Best Personal Loan Companies in the US, UK, Canada & Australia. Compare top lenders for low rates, instant approval, and quick funding today!

Navigating the world of personal loans can feel like searching for a needle in a haystack. Whether you need to consolidate high-interest credit card debt, finance a major home improvement project, or cover an unexpected emergency, the number of personal loan companies to choose from is staggering. This abundance of choice often leads to confusion and anxiety. How do you know which lender offers the best rates? Who can you trust to provide fast funding without hidden fees? The fear of making the wrong decision can be paralyzing, causing many borrowers to either stick with their familiar but often expensive local bank or accept a subpar offer, costing them thousands over the life of the loan.

This is where clarity becomes your most powerful tool. We’ve done the heavy lifting for you, researching and evaluating the top personal loan companies across the US, UK, Canada, and Australia for 2025. Our comprehensive guide cuts through the noise, providing a clear comparison of the best lenders based on what matters most: competitive interest rates, transparent fee structures, fast funding speeds, flexible terms, and outstanding customer service. We promise to equip you with the insights and confidence needed to compare leading online personal loan providers, understand your financing options, and select the perfect company to meet your financial goals quickly and affordably.

Best Personal Loan Lenders of 2025: Compare Rates, Reviews & Offers

Choosing the right personal loan company is the most critical decision in your borrowing journey. The “best” lender isn’t just the one with the flashiest advertisement; it’s the one that provides the most value through a combination of a low Annual Percentage Rate (APR), minimal fees, flexible repayment options, and a positive customer experience. As of October 2025, the online lending space is dominated by companies that leverage technology to offer a faster, more transparent, and often cheaper alternative to traditional banking. These top-tier lenders compete fiercely for your business, which means savvy borrowers who compare their options are in the best position to save money.

Mini Case Study:

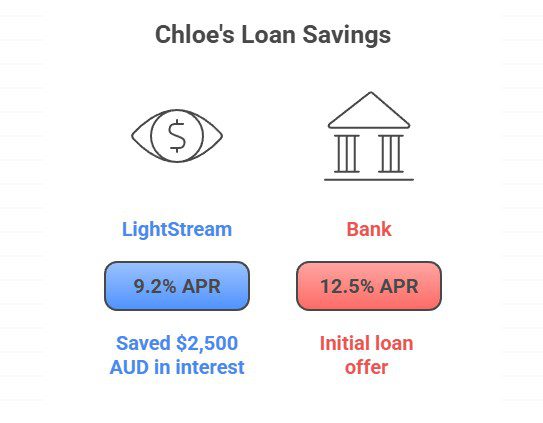

Chloe, a marketing manager in Sydney, Australia, needed a $25,000 AUD loan to consolidate credit card debt. Her initial instinct was to go to her long-time bank. They offered her a loan at 12.5% APR. Before accepting, she decided to compare offers online. She received pre-qualified rates from SoFi (9.8% APR) and LightStream (9.2% APR). She also read customer reviews, noting that both online lenders were highly praised for their speed and easy-to-use platforms. By looking beyond her bank, she found a significantly better deal.

Key Result → Chloe chose LightStream and saved over $2,500 AUD in interest over a five-year term compared to her bank’s initial offer. This demonstrates the immense value of comparison shopping.

The table below provides a snapshot of 2025’s leading personal loan companies.

Top Personal Loan Lenders of 2025 at a Glance

| Lender | Typical APR Range | Loan Amounts (USD Equivalent) | Min. Recommended Credit Score | Best For… |

| LightStream | 6.99% – 25.49% | $5,000 – $100,000 | 680 (with strong credit history) | Excellent credit borrowers seeking the lowest rates and no fees. |

| SoFi | 8.99% – 25.81% | $5,000 – $100,000 | 680 | Good-to-excellent credit borrowers wanting member perks and financial wellness tools. |

| Discover | 7.99% – 24.99% | $2,500 – $40,000 | 660 | Borrowers who prioritize a completely fee-free loan and strong customer support. |

| Upstart | 7.80% – 35.99% | $1,000 – $50,000 | 600 | Borrowers with fair credit or thin credit files, as their model considers non-traditional factors. |

| BHG Financial | Varies by partner | $20,000 – $500,000+ | 660 | Professionals and high-income earners seeking large loan amounts for business or personal use. |

Remember, the best lender for you depends entirely on your credit profile, loan purpose, and financial needs.

Average Personal Loan Interest Rates in the US, UK, Canada, and Australia

Understanding the current landscape of personal loan interest rates is essential to knowing whether you’re being offered a competitive deal. As of October 2025, rates across Tier One markets remain influenced by the policies of their respective central banks—the U.S. Federal Reserve, the Bank of England, the Bank of Canada, and the Reserve Bank of Australia. While a period of rate stabilization has created a competitive environment among lenders, your personal credit score remains the single most dominant factor in determining the rate you’ll receive.

Mini Case Study:

Mark, a teacher in the UK with a “good” credit profile, received a personal loan offer for £10,000 at 9.5% APR. He was unsure if this was a good deal. He researched the average personal loan rates in the UK for his credit tier and discovered that the typical range was between 10% and 15%. This knowledge gave him immediate confidence that the 9.5% APR offer was not only fair but highly competitive. He accepted the loan, knowing he had secured a rate better than the national average.

Key Takeaway → Benchmarking a loan offer against the average rate for your credit score is the quickest way to validate that you are getting a fair price.

