Compare marcus personal loans with low rates, no fees, and flexible terms—available in the US, UK, Canada, and Australia. Clear guidance for smart borrowing.

Struggling with high-interest credit card debt or an unexpected large expense? Borrowers in high-quality markets such as the US, UK, Canada, and Australia have been looking for financial solutions that provide transparency, simplicity and value for some time. The hunt would frequently take them to Marcus by Goldman Sachs, a digital banking offering that upended the personal lending industry with its borrower-friendly model. The primary pain point for a lot of them is slogging through a labyrinthine array of hidden fees, cryptic terms, and changing interest rates. A minor car repair or an unexpected bill can easily turn into a financial issue.

Marcus hit the market with a bold pledge: straight-up fixed-rate personal loans —no fees, no frills. No origination fees, no prepayment fees, and no late charges. This plain-vanilla model was meant to provide you, the borrower, with unvarnished control and predictability. Think about taking several credit card payments, and putting them all into an affordable monthly payment with a lower interest rate that could end up saving you hundreds or even thousands of dollars over the loan’s life. Although Marcus has since changed its tack and stopped taking applications for new loans, it remains a powerful force in the market. This in-depth look considers what made Marcus so competitive, discusses roadside assistance or other add-on services for current customers, and steers you to the best alternatives in your area that are available today.

Overview of Marcus by Goldman Sachs Personal Loans: Key Benefits and Features for Borrowers in Tier One Regions

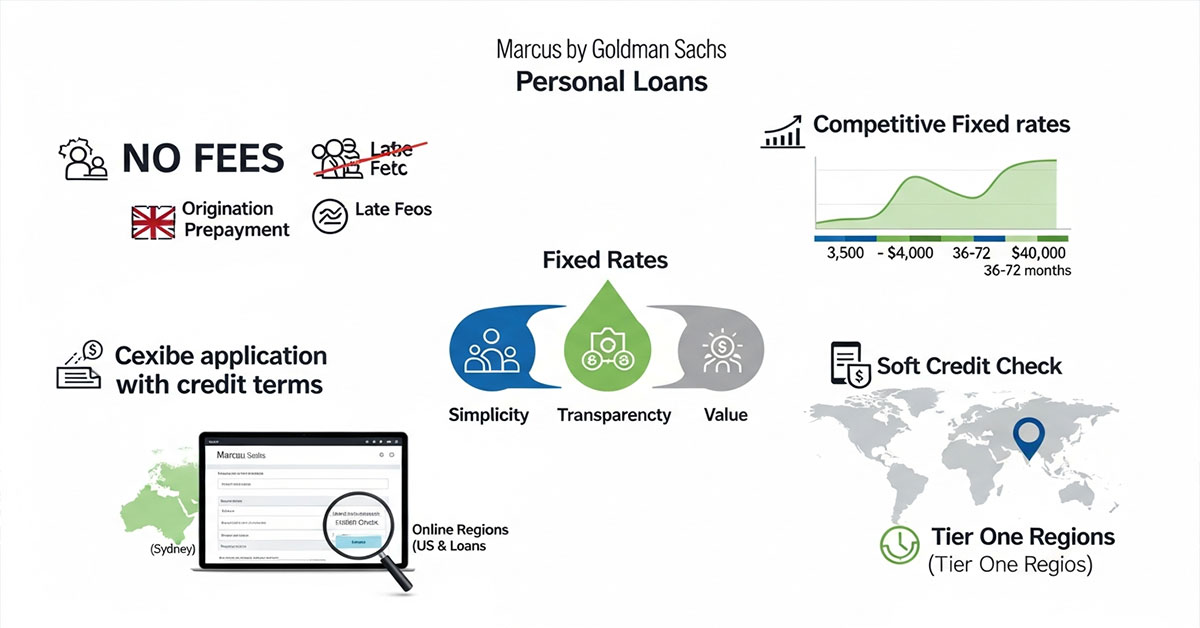

Marcus by Goldman Sachs emerged as a powerful player in the US and UK consumer lending markets with a product that tackled head-on the biggest complaints borrowers had about personal loans. Its architecture was based on three principles: simplicity, transparency, and value. Unlike many legacy banks and even some online lenders, Marcus cut out all common fees, a policy that would particularly appeal to customers looking for transparent financing.

The standout perk, according to reviewers? It’s “no-fee policy — period.” Originally, borrowers paid no origination fees to process the loan, prepayment fees if they paid it off earl,y or even late fees for missing a payment (except that interest would still accumulate). This policy was tremendously reassuring, and it helped us to let down our hair and better gauge the cost of borrowing. Rates were very competitive and were fixed (so the rate and payment never changed during the life of the loan). This certainty makes budgeting easier, whether you’re in Sydney doing a home renovation or in London consolidating debt.

Loans were flexible, ranging from a minimum amount of $3,500 to $40,000 in the United States and similar amounts in other countries. Terms on repayment varied from 36 months (three years) to 72 months (six years). This allowed borrowers to customize a loan that worked for them, one that achieves the best compromise between affordable monthly payments and as little total interest as possible. The application process was completed through and through online, with a soft credit check for pre-approval so you could see what rates you qualified for without affecting your credit score-a — a major plus in a competitive market.

Key Tip: The “no-fee” promise was Marcus’s biggest differentiator. When comparing alternatives, always calculate the total cost of the loan, including any origination fees, to understand the true value.

| Feature | Marcus by Goldman Sachs Details | Benefit for Tier One Borrowers |

| Fee Structure | $0 Origination Fee, $0 Prepayment Fee, $0 Late Fee | Maximizes the loan amount you receive and prevents penalty costs. |

| Interest Rates | Fixed Annual Percentage Rates (APRs) | Provides predictable, stable monthly payments for easier budgeting. |

| Loan Amounts | Flexible, e.g., $3,500 to $40,000 (US) | Covers a wide range of financial needs, from small projects to large debts. |

| Repayment Terms | 3 to 6 years | Allows borrowers to choose a plan that fits their monthly cash flow. |

| Pre-qualification | Soft credit inquiry | Check your potential rates without any negative impact on your credit score. |

| Direct Payment | Option to pay creditors directly for debt consolidation | Simplifies the debt consolidation process and ensures funds are used as intended. |

For existing customers, these features continue to define their loan experience. For those now seeking new loans, the Marcus model serves as a benchmark for what to look for in a top-tier lender.

How Marcus Personal Loans Help You Achieve Your Financial Goals: The Benefits Explained for the US, UK, Canada, and Australia

A personal loan can be a great way to tackle debt when used appropriately, and the Marcus loan was made to help serve a range of financial needs with its openness and simplicity. Aspiration made it easy to manage your finances and save for life’s biggest moments… Their model showed borrowers a direct way to start getting their finances in order. Debt consolidation, home improvemen, and major purchases were among the main use cases.

