How do I get a personal loan? Follow our simple 5-step guide to apply online, get fast approval, and secure low rates in the US, UK, Canada & Australia.

Navigating the world of personal loans can feel overwhelming, especially when you need funds quickly and want to secure a low interest rate. Whether you’re facing an unexpected car repair in Sydney, planning a home renovation in London, consolidating credit card debt in Toronto, or covering a medical bill in New York, a personal loan can provide the financial relief you need. The core challenge is clear: you need access to capital without getting trapped by high rates or a complicated application process. Many potential borrowers worry about their credit score, wonder what documents they need, and feel lost comparing endless options from banks and online lenders.

This guide is your roadmap. We will walk you through the entire process, from understanding your eligibility to managing your repayments responsibly. We promise to demystify the jargon, show you how to strengthen your application, and reveal strategies for finding the best possible terms, even if you have bad credit. You will learn how to check your credit score without hurting it, what lenders in Tier One markets are really looking for, and how to compare offers like a pro. By the end, you’ll have the confidence and knowledge to secure a loan that fits your budget and helps you achieve your financial goals.

Eligibility Requirements for a Personal Loan in Tier One Countries

Before you start applying for personal loans, understanding what lenders look for is the most critical step. Meeting eligibility requirements not only increases your chance of approval but also helps you qualify for more favorable interest rates. While specific criteria can vary between lenders in the US, UK, Canada, and Australia, they all assess your risk as a borrower based on a few key pillars.

The primary factors lenders evaluate are your creditworthiness, your capacity to repay the loan, and the stability of your financial situation. They use these data points to predict the likelihood of you making timely payments throughout the life of the loan.

1. Credit Score and History: This is a numerical representation of your reliability as a borrower. Lenders in the US often use the FICO or Vantage Score model (typically 300–850), while the UK, Canada, and Australia use systems from Experian, Equifax, and Transunion with varying score ranges. A higher score signals lower risk and often unlocks better rates. Your history includes your record of paying bills on time, the amount of debt you carry, and the age of your credit accounts.

2. Income and Employment: Lenders need to see that you have a stable and sufficient source of income to cover the new monthly loan payment. They will ask for proof of income, such as pay stubs, tax returns, or bank statements. A consistent employment history demonstrates financial stability.

3. Debt-to-Income (DTI) Ratio: This is a crucial metric, especially in the US and Canada. It’s calculated by dividing your total monthly debt payments by your gross monthly income. Most lenders prefer a DTI ratio below 43%, with many favoring applicants under 36%. A lower DTI shows that you have enough room in your budget to handle an additional payment.

Mini Case Study: Maria’s Application Journey

Maria, a graphic designer in Manchester, UK, wanted a £10,000 loan for a new vehicle. She had a steady income but was worried about a few late payments from two years ago. Before applying, she checked her Experian credit score and found it was “Fair.” She also calculated her DTI ratio and saw it was a healthy 28%. Knowing her credit was average, she focused her application on highlighting her stable income and low DTI. She was approved, though at a slightly higher interest rate than advertised. This shows that while credit is key, a strong income and low existing debt can make a significant difference.

| Eligibility Factor | United States | United Kingdom | Canada | Australia |

| Primary Credit Bureaus | Experian, Equifax, Transunion | Experian, Equifax, Transunion | Equifax, Transunion | Experian, Equifax, Ilion |

| Typical ‘Good’ Score | 670+ (FICO) | Varies by bureau | 660+ | 622+ |

| Key Income Metric | Debt-to-Income (DTI) Ratio | Affordability Assessment | Debt-to-Income (DTI) Ratio | Serviceability Assessment |

| Proof of Identity | SSN, Driver’s License | Passport, Driving License | SIN, Driver’s License | Passport, Driver’s License |

Key Takeaway: Lenders are looking for a holistic view of your financial health. A weakness in one area, like a fair credit score, can sometimes be offset by strengths in others, such as a high, stable income.

Check Your Credit Score Before You Apply for a Personal Loan

Applying for a personal loan without knowing your credit score is like going on a road trip without a map—you might get there, but you’ll likely face unnecessary detours and setbacks. Your credit score is one of the most influential factors determining whether you get approved and, more importantly, what interest rate you’ll pay. A few points can be the difference between a low, manageable monthly payment and a high-cost loan that strains your budget.

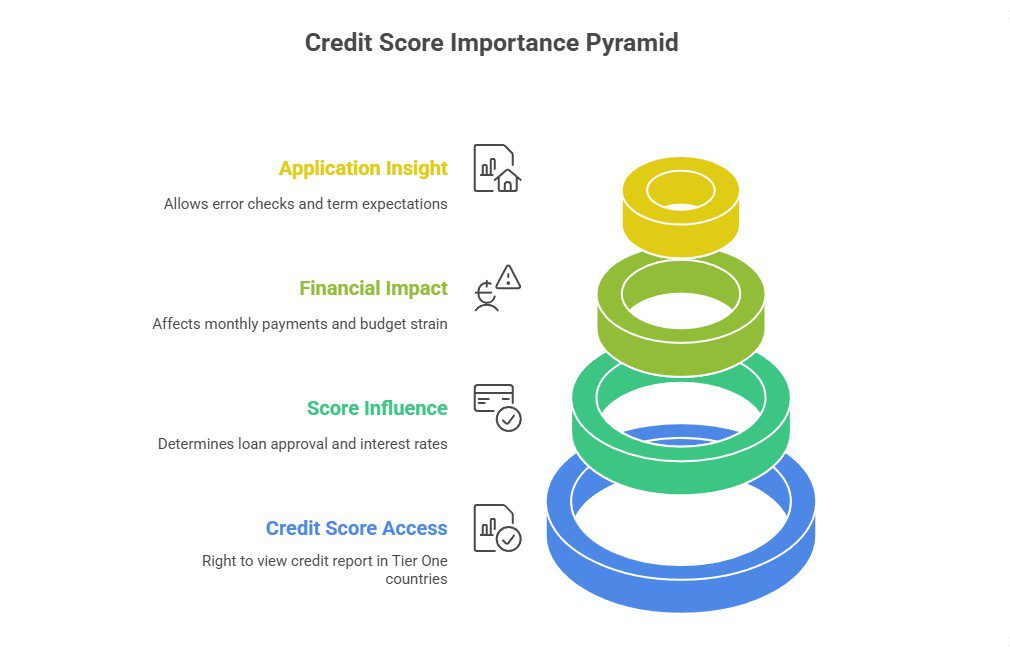

In all Tier One countries, you have the right to access your credit report and score. Lenders in the US rely heavily on FICO and Vantage Score scores, while the UK, Canada, and Australia have their own scoring models managed by major credit bureaus like Experian, Equifax, and Transunion. Before a lender ever sees your application, you should see what they will see. This allows you to check for errors that could be dragging your score down and gives you a realistic expectation of the loan terms you might receive.

Checking your own credit score is considered a “soft inquiry,” which does not affect your score at all. In contrast, when you formally apply for a loan, the lender performs a “hard inquiry,” which can temporarily dip your score by a few points. That’s why it’s wise to use prequalification tools offered by lenders, as they also use soft inquiries to show you potential offers without impacting your credit.

