Compare NerdWallet Personal Loans from top lenders in the US, UK, Canada & Australia. Get low rates, fast approval, and secure funding in 2025—apply today!

Facing an unexpected expense or staring down a mountain of high-interest credit card debt can feel overwhelming. The path to a solution—a personal loan—often seems just as daunting. How do you find the best rate? Which lender can you trust? The endless hours of research and the fear of a hard credit check just to see your options can lead to decision paralysis. This financial stress is a common story for households across the US, UK, Canada, and Australia, where navigating the complex lending landscape is a significant challenge. You need clarity, speed, and confidence that you’re not leaving money on the table.

Imagine a single platform that cuts through the noise. NerdWallet provides a clear, streamlined way to compare personal loan offers from a wide network of trusted lenders. Instead of filling out dozens of applications, you complete one simple pre-qualification form. This process won’t hurt your credit score and instantly presents you with personalized rate estimates, loan terms, and funding options tailored to your financial profile. NerdWallet empowers you to take control, transforming a confusing process into a simple one. Our goal is to connect you with lenders that can deposit funds into your account in as little as 24 hours, helping you secure the lowest possible rates and achieve your financial goals faster and with less stress.

Get Money in Your Account in as Little as 24 Hours with NerdWallet Personal Loans

When financial needs are urgent, waiting days or weeks for loan approval isn’t an option. Whether it’s a sudden medical bill in the United States, an emergency home repair in the United Kingdom, or a time-sensitive investment opportunity in Australia, the speed of funding is critical. NerdWallet’s marketplace connects you with lenders who specialize in rapid approval and disbursement, turning a stressful waiting game into a swift solution. The entire process is designed for efficiency, moving you from application to funding in record time. Many top-rated lenders can approve your application and deposit the cash directly into your bank account within just one business day.

Mini Case Study:

Meet Mark, a freelance graphic designer from Toronto, Canada. His main computer suddenly failed, putting his projects and income on hold. A new high-performance machine would cost over $5,000—money he didn’t have readily available. Instead of using a high-APR credit card, Mark used NerdWallet to compare personal loan options. He filled out the pre-qualification form in minutes and was presented with several offers. He chose a lender known for its fast funding. After submitting his final application and documentation online, he was approved in a few hours. The funds were in his account the very next morning. Mark bought his new computer and was back to work without missing a beat.

Key Result → Mark secured the funds he needed in under 24 hours, preventing a major disruption to his business and avoiding high-interest credit card debt.

This speed is possible because NerdWallet’s partners leverage technology to verify your information quickly and efficiently. The online application process eliminates the paperwork and long queues associated with traditional banking.

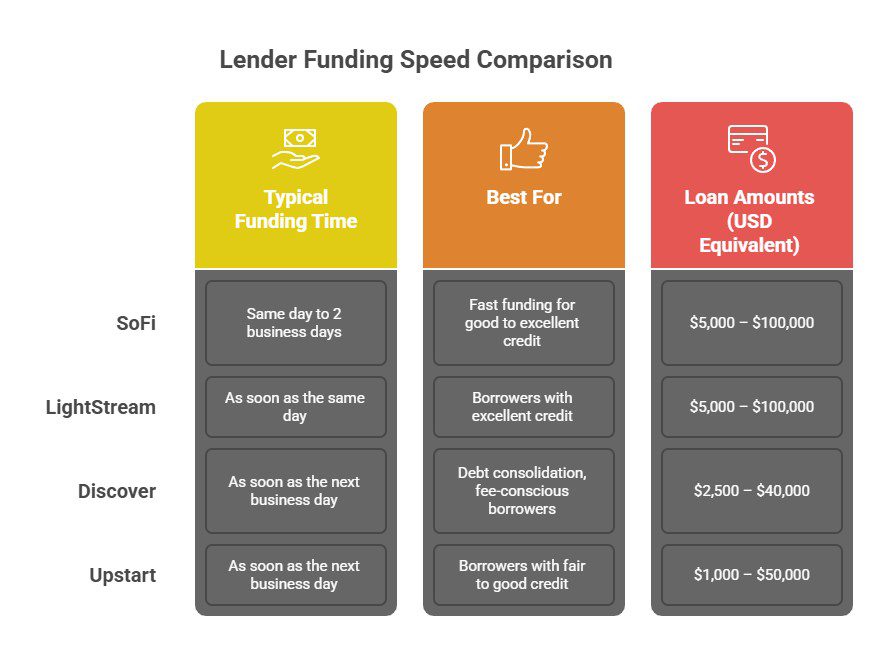

Lender Funding Speed Comparison

| Lender | Typical Funding Time | Best For | Loan Amounts (USD Equivalent) |

| SoFi | Same day to 2 business days | Fast funding for good to excellent credit | $5,000 – $100,000 |

| LightStream | As soon as the same day | Borrowers with excellent credit | $5,000 – $100,000 |

| Discover | As soon as the next business day | Debt consolidation, fee-conscious borrowers | $2,500 – $40,000 |

| Upstart | As soon as the next business day | Borrowers with fair to good credit | $1,000 – $50,000 |

Funding times are estimates and depend on the time of application, verification processes, and your bank’s processing times.

Don’t let time-sensitive expenses add to your stress. You can get the financial flexibility you need, right when you need it.

Top NerdWallet Personal Loan Lenders Compared for 2025

Choosing a lender is the most critical step in your borrowing journey. You need a partner that offers competitive rates, transparent terms, and features that align with your financial situation. NerdWallet acts as your personal loan marketplace, bringing together a curated list of the industry’s top lenders. This allows you to see how different companies stack up against each other in one convenient place. By comparing Annual Percentage Rates (APRs), loan amounts, and repayment terms side-by-side, you can make an informed decision without the pressure of committing to a single lender from the start. This comparison model fosters competition among lenders, which ultimately benefits you, the borrower.

Mini Case Study:

Consider Sarah, a teacher in Manchester, UK, who wanted to consolidate £15,000 in credit card debt. Her cards had an average APR of over 22%. She knew a personal loan would save her money, but was unsure where to start. Using NerdWallet, she compared several lenders. Lender A offered a lower headline interest rate but had a 4% origination fee. Lender B had a slightly higher interest rate but no origination fee and offered an autopay discount. After using the NerdWallet calculator, Sarah realized Lender B would save her more than £1,200 over the life of the loan due to the absence of fees. She confidently chose Lender B, consolidated her debt, and now has a single, manageable monthly payment.

Key Takeaway → Looking beyond the headline interest rate to compare the full APR, including fees, is essential for finding the true cost of a loan and maximizing your savings.