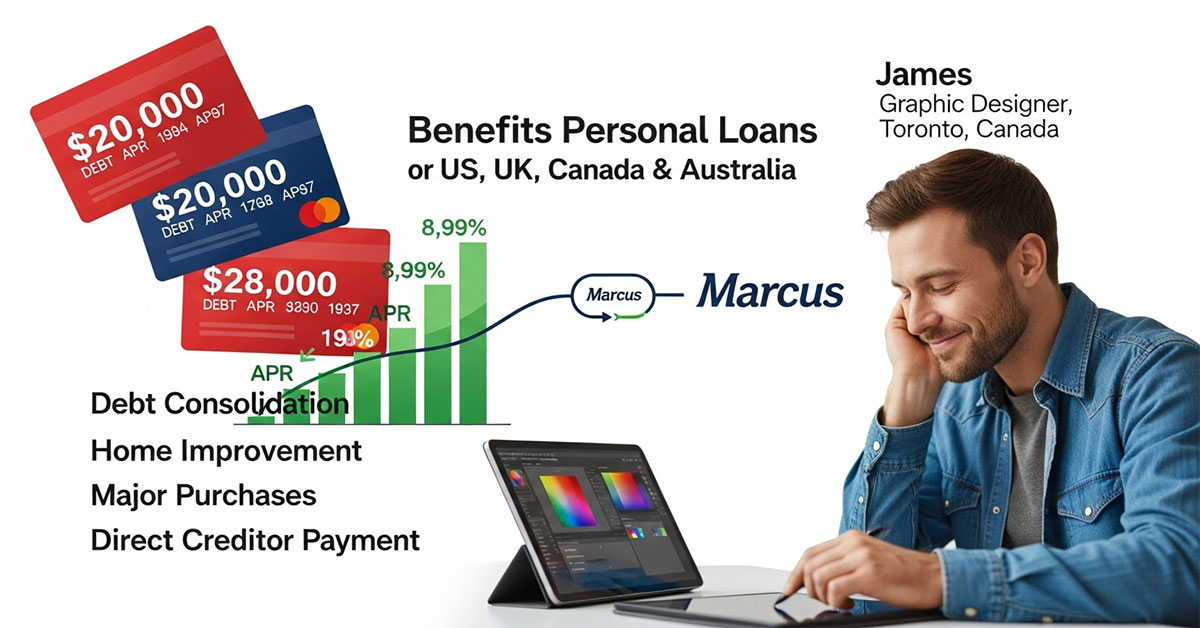

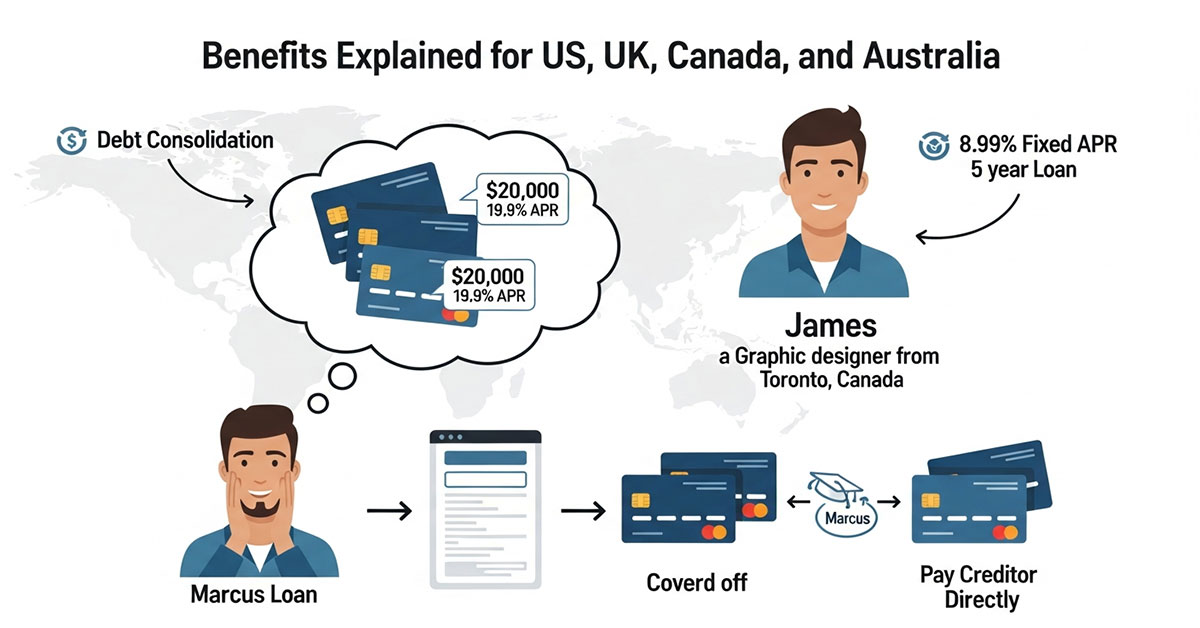

Let’s do a little case study here. Meet James, a graphic designer from Toronto, Canada. James owed $20,000 in credit card debt spread across three cards with an average APR of 19.9%. His monthly payments were more than $700, a lot of which was being eaten up by interest and barely making a dent in the amount he owed. The stress of multiple due dates was also a continuous nightmare.

James asked Marcus, and he qualified for a 5-year debt consolidation loan of $20,000 with an APR fixed rate of 8.99%. A major perk of Marcus was the ability to pay your creditors directly. Rather than receiving the cash, James had Marcus wire the funds directly to his credit card companies to cover his outstanding balances. It streamlined everything, and it took the temptation to use the money for other things away.

The Result:

· Simplified Finances: James went from three high-interest payments to one predictable, lower-interest monthly payment.

· Significant Savings: His new monthly payment was approximately $415, saving him nearly $300 per month. Over the 5-year term, he was projected to save thousands of dollars in interest.

· Reduced Stress: With a clear end date for his debt and a single payment to manage, James regained control over his finances.

This example illustrates the core value proposition. Whether you were in the US funding a wedding, in the UK renovating a kitchen, or in Australia consolidating personal debts, the loan’s structure was designed to create a clear, simple, and cost-effective path to achieving your objectives.

| Financial Goal | How a Marcus Loan (Historically) Provided a Solution | Key Feature Utilized |

| Debt Consolidation | Combine multiple high-interest debts into one loan with a lower fixed rate. | Direct Creditor Payment, Fixed APR |

| Home Improvement | Provided a lump sum of cash for renovations without needing home equity. | No Fees, Flexible Loan Amounts |

| Major Purchases | Financed cars, vacations, or weddings with predictable monthly payments. | Fixed Term and Payments |

| Unexpected Expenses | Covered medical bills or emergency repairs with fast funding. | Quick Online Application and Funding |

Takeaway: The true benefit of the Marcus personal loan was its ability to transform complex, high-cost debt into a simple, manageable financial obligation, empowering borrowers to focus on their goals rather than their debt.

Eligibility Requirements for Marcus Personal Loans: Your Path to Approval in Top Tier Countries

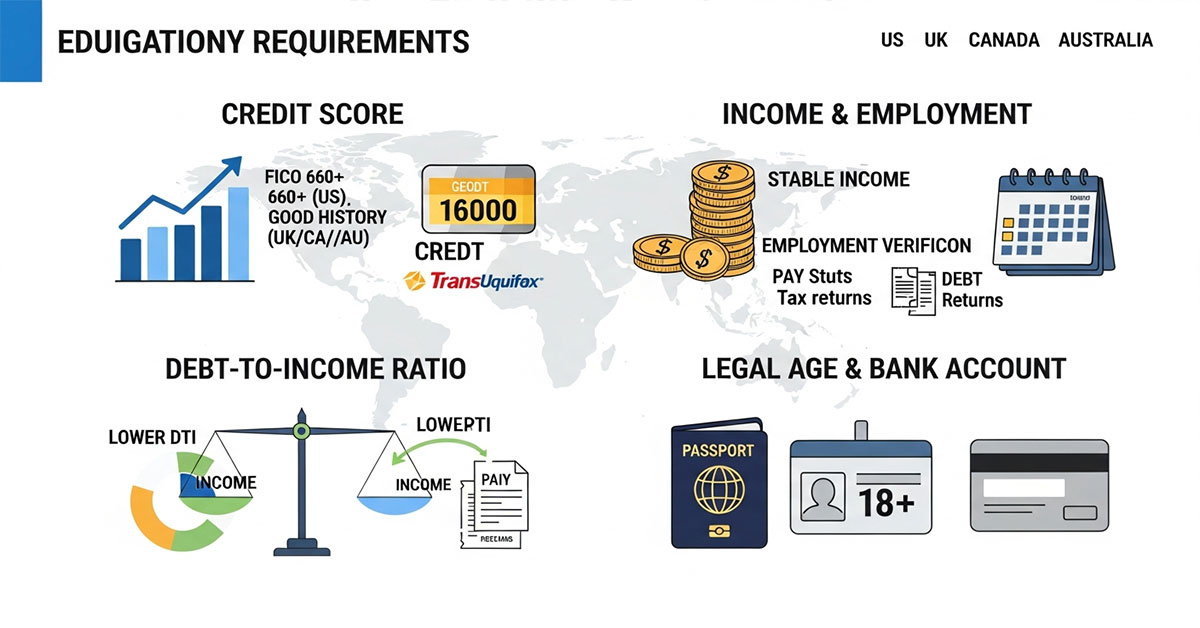

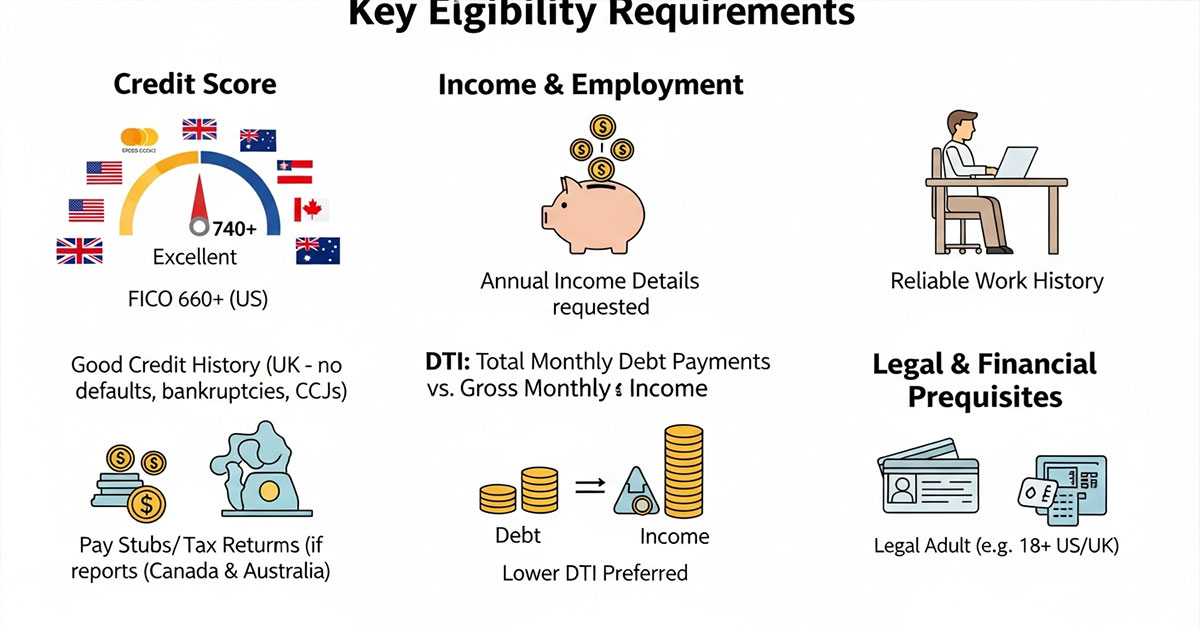

Although Marcus is no longer taking on new loan applications, it’s a great example of the type of factors top-tier lenders may be looking for in an ideal candidate. These conditions are quite typical throughout the us, UK, canada, and the Australian continent in terms of creditworthiness based on credit stability, regular income, and overall financial health. For those who qualified, Marcus provided a painless and transparent process to procure funds.