Lenders use risk-based pricing, meaning applicants with higher credit scores receive lower rates. Below is an illustrative breakdown of average APRs based on credit score.

Average Personal Loan APR by Credit Score (Tier One Markets, October 2025)

| Credit Score Tier | Credit Score Range (FICO Equivalent) | Average APR Range (%) | Borrower Profile |

| Excellent | 720 – 850 | 7% – 12% | Seen as very low risk; qualifies for the best rates from top lenders. |

| Good | 690 – 719 | 12% – 18% | Seen as a reliable borrower, qualifies for competitive rates from most lenders. |

| Fair | 630 – 689 | 18% – 26% | Seen as moderate risk; may qualify with online lenders or those specializing in this tier. |

| Poor / Bad Credit | Below 630 | 26% – 36% | Seen as high risk, options are limited to specialized lenders, and rates are high. |

These ranges provide a valuable baseline. If you have excellent credit and are being offered a rate in the “Fair” credit range, you know you should continue shopping for a better deal.

How Personal Loans Affect Your Credit Score and Financial Standing

Taking out a personal loan is a significant financial step that has both immediate and long-term effects on your credit score. Understanding this impact allows you to use a personal loan not just as a source of funds, but as a potential tool for building a stronger credit profile over time. The effect is twofold: a small, temporary dip at the beginning, followed by a substantial potential for a long-term boost if managed responsibly.

Mini Case Study:

David, from Toronto, Canada, had a credit score of 680. He took out a $15,000 CAD personal loan to consolidate $12,000 of high-interest credit card debt.

· Initial Impact (Month 1): His score dropped to 672. This was due to the lender’s hard credit inquiry and the new loan account lowering the average age of his credit.

· Positive Turnaround (Month 3): After the loan paid off his credit cards, his credit utilization ratio plummeted from 85% to 0%. This significant positive change caused his score to jump to 710.

· Long-Term Boost (Month 12): After a year of consistent, on-time payments on the personal loan, his score climbed to 735.

Key Result → By using the personal loan strategically for debt consolidation, David’s credit score increased by 55 points in one year, opening up access to better financial products in the future.

This table breaks down the specific impacts on your credit score.

Impact of a Personal Loan on Your Credit Score Over Time

| Timeframe | Potential Impact | Reason(s) |

| During Application | -5 points (temporary) | The lender performs a “hard inquiry” to review your credit report when you submit a full application. |

| Upon Approval | -5 to -10 points (temporary) | A new loan account is added, which lowers the average age of your credit accounts. |

| First 1-6 Months | +10 to +40 points (if used for consolidation) | Paying off revolving debt (credit cards) drastically lowers your credit utilization ratio, a major factor in your score. |

| Throughout the Loan Term | Steady Increase | Each on-time payment builds a positive payment history, the most important factor in your credit score. It also improves your “credit mix.” |

A well-managed personal loan demonstrates to lenders that you can handle different types of credit responsibly, which is a hallmark of a low-risk borrower.

Check your credit score for free to see your starting point → [Get My Free Credit Score]

Fast Online Personal Loans and Same-Day Funding Options for Tier One Borrowers

In today’s fast-paced world, some financial needs can’t wait. Whether it’s an urgent car repair in the US, an emergency medical expense in Australia, or a time-sensitive business opportunity in the UK, the speed at which you can access funds is often as important as the interest rate. Top online personal loan companies have revolutionized the lending industry by dramatically shortening the timeline from application to funding. By leveraging advanced automation and data verification technology, many lenders can now approve applicants and disburse funds in as little as 24 hours, with some even offering same-day funding.

Mini Case Study:

Sophia, an architect in Toronto, Canada, experienced a major plumbing leak in her home on a Tuesday morning. The estimated repair cost was an immediate $8,000 CAD. She didn’t have enough in her emergency fund and wanted to avoid using a high-APR credit card. At 9:30 AM, she applied for a personal loan with a well-known online lender that advertised fast funding. She completed the application and uploaded her documents from her phone in 20 minutes. The lender’s system automatically verified her income by linking to her bank. She was approved by 1:00 PM and e-signed her loan agreement. The $8,000 was in her bank account before she went to bed that night.

Key Result → Sophia secured the emergency funds she needed in less than 12 hours, allowing her to pay the plumbers immediately and prevent further damage to her home.

This incredible speed is a key differentiator for online lenders compared to traditional banks.

Fastest Personal Loan Companies (October 2025)

| Lender | Typical Funding Time | Key Feature for Speed | Best For… |

| LightStream | As soon as the same business day | Fully digital, streamlined application process for highly qualified borrowers. | Applicants with excellent credit who need large loan amounts quickly. |

| SoFi | Same day to 2 business days | Efficient online verification and a focus on a seamless digital experience. | Borrowers with good credit need fast access to funds for debt consolidation or other goals. |

| Upstart | As soon as the next business day | An AI-powered underwriting model that can provide instant decisions for many applicants. | Applicants with fair credit who need a quick decision and funding process. |

| Discover | As soon as the next business day | Well-established online infrastructure and a clear, step-by-step application. | Borrowers who want a balance of speed, no fees, and reliable customer support. |

To maximize your chances of fast funding, apply early on a business day and have all your required documents ready for immediate upload.