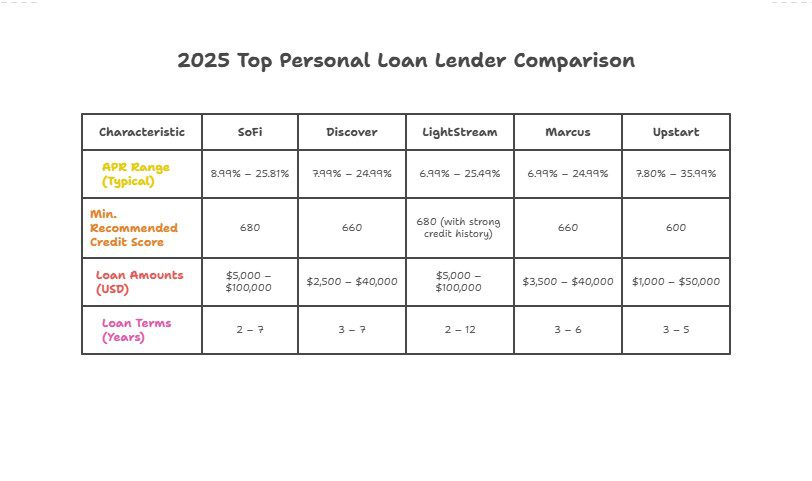

The table below provides a snapshot of what some of NerdWallet’s highly-rated lending partners offer. Keep in mind that the best lender for you depends entirely on your credit profile, income, and loan purpose.

2025 Top Personal Loan Lender Comparison

| Lender | APR Range (Typical) | Min. Recommended Credit Score | Loan Amounts (USD) | Loan Terms (Years) |

| SoFi | 8.99% – 25.81% | 680 | $5,000 – $100,000 | 2 – 7 |

| Discover | 7.99% – 24.99% | 660 | $2,500 – $40,000 | 3 – 7 |

| LightStream | 6.99% – 25.49% | 680 (with strong credit history) | $5,000 – $100,000 | 2 – 12* |

| Marcus | 6.99% – 24.99% | 660 | $3,500 – $40,000 | 3 – 6 |

| Upstart | 7.80% – 35.99% | 600 | $1,000 – $50,000 | 3 – 5 |

*Longer terms available for home improvement loans. Rates are for illustrative purposes and subject to change.

Average Personal Loan Rates and APR Trends for Tier One Borrowers

Understanding the average personal loan rates is key to knowing if you’re getting a good deal. The Annual Percentage Rate (APR) is the most important number to focus on, as it represents the total cost of borrowing, including the interest rate and any mandatory fees, like an origination fee. These rates are not static; they fluctuate based on the economic climate, including the benchmark rates set by central banks like the U.S. Federal Reserve, the Bank of England, the Bank of Canada, and the Reserve Bank of Australia. For 2025, experts anticipate that rates will remain competitive as lenders vie for well-qualified borrowers.

Your credit score, however, is the single most significant factor within your control. Borrowers with excellent credit in Tier One markets consistently secure the lowest APRs because they represent a lower risk to lenders. Conversely, those with fair or developing credit profiles can expect to see higher rates. The difference between a “good” rate and a “great” rate can translate into hundreds or even thousands of dollars saved over the life of the loan.

Mini Case Study:

Let’s look at two friends in the US, Alex and Ben, who both want to borrow $20,000 over five years. Alex has an excellent credit score of 780 and qualifies for an 8% APR. Ben has a fair credit score of 650 and is offered a 19% APR.

· Alex’s Payment: $406/month. Total interest paid: $4,332.

· Ben’s Payment: $519/month. Total interest paid: $11,137.

Key Result → By maintaining an excellent credit score, Alex will save over $6,800 in interest compared to Ben for the same loan amount.

The table below illustrates the strong correlation between credit scores and the average APRs you can expect.

Average Personal Loan APR by Credit Score (Illustrative)

| Credit Score Range (FICO) | Borrower Profile | Average Estimated APR |

| 720 – 850 | Excellent | 7% – 12% |

| 690 – 719 | Good | 12% – 18% |

| 630 – 689 | Fair | 18% – 26% |

| Below 630 | Developing Credit | 26% – 36% |

Knowing where you stand is the first step. Many services allow you to check your credit score for free. Once you have that number, you can use NerdWallet to see what rates you are likely to qualify for without any impact on your score.

Understanding Different Types of Personal Loans and Which One Fits You

A personal loan is a versatile financial tool, but it’s not a one-size-fits-all solution. Lenders often categorize loans by their intended use, and understanding these distinctions can help you find a product with features tailored to your specific goal. While the core product is an unsecured installment loan, its application can vary widely, from consolidating debt to financing a wedding. Choosing the right loan type helps you articulate your needs to the lender, which can sometimes influence the terms you’re offered. The primary purpose is to provide a lump sum of cash that you repay in fixed monthly installments over a set period.

Mini Case Study:

The Garcia family in Sydney, Australia, wanted to undertake a major backyard renovation estimated to cost $25,000 AUD. They considered using a credit card but were deterred by the high variable interest rates and the temptation to overspend. They also looked at a home equity line of credit (HELOC) but weren’t comfortable putting their house up as collateral for this specific project. They ultimately decided a “home improvement personal loan” was the perfect fit. Using NerdWallet, they found a lender offering favorable terms for this purpose. They received a fixed-rate loan over five years, which gave them a predictable monthly payment that fit their budget and a clear end date for their debt.

Key Takeaway → Matching the loan type to your specific financial goal ensures you get a structured, predictable repayment plan, which is often a smarter choice than using revolving credit for large, one-time expenses.

Here’s a breakdown of the most common uses for personal loans and who they are best for.

Personal Loan Types and Their Best Use Cases

| Loan Purpose | Typical APR Range | Best For… | Key Consideration |

| Debt Consolidation | 7% – 36% | Combining multiple high-interest debts (credit cards, etc.) into one lower-rate loan. | The new loan’s APR must be lower than the average rate of your existing debts to save money. |

| Home Improvement | 7% – 25% | Funding renovations, repairs, or upgrades without using home equity as collateral. | It can increase your home’s value. Some lenders offer longer terms for this purpose. |

| Major Purchase | 7% – 30% | Financing a large one-time expense like a wedding, vacation, or major appliance. | Provides a structured payment plan instead of putting a large balance on a credit card. |

| Medical/Dental Bills | 7% – 36% | Covering unexpected healthcare costs that aren’t covered by insurance. | Often, a better alternative to medical credit cards, that can have deferred interest clauses. |

No matter your reason for borrowing, the fundamental principle remains the same: secure the lowest possible APR to minimize your cost of borrowing.

How to Choose the Best NerdWallet Personal Loan for Your Financial Goals

Navigating the sea of loan options on NerdWallet can be empowering, but a structured approach is essential to find the loan that truly serves your best interests. The “best” loan isn’t just the one with the lowest advertised rate; it’s the one that balances affordability, terms, and features to align perfectly with your financial goals and budget. Making the right choice means looking beyond the monthly payment and considering the total cost of the loan, the lender’s reputation, and the flexibility of the repayment plan. Following a clear set of steps can demystify the process and lead you to a confident decision.