Mini Case Study: David Fixes an Error and Saves Thousands

David, a teacher in Alberta, Canada, was preparing to apply for a C20,000personalloantoconsolidatehigh−interestcreditcarddebt.Hethoughthehadgoodcredit,butwhenhecheckedhisTransUnionreport,hewasshockedtoseeascoreof640(“Fair”).Hediscoveredacollectionsaccountforautilitybillthathehadpaidoffyearsagobutwasstillbeingreportedasdelinquent.Heimmediatelydisputedtheerrorwiththecreditbureau.Within45days,theerrorwasremoved,andhisscorejumpedto725(“Good”).Thissimpleactofcheckinghisreportallowedhimtoqualifyforaloanwithaninterestrateof8.94,000 in interest over the life of the loan.

| Credit Score Range | US (FICO) | UK (Experian) | Canada (Equifax) | Australia (Equifax) |

| Excellent | 800–850 | 961–999 | 760–900 | 833–1200 |

| Good | 670–799 | 881–960 | 660–759 | 622–832 |

| Fair | 580–669 | 721–880 | 580–659 | 510–621 |

| Poor | 300–579 | 0–720 | 300–579 | 0–509 |

| Note: Score ranges are approximate and can vary by bureau and scoring model. |

Key Tip: Set a reminder to check your credit report with each major bureau annually. It’s often free and is your first line of defense against errors and identity theft.

Determine How Much You Need to Borrow and What You Can Afford

Once you know your credit standing, the next logical step is to pinpoint the exact loan amount you need and, crucially, what you can realistically afford to pay back each month. Borrowing too little can leave you short of your goal, while borrowing too much can lead to financial stress and potential default. This step is about finding the sweet spot between what you need and what your budget can handle.

Start by calculating the total cost of your project or the exact amount of debt you want to consolidate. Get quotes for home repairs, calculate the final bill for a medical procedure, or add up your credit card balances. Be precise. If you need $15,000, don’t round up to $20,000 “just in case.” The extra $5,000 will still accrue interest and increase your monthly payment.

Next, conduct a thorough review of your monthly budget. Tally your total income and subtract all your essential expenses: rent/mortgage, utilities, groceries, transportation, insurance, and existing debt payments. The amount left over is your discretionary income. A portion of this can be allocated to a new loan payment, but you should also leave a buffer for savings and unexpected costs. A good rule of thumb is to ensure your new loan payment doesn’t push your debt-to-income (DTI) ratio into a risky zone (ideally, keeping it below 36%).

Mini Case Study: The Lees’ Renovation Loan

The Lee family in Sydney, Australia, wanted to renovate their kitchen and estimated they needed A25,000.Beforeapplying,Mrs.Leeusedanonlinepersonalloancalculator.Sheinputtheloanamount(A25,000) and an estimated interest rate of 9% based on their “Excellent” credit scores.

- A 3-year term resulted in a monthly payment of roughly A$795.

- A 5-year term resulted in a monthly payment of roughly A795 payment was too tight. The A25,000 loan with a 5-year term, ensuring the loan was a tool for improvement, not a source of stress.

| Loan Amount | Interest Rate (APR) | 3-Year Monthly Payment | 5-Year Monthly Payment | Total Interest (5-Year) |

| $10,000 | 10% | $323 | $212 | $2,748 |

| $20,000 | 10% | $645 | $425 | $5,496 |

| $30,000 | 10% | $968 | $637 | $8,244 |

| Payments are illustrative examples. |

Key Result: By calculating your affordable monthly payment first, you can work backward to determine the right loan amount and term for your situation, preventing you from over-borrowing.

Compare Loan Offers, Rates, and Terms from Trusted Lenders

With your credit score in hand and your ideal loan amount determined, it’s time to shop around. Not all lenders are created equal, and the first offer you receive is rarely the best. Comparing loan offers from a variety of sources is the single most effective way to save money. Even a small difference in the Annual Percentage Rate (APR) can translate into hundreds or thousands of dollars in savings over the term of the loan.

Your main options will include:

- Traditional Banks: Institutions like Wells Fargo (US), Lloyds Bank (UK), RBC (Canada), or Commonwealth Bank (Australia). They often offer competitive rates to existing customers with good to excellent credit.

- Credit Unions: Member-owned non-profits that frequently offer lower interest rates and more flexible terms than traditional banks, especially for members with fair credit.

- Online Lenders (Fitch): Companies like Sofia, Lending Club, or Upstart have streamlined online applications, fast funding times, and often cater to a wider range of credit profiles.

When comparing offers, look beyond the headline interest rate. The Annual Percentage Rate (APR) is the most important number, as it includes the interest rate plus any mandatory fees, like an origination fee. This gives you a more accurate picture of the total cost of borrowing. Also, consider the loan term (the length of time you have to repay) and whether there are any prepayment penalties if you decide to pay the loan off early.

Mini Case Study: Chloe Shops for a Consolidation Loan

Chloe, an office manager in the US, had $18,000 in credit card debt and wanted to consolidate it with a personal loan. Her credit score was 710 (“Good”).

- Offer 1 (Her Bank): Offered a 12.99% APR with a 5-year term. The origination fee was $0.

- Offer 2 (An Online Lender): Prequalified her for a 10.99% APR with a 5-year term, but it included a 3% origination fee ($540), which would be deducted from the loan amount.

- Offer 3 (A Credit Union): Offered an 11.49% APR with a 5-year term and no origination fee.

At first, the online lender’s 10.99% APR seemed best. However, after calculating the total cost, the credit union’s offer was superior. It had a slightly higher APR but no upfront fee, making it the most affordable option over the five years. Chloe’s diligence in comparing the full offer saved her money.

| Lender Type | Pros | Cons | Best For… |

| Traditional Bank | Relationship benefits, in-person service, competitive rates for good credit. | Slower approval process, stricter eligibility. | Existing customers with strong credit. |

| Credit Union | Lower APRs and fees, more personalized service, flexible criteria. | Membership requirements, fewer branches/ATMs. | Borrowers with fair-to-good credit. |

| Online Lender | Fast application and funding, innovative underwriting, accessible to a wider credit range. | Can have higher fees (origination), no in-person support. | Borrowers needing fast cash or who have non-traditional income. |

Key Takeaway: Always compare at least three loan offers. Prequalifying with multiple lenders uses soft credit inquiries, so it won’t hurt your score and provides a clear view of your best options.

Benefits of Using a Personal Loan for Major Purchases or Debt Consolidation

A personal loan is a versatile financial tool that can provide a structured, predictable way to manage your finances. Unlike revolving credit (like a credit card), an unsecured personal loan gives you a lump sum of cash upfront with a fixed interest rate and a fixed monthly payment. This predictability makes it easier to budget and plan. The two most common and effective uses for personal loans are financing major one-time purchases and consolidating high-interest debt.

1. Debt Consolidation:

This is perhaps the most powerful use of a personal loan. If you are juggling multiple credit card balances, each with a high, variable interest rate, you can feel like you’re running on a treadmill. You make payments, but the balances barely budge due to accruing interest. A debt consolidation loan allows you to pay off all those cards at once. You are then left with a single monthly payment to the new lender, ideally at a much lower, fixed interest rate.

- Result: This strategy can simplify your finances, lower your total monthly outlay, and help you pay off your debt faster because more of your payment goes toward the principal balance rather than interest.

Mini Case Study: The Thompson’s Financial Turnaround

The Thompsons in the UK had accumulated £15,000 in debt across three credit cards with an average APR of 21.9%. Their minimum monthly payments totaled £450, but their balances were decreasing very slowly. They were approved for a personal loan at 9.9% APR over five years. They used the loan to pay off all three cards immediately. Their new single monthly payment was £318. They saved £132 per month, simplified their bills, and had a clear date for when they would be debt-free.

