Best Instant Personal Loan with fast approval and low interest rates. Compare trusted lenders in the US, UK, Canada & Australia and get funds within 24 hours.

When a financial emergency strikes—a sudden car repair, an urgent medical bill, or a time-sensitive home issue—waiting is not an option. You need access to funds now, not in a week. The traditional loan process, with its mountains of paperwork and lengthy approval times, feels completely out of step with the speed of modern life. This delay and uncertainty create immense stress. You are left wondering if you will be approved and when you will get the money, all while the financial pressure mounts. The core problem is the gap between needing immediate funds and the slow, complex process of getting them. You want a fast, simple solution, but worry about hidden fees, high interest rates, and predatory lenders.

This guide is your direct path to securing a fast, fair, and transparent instant personal loan. We promise to show you how top online lenders in the US, UK, Canada, and Australia have streamlined the application process to provide instant decisions and same-day funding. We will demystify the requirements, highlight lenders with no hidden fees, and explain how you can check your rates without affecting your credit score. You will learn how to apply in minutes, choose a repayment plan that fits your budget, and manage your loan with ease. By the end, you will have the confidence to secure the funds you need today, from a trusted lender at a competitive rate.

Apply Online in Minutes for Instant Personal Loan Approval

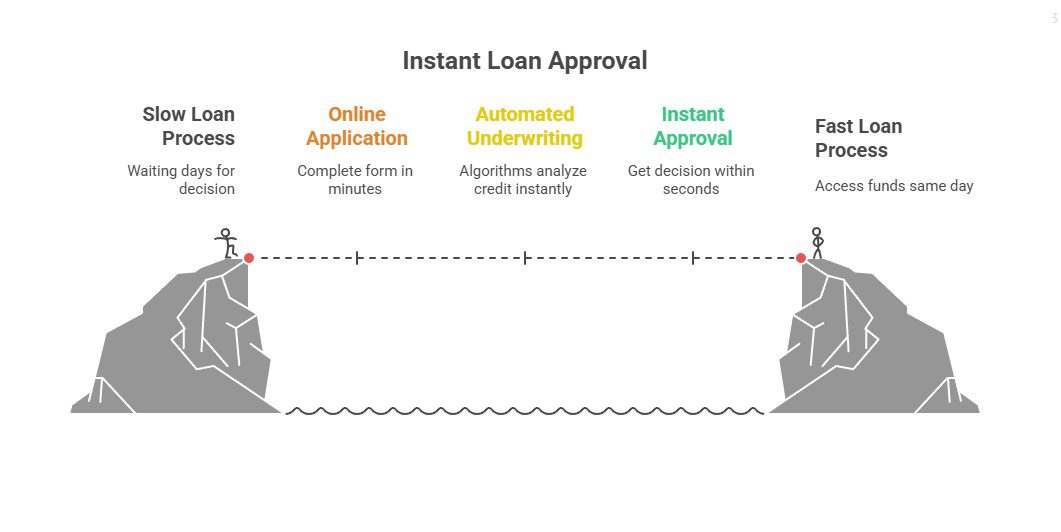

In today’s digital world, the idea of waiting days or weeks for a loan decision is outdated. Modern online lenders have revolutionized the borrowing experience, creating a process so fast and simple you can complete it from your couch in less time than it takes to watch a TV show. The entire journey, from the approval application, is designed for speed and convenience. You no longer need to schedule bank appointments or fill out endless paper forms. Instead, you use a secure, intuitive online portal that guides you through a few simple steps. You provide basic personal and financial information, and the lender’s advanced technology gets to work instantly.

This automated underwriting process is the key to instant approval. Lenders use sophisticated algorithms to analyze your credit profile, verify your income, and assess your ability to repay in real-time. This means you can get a definitive yes or no within seconds of hitting “submit.” This speed is not just about convenience; it’s about providing peace of mind when you need it most. When facing an urgent expense, knowing immediately whether you have access to the necessary funds allows you to make decisions and take action without delay. The process is built to be seamless, secure, and respectful of your time, turning a traditionally stressful task into a straightforward, empowering experience.

Mini Case Study: Chloe’s Emergency Vet Bill

Chloe, a graphic designer in London, was faced with a sudden £2,000 vet bill for her dog’s emergency surgery on a Tuesday morning. She didn’t have the full amount in her savings. Instead of panicking, she went online to a reputable UK lender. The application took her about eight minutes to complete on her laptop. She provided her name, address, employment details, and income. Within 60 seconds of submitting, she received an on-screen notification that she was approved. After a quick identity verification by uploading a photo of her driving license, she signed the digital loan agreement. The funds were in her bank account before she even left the veterinary clinic that afternoon.

| Step in the Online Process | Traditional Bank (In-Person) | Modern Online Lender |

| 1. Application | 30-60 minutes appointment + paperwork | 5-10 minutes online form |

| 2. Document Submission | Provide physical copies | Upload digital files instantly |

| 3. Underwriting/Decision | 2-7 business days | Seconds to minutes (automated) |

| 4. Final Agreement | Return to the branch to sign | Sign digitally from anywhere |

| 5. Funding | 1-3 days after signing | Same day or next business day |

Key Takeaway: The online application for an instant loan eliminates traditional barriers, using technology to provide a secure decision in minutes and putting you in control of your financial emergency.

Ready to see how fast it can be?

Get Funded Quickly with Flexible Loan Terms and Secure Processing

Receiving a fast approval is only half the battle; getting the cash in your bank account is what truly matters in an emergency. The best instant personal loan providers excel at rapid fund disbursement. Once you are approved and have digitally signed your loan agreement, their streamlined processes kick into gear to get you your money as quickly as possible, often on the same day. This is made possible through modern electronic fund transfer systems (like ACH in the US or Faster Payments in the UK), which move money securely and swiftly between financial institutions. For borrowers in the US, UK, Canada, and Australia, this means you can often apply in the morning and have the funds available by the evening.

