A fee is charged if you pay off your loan before the end of the term. | Discourages early repayment and locks you into paying more interest. |

| Late Payment Fee | A fee is charged if you miss your payment due date. | Increases the cost of the loan and can negatively impact your credit. |

Expert Insight: “The trend toward no-fee personal loans is a huge win for consumers,” says a consumer finance advocate. “It forces lenders to be more transparent and competitive with their interest rates. As a borrower, you should make a no-prepayment-penalty loan a non-negotiable feature. There should never be a penalty for being financially responsible and paying off your debt early.”

How Credit Scores Impact Personal Loan Approval and Interest Rates

Your credit score is arguably the single most important factor that lenders consider when you apply for a personal loan. This three-digit number is a snapshot of your creditworthiness and tells lenders how likely you are to repay your debts. A high credit score indicates a history of responsible borrowing, which makes you a low-risk applicant. As a result, lenders will be more likely to approve your loan application and will offer you their most competitive interest rates.

Conversely, a low credit score signals to lenders that you may be a higher-risk borrower. This can make it more difficult to get approved for a loan, and if you are approved, you will almost certainly be offered a higher interest rate to compensate the lender for the increased risk. In the US, UK, Canada, and Australia, different credit scoring models are used, but the principle remains the same. Understanding how your credit score is calculated and taking steps to improve it can have a profound impact on the cost and availability of credit to you.

| Credit Score Tier (General) | Impact on Approval | Impact on Interest Rate |

| Excellent (e.g., 780+) | Very high chance of approval | Lowest rates available |

| Good (e.g., 680-779) | High chance of approval | Competitive, but not the lowest rates |

| Fair (e.g., 600-679) | Moderate chance of approval | Higher interest rates |

| Poor (e.g., below 600) | Low chance of approval | Highest interest rates, if approved at all |

Expert Insight: “Think of your credit score as your financial GPA,” explains a credit counselor. “It’s a summary of your financial habits. The good news is that, unlike your school GPA, your credit score is not permanent. By consistently paying your bills on time, keeping your credit card balances low, and regularly monitoring your credit report, you can improve your score over time and unlock better financial opportunities, including lower-cost personal loans.”

Home Improvement and Debt Consolidation Loans with ROI Benefits

Using a personal loan for home improvement or debt consolidation can be a very smart financial move that offers a significant return on your investment (ROI). When you use a personal loan for a home improvement project, you are not just making your home more enjoyable to live in; you are often increasing its market value. Projects like kitchen and bathroom remodels, adding a new room, or improving energy efficiency can add significant equity to your home. This means that when you eventually sell, you could recoup much, if not all, of the cost of the loan.

Debt consolidation offers a more immediate and direct ROI in the form of interest savings. If you have multiple high-interest credit cards, the interest charges can feel like a treadmill you can’t get off. By consolidating those balances into a single personal loan with a lower, fixed interest rate, you can save a substantial amount of money each month and over the life of the loan. This allows you to pay off the principal balance much faster, helping you become debt-free sooner.

| Loan Purpose | How It Provides ROI | Example |

| Home Improvement | Increases the market value and equity of your home. | A $20,000 kitchen remodel could add $30,000 to your home’s sale price. |

| Debt Consolidation | Saves you money on interest payments, allowing you to pay off debt faster. | Consolidating $15,000 of credit card debt from 20% APR to a 10% APR loan could save you thousands in interest. |

Expert Insight: “When considering a personal loan for home improvement, focus on projects with the highest ROI,” advises a real estate expert. “Minor kitchen remodels, bathroom updates, and projects that improve curb appeal tend to offer the best bang for your buck. For debt consolidation, the key is to be disciplined. Once you’ve paid off your credit cards with the loan, avoid running up new balances.”

Same-Day Funding and Fast Approval Loans for Urgent Financial Needs

In times of financial emergency, speed is of the essence. Fortunately, the rise of online lenders has made same-day funding and fast approval personal loans a reality for many borrowers. These loans are designed for situations where you need cash immediately, such as for an urgent car repair, an unexpected medical bill, or a last-minute travel need. The application process for these loans is typically entirely online and can be completed in a matter of minutes. Lenders use automated underwriting systems to provide an instant or near-instant decision.

