Find a Personal Loan today! Compare 25+ reliable lenders offering low rates, quick approval, and flexible terms in the US, UK, Canada & Australia.

Navigating the world of personal loans can feel frustrating. You have a financial goal – consolidating high-interest debt, funding a home renovation, covering an unexpected expense – but cannot find a way to it. You may be worried about the high interest rates, thick applications, and fear choosing the wrong lender. This adds stress to an otherwise urgent financial situation and leaves you wishing for the right path you could trust. Imagine you could compare personal loan options from top-tier United States lenders to the United Kingdom, Canada, and Australia with confidence.

We promise to make that happen. We will teach you how to find personal loans with competitive rates, understand what you need for a fast and secure application, and access the funds you need in time. We will show you how to check eligibility without worrying about your credit score, what documents you will need for instant approval, and how to husband a loan that fits your budget perfectly. We help you take back your financials by connecting you with trusted online lenders who offer fast approval and flexible repayment terms. Let us turn your financial goal from a source of stress into a tale of success.

Check Your Rate and Apply Online for Trusted Personal Loans

The first hurdle is easily the scariest. You must find out what rate you qualify for, and most people fear that doing so will require a formal application and lead to a “hard” credit inquiry that will permanently damage their credit score. Fortunately, most modern online lenders in the US, UK, Canada, and Australia have revolutionized this part of the process. Nearly all of them offer a pre-qualification or “soft check” option that allows you to find out your potential rate and loan amount simply by submitting some basic financial information, no credit check required. This simple yet powerful tool puts the power back in your hands and allows you to discover what’s out there and compare offers risk-free.

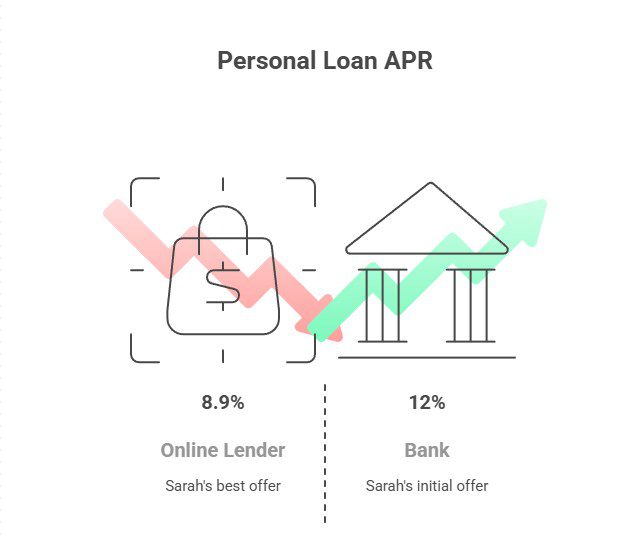

Mini Case Study: Sarah’s Smart Shopping in Toronto, Canada

Sarah hoped to refinance the $15,000 she had on her credit cards. He went to her bank and got an offer for a personal loan with an annual interest rate of 12%. Unsure if this was the best she could get, she was wary of getting her credit history may be damaged and did not want to submit applications everywhere. She proceeded to online comparison services. Sarah went to three different lender websites and checked her rate, without actually submitting the application.

In 30 minutes, Sarah received three offers – one for 11.5%, the other for 10.2%, and a third from her bank’s online-only challenger at 8.9% APR. Because she checked the offered rates and did not proceed with the process she then knew which product to apply for and which one would save her over $1,000 on the interest over the term. Then, she got the formal application and could be confident enough she is receiving the most competitive offer.

Key Takeaway: Always use the soft credit check feature to compare personalized rates from multiple lenders before committing to a full application. This single step can save you a significant amount of money.

This table shows how soft checks empower borrowers by providing crucial information upfront.

| Feature | Soft Credit Check (Pre-Qualification) | Hard Credit Check (Formal Application) |

| Credit Score Impact | None | Temporarily lowers score by a few points |

| Purpose | To estimate your potential rate and terms | To finalize and approve your loan offer |

| Information Provided | Basic personal and financial details | Detailed financial information and documents |

| When to Use | When you are comparing multiple lenders | When you have chosen a lender and are ready to borrow |

Checking your rate is a no-obligation way to understand your borrowing power. It provides a clear picture of what you can afford and helps you budget effectively for your monthly repayments. Once you find an offer that meets your needs, you can proceed with the full online application, which is often just as fast and straightforward.

Explore more details here → Ready to see what you qualify for? [Check your personalized rate in 2 minutes with our trusted partners.]

Compare Personal Loan Options and Interest Rates Across Top Lenders

Once you know your potential interest rate, compare the full loan package from different providers. It’s not just the interest rate; the Annual Percentage Rate is most important as it includes the rate plus any mandatory fees, which is the true cost of borrowing.

You should also compare the loan amount, repayment term, and lender-specific features. Tier One markets’ lenders run the spectrum from huge national banks and credit unions to agile, online fintechs. However, they all have unique strengths whether they’re lower rates for excellent credit, flexible terms for freelancers, or faster funding for emergencies. Mini-case study: Mark’s Debt Consolidation Mark, a graphic designer from Sydney, had three credit cards totaling $25,000 AUD with APRs of 18%, 21% and 22%, respectively. The high monthly payments were straining his household budget. Mark decided to search for a personal loan to roll his cards into a single, lower-interest payment.

He compared two online lenders and his local credit union. The credit union’s name was familiar. Still, its best APR was 13%. One of the online lenders that offered 10.5% APR, with 3-year terms, but another offered 11% APR with 5-year terms. Mark used a loan calculator to determine that the five-year loan’s lower monthly payment saved him money, so he selected the higher rate for his budget. To support his decision, which resulted in a more budget-friendly payment schedule, Mark successfully rolled his credit card debt into a single personal loan.

Result: By comparing the entire loan package—not just the APR—Mark found a solution that best fit his monthly budget and long-term financial health.