Mini Case Study:

Let’s follow Chloe from the UK as she chooses a loan to start her small baking business. She needs £8,000. After pre-qualifying on NerdWallet, she gets two competitive offers:

· Lender A: 9.5% APR, 3-year term, 3% origination fee.

· Lender B: 10.2% APR, 3-year term, no origination fee.

At first glance, Lender A seems better due to the lower APR. However, the 3% origination fee on £8,000 is £240, which is deducted from her loan amount. To get the full £8,000, she’d have to borrow more. Lender B, despite the slightly higher APR, offers the full amount upfront with no fees. Chloe uses a loan calculator and realizes the total cost of Lender B’s loan is actually lower over the three years. She chooses Lender B for its transparency and better overall value.

Key Takeaway → Always factor in fees when comparing loans. The APR is designed to do this for you, so a loan with a slightly higher APR but zero fees can often be the cheaper option.

Use this checklist to systematically evaluate and compare your loan offers.

Decision-Making Checklist for Personal Loans

| Evaluation Criteria | My Priority (High/Med/Low) | Lender 1 Offer | Lender 2 Offer | Lender 3 Offer |

| Annual Percentage Rate (APR) | High | |||

| Origination Fee | High | |||

| Prepayment Penalty | Medium | |||

| Total Interest Paid | High | |||

| Monthly Payment | High | |||

| Repayment Term Length | Medium | |||

| Funding Speed | Low | |||

| Customer Reviews | Medium |

Expert Insight: Financial advisor David Chen recommends, “Create a simple spreadsheet with this checklist. When you input your pre-qualified offers, the best choice often becomes visually obvious. Never skip the step of reading at least a dozen recent customer reviews for the specific lenders you’re considering.”

This methodical approach ensures you’re not swayed by a single attractive feature but are instead making a holistic decision based on all the factors that matter.

Use the NerdWallet Personal Loan Calculator to Estimate Payments Accurately

One of the most powerful tools at your disposal during the loan shopping process is a personal loan calculator. This simple utility demystifies the numbers behind your loan, giving you a clear picture of what your monthly financial commitment will be. Before you even apply, you can use the NerdWallet Personal Loan Calculator to model different scenarios. By inputting the loan amount, estimated APR, and loan term, you can instantly see your estimated monthly payment and the total interest you’ll pay over the life of the loan. This empowers you to adjust the variables to find a payment that comfortably fits within your budget.

The calculator uses a standard formula to determine your payment:

Where:

· = Monthly payment

· = Principal loan amount

· = Monthly interest rate (your APR divided by 12)

· = Number of payments (loan term in months)

Mini Case Study:

James, from a suburb of Chicago, USA, wanted to borrow $15,000 for a used car. His initial plan was to pay it off as quickly as possible, so he considered a 3-year (36-month) term. He pre-qualified for an APR of around 11%. Using the calculator, he found his monthly payment would be about $491. While manageable, it was tighter than he liked. He then used the calculator to model a 5-year (60-month) term. The payment dropped to a much more comfortable $326 per month. While he would pay more in total interest over the longer term, the lower monthly payment gave him crucial breathing room in his budget. He decided the flexibility was worth the extra cost.

Key Tip → The calculator is not just for finding a payment you can afford. It’s also a powerful negotiation tool. When you see what a 1% difference in APR does to your total cost, you’ll be more motivated to improve your credit score or shop around for a better rate.

See how different loan terms and APRs can impact your monthly budget.

Sample Loan Scenarios for a $10,000 Loan

| Loan Amount | APR | Term (Months) | Estimated Monthly Payment | Total Interest Paid |

| $10,000 | 9% | 36 | $318 | $1,448 |

| $10,000 | 9% | 60 | $208 | $2,455 |

| $10,000 | 15% | 36 | $347 | $2,482 |

| $10,000 | 15% | 60 | $238 | $4,274 |

This table clearly shows how both the APR and the term length have a massive impact on your total cost of borrowing. Experiment with the numbers to find your sweet spot.

Calculate your estimated payment now. Try the NerdWallet Loan Calculator → [Access the Free Calculator]

Best Personal Loans for Good to Excellent Credit Profiles

If you have a credit score of 690 or higher in the U.S. (or the equivalent in the UK, Canada, or Australia), you are in the driver’s seat. Lenders view you as a low-risk borrower, and they will compete for your business by offering their best possible rates and terms. Borrowers in this tier can expect to find loans with low single-digit APRs, no origination fees, and a host of borrower-friendly features like autopay discounts and flexible repayment options. Lenders like SoFi and LightStream often target this demographic, providing a seamless online experience and very fast funding.

When you have excellent credit, you should focus on more than just the interest rate. Look for lenders that add value. Do they offer unemployment protection? Can you change your payment date? Are there any relationship discounts for using their other financial products? These perks can make a significant difference in your borrowing experience. The goal is to leverage your strong credit profile to secure not just a cheap loan, but the best loan for your situation.

Expert Insight: “For borrowers with excellent credit, the biggest mistake is accepting the first offer they receive,” notes financial analyst Sarah Thompson. “Use a platform like NerdWallet to get at least three to five pre-qualified offers. This creates a competitive environment where lenders are incentivized to give you their absolute best rate, potentially saving you thousands over the life of the loan.”

Top Lenders for Borrowers with Good to Excellent Credit

| Lender | Min. Recommended Score | Typical APR Range for Top Tier | Key Feature |

| LightStream | 680 (with strong credit history) | 6.99% – 14.00% | Rate Beat Program; No fees of any kind |

| SoFi | 680 | 8.99% – 16.00% | Unemployment protection; Member benefits |

| Marcus by Goldman Sachs | 660 | 6.99% – 15.00% | On-time payment reward; No fees |

| Discover | 660 | 7.99% – 17.99% | Option to pay creditors directly; US-based support |

Having great credit is a financial asset. When you need to borrow, make sure you use it to your full advantage by comparing top-tier lenders and their premium offerings.

Personal Loans for Debt Consolidation — Reduce High-Interest Balances

Debt consolidation is one of the most popular and financially savvy reasons to take out a personal loan. The strategy is simple: you take out a new, single loan with a lower fixed interest rate to pay off multiple higher-interest, variable-rate debts, such as credit cards or store cards. This not only simplifies your finances down to one monthly payment but can also drastically reduce the amount of interest you pay, helping you get out of debt faster. Across Tier One countries, where credit card APRs can easily exceed 20%, a consolidation loan with an APR of 10-15% can lead to immediate and substantial savings.