Eligibility Requirements and Application Process for Leading Personal Loan Companies

While leading personal loan companies have made their application processes remarkably simple, they still have strict eligibility requirements to manage their lending risk. Understanding these criteria before you apply is crucial for a successful outcome. Although specific thresholds can vary between lenders in the US, UK, Canada, and Australia, the core requirements are consistent across the board. Meeting these standards demonstrates to lenders that you are a reliable borrower with the capacity to repay your loan.

Mini Case Study:

Liam, a U.S. citizen preparing to apply for his first personal loan, decided to get organized first. He knew lenders would check his credit, so he used a free service to check his FICO score, which was a solid 710. He gathered his required documents: his driver’s license, his last two pay stubs from work, and his Social Security number. He also calculated his debt-to-income (DTI) ratio and found it was a healthy 32%. Because he was prepared, Liam was able to complete the online pre-qualification and subsequent full application in under 20 minutes, with no need to stop and search for information.

Key Takeaway → Preparation is key. Having your financial information and documents ready before you start the application makes the process faster and smoother.

Here’s a breakdown of what you’ll need and the steps you’ll take.

Personal Loan Application Checklist

| Requirement | What You Need | Why It’s Needed by Lenders |

| Good Credit Score | Typically, a FICO score of 660 or higher (or equivalent). Top rates are reserved for 720+. | To assess your history of repaying debt and predict your future reliability. |

| Verifiable Income | Recent pay stubs, tax returns, or bank statements showing consistent income. | To confirm you have a stable source of funds and the financial means to make monthly payments. |

| Low Debt-to-Income (DTI) Ratio | A DTI of 43% or lower is preferred. This is your total monthly debt divided by your gross monthly income. | To ensure you have enough cash flow to comfortably afford a new loan payment without becoming overextended. |

| Proof of Identity & Residency | A valid government-issued photo ID (driver’s license, passport) and proof of address (utility bill). | To verify you are who you say you are and to comply with anti-fraud and “Know Your Customer” regulations. |

| Bank Account | An active checking account in your name. | For the lender to deposit the loan funds and for you to set up loan repayments. |

The Application Process is typically five steps:

1. Pre-qualification: Fill out a short form with a soft credit check to see potential rates.

2. Choose an Offer: Select the best lender and loan term from your pre-qualified options.

3. Full Application: Submit a detailed application, authorizing a hard credit check.

4. Verification: The lender verifies your identity, income, and employment.

5. Sign & Fund: Review and e-sign your final loan agreement, and the funds are deposited into your account.

H2: Alternatives to Personal Loans and Smart Refinancing Options for 2025

While personal loans are an incredibly versatile financial tool, they aren’t always the perfect solution for every situation. Exploring alternatives can sometimes reveal a more suitable or cost-effective option for your specific needs. Additionally, for those who already have a personal loan, the strategy of refinancing has become a popular way to improve financial standing in 2025.

Mini Case Study:

Emily, from a suburb of Chicago, needed $6,000 for a dental procedure. She considered a personal loan, and her pre-qualified offers were around 11% APR. However, she also received a promotional offer in the mail for a new credit card with 0% APR for the first 18 months. Since she was confident she could pay off the $6,000 within that 18-month window, she chose the credit card. For her specific situation—a manageable amount she could pay off quickly—the 0% APR offer was cheaper than a personal loan.

Key Takeaway → The “best” financing option depends on the amount you need and how quickly you can repay it. For short-term debt, a 0% APR card can be ideal; for long-term, structured payments, a personal loan is superior.

Here’s a comparison of common alternatives.

Personal Loans vs. Alternatives

| Option | Best For… | Key Risk |

| Personal Loan | Large, planned expenses ($5k-$100k) needing structured, fixed payments over several years (e.g., debt consolidation, home renovation). | Interest costs can be significant if you have fair or poor credit. |

| 0% APR Credit Card | Smaller expenses (under $10k) that you can confidently pay off in full during the introductory period (typically 12-21 months). | If you don’t pay it off in time, you’ll be hit with a very high standard interest rate (often 20%+). |

| Home Equity Line of Credit (HELOC) | Large, ongoing home improvement projects where you need to draw funds over time. Offers very low interest rates. | Your home is used as collateral, so you risk foreclosure if you cannot make the payments. The rate is often variable. |

| Balance Transfer Credit Card | Consolidating a moderate amount of credit card debt. Often comes with a 0% APR period and a one-time transfer fee (3-5%). | The transfer fee can be costly, and you need good credit to qualify for the best offers. |

Smart Refinancing for 2025

For those who already have a personal loan but have since improved their credit score, refinancing is a powerful strategy. It involves taking out a new personal loan at a lower interest rate to pay off your existing one. If your credit score has jumped by 50 points or more since you first borrowed, you could lower your APR by several percentage points, saving you hundreds or thousands of dollars.

What Can You Use a Personal Loan For? Real-Life Applications and ROI

A personal loan is one of the most flexible forms of credit available. Unlike an auto loan or a mortgage, the funds from an unsecured personal loan can be used for almost any legitimate purpose. This versatility makes them an ideal solution for a wide range of planned and unplanned expenses. Top personal loan companies allow you to consolidate debt, finance home improvements, cover medical bills, pay for a wedding, or fund a major purchase. The key is to use the loan for a purpose that improves your financial situation or helps you achieve a significant life goal.

Thinking about the Return on Investment (ROI) of a personal loan can help you borrow smartly. For example, using a loan for debt consolidation provides a clear ROI: if you consolidate credit cards with a 22% average APR into a personal loan at 9% APR, your return is the 13% interest spread you save. Similarly, a home improvement loan that funds a kitchen remodel can increase your property’s value, providing a tangible financial return. Even using a loan for education or career certification can yield a higher income down the line.