Comparing lenders requires looking beyond the headline rate. Consider the following table which breaks down hypothetical offers for a $20,000 loan.

| Lender | Target Market | Typical APR Range | Max Loan Amount | Typical Term Lengths | Key Feature |

| Mega Bank Corp | US / UK | 7.99% – 21.99% | $50,000 / £25,000 | 2–5 years | In-person branch support |

| FinTech Innovate | US / Canada | 6.99% – 19.99% | $100,000 / $50,000 CAD | 3–7 years | Fast online funding |

| Community Credit Union | Australia | 9.50% – 18.00% | $75,000 AUD | 1–7 years | Member-focused service |

| Digital Loans UK | UK | 5.90% – 24.90% | £35,000 | 2–7 years | No early repayment fees |

This comparison highlights that the “best” lender is subjective and depends on your personal needs. Do you prioritize the lowest possible APR, the flexibility of a longer repayment term, or the assurance of a physical branch? Answering these questions will help you narrow down your options effectively.

Explore more details here → [Use our free loan comparison tool to find the perfect lender for your goals.]

Get Quick Funding for Your Financial Needs with Secure Online Loans

At times, the funding speed is of equal importance as the interest rate. If you need to repair your car urgently, pay a medical bill or seize a one-time profitable investment opportunity, you simply cannot afford to wait for a traditional bank to consider your loan application for several weeks. The opportunity of borrowing money from online lending platforms in many countries, including the US, UK, Canada, and Australia, lies in the quick and easy access to the required sums. Due to state-of-the-art technologies, online lenders managed to automate ID verification, income verification, and credit scoring, thereby significantly shortening the time from the application to funding. Since some online lending platforms can render a decision on a loan in a matter of minutes and refund money to the borrower’s bank account on the next business day or even on the same day, the necessity of borrowing money a month prior or turning to the loan sharks is no longer a necessity.

Mini Case Study: Emily’s Emergency in Manchester, UK

One winter day, when Emily, a teacher from Manchester, was at work, the boiler in her home broke down. The cost of punctual replacement was estimated at £3,000, which was not available to Emily.

A regular consumer loan from a bank would take over a week to approve and fund. In a panic, Emily looked up “fast personal loans” and found a credible online lender. She completed her application on the smartphone in 15 minutes, took a digital copy of her payslip and one other digital copy of her bank account, and then got a notification of its authorization near instantaneously. She signed the digital loan agreement, and the £3,000 was in her bank account near next morning. She then hired a contractor to replenish the hot water in her house.

Key Tip: For urgent financial needs, prioritize online lenders who explicitly advertise “next-day” or “same-day” funding and have a fully digital application process.

The difference in funding speed between lender types can be significant. This table illustrates the typical timelines you can expect.

| Lender Type | Application Process | Approval Time | Funding Time |

| Online Lenders | Fully digital, upload documents online | Minutes to a few hours | Same day to 2 business days |

| Traditional Banks | Often requires in-person visit, paper forms | 2 to 7 business days | 3 to 10 business days total |

| Credit Unions | Mix of online and in-person, member-focused | 1 to 5 business days | 2 to 7 business days total |

However, this rate does not imply a lack of security. Large-scale online lenders guarantee the use of encryption technology at the level of banks, which helps keep your personal and financial information private and secure.

Furthermore, each online micro-lender operates under the strict regulation of the country of provision and offers a transparent borrowing process. Before you sign up, check borrower’s certified validation on the website appeared.

Expert Tips for Choosing the Right Personal Loan Provider

Choosing a personal loan provider is a major financial decision. With hundreds of options available across Tier One markets, it’s easy to get drawn in by a flashy headline rate without considering the finer details. A great interest rate is crucial, but the right provider also offers transparency, excellent customer service, and terms that align with your financial situation. Experts advise looking beyond the numbers to assess the lender’s reputation, flexibility, and overall value. A loan is a partnership, and you want to partner with a company that will support you throughout the repayment journey.

Mini Case Study: David’s Due Diligence in Austin, Texas

David wanted a $20,000 loan for a backyard renovation project. He was pre-approved by two lenders. Lender A offered a 7.5% APR, while Lender B offered 7.2% APR. At first glance, Lender B seemed like the obvious choice. However, David decided to dig deeper. He discovered that Lender A had no origination fees and no prepayment penalties, meaning he could pay off the loan early without any extra cost. Lender B, despite its lower APR, charged a 2% origination fee ($400) and a penalty for early repayment. Since David planned to pay off the loan in three years instead of the allotted five, Lender A was the more cost-effective and flexible option for him.

Result: By reading the fine print and considering his long-term plans, David chose a loan that saved him money and gave him the freedom to manage his debt on his own terms.

Use this checklist of expert tips to evaluate and compare personal loan providers effectively.

| Expert Checklist: Top 5 Things to Verify Before Signing | Your Check |

| 1. Check All Fees: Look for origination fees, late payment fees, and prepayment penalties. | ☐ |

| 2. Read Customer Reviews: Use sites like Trustpilot or the Better Business Bureau (in the US/Canada) to gauge customer satisfaction. | ☐ |

| 3. Confirm Repayment Flexibility: Does the lender allow you to change your payment date or make extra payments without penalty? | ☐ |

| 4. Assess Customer Support: Is support available via phone, email, or live chat? Check their hours of operation. | ☐ |

| 5. Understand the Fine Print: Review the terms and conditions for any hidden clauses or unfavorable terms. | ☐ |

A common mistake is focusing solely on the monthly payment. While affordability is key, an overly long loan term can mean you pay thousands more in interest. Use a personal loan calculator to model different scenarios. See how a shorter term increases your monthly payment but drastically reduces the total interest paid. The right provider will offer you tools and transparent information to make this informed choice.

Understand Personal Loan Interest Rates, APR, and Hidden Fees

The language of lending can be confusing, but the two most important terms to understand are the interest rate and the Annual Percentage Rate (APR). The interest rate is simply the percentage a lender charges you for borrowing money. The APR, however, gives you a more complete picture of the loan’s cost. It includes the interest rate plus any mandatory fees the lender charges, such as an origination fee (a one-time fee for processing your loan). Because it includes these fees, the APR is almost always slightly higher than the interest rate and is the most accurate number to use when comparing loan offers.