The key to successful debt consolidation is discipline. Once you’ve paid off your credit cards with the loan funds, you must resist the temptation to run up new balances. The loan provides a structured path out of debt with a fixed end date. Some lenders even simplify the process by offering to send the loan funds directly to your creditors, removing the friction and ensuring the debts are paid off as intended. This feature is particularly valuable for those who want a clear and direct path to becoming debt-free.

Expert Insight: “The most critical calculation in debt consolidation is the breakeven point,” explains personal finance author Michael Chen. “Ensure the APR on your new personal loan is significantly lower than the weighted average APR of the debts you’re paying off. Also, factor in any origination fees. A successful consolidation should save you money, not just rearrange your deck chairs.”

Pros and Cons of Debt Consolidation Loans

| Pros | Cons |

| ✅ Lower Interest Rate: Can save you thousands over time. | ❌ Potential Origination Fees: Can add to the total cost of the loan. |

| ✅ Simplified Finances: One payment is easier to manage than many. | ❌ Requires Discipline: You must avoid accumulating new high-interest debt. |

| ✅ Fixed Repayment Schedule: You know exactly when you’ll be debt-free. | ❌ May Not Address Spending Habits: The underlying cause of the debt must be addressed. |

| ✅ Potential Credit Score Boost: Lowering credit card utilization can improve your score. | ❌ Could Extend Repayment: A longer term may lower payments but increase total interest. |

For many, a debt consolidation loan is a powerful tool to regain control of their finances and accelerate their journey to financial freedom.

Pros and Cons of NerdWallet Personal Loans Explained

It’s crucial to understand that NerdWallet is not a direct lender. It is a financial technology company that operates a comparison marketplace. This model presents a unique set of advantages and some considerations to keep in mind. The primary benefit is choice and transparency. NerdWallet empowers you by laying out multiple options from different lenders, allowing you to shop for the best rates and terms in one place using a “soft” credit pull that doesn’t damage your score. This saves you an immense amount of time and effort compared to applying to each lender individually.

However, because NerdWallet is an intermediary, the final loan agreement will be with the lender you choose, not with NerdWallet. This means that customer service, payment processing, and any future account management will be handled directly by that lender. Additionally, the rates and terms you see during pre-qualification are estimates. While highly accurate, the final offer is only confirmed after you complete a full application with the lender and they perform a “hard” credit inquiry.

Expert Insight: “Think of NerdWallet as a highly-skilled real estate agent for loans,” says industry analyst Laura Finch. “They don’t own the houses, but they have the market knowledge to show you the best properties that fit your needs and budget. Their value is in the search and comparison phase. Once you choose a ‘house’—or a lender—you work directly with the owner.”

Pros vs. Cons of Using the NerdWallet Platform

| Pros of Using NerdWallet | Cons of Using NerdWallet |

| ✅ Efficient Comparison: See rates from multiple lenders at once. | ❌ Not a Direct Lender: Your loan is managed by the partner you choose. |

| ✅ Protects Your Credit Score: Pre-qualification uses a soft credit inquiry. | ❌ Offers are Preliminary: Final rates are confirmed only after a hard inquiry. |

| ✅ Free to Use: Borrowers do not pay any fees to use the platform. | ❌ Not All Lenders are Included: The marketplace features partners, not every lender. |

| ✅ Educational Resources: Provides calculators, reviews, and articles to inform your decision. | ❌ Options May Be Limited for Poor Credit: Fewer partners cater to sub-600 credit scores. |

Ultimately, using NerdWallet is a powerful first step for any savvy borrower. It maximizes your options while minimizing the initial impact on your credit, putting you in a position of strength before you finalize your decision.

Steps to Apply for a Personal Loan Through NerdWallet

NerdWallet has streamlined the loan application process to be as simple and intuitive as possible. By following a few clear steps, you can move from researching to receiving funds in a remarkably short time. The platform guides you through the initial, most crucial phase—comparison shopping—before handing you off to your chosen lender to complete the final steps. This process is designed to be user-friendly, even for those who are not financial experts.

Here is a breakdown of the journey from start to finish:

1. Gather Your Information: Before you begin, have key details handy. This includes your personal contact information, Social Security Number (in the US) or equivalent national identifier, proof of income (like recent pay stubs or tax returns), and an estimate of your monthly expenses.

2. Complete the Pre-qualification Form on NerdWallet: This is a short, secure online form that asks for basic information about you, your income, and how much you want to borrow. This step triggers a soft credit check, which does not affect your credit score.

3. Compare Your Personalized Offers: Based on your information, NerdWallet will present you with a dashboard of potential loan offers from its network of lending partners. Here, you can compare APRs, loan terms, monthly payments, and any fees.

4. Select Your Preferred Lender: After reviewing your options, choose the lender and loan offer that best fits your needs. Clicking on this offer will securely redirect you to the lender’s website.

5. Finalize Your Application with the Lender: On the lender’s site, you will complete the official application. This may involve verifying your identity and income by uploading documents. At this stage, the lender will perform a hard credit inquiry, which may temporarily affect your score by a few points.

6. Review and Sign Your Loan Agreement: Once approved, the lender will provide a final loan agreement. Read this document carefully to ensure you understand all the terms and conditions. If you agree, you can e-sign it online.

7. Receive Your Funds: After you’ve signed the agreement, the lender will disburse the funds, typically via direct deposit to your bank account. Funding can occur in as little as one business day.

This structured process removes the guesswork and helps you secure financing efficiently and confidently.

The Impact of Personal Loans on Your Credit Score Over Time

Taking out a personal loan has a multifaceted effect on your credit score, with different impacts occurring at different stages of the loan’s life. Understanding this can help you manage your loan responsibly and even use it as a tool to build a stronger credit profile over the long term. The initial impact is typically a small, temporary dip in your score. This happens for two reasons: the lender performs a hard credit inquiry when you formally apply, and the new loan account reduces the average age of your credit accounts.

However, the long-term impact is often positive, provided you manage the loan well. The most significant factor in your credit score (around 35%) is your payment history. By making every monthly payment on time, you build a strong, positive record of creditworthiness. Furthermore, a personal loan adds to your “credit mix” (10% of your score). Lenders like to see that you can responsibly manage different types of credit, such as both revolving debt (credit cards) and installment debt (loans). If you use the loan for debt consolidation, the positive effect can be even greater. Paying off credit card balances lowers your credit utilization ratio, which is another major factor in your score (30%).

Expert Insight: “A personal loan is like a workout for your credit score,” says credit expert John Ulzheimer. “There’s a little bit of strain at the beginning—the hard inquiry and new account age. But with the consistent, disciplined ‘exercise’ of on-time payments, your score will become stronger and healthier than it was before.”

Visualizing the Impact on Your Credit Score

(Imagine a simple line chart here)

· X-Axis (Time): Month 0, Month 1, Month 6, Month 12, Month 24

· Y-Axis (Credit Score): A line starts at a hypothetical score (e.g., 700).