Applicants’ credit scores were the most significant factor. Marcus had focused largely on borrowers with good or excellent credit. For the United States, that usually meant a FICO credit score of 660 or above, and the best interest rates were offered to those with scores over 740. Likewise, in the UK you needed to have a good credit history with no defaults, receiving bankruptcies or County Court Judgements (CCJs) in last few years. Lenders in Canada and Australia operate on a similar principle, looking at credit reports provided by agencies such as TransUnion and Equifax.

In addition to the credit score, Marcus confirmed an applicant’s income and employment status to make sure they were bringing in enough money to comfortably manage those monthly loan payments. Applicants had to supply details about their annual income, and in some cases, they were required to submit documentation such as pay stubs or tax returns. A reliable work history was a significant positive predictor. Another contributing factor was the debt-to-income (DTI) ratio, which compares your total monthly debt payments to your gross monthly income. Lenders like to see a lower DTI because it means you are not spending too much money and can handle new debt easily.

And finally, applicants had to be a legal adult in their country (i.e,. 18 years old ithe n US and UK) and have a valid bank account to receive money as well as make payments.

Key Takeaway: Building and maintaining a strong credit profile is the single most important step toward qualifying for personal loans with the best rates and terms from any top lender.

| Eligibility Criterion | Why It Matters to Lenders | How to Improve Your Standing |

| Credit Score (e.g., FICO) | A primary indicator of your history of repaying debt. | Pay all bills on time, every time. Keep credit card balances low. |

| Verifiable Income | Confirms you have the financial means to make monthly payments. | Maintain stable employment and keep records (pay stubs, tax forms). |

| Debt-to-Income (DTI) Ratio | Shows how much of your income is already committed to debt. | Pay down existing debts before applying for new credit. Avoid taking on unnecessary loans. |

| Credit History Length | A longer history provides more data on your financial behavior. | Keep old credit accounts open (if in good standing) to preserve history. |

Marcus Personal Loan Interest Rates, Fees, and Terms: What You Need to Know to Make an Informed Decision

One of the reasons for the popularity of Marcus by Goldman Sachs in the US and UK was that it has a no-nonsense pricing which is transparent and beneficial to the borrower. Interest rate (APR), fees, and repayment term are the three main factors to consider when deciding on any personal loan. Marcus has been good with competitive rates, and most importantly, being free. The

Annual Percentage Rate (APR) of a Marcus personal loan is locked in when you obtain the loan and will not change. That had the advantage of giving borrowers a consistent monthly amount, and they could see how much they would be paying for borrowing. The APRs used to span between 6.99% and 19.99% in the US — A meaningful range that varied greatly according to the credit score/fiscal condition of the applicant at hand. Those with good credit obtained lower rates, providing value to borrowers looking to consolidate debt from high-interest credit cards.

The most significant feature was the no-fee promise. Marcus charged:

· $0 Origination Fee: Many lenders charge 1% to 8% of the loan amount just for processing it. Marcus charged nothing, so you received the full loan amount.

· $0 Prepayment Penalty: You could pay off your loan early without any financial penalty, saving money on future interest.

· $0 Late Fee: While interest would still accrue on a late payment, and it could be reported to credit bureaus, Marcus did not charge an additional punitive fee.

Repayment terms were flexible, typically offering options between 36 and 72 months (3 to 6 years). Shorter terms resulted in higher monthly payments but lower total interest costs, while longer terms provided lower monthly payments but cost more in interest over time. This flexibility allowed borrowers in diverse financial situations, from Sydney to Manchester, to find a plan that worked for their budget.

| Component | Typical Marcus Offering (Historical) | Impact on Borrower |

| APR Range | Fixed rates, e.g., 6.99% – 19.99% (US) | The rate was locked in, ensuring predictable payments. Better credit meant lower rates. |

| Fees | Absolutely none (origination, prepayment, late) | Saved borrowers hundreds or thousands of dollars compared to competitors. |

| Loan Amounts | $3,500 – $40,000 (US) | Covered a wide spectrum of needs, from minor expenses to major consolidations. |

| Repayment Terms | 36 – 72 months | Offered a choice to prioritize either low monthly payments or low total interest cost. |

Expert Insight: “When Marcus was active, its no-fee structure was a game-changer. For anyone looking for a loan today, it’s crucial to look beyond the headline interest rate and factor in all fees. A loan with a slightly higher APR but no origination fee can often be cheaper than a loan with a lower APR and a high fee.” — Financial Analyst.

This transparent framework set a high standard in the personal loan market, and its principles are what borrowers should look for when evaluating today’s leading lenders.

How to Apply for a Marcus Personal Loan Online: Simple Steps for Borrowers in Tier One Countries

Although Marcus is no longer accepting new loan applications, its streamlined, fully digital application process became a model for the fintech industry. Understanding how it worked can help you navigate the application process with other modern lenders, as many have adopted a similar user-friendly approach. The entire journey, from checking your rate to receiving funds, could be completed from home in the US, UK, or other service areas.

The process began with pre-qualification. This was a critical, consumer-friendly first step.

1. Check Your Rate: You would navigate to the Marcus website and enter basic personal information, including your name, address, date of birth, and annual income. You would also specify the loan amount you desired and the purpose of the loan (e.g., debt consolidation, home improvement).

2. Soft Credit Check: Marcus would then perform a soft credit inquiry. This is a crucial feature because, unlike a hard credit check, it does not affect your credit score. Within minutes, you would be presented with potential loan offers, including the loan amount, APR, and different repayment term options you pre-qualified for.

3. Select Your Loan: If you were satisfied with an offer, you could choose the loan term that best suited your budget. The system would clearly display how the term length affected your monthly payment and total interest paid.

4. Formal Application and Verification: After selecting your terms, you would proceed to the formal application. This step required more detailed information, including your Social Security Number (in the US) or equivalent, and your bank account details. You might also be asked to upload documents to verify your identity (like a driver’s license) and income (like recent pay stubs). This stage triggered a hard credit check.

5. Sign and Receive Funds: Once your information was verified and the loan was formally approved, you would sign the loan agreement electronically. The funds were then typically deposited directly into your linked bank account within one to four business days.

Takeaway: The Marcus application process prioritized transparency and user convenience, particularly the ability to check rates without impacting your credit score. This is now a feature you should expect from any top-tier online lender.

Pros and Cons of Marcus Personal Loans: Is This the Right Loan for You?

Even though Marcus has paused new loan originations, a balanced review of its pros and cons is essential for existing customers and for those using it as a benchmark to evaluate other lenders. Marcus built its reputation on a strong set of advantages, but it also had limitations that made it unsuitable for some borrowers.

The Pros of Marcus Personal Loans

The most celebrated advantage was the no-fee structure. This policy was revolutionary in a market where origination fees of up to 8% are common. It meant that a borrower approved for a $20,000 loan received the full $20,000, not a reduced amount. The absence of prepayment and late fees further enhanced its appeal.

Another major pro was competitive, fixed interest rates. For borrowers with strong credit profiles in the US, UK, and beyond, Marcus offered APRs that were often lower than those of traditional banks and credit cards. The fixed nature of the rate ensured payments were predictable for the entire term.

Finally, features like the On-Time Payment Reward (which allowed borrowers to defer one payment after 12 consecutive on-time payments) and direct creditor payments for debt consolidation were highly practical benefits that set Marcus apart from many competitors. The fully online process was also fast and convenient.

The Cons of Marcus Personal Loans

The biggest con today is obvious: they are no longer available for new applicants. This is a definitive barrier for anyone currently in the market for a loan.

When they were active, the primary drawback was the strict credit requirement. Marcus was designed for borrowers with good-to-excellent credit, typically a FICO score of 660 or higher in the US. This excluded a significant portion of the market, including those with fair or poor credit who are often most in need of consolidation loans.

Additionally, Marcus did not offer co-signed or joint loans. This meant applicants had to qualify based solely on their own credit and income, which could be a hurdle for some. Lastly, while the loan amounts were flexible, the maximum of $40,000 in the US was lower than what some other lenders, like LightStream or SoFi, offered.

| Pros | Cons |

| ✅ No Fees of Any Kind (Origination, Late, Prepayment) | ❌ No Longer Accepting New Loan Applications |

| ✅ Competitive, Fixed APRs | ❌ Requires Good to Excellent Credit |

| ✅ Soft Credit Check for Pre-qualification | ❌ No Co-Signer or Joint Applicant Option |

| ✅ User-Friendly Features (On-Time Payment Reward, Direct Payment) | ❌ Lower Maximum Loan Amount than Some Competitors |

Takeaway: Marcus was an excellent choice for creditworthy borrowers seeking a simple, low-cost loan. However, its unavailability and strict requirements mean many must now look to other lenders that may offer more flexibility, albeit sometimes with fees attached.