Mini Case Study: Chloe’s Cost Comparison in London, UK

Chloe was comparing two personal loan offers for £10,000 over three years.

- Lender 1: Offered a 6% interest rate with a £150 origination fee.

- Lender 2: Offered a 6.5% interest rate with no fees.

Initially, Lender 1’s 6% interest rate looked more appealing. However, when she looked at the APR, the story changed. Lender 1’s APR was 7.1% because the £150 fee was factored into the total cost of the loan. Lender 2, with no fees, had an APR of exactly 6.5%. Chloe realized that Lender 2 was the cheaper option over the life of the loan, saving her money despite its slightly higher headline interest rate.

Key Takeaway: Always compare loans using the APR, not the interest rate. The APR represents the true annual cost of borrowing.

Let’s break down how fees can impact the total cost of a $15,000 loan over 4 years.

| Loan Detail | Loan A (with Origination Fee) | Loan B (No Origination Fee) |

| Loan Amount | $15,000 | $15,000 |

| Interest Rate | 8.0% | 8.5% |

| Origination Fee | 3% ($450) | 0% ($0) |

| APR | 8.82% | 8.50% |

| Monthly Payment | $366.19 | $369.84 |

| Total Repaid | $17,577.12 | $17,752.32 |

| Total Cost of Borrowing | $2,577.12 + $450 fee = $3,027.12 | $2,752.32 |

Note: APR calculations can be complex; this table is for illustrative purposes.

As you can see, even though Loan B has a higher interest rate and a slightly higher monthly payment, its total cost is lower because it avoids the upfront origination fee. Other hidden fees to watch for include late payment fees, returned payment fees (for bounced checks or direct debits), and prepayment penalties, which charge you for paying off your loan ahead of schedule. Reputable lenders in Tier One countries are legally required to disclose the APR and all associated fees clearly in the loan agreement.

Eligibility Requirements and Documents Needed for Instant Loan Approval

To achieve fast, instant loan approval, lenders need to quickly verify two main things: your identity and your ability to repay the loan. While specific requirements vary slightly between the US, UK, Canada, and Australia, the core principles are the same. Lenders assess your creditworthiness, your income stability, and your existing debt levels. Being prepared with the right information and documents can turn a multi-day process into a matter of minutes. The key is to present yourself as a reliable borrower with a clear capacity to handle the new monthly payments.

Mini Case Study: David’s Organized Application in Melbourne, Australia

David wanted to secure a $30,000 AUD loan for a new car. Before he even started looking at lenders, he took an hour to prepare. He downloaded his last three payslips as PDFs, saved his most recent bank statement, and checked his credit report to ensure there were no errors. When he found an online lender with a great rate, he was able to fly through the application. The system prompted him to upload his documents, and since he had them ready in a dedicated folder, the entire process took him less than 10 minutes. His loan was approved within the hour, and the funds were available the next day. His friend, who applied for a similar loan elsewhere, spent two days searching for the right paperwork, delaying his own approval.

Key Tip: Prepare your documents before you apply. Having digital copies of your payslips, bank statements, and ID ready will dramatically speed up the approval process.

The documents you need can differ based on your country and employment status. This checklist covers the most common requirements for a standard applicant.

| Document Type | United States (US) | United Kingdom (UK) | Canada (CAN) | Australia (AUS) |

| Proof of Identity | Driver’s License, Passport | Driver’s License, Passport | Driver’s License, Passport | Driver’s License, Passport |

| Proof of Address | Utility Bill, Lease Agreement | Utility Bill, Council Tax Bill | Utility Bill, Bank Statement | Utility Bill, Bank Statement |

| Proof of Income | Pay Stubs, W-2 Form, Tax Returns | Payslips, Bank Statements | Pay Stubs, T4 Slip, Tax Assessment | Payslips, Bank Statements |

| Social Security/ID Number | Social Security Number (SSN) | N/A | Social Insurance Number (SIN) | N/A (TFN may be requested) |

| Bank Details | Bank Account and Routing Number | Bank Account and Sort Code | Bank Account and Transit Number | Bank Account and BSB Number |

Beyond documents, lenders focus on key financial metrics. The most important is your Debt-to-Income (DTI) ratio, which is your total monthly debt payments divided by your gross monthly income. Most lenders prefer a DTI below 40%. They will also look at your credit score, which signals your history of repaying debt. A higher credit score generally unlocks lower interest rates.

How Much Can You Borrow with Leading Lenders in the US and UK?

The amount you can borrow with a personal loan depends on several factors, primarily your credit score, income, and existing debt. Lenders in the United States and the United Kingdom offer a wide range of loan amounts, catering to everything from small emergency expenses to major life projects. Typically, unsecured personal loans can range from as little as $1,000 (£1,000) up to $100,000 (£50,000), though amounts above $50,000 are generally reserved for borrowers with excellent credit and high, stable incomes.

Online lenders have become particularly competitive in this space, often offering higher loan amounts than traditional banks due to their lower overhead costs and data-driven risk assessments. Your DTI ratio plays a critical role here; a lower DTI indicates to the lender that you have enough disposable income to comfortably manage a new loan payment, making them more willing to offer you a larger sum.

Expert Insight:

“Don’t just borrow the maximum amount you’re offered,” advises financial planner Claire Thompson. “Instead, calculate the exact amount you need for your project and borrow only that. This keeps your monthly payments manageable and minimizes the total interest you’ll pay. Over-borrowing is a common mistake that can lead to unnecessary financial strain.”