2. Financing a Major Purchase:

For significant, one-time expenses like a wedding, essential home improvements, or unexpected medical bills, a personal loan offers a distinct advantage over credit cards. It prevents you from draining your emergency savings and provides a disciplined repayment plan. Using a loan with a fixed rate is often far cheaper than putting a large purchase on a credit card and carrying the balance for months or years.

| Feature | Personal Loan | Credit Card |

| Interest Rate | Typically lower, and fixed. | Often higher, and variable. |

| Repayment Structure | Fixed monthly payments over a set term. | Minimum payments, revolving balance. |

| Credit Impact | An installment loan can diversify your credit mix. | High utilization can hurt your credit score. |

| Best For | Large, planned expenses and debt consolidation. | Small, everyday purchases and earning rewards. |

Key Takeaway: A personal loan transforms unpredictable, high-interest debt into a single, manageable payment, giving you a clear path out of debt and saving you significant money on interest.

Want to see how much you could save? Explore debt consolidation options and calculate your savings →

Fast Funding and Flexible Options for Personal Loan Borrowers

In today’s fast-paced world, when you need money, you often need it quickly. Whether it’s an emergency car repair or a time-sensitive opportunity, waiting weeks for a loan approval from a traditional bank isn’t always feasible. This is where the evolution of the lending industry, particularly the rise of online lenders and fintech companies, has been a game-changer for borrowers in the US, UK, Canada, and Australia.

The speed of funding is a major differentiator. Many online lenders have automated their underwriting processes, allowing them to give you a pre-approval decision in minutes and, in some cases, deposit the funds into your bank account within one business day of final approval. This is a stark contrast to the week-long (or longer) process that can be common with some brick-and-mortar banks.

Flexibility is another key benefit. Lenders now offer a wider range of options to suit different financial situations:

- Loan Amounts: You can often borrow as little as $1,000 or as much as $100,000, depending on the lender and your qualifications.

- Repayment Terms: Terms typically range from two to seven years (24 to 84 months). A shorter term means a higher monthly payment but less total interest paid. A longer term provides a more manageable monthly payment but costs more in interest over time.

- Rate Types: While most personal loans are fixed-rate, some lenders offer variable-rate options, which may start lower but can change over the life of the loan.

Mini Case Study: A Quick Fix for a Leaky Roof

Sarah, a homeowner in Toronto, discovered a major leak in her roof after a storm. The repair quote was C8,000,anditneededtobedoneimmediatelytopreventfurtherdamage.Shedidn′thavethatmuchinheremergencyfund.OnaTuesdaymorning,sheappliedwiththreeonlinelenders.ByTuesdayafternoon,shehadcomparedpre−approvedoffersandacceptedonewitha3−yeartermthatfitherbudget.Afteruploadingherpaystubanddriver′slicenseforverification,shesignedthedigitalloanagreement.TheC8,000 was in her bank account on Wednesday morning, allowing her to pay the roofer and secure her home without delay.

| Lender Type | Typical Funding Speed | Typical Term Lengths | Interest Rate Type |

| Online Lenders | 1-3 business days | 2-7 years | Fixed |

| Traditional Banks | 3-7 business days | 2-5 years | Fixed or Variable |

| Credit Unions | 2-5 business days | 1-6 years | Fixed |

Key Tip: If speed is your top priority, focus on online lenders. Have your digital documents (like PDF pay stubs and bank statements) ready to upload to expedite the verification process.

Steps to Apply for a Personal Loan Online and Get Approved Quickly

Applying for a personal loan online has become a refreshingly straightforward process. Most lenders have designed their platforms to be user-friendly and efficient. Following these steps can help you move from application to approval in record time.

- Check Your Prequalification Status: This is the most important first step. Instead of filling out a full application that triggers a hard credit check, use lenders’ prequalification tools. You’ll enter basic information like your name, income, and desired loan amount. The lender performs a soft credit pull (which doesn’t affect your score) and tells you if you’re likely to be approved and what rates you might get. Prequalify with at least 3-5 lenders (banks, credit unions, online platforms) to shop for the best offer.

- Choose the Best Offer and Gather Your Documents: Once you’ve compared your prequalified offers, select the one with the best combination of APR, loan term, and fees. Now, get your paperwork in order. Lenders will need to verify your identity, address, and income. Common documents include a government-issued photo ID (driver’s license, passport), a recent utility bill or bank statement, and recent pay stubs or tax returns.

- Complete the Formal Application: Navigate to the lender’s official website and fill out the full application. This is where you’ll provide more detailed information and consent to a hard credit check. Since you’ve already been prequalified, your chances of final approval are very high, assuming the information you provide matches your initial submission.

- Undergo Verification and Sign the Agreement: The lender will review your submitted documents to verify your information. They may call your employer to confirm your job status. Once everything is verified, you will receive a final loan agreement. Read it carefully to ensure the APR, monthly payment, and total loan amount are what you expected. If everything looks good, you can sign it digitally.

- Receive Your Funds: After you sign the agreement, the lender will initiate the transfer of funds. Most online lenders use an electronic transfer (like ACH in the US) to deposit the money directly into your bank account. This process is typically completed within 1-3 business days, with some lenders offering next-day or even same-day funding.

Expert Insight: “The biggest mistake applicants make is submitting an application with outdated income or address information. Always double-check that your application details match your verification documents perfectly. A small mismatch can cause delays or even a rejection.” — Loan Underwriting Specialist

Understanding Different Types of Personal Loans and Which Is Best for You

Personal loans are not a one-size-fits-all product. The type of loan you choose can significantly impact your interest rate, your repayment obligations, and the overall cost. The most common distinction is between unsecured and secured loans, followed by the choice between fixed and variable interest rates.

Unsecured vs. Secured Personal Loans

- Unsecured Personal Loans: This is the most common type. The loan is granted based solely on your creditworthiness (your credit score, income, and financial history). You do not have to provide any collateral. Because the lender assumes more risk, unsecured loans typically have slightly higher interest rates than secured loans. They are ideal for borrowers with good-to-excellent credit who don’t want to risk an asset.

- Secured Personal Loans: This type of loan requires you to pledge an asset, such as a car, savings account, or another valuable item, as collateral. If you fail to repay the loan, the lender can seize the collateral to recoup their losses. Because this reduces the lender’s risk, secured loans often come with lower interest rates and may be accessible to borrowers with fair or bad credit who might not qualify for an unsecured loan.

| Feature | Unsecured Loan | Secured Loan |

| Collateral Required? | No | Yes (e.g., car, savings) |

| Interest Rate | Typically Higher | Typically Lower |

| Risk to Borrower | Default hurts credit score | Default hurts credit & lose asset |

| Best For | Good credit, debt consolidation | Fair/bad credit, building credit |

Fixed-Rate vs. Variable-Rate Loans

- Fixed-Rate Loans: The vast majority of personal loans have a fixed interest rate. This means your interest rate—and therefore your monthly payment—will remain the same for the entire life of the loan. This predictability makes budgeting easy and protects you from sudden rate increases.

- Variable-Rate Loans: A variable-rate loan has an interest rate that can change over time, as it is tied to a benchmark index rate. It might start lower than a fixed-rate loan, but it could increase if the benchmark rate rises, causing your monthly payment to go up. These are less common for personal loans and are generally riskier for the borrower.

Which is best for you? For most people, a fixed-rate, unsecured personal loan offers the best combination of security, predictability, and convenience. However, if you have a low credit score or want to secure the lowest possible interest rate and have an asset to leverage, a secured loan could be a better choice.

Credit Check Tips to Protect and Improve Your Credit Score Before Applying

Your credit score is the key that unlocks loan approvals and low interest rates. Taking a few proactive steps to protect and improve it before you apply can save you a significant amount of money and frustration. Think of it as preparing for a big exam—a little effort beforehand goes a long way.