If you are approved, the final steps of verifying your information and signing the loan agreement are also done electronically. Once everything is complete, the lender can initiate a wire transfer to your bank account, and in many cases, you can receive the funds on the same business day you apply, especially if you complete your application early in the day. While this speed is incredibly convenient, be aware that some lenders may charge a premium in the form of a higher interest rate for this expedited service.

| Lender Type | Approval Speed | Funding Speed | Best For |

| Online Lenders | Minutes to hours | Same day to 2 business days | Urgent financial needs, convenience |

| Some Credit Unions | 1-2 business days | 1-3 business days | Members with an emergency need |

| Payday Lenders (Use with Caution) | Minutes | Same day | Very small, short-term emergencies (high cost) |

Expert Insight: “While same-day funding can be a lifesaver in a true emergency, it’s important to read the fine print carefully,” warns a consumer protection advocate. “Ensure that the lender is reputable and that the terms are clear. Avoid the temptation to rush through the agreement. A loan taken out in haste can lead to long-term financial regret if the terms are unfavorable.”

Secured vs Unsecured Personal Loans: Which Is Better for You?

When you seek a personal loan, you’ll encounter two main types: secured and unsecured. An unsecured personal loan is the most common and is not backed by any collateral. Lenders approve these loans based on your creditworthiness, including your credit score, income, and debt-to-income ratio. A secured personal loan, on the other hand, requires you to pledge an asset, such as a car or a savings account, as collateral. Because the lender has an asset to seize if you default, these loans are less risky for them and may be easier to qualify for, especially if you have a lower credit score. They also often come with lower interest rates. The best choice depends on your financial situation and comfort level with pledging an asset.

Checklist: Choosing Between Secured and Unsecured Loans

· Assess Your Credit Score: If it’s high, an unsecured loan is likely your best bet. If it’s low, a secured loan may be more accessible.

· Evaluate Your Assets: Do you have an asset you are willing to use as collateral?

· Compare Interest Rates: A secured loan will likely offer a lower rate, but is the savings worth the risk?

· Consider the Loan Amount: For larger loans, a secured option might be more readily available.

Explore your loan options and find the right fit for your needs. →

Understanding Loan Amounts and Term Options for Maximum Value

Choosing the right loan amount and term is crucial for maximizing the value of your personal loan. You should only borrow what you absolutely need. Taking out a larger loan than necessary will just mean paying more in interest. The loan term—the length of time you have to repay the loan—also has a significant impact on the total cost. A shorter term (e.g., three years) will have higher monthly payments but a lower total interest cost. A longer term (e.g., seven years) will have lower, more manageable monthly payments, but you’ll pay much more in interest over the life of the loan. The key is to find a balance between a monthly payment that fits your budget and a loan term that minimizes the total interest you pay.

Checklist: Selecting Your Loan Amount and Term

· Create a Detailed Budget: Know exactly how much you need to borrow for your specific purpose.

· Use a Loan Calculator: Model different loan terms to see how they affect your monthly payment and total interest cost.

· Choose the Shortest Term You Can Afford: This will save you the most money in the long run.

· Confirm There’s No Prepayment Penalty: This gives you the flexibility to pay it off even faster if you can.

Calculate your potential payments and find the perfect loan term. →

Emergency and Major Expense Loans: What Borrowers Should Know

When faced with an emergency or a major, unexpected expense, a personal loan can be a much better option than a high-interest credit card or a predatory payday loan. These loans provide a lump sum of cash quickly, allowing you to cover costs like medical bills, urgent home repairs, or funeral expenses. When seeking an emergency loan, prioritize lenders that offer fast approval and funding times. Online lenders are often the best choice in these situations. It’s important to remain calm and still take a few moments to compare your options. Even in an emergency, you want to avoid locking yourself into a loan with an exorbitant interest rate.

Checklist: Applying for an Emergency Loan

· Get a Clear Estimate of the Cost: Know exactly how much you need to borrow.

· Prioritize Lenders with Fast Funding: Look for online lenders that advertise same-day or next-day funding.

· Pre-qualify if Possible: Even a quick comparison can save you money.

· Read the Fine Print: Understand the terms, even if you are in a hurry.

· Have a Repayment Plan: Know how you will fit the new loan payment into your budget.

Get fast access to funds for your emergency needs. →

Auto and Medical Personal Loan Offers: How to Get the Best Deal

Personal loans can be an excellent way to finance a vehicle purchase or cover medical expenses. For a car purchase, a personal loan can sometimes offer a better interest rate than the financing offered at a dealership, especially if you have good credit. It also gives you the negotiating power of a cash buyer. When it comes to medical expenses, a personal loan can help you consolidate multiple bills into one manageable payment and may offer a lower interest rate than a medical credit card or a payment plan through the provider’s office. To get the best deal, you should compare offers from multiple lenders, including online lenders, banks, and credit unions.