Beyond speed, top lenders offer the flexibility you need to manage the loan responsibly. You are not locked into a one-size-fits-all plan. Instead, you can often choose your repayment term, typically ranging from two to seven years. A shorter term means a higher monthly payment but less interest paid overall, while a longer term offers a more manageable monthly payment but costs more in the long run. This choice empowers you to balance your immediate budgetary needs with your long-term financial goals. The entire process is underpinned by robust security measures, including data encryption and identity verification, ensuring that your sensitive personal and financial information remains protected every step of the way.

Mini Case Study: Mark’s Urgent Car Repair

Mark, a sales representative in Chicago, relied on his car for work. When the transmission failed, he was quoted a $4,500 repair bill and was told it would take a week, leaving him unable to work. He needed the repair done immediately. On a Thursday morning, he applied for a $5,000 instant loan online. He was approved in minutes and chose a 36-month repayment term that fit his budget. He completed the verification process by linking his bank account online. The lender initiated the transfer, and the $5,000 was in his account by 4 p.m. that same day. Mark was able to pay the mechanic upfront, get his car back on the road by Friday, and didn’t miss a single day of work.

| Feature | Description | Benefit to Borrower |

| Same-Day Funding | Funds are disbursed to your bank account within 24 hours of approval. | Solves urgent financial needs immediately, reducing stress. |

| Flexible Loan Terms | Repayment periods typically range from 24 to 84 months. | Allows you to choose a payment that fits your monthly budget. |

| Secure Digital Processing | End-to-end data encryption and secure identity verification. | Protects your sensitive information from unauthorized access. |

| No Prepayment Penalties | Freedom to pay off your loan early without any extra fees. | Saves you money on interest if your financial situation improves. |

Key Result: Instant loans combine the speed you need in an emergency with the flexibility and security you deserve, providing a reliable and modern financial solution.

Need cash fast? Check your eligibility for a same-day personal loan now →

No Fees, No Surprises — 100% Transparent Loan Conditions

One of the biggest anxieties for borrowers is the fear of hidden costs. You see an attractive headline interest rate, only to discover later that origination fees, application fees, or other charges have been added, making the loan far more expensive than you thought. The best instant personal loan lenders have built their reputation on transparency, eliminating these surprise costs entirely. Their business model is straightforward: what you see is what you get. The Annual Percentage Rate (APR) they quote you is the true, all-in cost of your loan. This commitment to transparency builds trust and allows you to budget with absolute certainty.

The most common fee that transparent lenders eliminate is the origination fee. This is a charge some lenders apply for processing your loan, often ranging from 1% to 8% of the total loan amount. On a $10,000 loan, that could be up to $800 deducted from your funds before you even receive them. A no-fee lender gives you the full amount you borrow. Furthermore, these top-tier lenders rarely charge prepayment penalties. This gives you the crucial flexibility to pay off your loan ahead of schedule if your financial situation improves, saving you money on future interest payments without any punishment. This borrower-friendly approach ensures that the loan terms are clear, fair, and designed to help you, not trap you.

Mini Case Study: The Lees Compare Two Offers

The Lee family in Sydney, Australia, needed A$20,000 for a time-sensitive investment. They received two offers:

· Lender A: Offered a 7.9% interest rate but had a 4% origination fee (A20,000.

· Lender B (No-Fee Lender): Offered a slightly higher 8.5% APR but had zero origination fees and no other hidden charges.

Initially, Lender A looked cheaper. But when the Lees calculated the true cost, they realized they would only receive A19,200afterthefeefromLenderAbutwouldhavetorepaythefullA20,000. Lender B, the no-fee lender, gave them the full A$20,000. They chose Lender B for its transparency and straightforward terms, ensuring they got the exact amount they needed without any surprise deductions.

| Fee Type | What It Is | Impact on Borrower | Status with Top Lenders |

| Origination Fee | A fee to process or “originate” the loan. | Reduces the amount of cash you receive. | Eliminated |

| Application Fee | A charge simply to apply for the loan. | A barrier to even checking your options. | Eliminated |

| Prepayment Penalty | A fee for paying off your loan early. | Traps you into paying more interest over time. | Eliminated |

| Late Payment Fee | A standard charge for a missed payment. | An avoidable cost, but the terms are clearly stated. | Clearly Disclosed |

Key Takeaway: Choosing a lender with a “no hidden fees” policy means the APR you are quoted is the real rate you will pay, providing clarity and peace of mind throughout the life of your loan.

Don’t get caught by surprise costs. Find trusted no-fee lenders in your area →

Choose Your Ideal Loan Amount and Repayment Plan for Financial Flexibility

A personal loan should be a tool that fits your unique financial situation, not a rigid product that forces you into a box. Leading providers of instant loans understand this, offering a wide range of loan amounts and repayment plans to give you maximum control and flexibility. Whether you need a small amount to cover a minor emergency or a substantial sum for a major life event, you can request the exact amount you need. Loan amounts typically range from as little as $1,000-$2,000 to as much as $50,000 or even $100,000, depending on the lender and your creditworthiness. This precision prevents you from borrowing—and paying interest on—more money than you actually need.

Once you have selected your loan amount, you can tailor your repayment plan to fit your monthly budget. Most lenders offer repayment terms ranging from 24 months (2 years) to 84 months (7 years). This choice has a direct impact on your monthly payment:

· Shorter Term: Higher monthly payment, but you pay less in total interest and become debt-free faster.

· Longer Term: Lower monthly payment, making it more manageable for your budget, but you pay more in total interest over the life of the loan.

Online loan calculators allow you to instantly see how different terms affect your payment, empowering you to find the perfect balance between monthly affordability and long-term cost savings. This level of customization ensures that the loan supports your financial goals instead of straining them.

Mini Case Study: David’s Debt Consolidation Plan

David, from Toronto, Canada, had C$15,000 in high-interest credit card debt. He was approved for a personal loan at a 9% APR. He used the lender’s online tool to explore his repayment options:

· 3-Year (36-month) Term: Monthly payment of C2,172.

· 5-Year (60-month) Term: Monthly payment of C3,660.

· 7-Year (84-month) Term: Monthly payment of C242.Total interest: C5,328.