1. Know Your Score and Report Inside-Out:

Before you do anything else, get a free copy of your credit report from the major bureaus in your country (e.g., Experian, Equifax, Transunion). Scrutinize it for any errors, such as incorrect late payments, accounts that aren’t yours, or wrong credit limits. Disputing and correcting errors is one of the fastest ways to potentially boost your score.

2. Lower Your Credit Utilization Ratio:

This ratio is the amount of revolving credit you’re using divided by your total credit limits. Lenders see high utilization (typically above 30%) as a sign of financial stress. If your credit cards are maxed out, make it a priority to pay them down as much as possible before applying for a loan. Even paying down a balance by a few hundred dollars can make a noticeable difference in your score.

3. Make On-Time Payments, Every Time:

Your payment history is the single most important factor in your credit score, making up about 35% of a typical FICO score. If you have any accounts that are past due, bring them current immediately. If you’ve been consistently on time, keep it up. One late payment can stay on your report for years.

4. Limit New Credit Applications:

When you formally apply for a loan, it results in a hard inquiry on your credit report. Too many hard inquiries in a short period can signal desperation to lenders and slightly lower your score. This is why using soft-inquiry prequalification tools is so crucial. Only submit a formal application once you’ve chosen the lender and offer you want.

Expert Insight: “A common misconception is that closing old credit card accounts helps your score. In reality, it can hurt it. Closing an old account reduces your total available credit (increasing your utilization ratio) and shortens the average age of your accounts. It’s better to keep old, unused accounts open, perhaps using them for a small purchase once a year to keep them active.” — Certified Credit Counselor

| Action to Take | Potential Impact on Score | Timeframe |

| Dispute Report Errors | High | 1-2 months |

| Pay Down Credit Cards | High | 1-2 months |

| Become Current on Bills | Medium | Immediate |

| Limit Hard Inquiries | Low (but important) | Immediate |

Loan Purposes and Smart Ways to Use Borrowed Funds Effectively

A personal loan can be a powerful financial ally, but only when used responsibly. The purpose of your loan matters—not just to the lender, but to your long-term financial health. Using a loan to invest in your future or solve a high-interest debt problem is a smart move. Using it to fund a lifestyle you can’t afford is a recipe for trouble.

Smart Loan Purposes:

- Debt Consolidation: As discussed, this is a top-tier use case. Swapping high-interest, variable-rate credit card debt for a lower, fixed-rate installment loan can save you money and simplify your life.

- Home Improvements: Funding a kitchen remodel, a new roof, or finishing a basement can add significant value to your home. This is an investment that can provide a tangible return.

- Major Car Repairs: If your car needs a new engine or transmission to remain reliable for getting to work, a loan is a sensible way to cover a large, unexpected, but essential expense.

- Medical or Dental Bills: For necessary procedures not fully covered by insurance, a personal loan provides a structured way to pay off the cost over time, often at a lower rate than medical financing plans.

Loan Purposes to Approach with Caution:

- Vacations or Luxury Goods: While tempting, borrowing money for non-essential, depreciating experiences or items is generally unwise. It’s better to save for these goals.

- Risky Investments: Using a loan to invest in the stock market or crypto currency is extremely risky. If the investment fails, you’re still on the hook for the loan payments.

- Covering Everyday Expenses: If you need a loan to pay for groceries, rent, or utilities, it may be a sign of a deeper budgeting issue. A loan can provide temporary relief but isn’t a long-term solution.

Effective Fund Management:

Once your loan is approved and the funds are in your account, be disciplined.

- For Debt Consolidation: Immediately use the funds to pay off the credit cards or other debts as planned. Don’t leave the money sitting in your account where it might be spent on something else.

- For a Major Purchase: Create a clear budget for your project. Pay the contractor or vendor directly from the loan funds and track expenses to ensure you don’t overspend.

- Avoid New Debt: After consolidating credit card debt, resist the temptation to run up the balances again. You could end up in a worse position with both the loan and new card debt.

Budgeting and Monthly Payment Considerations for Responsible Borrowing

Securing a personal loan is only half the journey; managing it responsibly is the other half. The key to successful repayment is ensuring the monthly payment fits comfortably within your budget from day one. A loan should reduce financial stress, not add to it.

Before you even sign the loan agreement, you must have a clear understanding of how the new payment will impact your monthly cash flow.

1. The 50/30/20 Budgeting Rule: A simple yet effective framework is the 50/30/20 rule.

- 50% for Needs: No more than half of your after-tax income should go to essential needs, including housing, utilities, transportation, and now, your loan payment.

- 30% for Wants: This category includes dining out, entertainment, hobbies, and travel.

- 20% for Savings and Debt Repayment: This portion goes toward building an emergency fund, saving for retirement, and making extra payments on debt (including your new loan, if possible).

Your new loan payment should fit within the “Needs” or “Debt Repayment” categories without pushing them beyond their recommended percentages.

2. Set Up Automatic Payments: The single best thing you can do to ensure you never miss a payment is to set up automatic transfers from your checking account to the lender. This “set it and forget it” approach protects your credit score from accidental late payments and helps you avoid late fees. Most lenders in the US, UK, Canada, and Australia offer this feature.

3. Plan for the Unexpected: What happens if you lose your job or face an unexpected medical bill? This is where an emergency fund is critical. Aim to have at least 3-6 months of essential living expenses saved in a high-yield savings account. This fund acts as a buffer, so you can continue making your loan payments even if your income is temporarily disrupted.

Sample Monthly Budget Breakdown:

| Budget Category | Monthly Income: $4,000 | After New Loan Payment |

| :— | :— | :— |

| Needs (50% = $2,000) | Rent: $1,200 | Rent: $1,200 |

| | Utilities: $200 | Utilities: $200 |

| | Groceries: $400 | Groceries: $400 |

| | New Loan Payment: $0 | New Loan Payment: $300 |

| | Total Needs: | $1,800 | $2,100 (52.5%) |

| Wants (30% = $1,200) | Spending: $1,200 | Spending: $1,000 |

| Savings (20% = $800) | Savings: $800 | Savings: $800 |

In this example, the new loan payment pushed the “Needs” category slightly over budget. The borrower responsibly adjusted their “Wants” category to accommodate the payment, ensuring their financial plan remains balanced.

Comparing Lenders and Financial Institutions to Find the Best Fit for Your Needs

Finding the right lender is just as important as finding the right loan. The lender you choose will be your financial partner for the next several years, so it’s worth looking beyond the numbers (like APR) and considering factors like customer service, reputation, and flexibility. The best fit depends entirely on your personal priorities.

Key Comparison Points:

- Lender Type: As we’ve covered, banks, credit unions, and online lenders each have unique strengths.

- Banks: Best for established customers with strong credit who value face-to-face interaction.

- Credit Unions: Excellent for those seeking lower rates and a community-focused experience, especially if their credit is less than perfect.

- Online Lenders: Ideal for tech-savvy borrowers who prioritize speed, convenience, and a wider range of eligibility criteria.

- Rates, Fees, and Terms: This is the core financial comparison. Create a simple spreadsheet to track the APR, origination fees, prepayment penalties, and available term lengths for each lender you’re considering. Remember, the lowest APR is king.

- Customer Service and Reputation: How does the lender treat its customers? Look for reviews on independent sites like Trust pilot or the Better Business Bureau (in North America). Do borrowers praise their helpful support team, or do they complain about hidden fees and a frustrating verification process? A lender with a responsive and helpful customer service team can be invaluable if you ever run into issues.

- Borrower Perks and Features: Some lenders offer additional benefits that can make a difference.

- Payment Flexibility: Can you change your payment due date? Do they offer a hardship program if you lose your job?

- Rate Discounts: Many lenders offer a small rate reduction (e.g., 0.25%) if you set up automatic payments.

