Find Personal Loan Cheap Interest options in the US, UK, Canada & Australia. Compare 100+ trusted lenders, secure low rates, and save thousands today!

When you need to borrow money, the interest rate is the single most important number to consider. It dictates the true cost of your loan, determining how much you’ll pay each month and over the entire term. A personal loan with cheap interest can be a powerful financial tool, helping you consolidate high-cost debt or fund a major purchase affordably. However, many borrowers in Tier One markets like the US, UK, Canada, and Australia leave thousands of dollars on the table by accepting the first loan offer they receive, often from their primary bank. The world of lending is vast and competitive, and failing to shop around means you are almost certainly overpaying.

The pain of a high-interest loan is a slow burn—a higher monthly payment that strains your budget and a total cost that balloons over time, keeping you in debt longer. But you have the power to change this outcome. The promise of modern online lending is transparency and competition. By using online comparison tools, you can pre-qualify for multiple loan offers in minutes without impacting your credit score. This guide will empower you with the knowledge to understand what drives interest rates, the actionable steps you can take to qualify for a lower rate, and the expert strategies to find and secure the cheapest personal loan interest rates available. Prepare to take control of your borrowing and save big.

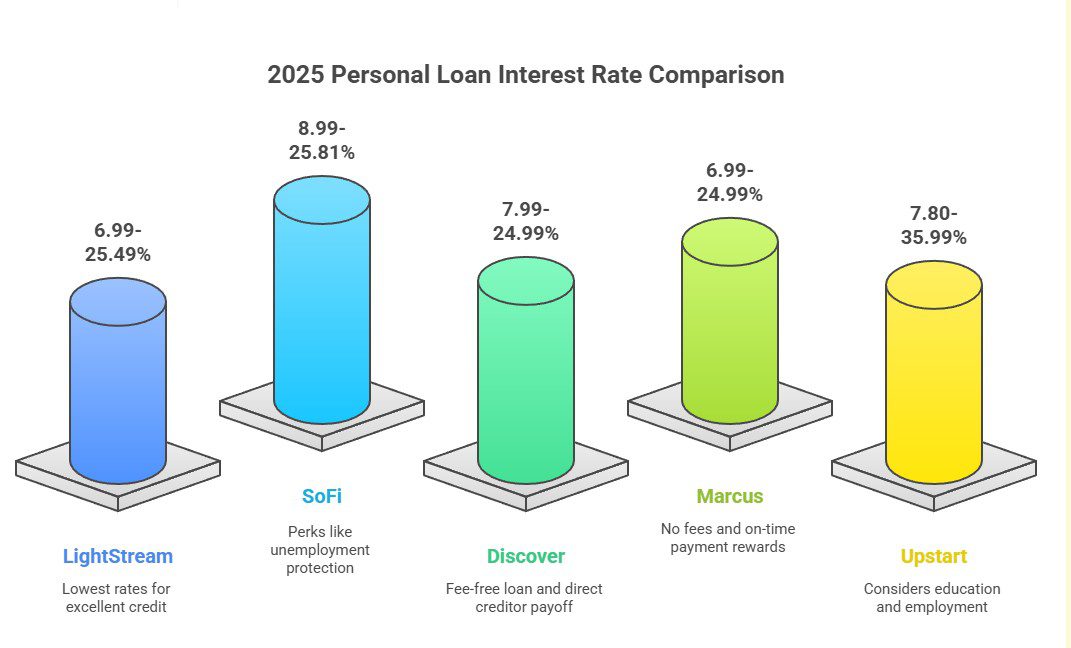

Compare the Best Personal Loan Interest Rates for 2025

Finding a personal loan with cheap interest starts with one crucial step: comparison shopping. In 2025, the lending market across the US, UK, Canada, and Australia is more competitive than ever, with online lenders, traditional banks, and credit unions all vying for your business. This competition is your greatest advantage. By comparing offers side-by-side, you can instantly see which lender is providing the most value. The lowest interest rate isn’t just a number; it translates into real savings, lower monthly payments, and a faster path to being debt-free.

Mini Case Study:

Ava, a graphic designer from Vancouver, Canada, needed a $15,000 CAD loan to invest in new equipment for her freelance business. Her own bank offered her a loan at 11.5% APR. Instead of accepting, she spent 20 minutes on an online comparison tool and received two more pre-qualified offers:

· Lender A (Online Fintech): 9.2% APR with a 1% origination fee.

· Lender B (Credit Union): 9.8% APR with no fees.

Using a loan calculator, Ava determined that despite Lender A’s lower APR, the upfront origination fee made the total cost slightly higher than Lender B’s offer over a four-year term. She confidently chose Lender B, securing a rate nearly two percentage points lower than her bank’s initial offer.

Key Result → By investing just 20 minutes to compare lenders, Ava saved over $850 in interest over the life of her loan.

The table below highlights some of the top lenders known for their competitive interest rates, but the best offer for you will always depend on your personal credit profile.

2025 Personal Loan Interest Rate Comparison

| Lender | Typical APR Range | Minimum Recommended Credit Score | Best For… |

| LightStream | 6.99% – 25.49% | 680 (with strong credit history) | Borrowers with excellent credit are seeking the lowest rates and no fees. |

| SoFi | 8.99% – 25.81% | 680 | Good-to-excellent credit borrowers looking for perks like unemployment protection. |

| Discover | 7.99% – 24.99% | 660 | Good credit borrowers who value a fee-free loan and direct creditor payoff for consolidation. |

| Marcus | 6.99% – 24.99% | 660 | Borrowers with good credit who appreciate no fees and on-time payment rewards. |

| Upstart | 7.80% – 35.99% | 600 | Borrowers with fair credit or thin credit files are considered, as they consider education and employment. |

Rates are as of October 2025 for illustrative purposes and are subject to change. Your actual rate will depend on your creditworthiness.