After reviewing his budget, David saw that he could comfortably afford the C477payment. By choosing the shorter 3-year term, he saved over C1,400 in interest compared to the 5-year option and would be debt-free two years sooner.

| Loan Term | Monthly Payment (on a $20,000 loan at 8% APR) | Total Interest Paid | Best For… |

| 36 Months | $627 | $2,561 | Borrowers who want to save the most on interest and can afford a higher payment. |

| 60 Months | $406 | $4,332 | Borrowers seek a balance between a manageable payment and total cost. |

| 84 Months | $313 | $6,256 | Borrowers who need the lowest possible monthly payment to fit their budget. |

Key Result: The ability to customize both your loan amount and repayment term puts you in the driver’s seat, allowing you to design a loan that perfectly aligns with your financial reality.

Ready to find your perfect payment plan? Use a free loan calculator to explore your options →

Fast Decisions and Instant Approval Options from Trusted Lenders

When time is of the essence, the last thing you want is to be left in limbo, waiting for a lender to make up their mind. The concept of a “fast decision” is at the heart of the instant personal loan experience. Trusted online lenders in the US, UK, Canada, and Australia have invested heavily in technology to eliminate the slow, manual review processes of the past. They leverage powerful, secure algorithms that can assess thousands of data points on a credit report, verify income information, and run it against their lending criteria in a matter of seconds. This results in a near-instantaneous decision for the vast majority of applicants.

This immediate feedback is incredibly valuable. It removes the anxiety of the unknown and allows you to move forward with your financial planning immediately. If you are approved, you can proceed to the final steps of securing your funds. If you are not approved, you are not left waiting for days to find out; you can immediately explore other options. This efficiency is a hallmark of customer-centric design. Lenders who offer instant decisions understand that their customers are often in stressful situations and that providing a clear, fast answer is a critical part of a positive borrowing experience. This speed is achieved without compromising on security or responsible lending practices, ensuring that the decision is both quick and reliable.

Mini Case Study: The Watsons’ Last-Minute Wedding Expense

The Watson couple in the US were a week away from their wedding when their venue informed them of a surprise $3,000 mandatory insurance fee. Stressed and short on time, they turned to an online lender known for fast decisions. They applied together online, a process that took about 10 minutes. As soon as they hit submit, the screen refreshed with an approval notification and the loan terms. They were able to review the offer, sign the documents electronically, and receive the funds the next day, resolving the issue long before their wedding day. The instant decision removed a huge source of stress during an already busy time.

| Lender Type | Decision Speed | Underwriting Process | Best For |

| Top Online Lenders | Seconds to Minutes | Fully automated, data-driven algorithms. | Urgent funding needs, tech-savvy borrowers. |

| Traditional Banks | 2-7 Business Days | Manual review by a loan officer. | Existing customers with excellent credit, non-urgent needs. |

| Credit Unions | 1-5 Business Days | A combination of automated and manual review. | Members seeking personalized service. |

Key Tip: To ensure the fastest possible decision, double-check all your information for accuracy before submitting your application. A simple typo in your name, address, or income can flag the system for a manual review, slowing down the process.

Manage Your Instant Personal Loan Conveniently Online Anytime

The convenience of an instant personal loan doesn’t end once the funds are in your account. The best modern lenders provide robust online dashboards and mobile apps that give you complete control over your loan 24/7. This digital-first approach means you are no longer tied to a bank’s business hours to manage your finances. Whether you want to check your outstanding balance, make an extra payment, or view your payment history, you can do it all from your computer or smartphone at any time, from anywhere. This level of access and control empowers you to stay on top of your loan and manage your financial health proactively.

These online portals are designed to be user-friendly and intuitive. You can easily set up and manage automatic payments, which is the surest way to build a positive payment history and protect your credit score. If your financial situation improves and you want to pay your loan off faster, you can make extra principal payments with just a few clicks, saving you money on interest. The dashboard will often include helpful tools like an amortization calculator to show you exactly how much interest you can save by paying more. This transparency and ease of use transform loan management from a chore into a simple, straightforward part of your financial routine, giving you the tools you need for long-term success.

Mini Case Study: Sarah’s Proactive Loan Management

Sarah, from the UK, took out a 4-year instant personal loan for home renovations. Six months into her loan, she received a small bonus at work. Instead of spending it, she logged into her lender’s mobile app. She used the app’s calculator to see that making a one-time extra payment of £500 would shorten her loan term by three months and save her nearly £80 in interest. She made the extra payment directly through the app in under a minute. Throughout her loan, she continued to use the app to monitor her progress and make small extra payments whenever she could, ultimately paying off her debt nearly a year ahead of schedule.

| Features of the Online Portal | Benefit to Borrower | How It Works |

| 24/7 Account Access | Manage your loan on your own schedule. | Log in via a secure website or mobile app. |

| Automatic Payment Setup | Ensures on-time payments, protects your credit. | Link your bank account and choose your payment date. |

| Extra Payment Options | Pay off your loan faster and save on interest. | Make one-time or recurring extra payments to the principal. |

| Loan Amortization Tools | See the impact of extra payments in real-time. | Interactive calculators show you interest savings and new payoff dates. |

| Secure Document Center | Access your loan agreement and statements easily. | Download PDF copies of all your important loan documents. |

Key Takeaway: A great online management platform is a standard feature of a top instant loan, giving you the transparency and control needed to manage your debt effectively and achieve your financial goals faster.

Debt Consolidation Solutions That Save You Money on Interest

High-interest credit card debt can feel like a trap. You make monthly payments, but the balance barely shrinks because of steep interest charges, often 20% or more. An instant personal loan is a powerful tool to break this cycle. The strategy is simple: you take out a single loan at a lower, fixed interest rate and use the funds to pay off all your high-interest credit cards at once.