Loan Amounts, Repayment Terms, and APR Details: Find the Best Option for Your Financial Needs

The specific details of the figures behind Marcus’ personal loans explain why they were among the best in markets such as the US and UK. The full range of loan amounts, term lengths, and fixed APRs was created to provide personalized options for a range of financial needs. And, while two of these choices may be ancient history, they can be a great blueprint for what to expect from an alternative lender.

Marcus in the United States usually provided unsecured personal loans of $3,500 to $40,000. In the U.K., that range was similar: typically £3,500 to £25,000. This range was A large enough span to include everything from small emergencies to major debt consolidation or home renovation projects.

Terms of repayment were an area of significant flexibility. Most borrowers could select a term of 36 to 72 months (3 to 6 years). This decision had a direct bearing on both the monthly payment and total interest paid over the life of the loan. A shorter term, like 3 years, and a higher monthly payment now, meant less interest in the long run longer term of 6 years would provide a more affordable monthly payment, but pay more in interest.

The APR was fixed and dependent upon the credibility of the borrower. In the United States, the promotional APR range was between 6.99% and 19.99%. The lowest rates were reserved for consumers with the strongest credit profiles — excellent scores, a big incom,e and high debt-to-income ratios.

Expert Insight: “When selecting a loan term, many people default to the longest option to get the lowest monthly payment. This can be a mistake. Always use a loan calculator to see the total interest cost for each term. If you can afford the higher payment of a shorter term, you can save a significant amount of money.”

| Loan Term | Example Monthly Payment* | Example Total Interest Paid* | Best For |

| 36 Months (3 Years) | $631 | $2,727 | Borrowers who want to pay off debt quickly and minimize total interest. |

| 60 Months (5 Years) | $415 | $4,901 | A balanced approach with manageable payments and moderate interest costs. |

| 72 Months (6 Years) | $369 | $6,543 | Borrowers who need the lowest possible monthly payment to fit their budget. |

*Table assumes a $20,000 loan with a 9.0% APR for illustrative purposes.

This structure gave borrowers the control to build a loan that aligned perfectly with their financial strategy, a principle that remains crucial when shopping for any personal loan today.

Autopay Discounts and Flexible Payment Options: Save More with Marcus Personal Loans in Tier One Markets

In addition to its no-fee promise and competitive rates, Marcus by Goldman Sachs included several features that seek to reward responsible borrowing and offer flexibility. These benefits available to borrowers in the US and UK not only helped lower the overall cost of a loan but also provided some protection against unexpected financial hardships.

The most sought-after feature? The Autopay discount. Borrowers got a 0.25% interest rate reduction when they arranged automatic payment from a bank account. A quarter of a percent may not sound like much, but on a large loan costing thousands of dollars over many years, the discount could mean significant savings. So on a $25,000 loan, with five years left to go, the reduction of 0.25% could save you some $170 in interest. And it was a “set it and forget it” thing that meant not worrying about making payments on time.

Another great and highly praised benefit was the On-Time Payment Reward. After 12 back-to-back on-time monthly payments, the borrower won the right to postpone one future payment without fees or interest. The loan would be further extended for one month. This was a useful buffer that helped if you ever ran into some sudden potential expense — a medical bill or expensive car repair or whatever that prevented you from making the payment by its due date without falling behind. This incentive could be collected more than once in the life of the loan.

Additionally, Marcus gave borrowers the option to change their payment due date as many as three times. This flexibility allowed the consumer to time their loan payment with their payday or other monthly bills, thus simplifying budgeting and lowering the chances of a late payment.

Key Takeaway: These little details were the signals of commitment

to the borrower’s financial well-being. When comparing modern lenders, look beyond the main rates and fees to see if they offer similar discounts for automatic payments or flexible options for managing your payment schedule. These benefits can make a substantial difference over the term of your loan.

Direct Creditor Payment and No-Fee Policy: Why Marcus Personal Loans Stand Out in the US, UK, Canada, and Australia

Two core features cemented the reputation of Marcus’ personal loans as a top-tier financial product: its direct creditor payment option for debt consolidation and its unwavering no-fee policy. These elements worked in tandem to create a transparent, efficient, and cost-effective borrowing experience that directly addressed major consumer pain points across the US, UK, and other developed markets.

The no-fee policy was the cornerstone of the Marcus value proposition. In an industry where fees are often hidden in the fine print, Marcus eliminated them.

· No Origination Fee: Lenders often charge this fee (1-8% of the loan amount) to cover processing costs. On a $30,000 loan, that could mean losing up to $2,400 of your funds instantly. With Marcus, you received the full amount.

· No Prepayment Penalty: This gave borrowers the freedom to pay off their loan ahead of schedule to save on interest without being penalized.

· No Late Fees: This removed the sting of an accidental late payment, although it didn’t stop interest from accruing.

This approach made the total cost of borrowing exceptionally clear and easy to calculate.

The direct creditor payment feature was a game-changer for anyone using the loan for debt consolidation. Instead of receiving a lump sum of cash and being responsible for distributing it to various credit card companies, a borrower could provide Marcus with the account details and payment amounts for up to 10 creditors. Marcus would then send the payments directly. This offered two powerful benefits:

1. Simplicity and Certainty: It ensured the debts were paid off as intended, streamlining a potentially complicated process.

2. Removes Temptation: It prevents the borrower from using the loan funds for other purposes, keeping them focused on the goal of becoming debt-free.

Together, these features created a powerful tool for financial management. The no-fee structure maximized the value of the loan, while direct payments ensured it was used effectively. This combination is why the Marcus model is still seen as a benchmark for excellence in the personal lending industry.

Customer Experience and Service Quality: What Borrowers in Top Regions Are Saying About Marcus Loans

User experience — the customer’s interaction with a financial product or service — is assential, and by most measures, Marcus by Goldman Sachs received top ratings from its loan customers in the US and UK alike. Trustpilot, BBB, and financial bloggers were often showing how they loved them for being simple, transparen,t and having a user-friendly digital face.

One of the largest sources of positive feedback was the online application process. Customers valued being able to compare rates using a soft credit pull (allowing shopping around without being penalized). Common positives were that the site and user interface were exceptionally clean, simple to use, and easy to navigate when it came to viewing loan balances, payment schedules, and account documents. This digital-first mindset resonated with today’s consumer, who traditionally favors self-serve tools to banking.

The no-fee policy was cited as the number one factor for customer satisfaction. Borrowers appreciated that Marcus was upfront and honest about the costs, which created a sense of trust. There was even arief discussion on the company’s customer service representatives that were available by telephone, and most have reported they were helpful and professional, especially when helping with direct creditor payment setup in a debt consolidation.

But not everyone had a flawless experience. Some complaints mentioned funding times longer than they expected: a few borrowers waited several days for the loan to be deposited after they’d been approved. Still others cited challenges with the income verification phase, during which requests for documents could come in and stall things. Some customers have also had to wait longer to speak to customer service reps when there’s a large volume of applications, according to the company.

Expert Insight: “A lender’s reputation is built on more than just rates. The user experience, from application to final payment, is key. Marcus understood this and invested in a strong digital platform. While no service is perfect, the overwhelmingly positive sentiment around their transparency and ease of use set a high bar for the industry.”

Overall, the customer consensus was that Marcus provided a superior borrowing experience defined by clarity and convenience, making it a trusted choice for thousands of borrowers.

Exploring Alternatives to Marcus Personal Loans: Find Other Leading Lenders in Tier One Markets

With Marcus no longer offering new personal loans, borrowers in the US, UK, Canada, and Australia must look to other top-tier lenders to meet their financing needs. Fortunately, the market is filled with excellent alternatives, many of which have adopted the same consumer-friendly features that made Marcus popular, such as soft credit checks, competitive fixed rates, and no-fee options.

The best alternative for you will depend on your credit score, the loan amount you need, and what features you prioritize. Here are some of the leading competitors in the personal loan space:

For Borrowers with Excellent Credit (US):

· SoFi: Offers high loan amounts (up to $100,000), competitive rates, and member benefits like unemployment protection and career coaching. Like Marcus, SoFi has no origination or prepayment fees.

· LightStream: Known for its “Rate Beat Program” and high loan maximums for well-qualified borrowers. They offer loans for a wide variety of purposes and pride themselves on a simple online process and fast funding.

For Borrowers with Good Credit (US, UK, Canada):

· Discover Personal Loans: A trusted brand that offers flexible repayment terms, no origination fees, and the option for direct creditor payments, similar to Marcus. They are a strong choice for debt consolidation.

· Upstart: Uses an AI-powered model that looks beyond just credit scores, considering factors like education and employment history. This can make it a great option for those with a limited credit history but a solid income.