Expert Insight: “The smartest borrowers view a personal loan not as ‘extra money,’ but as a strategic investment in their financial health or personal growth,” notes UK financial advisor Emily Clarke. “Whether that investment is in lowering their interest burden or improving their home, there should always be a clear, positive outcome.”

Common uses include:

· Debt Consolidation: The most popular use, simplifying finances and saving on interest.

· Home Improvement: Funding renovations without tapping into home equity.

· Medical Expenses: Covering procedures or bills not covered by insurance.

· Major Purchases: Financing weddings, vacations, or large appliances with a structured payment plan.

· Emergency Funding: Handling unexpected events like car repairs or job loss.

Loan Amounts and Terms Explained for Better Budget Planning

Understanding the relationship between loan amounts, loan terms, and your monthly payment is fundamental to responsible borrowing. Personal loan companies offer a wide range of options to fit different needs, and choosing the right combination is essential for your budget.

Loan Amounts: Top online lenders typically offer personal loans ranging from as little as $1,000 up to $100,000 (or the local equivalent in the UK, Canada, and Australia). The amount you qualify for depends on your creditworthiness, income, and existing debt. It is crucial to borrow only what you truly need. Taking on a larger loan than necessary will increase your monthly payment and the total interest you pay.

Loan Terms: The loan term is the period over which you’ll repay the loan. Standard terms range from 24 to 84 months (2 to 7 years). This choice creates a critical tradeoff:

· Shorter Term (e.g., 3 years): Results in higher monthly payments but significantly less total interest paid. This is the most cost-effective option.

· Longer Term (e.g., 5-7 years): Results in lower, more affordable monthly payments but a much higher total interest cost.

The chart below shows the impact of changing the term on a $15,000 loan at a 10% APR.

(Imagine a simple bar chart here. The X-axis has three sets of bars for 3-Year, 5-Year, and 7-Year terms. For each term, there are two bars: one for “Monthly Payment” and one for “Total Interest Paid.” The 3-Year term has the highest monthly payment bar but the lowest total interest bar. The 7-Year term has the lowest monthly payment bar but the highest total interest bar.)

Use a loan calculator to find the shortest term with a monthly payment that fits comfortably in your budget.

Debt Consolidation with Personal Loans: Save More and Simplify Repayments

Debt consolidation remains one of the most powerful and popular uses for a personal loan. The strategy is simple: you take out a single, fixed-rate personal loan to pay off multiple, high-interest, variable-rate debts—most commonly credit cards. This approach offers two major benefits: saving money and simplifying your financial life. By securing a personal loan with an APR that is lower than the average APR of your credit cards, you can dramatically reduce the amount of interest you pay, allowing you to get out of debt faster.

Instead of juggling multiple payments with different due dates and interest rates, you’ll have just one predictable monthly payment to manage. This simplification reduces stress and makes it easier to budget. Many top personal loan companies, such as Discover and SoFi, even offer to send the loan funds directly to your creditors, which streamlines the process and removes the temptation to spend the money elsewhere. For the strategy to be successful, however, you must commit to not running up new balances on the credit cards you’ve just paid off.

Expert Insight: “A debt consolidation loan is a fantastic tool, but it’s not a magic wand,” says a Canadian Credit Bureau analyst. “It restructures your debt into a more manageable form, but the borrower must also address the spending habits that led to the debt in the first place for long-term success.”

Pros and Cons of Debt Consolidation

| Pros | Cons |

| ✅ Lower Interest Rate: Can save you thousands of dollars. | ❌ Potential Origination Fees: Can add to the cost of the loan if you don’t choose a no-fee lender. |

| ✅ Simplified Payments: One fixed payment is easier to track. | ❌ Requires Discipline: You must avoid accumulating new credit card debt. |

| ✅ Fixed Payoff Date: Provides a clear timeline for becoming debt-free. | ❌ May Extend Repayment: A longer term can lower payments but increase total interest paid over time. |

| ✅ Potential Credit Score Boost: Lowering credit card utilization can significantly improve your score. | ❌ Approval Not Guaranteed: You need good enough credit to qualify for a low-rate consolidation loan. |

Home Improvement and Major Expense Financing Made Easy

Using a personal loan to finance home improvements or other major life expenses offers a structured and predictable way to manage costs. For home renovations, a fixed-rate personal loan provides a lump sum of cash upfront. This is ideal for projects with a known budget, such as a bathroom remodel or window replacement. It allows you to pay contractors and purchase materials without draining your savings. Unlike a home equity line of credit (HELOC), an unsecured personal loan doesn’t require you to use your house as collateral, which is a significant advantage for many homeowners.

The same logic applies to other large, one-time expenses like a wedding, a dream vacation, or significant medical bills. Instead of putting a $20,000 wedding on a high-interest credit card where the balance can linger for years, a personal loan with a 5-year term creates a clear path to repayment. You know exactly what your monthly payment will be and precisely when the debt will be paid off. This financial discipline prevents a celebratory event from turning into a long-term financial burden. Top personal loan companies have made the application and funding process so fast that you can get the cash you need for these major expenses in just a few days.