The first step to saving money is knowing your options. Pre-qualification is free, fast, and won’t hurt your credit score.

Factors That Affect Your Personal Loan Interest Rate in Tier One Markets

Why does one borrower get a personal loan offer with a 7% interest rate while another is offered 17%? The answer lies in risk assessment. Lenders in the US, UK, Canada, and Australia use a sophisticated set of factors to predict the likelihood that a borrower will repay their loan on time. The lower the perceived risk, the lower the interest rate they will offer. Understanding these key factors empowers you to see your application from the lender’s perspective and identify areas where you can improve to secure a cheaper rate.

Mini Case Study:

James, an IT consultant in the UK with a high credit score of 780, was surprised when he was quoted a 12% APR on a personal loan—higher than he expected. He reviewed his finances and realized that while his score was excellent, his debt-to-income (DTI) ratio was 45% due to a recent car loan and existing credit card debt. The lender viewed his high monthly debt obligations as a risk factor, despite his perfect payment history. This illustrates a critical point: your interest rate is determined by your entire financial picture, not just your credit score.

Key Takeaway → Lenders weigh both your history of repaying debt (credit score) and your current capacity to take on new debt (DTI ratio). Both must be healthy to unlock the best rates.

Here are the primary factors lenders analyze to determine your interest rate.

How Key Factors Influence Your Interest Rate

| Factor | Impact of a Good / Strong Value | Impact of a Poor / Weak Value |

| Credit Score | A high score (e.g., 720+) signals low risk, leading to the lowest interest rates. | A low score (e.g., below 660) indicates a higher risk, resulting in higher interest rates. |

| Debt-to-Income (DTI) Ratio | A low DTI (e.g., below 36%) shows you have ample income to cover payments, earning you a lower rate. | A high DTI (e.g., above 43%) suggests you might be stretched thin, leading to a higher rate. |

| Loan Term | A shorter term (e.g., 2-3 years) often comes with a lower interest rate because the lender’s risk is for a shorter period. | A longer term (e.g., 5-7 years) may have a slightly higher rate to compensate for the extended risk period. |

| Loan Amount | A larger loan amount may sometimes qualify for a lower interest rate, as lenders prefer to issue more substantial loans to top-tier applicants. | A very small loan amount might have a higher rate as the administrative costs are similar for the lender. |

| Employment & Income Stability | A long, stable employment history and a high, verifiable income reduce risk and can help you secure a cheaper interest rate. | A short or inconsistent work history can be seen as a risk factor, potentially leading to a higher rate. |

By strengthening these areas of your financial life, you are directly investing in your ability to borrow money more affordably.

How to Qualify for a Lower Personal Loan Interest Rate

Qualifying for a personal loan with cheap interest is not a matter of luck; it’s a result of strategic financial planning. You have significant control over the factors that lenders use to set your rate. By taking deliberate steps to improve your creditworthiness, you can transform yourself into a top-tier applicant who commands the best offers. Even if you need a loan quickly, a few simple actions can make a difference. If you have more time, a six-month plan can lead to substantial savings.

Mini Case Study:

Priya, a teacher in Melbourne, Australia, wanted to take out a $20,000 AUD loan for a master’s degree program that started in six months. Her initial credit check showed a score of 670, which would likely result in a double-digit interest rate. She created a simple action plan. First, she reviewed her credit report and found a small, incorrect collection account, which she successfully disputed and had removed. Second, she focused on paying down the balance on her one credit card, reducing her credit utilization from 70% to under 20%. Six months later, her credit score had jumped to 735. When she applied for the loan, she was offered a rate of 8.5%, saving her an estimated $1,800 in interest compared to her initial quote.

Key Result → Proactive credit management directly translated into a lower interest rate and significant financial savings for Priya.

Here are the most effective ways to position yourself for a lower interest rate.

Action Plan for a Lower Interest Rate

| Action | Description | Potential Impact on Rate |

| Boost Your Credit Score | Make all payments on time and pay down revolving credit balances (like credit cards) to lower your credit utilization ratio. | High – This is the most significant factor you can control. |

| Lower Your Debt-to-Income (DTI) Ratio | Before applying for a new loan, pay off or reduce the balance on existing debts to free up more of your monthly income. | High – Shows lenders you have the capacity to take on new payments comfortably. |

| Choose a Shorter Loan Term | Opting for a 3-year term instead of a 5-year term often results in a lower APR, as the lender’s risk is for a shorter period. | Medium – Can often lower your rate by 0.25% to 1.00%. |

| Consider a Co-signer | Applying with a co-signer who has an excellent credit score and strong income can help you qualify for a much lower rate than you could on your own. | High – But requires a great deal of trust with the co-signer. |

| Shop Around Extensively | Get pre-qualified offers from at least 3-5 lenders, including online lenders, banks, and credit unions, to ensure you see the most competitive rates available. | High – Different lenders have different risk models, so rates for the same person can vary widely. |

Your financial health is dynamic. Taking steps to improve it before you borrow is the surest path to a cheap interest personal loan.

Understanding Fixed vs. Variable Interest Options for Borrowers

When you take out a personal loan, the interest rate will be structured in one of two ways: fixed or variable. The choice between these two options has a profound impact on the predictability and overall cost of your loan. For the vast majority of borrowers in Tier One markets, a fixed-rate loan is the standard and most recommended option due to its stability and simplicity.