For a Peer-to-Peer Lending Experience:

· LendingClub: A marketplace lender that connects borrowers with investors. It can offer competitive rates but typically charges an origination fee, which is deducted from the loan proceeds.

| Lender | Key Feature | Best For… | Typical Fee Structure |

| SoFi | High loan amounts, member perks | Excellent credit, larger financing needs | No origination or late fees |

| LightStream | Fast funding, Rate Beat Program | Home improvement, excellent credit | No origination or late fees |

| Discover | Direct creditor payment | Good credit, debt consolidation | No origination fees |

| Upstart | AI-based approval model | Fair to good credit, thin credit files | Charges an origination fee |

Key Takeaway: The personal loan landscape is highly competitive. Before choosing a lender, take advantage of pre-qualification offers with soft credit checks from multiple providers. This allows you to compare actual APRs and terms without impacting your credit score, ensuring you get the best possible deal.

Why Marcus Stopped Offering New Personal Loans: What It Means for Borrowers in the US, UK, Canada, and Australia

In early 2023, Goldman Sachs announced a significant strategic shift: it would be scaling back its consumer banking ambitions, which included halting new originations for its Marcus personal loans. This news came as a surprise to many, as the Marcus brand had been highly successful in attracting customers in the US and UK. The decision was not due to the failure of the loan product itself but was part of a broader corporate restructuring.

Goldman Sachs, traditionally an investment banking and asset management powerhouse for corporations and high-net-worth individuals, had ventured into consumer finance with Marcus to diversify its revenue streams. However, the consumer division, while popular, proved to be less profitable and more challenging to scale than anticipated. The bank faced mounting costs associated with marketing, technology, and navigating the consumer regulatory landscape. Ultimately, Goldman Sachs’s leadership decided to refocus on its core strengths: investment banking and wealth management.

What this means for borrowers:

· Existing Customers: If you have a personal loan with Marcus, nothing changes for you. Your loan agreement remains in full effect. You must continue to make your payments as scheduled. The loan servicing—the process of collecting payments and providing customer support—will continue. While Goldman Sachs has sold some of its loan portfolio to other investors, the terms of your original contract are protected.

· Prospective Borrowers: You can no longer apply for a new personal loan through Marcus. You will need to explore alternative lenders in the market. The good news is that the competitive pressure Marcus created forced many other lenders to improve their offerings, with more no-fee options available now than before.

The shutdown of new Marcus loans serves as a reminder that the financial landscape is always evolving. While the brand set a high standard for transparency and value, its exit opens the door for other innovative lenders to win over customers in Tier One markets.

Expert Insight: “Goldman Sachs’s retreat from consumer lending highlights the immense difficulty of competing in the mass-market financial space. For consumers, it underscores the importance of not just looking at the product, but also the stability and long-term strategy of the lender.”

Credit Score Guidelines for Marcus Loan Approval: Practical Tips for Borrowers in the US, UK, and Beyond

While you can no longer apply for a Marcus loan, the credit standards they used are a strong benchmark for what other top-tier lenders require. To get the best personal loan rates, you need to present yourself as a low-risk borrower, and that starts with your credit score. Marcus primarily targeted applicants with good to excellent credit, which in the US typically means a FICO score of 660 or higher. The most competitive rates were reserved for those with scores of 740 and above.

If you’re preparing to apply for a loan from an alternative lender, here are practical tips to strengthen your credit profile:

Checklist for Improving Your Credit Score:

· ✅ Review Your Credit Reports: Obtain free copies of your credit reports from the major bureaus in your country (e.g., Experian, TransUnion, Equifax). Check for any errors or inaccuracies and dispute them immediately. An error could unfairly lower your score.

· ✅ Pay Every Bill on Time: Payment history is the single largest factor in your credit score. Set up automatic payments or calendar reminders for all your bills, from credit cards to utilities, to ensure you never miss a due date.

· ✅ Lower Your Credit Utilization Ratio: This ratio is the amount of credit you’re using compared to your total credit limit. Aim to keep your utilization below 30% on each credit card. For example, if you have a $10,000 limit, try to keep your balance below $3,000.

· ✅ Avoid Opening Multiple New Accounts: Each time you apply for new credit, it can result in a hard inquiry, which can temporarily dip your score. Apply for new credit sparingly and only when necessary.

· ✅ Keep Old Accounts Open: The length of your credit history matters. Even if you don’t use an old credit card, keeping it open (as long as it has no annual fee) can help maintain the average age of your accounts, which positively impacts your score.

Key Tip: Making small, consistent improvements over several months can significantly boost your credit score, making you eligible for much lower interest rates and saving you a substantial amount of money.

How to Pre-Qualify for a Marcus Personal Loan Without Affecting Your Credit Score: A Step-by-Step Guide

One of the most consumer-friendly innovations popularized by online lenders like Marcus was the ability to pre-qualify for a loan using a soft credit check. Although Marcus is no longer an option for new loans, this process is now a standard feature for most reputable online lenders, and understanding how it works is key to shopping for a loan smartly.

A soft credit inquiry (or soft pull) allows a lender to review a version of your credit report without it being recorded as a formal application. These inquiries are not visible to other lenders and have zero impact on your credit score. In contrast, a hard credit inquiry (or hard pull) occurs when you officially apply for a loan. It is recorded on your report for two years and can cause a small, temporary drop in your credit score.

Here was the step-by-step process for pre-qualification with Marcus, which you can apply to other lenders:

1. Navigate to the Lender’s “Check Your Rate” Page: This is usually the first step on their personal loans page. You are not yet formally applying.

2. Provide Basic Information: You’ll be asked for your name, address, income, and the loan amount you want. You will also need to consent to a soft credit check. You are not committing to anything at this stage.

3. Receive Your Offers: Within moments, the lender’s system analyzes your information and presents you with potential loan offers. These will include estimated APRs, loan amounts, and different term lengths you are likely to qualify for.

4. Compare and Decide: Because this process doesn’t affect your credit, you can do this with multiple lenders. This allows you to compare real, personalized offers side-by-side to find the absolute best deal. Only after you choose a lender and officially apply will a hard credit check be performed.

Takeaway: Always choose lenders that offer a soft-credit-check pre-qualification. It is the most powerful tool a borrower has for comparing loans without negatively impacting their credit score.

Payment Date Flexibility and On-Time Rewards with Marcus Personal Loans: Maximize Your Benefits

For existing Marcus loan customers, two standout features continue to add significant value and flexibility to the borrowing experience: the ability to change your payment date and the unique On-Time Payment Reward. These benefits were designed to accommodate life’s unpredictability and reward consistent, responsible financial behavior.

The option to change your payment due date allows you to better align your loan payment with your personal cash flow. For instance, if you get a new job where you are paid on the 1st of the month instead of the 15th, you can move your due date to better match your new payday. Marcus allows customers to change their payment date up to three times during the life of the loan, providing a simple way to stay on top of payments and avoid financial strain.

Even more compelling is the On-Time Payment Reward. After you make 12 consecutive, full-on-time monthly payments, Marcus rewards you by allowing you to defer one payment.

· How it Works: You can choose to skip one month’s payment without any penalty.

· Interest: No interest is charged during the deferred month.

· Loan Term: Your loan’s maturity date is simply extended by one month.

This is not a loan modification but a built-in reward for reliability. It acts as a valuable emergency buffer. If you suddenly face an unexpected expense, you can use this reward to free up cash for that month without damaging your credit or defaulting on your loan. This reward can be earned multiple times, giving you a recurring safety net for consistent financial management.

Key Tip for Existing Borrowers: Check your Marcus account dashboard to see your progress toward your next On-Time Payment Reward. Planning to use it strategically can provide valuable breathing room in your budget when you need it most.

Comparison of Marcus Personal Loans vs Competitors: How Does It Stack Up Against Leading Lenders in Tier One Countries?

To understand the impact Marcus had on the market, it’s helpful to compare its historical offering against some of the leading competitors that are still active today in the US, UK, and other top-tier regions. This comparison highlights why Marcus was so disruptive and what features borrowers should look for in an alternative. We’ll compare it against three major players: SoFi, Discover, and LendingClub.

The Main Differentiator: Fees

Marcus’s ace in the hole was its absolute no-fee policy. While competitors like SoFi and Discover also eliminated origination fees, many others, particularly marketplace lenders like LendingClub, still charge them. An origination fee of 5% on a $20,000 loan means you only receive $19,000, which can be a significant drawback.

Where Competitors Excel

While Marcus was strong, it wasn’t the best in every category. SoFi, for example, offers much higher loan amounts (up to $100,000) and comes with a suite of member benefits like career services and unemployment protection, which Marcus lacked. Upstart (not shown in the table) excels at serving borrowers with less-than-perfect credit by using alternative data for approvals.

| Feature | Marcus (Historically) | SoFi | Discover Personal Loans | LendingClub |

| Origination Fee | None | None | None | 3% – 8% |

| Typical APR Range | Competitive Fixed Rates | Very Competitive Rates | Competitive Rates | Varies, Can Be Higher |

| Max Loan Amount (US) | $40,000 | $100,000 | $40,000 | $40,000 |

| Key Feature | No-Fee Guarantee, On-Time Payment Reward | Member Benefits, High Loan Amounts | Direct Creditor Payment, Trusted Brand | Marketplace Lending Model |

| Best For | Creditworthy borrowers seeking simplicity. | Borrowers with excellent credit need large loans. | Debt consolidation for those with good credit. | Borrowers who may not qualify elsewhere. |

Conclusion: Marcus set a high bar for transparency and value with its no-fee promise. However, competitors like SoFi offer more for high-earning, excellent-credit borrowers, while others provide access to credit for a broader audience. The best choice today depends entirely on your personal financial profile and needs.