Understanding Prepayment and Fees: Avoid Hidden Charges

A low interest rate is attractive, but a great loan offer can be soured by hidden fees. The best personal loan companies are transparent about their costs, with many top-tier lenders now offering loans with no fees at all. It’s crucial to read the fine print and understand the potential charges before you sign a loan agreement.

The most common fee to watch for is an origination fee. This is a one-time charge to process your loan, typically ranging from 1% to 8% of the total loan amount. The lender deducts this fee from the funds you receive. For example, on a $10,000 loan with a 5% origination fee, you would only get $9,500. Always compare loans using the APR, which includes this fee.

Another important feature is the prepayment penalty. This is a fee some lenders charge if you pay off your loan ahead of schedule. Reputable online lenders like LightStream, SoFi, and Discover have no prepayment penalties, giving you the flexibility to pay off your debt faster and save on interest without any extra cost. Finally, be aware of late payment fees, which are standard on most loans.

Expert Insight: “A ‘no-fee’ personal loan is the gold standard for transparency,” says a leading financial expert. “Companies like Discover and Marcus have built their reputation on this model. When you see an APR from them, you know that’s the true, all-in cost, which simplifies the comparison process immensely for borrowers.”

How Long Does It Take to Get a Personal Loan Approved in Tier One Markets

The time it takes to get a personal loan approved and funded has decreased dramatically thanks to the efficiency of online lenders. In the US, UK, Canada, and Australia, the entire process can now be completed in just a few business days, a stark contrast to the weeks it might have taken at a traditional bank in the past.

The timeline can be broken into three main stages:

1. Pre-qualification and Application (15-30 minutes): This initial step is nearly instantaneous. You can fill out a short online form and receive pre-qualified offers from multiple lenders in minutes. Completing the full application with your chosen lender typically takes less than half an hour if you have your documents ready.

2. Verification and Underwriting (1-2 business days): This is the core of the approval process. The lender’s team (or automated system) verifies your identity, income, and employment, and performs a hard credit check. For a straightforward application, this can be completed in a single business day.

3. Final Approval and Funding (1-2 business days): Once your information is verified, you’ll receive a final approval notice and a loan agreement to e-sign. After you sign, the lender will initiate the transfer of funds. Many online lenders can deposit the money into your bank account as soon as the next business day, with some even offering same-day funding.

From start to finish, a prepared applicant using an efficient online lender can expect to have money in hand within 2 to 3 business days.

How to Check Your Rate Without Affecting Your Credit Score

One of the biggest fears for borrowers is that shopping for a loan will damage their credit score. In the past, every inquiry could cause a score to drop. Today, however, the best personal loan companies have solved this problem with a process called pre-qualification.

When you pre-qualify for a loan, you provide basic personal and financial information. The lender then performs a soft credit inquiry (or soft pull). This is a preliminary check of your credit that is not visible to other lenders and has zero impact on your credit score. Based on this soft pull, the lender can give you a highly accurate estimate of the interest rate and loan terms you would likely receive. You can pre-qualify with as many lenders as you want without any negative effects. A hard credit inquiry, which can temporarily lower your score by a few points, is only performed after you have chosen a lender and submitted a full, formal application.

Key Tip → Always use the pre-qualification process to shop for rates. It’s a risk-free way to find the best deal before you commit.

Why Fixed Monthly Payments Help Manage Debt More Effectively

The vast majority of top personal loan companies offer fixed-rate loans, and for a good reason: predictability is a borrower’s best friend. A fixed-rate loan means your interest rate—and therefore your monthly payment—is locked in for the entire duration of the loan. Your payment on day one will be the exact same as your final payment.

This stability is incredibly powerful for debt management and budgeting. You know precisely how much you need to allocate to your loan each month, which eliminates surprises and makes it easy to plan your finances. This contrasts sharply with variable-rate debt, like credit cards, where fluctuating rates can cause payments to change. A fixed monthly payment provides a clear, steady target and a defined end date for your debt, transforming a potentially chaotic repayment process into a simple, manageable plan. This structure and predictability are key reasons why personal loans are so effective for debt consolidation.

Explore more details here → [Calculate Your Potential Fixed Monthly Payment]

What No Fees and No Collateral Personal Loans Mean for Borrowers

When you see a personal loan company advertising “no fees” and “no collateral,” it signifies a borrower-friendly and accessible loan product.

No Collateral (Unsecured Loan): This means the loan is not backed by any of your personal assets, such as your house or car. The lender approves you based on your creditworthiness (your credit score, income, and financial history) alone. For you, the borrower, this is a major advantage. It means your personal property is not at risk if you were to face financial hardship and default on the loan. The vast majority of personal loans from top online lenders are unsecured.

No Fees: This typically refers to the absence of two key charges:

· No Origination Fee: The lender does not charge you a fee to process the loan, so you receive the full amount you were approved for.

· No Prepayment Penalty: The lender does not penalize you for paying off the loan ahead of schedule.

Lenders like Discover and Marcus are famous for this no-fee model, which provides ultimate transparency and value for the borrower.

How to Choose Flexible Loan Terms That Fit Your Financial Goals

Choosing the right loan term is a balancing act between your monthly budget and your long-term goal of paying the least amount of interest. The best personal loan companies offer a range of flexible terms, typically from 2 to 7 years (24 to 84 months), allowing you to customize your repayment plan.