· Month 1: The line dips slightly (e.g., to 695) to reflect the hard inquiry and new account.

· Month 6 onwards: The line begins a steady upward climb as on-time payments are reported, surpassing the original score and continuing to grow.

By making timely payments, you demonstrate financial responsibility, which credit bureaus and lenders will reward over time.

Evaluating NerdWallet Personal Loan Features, Rates, and Customer Support

A smart borrower looks beyond the two main numbers—loan amount and monthly payment. The fine print contains features that can significantly impact your experience and the overall cost of the loan. When you compare offers on NerdWallet, it’s essential to dig into these details. Key features to look for include autopay discounts, which can lower your APR by 0.25% to 0.50%, and the absence of prepayment penalties, which gives you the freedom to pay off your loan early without any extra charges.

Rates are paramount. Always focus on the Annual Percentage Rate (APR), not just the interest rate. The APR includes most fees, giving you the truest comparison of costs between lenders. An offer with a low interest rate but a high origination fee might be more expensive than an offer with a slightly higher interest rate but no fees. Use the APR as your primary metric for an apples-to-apples comparison.

Finally, remember that you will be dealing with the lender, not NerdWallet, after your loan is funded. Therefore, evaluating their customer support is critical. Read reviews on sites like Trustpilot or the Better Business Bureau. Do they have accessible, U.S. or UK-based customer service? Do they offer a user-friendly online portal or mobile app for managing your loan? Good support can be invaluable if you ever face a financial hardship or simply have a question about your account.

Expert Insight: “I advise clients to create a ‘Lender Scorecard,'” suggests financial planner Maria Ramos. “Rate each lender on a scale of 1-5 across key categories: APR, Fees, Flexibility Features, and Customer Support Reviews. The highest total score often reveals the best overall loan, not just the one with the flashiest advertisement.”

Feature Comparison Checklist

| Feature | Importance | Lender A | Lender B | Lender C |

| No Origination Fee | High | ☐ Yes / ☐ No | ☐ Yes / ☐ No | ☐ Yes / ☐ No |

| No Prepayment Penalty | High | ✅ Yes | ✅ Yes | ✅ Yes |

| Autopay Discount | Medium | ☐ Yes (0.25%) | ☐ Yes (0.50%) | ☐ No |

| Flexible Payment Date | Medium | ☐ Yes | ☐ No | ☐ Yes |

| Direct Creditor Payoff (for consolidation) | High (if applicable) | ☐ Yes | ☐ Yes | ☐ No |

Taking a few extra minutes to evaluate these components ensures you choose a lender you’ll be happy with for the entire term of your loan.

SoFi Personal Loan Review — Flexible Options and Fast Approval

SoFi (Social Finance) has established itself as a top choice for borrowers with good-to-excellent credit, offering a compelling blend of competitive rates, high loan amounts, and unique member perks. Their personal loans are unsecured, meaning you don’t need to provide collateral. They are particularly well-suited for debt consolidation, home improvement projects, or other large expenses, with loan amounts ranging from $5,000 up to $100,000 in the U.S.

One of SoFi’s standout features is its commitment to fee transparency. They charge no origination fees, no late fees, and no prepayment penalties, which is a significant advantage. Furthermore, SoFi provides a valuable safety net with its Unemployment Protection program. If you lose your job through no fault of your own, you may be able to temporarily pause your monthly payments. Approval and funding are also remarkably fast, often happening within the same day or the next business day. However, SoFi maintains a high bar for applicants, typically requiring a credit score of 680 or above and a strong income to qualify.

Key Tip → If you have a strong credit profile and value perks like career coaching and financial planning tools, SoFi offers a holistic financial partnership, not just a loan.

Explore more details here → [See if You Pre-qualify for a SoFi Loan]

Discover Personal Loan Review — Transparent Fees and Fixed APRs

Discover is a well-known name in credit cards, and it brings the same reputation for customer service and transparency to its personal loans. Discover loans are a strong option for borrowers with good credit who are looking for a straightforward, fee-averse experience. They offer fixed-rate personal loans from $2,500 to $40,000 in the U.S., making them ideal for mid-sized needs like debt consolidation, vacations, or wedding expenses.

Discover’s biggest selling point is its fee structure—or lack thereof. There are no origination fees, no prepayment penalties, and no application fees. This simplicity makes it easy to understand the total cost of your loan. Another excellent feature, particularly for debt consolidation, is their option to pay your creditors directly. This streamlines the process and ensures the funds are used as intended. While their APRs are competitive, they may not always be the absolute lowest on the market, and they require a minimum credit score of around 660. Their repayment terms are also slightly less flexible, typically ranging from 36 to 84 months.

Key Tip → Discover offers a 30-day satisfaction guarantee. If you’re not happy with your loan for any reason within 30 days, you can return the funds without paying any interest.

Explore more details here → [Compare Discover with Other Top Lenders]

H4: LightStream Personal Loan Details — Best for Low-Interest Borrowers

LightStream, a division of Truist Bank, consistently ranks as a top choice for borrowers with excellent credit who are seeking the lowest possible interest rates. Their tagline, “Loans for Practically Anything,” reflects their versatility, funding everything from kitchen remodels and swimming pools to classic cars and medical procedures. Loan amounts are generous, ranging from $5,000 to $100,000.

The primary appeal of LightStream is its combination of low, fixed rates and a complete absence of fees. They have no origination fees, late fees, or prepayment penalties. Their “Rate Beat Program” promises to beat a competitor’s qualifying rate by 0.10 percentage points, demonstrating their confidence in their pricing. Furthermore, they are known for same-day funding for approved applicants. The tradeoff for these premium features is a strict underwriting process. LightStream requires a good-to-excellent credit history, stable income, and evidence of assets or savings. It is not an option for those with fair or developing credit.

Key Tip → LightStream’s application process is entirely online. To secure their lowest rates, you must sign up for AutoPay before the loan is funded.

Fixed vs. Variable Rates and Loan Terms: What You Need to Know

When you take out a personal loan, two of the most fundamental choices you’ll make are the type of interest rate and the length of the loan term.

Fixed-Rate Loans: The vast majority of personal loans offered by NerdWallet’s partners are fixed-rate loans. This means the interest rate is locked in for the entire life of the loan. Your monthly payment will be the exact same amount every single month until the loan is paid off. This predictability is a huge advantage, as it makes budgeting simple and protects you from any future increases in market interest rates. If you value stability and knowing exactly what your costs will be, a fixed-rate loan is the best choice.

Variable-Rate Loans: While less common for personal loans, some lenders offer variable rates. These rates are tied to a benchmark index, like the Prime Rate. A variable-rate loan might start with a lower introductory APR than a fixed-rate loan, but it can change over time. If the benchmark rate goes up, your APR and monthly payment will also increase. This introduces an element of risk, but it could potentially save you money if rates fall.