A fixed-rate personal loan has an interest rate that is locked in for the entire life of the loan. This means your monthly payment will be the exact same amount every single month, from your first payment to your last. This predictability is invaluable for budgeting. You’ll know precisely how much to set aside each month, and you are completely protected from any future increases in market interest rates. If the central bank raises rates, your loan payment remains unchanged.

A variable-rate personal loan, which is much less common, has an interest rate that can change over time. It is tied to a benchmark financial index, such as the Prime Rate. A variable-rate loan might entice borrowers with a lower introductory rate, but it carries significant risk. If the benchmark index rises, your interest rate and your monthly payment will also rise. This can make budgeting difficult and could potentially make the loan much more expensive over time.

Mini Case Study:

Tom in the US needed to consolidate $25,000 in credit card debt. He planned to pay it off over five years. He was offered both a fixed-rate loan at 9% APR and a variable-rate option that started at 7.5% APR. While the initial savings of the variable rate were tempting, he recognized that market rates could easily rise over five years. He chose the 9% fixed-rate loan for the peace of mind of knowing his payment would never change, allowing him to create a stable, long-term budget to eliminate his debt.

Key Takeaway → For a multi-year installment loan, the stability of a fixed rate almost always outweighs the potential risk of a variable rate.

Fixed vs. Variable Rate Personal Loans

| Feature | Fixed Rate | Variable Rate |

| Payment Stability | ✅ Payments are the same every month. | ❌ Payments can change (increase or decrease). |

| Budgeting | ✅ Easy and predictable. | ❌ Difficult and unpredictable. |

| Risk Level | ✅ Low – You are protected from rate hikes. | ❌ High – Your costs could increase significantly. |

| Best For… | Nearly all borrowers, especially for long-term loans (2+ years), and debt consolidation. | Potentially for very short-term loans (under 1 year) if you strongly expect market rates to fall. |

When searching for a cheap interest personal loan, focus your comparison on lenders offering competitive fixed-rate APRs.

Expert Tips to Find the Cheapest Personal Loan Rates Online

The internet has democratized the process of finding a personal loan, putting the power of comparison directly into your hands. However, navigating the vast number of online lenders requires a smart strategy. Following a few expert tips can help you cut through the noise, avoid common pitfalls, and zero in on the lenders offering the absolute best rates for your financial profile. Finding the cheapest rate is a process of preparation, diligent searching, and careful evaluation.

Mini Case Study:

Let’s follow Sarah from the UK, who needed a £10,000 loan.

1. She started with a Soft Check: Sarah used an online comparison tool to get pre-qualified offers from six different lenders. This soft inquiry didn’t affect her credit score.

2. She Looked Beyond Her Bank: Her primary bank’s offer was 10.9% APR. The comparison tool showed her offers from online-only lenders as low as 8.2% APR.

3. She Checked Credit Unions: She also checked with a local credit union, which offered her 8.5% APR with a relationship discount.

4. She focused on the APR: She ignored the headline “interest rates” and compared the Annual Percentage Rate (APR), which includes fees.

5. She looked for Discounts: The online lender with the 8.2% APR also offered an additional 0.25% discount for setting up autopay, bringing the final APR down to 7.95%.

Key Result → By being a savvy online shopper, Sarah found a rate that was almost 3% lower than her bank’s initial offer, saving her over £800 in interest.

Here are the top expert strategies for your search.

Online Search Checklist for Low Personal Loan Rates

| Tip | Why It’s Important |

| ☐ Use a Loan Comparison Website First | This is the fastest way to see offers from multiple lenders at once without filling out numerous applications or impacting your credit score. |

| ☐ Pre-Qualify with at Least 3-5 Lenders | Don’t stop at one or two offers. The more lenders you check, the higher your chances of finding a standout low rate. |

| ☐ Compare APR, Not Just Interest Rate | The APR is the all-in cost of the loan. A lender with a low interest rate but a high origination fee can be more expensive than a fee-free lender with a slightly higher rate. |

| ☐ Look for Autopay and Other Discounts | Most online lenders offer a rate discount of 0.25% to 0.50% for setting up automatic payments. This is an easy way to lock in extra savings. |

| ☐ Read Reviews and Fine Print | A low rate is great, but ensure the lender has positive customer reviews. Also, confirm there are no prepayment penalties if you plan to pay the loan off early. |

| ☐ Check with Credit Unions | As non-profit institutions, credit unions often offer some of the most competitive rates on the market, especially for members. |

A methodical online search is the proven path to securing a personal loan with cheap interest.

Explore more details here → [Compare Top-Rated Low-Interest Lenders Now]

When and Why to Refinance Your Personal Loan for Better Savings

Securing a personal loan doesn’t have to be the end of your savings journey. Refinancing is a powerful financial strategy where you take out a new, lower-interest loan to pay off your existing personal loan. The primary goal is simple: to save money. If your financial situation has improved since you first took out your loan, or if market interest rates have dropped, you may be eligible for a significantly cheaper rate. This can reduce your monthly payments, lower the total interest you pay, or even help you pay off your debt faster.

Mini Case Study:

Two years ago, David, an engineer from Texas, took out a $20,000 personal loan at 16% APR to cover some medical bills. At the time, his credit score was 650. Over the past two years, he has made every payment on time and has paid down his credit card debt. His credit score has now improved to 740. He still owes $13,000 on his loan. He shopped for refinancing offers and was approved for a new personal loan at 9% APR. He used the new loan to pay off the old one.

· Old Loan: $13,000 balance at 16% APR.

· New Loan: $13,000 balance at 9% APR.

Key Result → By refinancing, David lowered his monthly payment by nearly $50 and is projected to save over $1,600 in interest over the remaining term of his loan.

Knowing when to look for refinancing opportunities is key.