This has two immediate benefits. First, you simplify your finances from multiple payments down to just one predictable monthly payment. Second, and more importantly, you save a significant amount of money. By swapping a high, variable APR for a lower, fixed APR, more of your payment goes toward paying down the principal balance, not just the interest. This allows you to pay off your debt much faster. Online lenders make this process quick and easy, allowing you to get the funds you need to pay off those cards in as little as 24 hours.

| Feature | Credit Cards | Debt Consolidation Loan |

| Average APR | 20%+ (Variable) | 8-15% (Fixed) |

| Monthly Payments | Multiple, variable minimums | One fixed payment |

| Payoff Timeline | Unpredictable, often years | Clear end date (e.g., 3-5 years) |

| Financial Impact | Can hurt credit (high utilization) | Can help credit (improves mix) |

Expert Insight: “After consolidating your credit cards with a loan, avoid the temptation to run up new balances on those cards. The goal is to eliminate debt, not create more. Consider keeping the card accounts open with a zero balance to preserve your credit history, but be disciplined about not using them for new purchases you can’t pay off immediately.” — Debt Counselor

Home Improvement Financing with Quick Online Access to Funds

When you have a time-sensitive home improvement project—like a leaky roof, a broken furnace, or an opportunity to get a deal on new appliances—you need access to financing quickly. An instant personal loan is an excellent option because it provides a lump sum of cash upfront, allowing you to pay contractors and purchase materials without delay. Unlike a home equity line of credit (HELOC), which can take weeks to approve and requires you to use your house as collateral, an unsecured personal loan is fast and straightforward.

The online application process means you can apply for the funds you need and get an approval decision in minutes. Funding can happen as quickly as the same or the next business day, allowing your project to stay on schedule. This speed is invaluable for both emergency repairs and planned renovations where timing is critical. With a fixed interest rate and a predictable monthly payment, you can budget for your renovation with confidence, knowing that your financing costs will not change over time. This makes an instant loan a simple, secure, and efficient way to invest in your home’s value and comfort.

| Financing Option | Approval Speed | Collateral Required? | Best For… |

| Instant Personal Loan | Same or next day | No | Fast, unsecured funding for projects up to $50k-$100k. |

| HELOC | Several weeks | Yes (your home) | Larger, ongoing projects where you need a flexible credit line. |

| Credit Card | Instant | No | Small DIY projects, but risky for large balances due to high interest. |

Cover Major Purchases and Personal Expenses Without Delays

Life is full of major events and purchases that require significant upfront funding—a wedding, a cross-country move, essential medical procedures, or even the purchase of a used vehicle. An instant personal loan provides a structured and often more affordable way to finance these expenses compared to putting them on a high-interest credit card. The speed of an online loan means you can make decisions and commit to plans without the uncertainty of slow financing.

For example, when planning a wedding, you often need to pay deposits to vendors months in advance. An instant loan gives you the cash to lock in your preferred vendors immediately. For unexpected medical or dental bills, a fast loan can ensure you get the care you need without delay. The process is designed for modern life: apply online in minutes, receive an instant decision, and get your funds quickly. With a fixed monthly payment, you know exactly how the expense will fit into your budget over the next few years, providing a level of predictability that revolving credit simply cannot match. This makes an instant loan a smart and responsible way to manage life’s biggest moments.

Expert Insight: “Before taking out a loan for a major purchase, it’s wise to have a detailed budget for the expense. Borrowing the exact amount you need, rather than estimating, ensures you don’t take on unnecessary debt. A loan should be a precise tool to achieve a specific goal, not a source of excess cash that can be easily misspent.” — Financial Planner.

Credit Card Refinancing Made Simple with Instant Loan Payouts

Credit card refinancing is another term for debt consolidation, specifically targeting high-interest credit card balances. It is one of the most common and financially savvy uses of an instant personal loan. The high, variable interest rates on credit cards can make it feel impossible to pay down your principal balance. Refinancing simplifies this problem by replacing that expensive debt with a more affordable, fixed-rate installment loan.

The process is incredibly simple with an instant loan. You apply for a loan amount that equals the total of your credit card balances. Once you are approved and the funds are deposited into your account (often within 24 hours), you use that money to pay off each of your credit cards in full. The result is that you are left with just one loan and one monthly payment, at an interest rate that is often half—or even less—of what your credit cards were charging. This not only saves you a significant amount of money but also provides a clear end date for your debt, giving you a structured path to financial freedom.

| Debt Situation | Before Refinancing | After Refinancing |

| Total Debt | $15,000 (across 3 cards) | $15,000 (one loan) |

| Average APR | 22% (Variable) | 10% (Fixed) |

| Monthly Payments | ~$450 (minimums) | ~$334 (5-year term) |

| Financial Health | Stressful, unpredictable | Simplified, predictable payoff |

Flexible Repayment Options to Fit Your Income Schedule

The best instant loan lenders recognize that not everyone gets paid on the 1st of the month. To accommodate different financial lives, many offer flexible repayment options that can make managing your loan much easier and less stressful. This flexibility is a key feature that distinguishes top-tier lenders.

One of the most valuable options is the ability to change your payment due date. After you have made a few on-time payments, many lenders will allow you to move your due date to better align with your payday. If you get paid on the 15th, you can set your loan payment to be due on the 18th, ensuring you always have the funds available in your account. This simple feature can be a game-changer for budgeting and avoiding accidental overdrafts.

Additionally, lenders offer a variety of ways to pay, from the standard “set it and forget it” autopay to one-time online payments, payments by phone, or even by mail. Some also allow for bi-weekly payments. Instead of making one full payment per month, you make a half-payment every two weeks. Because there are 26 two-week periods in a year, this results in 13 full payments instead of 12, helping you pay off your loan faster and save on interest.

Expert Insight: “When you receive your loan offer, check the lender’s policy on payment date changes. While many offer this flexibility, some do not. Knowing this upfront can help you choose a lender whose policies best match your personal cash flow needs, setting you up for success from day one.” — Loan Servicing Manager.

Quick Access to Funds When You Need It Most — Even the Same Day

When an emergency hits, “quick” is a relative term. For many situations, next-day funding is fine, but sometimes, you need the money today. A select group of online lenders specializes in offering same-day loans, providing the fastest possible access to cash.