The table below illustrates typical loan amount ranges from different types of lenders in the US and UK.

| Lender Type | Typical Minimum Loan Amount | Typical Maximum Loan Amount | Best For |

| Major US Bank | $3,000 | $50,000 | Borrowers with good to excellent credit who prefer an established institution. |

| US Online Lender | $2,000 | $100,000 | Borrowers seeking fast funding, competitive rates, and a fully digital experience. |

| Major UK Bank | £1,000 | £25,000 | Existing customers who may benefit from relationship-based rates and offers. |

| UK Online Lender | £1,000 | £35,000 | Borrowers across the credit spectrum, including those who may not qualify at a high street bank. |

Ultimately, the best way to determine how much you can borrow is to go through a pre-qualification process. This gives you a personalized offer based on your financial profile without affecting your credit score.

Top Uses for a Personal Loan: From Debt Consolidation to Home Improvement

A personal loan is a versatile financial tool that can be used for almost any purpose. Unlike a mortgage or auto loan, which are tied to a specific asset, personal loans provide you with a lump sum of cash to use as you see fit. This flexibility makes them an ideal solution for a variety of planned and unplanned expenses. In Tier One markets, borrowers consistently turn to personal loans to achieve specific financial goals, improve their quality of life, or manage difficult situations.

The most popular use is debt consolidation. This involves taking out a single new loan to pay off multiple high-interest debts, such as credit cards or store cards. The primary benefit is simplifying your finances into one monthly payment, often at a significantly lower interest rate, which can save you money and help you pay off debt faster. Another common use is home improvement. A personal loan can fund projects like a kitchen remodel, a bathroom upgrade, or landscaping, adding value to your home without requiring you to take out a home equity loan.

Expert Insight:

“When considering a personal loan for a large purchase, always ask if it creates value,” says Canadian financial advisor Mark Jennings. “Using a loan for debt consolidation or a home renovation is an investment in your financial health or your home’s equity. Using it for a luxury vacation, on the other hand, should be weighed more carefully against your long-term budget.”

Here’s a breakdown of common uses for personal loans and their primary benefits.

| Use Case | Primary Benefit | Potential Drawback |

| Debt Consolidation | Lower interest rate, single monthly payment. | Potential for a longer repayment term if not managed carefully. |

| Home Improvement | Adds value to your property, fixed repayment schedule. | Interest rates may be higher than a secured home equity loan. |

| Major Purchases | Allows for large, one-time purchases (e.g., car, boat, wedding). | Commits you to a multi-year repayment plan for a depreciating asset. |

| Medical Expenses | Covers unexpected or elective medical procedures immediately. | Can add financial stress during a health crisis if the payments are high. |

| Emergency Funding | Provides quick access to cash for urgent needs (e.g., repairs, travel). | Faster funding can sometimes come with slightly higher interest rates. |

Choosing to take out a personal loan is a strategic decision. By aligning the loan’s purpose with a clear financial benefit, you can leverage it as a powerful tool to move your life forward.

Step-by-Step Application Process for Fast Online Loan Approval

The online personal loan application process is designed for speed and simplicity. Gone are the days of scheduling bank appointments and filling out mountains of paperwork. Today, you can apply for and secure a loan from your computer or smartphone in under an hour. While each lender’s interface is unique, they all follow a similar three-stage process: pre-qualification, formal application and verification, and funding. Understanding these steps helps you prepare and move through the process seamlessly.

Step 1: Pre-Qualification (Soft Credit Check)

This is your initial shopping phase. You provide basic information like your name, address, income, and desired loan amount. The lender performs a soft credit check, which does not impact your credit score, to determine your eligibility and present you with potential loan offers, including estimated interest rates and terms. This is the perfect time to compare offers from several lenders.

Step 2: Formal Application & Verification (Hard Credit Check)

Once you’ve selected the best offer, you’ll proceed with the formal application. Here, you’ll provide more detailed information and upload supporting documents. This typically includes:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., recent payslips, tax returns)

- Proof of address (e.g., utility bill)

- Bank account details for funding

At this stage, the lender will perform a hard credit check, which will be recorded on your credit report. Thanks to automation, many online lenders can verify your information electronically within minutes.

Step 3: Review, Sign, and Receive Funds

If your application is approved, the lender will present you with a final loan agreement. It is crucial to read this document carefully. It will outline your final APR, monthly payment, total repayment amount, and all terms and conditions. If you agree, you’ll sign the contract electronically. Once signed, the lender will initiate the fund transfer. Most online lenders can deposit the money directly into your bank account within one to two business days, with some offering same-day funding.

Expert Insight:

“The single most common cause for delay is inaccurate information,” notes a loan underwriter from a major US fintech firm. “Double-check your income, address, and Social Security or Social Insurance Number before submitting. A simple typo can flag your application for manual review, slowing everything down.”

Secured vs. Unsecured Personal Loans: Which Option Fits Your Budget?

When you explore personal loans, you will encounter two primary categories: secured and unsecured. The difference is simple but significant. Unsecured personal loans are the most common type. They are approved based on your creditworthiness—your credit score, income, and financial history. You do not have to provide any collateral to back the loan. Secured personal loans, on the other hand, require you to pledge an asset, such as a car, savings account, or other valuable property, as collateral.

The choice between the two depends on your financial profile and comfort with risk. If you have a strong credit history, you can likely qualify for an unsecured loan with a competitive interest rate. However, if your credit is fair or poor, or if you want to borrow a very large amount, a secured loan might be your only option, or it may help you access a much lower interest rate.

Expert Insight:

“A secured loan is a powerful tool for rebuilding credit or securing a low rate, but the risk is real,” warns Australian credit counsellor Jenna Lee. “Before you pledge an asset, be 100% certain you can make the monthly payments. Defaulting on a secured loan means the lender can seize your collateral, turning a debt problem into an even bigger one.”