Loan Terms: The loan term is the amount of time you have to repay the loan, typically ranging from 2 to 7 years (24 to 84 months).

· Shorter Term (e.g., 3 years): This results in higher monthly payments but a lower total interest cost because you are paying off the principal faster.

· Longer Term (e.g., 5-7 years): This results in lower, more manageable monthly payments but a higher total interest cost because interest accrues for a longer period.

Key Takeaway → The best strategy is to choose the shortest loan term you can comfortably afford to minimize the total interest you pay.

Eligibility Requirements for NerdWallet Personal Loans in the US and UK

While specific requirements vary by lender, a set of common eligibility criteria applies to most personal loan applicants in Tier One markets like the United States and the United Kingdom. Understanding these before you apply can help you prepare your documentation and set realistic expectations.

Common Requirements in the US and UK:

1. Age and Residency: You must be at least 18 years old and a legal resident of the country you are applying. You will need to provide proof of address, such as a utility bill or bank statement.

2. Verifiable Income: Lenders need to see that you have a steady source of income to repay the loan. This can be from employment, self-employment, or other consistent sources. Be prepared to provide recent pay stubs, bank statements, or tax returns.

3. Credit History: Lenders will check your credit history to assess your past borrowing behavior. A higher credit score generally leads to better approval odds and lower interest rates. Most lenders on NerdWallet look for a score of at least 600-660.

4. Bank Account: You will need an active checking or current account in your name for the lender to deposit the funds and for you to set up automatic payments.

5. Debt-to-Income (DTI) Ratio: Lenders will calculate your DTI ratio by dividing your total monthly debt payments by your gross monthly income. A lower DTI ratio (typically under 40%) indicates that you have enough room in your budget to handle a new loan payment.

Loan Amount, Repayment Periods, and Funding Speed Options Explained

The three core components of any personal loan offer are the amount you can borrow, the time you have to pay it back, and how quickly you can get the cash. These elements are interconnected and influence both your monthly payment and the total cost of the loan.

Loan Amount:

Lenders on the NerdWallet platform typically offer personal loans ranging from as little as $1,000 (or the £/CAD/AUD equivalent) up to $100,000. The amount you are approved for depends on your creditworthiness, income, and DTI ratio. It’s crucial to borrow only what you need. Taking on a larger loan than necessary increases your monthly payment and the total interest you’ll pay.

Repayment Periods (Loan Term):

This is the length of time you have to repay the loan. Common terms are 3, 5, or 7 years.

· Pros of a shorter term: You pay less interest overall and become debt-free sooner.

· Pros of a longer term: Your monthly payments are lower and more manageable.

Use a loan calculator to see how changing the term affects your payment.

Funding Speed:

This refers to how quickly the lender can get the money into your bank account after you’ve been approved and signed the loan agreement. Many online lenders excel at this, with funding possible in as little as 24 hours or even the same business day. Traditional banks might take several business days. If you have an urgent need, filtering for lenders with fast funding is a key strategy.

Micro-CTA → [Model different loan scenarios with our free calculator]

NerdWallet Ratings, Expert Reviews, and Customer Feedback Insights

NerdWallet employs a rigorous rating system for the lenders on its platform. Their experts assign a star rating (from 1 to 5) based on a comprehensive evaluation of each lender’s features, affordability, and customer experience. This includes analyzing factors like APR ranges, the prevalence of fees, the availability of borrower-friendly options (like flexible payments), and the transparency of the application process. These expert reviews provide a professional, unbiased baseline for your comparison.

However, to get the full picture, you should supplement these expert ratings with real customer feedback. NerdWallet often includes snippets of user reviews, and it’s wise to also check third-party sites like Trustpilot. Customer feedback provides insights into the post-funding experience: How easy is the online portal to use? Is the customer service team helpful? Were there any unexpected issues? A lender might have a great rating on paper, but consistent negative customer reviews can be a major red flag.

Key Takeaway → The best approach is to find a lender with a high expert rating from NerdWallet and a strong track record of positive customer feedback.

Estimated APR and Interest Rate Trends for 2025

Personal loan interest rates are not set in a vacuum. They are heavily influenced by the broader economic environment, particularly the policy rates set by the central banks in Tier One markets: the U.S. Federal Reserve, the Bank of England, the Bank of Canada, and the Reserve Bank of Australia. When these central banks raise rates to combat inflation, the cost of borrowing for lenders goes up, and those costs are passed on to consumers in the form of higher APRs.

For 2025, many economists predict a stabilization or potential slight decrease in central bank rates as inflation comes under control. If this holds, it could lead to a more favorable and competitive market for personal loan borrowers. Lenders may become more aggressive in offering lower APRs to attract well-qualified applicants. However, rates are still expected to remain above the historic lows seen in previous years. For borrowers, this means that while 2025 may offer better opportunities than the recent past, having a strong credit score will be more important than ever to secure the best possible rates.

Benefits of Choosing Low-Interest NerdWallet Personal Loans

Choosing a personal loan with a low interest rate is one of the most impactful financial decisions you can make. The direct benefit is simple: you pay less money over the life of the loan. A lower Annual Percentage Rate (APR) means a smaller portion of your monthly payment goes toward interest and a larger portion goes toward paying down your principal balance. This allows you to get out of debt faster and for a lower total cost.

The savings can be dramatic. As shown in the table below, even a few percentage points on a mid-sized loan can add up to thousands of dollars in savings. This is money that stays in your pocket, free to be used for other financial goals like saving for retirement, investing, or building an emergency fund. Securing a low-interest loan through a comparison platform like NerdWallet means you’ve done your due diligence to find the most affordable credit available to you.

Savings Comparison on a $15,000 Loan Over 5 Years

| Loan APR | Monthly Payment | Total Interest Paid | Total Savings |

| 18% | $380 | $7,804 | – |

| 11% | $326 | $4,561 | $3,243 |

| 8% | $304 | $3,258 | $4,546 |

Secured vs. Unsecured Personal Loans — Which One Is Right for You?

The vast majority of loans featured on NerdWallet are unsecured personal loans. This means you are approved based on your creditworthiness, income, and financial history alone. You do not have to put up any collateral, such as your car or house, to back the loan. The primary advantage is that your personal assets are not at risk if you default on the loan. This makes it a safer and more popular option for most borrowers. The lender takes on more risk, which is why having a good credit score is so important for approval.

A secured personal loan, on the other hand, requires you to pledge an asset as collateral. For example, you might use your savings account or a vehicle as security. Because the lender’s risk is reduced (they can seize the collateral if you fail to pay), secured loans can sometimes offer lower interest rates or be easier to obtain for borrowers with poor or limited credit. However, you must be willing to accept the risk of losing your asset. For most borrowers with fair to excellent credit, an unsecured loan is the preferred and more accessible choice.