- Credit Score Monitoring: Some provide free access to your credit score throughout the life of the loan.

Expert Insight: “When you prequalify, you’re not just seeing if you’re eligible; you’re also auditioning the lender. Pay attention to their website’s user-friendliness, the clarity of their communication, and how easy it is to find information. A transparent and simple online experience often reflects a customer-centric company culture.” — Fintech Product Manager

Ultimately, the “best” lender is the one that offers you the most affordable loan while making you feel confident and supported throughout the repayment process.

What Documents Are Needed for Loan Approval and Faster Processing

Having your documents ready before you apply is the secret to a fast, smooth approval process. Lenders require this information to verify your identity, confirm your income, and ensure you can afford the loan. While requirements vary slightly, here is a standard checklist that applies across the US, UK, Canada, and Australia.

Checklist of Common Documents:

1. Proof of Identity:

- What it is: A government-issued document to prove you are who you say you are.

- Examples:

- Driver’s License or Provisional License

- Passport

- State-issued ID Card (US)

- Permanent Resident Card

2. Proof of Address:

- What it is: A document that confirms your current residential address. It must be recent, typically within the last 3 months.

- Examples:

- Utility Bill (electricity, gas, water)

- Bank Statement

- Council Tax Bill (UK) or Property Tax Bill

- Tenancy Agreement or Mortgage Statement

3. Proof of Income:

- What it is: Evidence of your regular earnings to prove you can make the monthly payments.

- For Salaried Employees:

- Recent Pay Stubs (pays lips) covering the last 1-2 months.

- Most recent annual tax return (e.g., W-2 in the US, T4 in Canada, P60 in the UK).

- For Self-Employed Individuals:

- Last 1-2 years of full tax returns.

- Recent bank statements (3-6 months) showing business income.

- Invoices or proof of contracts.

4. Bank Account Information:

- What it is: Your bank’s name, account number, and routing/sort code. This is needed both for verification and for depositing the loan funds.

Key Tip: Scan or take clear photos of these documents and save them in a secure folder on your computer or phone. When you apply online, you can upload them instantly, shaving days off the processing time.

Explore more details here → See a full list of acceptable documents for top lenders in your country.

Application Process Overview: From Prequalification to Final Funding

Understanding the loan application journey from a high-level perspective can remove anxiety and help you navigate it with confidence. The entire process can be broken down into four main stages, designed to move you from a potential borrower to a funded client efficiently.

Stage 1: Research & Prequalification (1-2 Days)

This is your homework phase. You are in control.

- Action: Check your credit score. Use online calculators to determine your budget. Prequalify with 3-5 different lenders (banks, credit unions, online platforms) using their soft-inquiry tools.

- Goal: Compare potential APRs, terms, and fees without impacting your credit score. You are shopping for the best possible offer.

Stage 2: Formal Application & Document Submission (1 Day)

You’ve chosen your best offer and are now ready to move forward.

- Action: Complete the lender’s official, more detailed application form. Upload your required verification documents (ID, proof of income, etc.).

- Goal: Provide the lender with all the information they need to make a final decision. This step will trigger a hard credit inquiry.

Stage 3: Verification & Underwriting (1-3 Days)

The lender now takes the lead to verify your information.

- Lender’s Action: An underwriter reviews your application, documents, and credit report. They may contact you or your employer if they need to clarify any details.

- Goal: The lender confirms that you meet all their lending criteria and that all information is accurate.

Stage 4: Final Approval & Funding (1-2 Days)

This is the final step where the loan becomes official.

- Action: You receive the final loan agreement. Review the terms carefully, then digitally sign it.

- Lender’s Action: Once the signed agreement is received, the lender initiates the transfer of funds to your bank account.

- Goal: Receive the cash and begin your project or debt consolidation.

This modern, streamlined process means you can often go from starting your research to having cash in hand in less than a week.

Prequalification Steps for a Personal Loan and Why They Matter

Prequalification is arguably the most valuable tool for a modern loan shopper. It takes the guesswork out of applying and empowers you to find the best deal without any risk to your credit score. Think of it as a free preview of the loan offers you’re likely to receive.

Why Prequalification is Essential:

- No Credit Score Impact: Prequalification uses a soft credit inquiry, which is invisible to other lenders and has zero effect on your credit score. You can check your status with as many lenders as you want.

- Realistic Expectations: It provides you with a real, personalized estimate of the interest rate (APR) and loan amount you could qualify for. This prevents you from wasting time applying for loans you’re unlikely to get.

- Saves Time and Effort: Instead of filling out lengthy applications for each lender, the prequalification process is quick, often taking just a few minutes online.

The Simple Steps to Prequalify:

- Gather Basic Information: You will need your:

- Full Name and Address

- Date of Birth

- Gross Annual Income

- Monthly Housing Payment (Rent/Mortgage)

- Desired Loan Amount and Purpose

- Visit Lender Websites: Go to the personal loan section of a bank, credit union, or online lender’s website. Look for a button that says “Check My Rate,” “Prequalify,” or “See My Offer.”

- Enter Your Information: Fill out the short online form. The entire process typically takes less than five minutes.

- Receive Your Offers: Within seconds or minutes, the lender’s system will analyze your information and present you with potential loan offers, including the estimated APR, term, and monthly payment.

Key Takeaway: Always start with prequalification. It transforms you from a hopeful applicant into an informed shopper, allowing you to compare concrete offers side-by-side and choose the most affordable option with confidence.

Get started now → Prequalify with a network of trusted lenders in minutes.

Interest Rates and Loan Terms Explained for Tier One Borrowers

Understanding the core components of a loan offer—the interest rate and the term—is fundamental to making a smart borrowing decision. These two factors work together to determine both your monthly payment and the total cost of your loan.

Interest Rate and APR:

- Interest Rate: This is the percentage the lender charges you for borrowing their money. It’s a key component of the cost, but it’s not the whole story.

- Annual Percentage Rate (APR): This is the most important number to compare. The APR includes the interest rate plus any mandatory lender fees, such as an origination fee. It represents the true annual cost of the loan. In the US, UK, Canada, and Australia, lenders are required by law to disclose the APR, making it the standard for comparing offers.

Loan Term:

- Definition: The loan term is the length of time you have to repay the loan, typically expressed in months or years (e.g., 36 months or 3 years).

- The Trade-Off:

- Short Term (e.g., 2-3 years): This results in a higher monthly payment but a lower total interest cost over the life of the loan. You become debt-free faster.

- Long Term (e.g., 5-7 years): This results in a lower, more affordable monthly payment, but you will pay more in total interest because you’re borrowing the money for a longer period.

Example: A $15,000 Loan at 10% APR

- 3-Year Term:

- Monthly Payment: ~$484

- Total Interest Paid: ~$2,424

- 5-Year Term:

- Monthly Payment: ~$318

- Total Interest Paid: ~$4,111

Result: Choosing the shorter term saves you nearly $1,700 in interest, but you must be able to afford the higher monthly payment. The best choice depends on balancing your monthly budget with your goal of minimizing total cost.

Repayment Options and Flexibility Based on Your Financial Goals

A good lender understands that financial situations can change. Modern personal loans often come with a variety of repayment options and flexible features that can help you manage your loan effectively and align it with your financial goals.

Standard Repayment Options:

- Auto pay: The most common and recommended option. You authorize the lender to automatically deduct the payment from your bank account on the due date. This helps you avoid late fees and build a positive payment history. Many lenders even offer a 0.25%–0.50% APR discount for enrolling in auto pay.

- Online/Mobile App Payments: Make manual payments each month through the lender’s website or mobile app. This gives you more control but requires you to remember the due date.