This table provides a clear comparison to help you decide which option is right for you.

| Feature | Unsecured Personal Loan | Secured Personal Loan |

| Collateral Required? | No | Yes (e.g., car, savings) |

| Risk to Lender | Higher (based solely on your promise to pay) | Lower (can seize collateral if you default) |

| Typical Interest Rates | Generally higher | Generally lower |

| Credit Score Requirement | Typically requires good to excellent credit for best rates | More accessible to borrowers with fair or poor credit |

| Loan Amounts | May have lower maximum borrowing limits | Can often borrow larger amounts |

| Risk to Borrower | Defaulting damages your credit score and leads to collections | Defaulting damages credit and results in loss of your asset |

For most borrowers with stable finances and a solid credit history in Tier One markets, an unsecured personal loan offers the perfect blend of convenience and accessibility. It provides the funds you need without putting your personal assets on the line.

Loan Terms and Repayment Options Tailored to Your Financial Goals

The loan term is the length of time you have to repay your personal loan. This is one of the most critical factors in structuring a loan that fits your budget. Lenders in the US, UK, Canada, and Australia typically offer terms ranging from one year (12 months) to seven years (84 months), with three to five years being the most common. The term you choose directly impacts two things: the size of your monthly payment and the total amount of interest you will pay over the life of the loan.

- Shorter Term (e.g., 2-3 years): Results in higher monthly payments but a lower total interest cost. This is a great option if you can afford the higher payment and want to be debt-free sooner.

- Longer Term (e.g., 5-7 years): Results in lower, more manageable monthly payments but a higher total interest cost because you are paying interest for a longer period. This is ideal if your primary goal is to keep your monthly expenses low.

Expert Insight:

“Many borrowers default to the longest possible term to get the lowest payment, but this is often a costly mistake,” says UK financial coach Daniel Evans. “I advise my clients to choose the shortest term they can comfortably afford. Use a loan calculator to see the difference in total interest paid between a three-year and a five-year term. The savings are often shocking and can be a powerful motivator.”

This chart illustrates how the loan term affects the payments and total interest on a $15,000 loan with a 9% APR.

| Loan Term | Monthly Payment | Total Interest Paid | Total Amount Repaid |

| 3 Years (36 months) | $477.42 | $2,187.12 | $17,187.12 |

| 5 Years (60 months) | $311.38 | $3,682.80 | $18,682.80 |

| 7 Years (84 months) | $242.34 | $5,356.56 | $20,356.56 |

As you can see, extending the term from three to seven years lowers the monthly payment by over $235, but it costs you an extra $3,169 in interest. The best lenders offer a range of repayment options, allowing you to find the perfect balance between monthly affordability and long-term savings. Always check if a lender charges a prepayment penalty, as the freedom to make extra payments or pay off the loan early can save you even more money.

Customer Reviews and Real Success Stories from Tier One Borrowers

In the digital age, customer reviews are a powerful tool for vetting any product or service, and personal loans are no exception. While a lender’s website can promise low rates and great service, real-world experiences from past borrowers provide invaluable, unbiased insight. Reputable review platforms like Trustpilot, the Better Business Bureau (in North America), and ProductReview.com.au (in Australia) offer a transparent look at a lender’s performance. Pay close attention to reviews that mention the application process, the speed of funding, customer service interactions, and any unexpected fees or issues.

Here are a few fictional but representative success stories from borrowers across Tier One markets:

Success Story 1: The UK Debt Consolidator

Name: James P., London, UK

Goal: Consolidate £12,000 in credit card debt.

Review Snippet: “I was drowning in card payments with rates over 20%. I found an online lender through a comparison site and was pre-approved in minutes. The entire process was online, and the customer service chat was incredibly helpful when I had a question about my payslip. The 8% APR I received is saving me over £150 a month. It’s a huge relief to have one simple payment and a clear end date for my debt.”

Success Story 2: The US Home Improver

Name: Maria G., California, USA

Goal: Fund a $25,000 kitchen remodel.

Review Snippet: “My credit union’s process was too slow, and we wanted to start construction. We applied with a fintech lender on a Tuesday, uploaded our documents, and the money was in our account by Thursday morning. The rate was competitive, and the lack of an origination fee was a big plus. Seeing ‘Excellent’ reviews on Trustpilot gave us the confidence to apply, and they delivered on their promise of speed and simplicity.”

Success Story 3: The Canadian Car Buyer

Name: David L., Vancouver, Canada

Goal: Secure a $20,000 CAD loan for a used car.

Review Snippet: “The dealership’s financing was high, so I decided to get my own loan. I used a Canadian lender that specialized in online loans. The application was straightforward, and I liked that I could see my rate without a hard credit check. The whole experience felt much more transparent than dealership financing. I got a great rate and bought the car the next day.”

Key Takeaway: While individual results vary, consistently positive reviews about transparency, speed, and customer support are strong indicators of a trustworthy lender. Look for patterns in the feedback to make an informed decision.

How Pre-Approval and Eligibility Checks Work for Personal Loans in Tier One Markets

Pre-approval, or pre-qualification, is your best friend when shopping for a personal loan. It’s a lender’s conditional offer that estimates the loan amount, term, and interest rate you might qualify for, all based on a preliminary review of your financial profile. The best part? In nearly all cases across the US, UK, Canada, and Australia, this process uses a soft credit inquiry.

A soft inquiry allows the lender to view a summary of your credit report without affecting your credit score. This is different from a hard inquiry, which occurs during a formal application and can temporarily lower your score by a few points. This distinction is crucial because it allows you to:

- Shop around with multiple lenders risk-free.

- Get a realistic idea of what you can afford.

- Avoid applying for loans you are unlikely to be approved for.

Your Pre-Approval Checklist:

- Gather Basic Information: Have your gross annual income, monthly housing payment, and an estimate of your credit score ready.

- Use Online Tools: Most lenders have a simple form on their website that takes just a few minutes to complete.

- Compare Offers: Collect pre-approval offers from at least three different lenders (e.g., a bank, a credit union, and an online lender) to see who provides the best terms.

- Read the Details: An offer is not a guarantee. Your final rate may change after the lender completes its full underwriting process and performs a hard credit check.