Co-Signed and Joint Personal Loan Options for Better Approval Odds

If you have a limited credit history or a credit score that’s just below a lender’s minimum requirement, a co-signed or joint loan can be a strategic way to gain approval and secure a more favorable interest rate.

A co-signed loan involves adding another person, typically a family member or close friend with a strong credit profile, to your application. This person, the co-signer, agrees to be legally responsible for the debt if you fail to make payments. Their good credit history provides an extra layer of security for the lender, increasing your chances of being approved.

A joint personal loan is similar, but it’s designed for two people who will share responsibility for the loan and also share access to the funds. This is common for married couples or partners financing a joint purchase. Both individuals’ credit and income are evaluated, and both are equally responsible for repayment. Both options can be powerful tools, but they require a great deal of trust between the applicants.

Refinancing and Flexible Repayment Plans to Manage Debt Effectively

Your financial situation isn’t static, and your loan management strategy shouldn’t be either. Two important tools to remember after you’ve taken out a loan are refinancing and flexible repayment plans.

Refinancing: If your credit score has significantly improved since you first took out your loan, or if market interest rates have dropped, you may be able to refinance. This involves taking out a new personal loan with a lower APR to pay off your existing loan. The goal is to reduce your monthly payment, lower your total interest cost, or both. You can use platforms like NerdWallet to check refinancing rates just as you did for your original loan.

Flexible Repayment Plans: Life happens. If you face a sudden job loss or unexpected financial hardship, don’t just stop making payments. Many reputable lenders offer hardship programs or flexible repayment options. This could involve temporarily reducing your monthly payments or allowing you to pause payments for a short period. It’s crucial to contact your lender proactively as soon as you anticipate having trouble.

Step-by-Step Application Guide for NerdWallet Personal Loans

Applying for a loan through NerdWallet is a straightforward process designed for clarity and speed. First, gather your key financial documents, including proof of income and identification. Next, navigate to NerdWallet’s personal loan section and fill out a single pre-qualification form. This soft inquiry won’t affect your credit score. Based on this information, NerdWallet will present you with a list of potential loan offers from its partners. Carefully compare the APRs, terms, and fees of each offer. Once you select the best fit, you’ll be directed to the lender’s website to complete the final application, which will involve a hard credit check. After approval and signing the loan agreement, the funds are typically deposited directly into your bank account, often within one business day.

Monthly Payment Calculation and Real-World Loan Estimate Examples

Understanding your monthly payment is crucial for budgeting. Using NerdWallet’s personal loan calculator is the easiest way to estimate this. For a real-world example, let’s consider a $12,000 loan. With an excellent credit score, you might secure a 9% APR over 48 months (4 years). Your estimated monthly payment would be around $298. Over the life of the loan, you’d pay approximately $2,300 in total interest. Now, imagine a borrower with a fair credit score who gets a 20% APR for the same loan. Their monthly payment would jump to about $365, and they would pay over $5,500 in interest. This stark difference highlights why comparing lenders to find the lowest possible APR is so financially important.

H6: Customer Reviews and Success Stories from Tier One Borrowers

Social proof is a powerful indicator of a lender’s quality. Beyond expert ratings, reading reviews from borrowers in the US, UK, Canada, and Australia provides real-world context. A common success story involves a borrower who felt trapped by high-interest credit card debt. For example, a user from Texas might write: “I used NerdWallet to compare my options and found a loan that cut my interest rate in half. I consolidated four credit card payments into one, and I’ll be debt-free two years sooner. The process was fast and completely online.” These stories demonstrate the tangible impact of using a comparison platform to find a smarter borrowing solution, transforming financial stress into a clear, manageable plan.

Common Mistakes to Avoid When Applying for Personal Loans Online

When applying for personal loans, a few common pitfalls can cost you time and money. The biggest mistake is accepting the first loan offer you receive without shopping around. Always use a comparison tool like NerdWallet to see multiple options. Another error is focusing only on the monthly payment while ignoring the APR and loan term; a low payment on a very long-term loan can cost you thousands more in interest. Also, avoid borrowing more than you absolutely need. Finally, don’t submit multiple formal applications to different lenders directly, as each one will trigger a hard credit inquiry. Instead, use a pre-qualification tool that relies on a soft inquiry to protect your credit score during the shopping phase.

Pre-Qualification and Approval Checklist for NerdWallet Loan Applicants

Before you begin the pre-qualification process on NerdWallet, run through this simple checklist to ensure a smooth experience. First, check your credit score for free to know where you stand. Second, gather your documents: have your government-issued ID, recent pay stubs or tax returns, and bank account details ready. Third, calculate your debt-to-income ratio to see if it’s in a healthy range (ideally below 40%). Fourth, clearly define how much you need to borrow and what you can comfortably afford as a monthly payment. Finally, confirm your personal information (name, address, etc.) is accurate and consistent across all documents. Being prepared will speed up the process and increase your chances of a successful application and quick funding.

Key Factors Affecting Personal Loan Rates and Terms Across Lenders

Several key factors determine the personal loan rates and terms you’ll be offered. The most influential is your credit score; a higher score signals lower risk and unlocks better rates. Your debt-to-income (DTI) ratio is also critical; a low DTI shows lenders you can easily manage new debt. Your income level and employment stability provide assurance that you have the means to repay the loan. The loan amount and term length also play a role; sometimes, shorter terms or larger loan amounts can secure a lower APR. Finally, the overall economic climate and central bank policies influence the entire lending market. By optimizing the factors within your control, like your credit score and DTI, you can secure the most favorable terms.

FAQ

Does NerdWallet Offer Personal Loans Directly or Through Partners?

NerdWallet does not offer personal loans directly. It is not a bank or a lender. Instead, NerdWallet operates as a financial comparison marketplace. Its platform connects you with a wide network of trusted lending partners, including well-known banks, credit unions, and online lenders. When you fill out a pre-qualification form on NerdWallet, your information is used to check for offers from these partners. You can then compare the rates, terms, and features of these loans side-by-side. Once you choose an offer you like, NerdWallet directs you to the lender’s website to complete the application process. This model benefits you by allowing you to shop multiple lenders at once with a single form and a soft credit check that doesn’t harm your score.

How Much Would a $10,000 Loan Cost Per Month Over 5 Years?

The monthly cost of a $10,000 loan over 5 years (60 months) depends entirely on the Annual Percentage Rate (APR) you qualify for. The APR is determined by your credit score and financial profile. Here are a few examples to illustrate the difference:

· Excellent Credit (e.g., 9% APR): Your estimated monthly payment would be approximately $208. Over 5 years, you would pay back a total of $12,455, meaning $2,455 in interest.

· Good Credit (e.g., 15% APR): Your estimated monthly payment would be about $238. You would pay back a total of $14,274, with $4,274 going toward interest.