Achieving same-day funding requires a combination of lender efficiency and borrower preparedness. Here is how it works:

1. Choose the Right Lender: Focus on lenders who explicitly advertise “Same-Day Funding” or “Instant Payouts.”

2. Apply Early on a Weekday: The banking system’s cutoff times for electronic transfers are crucial. To get funds on the same day, you must apply, get approved, and sign your agreement early in the morning, typically before 11 a.m. EST in the US or an equivalent time in other markets. Applications submitted in the afternoon, on a weekend, or on a holiday will be funded on the next business day.

3. Be Prepared: Have your documents (ID, proof of income) ready as digital files. Use a bank account that can be instantly verified online. Any step that requires a manual review will add delays.

4. Have a Compatible Bank Account: Ensure your bank accepts faster payment transfers. Nearly all major banks in Tier One countries do.

When these conditions are met, the lender can process your approved loan and initiate a wire transfer or real-time payment that can have the funds in your account within hours.

Why Competitive Fixed Interest Rates Matter for Instant Loans

For an instant loan, a competitive, fixed interest rate is your most important feature. It provides the stability and predictability you need to manage your finances effectively.

· What is a Fixed Rate? A fixed interest rate is locked in for the entire life of your loan. It will not change, regardless of economic fluctuations. This means your monthly payment will be the same from the first payment to the last.

· Why It Matters for Budgeting: This predictability is crucial. You can set your budget with confidence, knowing exactly how much you need to allocate to your loan payment each month without any surprises.

· Protection from Rate Hikes: Unlike variable-rate loans (like credit cards), a fixed-rate loan protects you from rising interest rates. If market rates go up, your rate stays the same, potentially saving you a significant amount of money.

· Competitive is Key: “Competitive” means the rate is as low as possible for your credit profile. Shopping around by prequalifying with multiple lenders ensures you find the lowest fixed rate available, which directly translates to a lower monthly payment and less total interest paid.

Key Takeaway: A fixed rate offers peace of mind. It turns an unpredictable debt into a manageable, fixed expense, which is the foundation of a successful repayment plan.

Explore more details here → See today’s average personal loan rates in your country.

What No Origination or Hidden Fees Mean for Borrowers

Choosing a lender that advertises “no origination fees” or “no hidden fees” is a major win for you as a borrower. It simplifies the entire loan process and ensures you get the full value of the money you are borrowing.

Checklist of What “No Fees” Means:

· ✅ No Origination Fee: You receive 100% of the loan amount you are approved for. A $10,000 loan means $10,000 in your bank account, not $9,500 after a fee is deducted.

· ✅ No Application Fee: You are never charged just for applying for a loan, so you can shop around for the best rates without any cost.

· ✅ No Prepayment Penalty: You have the freedom to pay off your loan ahead of schedule to save on interest without being charged an extra fee.

The Benefit of Transparency:

This straightforward approach removes the confusion and suspicion that can come with borrowing. You can trust that the APR you are quoted is the real, all-in cost. This builds a better relationship between you and the lender and allows you to compare different loan offers on a true apples-to-apples basis. While standard charges like late payment fees still apply if you miss a payment, a “no hidden fees” policy means there are no surprise costs to worry about as long as you pay on time.

How Loan Amounts Are Tailored to Meet Your Specific Needs

Instant loan lenders offer a wide spectrum of loan amounts to ensure you can borrow precisely what you need without taking on unnecessary debt. This flexibility is a core feature of modern online lending.

Typical Loan Ranges:

· Small Loans ($1,000 – $5,000): Perfect for covering minor emergencies like a car repair, a dental bill, or a small home repair. These are often easier to qualify for and can be paid back over a shorter term.

· Medium Loans ($5,001 – $20,000): This is the most common range, ideal for debt consolidation, funding a significant home improvement project, or covering major life events like a wedding.

· Large Loans ($20,001 – $100,000): Offered by some lenders to borrowers with excellent credit and high, stable incomes. These are used for substantial projects, such as large-scale renovations or significant debt refinancing.

The amount you are approved for depends on your creditworthiness, income, and existing debt (your DTI ratio). By offering this tailored approach, lenders empower you to solve your specific financial problem without the burden of an oversized loan and the extra interest it would accrue.

How Prequalification Works Without Affecting Your Credit Score

Prequalification is the single most important tool for a smart loan shopper. It allows you to see the personalized rates and terms you are likely to receive from a lender before you formally apply, all without any impact on your credit score.

The Process Explained:

1. You Provide Basic Information: You fill out a short, simple form on the lender’s website with your name, address, income, and desired loan amount.

2. The Lender Performs a “Soft Inquiry”: The lender uses this information to perform a soft credit pull. This allows them to see a summary of your credit profile, but it is not recorded as a formal application on your credit report and is invisible to other lenders.

3. You Receive Your Offers: Based on this soft inquiry, the lender’s system instantly presents you with potential loan offers, including the estimated APR and loan terms.

Why This Matters:

Because it doesn’t affect your credit, you can prequalify with multiple lenders—banks, credit unions, and online platforms—to truly compare offers and find the best deal. It takes the guesswork out of applying and ensures you only submit a formal application (which does trigger a hard inquiry) once you have found the most competitive offer.

Why Transparent Terms and Conditions Build Borrower Trust

Trust is the foundation of any financial relationship. In the world of instant loans, where the process is fast and digital, transparency in the terms and conditions is what builds and maintains that trust.

Hallmarks of Transparent T&Cs:

· Plain Language: The loan agreement is written in clear, easy-to-understand language, avoiding confusing legal jargon.

· Clear Disclosure of APR: The Annual Percentage Rate is displayed prominently, so you know the all-in cost of the loan.

· Explicit Fee Schedule: Any potential fees, such as late payment fees, are clearly listed. A trustworthy lender will also prominently state that there are no origination fees or prepayment penalties.

· Easy Access: You are given ample opportunity to read and download the full terms and conditions before you are asked to sign anything.

When a lender is upfront about every aspect of the loan, it shows they are confident in their product and respect you as a customer. This transparency eliminates the fear of being tricked or taken advantage of, allowing you to enter into the loan agreement with confidence and peace of mind. It signals a long-term partnership rather than a one-time transaction.