Micro-CTA: [See your pre-approved loan options now with no impact on your credit score →]

H4: What Loan Amounts and Repayment Schedules Mean for Your Monthly Budget

Understanding the relationship between loan amount, term, and monthly payment is essential for responsible borrowing. When you take out a personal loan, you are committing to a fixed monthly payment for a set period. This payment must fit comfortably within your budget without causing financial strain.

A loan calculator is the most effective tool for this. By inputting different loan amounts and repayment schedules (terms), you can instantly see how your monthly payment changes. For example, a $20,000 loan over three years will have a much higher monthly payment than the same loan spread over seven years. The longer term makes the loan more affordable on a month-to-month basis, but as discussed, it significantly increases the total interest you pay.

Key Tips for Budgeting:

- Calculate Your Disposable Income: Subtract all your essential monthly expenses (rent/mortgage, utilities, food, transportation, existing debt) from your monthly take-home pay. Your new loan payment should be a manageable fraction of what’s left.

- Aim for a Shorter Term: Choose the shortest loan term that still results in a monthly payment you can comfortably afford.

- Factor in an Emergency Fund: Ensure you still have room in your budget to save for unexpected expenses even after taking on the new loan payment.

Choosing the right combination ensures you can meet your financial goal without jeopardizing your long-term financial stability.

Why Interest Rate Factors and APR Ranges Differ Between Lenders

You may notice that for the exact same loan amount, different lenders will offer you wildly different interest rates. This is because each lender has its own unique formula—or risk model—for assessing borrowers. While they all look at similar core factors, they may weigh them differently. Understanding these factors can help you improve your profile and secure a better rate.

The Top 4 Factors Influencing Your Interest Rate:

- Credit Score: This is the most significant factor. A higher credit score (e.g., above 720 in the US, or ‘Excellent’ ratings in the UK/Australia) demonstrates a history of responsible borrowing and results in the lowest rates.

- Debt-to-Income (DTI) Ratio: A low DTI shows lenders you have plenty of income to cover your existing debts plus a new loan payment. Lenders see you as a lower risk.

- Loan Term: Longer loan terms sometimes carry slightly higher interest rates. Lenders are taking on risk for a longer period, and the rate can reflect that.

- Lender Type: Online lenders often have lower overhead than traditional banks with physical branches, allowing them to pass those savings on to borrowers in the form of lower rates.

APR ranges listed on lender websites (e.g., “Rates from 6.99% to 29.99% APR”) reflect this. The lowest rate is reserved for “ideal” candidates with excellent credit and low DTI, while borrowers with fair or poor credit will be offered rates at the higher end of the range.

Application Timeline: From Online Submission to Same-Day Funding

The speed of receiving your personal loan funds can vary dramatically, from a few hours to over a week. Online lenders have revolutionized this timeline, making fast funding a key competitive advantage. If speed is your priority, understanding the process helps you choose the right lender and prepare accordingly.

Typical Timeline for an Online Lender:

- Online Submission (5–15 minutes): You fill out the application and upload digital documents.

- Automated Verification (5 minutes – 2 hours): The lender’s system verifies your identity, income, and credit information. Most applications are approved at this stage. Some may be flagged for a brief manual review.

- Approval & Signing (10 minutes): You receive the final loan offer via email. You review the terms and sign the digital contract.

- Funding (1 Business Day): Once the contract is signed, the lender initiates an electronic funds transfer (e.g., ACH in the US, Faster Payments in the UK). Funds often arrive in your bank account the next business day.

For “Same-Day” Funding:

To qualify for same-day funding, you typically need to:

- Apply early in the day (e.g., before 11 AM EST).

- Have all your documents ready for immediate upload.

- Bank with a major financial institution that processes transfers quickly.

- Have a straightforward application with no red flags that require manual review.

Traditional banks and credit unions usually have a longer timeline (3-7 business days) due to manual underwriting processes and potentially requiring in-person visits.

Benefits of Using Online Lenders vs. Traditional Banks

The choice between an online lender and a traditional brick-and-mortar bank is a key decision in your loan search. While banks offer familiarity and in-person service, online lenders have emerged as powerful competitors by leveraging technology to offer a more convenient and often more affordable borrowing experience.

Here’s a direct comparison of the benefits:

| Feature | Online Lenders | Traditional Banks |

| Speed | Advantage: Automated processes often lead to approval in minutes and funding in 1-2 business days. | Slower, manual processes can take several days to a week or more. |

| Convenience | Advantage: Apply from anywhere, 24/7, with a fully digital process. | Often requires scheduling an appointment and visiting a branch during business hours. |

| Interest Rates | Advantage: Lower overhead costs can translate to more competitive APRs, especially for good-credit borrowers. | Rates can be less competitive, though existing customers may receive preferential offers. |

| Eligibility | Advantage: Often use more advanced algorithms to assess risk, potentially approving a wider range of credit profiles. | Tend to have more traditional, rigid lending criteria. |

| Personal Support | Advantage: Offer robust customer support via phone, live chat, and email. | Advantage: Offer face-to-face interaction and personalized advice from a loan officer. |

The Bottom Line:

- Choose an online lender if: Your top priorities are speed, convenience, and securing the most competitive interest rate.

- Choose a traditional bank if: You value in-person service, already have a strong relationship with your bank, or have a complex financial situation that you’d prefer to discuss face-to-face.

Micro-CTA: [Compare rates from leading online lenders and traditional banks side-by-side →]

How to Use Comparison Tools and Loan Calculators Effectively

Online loan comparison tools and calculators are your secret weapons for finding the best deal. They replace guesswork with data, allowing you to model different scenarios and make financially sound decisions. However, using them effectively means knowing what to input and how to interpret the results.

Using a Loan Comparison Website:

- Enter Accurate Information: Provide an accurate estimate of your credit score and income. This allows the tool to filter lenders and show you more relevant options.

- Look at the APR: Always sort and compare offers by APR, not the advertised interest rate, to see the true cost.

- Filter by Features: Use filters to narrow down lenders based on what matters to you, such as “no origination fee,” “fast funding,” or “good for fair credit.”