Understanding Marcus Loan Servicing After Shutdown: What Borrowers in Tier One Regions Need to Know

If you are one of the many people in the US or UK with an existing personal loan from Marcus, the news of the company halting new loans might have caused some concern. It is crucial to understand what this means for you. The most important takeaway is that your loan agreement remains unchanged and is still fully active.

Goldman Sachs’s decision to exit the business was a strategic one, not a financial collapse. As such, the company has an obligation to manage all existing loans according to their original terms. This process is known as loan servicing. Servicing includes all the administrative tasks associated with your loan, such as:

· Collecting and processing your monthly payments.

· Providing customer service for any questions you may have.

· Sending you monthly statements and annual tax forms.

· Managing your account information through the online portal.

In some cases, a company exiting a business line may sell its portfolio of loans to another financial institution. This is a common practice. If this happens, you will be formally notified of the change. The new servicer is legally required to honor the original terms of your loan agreement. Your interest rate, monthly payment, and final payoff date cannot change. The only thing that would change is the name of the company you make your payments to and the website you use to log in.

Checklist for Existing Borrowers:

· ☐ Continue Making Payments: This is the most critical step. Do not stop making your payments as scheduled.

· ☐ Keep Your Contact Information Updated: Ensure Marcus (or the new servicer) has your current mailing address, email, and phone number so you receive all communications.

· ☐ Monitor Your Statements: Regularly check your monthly statements for any notifications or changes.

· ☐ Use the Official Login Portal: Continue to use the official Marcus website or app to manage your account unless you are officially instructed otherwise.

Takeaway: Your responsibilities as a borrower have not changed. Your loan is secure, and the original terms are protected.

How Marcus Personal Loans Support Debt Consolidation: A Valuable Tool for Financial Freedom in Top Markets

Debt consolidation remains one of the most popular and effective uses for a personal loan, and the Marcus loan was particularly well-suited for this purpose. The core idea is simple: you take out a single, new loan to pay off multiple existing debts, such as credit cards, store cards, and other high-interest loans. This strategy was a path to financial freedom for many in the US, UK, and beyond.

Imagine a scenario:

· Before Consolidation: You have three credit cards with a total balance of $15,000.

o Card 1: $5,000 at 22.99% APR

o Card 2: $6,000 at 18.99% APR

o Card 3: $4,000 at 24.99% APR

o You’re juggling three different due dates and paying a high blended interest rate.

The Marcus Solution (Historically):

You could apply for a $15,000 personal loan from Marcus. If you had a good credit score, you might qualify for a 5-year loan at a fixed APR of 9.99%.

The benefits are immediate and substantial:

1. Lower Interest Rate: Your new rate (9.99%) is significantly lower than the average of your credit card rates (~22%). This means more of your payment goes toward reducing the principal balance, not just servicing the interest.

2. Simplified Payments: You now have only one monthly payment to manage instead of three. This reduces complexity and the risk of missing a payment.

3. Predictable Payoff Date: With a fixed-term loan, you have a clear end date for your debt. You know that in 5 years, the balance will be zero, which is a powerful motivator.

4. Streamlined Process: Marcus’s direct creditor payment option made the process even easier. You could instruct them to send the funds directly to the credit card companies, ensuring the high-interest debts are paid off immediately.

Key Result: Debt consolidation with a tool like a Marcus personal loan doesn’t eliminate debt, but it restructures it in a smarter, more affordable way. It provides a clear, manageable plan to regain control of your finances. Many alternative lenders today offer these same benefits.

Marcus vs SoFi Personal Loans: A Side-by-Side Comparison for Borrowers in the US, UK, Canada, and Australia

When comparing Marcus to one of its biggest competitors, SoFi, you see two top-tier lenders with slightly different target audiences. While Marcus focused on simplicity and a no-frills approach, SoFi appeals to high-earning professionals with a broader suite of financial products and member benefits. Both are excellent no-fee options, but their strengths vary.

Marcus built its brand on being the most straightforward, transparent lender possible. Its no-fee guarantee and simple reward for on-time payments were its core selling points. The process was designed to be quick, easy, and predictable.

SoFi, on the other hand, aims to build a long-term relationship with its members. Personal loans often come with higher borrowing limits, making them suitable for more significant expenses. SoFi also provides unique protections, such as an unemployment protection program that temporarily pauses payments if you lose your job. Their ecosystem includes investing, banking, and credit cards, creating an all-in-one financial hub.

For a borrower in the US or other Tier One markets, the choice would have depended on their needs. For a simple debt consolidation loan with no hassle, Marcus was a perfect fit. For someone needing a larger loan or wanting to be part of a broader financial platform with added perks, SoFi holds the edge.

| Feature | Marcus by Goldman Sachs (Historical) | SoFi (Current) |

| Target Audience | Good-to-excellent credit borrowers seeking simplicity. | Excellent-credit borrowers, high earners. |

| Max Loan (US) | Up to $40,000 | Up to $100,000 |

| Key Perk | On-Time Payment Reward (payment deferral) | Unemployment Protection, Member Benefits |

| Fee Structure | No origination, late, or prepayment fees. | No origination, late, or prepayment fees. |

Takeaway: SoFi stands as a premier alternative to Marcus, especially for well-qualified borrowers who need larger loan amounts and value additional member benefits.

Marcus vs LightStream Personal Loans: Which Lender Offers the Best Rates for Tier One Borrowers?

LightStream, the online lending division of Truist Bank, is another top competitor that often goes head-to-head with the model established by Marcus. Both lenders target borrowers with strong credit and promise a simple, no-fee experience. However, their approach to rates and loan purposes differs slightly.

Marcus offered a competitive range of fixed APRs applicable to general-purpose loans. The rate you received was based purely on your creditworthiness. LightStream takes a slightly different approach, offering different APR ranges based on the loan’s purpose. For example, a loan for a new car or a kitchen remodel might receive a lower interest rate than a loan for debt consolidation.

LightStream’s key promise is its “Rate Beat Program,” where they state they will beat a competitor’s interest rate by 0.10 percentage points if the applicant meets certain criteria. This makes them highly competitive on price. Furthermore, LightStream often provides faster funding, with some approved loans being funded the same day. The primary drawback is that LightStream’s credit requirements are known to be even more stringent than Marcus’s were; they exclusively serve borrowers with excellent and deep credit histories.

| Feature | Marcus by Goldman Sachs (Historical) | LightStream (Current) |

| Interest Rate Model | Based solely on creditworthiness. | Varies by loan purpose (e.g., auto, home). |

| Funding Speed | 1-4 business days. | It can be as fast as the same business day. |

| Unique Feature | On-Time Payment Reward. | Rate Beat Program, loan-purpose discounts. |

| Credit Requirement | Good to Excellent. | Excellent only. |

Takeaway: For Tier One borrowers with stellar credit, LightStream is a powerful alternative to Marcus, potentially offering even lower rates and faster funding, especially for specific uses like home improvement or auto purchases.

Marcus vs Discover Personal Loans: How Marcus Stands Out in the Personal Loan Market

Discover is a household name in the financial world, and its personal loans are a direct and compelling competitor to what Marcus offered. Both lenders appeal to a similar customer base: borrowers with good credit who want a transparent, fee-free experience. While they share many similarities, a few key differences historically set them apart.

Both Marcus and Discover excel in their commitment to customer-friendly terms. Neither charges origination fees nor prepayment penalties, which is a significant plus for borrowers. Both also offer a direct creditor payment option, making them ideal for debt consolidation.

Where Marcus historically stood out was in its unique rewards. The On-Time Payment Reward, which allowed for a deferred payment after 12 months of on-time payments, was a feature that Discover does not offer. This provided a level of flexibility that was unique in the market.

Discover, on the other hand, has the advantage of being a long-established, diversified financial institution. Borrowers may already have a relationship with Discover through their credit cards or bank accounts, which can add a level of comfort and trust. Discover also offers a slightly longer repayment term option, up to 84 months (7 years), which can result in a lower monthly payment.

| Feature | Marcus by Goldman Sachs (Historical) | Discover Personal Loans (Current) |

| Origination Fee | None | None |

| Direct Debt Payoff | Yes | Yes |

| Unique Feature | On-Time Payment Reward (deferred payment) | Longer max repayment term (up to 7 years) |

| Brand Recognition | Strong as part of Goldman Sachs | Very high, trusted consumer brand |

Takeaway: Discover Personal Loans is an extremely strong alternative to Marcus, offering many of the same core benefits, like no origination fees and direct debt payoff. While it lacks a payment reward feature, its trusted brand name and longer repayment options make it a top contender.