- Pay-by-Phone or Mail: Traditional options that are still available but less common. These can sometimes incur processing fees.

Flexibility for Your Goals:

- Making Extra Payments: Most personal loans in Tier One markets do not have prepayment penalties. This means you can pay more than your minimum monthly payment—or pay the entire loan off early—without being charged a fee. This is a great way to save money on interest and become debt-free sooner. You can often specify whether an extra payment should go toward the principal balance.

- Bi-Weekly Payments: Some borrowers choose to pay half of their monthly payment every two weeks. Over a year, this results in 26 half-payments, or 13 full monthly payments instead of 12. This simple strategy can shave months or even years off your loan term and reduce your total interest cost.

- Hardship Plans: If you face a job loss or another financial emergency, contact your lender immediately. Many reputable lenders have hardship programs that might allow you to temporarily defer payments or make interest-only payments until you get back on your feet.

Key Tip: Before signing your loan agreement, always confirm that there is no prepayment penalty. This flexibility is crucial for responsible debt management.

Support and Customer Service Options from Major Banks and Online Lenders

When you have a question about your loan or run into an issue, the quality of your lender’s customer support can make a world of difference. The type and level of support available often differ between traditional banks and online lenders.

Traditional Banks (e.g., U.S. Bank, RBC, Lloyds):

- In-Person Support: The biggest advantage of a traditional bank is the ability to walk into a physical branch and speak with a loan officer or banker face-to-face. This can be comforting for complex issues or for those who are less tech-savvy.

- Phone Support: They offer robust phone support with established call centers, often with dedicated departments for personal loans.

- Online Portals: Major banks have sophisticated websites and mobile apps where you can manage your loan, make payments, and view statements.

Online Lenders (e.g., Sofia, Lending Club, Fair stone Canada):

- Digital-First Support: These lenders excel at digital communication. Support is primarily offered through secure messaging within their app or website, live chat, and email. Response times are often very fast.

- Comprehensive FAQs and Help Centers: Their websites feature extensive, searchable knowledge bases that can answer most common questions without needing to speak to a person.

- Phone Support: While they may not have branches, most reputable online lenders provide phone support for issues that require a conversation.

Credit Unions:

- Personalized Service: Credit unions are known for their member-centric approach. You are more likely to get personalized, friendly service over the phone or in a branch, where staff may have more flexibility to help you.

What to Look For:

- Availability: Does the lender offer support during hours that are convenient for you? Some offer 24/7 digital support.

- Multiple Channels: The best lenders offer multiple ways to get in touch (phone, chat, email, in-person) so you can choose what works for you.

- Positive Reviews: Check independent review sites to see what other borrowers say about their customer service experiences.

Case Study: Improving Your Credit Score Before Applying for a Personal Loan

Meet James, a marketing coordinator in the US with a goal to get a $10,000 personal loan for debt consolidation. His initial check showed a FICO score of 630 (“Fair”). The prequalified offers he received were for APRs around 22-25%, which was too high. Instead of accepting a bad deal, he decided to wait six months and work on his credit.

James’s 6-Month Action Plan:

- Lowered Credit Utilization: He had a credit card with a $3,000 balance on a $4,000 limit (75% utilization). He created a strict budget and paid it down to $1,000 (25% utilization).

- Corrected an Error: He found an old, paid-off medical bill still listed as a collection on his report. He disputed it with Experian, and it was removed.

- Maintained On-Time Payments: He set up auto pay for all his bills to ensure no accidental late payments.

The Result: After six months, his FICO score had climbed to 710 (“Good”). He reapplied for the same $10,000 loan.

| Metric | Before (630 Score) | After (710 Score) |

| Offered APR | 24% | 11% |

| Monthly Payment (5yr) | $288 | $217 |

| Total Interest Paid | $7,258 | $3,048 |

Takeaway: By being patient and taking strategic steps to improve his credit, James saved over $4,200 in interest and secured a much more affordable monthly payment. This demonstrates that a few months of financial discipline can yield a massive return.

Insight: Loan Fees, Charges, and How to Avoid Hidden Costs

The APR is designed to capture the total cost of a loan, but it’s still wise to understand the specific fees that might be involved. Being aware of these potential charges helps you avoid surprises and make a truly informed decision.

1. Origination Fee:

- What it is: A one-time fee some lenders charge for processing your loan application. It’s the most common fee associated with personal loans, especially from online lenders.

- How it works: It’s usually a percentage of the loan amount (e.g., 1% to 8%) and is often deducted from the loan proceeds. For example, if you borrow $10,000 with a 5% origination fee, you will receive $9,500 in your bank account but will be responsible for repaying the full $10,000.

- How to avoid it: Many banks, credit unions, and some online lenders offer loans with no origination fees. When comparing loans, factor this fee into the total cost. A no-fee loan with a slightly higher APR can sometimes be cheaper than a low-APR loan with a high fee.

2. Prepayment Penalty:

- What it is: A fee charged if you pay off your loan ahead of schedule. Lenders make money from interest, and this fee is meant to compensate them for the interest they lose when you pay early.

- How to avoid it: This is now rare for personal loans in Tier One markets but always double-check. Only choose lenders that explicitly state they have no prepayment penalties.

3. Late Payment Fee:

- What it is: A fee charged if you miss your payment due date. This is a standard fee for almost all loans.

- How to avoid it: Set up automatic payments. If you know you’ll be late, contact your lender beforehand—they may be willing to offer a grace period.

4. Insufficient Funds Fee (NSF Fee):

- What it is: Charged if your automatic payment is rejected because there isn’t enough money in your bank account.

- How to avoid it: Ensure your account is sufficiently funded a few days before your payment is scheduled to be withdrawn.

Eligibility Check and Prequalification Tips for Faster Approval

To speed through the prequalification and approval process, preparation is key. Having the right information and approach can help you get accurate offers and a quick final decision.

Tips for a Smooth Process:

- Use Accurate Income Figures: Always use your gross annual income (before taxes). If your income is variable (e.g., you’re self-employed or work on commission), calculate a conservative monthly average based on your last 1-2 years of tax returns. Inflating your income will only lead to a rejection during the verification stage.

- Know Your Major Monthly Expenses: Be ready to provide your monthly rent or mortgage payment. This is a key part of the debt-to-income calculation.

- Have a Specific Loan Amount in Mind: Instead of guessing, know exactly how much you need to borrow. This shows the lender you have a clear plan for the funds.

- Use Consistent Information: When you prequalify with multiple lenders, use the exact same name, address, and income information for each one. This ensures you’re comparing apples to apples.

- Check for Typos: A simple typo in your name, address, or Social Security/Insurance Number can cause delays or prevent the system from finding your credit file. Double-check everything before submitting.

By following these tips, you provide lenders with clear, accurate data, allowing their automated systems to give you a reliable prequalification offer and paving the way for a seamless final approval.

Funding Speed and How to Receive Your Personal Loan Quickly

When you need funds fast, the time between signing your loan agreement and seeing the money in your account is critical. Funding speed varies by lender type and can be influenced by several factors.

Typical Funding Timelines:

- Online Lenders: Fastest. Many offer next-business-day funding. Some can even provide same-day funding if the application is completed and approved early on a weekday.

- Traditional Banks: Can be slower. Funding may take 2-5 business days, especially if you are not already a customer of the bank.

- Credit Unions: Similar to banks, funding typically takes 2-5 business days.

How to Accelerate the Funding Process:

- Apply on a Weekday: Banks and electronic transfer systems (like ACH) operate on business days. Applying on a Monday morning gives you the best chance of quick funding compared to applying on a Friday afternoon.