How Dedicated Customer Support Enhances Your Loan Experience

Even with the most streamlined online process, questions and unique situations can arise. This is where a dedicated customer support team becomes invaluable. The best instant loan providers back up their technology with accessible, knowledgeable, and empathetic human support.

What to Look for in Customer Support:

· Multiple Contact Channels: They should be reachable through various channels, including phone, secure online chat, and email, allowing you to choose the method you are most comfortable with.

· Extended Hours: Support should be available during convenient hours, including evenings and weekends, not just standard banking hours.

· Knowledgeable Staff: When you contact them, the representatives should be well-trained and able to answer specific questions about your application, the verification process, or your repayment options.

· Based in Your Region: Lenders focused on Tier One markets often have support teams located in the US, UK, Canada, or Australia, ensuring they understand local regulations and nuances.

A great support team can turn a potentially confusing moment into a clear and positive one, whether it’s helping you upload a document or explaining how to make an extra payment. This human element is a critical part of a top-tier loan experience.

Case Study: Fast Funding for Urgent Financial Needs Across the US and UK

Scenario: An unexpected and severe storm caused a tree to fall, damaging the roofs of two homeowners: David in Texas, US, and Sarah in Manchester, UK. Both needed immediate funds for repairs to prevent further water damage.

David (US): The repair quote was $8,000. David’s insurance deductible was high. He applied for an instant personal loan with a US-based online lender at 9 a.m. Central Time. The application was approved in minutes. He used his smartphone to upload a photo of his driver’s license and his most recent pay stub. He signed the digital agreement by 10 a.m. The funds were disbursed via an ACH transfer and were available in his bank account the next morning.

Sarah (UK): The repair quote was £6,000. Sarah applied with a UK fintech lender known for fast payouts. The online application took her 10 minutes. Because UK banks use the Faster Payments System, once her loan was approved and she signed the agreement around 11 a.m. GMT, the funds were in her account less than two hours later.

Result: Both David and Sarah used the speed of instant online loans in their respective countries to address their emergencies immediately, demonstrating the effectiveness of these platforms across Tier One markets.

Insight: Easy Online Application Process for Instant Personal Loans

The online application for an instant loan is designed with one goal in mind: simplicity. Lenders have refined the process to be as frictionless as possible. It typically consists of three short stages:

1. Basic Information (2-3 minutes): Enter your name, address, contact information, and the reason for the loan.

2. Financial Snapshot (3-5 minutes): Provide your employment status, gross annual income, and major monthly expenses like your rent or mortgage payment. This allows the lender to calculate your debt-to-income ratio.

3. Review and Submit (1 minute): Create an account with a password, agree to the credit check (initially a soft pull for prequalification), and submit the form.

The entire process often takes less than 10 minutes. The user interface is clean, with clear instructions and helpful info-tips along the way. This ease of use removes the intimidation factor from borrowing and makes financial help accessible to everyone, regardless of their financial expertise.

FAQ: How to Check Your Personalized Loan Rate Before Applying

Checking your personalized loan rate without impacting your credit score is the first step you should take. This is done through a process called prequalification.

Simply navigate to a trusted lender’s website and find the “Check Your Rate” button. You will be asked to fill out a short form with basic personal and financial details. The lender will then perform a soft credit inquiry, which does not affect your credit score and is not visible to other lenders. Within seconds, the system will show you the interest rates (APR) and loan terms you are likely to qualify for based on this initial check. This is not a firm offer of credit, but it is a highly accurate estimate. By doing this with 2-3 different lenders, you can easily compare your personalized rates and choose the most affordable option before proceeding with a formal application.

Feature: Automatic Payment Setup for Stress-Free Loan Management

Setting up automatic payments, or “autopay,” is the single best way to manage your loan and build a positive credit history. It is a simple feature with powerful benefits.

· How it works: During the final loan setup or anytime through your online dashboard, you link your checking account and authorize the lender to withdraw your payment on the same date each month.

· Benefits:

o Never Miss a Payment: It automates the process, so you don’t have to worry about remembering due dates, protecting you from late fees.

o Builds Positive Credit: On-time payments are the most important factor in your credit score. Autopay ensures a perfect payment history.

o Potential Rate Discount: Many lenders offer an APR discount of 0.25% or more just for enrolling in autopay, saving you money.

This “set it and forget it” feature provides peace of mind and makes responsible loan management effortless.

| Autopay Feature | Benefit |

| Automated Deductions | Eliminates late payments and fees. |

| APR Discount | Lowers your interest rate. |

| Credit Building | Creates a perfect payment history. |

Comparison: Loan Terms from Short to Long Duration Explained

The loan term is the length of time you have to repay your loan. Choosing the right term is about balancing your monthly budget with the total cost of borrowing.

· Short-Term Loans (12-36 months):

o Pros: You pay significantly less in total interest. You become debt-free much faster.

o Cons: The monthly payments are considerably higher.

o Best for: Borrowers with strong cash flow who want to minimize the overall cost of the loan.

· Long-Term Loans (60-84 months):

o Pros: The monthly payments are much lower and more manageable, fitting into tighter budgets.

o Cons: You pay substantially more in total interest over the life of the loan.

o Best for: Borrowers whose primary need is an affordable monthly payment, even if it costs more in the long run.

Most borrowers choose a middle ground, such as a 48 or 60-month term, which offers a reasonable balance between the two extremes.

Success Story: Join Millions of Satisfied Borrowers Worldwide

Meet Emily, a young professional in Canada who was juggling three high-interest credit cards with a total balance of C400, and she felt like she was making no progress.

She discovered an online lender that offered instant loans for debt consolidation. She applied, was approved for a C393. She used the funds to completely pay off all three credit cards.

The Result: Not only did she simplify her finances into one easy payment, but she also had a clear date for when she would be debt-free. She successfully paid off the loan in three years, saving over C$2,500 in interest compared to what she would have paid on her credit cards. Her credit score also increased by over 50 points due to her perfect payment history and lower credit utilization. Emily is one of millions who have used an instant loan as a strategic tool to regain control of their financial future.