Should You Refinance Your Personal Loan?

| Consider Refinancing If… | Why It Works |

| Your Credit Score Has Improved Significantly | A higher credit score makes you a lower-risk borrower, qualifying you for much better interest rates than you could get before. This is the most common reason to refinance. |

| Market Interest Rates Have Dropped | If overall interest rates have fallen since you took out your loan, you may be able to get a cheaper rate even if your personal credit profile hasn’t changed. |

| You Want to Lower Your Monthly Payment | Refinancing into a loan with a lower APR or a longer term can reduce your monthly payment, freeing up cash flow for other expenses. |

| You Want to Switch from a Variable to a Fixed Rate | If you have a risky variable-rate loan, refinancing into a predictable fixed-rate loan can provide valuable financial stability. |

| Your Original Loan Had High Fees | If your initial loan came with a high origination fee, refinancing into a no-fee loan can provide better long-term value. |

The best time to check refinancing rates is about 12-18 months after taking out your original loan, provided you’ve maintained a perfect payment history.

Credit Score Impact on Your Personal Loan Interest Rate

Your credit score is the most influential factor in determining the interest rate you’ll be offered on a personal loan. Lenders view this three-digit number as a direct reflection of your financial reliability. A high score indicates a history of responsible borrowing and on-time payments, marking you as a low-risk applicant. A low score, conversely, signals a higher risk of default. This risk-based pricing model means that the difference between an excellent credit score and a fair one can translate into thousands of dollars in interest payments over the life of a loan.

Imagine two applicants seeking a $15,000 loan over five years. One has an excellent credit score of 780, while the other has a fair score of 660. The applicant with excellent credit might be offered an APR of 8%, while the applicant with fair credit is offered 18%. The borrower with the higher credit score would pay approximately $3,258 in total interest. The borrower with the lower score would pay a staggering $7,804 in interest, more than double for the same loan amount. This demonstrates that investing time in building your credit score offers one of the highest returns in personal finance.

Expert Insight: “Your credit score is your financial reputation,” says credit analyst Laura Adams. “A strong reputation earns you the trust of lenders, and they reward that trust with their best possible interest rates. Every point matters, but the biggest rate drops happen as you move up through the credit tiers—from poor to fair, and from fair to good.”

(Imagine a line chart here showing a downward slope. The X-axis is “Credit Score” from 600 to 800. The Y-axis is “Average Personal Loan APR” from 25% down to 7%. The line clearly shows that as the credit score increases, the APR dramatically decreases.)

APR vs. Interest Rate — Understanding What You’re Really Paying

When you shop for a personal loan, you’ll see two key terms: “interest rate” and “APR.” While they seem similar, understanding the difference is crucial to finding the cheapest loan. The interest rate is simply the percentage a lender charges you for borrowing money. It’s the base cost of the loan. However, it doesn’t tell the whole story.

The Annual Percentage Rate (APR) is the all-encompassing, true cost of your loan. It includes the interest rate plus any mandatory fees the lender charges, most commonly an origination fee. An origination fee is a one-time charge, usually 1% to 8% of the loan amount, that the lender deducts from your loan proceeds. Because the APR factors in this fee, it gives you a more accurate, apples-to-apples way to compare loan offers.

For example:

· Loan A: $10,000 with a 9% interest rate and a $500 (5%) origination fee.

· Loan B: $10,000 with a 10% interest rate and no origination fee.

At first glance, Loan A seems cheaper because of the lower interest rate. However, its APR will be over 11% due to the hefty fee. Loan B’s APR is 10%. Therefore, Loan B is the cheaper option.

Key Takeaway → Always use the APR as your primary comparison point. It is the most transparent measure of a loan’s total cost.

Loan Term and Monthly Payment Tradeoffs Explained

When you structure a personal loan, you must choose a loan term—the amount of time you have to repay the money. This decision creates a fundamental tradeoff between your monthly payment amount and the total interest you will pay. Understanding this relationship is key to choosing a loan that fits both your monthly budget and your long-term financial goals.

A shorter loan term (e.g., 2 or 3 years) means you will have higher monthly payments because you are paying the loan back more quickly. However, because interest has less time to accrue, you will pay significantly less in total interest over the life of the loan. This is the most cost-effective way to borrow money.

A longer loan term (e.g., 5 or 7 years) results in lower, more manageable monthly payments. This can be very tempting as it creates more breathing room in your budget. However, because you are paying interest for a longer period, the total cost of the loan will be much higher.

Expert Insight: “The golden rule is to choose the shortest loan term with a monthly payment you can comfortably afford,” advises financial counselor David Reed. “Don’t be lured by the lowest possible payment if it means paying thousands more in interest. Use a loan calculator to see the total cost difference—it’s often a real eye-opener.”

Loan Term Tradeoff: $10,000 Loan at 10% APR

| Loan Term | Estimated Monthly Payment | Total Interest Paid |

| 3 Years (36 Months) | $323 | $1,616 |

| 5 Years (60 Months) | $212 | $2,748 |

| 7 Years (84 Months) | $166 | $3,944 |

As you can see, stretching the loan from 3 to 7 years lowers the payment by half but more than doubles the total interest cost.

How Income and Debt Ratio Influence Your Interest Rate

While your credit score reflects your past borrowing behavior, your income and debt-to-income (DTI) ratio demonstrate your present capacity to handle new debt. Lenders scrutinize these figures to ensure you can afford the monthly payments on the loan you’re requesting. A strong income and a low DTI ratio signal financial stability, reducing the lender’s risk and earning you a more favorable interest rate.

Your income provides the raw material for loan repayment. Lenders need to see that you have a sufficient and stable source of funds. They will verify the income you state on your application using pay stubs or tax returns.