To choose the right term, use an online personal loan calculator. First, determine the maximum monthly payment you can comfortably afford without straining your budget. Then, input your desired loan amount and an estimated APR into the calculator. Adjust the loan term until the monthly payment aligns with your budget. The ideal choice is the shortest possible term that still provides a manageable monthly payment. While a longer term will give you the lowest payment, it will always cost you more in total interest. Resisting the temptation of the lowest payment in favor of a shorter, more cost-effective term is a hallmark of a savvy borrower.

How Same-Day Funding Works for Fast Access to Cash

Same-day funding is a premium feature offered by some of the most efficient online personal loan companies, like LightStream. This rapid access to cash is made possible through advanced technology and streamlined processes.

Here’s how it works:

1. Automated Underwriting: The lender uses a sophisticated algorithm to analyze your application, credit data, and verified income in real-time, allowing for a near-instant approval decision for many applicants.

2. Electronic Verification: Instead of manually checking documents, lenders use secure services to instantly verify your identity and bank information online.

3. E-Signature: You can review and sign your loan agreement electronically from any device, eliminating the need for printing and mailing.

4. Expedited Funds Transfer: Once you sign, the lender initiates an electronic funds transfer (like an ACH transfer or wire) to your bank account. If all steps are completed early on a business day, the funds can be processed and made available by your bank before the end of the day.

This entire process removes the manual bottlenecks of traditional lending, turning a multi-day affair into a matter of hours.

How to Choose the Right Personal Loan Provider in the US, UK, or Canada

Choosing the right personal loan provider from the many available in Tier One markets requires a methodical approach. Follow this simple checklist to ensure you select a reputable company that offers the best value for your needs.

· 1. Compare APRs: Start by getting pre-qualified offers from 3-5 lenders. Focus on the Annual Percentage Rate (APR), as this is the true, all-in cost of the loan.

· 2. Check for Fees: Prioritize lenders that charge no origination fees or prepayment penalties. Lenders like Discover, Marcus, and LightStream excel here.

· 3. Verify Funding Speed: If you need money quickly, confirm the lender’s typical funding timeline. Look for those advertising next-day or same-day funding.

· 4. Read Customer Reviews: Look up recent reviews on third-party sites like Trustpilot to gauge the lender’s customer service and reliability.

· 5. Confirm Loan Options: Ensure the lender offers the loan amount you need and a repayment term that fits your budget.

· 6. Check Eligibility: Before applying, make sure you meet the lender’s minimum credit score and income requirements.

By systematically evaluating each provider against these criteria, you can confidently choose the best personal loan company for your situation.

LightStream: Best Overall Personal Loan Provider for Tier One Borrowers

LightStream, the online lending division of Truist Bank, consistently earns its place as the best overall personal loan provider for borrowers with strong credit. Its value proposition is simple and powerful: offer some of the lowest fixed rates on the market with absolutely no fees. LightStream has no origination fees, no late payment fees, and no prepayment penalties. This transparent, “what you see is what you get” model is highly appealing. They also offer an exceptionally wide range of loan amounts (from $5,000 to $100,000) and some of the longest repayment terms in the industry, up to 144 months for home improvement loans. For applicants who are approved early in the day, LightStream can often provide funding on the same business day. The primary consideration is their strict credit requirement; you need a good-to-excellent credit history to qualify.

SoFi: Best for Debt Consolidation and Financial Wellness Tools

SoFi (Social Finance) has evolved from a student loan refinancer into a full-service digital finance company, and its personal loans are a flagship product. SoFi is an excellent choice for borrowers with good-to-excellent credit, particularly for debt consolidation. They offer high loan amounts (up to $100,000), competitive fixed rates, and charge no origination or prepayment fees. What sets SoFi apart are its member benefits. Borrowers gain access to complimentary financial planning sessions, career coaching, and an active member community. Their unique Unemployment Protection feature allows you to temporarily pause payments if you lose your job through no fault of your own. This combination of a strong loan product and a focus on overall financial wellness makes SoFi a top contender.

BHG Financial: Best for Online Bank Loans and Professional Borrowers

BHG Financial (Bankers Healthcare Group) specializes in providing large personal loans to high-income professionals, such as doctors, lawyers, and business owners. While they started in the healthcare space, they have expanded to serve a wide range of top-tier borrowers. BHG Financial is not a direct lender but works with a network of partner banks to source loans. Their key advantage is the ability to fund very large loan amounts—from $20,000 up to $500,000 or more—often with extended repayment terms. This makes them an ideal choice for significant investments, business expansion, or consolidating extensive professional debt. The application process is streamlined for busy professionals, and they are known for fast funding. While not for the average borrower, BHG is a leading option for those with high income and substantial financing needs.

Upstart: Best Personal Loan Company for Fair or Average Credit

Upstart has revolutionized lending for borrowers who may not fit the traditional mold. While most lenders focus almost exclusively on credit score, Upstart’s AI-powered underwriting model considers additional factors like your education, area of study, and employment history. This allows them to approve a wider range of applicants, making them the best personal loan company for those with fair credit (scores in the low-to-mid 600s) or a limited credit history. Upstart offers competitive rates for its target demographic and provides a fast, fully online application process with funding as soon as the next business day. While they do charge origination fees, for many borrowers who might otherwise be denied, Upstart provides crucial access to affordable credit.