Marcus vs LendingClub Personal Loans: A Comparative Analysis for Borrowers Seeking Flexible Terms

Comparing Marcus to LendingClub highlights a fundamental difference in lending models. Marcus was a direct lender, using its own capital (from parent Goldman Sachs) to fund loans. LendingClub, conversely, is a peer-to-peer (P2P) or marketplace lender. It acts as an intermediary, connecting individual borrowers with investors who fund the loans. This structural difference leads to key variations in fees, rates, and approval criteria.

The most significant difference is the fee structure. Marcus was famous for having no fees. LendingClub, like most marketplace lenders, charges an origination fee. This fee typically ranges from 3% to 8% of the loan amount and is deducted from the loan proceeds before the borrower receives the funds. This makes LendingClub a more expensive option upfront.

However, LendingClub’s model can sometimes offer more flexibility in approvals. Because they cater to a wide range of investors with varying risk appetites, they may approve borrowers with slightly lower credit scores who might not have met the stricter criteria at Marcus. LendingClub also allows for co-applicants, which can help borrowers improve their chances of approval or secure a lower rate—a feature Marcus did not offer.

| Feature | Marcus by Goldman Sachs (Historical) | LendingClub (Current) |

| Lending Model | Direct Lender | Peer-to-Peer Marketplace |

| Origination Fee | None | 3% – 8% |

| Co-Applicants | Not allowed | Allowed (Joint Loans) |

| Credit Focus | Good to Excellent | Fair to Excellent |

Takeaway: For borrowers with strong credit, the Marcus model was superior due to its no-fee structure. However, for those with fair-to-good credit or who could benefit from applying with a co-borrower, LendingClub remains a viable alternative, provided they are comfortable with the origination fee.

Marcus vs Upstart Personal Loans: Find Out Which Lender Is Best for You in the US, UK, and Canada

The comparison between Marcus and Upstart showcases the evolution of lending technology. Marcus represented the best of the modern, transparent bank-led lending model. Upstart, on the other hand, is a fintech platform that leverages artificial intelligence (AI) to create a different path to loan approval.

Marcus relied on traditional underwriting metrics, primarily the FICO score and debt-to-income ratio, to approve applicants. This is a time-tested model, but it can sometimes exclude creditworthy individuals who don’t fit the standard mold, such as young professionals with high earning potential but a thin credit file.

Upstart’s core innovation is its AI-powered approval model. It looks beyond the credit score, analyzing over 1,000 variables, including the borrower’s education, area of study, and employment history. This allows Upstart to identify and approve borrowers who might otherwise be declined. As a result, Upstart can serve a much broader range of credit profiles, from fair to excellent. The trade-off is that Upstart typically charges an origination fee, which Marcus does not. Upstart also has a lower maximum loan amount in some cases.

| Feature | Marcus by Goldman Sachs (Historical) | Upstart (Current) |

| Approval Model | Traditional (FICO score, DTI) | AI-Powered (Alternative Data) |

| Target Borrower | Good to Excellent Credit | Fair to Excellent Credit (incl. thin files) |

| Origination Fee | None | Yes (varies) |

| Key Advantage | No-fee simplicity | Higher approval rates for non-traditional applicants |

Takeaway: If you have a strong, established credit history, the Marcus model would have been ideal. However, if you are a borrower with a fair credit score or a limited credit history but have a good education and stable job, Upstart presents an excellent opportunity to secure a loan that you might not qualify for elsewhere.

Marcus vs Best Egg Personal Loans: Key Differences for Borrowers in Tier One Countries

Best Egg is another prominent online lender that competes directly in the space Marcus once dominated. Both platforms are known for fast online applications and quick funding, appealing to borrowers who need money for immediate needs like debt consolidation or emergency expenses. However, their fee structures and target audiences have key differences.

The primary distinction is the origination fee. Marcus famously had no fees. Best Egg, however, does charge an origination fee on most of its loans, ranging from 0.99% to 8.99%. This fee is deducted from the loan proceeds, so the amount you receive in your bank account will be less than the total loan amount.

In exchange for this fee, Best Egg often provides exceptionally fast funding, sometimes depositing money as quickly as the next business day. They also have a reputation for high customer satisfaction, much like Marcus. While Best Egg requires a good credit score (typically 640+), they offer a secured loan option in some US states, allowing borrowers to use their vehicle’s title as collateral. This can help some applicants qualify or secure a lower interest rate, a feature Marcus did not provide.

| Feature | Marcus by Goldman Sachs (Historical) | Best Egg (Current) |

| Origination Fee | None | 0.99% – 8.99% |

| Funding Speed | 1-4 business days | As fast as 1 business day |

| Secured Loans | Not available | Available in some areas (using a car title) |

| Credit Focus | Good to Excellent | Good to Excellent |

Takeaway: For borrowers in Tier One countries who prioritize avoiding fees above all else, the Marcus model was the clear winner. However, for those who need funds as quickly as possible and have a strong enough profile to secure a low origination fee, Best Egg is a very strong and fast alternative.

Expert Insights on Repaying Your Marcus Personal Loan Effectively: Tips for Borrowers in the US, UK, Canada, and Australia

For existing Marcus customers, managing your loan effectively is key to improving your financial health. A personal loan is a commitment, and a strategic approach to repayment can save you money and boost your credit score. First and foremost, enable Autopay. This not only ensures you never miss a payment but also secures the 0.25% interest rate discount, which adds up over time.

Consider making bi-weekly payments instead of one monthly payment. By splitting your monthly payment in two and paying every two weeks, you will end up making one extra full payment per year. This accelerates your repayment schedule, reduces the total interest you pay, and helps you become debt-free sooner. Before doing this, confirm with customer service that extra payments are applied directly to the principal.

Finally, whenever you receive unexpected income—a bonus, a tax refund, or a gift—consider making a lump-sum payment toward your loan’s principal. Because Marcus has no prepayment penalties, every extra dollar you pay goes directly toward reducing your debt and the future interest you’ll owe. This disciplined approach will maximize the value you get from your loan.

Managing Debt with Marcus Personal Loans: A Practical Approach to Financial Freedom in Top Tier Regions

Using a Marcus personal loan for debt consolidation was a powerful first step toward financial freedom for many, but the loan itself is a tool, not a complete solution. The most crucial part of managing debt is changing the habits that led to it. Once you’ve consolidated high-interest credit card debt, the primary goal should be to avoid accumulating new balances.

Create a detailed monthly budget that tracks all your income and expenses. This will show you exactly where your money is going and identify areas where you can cut back. The money you save each month from the lower interest rate on your Marcus loan should be allocated strategically—either toward paying down the loan faster or building an emergency fund.

An emergency fund with 3-6 months of living expenses is your best defense against future debt. It provides a cash cushion to handle unexpected costs like car repairs or medical bills without having to rely on credit cards. By pairing your consolidation loan with disciplined budgeting and saving, you transform a short-term fix into a long-term strategy for financial well-being.

Building Credit Through Consistent Marcus Payments: How Marcus Loans Can Improve Your Credit Score

For current Marcus loan holders, your loan is a powerful tool for building a positive credit history. How you manage this installment loan can significantly impact your credit score in several positive ways, a principle that applies across the US, UK, Canada, and Australia.

First, payment history is the most important factor in your credit score, accounting for about 35% of its calculation. By making your Marcus payment on time every single month without fail, you are building a consistent record of reliability that other lenders will see as a major positive.

Second, a personal loan adds to your credit mix. Lenders like to see that you can responsibly manage different types of credit, including both revolving credit (like credit cards) and installment credit (like a personal loan with fixed payments). Successfully managing an installment loan demonstrates this ability.

Finally, if you used the loan to pay off high-balance credit cards, you likely lowered your credit utilization ratio. This ratio of how much you owe versus your credit limit is a major scoring factor. By shifting debt from revolving credit cards to a fixed installment loan, you can give your score a significant boost.

Customer Reviews and Satisfaction Insights: What Borrowers in Tier One Countries Say About Marcus Personal Loans

Overall, customer reviews for Marcus’ personal loans in Tier One markets like the US and UK have been overwhelmingly positive. The recurring themes in these reviews center on transparency, simplicity, and value. Borrowers consistently praise the no-fee structure, often highlighting it as the primary reason they chose Marcus over competitors. The feeling of not having to worry about hidden costs created a high level of trust and satisfaction.

The digital experience is another area of frequent acclaim. Reviewers describe the online application as “quick,” “simple,” and “stress-free.” The ability to get a rate quote with a soft credit check is a particularly valued feature. The user dashboard for managing an existing loan is also noted for its clean design and ease of use.

While most feedback is positive, some criticisms have appeared. The most common complaints relate to the strict approval criteria, with some applicants expressing frustration at being denied despite having what they considered to be good credit. A smaller number of reviews mention delays in the income verification process. However, the consensus remains that Marcus delivered a superior, customer-centric borrowing experience.

Maximizing the Benefits of Marcus Personal Loans: Expert Tips for Borrowers in the US, UK, Canada, and Australia

If you are an existing Marcus loan customer, there are several ways to ensure you’re getting the absolute most out of your financial product. These tips can help you save money and use the loan’s features to your full advantage.

First, double-check that you are enrolled in Autopay. This is the easiest way to save money, thanks to the 0.25% APR discount. It’s a small but guaranteed return for simply being organized.