Your debt-to-income (DTI) ratio puts your income into context. It’s calculated by dividing your total monthly debt payments (including rent/mortgage, credit cards, auto loans, etc.) by your gross monthly income. For example, if your monthly debts are $2,000 and your gross income is $6,000, your DTI is 33%. Lenders prefer a DTI below 43%, with the best rates often reserved for applicants with a DTI under 36%. A high DTI suggests you may struggle to make payments if you face an unexpected expense, making you a riskier borrower.

Key Takeaway → Lowering your DTI by paying down existing debt before you apply for a new loan is one of the most effective strategies for securing a cheaper interest rate.

Why Comparing Multiple Lenders Can Save You Thousands

The single biggest mistake a borrower can make is accepting the first loan offer they get without shopping around. Every lender has its own unique formula for assessing risk, meaning the interest rate you’re offered for the same loan can vary dramatically from one institution to another. By not comparing, you are essentially leaving money on the table—potentially thousands of dollars.

Consider a borrower looking for a $20,000 loan over five years.

· Lender A (Their primary bank): Offers them a 12% APR. Total interest paid would be $6,635.

· Lender B (An online lender): Offers them a 9% APR. Total interest paid would be $4,910.

By taking 15 minutes to get a pre-qualified offer from Lender B, this borrower would save $1,725. This is the power of comparison. Online marketplaces have made this process incredibly efficient. With a single form that doesn’t impact your credit score, you can receive multiple pre-qualified offers, giving you a clear view of the most competitive rates available to you.

Expert Insight: “Treat shopping for a loan like shopping for a car or a flight,” suggests consumer advocate Chloe Miller. “You would never buy the first one you see. You compare features and prices. Lending is no different. The ‘product’ is money, and the ‘price’ is the APR. Be a savvy consumer and find the lowest price.”

Using Collateral, Discounts, or AutoPay to Lower Your Loan Interest

Beyond improving your core financial profile, there are several specific tactics you can use to chip away at your interest rate and secure a cheaper loan.

1. Using Collateral (Secured Loans): Most personal loans are unsecured, meaning they aren’t backed by an asset. However, if you have collateral, such as a paid-off car or savings in a CD, you can apply for a secured loan. Because you are providing security, the lender’s risk is significantly reduced. They reward this with much lower interest rates. This is a great option for borrowers who may not qualify for a low-rate unsecured loan, but it carries the risk of losing your asset if you fail to pay.

2. Relationship Discounts: Many traditional banks and credit unions offer rate discounts to their existing customers. If you have a long-standing checking or savings account with an institution, always ask if you qualify for a “relationship discount” on a personal loan. This can often reduce your rate by 0.25% to 0.50%.

3. AutoPay Discounts: This is the easiest discount to get and is offered by nearly all online lenders. By agreeing to have your monthly payments automatically debited from your bank account, you reduce the risk of missed payments for the lender. In return, they typically offer an APR discount of 0.25% or 0.50%. It’s a simple, win-win strategy for a cheaper loan.

Hidden Fees That Increase Your Effective Interest Rate

When searching for a personal loan with cheap interest, it’s crucial to look beyond the headline interest rate and be aware of fees that can increase your total cost of borrowing. The most significant of these is the origination fee. This is a one-time, upfront charge that some lenders deduct from your loan proceeds to cover the cost of processing your application. These fees can range from 1% to as high as 10% of the loan amount. For example, if you are approved for a $10,000 loan with a 5% origination fee, you will only receive $9,500 in your bank account, but you will be responsible for repaying the full $10,000. This is why comparing loans using the APR, which includes these fees, is essential. Other fees to watch for include late payment fees and, although less common now, prepayment penalties for paying off your loan early.

Micro-CTA → [Find no-fee personal loan offers now]

AutoPay and Relationship Rate Discounts — How They Work

Lenders love predictability, and they often reward borrowers who help reduce risk. Two of the most common ways to get a rate discount are through AutoPay and existing customer relationships.

· AutoPay Discount: This is the most common discount offered by online lenders. When you agree to have your monthly loan payment automatically transferred from your bank account, the lender reduces your interest rate, typically by 0.25% to 0.50%. For the lender, this significantly lowers the chance of a missed payment. For you, it’s a “set it and forget it” feature that guarantees on-time payments and saves you money. It’s a simple and highly effective way to get a cheaper loan.

· Relationship Rate Discounts: Traditional banks and credit unions often offer these discounts to attract and retain customers. If you have a qualifying checking account, savings account, or investment account with the institution, they may offer you a small rate reduction on a personal loan. Always ask your bank if you are eligible for any relationship or loyalty discounts.

Examples of Loan Costs at Different Terms and Interest Levels

To truly understand the impact of securing a cheap interest rate, it helps to look at the numbers. The table below illustrates how both the APR and the loan term affect the monthly payment and total interest paid on a common $15,000 loan. Notice how a lower APR dramatically reduces the total cost, while a shorter term, despite its higher monthly payment, also leads to significant interest savings. This demonstrates the dual importance of finding a low rate and choosing the shortest term you can comfortably afford.

Cost Comparison for a $15,000 Personal Loan

| APR | Loan Term | Monthly Payment | Total Interest Paid |

| 8% | 3 Years | $470 | $1,929 |

| 8% | 5 Years | $304 | $3,258 |

| 12% | 3 Years | $498 | $2,933 |

| 12% | 5 Years | $334 | $5,018 |

| 18% | 3 Years | $542 | $4,512 |

| 18% | 5 Years | $380 | $7,804 |

How to Compare Offers from Multiple Lenders Like a Pro

Comparing loan offers effectively is a skill that can save you a fortune. When you receive your pre-qualified offers, don’t just glance at the interest rate. Use this professional checklist to perform a thorough comparison and identify the true best deal.