- Have Documents Ready: As mentioned, having digital copies of your ID, pay stubs, and bank statements ready to upload instantly will prevent delays in the verification stage.

- Respond Quickly: After you apply, monitor your email and phone. If the lender requests additional information, provide it immediately.

- Use an Existing Bank: Applying for a loan with the bank where you have your checking account can sometimes speed up the funding process, as they can verify your information and transfer the money internally.

| Factor | Impact on Speed | Tip |

| Lender Type | High | Choose online lenders for speed. |

| Application Day | Medium | Apply early on a business day. |

| Document Prep | High | Have digital copies ready. |

| Responsiveness | High | Reply to lender requests promptly. |

Secured vs. Unsecured Loan Options — Which Is Right for You?

Choosing between a secured and an unsecured loan is a key decision that hinges on your credit profile, risk tolerance, and financial goals.

Unsecured Loans: The Standard Choice

- How they work: Based on your creditworthiness alone. No collateral is required.

- Pros: Your assets (car, home, savings) are not at risk. The application process is typically faster and simpler.

- Cons: Interest rates can be higher since the lender takes on more risk. Eligibility requirements are stricter, usually requiring a fair-to-good credit score.

- Best for: Borrowers with good credit, those who don’t have a valuable asset to pledge, or those who are unwilling to risk an asset. This is the right choice for most personal loan needs, like debt consolidation or home improvements.

Secured Loans: A Tool for Building Credit or Lowering Rates

- How they work: You pledge an asset as collateral. Common examples include using your car title for a secured auto loan or your savings account for a savings-secured loan.

- Pros: Easier to qualify for with bad or fair credit. Interest rates are generally lower than for unsecured loans. Can be a good way to build a positive payment history.

- Cons: You could lose your asset if you fail to repay the loan. The application process may be longer due to the need for an asset appraisal (e.g., for a car).

- Best for: Borrowers with poor credit who are struggling to get approved for an unsecured loan. Also suitable for anyone who wants the lowest possible interest rate and is comfortable with the risk.

Tips for Getting a Personal Loan with Bad Credit in the US or UK

Getting a personal loan with bad credit (typically a FICO score below 630 in the US or a “Poor” rating in the UK) is challenging, but not impossible. The key is to know where to look and how to strengthen your application.

- Check with Credit Unions: Credit unions are non-profits that are often more willing to work with members who have less-than-perfect credit. They may look beyond the score and consider your whole financial picture and history as a member.

- Look for a Co-signer: A co-signer is someone with good credit (often a family member or close friend) who agrees to take responsibility for the loan if you default. Having a co-signer significantly reduces the lender’s risk and dramatically increases your chances of approval and of getting a better interest rate.

- Consider a Secured Loan: As detailed above, if you have a paid-off vehicle or money in a savings account, you can use it as collateral to secure a loan. This is one of the most effective ways for someone with bad credit to get approved.

- Seek Out Specialist Lenders: Some online lenders specialize in providing loans to borrowers with bad credit. Be aware that these loans will come with very high APRs to compensate for the risk. Use them as a last resort and ensure you can afford the payments.

- Lower Your Loan Amount: Requesting a smaller loan amount reduces the lender’s potential loss if you default, which can increase your approval odds. Only borrow what you absolutely need.

Important Warning: Be extremely cautious of “no credit check” or “guaranteed approval” loan offers. These are often predatory payday loans with triple-digit APRs that can trap you in a cycle of debt. Always check that the lender is reputable and regulated (e.g., by the FCA in the UK or the CFPB in the US).

Expert Insight: Common Application Mistakes to Avoid When Getting a Loan

Even with a strong credit profile, simple mistakes on your application can lead to delays or denials. Loan officers see the same correctable errors time and again. Avoiding them can put you on the fast track to approval.

- Applying for Too Much: Lenders use your DTI to see if you can afford the payment. Requesting a loan amount that pushes your DTI too high is an immediate red flag. Use a loan calculator to find a realistic amount before you apply.

- Listing Inconsistent Income: Stating one income figure on the application but providing pay stubs that show a different amount is a common problem, especially for those with variable pay. Use a conservative, provable figure.

- Submitting Multiple Applications Blindly: Firing off full applications to numerous lenders in a short time frame results in multiple hard inquiries, which can lower your score. Prequalify first, then submit only one formal application to your chosen lender.

- Not Disclosing All Debts: Failing to list all your current debts (like other loans or credit cards) on the application is a mistake. Lenders will see them all on your credit report anyway, and the omission can be seen as dishonest.

Financial Advisor View: Key Approval Factors Lenders Consider

When an underwriter reviews your file, they are guided by the “Three C’s of Credit,” a time-tested framework for assessing risk. Understanding these factors helps you see your application through the lender’s eyes.

- Capacity: This is your ability to repay the loan. Lenders assess this primarily through your income stability and your debt-to-income (DTI) ratio. A steady job and a low DTI are powerful indicators that you have the financial capacity to take on a new payment.

- Credit History (Character): This is your track record of managing debt. Your credit score is the summary, but lenders look at the details: Do you pay bills on time? How much existing debt do you have? Have you ever defaulted on a loan? A long history of responsible credit use signals good character.

- Collateral: This applies mainly to secured loans. If you are pledging an asset, the lender assesses its value to ensure it’s sufficient to cover the loan amount if you default. For unsecured loans, your income and credit history act as a form of “financial collateral.”

A strong application demonstrates strength in all relevant areas, giving the lender confidence to approve your loan at a competitive rate.

Post-Approval Steps and Loan Management for Better Credit Health

Your work isn’t done once the loan funds hit your account. How you manage the loan from this point forward will have a major impact on your long-term credit health.

- Confirm Autopay is Active: Immediately after funding, log into your new online account and double-check that your automatic payments are set up correctly from the right bank account and for the correct date. Don’t assume it was done automatically.

- Update Your Budget: Add your new loan payment as a fixed line item in your monthly budget. Knowing exactly where that money is coming from each month prevents end-of-month financial stress.

- Track Your Credit Score: Your consistent, on-time payments will have a positive effect on your credit score. Monitor your score every few months. Seeing it rise can be a great motivator to continue your good financial habits.

- Create a Payoff Goal: If your budget allows, consider making extra payments toward the principal. Even an extra $25 or $50 per month can help you pay the loan off faster and save on interest. Use an online calculator to see how different extra payment amounts can shorten your loan term.

Loan Documentation and Verification Process Explained by Bank Specialists

The documentation and verification stage is where a loan application moves from a set of numbers to a verified file. Bank specialists follow a meticulous process to protect both the bank from fraud and the borrower from taking on a loan they can’t afford.

First, the identity verification step confirms you are who you say you are, cross-referencing your photo ID with your application details. This is a critical anti-fraud measure.

Second, the income verification step is the most detailed. A specialist will look at your pay stubs or tax returns not just for the total income, but for consistency. They’ll check for stable employment by looking at your employer’s name and your pay history. If anything seems unclear, they may call your employer’s HR department for a verbal confirmation of your employment status (they will not disclose that you are applying for a loan).

Finally, address verification via a utility bill or bank statement confirms your residence. Every piece of documentation must match the application exactly. Any discrepancy, however small, will halt the process until it’s clarified, which is why accuracy is so important for fast approval.

Customer Reviews and Borrower Experiences from Tier One Countries

Before committing to a lender, it’s incredibly valuable to learn from the experiences of others. Customer reviews can provide insights that you won’t find in a lender’s marketing materials.

Where to Look for Reviews:

- Independent Review Platforms: Websites like Trust pilot are excellent resources, offering aggregated scores and detailed reviews from verified customers across the US, UK, Canada, and Australia.