Expert Insight: Personalized Loan Options for Every Borrower Type

Financial experts emphasize that the modern lending landscape offers personalized solutions for nearly every type of borrower. For individuals with excellent credit, lenders compete aggressively, offering very low APRs, high loan amounts, and no fees, rewarding them for their financial discipline. For those with fair credit or a limited credit history, many fintech lenders use advanced data analytics that look beyond just the credit score, considering factors like income stability and cash flow to increase approval chances. For borrowers with bad credit, options like secured loans or applying with a co-signer can provide a pathway to affordable credit. The key is to identify which category you fall into and seek out lenders that specialize in serving that specific profile.

Resource Center: Tools and Calculators to Manage Your Loan Efficiently

The best lenders empower their customers with a suite of free online tools and calculators. These resources help you make informed decisions before you borrow and manage your loan effectively afterward. A Personal Loan Calculator is essential for modeling how different loan amounts, interest rates, and terms will affect your monthly payment. A Debt Consolidation Calculator can show you exactly how much you could save in interest by refinancing your credit cards. After you get your loan, an Amortization Calculator within your online dashboard can show you how making extra payments will shorten your loan term and reduce your total interest paid. Using these tools transforms you from a passive borrower into an active manager of your own debt.

Financial Expert View: Understanding the True Benefits of Instant Loans

From a financial expert’s perspective, the true benefit of an instant loan lies in its strategic application. While the speed is invaluable for emergencies, the real power comes from using it to improve your financial health. The most impactful use is replacing high-interest, toxic debt (like credit card balances) with a lower-cost, fixed-rate installment loan. This single move can save thousands in interest, provide a clear path out of debt, and improve your credit score over time. The “instant” nature of the loan simply accelerates this positive financial change, allowing you to stop overpaying on interest today, not next month. The speed is the catalyst; the financial restructuring is the lasting benefit.

Step-by-Step Guidance from Loan Advisors Through the Application Process

Even with a simple online application, having access to human guidance is crucial. Top lenders provide a dedicated team of loan advisors or specialists who can walk you through every step of the process. If you have a question about what income to declare, how to upload a document, or what a specific term in the loan agreement means, you can contact them via phone or chat. These advisors are trained to provide clear, helpful answers to ensure your application is accurate and complete. This personalized support demystifies the process and provides a safety net, ensuring you feel confident and supported from the moment you start your application to the moment your loan is funded.

Tips from Credit Specialists for Optimizing Your Loan Approval Chances

Credit specialists offer key tips to maximize your chances of getting approved for an instant loan. First, check your credit report for errors before you apply. A single mistake could be holding your score down. Second, know your numbers—provide your exact gross income and be honest about your monthly housing payment. Inaccurate information is a major red flag. Third, if you have high credit card balances, pay them down as much as possible before applying. Lowering your credit utilization ratio can provide a quick boost to your credit score. Finally, start with prequalification. This allows you to see your likelihood of approval from multiple lenders without the risk of a hard inquiry, so you can apply formally where your chances are best.

Support Programs for All Your Financial Goals in Tier One Markets

Leading financial institutions in the US, UK, Canada, and Australia are increasingly offering more than just loans; they provide holistic support programs. This can include free access to your credit score, personalized tips on how to improve it, and budgeting tools to help you manage your cash flow. If you take out a loan for debt consolidation, some lenders offer free access to financial counselors who can help you create a plan to stay out of debt for good. Should you face unexpected financial hardship during your loan term, like a job loss, many have forbearance or hardship programs that can offer temporary relief. These support systems show a commitment to your long-term financial success, not just the immediate loan transaction.

FAQ: Frequently Asked Questions

Can You Get a Personal Loan Immediately from a Trusted Lender?

Yes, you can. While “immediately” isn’t instantaneous, the process with top online lenders is incredibly fast. You can complete an online application in minutes and receive an approval decision almost instantly. If you apply early on a business day and are prepared with your digital documents, many trusted lenders in the US, UK, Canada, and Australia can disburse the funds on the same day or the next business day. The key is to choose a reputable fintech lender that has built its platform specifically for speed, security, and convenience, allowing for near-immediate access to funds in urgent situations.

How to Get a $5,000 Loan ASAP — Instant Funding Explained

To get a $5,000 loan as soon as possible, your best bet is an online personal loan lender. First, use a prequalification tool to check your rates with a few lenders—this is instant and won’t affect your credit. Once you choose the best offer, complete the formal application. To enable instant funding, apply early on a weekday morning. Have digital copies of your photo ID and a recent pay stub ready to upload. Opt for the lender’s electronic bank verification if available, as it’s faster than manual review. If approved before the lender’s cutoff time, they can initiate a transfer that could have the $5,000 in your account the same or the next business day.

How to Get $400 Today with Fast Online Approval?

Getting a small amount like $400 today is possible through a few avenues. Some personal loan lenders have minimums of $1,000 or more, but others offer smaller loans. An online lender specializing in small personal loans is a good option. Alternatively, cash advance apps (like Earnin in the US or similar services) allow you to borrow against your upcoming paycheck and can deposit funds instantly for a small fee. A credit card cash advance is another option, but be aware of very high fees and interest rates. For a $400 need, a cash advance app is often the fastest and most cost-effective choice if you are eligible.

Which App Gives $5,000 Loan Instantly in the US or Canada?

In the US and Canada, you won’t typically find a mobile “app” that grants a $5,000 loan instantly in the same way cash advance apps offer small amounts. For a loan of this size, you will use the mobile-friendly websites or dedicated apps of established online lenders. In the US, lenders like Upgrade, Upstart, and LightStream have very fast processes. In Canada, lenders like Fairstone or Mogo offer similar quick online loan services. The application is done through their app or website, you get an instant decision, and funding can follow as quickly as the same or next business day, making it the closest you can get to an “instant” $5,000 loan.

Upgrade Loans — Features, Eligibility, and Funding Speed

Upgrade is a popular online lending platform in the US known for its accessibility to a wide range of borrowers, including those with fair credit (scores of 620 and above). Key features include personal loans from $1,000 to $50,000 with fixed rates and terms from 24 to 84 months. One of their standout features is that they pay some third-party creditors directly, which is ideal for debt consolidation. Upgrade does charge an origination fee. Regarding funding speed, after approval and signing, funds are typically sent to your bank account via ACH transfer within one business day, making it a very fast option for those who need quick access to cash.