1. Compare the APR First: This is the all-in cost. A loan with a 9% APR is cheaper than a loan with a 9.5% APR, regardless of the interest rate and fees.

2. Check for an Origination Fee: If two loans have the same APR, the one with no origination fee is often preferable, as you receive the full loan amount.

3. Confirm It’s a Fixed Rate: Ensure you are comparing fixed-rate loans for payment stability.

4. Evaluate the Loan Term: Make sure the term aligns with your goal of paying off the debt affordably but efficiently.

5. Look for Prepayment Penalties: Choose a lender that allows you to pay off the loan early without any extra charges.

6. Read Recent Customer Reviews: A cheap rate from a lender with terrible customer service can lead to headaches later on. Check their reputation on sites like Trustpilot.

Micro-CTA → [Start comparing real loan offers now]

Refinancing Options to Reduce Total Loan Cost and APR

Refinancing is your opportunity for a financial do-over. If you’ve improved your credit score or if market rates have dropped since you took out your original personal loan, you can apply for a new loan at a lower interest rate to pay off the old one. This can significantly reduce your total loan cost and lower your APR. The process is identical to applying for your first loan. You can use the same online comparison tools to shop for refinancing offers from various lenders. The goal is to find a new loan with an APR that is at least one to two percentage points lower than your current loan’s rate to make the process worthwhile. Refinancing is a powerful strategy for borrowers whose financial standing has improved, allowing them to benefit from their newfound creditworthiness.

How to Manage Payments Strategically for Long-Term Interest Savings

Once you’ve secured a personal loan with a cheap interest rate, you can save even more money with smart payment strategies. Since most personal loans have no prepayment penalties, any extra money you pay goes directly toward the principal balance. This reduces the amount of interest that accrues over time and helps you get out of debt faster.

· Make Bi-Weekly Payments: Instead of one monthly payment, split it in half and pay that amount every two weeks. Over a year, you’ll make 26 half-payments, which equals 13 full monthly payments instead of 12. This one extra payment each year can shave months or even years off your loan term.

· Round Up Your Payments: If your monthly payment is $280, consider rounding it up to an even $300. That extra $20 each month goes straight to the principal.

· Apply Windfalls: If you receive a bonus at work or a tax refund, consider applying a portion of it to your loan balance.

These small, consistent actions can add up to hundreds of dollars in interest savings.

Sample Scenarios: How Cheap Interest Personal Loans Save You Money

The impact of a low-interest personal loan is best illustrated with real-world scenarios.

· Scenario 1: Debt Consolidation. Sarah has $15,000 in credit card debt with an average 22% APR. Her monthly payments are high, and the balance barely moves. She qualifies for a personal loan at 9% APR over five years. By consolidating, she not only simplifies her finances to a single payment but also saves over $7,000 in interest.

· Scenario 2: Financing a Purchase. Mark wants to buy a used car for $12,000. The dealership offers him financing at 11% APR. Before accepting, he checks with his credit union and gets approved for a personal loan at 7% APR. By securing his own financing, Mark saves nearly $1,000 over the four-year loan term.

In both cases, finding a cheaper interest rate directly translated into significant, tangible savings.

Steps to Negotiate a Lower Personal Loan Rate with Lenders

While the rates from most large online lenders are algorithmically determined and typically non-negotiable, you may have some leverage with smaller banks or credit unions, especially if you are a long-standing customer.

1. Come Prepared: The most important step is to have a competing offer in hand. Use an online comparison tool to get your best pre-qualified offer from another lender.

2. Schedule a Meeting: Talk to a loan officer at your bank or credit union in person or over the phone.

3. State Your Case: Explain that you are a loyal customer and would prefer to keep your business with them.

4. Present the Competing Offer: Politely inform them of the rate and terms you were offered by the other lender and ask if they can match or beat it.

Even if they can’t beat it, they may be able to offer other perks. This strategy is most effective when you have excellent credit and a solid relationship with the institution.

When to Walk Away from High-Interest Personal Loan Offers

Not all loan offers are good ones. It’s crucial to know when to say “no” and walk away. You should decline a high-interest personal loan offer if the APR is 30% or higher, as this borders on predatory lending in many regions and can be incredibly difficult to pay back. If you are trying to consolidate debt, you should walk away if the loan’s APR is not significantly lower than the average APR of the debts you plan to pay off. Taking out a loan at 18% to pay off credit cards at 19% provides very little benefit and may not be worth the effort or the origination fee. Finally, if the monthly payment for the loan would strain your budget and push your DTI ratio into a dangerous zone, it is better to walk away and seek alternative solutions.

Improving Your Credit Before Reapplying for a Cheaper Rate

If you are denied a low-interest loan or only qualify for high-rate offers, don’t be discouraged. Use it as a motivation to improve your credit profile before you reapply. First, obtain a copy of your credit report and check it for any errors that could be dragging down your score. Second, focus on lowering your credit utilization ratio. This is the fastest way to boost your score. Pay down the balances on your credit cards, aiming to get them below 30% of their limits. Third, commit to making every single payment on all your debts on time, as payment history is the most important factor. After 6 to 12 months of this disciplined approach, your score will likely be significantly higher, and you can reapply with confidence for a much cheaper interest rate.

Timing Your Loan Application for the Best Interest Rates

The interest rates you are offered are a product of two things: your personal financial health and the broader economic climate. To get the best rates, you should time your application to when both are in your favor. The most important element is your personal profile. The best time to apply is always when your credit score is at its peak, your income is stable, and your existing debt is low. Beyond personal factors, market interest rates, influenced by central banks like the U.S. Federal Reserve, do fluctuate. When the economy is strong and central banks raise rates, personal loan rates tend to rise as well. While it’s difficult to time the market perfectly, being aware of current economic trends can provide some context for the rates you see.