Checklist: Getting the Best Deal on a Niche Loan

· Get Pre-approved Before You Shop: This is especially important for auto loans.

· Compare the APR, Not Just the Interest Rate: This gives you the true cost of the loan.

· Negotiate with Your Medical Provider: See if they can offer a discount for paying in cash before you take out a loan.

· Read Customer Reviews: See what other borrowers’ experiences have been with the lender.

· Check for Special Promotions: Some lenders may have special offers for auto or medical financing.

Compare specialized loan offers for your auto or medical needs. →

Digital Account Management and Online Tools for Loan Tracking

In today’s digital world, the ability to manage your personal loan online is a standard feature offered by most top lenders. This includes access to a secure online portal or a mobile app where you can view your loan balance, see your payment history, make payments, and update your personal information. Many lenders also offer helpful online tools, such as payment calculators that allow you to see how making extra payments could affect your loan payoff date and total interest saved. These digital tools provide convenience and empower you to stay on top of your loan and manage your finances more effectively.

Checklist: Evaluating a Lender’s Digital Tools

· Check for a Mobile App: Does the lender have a well-rated app for iOS and Android?

· Explore the Online Portal: Is it easy to navigate and find the information you need?

· Look for Budgeting Tools: Do they offer resources to help you manage your finances?

· Confirm Online Payment Options: Can you easily set up automatic payments or make one-time payments online?

· Assess Customer Support Options: Can you access support through the app or portal via chat?

Choose a lender with the modern tools you need to manage your loan. →

Promotions and Exclusive Member Benefits on Personal Loan Offers

To stand out in a crowded market, many lenders offer special promotions and exclusive member benefits on their personal loan offers. These can include a temporary reduction in the interest rate, a waived origination fee, or even a cash bonus upon funding. Credit unions are particularly known for offering member benefits, which can include rate discounts for having other products with them or for setting up direct deposit. Some online lenders also have member communities that offer benefits like free financial coaching, career advice, or networking opportunities. When comparing loan offers, be sure to factor in the value of any promotions or exclusive benefits.

Checklist: Finding the Best Loan Promotions

· Check the Lender’s Website for Current Offers: Promotions are often listed on the personal loan page.

· Ask About Relationship Discounts: If you’re an existing customer of a bank or credit union, inquire about loyalty benefits.

· Look for Autopay Discounts: Many lenders offer a rate reduction of 0.25% to 0.50% for enrolling in automatic payments.

· Compare Welcome Bonuses: Some lenders may offer a cash bonus for new borrowers.

· Factor in Non-Monetary Benefits: Consider the value of services like financial coaching.

Don’t miss out on special offers. Check for promotions now. →

Application Steps for Personal Loan Offers: From Prequalification to Funding

The personal loan application process has become remarkably streamlined. It typically starts with pre-qualification, where you provide basic information to see potential rates without affecting your credit score. If you choose an offer, you’ll proceed to the full application, which requires more detailed financial information and supporting documents like pay stubs and ID. The lender then verifies your information and performs a hard credit check. Upon final approval, you’ll receive a loan agreement to sign electronically. Once signed, the lender will disburse the funds directly to your bank account, often within one to three business days.

Prequalification and Rate Estimates Without Affecting Your Credit

Prequalification is a borrower’s best friend. This initial step allows you to shop around for the best personal loan offers without any negative impact on your credit score. Lenders use a soft credit inquiry to review your credit profile and provide you with a rate and term estimate. This allows you to compare potential offers from multiple lenders side-by-side, empowering you to choose the most competitive loan before you commit to a full application. It’s a risk-free way to gauge your eligibility and see what rates you can expect.

Repayment Plans and Flexible Schedules Explained by Experts

Experts agree that a good repayment plan is one that fits comfortably within your budget. Most personal loans have fixed monthly payments, making them easy to plan for. The most common repayment feature is the ability to choose your loan term, typically between two and seven years. A shorter term saves you money on interest but has higher monthly payments, while a longer term is more affordable monthly but costs more overall. Many lenders also offer the flexibility to change your payment date or make bi-weekly payments, which can help you pay off the loan faster.