Using a Personal Loan Calculator:

A calculator helps you understand the impact of loan terms on your budget. To use it effectively:

- Start with Your Desired Loan Amount: Enter the total amount you need to borrow.

- Input the Estimated APR: Use the APR you received during pre-qualification for the most accurate results.

- Adjust the Loan Term: This is the most important variable. Slide the term length up and down (e.g., from 36 months to 60 months) and watch how the “Monthly Payment” and “Total Interest Paid” figures change.

The goal is to find the sweet spot: a monthly payment that fits your budget and a loan term that keeps your total interest costs as low as possible.

Case Study: Required Documents That Speed Up Loan Approval in the US and Canada

Maria, a project manager in Toronto, Canada, needed a $15,000 CAD loan quickly to pay for a professional development course with an upcoming registration deadline. She knew that any delay could mean missing her opportunity.

Before starting her application, she created a digital folder on her computer named “Loan Application.” She saved PDF copies of:

- Her last two pay stubs from her employer.

- Her most recent T4 slip from the previous tax year.

- A recent hydro bill as proof of address.

- A photo of the front and back of her driver’s license.

When she found a Canadian online lender with favorable terms, she breezed through the application. The online portal prompted her to upload these exact documents. Because they were already organized and ready, she completed the entire process in under 15 minutes. Her loan was approved that afternoon, and the funds were in her account the next morning, well before her registration deadline.

Takeaway: A few minutes of preparation can save you days of waiting.

| Essential Documents (Digital Copies) | US Applicant | Canadian Applicant |

| Income Verification | W-2, Pay Stubs | T4, Pay Stubs |

| Identity Verification | Driver’s License/Passport | Driver’s License/Passport |

| Address Verification | Utility Bill/Lease | Utility Bill/Bank Statement |

Insight: Proven Tips to Improve Your Chances of Personal Loan Approval

Lenders are looking for creditworthy, reliable borrowers. You can significantly increase your approval odds by presenting the best possible financial profile. Before you apply, take these proven steps:

- Check Your Credit Report: Obtain a free copy of your credit report from the major bureaus (Equifax, TransUnion, Experian). Dispute any errors you find, as even small mistakes can lower your score.

- Pay Down Credit Card Balances: High credit card balances increase your credit utilization ratio, which can hurt your score. Paying them down, even by a small amount, shows lenders you are managing your debt effectively.

- Lower Your DTI Ratio: If possible, pay off any small, lingering debts before applying. This lowers your debt-to-income ratio, one of the key metrics lenders review.

- Avoid New Credit Applications: Refrain from applying for new credit cards or loans in the weeks leading up to your personal loan application. Multiple hard inquiries in a short period can be a red flag.

- Ensure Stable Income: Lenders value stability. If you’ve recently started a new job, waiting a few months to accumulate a consistent payment history can strengthen your application.

Common Mistakes Applicants Make When Applying for a Personal Loan

Even with a streamlined online process, simple mistakes can lead to denial or unfavorable terms. Avoiding these common pitfalls can ensure a smoother experience.

- Mistake 1: Not Shopping Around. Many applicants accept the first offer they receive, often from their primary bank. This can cost thousands in extra interest. Solution: Get pre-qualified with at least three different lenders to ensure you’re getting a competitive rate.

- Mistake 2: Ignoring the Fees. Focusing only on the interest rate and ignoring the APR is a classic error. An origination fee can add hundreds or thousands to your total cost. Solution: Always compare loans based on the full APR and ask about any potential fees, like prepayment penalties.

- Mistake 3: Entering Incorrect Information. Small typos in your income, address, or Social Security/Insurance Number can cause delays or outright rejection. Solution: Meticulously review every field in the application before you click “submit.”

- Mistake 4: Borrowing More Than You Need. Being approved for a large amount can be tempting, but it leads to higher payments and more interest. Solution: Create a detailed budget for your project and borrow only the exact amount required.

Pros and Cons of Fixed and Variable Personal Loan Options

Nearly all personal loans offered in Tier One markets are fixed-rate loans. However, it’s helpful to understand the difference between fixed and variable rates.

Fixed-Rate Personal Loans:

- Pros: The interest rate is locked in for the entire loan term. Your monthly payment will never change, making it easy to budget. This provides predictability and stability.

- Cons: If market interest rates drop significantly after you take out your loan, you won’t benefit from the lower rates unless you refinance.

Variable-Rate Personal Loans:

(These are much less common for unsecured personal loans but exist for other credit products.)

- Pros: They often start with a lower initial interest rate than fixed-rate loans. If market rates fall, your interest rate and monthly payment could also decrease.

- Cons: The interest rate is tied to a benchmark index and can rise over time. This means your monthly payment could increase unexpectedly, making it harder to budget and potentially more expensive in the long run.

Takeaway: For the vast majority of borrowers, a fixed-rate personal loan is the superior choice. It offers financial certainty and protects you from the risk of rising interest rates.

How Fast Will You Get Funded? Disbursement Details Explained

Once your loan is approved and you’ve signed the agreement, the final step is disbursement—the process of the lender sending you the money. The method and speed of this transfer determine how quickly you can access your funds.

- ACH Transfer (Most Common in the US): The Automated Clearing House (ACH) network is the standard method for online lenders. It is secure and reliable. Typically, funds transferred via ACH will be available in your bank account in 1 to 2 business days.

- Faster Payments (UK): The UK’s Faster Payments Service allows for near-instantaneous transfers. Many UK online lenders use this system, meaning funds can appear in your account within hours of signing your agreement.

- Electronic Funds Transfer (EFT) (Canada & Australia): Similar to ACH, EFT is the standard for transferring money between banks. Funds are typically available in 1 to 3 business days.

- Wire Transfer: Some lenders offer wire transfers for a fee, which can be faster than ACH, sometimes arriving the same day.

- Check: This is the slowest method and is rarely used by online lenders. It can take 7-10 business days for a check to be mailed and for the funds to clear.