Choosing Between Short-Term and Long-Term Loans — What’s Cheaper?

When it comes to the total cost of borrowing, a short-term loan is always cheaper. Although a short-term loan (e.g., 3 years) has a higher monthly payment, you pay interest for a much shorter period. This results in a significantly lower amount of total interest paid over the life of the loan. A long-term loan (e.g., 7 years) offers the allure of a much lower and more manageable monthly payment, but it is the more expensive option. You will end up paying far more in total interest because the interest has more time to accrue. The best financial strategy is to choose the shortest loan term that has a monthly payment you can comfortably and consistently afford without straining your budget. Use a loan calculator to compare the total interest costs for different terms.

Monitoring Interest Rate Trends and Credit Score Changes in 2025

To be a savvy borrower in 2025, stay informed about two key data points: macroeconomic interest rate trends and your own personal credit score. Keep an eye on announcements from central banks like the U.S. Federal Reserve or the Bank of England. Their policy decisions directly influence the rates lenders offer. If rates are trending down, it may be a good time to apply or refinance. Just as importantly, monitor your own credit score using a free credit monitoring service. These services often provide alerts when your score changes and offer improvement tips. By understanding both the broad market and your personal financial standing, you can time your loan application to maximize your chances of securing the cheapest interest rate.

How Origination Fees Affect Your Real Loan Cost

An origination fee is a silent rate-hiker. While it’s not an “interest” charge, it is a direct cost of borrowing that is factored into your loan’s Annual Percentage Rate (APR). A $15,000 loan with a 4% origination fee means you only receive $14,400, but your payments are calculated based on the full $15,000 you are borrowing. This fee effectively increases the real cost of your loan. Therefore, a loan with a 9% interest rate and a 4% origination fee will have a higher APR—and be more expensive—than a loan with a 10% interest rate and zero fees. When comparing loan offers, always use the APR as your guide, as it provides the most honest reflection of what you’ll actually pay.

Reapplying When Your Credit Score Improves — Best Practices

If you’ve spent time improving your credit score since your last loan application, reapplying can unlock much cheaper interest rates. For best results, wait at least six months from your last application. Before you reapply, confirm your score has seen a significant jump (e.g., 30+ points) and that you’ve addressed any issues that may have caused a previous denial, such as a high DTI ratio. When you reapply, start with the pre-qualification process again to shop for rates without a hard credit check. This allows you to see the new, better offers your improved score now commands. This patient and strategic approach demonstrates financial maturity to lenders and ensures you are rewarded with the low rate you’ve worked to achieve.

Using Loan Rate Calculators to Estimate Monthly Savings

A personal loan calculator is your most powerful tool for visualizing the benefits of a cheap interest rate. Before you even apply, you can use a calculator to input different loan amounts, terms, and interest rates to see how they affect both your monthly payment and the total interest paid. When you receive pre-qualified offers, plug each loan’s APR and term into the calculator. This will immediately show you, in clear dollar amounts, which loan is the most affordable over its lifetime. This simple step transforms abstract percentages into concrete figures, making it easy to identify the offer that will save you the most money and help you choose the best loan with confidence.

Recognizing When It’s Time to Refinance Your Personal Loan

Knowing when to refinance your personal loan can save you a significant amount of money. The primary signal that it’s time to check refinancing rates is a major improvement in your credit score—if your score has increased by 50 points or more since you took out the loan, you likely qualify for a much cheaper rate. Another trigger is a drop in overall market interest rates. If you hear news that rates are falling, it’s a good time to see if you can get a better deal. Finally, if you are struggling with your monthly payment, refinancing into a loan with a lower rate or a longer term can provide immediate financial relief. Regularly checking your credit score and staying aware of your refinancing options is a smart financial habit.

Maintaining Good Payment Habits to Keep Your Low Interest Rate Long-Term

You’ve done the work to secure a personal loan with a cheap, fixed interest rate. Now, the key is to maintain it. The best way to do this is by establishing flawless payment habits. Setting up autopay is the most effective strategy, as it ensures your payment is never late and you continue to benefit from any associated discount. A fixed-rate loan means your rate won’t change, but a late payment can result in hefty fees and a negative mark on your credit report, which will make it harder to get cheap interest rates on future loans. By consistently paying on time, you not only honor the terms of your current loan but also continue to build a positive credit history, paving the way for affordable borrowing in the future.

FAQ

Which Bank Is Giving the Lowest Interest Rate for a Personal Loan?

There is no single bank that consistently offers the lowest interest rate for every single borrower. The rate you are offered is highly personalized and depends on your credit score, income, and debt-to-income ratio. While large banks offer personal loans, online lenders and credit unions are often more competitive. Online lenders like LightStream and SoFi are frequently cited as offering some of the lowest rates for borrowers with excellent credit. Credit unions, being non-profit, also typically provide very low rates to their members. The only way to know which institution will give you the lowest rate is to use an online comparison tool to get pre-qualified offers from a variety of lenders. This allows you to see the best rate available for your specific financial profile.

Can I Get a 0% Interest Personal Loan?

It is extremely rare to find a 0% interest personal loan. Personal loans are a form of unsecured credit, and lenders charge interest to compensate for the risk they are taking. Offers of “0% financing” are typically associated with other products, such as promotional periods on new credit cards, point-of-sale financing from a retailer (e.g., for a mattress or electronics), or some auto loans from captive lenders. These offers often come with deferred interest clauses, meaning if you don’t pay the balance in full by the end of the promotional period, you could be charged all the interest that has accrued. For a traditional lump-sum personal loan from a bank or online lender, you should expect to pay interest.