Discover: Best for No Fees and Strong Customer Support

Discover is well-known for its credit cards, and it brings the same commitment to customer satisfaction and transparency to its personal loans. Discover’s key feature is its complete lack of fees. They charge no origination fees, no prepayment penalties, and no application fees, which makes understanding the cost of your loan incredibly simple. They offer competitive fixed rates on loans up to $40,000. Another standout feature, particularly useful for debt consolidation, is the option to have Discover send the loan funds directly to your creditors on your behalf. With a 100% U.S.-based customer service team and a 30-day money-back guarantee, Discover is an excellent choice for borrowers who value a straightforward, fee-free loan experience backed by a reputable company.

LendingClub: Best Peer-to-Peer Lending Platform in 2025

LendingClub is one of the pioneers of peer-to-peer (P2P) lending, although it has since evolved into a more traditional online lender after acquiring a bank. It remains a top platform for connecting borrowers with investors who fund the loans. LendingClub is particularly strong for borrowers looking to consolidate debt or refinance credit cards and offers a unique option to apply for a joint loan, which can help applicants with lower credit scores get approved with a co-borrower. They provide loans up to $40,000 with competitive, fixed rates. While LendingClub does charge an origination fee, its broad credit acceptance and flexible options make it a go-to choice for a wide spectrum of borrowers in the US market.

John Peterson, Loan Analyst (US): ‘Easy Online Application Process Drives 2025 Growth’

“The defining trend in personal lending for 2025 is the continued refinement of the digital application process,” states John Peterson, a leading U.S.-based loan analyst. “Top personal loan companies have invested heavily in creating seamless, mobile-first experiences. Borrowers can now go from initial rate check to a fully funded loan in under 24 hours without ever speaking to a human. This isn’t just about convenience; it’s about accessibility. By making the application process less intimidating and more transparent, companies are attracting a wider range of qualified borrowers who were previously underserved or put off by the cumbersome nature of traditional lending. This focus on user experience is the primary engine of growth in the sector.”

Emily Clarke, UK Financial Advisor: ‘Personalized Loan Offers Improve Approval Rates’

“We’re seeing a significant shift from one-size-fits-all lending to highly personalized loan offers, particularly in the UK market,” notes financial advisor Emily Clarke. “Instead of a simple approval or denial, the best personal loan companies are using advanced analytics to provide tailored options. For example, if a borrower doesn’t qualify for their requested £15,000, the system might instantly return a counteroffer for £12,000 with specific terms. This personalization increases approval rates and provides viable solutions for a broader range of consumers. It turns a ‘no’ into a ‘yes, with these options, which is a much more constructive and positive experience for the borrower, fostering greater trust in online lenders.”

Canadian Credit Bureau Report: ‘Soft Credit Pulls Reduce Borrower Risk’

A recent report from a major Canadian credit bureau highlights the transformative impact of soft credit inquiries. “The widespread adoption of pre-qualification based on soft credit pulls has fundamentally changed consumer borrowing behavior for the better,” the report concludes. “Previously, Canadians were hesitant to shop for the best loan rates for fear that multiple hard inquiries would damage their credit score. Today, consumers can confidently compare offers from numerous lenders without any negative impact. This has not only increased competition and driven down interest rates but has also reduced borrower risk. By finding the most affordable loan, consumers are less likely to become over-indebted, leading to lower default rates and a healthier credit ecosystem for everyone involved.”

Finance Expert Insight: ‘Understanding Loan Benefits Increases ROI on Borrowed Funds’

“The conversation around personal loans is maturing,” says a prominent finance expert. “It’s moving beyond ‘how much can I get?’ to ‘what is the return on investment for this debt?’ The best personal loan companies are leaning into this by providing educational resources that help borrowers think strategically. A loan used to consolidate 25% APR credit card debt into a 9% APR loan provides an immediate 16% return. A loan for a home renovation that adds more value to the property than the cost of the loan is a net financial positive. When borrowers understand these benefits, they make smarter decisions, use funds more effectively, and are more likely to view the loan as a successful financial tool rather than just a burden.”

Industry Statistic 2025: ‘Fast Approval Loans Now Average Under 24 Hours’

According to a key industry report released in October 2025, the average time from application to funding for a personal loan from a top online lender has dropped to a new record low. “For approved borrowers in Tier One markets, the average funding time now stands at 22.5 hours,” the report states. “This represents a significant increase in efficiency over previous years. This acceleration is attributed to the widespread adoption of AI-driven underwriting and seamless bank verification technologies. For a growing number of highly qualified applicants, same-day funding is no longer an exception but the standard. This speed has made online personal loans an increasingly viable alternative to credit cards for handling urgent financial needs.”

Loan Education Hub: ‘Learning Resources for Smarter Personal Loan Decisions’

The best personal loan companies in 2025 differentiate themselves not just on rates and speed, but also on borrower education. Recognizing that an informed customer is a better customer, leading lenders have built out robust online education hubs. These resources feature articles, videos, and calculators designed to demystify personal finance. Topics range from explaining the difference between APR and interest rates to providing strategies for improving a credit score and managing debt effectively. By empowering potential borrowers with knowledge before they even apply, these companies are fostering a more transparent and responsible lending environment, helping consumers make smarter decisions that align with their long-term financial well-being.

FAQ

What company is best for a personal loan in 2025?

The “best” personal loan company is subjective and depends heavily on your credit profile and needs. For borrowers with excellent credit (720+ FICO), LightStream is often considered the best due to its exceptionally low rates and no-fee structure. For those with good credit who value member benefits and financial tools, SoFi is a top contender. If you have fair credit or a limited credit history, Upstart is likely the best choice because its unique underwriting model considers factors beyond just your credit score. The best practice is to use a comparison tool to get pre-qualified offers from multiple companies to see which one provides the most favorable terms for your specific situation.