LightStream Loans — Compare Rates and Application Process

LightStream, a division of Truist Bank in the US, is a top-tier lender for borrowers with good to excellent credit (typically 680+). They are highly competitive because they charge no origination fees, no prepayment penalties, and no late fees. Their “Rate Beat Program” promises to beat a competitor’s rate by 0.10 percentage points under certain conditions. Loan amounts range from $5,000 to $100,000. The application process is entirely online and very fast. For some applicants, if the application is completed and approved on a business day, funds can be deposited into their bank account on the same day, making Light Stream one of the fastest lenders on the market for qualified borrowers.

Loans Personal — Find the Best Instant Options Online

To find the best instant personal loan online, start by using a loan comparison website or by directly visiting the sites of top-rated online lenders. The key is to use their prequalification tools. This allows you to enter your information once and see potential offers from multiple lenders without affecting your credit score. When comparing, look beyond the headline interest rate. Focus on the APR (which includes fees), check if there’s an origination fee, and confirm there’s no prepayment penalty. Read recent customer reviews to gauge their reputation for funding speed and customer service. The best option will be the lender that offers you the lowest APR with the most transparent and flexible terms.

Personal Loans — Quick Approval and Same-Day Disbursement

Quick approval for personal loans is now standard for most online lenders, who give an application decision in minutes. Same-day disbursement, however, is a premium feature offered by a smaller group of highly efficient lenders. To get same-day funding, you must apply on a weekday, typically before noon. You need a complete, accurate application and must have your verification documents ready for immediate upload. Lenders like LightStream in the US or some fintechs in the UK (using the Faster Payments network) are known for this speed. While many lenders promise funding in one business day, which is very fast, always check for specific “same-day” language if immediate funding is your absolute priority.

Get a Personal Loan — Online Application and Instant Decision

Getting a personal loan online with an instant decision is the modern standard. The process is simple: 1) Choose a reputable online lender. 2) Fill out their secure application form, which usually takes 5-10 minutes. You will provide your identity, income, and housing information. 3) Apply. The lender’s automated technology will analyze your information and credit profile in real-time. 4) Within seconds to minutes, you will receive an on-screen decision—approved, denied, or pending further review. This instant feedback eliminates the stressful waiting period associated with traditional lending, allowing you to know exactly where you stand immediately.

Best Online Loans with Instant Approval — 2025 Guide

As of 2025, the best online loans with instant approval are offered by lenders who combine speed, transparency, and competitive rates. In the US, top contenders for those with good credit include Light Stream and SoFi for their no-fee structures and low rates. For fair credit, Upgrade and Upstart are excellent, using advanced analytics to improve approval odds. In the UK, fintech lenders like Zopa and Monzo provide fast, integrated loan experiences. In Canada, Fairstone and Borrowell are strong digital players. The “best” loan depends on your credit profile, but all these lenders offer instant decisions and fast funding that define the modern borrowing experience.

Fast Personal Loans — Secure and Trusted Lenders Compared

When seeking a fast personal loan, trust and security are paramount. Trusted lenders are transparent about their rates and fees, have strong positive customer reviews, and use robust encryption to protect your data. Light Stream (US) is highly trusted due to its no-fee policy and backing by a major bank. Upgrade (US) is trusted for its accessibility and clear terms. In the UK, lenders regulated by the Financial Conduct Authority (FCA), like HSBC or Zopa, ensure consumer protection. In Canada, major banks like RBC and established online lenders like Fair stone are secure choices. Always verify a lender’s credentials and read reviews before applying to ensure you are working with a reputable company.

Personal Loans Online — How to Apply and What to Expect

Applying for a personal loan online is a straightforward process. First, choose a lender and use their prequalification tool to check your rates. If you decide to proceed, you’ll complete a full application, which requires more detailed financial information. Expect to provide or upload a government-issued photo ID and proof of income (like pay stubs). After submission, you’ll get a quick final decision. If approved, you will receive a loan agreement to review and sign digitally. Read this carefully, paying attention to the APR, monthly payment, and loan term. Once you sign, expect the funds to be deposited into your bank account within 1-3 business days, or even sooner for some lenders.

Quick Loans Same Day — Instant Funding for Urgent Needs

“Quick loans same day” refers to personal loans that are applied for, approved, and funded within a single business day. This service is primarily offered by online lenders. The key to success is speed and timing. You must complete your application and be approved before the lender’s daily cutoff time (usually late morning). A clean, error-free application that can be verified automatically is essential. Lenders in the UK often use the Faster Payments System to transfer funds in under two hours. In the US, some lenders like Light Stream can use wire transfers for same-day funding for eligible borrowers. While not all lenders can guarantee it, this option is available for those in truly urgent situations.

Instant Loans Online with Guaranteed Approval — What You Should Know

You should be extremely cautious of any lender advertising “guaranteed approval.” In regulated lending markets like the US, UK, Canada, and Australia, legitimate lenders are required by law to perform due diligence and assess a borrower’s ability to repay. Therefore, guaranteed approval does not exist for legitimate personal loans. Lenders that make this claim are often predatory and may be offering payday loans with extremely high fees and interest rates that can trap you in a cycle of debt. While many online lenders have high approval rates for certain credit profiles, they will always review your credit and income before making a final decision.

Same Day Personal Loans with Guaranteed Approval — Myths vs. Facts

The phrase “same day personal loans with guaranteed approval” is a major red flag and combines a myth with a fact. Fact: Same-day personal loans are real. Many online lenders can and do provide funds within one business day, and sometimes on the same day. Myth: Guaranteed approval is not real for regulated personal loans. All responsible lenders must check your credit and verify your income to assess risk. Lenders that promise “guaranteed approval” are often predatory and should be avoided. The reality is you can get a very fast loan decision and funding from a legitimate lender, but your approval is always based on your creditworthiness and ability to repay.