Comparing Bank vs Online Personal Loan Offers Across Tier One Countries

In the US, UK, Canada, and Australia, both banks and online lenders offer competitive personal loans. Online lenders often have a slight edge in terms of speed, convenience, and sometimes lower rates due to their lower overhead. They are an excellent choice for tech-savvy borrowers who need funds quickly. Banks and credit unions, however, offer the benefit of in-person service and may provide relationship discounts to existing customers. If you have a complex financial situation or prefer face-to-face interaction, a traditional bank or credit union might be a better fit.

| Feature | Online Lenders | Banks & Credit Unions |

| Speed | Faster (often 1-3 days) | Slower (often 2-7 days) |

| Convenience | High (fully online) | Lower (may require branch visit) |

| Rates | Highly competitive | Competitive, especially for members |

| Service | Digital (chat, email) | In-person, personalized |

Funding Timeline and Process Overview: How Long Does It Take?

The funding timeline for a personal loan can vary significantly, from the same day to over a week. Online lenders are typically the fastest, with many able to get funds into your account within one to three business days of approval. Some even offer same-day funding if the application is completed early in the day. Traditional banks and credit unions may take a bit longer, often between two and seven business days, as their verification process can be more manual. The key to a fast funding process is to have all your required documents ready and to respond promptly to any requests from the lender.

Customer Support and Assistance Options for Personal Loan Applicants

Excellent customer support can make the borrowing process much smoother. Look for lenders that offer multiple channels for assistance, including phone, email, and live chat. Many lenders also have extensive FAQ sections on their websites that can answer common questions. Before you apply, it can be a good idea to test out their customer service by asking a few questions. The responsiveness and quality of their support can be a good indicator of the kind of service you will receive as a customer throughout the life of your loan.

Federal Reserve Report (US): ‘Current Interest Rates and APR Trends for 2025’

According to the latest reports tracking 2025 financial trends, personal loan interest rates in the US have remained relatively stable, with a slight upward trend in response to broader economic factors. The Federal Reserve’s current stance suggests that well-qualified borrowers with excellent credit (scores of 760 and above) can expect to find unsecured personal loan APRs starting in the 8% to 12% range. Borrowers with good credit may see rates from 13% to 20%. The report emphasizes the growing gap in rates offered to prime and subprime borrowers, making it more important than ever for consumers to focus on improving their creditworthiness before applying for new credit.

Financial Expert Insight (UK): ‘Eligibility Criteria and Smart Qualification Tips’

A leading financial expert in the UK advises that lenders are placing increased emphasis on affordability checks in 2025. “Beyond a good credit history, lenders want to see a stable income and a healthy debt-to-income ratio,” she states. “To improve your chances of qualifying for the best offers, consolidate your financial documents before you apply. Have at least three months of payslips and bank statements ready. Also, ensure you are on the electoral roll at your current address, as this is a simple but crucial step for identity verification that many applicants overlook.”

Canadian Loan Advisor: ‘Use Payment Calculators for Better Budget Planning’

A prominent Canadian loan advisor stresses the importance of using online payment calculators before accepting any personal loan offer. “These tools are invaluable for understanding the true cost of a loan,” he explains. “You can input different loan amounts, interest rates, and term lengths to see how the monthly payment changes. This allows you to find a payment that genuinely fits your budget, preventing you from over-borrowing or agreeing to a payment that will strain your finances. A smart loan is an affordable loan, and a calculator is your best tool for ensuring affordability.”

Industry Guide: ‘Loan Terms and Conditions Simplified for Borrowers’

A new industry guide aimed at simplifying finance for consumers breaks down key loan terms. The guide highlights the importance of understanding the difference between a fixed and variable rate, noting that fixed rates offer stability and are preferable for most borrowers. It also explains the Annual Percentage Rate (APR), clarifying that it represents the total annual cost of borrowing, including fees, and is therefore a more accurate comparison point than the interest rate alone. Finally, it strongly advises borrowers to look for loans with no prepayment penalties, which provides the flexibility to pay off the debt early without extra charges.

Verified Customer Testimonials: ‘Top-Rated Personal Loan Offers Reviewed’

An analysis of verified customer testimonials from 2025 reveals a clear preference for lenders who offer a combination of competitive rates, a seamless online application process, and responsive customer service. One top-rated online lender was consistently praised for its “no-fee” structure and fast funding times. A national credit union received high marks for its personalized service and for offering relationship discounts to its members. The reviews consistently show that while a low rate is the primary driver, borrowers highly value transparency and a positive customer experience.