Second, be strategic with the On-Time Payment Reward. After 12 consecutive on-time payments, you can defer a payment. Don’t use this reward casually. Instead, save it as a part of your emergency financial plan. If you have a month with an unexpectedly large expense, using the deferment can provide critical breathing room in your budget without any negative consequences.

Finally, leverage the no-prepayment penalty. Any time you can afford to pay extra, do so. Even an extra $50 per month can shorten your loan term and reduce the total interest you pay over time. By combining these three features, you can actively manage your loan to minimize its cost and maximize its flexibility.

Future Outlook for Marcus Personal Loans and the Personal Lending Market: What Borrowers Can Expect in the Coming Years

The exit of Marcus by Goldman Sachs from the new personal loan market is a significant event that signals broader trends in consumer finance. It highlights the intense competition and high operational costs in the fintech space. While Marcus itself is no longer an option for new borrowers, its influence will persist.

The future of the personal lending market will likely be shaped by a few key trends. First, the high standard for transparency set by Marcus—especially the no-fee model—will continue to be a competitive pressure point. Lenders who charge high origination fees will face increasing scrutiny from consumers who now expect more upfront value.

Second, the use of AI and alternative data for underwriting, as popularized by lenders like Upstart, will become more mainstream. This will open up access to credit for a wider range of borrowers who may not have perfect traditional credit files.

Finally, we can expect to see more integrated financial platforms, like SoFi, that offer personal loans as part of a larger ecosystem of banking, investing, and other financial services. For borrowers in Tier One countries, this means more choice, but also a greater need to carefully compare not just loan terms, but the overall value proposition of each lender.

Frequently Asked Questions (FAQ)

Does Marcus Still Offer Personal Loans? What Borrowers Need to Know

No, Marcus by Goldman Sachs is no longer accepting applications for new personal loans. This decision was part of a strategic shift by Goldman Sachs to scale back its consumer lending operations. For existing customers, however, nothing has changed regarding their loan terms or payment obligations. All current loans remain active and must be paid back according to the original agreement. The online portal for managing accounts and making payments is still operational for all current borrowers. If you are seeking a new loan, you will need to explore other lenders. Many reputable banks and online platforms now offer competitive, no-fee personal loans similar to the product that Marcus popularized.

Why Did Marcus Stop Offering Personal Loans? Understanding the Shift

Marcus stopped offering new personal loans because its parent company, Goldman Sachs, decided to restructure its business and move away from the consumer banking sector. While the Marcus loan product was very popular with customers and well-regarded in the industry for its transparency and no-fee structure, the overall consumer division was not as profitable as the bank had hoped. The high costs of marketing, technology, and customer acquisition in the competitive consumer space led Goldman Sachs to refocus on its traditional strengths: investment banking and wealth management for high-net-worth clients. The decision was a strategic business move to improve the firm’s overall profitability, not a reflection of any failure or issue with the loan product itself.

Who Took Over Marcus Personal Loans? What It Means for Borrowers

For the majority of existing borrowers, Marcus by Goldman Sachs continues to service their loans directly. This means you will still make payments to Marcus and use their online platform to manage your account. However, it is a common business practice for a company exiting a market to sell its loan portfolio. Goldman Sachs has sold some portions of its loan assets to other financial institutions. If your specific loan is sold to a new servicer, you will be formally and clearly notified in writing by both Marcus and the new company. Legally, the new servicer must honor all the terms and conditions of your original loan agreement. Your interest rate, monthly payment, and loan duration cannot be changed.

Is Goldman Sachs Closing Marcus Personal Loans? Latest Updates and Insights

Goldman Sachs is not “closing” existing Marcus personal loans. Rather, it has closed the door to new applicants. All existing loan agreements are legally binding contracts that will continue to be serviced until they are fully paid off. If you are a current borrower, you must continue to make your payments as usual. The company is simply exiting this specific line of business for future customers. The Marcus brand still exists, primarily for its high-yield savings accounts and certificates of deposit (CDs), which were not affected by the decision to stop offering loans. The core change is solely the halt of new loan originations as part of a broader corporate strategy.

Marcus Personal Loans Reviews: Are Borrowers Satisfied with the Terms?

Yes, overall, borrowers have been highly satisfied with the terms of Marcus’s personal loans. Customer reviews consistently praise the platform for its transparency and value. The most celebrated feature is the no-fee policy, which eliminates origination fees, prepayment penalties, and late fees. This straightforward approach built a high level of trust. Borrowers also frequently report satisfaction with the competitive, fixed interest rates, which provide predictable monthly payments. The simple online application, which included a soft credit check for pre-qualification, was another highly-rated feature. While some negative reviews mention strict credit requirements or occasional document verification delays, the overwhelming consensus is that Marcus offered one of the most borrower-friendly loan products on the market.

Marcus Personal Loans Login: How to Access Your Account and Manage Your Loan

Even though new loans are not being offered, existing customers can easily access and manage their accounts through the official Marcus website. To log in, simply navigate to the Marcus by Goldman Sachs homepage for your country (e.g., marcus.com in the US or marcus.co.uk in the UK). You will find a “Log In” button, typically in the top-right corner of the page. You will need the username and password you created when you first opened your account. Once logged in, your dashboard will allow you to view your loan balance, see your payment history, update your personal information, set up Autopay, and access important documents like statements. If you’ve forgotten your password, there is a “Forgot Password” link to help you reset it securely.

Marcus Personal Loans Requirements: What You Need to Qualify

Historically, to qualify for a Marcus personal loan, applicants needed to meet several key requirements, primarily centered on creditworthiness. The most important factor was having a good to excellent credit score, which in the US generally meant a FICO score of 660 or higher. The best rates were reserved for applicants with scores above 740. Additionally, applicants needed to provide proof of stable and sufficient income to demonstrate their ability to repay the loan. A low debt-to-income (DTI) ratio was also crucial. Other basic requirements included being of legal age in your country of residence (18+ in the US/UK) and having a valid bank account for fund disbursement and payments. Marcus did not allow for co-signers or joint applicants.

Marcus Personal Loans Phone Number: How to Contact Customer Service

For existing Marcus personal loan customers who need to speak with a representative, the best way to find the correct phone number is to check your most recent loan statement or log in to your account on the official Marcus website. Contact information is typically listed prominently in account dashboards and on official documents. Because phone numbers can change and may differ by country (US vs. UK), checking these official sources is the most reliable method. For US customers, the loan servicing number has historically been 1-844-MARCUS1 (1-844-627-2871). However, always verify this on the website to ensure you have the most current contact details before calling for assistance with your account.

Marcus Personal Loans Calculator: Estimate Your Loan Terms and Payments

While the official Marcus loan calculator is no longer available for new applicants, you can use any standard personal loan calculator online to estimate potential payments. These tools are invaluable for financial planning. To use one, you will typically need to input three pieces of information: the loan amount (how much you want to borrow), the repayment term (the number of months or years you want to pay it back, e.g., 36, 60, or 72 months), and the estimated interest rate (APR) you expect to qualify for based on your credit score. The calculator will then instantly show you your estimated monthly payment and the total amount of interest you will pay over the life of the loan. This helps you compare different scenarios to find a payment that fits your budget.

Apply for Marcus Personal Loan: Simple Application Process for Borrowers in Tier One Regions

Marcus is no longer accepting applications for new personal loans. However, its historical application process was known for its simplicity and can serve as a model for what to expect from other top online lenders. The process was entirely digital and started with a pre-qualification step that required only basic personal and financial information. This resulted in a soft credit check, which allowed you to see potential loan offers without affecting your credit score. If you chose to proceed, you would complete a more detailed application, which triggered a hard credit check. After verifying your identity and income, you would sign the loan agreement electronically, and funds would typically deposited into your bank account within a few business days.

Goldman Sachs Personal Loan: The Trusted Option for Borrowers Seeking Competitive Terms

“Marcus” is the brand name for the consumer finance division of Goldman Sachs. So, a Marcus personal loan was a Goldman Sachs personal loan. The product was launched to bring Goldman Sachs’s reputation for financial expertise to the mainstream consumer market. It quickly became a trusted option because it combined the stability and security of a major global investment bank with a modern, customer-friendly fintech platform. Borrowers were drawn to the competitive, fixed-rate terms and the complete absence of fees, which was a departure from many other lenders. While Goldman Sachs has now pivoted away from offering new loans under the Marcus brand, the trust and positive reputation it built remain influential in the industry.

Marcus Debt Consolidation Loan: How to Use a Personal Loan to Consolidate Debt and Save

A Marcus debt consolidation loan was designed to simplify your finances and save you money. The process involved taking out one larger loan to pay off multiple smaller, high-interest debts, such as credit cards. For example, if you had $20,000 in credit card debt with an average APR of 21%, you could get a Marcus loan for $20,000 at a much lower fixed rate, perhaps 9%. You would then use the loan funds to pay off all your credit cards at once. Marcus made this even easier with its direct creditor payment feature, sending the money straight to your creditors. This left you with just one manageable monthly payment at a lower interest rate, which could save you thousands of dollars in interest and help you pay off your debt significantly faster.