· Fair Credit (e.g., 22% APR): Your estimated monthly payment would be around $276. You would pay back a total of $16,560, with $6,560 in interest.

To find your specific cost, it’s essential to use a personal loan calculator and get pre-qualified to see what APR you can receive.

What Credit Score Is Needed for a $30,000 Personal Loan?

To qualify for a substantial loan amount like $30,000, most lenders will require you to have a good to excellent credit score, typically 690 or higher on the FICO scale. While your credit score is a critical factor, it’s not the only one. Lenders will also conduct a thorough review of your overall financial health. They will look for a stable and sufficient income that can comfortably support the new monthly payment on top of your existing debts. They will also calculate your debt-to-income (DTI) ratio, and they generally prefer to see a DTI below 40%. Therefore, a person with a 720 credit score and a high income might be easily approved, while someone with the same score but a lower income or higher existing debt may be denied.

Can I Get a $5,000 Personal Loan Online Through NerdWallet?

Yes, absolutely. A $5,000 loan is a very common amount, and you can easily find and compare options for it online through the NerdWallet marketplace. The process is designed to be fast and simple. You start by filling out NerdWallet’s pre-qualification form, where you’ll specify that you’re seeking a $5,000 loan. This won’t impact your credit score. Based on your credit profile and income, NerdWallet will show you potential offers from its lending partners that meet your request. You can then compare the APRs and terms for a $5,000 loan from different lenders and choose the one that is most affordable for you. The entire process, from comparison to funding, can often be completed within one to two business days.

NerdWallet Personal Loans Reviews — What Real Borrowers Say

Borrowers generally review NerdWallet very positively as a tool for comparing financial products. Users frequently praise the platform for its ease of use, transparency, and the ability to see multiple loan offers without a hard credit inquiry. Many reviews highlight how NerdWallet saved them time and helped them find a lower interest rate than they could find on their own. For example, a common sentiment is, “NerdWallet made the process of finding a personal loan so much less stressful.” It’s important to remember that reviews of the lenders themselves will vary. NerdWallet provides its own expert ratings and reviews for each partner, but smart borrowers also read customer reviews on third-party sites to learn about a specific lender’s customer service and payment processing before making a final decision.

NerdWallet Personal Loan Calculator — Estimate Monthly Payments

The NerdWallet Personal Loan Calculator is a free, easy-to-use online tool designed to help you understand the potential costs of a loan before you apply. It empowers you to make informed borrowing decisions by estimating your monthly payments and total interest costs. To use it, you simply input three key pieces of information: the desired loan amount, the estimated Annual Percentage Rate (APR) you might qualify for, and the desired loan term (in years or months). The calculator instantly shows you what your fixed monthly payment would be. You can adjust any of the numbers to see how the payment changes, helping you find a loan structure that fits comfortably within your personal budget. It’s an essential first step in planning your finances for a new loan.

NerdWallet Personal Loans Login — How to Manage Your Account

This is a common point of confusion. Since NerdWallet is a comparison marketplace and not a direct lender, there is no “NerdWallet Personal Loans Login” to manage your loan after it has been funded. Once you choose a lender through NerdWallet and your loan is finalized, you will manage your account directly with that lender. You will create a login on the lender’s website or mobile app. Through that lender’s portal, you will be able to check your balance, make monthly payments, view your payment history, and contact customer support. While you might create a NerdWallet account to save your preferences or track your credit score, your actual loan management will always take place on the platform of the company that issued the funds.

NerdWallet Personal Loans for Bad Credit — What Are Your Options?

While NerdWallet’s marketplace has more options for those with good or excellent credit, it does feature partners who specialize in personal loans for borrowers with bad credit (typically a score below 630). These options are crucial for individuals who may not qualify for a traditional loan. Lenders in this space often look at factors beyond just the credit score, such as your income and employment history. However, you should be prepared for higher APRs, which can range from 20% to 36%, to compensate the lender for the increased risk. The loan amounts may also be smaller. NerdWallet can help you compare these specialized lenders to find the most affordable terms possible for your situation and avoid predatory lenders who are not on the platform.

Best Personal Loans with Low Interest Rates Compared

The “best” personal loan with a low interest rate is highly dependent on your credit profile. For borrowers with excellent credit scores (720+), lenders like LightStream and SoFi consistently offer some of the lowest APRs on the market, often in the single digits. These lenders also typically charge no origination fees, which further reduces the total cost of borrowing. For borrowers with good credit (690-719), lenders like Discover and Marcus by Goldman Sachs are very competitive, providing low rates and a transparent, fee-free experience. The key to finding the best low-interest loan is to use NerdWallet to pre-qualify and compare personalized offers from these and other top lenders. This allows you to see the actual rates you’re eligible for and choose the most cost-effective option.

LightStream Personal Loan — Review and Rate Comparison

LightStream is widely regarded as a top-tier lender, especially for borrowers with a strong credit history. Its main advantages are exceptionally low interest rates for qualified applicants, high loan amounts (up to $100,000), and a complete lack of fees—no origination fees, late fees, or prepayment penalties. They also offer a “Rate Beat Program,” promising to beat a competitor’s offer by 0.10 percentage points. The funding process is also very fast, often with same-day funding available. When compared to other lenders, LightStream’s rates are almost always among the lowest for the super-prime credit tier. However, the primary drawback is its strict eligibility requirement. It is not an option for those with fair or developing credit, making it an exclusive choice for the most creditworthy borrowers.

Best Personal Loans for 2025 — NerdWallet’s Top Picks

While specific top picks can change based on market conditions, NerdWallet consistently recommends a group of lenders who excel in different categories for 2025. For Overall Excellence and Low Rates, SoFi and LightStream are perennial favorites due to their competitive APRs, lack of fees, and strong features for borrowers with good to excellent credit. For Debt Consolidation, Discover is often highlighted for its option to pay creditors directly. For Fair Credit Borrowers, Upstart is a top pick because its AI-based model considers factors beyond just a credit score, increasing access to credit. For Fee-Conscious Borrowers, Marcus by Goldman Sachs is frequently recommended for its transparent, no-fee loans. The best loan for you will depend on your specific needs and credit profile.

Credible Personal Loans vs. NerdWallet — Which Is Better for You?

Credible and NerdWallet are both excellent, reputable financial comparison marketplaces, and they operate on a similar model. Neither is a direct lender. Both allow you to compare personalized loan offers from multiple lenders with a single pre-qualification form and a soft credit check. The primary difference lies in their network of lending partners. While there is significant overlap, some lenders may be on one platform but not the other. Therefore, there isn’t a single “better” platform for everyone. The smartest strategy for a borrower seeking the absolute lowest rate is to use both. The process on each site only takes a few minutes. By checking your options on both NerdWallet and Credible, you cast the widest possible net, ensuring you see more offers and increasing your chances of finding the perfect loan for your needs.