Finance Authority Tip: ‘Maximize Your Loan Benefits and Minimize Interest Costs’

A tip from a national finance authority recommends a simple strategy to maximize loan benefits and minimize costs: “Always choose the shortest loan term with a monthly payment you can comfortably afford. While a longer term offers a lower payment, it dramatically increases the total interest you pay. Additionally, once you have the loan, enroll in automatic payments, as many lenders offer a rate discount of 0.25% or more for doing so. This small discount can add up to significant savings over the life of the loan.”

FAQ

Capital One personal loan: How to Apply and Qualify in 2025

As of 2025, Capital One is not offering new personal loans to customers. The company has shifted its focus to its core credit card and auto financing products. If you are an existing Capital One personal loan customer, you can continue to manage your account through their online portal. For new borrowers seeking a personal loan, it is necessary to explore other options. Many reputable lenders, including SoFi, Wells Fargo, and numerous online platforms like LendingClub and Upstart, offer competitive personal loans with a wide range of terms and rates. Always compare multiple lenders to find the best offer for your financial situation.

Personal loans for good and bad credit borrowers

Borrowers with good credit (typically a score of 670 or higher) will find a wide array of personal loan options with competitive interest rates and favorable terms from banks, credit unions, and online lenders. For those with bad credit (a score below 600), options are more limited, but still available. Lenders like Avant, OneMain Financial, and some credit unions specialize in loans for this demographic. Be prepared for higher interest rates and potentially more fees to offset the lender’s risk. Improving your credit score before applying is the most effective way to secure a better loan offer.

Personal loan companies offering the lowest interest rates

The personal loan companies offering the lowest interest rates are typically reserved for borrowers with excellent credit scores (760 and above). Online lenders like SoFi and LightStream are known for their highly competitive rates and no-fee structures. Credit unions are another excellent source for low-interest loans, as their non-profit status often allows them to offer better rates than traditional banks. To find the absolute lowest rate for your profile, it is essential to use a loan comparison tool to get pre-qualified offers from multiple lenders. Also, consider a secured loan if you have collateral, as this can often result in a lower interest rate.

Wells Fargo personal loan: Rates, Terms, and Benefits

Wells Fargo offers unsecured personal loans with competitive fixed interest rates, particularly for existing customers with a good banking history. Loan amounts typically range from $3,000 to $100,000, with repayment terms from one to seven years. As of 2025, their APRs for well-qualified borrowers are competitive with other major banks. A key benefit of a Wells Fargo loan is the potential for a relationship discount on your interest rate if you are an existing customer. They also have a large network of physical branches, which is appealing for those who prefer in-person service. To qualify, you will generally need a good to excellent credit score and a stable income.

How to get a personal loan from a bank quickly

To get a personal loan from a bank quickly, start by leveraging any existing relationships you have. If you are already a customer, the bank will have your financial history, which can speed up the application and verification process. Many banks now offer online applications, which are significantly faster than applying in person. Before you apply, gather all necessary documents, such as your last two pay stubs, recent bank statements, and a government-issued ID. Applying online early in the business day can also increase the chances of a faster decision and funding.

Best personal loans for home renovation and debt consolidation

The best personal loans for home renovation and debt consolidation typically come from lenders that offer large loan amounts, competitive fixed rates, and no prepayment penalties. For home renovations, a personal loan is a great option for projects that don’t require tapping into home equity. For debt consolidation, the key is to find a loan with an APR that is significantly lower than the average APR of the debts you are paying off. Online lenders like SoFi and LightStream are excellent for both purposes, often offering loans up to $100,000 with low rates for qualified borrowers.

Chase Personal Loans: Application Process and Eligibility

Currently, Chase Bank does not offer personal loans to new customers. They focus on other credit products like mortgages, auto loans, and their extensive line of credit cards. If you are a Chase customer looking for a personal loan, you will need to seek financing from other institutions. Many national banks, such as Wells Fargo and Citibank, as well as a plethora of online lenders and credit unions, are available alternatives. Always check a bank’s current product offerings on its official website, as these can change over time.

Apply for a personal loan online with an instant decision.

To apply for a personal loan online with an instant decision, start by researching online lenders known for their fast processing times, such as LightStream, SoFi, or Upstart. The application process is designed for speed. You will begin by filling out a pre-qualification form with basic personal and financial details. This triggers a soft credit check that does not affect your score and results in a preliminary offer and an “instant decision” within minutes. If you accept the offer, you will proceed to a full application, upload necessary documents, and agree to a hard credit check. If everything is verified, you can often receive funding in as little as one business day.