- Better Business Bureau (BBB): Primarily for the US and Canada, the BBB lists customer complaints and how the business responded, giving you a sense of their conflict resolution process.

- Financial Blogs and News Sites: Many reputable financial publications conduct in-depth reviews of personal loan lenders, comparing their pros and cons.

What to Look For in Reviews:

- Transparency: Do reviewers frequently mention “hidden fees” or that the final APR was much higher than the prequalified rate?

- Customer Service: Are there common complaints about long wait times, unhelpful staff, or a difficult-to-use website?

- Funding Speed: Did the lender live up to their promises of fast funding, or were there unexpected delays?

Look for patterns. A few negative reviews are normal for any company, but a consistent theme of complaints is a major red flag.

Next Steps After Receiving Your Personal Loan and Managing Repayments

Congratulations, your loan is funded! This is a fresh start and an opportunity to build a stronger financial future. Here are your immediate next steps to ensure success.

- Execute Your Plan: If the loan is for debt consolidation, use the funds to pay off your high-interest cards immediately. If it’s for a home renovation, deposit the funds into a separate account to track project expenses. Stick to the original purpose of the loan.

- Close or Keep Credit Cards? After consolidating credit card debt, don’t close all your old card accounts at once, as this can lower your credit score. It may be wise to keep one or two of your oldest accounts open with a zero balance, perhaps using them for a small, recurring charge that you pay off each month to build positive history.

- Build Your Emergency Fund: Now that your monthly payments are more manageable, make it a priority to build an emergency fund of 3-6 months of living expenses. This fund will be your safety net, preventing you from needing to borrow again for unexpected costs.

- Review Your Finances Annually: Once a year, review your budget and your loan. As your income increases, you may be able to increase your monthly payments to pay the loan off even faster.

FAQ: Frequently Asked Questions

Loans Personal — How to Find the Right Loan for Your Needs

Finding the right personal loan starts with a self-assessment. First, clarify the loan’s purpose (e.g., debt consolidation, home repair) and calculate the exact amount you need. Next, check your credit score from a major bureau in your country (like Experian or Equifax) to understand what rates you’ll likely qualify for. Then, use this information to prequalify with multiple lenders, including your local bank, a credit union, and at least two online lenders. Compare their offers not just by the interest rate, but by the Annual Percentage Rate (APR), which includes fees. Also, consider the loan term—a shorter term saves interest but has higher payments. The right loan is the one that offers the lowest total cost while keeping the monthly payment comfortably within your budget.

How Do I Get a Personal Loan Online with Instant Prequalification?

Getting a personal loan online with instant prequalification is a simple, three-step process. First, choose several reputable online lenders and navigate to their personal loan page. Look for a “Check My Rate” or “Prequalify Now” button. Second, you will fill out a short form with your name, address, income, and desired loan amount. This process uses a soft credit inquiry, which does not affect your credit score. Third, submit the form. The lender’s system will analyze your data in seconds and present you with potential loan offers, including the estimated APR and term lengths you qualify for. This “instant” feedback allows you to compare real offers from multiple lenders without any commitment or impact on your credit, making it the smartest way to start your loan search.

How to Get a Personal Loan from a Bank — Step-by-Step Process

Getting a personal loan from a bank typically involves a more traditional process. Step one is to check if you meet their eligibility criteria, which you can usually find on their website; they often favor clients with good to excellent credit. Step two is to gather your documentation, including proof of identity (like a passport), proof of income (pay stubs or tax returns), and proof of address. Step three is to apply. You can often do this online through the bank’s portal, or you can schedule an appointment to apply in person at a branch. Step four is the underwriting and verification process, which may take several business days. If approved, you will receive a loan offer. Once you sign the agreement, the funds are typically deposited into your bank account within 2-5 business days.

How Do I Get a Personal Loan Fast with Same-Day Funding?

To get a personal loan with same-day funding, you need to be strategic and prepared. Your best bet is to focus on online lenders who specifically advertise this feature. To maximize your chances, apply early on a weekday (e.g., Monday-Friday morning), as bank transfers are not processed on weekends or holidays. Before you apply, have all your required documents, like your photo ID and proof of income, saved as digital files (PDFs or JPEGs) on your computer or phone. Fill out the application with extreme care to avoid typos or errors that could cause delays. If the lender’s automated system can verify all your information instantly and you are approved, you can sign the loan agreement digitally and potentially receive the funds via an electronic transfer to your bank account by the end of the business day.

Capital One Personal Loan — Compare Offers and Apply Online

Capital One, a major bank in the US, does not currently offer new personal loans. They previously offered them to existing cardholders, but this program has been discontinued for new applicants. If you receive a mail offer, it is a targeted promotion and you can follow the instructions to apply. However, for most consumers, you will need to explore other lenders. It’s a great opportunity to compare offers from other major banks like Wells Fargo or U.S. Bank, as well as top-rated online lenders and local credit unions. By prequalifying with several other institutions, you can ensure you are getting the most competitive rate and terms available for your credit profile, potentially finding an even better deal than you might have otherwise.

Where Can I Get a Personal Loan with Flexible Terms?

You can find personal loans with flexible terms from a variety of sources, with online lenders and credit unions often leading the pack. Flexibility can mean several things. If you need a long repayment period to lower your monthly payments, many online lenders offer terms as long as seven years (84 months). If flexibility means no penalty for paying the loan off early, that is a standard feature for most reputable personal loan providers in the US, UK, and Canada, but you should always confirm. If you need the ability to change your payment date or access a hardship program if you run into trouble, look for lenders that highlight these features. Reading customer reviews and the fine print of the loan agreement before you sign is the best way to gauge a lender’s true flexibility.

Personal Loans — Best Options for Borrowers in the US, UK, and Canada

The best personal loan options vary based on your credit profile and needs. In the US, top online lenders like Sofia and Light Stream are excellent for borrowers with good-to-excellent credit, offering low rates and no fees. For those with fair credit, Upstart and Avant use AI-powered underwriting that may increase approval odds. In the UK, high-street banks like HSBC and Barclays compete with peer-to-peer lenders like Zopa and online banks like M&S Bank for customer loans. In Canada, major banks like RBC and Scotia bank are go-to options, while online lenders like fair stone and Mojo offer alternatives for a wider range of credit scores. In all three countries, local credit unions are a fantastic choice, often providing competitive rates and personalized service, especially for existing members.

Wells Fargo Personal Loan — Eligibility and Interest Rate Overview

Wells Fargo offers unsecured personal loans to qualified applicants in the United States, with a focus on existing customers. To be eligible, you generally need a good to excellent credit score (typically 670 or higher). They look for a stable income, a positive credit history, and a healthy debt-to-income ratio. Loan amounts typically range from $3,000 to $100,000, and repayment terms are between 12 and 84 months. Interest rates are competitive but depend heavily on your creditworthiness. They offer a rate discount for qualifying customers who set up automatic payments from a Wells Fargo checking account. There are no origination fees or prepayment penalties. You can check your personalized rates on their website through a soft-inquiry prequalification process before committing to a full application.

U.S. Bank Personal Loan — Application Guide and Documentation Needed

To apply for a U.S. Bank personal loan, you will typically need a good credit score and a stable financial history, with preference often given to existing customers. The application can be completed online, over the phone, or in a branch. First, use their online tool to see your prequalified offers, which only requires a soft credit pull. If you proceed, you will need to provide standard documentation. This includes a government-issued photo ID (like a driver’s license or passport), your Social Security number, and proof of income. For income verification, you’ll need recent pay stubs if you are employed, or the last two years of tax returns if you are self-employed. You will also need to provide your current housing and employment information. Having these documents ready will make the application process much faster.