How much will a $10,000 personal loan cost per month?

The monthly cost of a $10,000 personal loan is determined by its Annual Percentage Rate (APR) and the loan term. Here are a few examples for a 5-year (60-month) term:

· Excellent Credit (e.g., 8% APR): Your monthly payment would be approximately $203.

· Good Credit (e.g., 12% APR): Your monthly payment would be about $222.

· Fair Credit (e.g., 20% APR): Your monthly payment would be around $265.

As you can see, a lower APR significantly reduces your monthly payment. A shorter loan term (e.g., 3 years) would result in a higher monthly payment but lower total interest paid. Using an online loan calculator is the best way to estimate your exact payment.

How to get $3,000 today with fast personal loan approval?

Getting $3,000 today is possible with lenders that offer same-day funding, but it requires you to be prepared and act quickly. First, check your credit score to ensure you meet the lender’s criteria. You will likely need at least a fair credit score (630+). Next, choose an online lender known for speed, such as LightStream or SoFi. Have your documents—government-issued ID, proof of income (pay stubs), and bank account details—digitized and ready to upload. Apply as early as possible on a business day (e.g., before noon) to allow time for verification and processing. If you have a straightforward application and are approved quickly, some lenders can deposit the funds into your account by the end of the day.

Who gives the cheapest personal loan in Tier One countries?

The cheapest personal loans, meaning those with the lowest APRs, are consistently offered to borrowers with the highest credit scores. Across the US, UK, Canada, and Australia, the most competitive lenders are often online-only institutions and credit unions. Companies like LightStream are renowned for their rock-bottom rates for super-prime borrowers. However, the “cheapest” loan for you can only be found by comparing personalized offers. A lender that is cheapest for someone with a 780 credit score may not be the cheapest for someone with a 680 score. Using a pre-qualification tool on a loan marketplace is the most effective way to survey the market and find the lender offering you the lowest APR.

Personal loan companies near Arizona

The best personal loan companies, particularly online lenders, operate nationwide across the US, so you are not limited to companies physically located “near Arizona.” Top-rated national providers like SoFi, LightStream, Discover, and Upstart all serve residents of Arizona. They offer a fully online application process, meaning you can apply from anywhere and receive funds directly to your Arizona-based bank account. While you can also check with local Arizona credit unions like Desert Financial or OneAZ Credit Union, it is highly recommended to first compare rates from national online lenders, as they often have more competitive APRs due to their lower overhead costs.

Personal loan companies near Colorado

Residents of Colorado have access to all the top national online personal loan companies. Providers such as SoFi, Marcus by Goldman Sachs, LightStream, and Upstart offer loans to Colorado residents with a seamless online application. Your physical location within the state does not impact your eligibility or interest rate. You can apply from Denver, Boulder, or anywhere else and have the funds deposited into your local bank account. In addition to these national lenders, you may also consider Colorado-based credit unions like Canvas Credit Union or Bellco Credit Union. The smartest approach is to compare the offers from national online lenders with those from local institutions to ensure you’re getting the most competitive deal available.

Top personal loan companies online in 2025

In 2025, the top personal loan companies online are those that combine low interest rates, no fees, fast funding, and a great user experience. For borrowers with excellent credit, LightStream is a top choice due to its low APRs and fee-free structure. SoFi is another leader, appealing to good-credit borrowers with its member benefits and high loan amounts. Discover and Marcus by Goldman Sachs are highly rated for their commitment to no-fee loans and strong customer service. For those with fair credit, Upstart stands out with its AI-powered and inclusive underwriting model. These companies consistently lead the market in transparency, speed, and value.

Personal loan companies for bad credit borrowers

Finding a personal loan with bad credit (a score below 630) is challenging, but several specialized companies serve this market. Upstart is a good starting point, as its model considers factors beyond just credit score, potentially increasing approval odds. Other companies that cater to bad credit borrowers in the US include Avant, OneMain Financial, and LendingPoint. Be prepared for higher interest rates (often 20% to 36%) from these lenders to compensate for the increased risk. It’s also wise to check with local credit unions, which may have more flexible lending criteria. Avoid predatory payday lenders, which charge exorbitant fees and are not a sustainable solution.

Top 10 personal loan companies with low interest rates

While the exact order can fluctuate, a list of the top 10 personal loan companies for low interest rates (for good to excellent credit) in 2025 typically includes:

1. LightStream

2. SoFi

3. Marcus by Goldman Sachs

4. Discover

5. Happy Money (Payoff)

6. Best Egg

7. Upstart

8. LendingClub

9. Prosper

10. PenFed Credit Union

This list features a mix of online lenders, direct banks, and credit unions, all known for offering competitive APRs to qualified borrowers. The key is that the lowest rates from these companies are reserved for applicants with the strongest credit profiles.

Best online personal loans for fast approval and low fees

The best online personal loans that balance fast approval and low fees are typically offered by major fintech lenders. LightStream is a top choice, offering same-day funding for some applicants and charging absolutely no fees. SoFi also provides fast funding (often same-day or next-day) and has no origination fees or prepayment penalties. Discover is another excellent option, renowned for its no-fee structure and next-day funding capability. These companies have optimized their online application and verification processes for speed and efficiency, making them ideal for borrowers who need quick access to funds without being burdened by excessive costs.