Which Bank Has the Lowest Personal Loan Interest Right Now?

The personal loan market is dynamic, and the bank with the lowest interest rate “right now” can change daily and varies for each applicant. As of late 2025, online lenders and direct banks such as LightStream, Marcus by Goldman Sachs, and SoFi consistently offer some of the most competitive fixed-rate APRs to borrowers with good to excellent credit. Credit unions are also a strong source of low-interest loans. Traditional brick-and-mortar banks may have higher advertised rates but can sometimes offer discounts to existing customers. The most reliable way to find the lowest rate for you right now is to use a free online pre-qualification tool. This will give you personalized rate quotes from multiple lenders based on your current credit standing.

Do Banks Offer 0% Interest Personal Loans?

No, traditional banks do not offer 0% interest personal loans. A personal loan is a standard credit product where the bank assumes risk by lending you money without collateral. They profit from the interest charged on that loan. Zero-percent financing is a marketing tool used for specific retail products or credit card balance transfers, not for general-purpose installment loans from a bank. Be wary of any service advertising a “0% personal loan,” as it is likely not a traditional loan and may have hidden fees or clauses. The goal for a savvy borrower is not to find a 0% loan, but to secure the lowest, most competitive fixed-rate APR possible by improving their credit and comparing multiple lenders.

Personal Loan Cheap Interest Rates — How to Compare and Apply

To find and apply for a personal loan with cheap interest, follow these steps. First, check and improve your credit score, as this is the biggest factor in the rate you’ll get. Second, use an online loan comparison website. These platforms allow you to fill out one short form and receive pre-qualified offers from multiple lenders without a hard credit check. Third, when you receive offers, compare them based on the Annual Percentage Rate (APR), not just the interest rate, as the APR includes fees. Once you’ve identified the loan with the lowest APR and best terms, you can proceed to that lender’s website to complete the official application, upload your documents, and finalize the loan.

Which Bank Has the Lowest Interest Rate on a Personal Loan Near Me?

While you might find a competitive offer at a local bank branch “near you,” especially at a credit union, the lowest interest rates are often found with national online lenders. These lenders have lower overhead costs than brick-and-mortar banks and pass those savings on to borrowers in the form of cheaper rates. Your geographic location has less influence on your rate than your credit profile does. The best strategy is to start your search online. Use a comparison tool to see what rates are available from top national online lenders. You can then use the best online offer as a benchmark to compare against any offers from your local bank or credit union.

Personal Loan Cheap Interest Calculator — Estimate Your Savings

A personal loan calculator is an essential tool for understanding the impact of a cheap interest rate. It allows you to estimate your monthly payments and total interest costs. To use it, you input the loan amount, the loan term (in years), and the interest rate (APR). You can then experiment with the numbers. For example, you can directly compare a loan offer at 12% APR versus one at 9% APR. The calculator will show you the exact difference in the monthly payment and, more importantly, the total interest you would save over the life of the loan. This helps you quantify the benefits of shopping around and makes it easy to choose the most affordable loan offer.

Personal Loan Cheap Interest for Bad Credit — What to Expect

Finding a personal loan with cheap interest is very challenging if you have bad credit (a score below 630). Lenders view a low credit score as a sign of high risk, and they compensate for that risk by charging much higher interest rates. For borrowers with bad credit, APRs can range from 20% to 36%, which is the maximum allowed in many areas. While this is not “cheap,” it can still be a better option than a payday loan. Your best options are to apply with lenders that specialize in bad credit loans, consider a secured loan if you have collateral, or apply with a creditworthy co-signer. Improving your credit score before applying remains the most effective strategy.

Personal Loans — Compare Offers Across Major Tier One Lenders

To secure the best deal on a personal loan, it is vital to compare offers from a wide range of major lenders serving Tier One markets (US, UK, Canada, Australia). This includes a mix of online-only lenders (like SoFi and Marcus), traditional banks (if you’re a customer), and credit unions. Each has a different risk model, so an applicant might receive vastly different offers from each. The most efficient way to do this is through an online marketplace that partners with numerous lenders. This allows you to check your eligibility and see personalized rate estimates from multiple institutions at once, all through a single, simple process that does not impact your credit score, ensuring you get a comprehensive view of your options.

LightStream Personal Loan — Low Rate Comparison and Benefits

LightStream consistently ranks as a top choice for borrowers with excellent credit seeking low-interest personal loans. Their primary benefit is offering some of the lowest fixed APRs on the market, combined with a “Rate Beat Program” where they promise to beat a competitor’s qualifying rate. Furthermore, LightStream charges no fees of any kind—no origination fees, no late payment fees, and no prepayment penalties. They also offer a wide range of loan amounts and long repayment terms. When compared to other lenders, their rates are typically the most competitive for applicants in the super-prime credit tier (scores of 720+). However, their strict credit requirements mean they are not an option for those with fair or developing credit.

Wells Fargo Personal Loan — Interest Rate Breakdown and Eligibility

Wells Fargo is a major U.S. bank that offers personal loans, but primarily to its existing customers. To be eligible, you generally must have a qualifying account relationship with the bank. Their interest rates are competitive, especially for customers with high credit scores and a strong banking history with them. They offer fixed-rate loans with terms typically ranging from 12 to 84 months. As with most lenders, the final APR you receive depends on your creditworthiness, the loan amount, and the term length. While Wells Fargo is a reputable lender, their requirement of an existing relationship means it’s not an option for everyone, and existing customers should still compare Wells Fargo’s offer to those from top online lenders to ensure they are getting the best possible rate.