Result: If your priority is speed, choose an online lender that advertises “next-day” or “same-day” funding and apply early on a business day.

Smart Repayment Strategies and Planning to Avoid High Interest Costs

Signing the loan agreement is just the beginning. A smart repayment strategy can save you hundreds or even thousands of dollars in interest and help you become debt-free faster. The key is to pay more than the minimum required amount whenever possible.

Here are three effective strategies:

- Make Bi-Weekly Payments: Instead of one monthly payment, split it in half and pay that amount every two weeks. Over a year, you’ll make 26 half-payments, which equals 13 full monthly payments instead of 12. This extra payment goes directly toward the principal, reducing your balance faster.

- Round Up Your Payments: If your monthly payment is $265, round it up to $300. That extra $35 each month may not seem like much, but it adds up over the life of the loan, chipping away at the principal and reducing the total interest paid.

- Use Windfalls Wisely: If you receive a bonus at work, a tax refund, or another unexpected sum of money, apply it directly to your loan’s principal balance.

Important Note: Before implementing any of these strategies, confirm with your lender that they do not charge a prepayment penalty and that extra payments will be applied to the principal, not future interest.

Financial Advisor Insights: How Online and Branch Support Channels Differ in the UK

In the UK, the choice between an online-only lender and a traditional high-street bank often comes down to the type of support you value. Online lenders invest heavily in efficient, accessible digital support. You can typically reach them via live chat, secure messaging, or comprehensive FAQ sections, with phone support available for more complex issues. This model is perfect for self-sufficient borrowers who value quick, on-demand answers.

In contrast, high-street banks offer the traditional branch experience. This allows for face-to-face conversations with a loan advisor, which can be comforting for those making a large financial decision for the first time or for individuals with unique financial circumstances. However, this support is limited to business hours and may require an appointment. The key difference is accessibility versus personalization. Online channels offer 24/7 information access, while branches provide dedicated, in-person guidance.

Privacy Policy and Terms of Service: Protecting Borrower Data in Tier One Countries

When you apply for a personal loan, you are sharing sensitive personal and financial data. Reputable lenders in the US, UK, Canada, and Australia operate under strict data protection regulations to keep your information safe. Key regulations include the General Data Protection Regulation (GDPR) in the UK, the California Consumer Privacy Act (CCPA) in the US, the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada, and the Privacy Act in Australia.

These laws require lenders to be transparent about what data they collect, how they use it, and how they secure it. Always look for a clear privacy policy on a lender’s website. Ensure their site uses HTTPS encryption to protect the data you submit. Reading the terms of service helps you understand your rights and the lender’s obligations, ensuring a secure and trustworthy borrowing experience.

Expert FAQ: What You Need to Know About Personal Loans in 2025

As we look at the personal loan landscape in 2025, a few key trends stand out. First, expect interest rates to remain competitive as online lenders and traditional banks continue to vie for creditworthy borrowers. Second, the use of AI in underwriting is becoming more sophisticated. This could mean faster, more accurate approvals and potentially better rates for borrowers with non-traditional income streams, like gig economy workers. Finally, transparency will be paramount. Lenders will continue to simplify their language and provide better digital tools, empowering consumers to make more informed decisions about their borrowing. The focus will remain on speed, security, and personalization.

Loan Calculators and Financial Tools Trusted by US and Australian Borrowers

The most valuable resource for any borrower is a good financial tool. In the US and Australia, borrowers rely heavily on online loan calculators to plan their finances. These tools are often integrated directly into lender and comparison websites. They allow you to instantly see how different loan amounts, interest rates, and terms will affect your monthly payment and total interest cost. Beyond simple calculators, many platforms offer budgeting tools and credit score simulators. These resources help you understand your complete financial picture, empowering you to choose a loan that not only meets your immediate needs but also supports your long-term financial health. Using these tools is a non-negotiable step for any savvy borrower.

H6: Branch Locations and Verified Contact Details for Major Lenders

While online lenders operate digitally, traditional banks and some larger fintech companies maintain physical branch locations. If you prefer in-person service, you can find branch locations for major lenders like Chase, Wells Fargo (US), Lloyds Bank, Barclays (UK), RBC, TD Bank (Canada), and Commonwealth Bank, ANZ (Australia) directly on their official websites. Always use the “Branch Locator” tool on the lender’s site to find the address, hours, and contact number for your nearest location. For all lenders, online or traditional, the most secure way to find verified contact details is to go directly to their official website. Avoid using phone numbers or links from unsolicited emails to protect yourself from phishing scams.

Resources and Guides for First-Time Borrowers and Repeat Applicants

Navigating the personal loan process can be challenging, whether it’s your first time or you’re a seasoned borrower looking for a better deal. The best lenders and financial wellness sites provide a wealth of free resources. Look for educational guides that explain key terms like APR, DTI, and credit scores. Many offer checklists for applicants, blog posts with tips for improving your credit, and video tutorials that walk you through the application process. For first-time borrowers, these guides can build confidence and demystify the process. For repeat applicants, they can offer advanced strategies for securing the lowest possible rates. Tapping into these resources ensures you are a well-informed and empowered borrower.

FAQ

Small Loan: How to Find Short-Term Personal Loans with Fast Approval

To find a short-term personal loan with fast approval, focus on online lenders and fintech companies. These lenders specialize in streamlined digital applications that can provide decisions in minutes and funding within one business day. Start by using a loan comparison website to filter for lenders offering smaller loan amounts, typically ranging from $500 to $5,000, and short repayment terms of 12-24 months.

When applying, have digital copies of your proof of income (payslips) and ID ready to upload, as this will accelerate the verification process. Look for lenders that advertise “soft credit checks” for pre-qualification, allowing you to see your potential rate without impacting your credit score. Prioritize lenders with strong positive reviews on platforms like Trustpilot, paying special attention to comments about the speed of funding and customer service. Always check the APR to understand the full cost, as some very short-term loans can have higher rates.

LightStream Loans: Low Rates for Excellent Credit Borrowers

LightStream, a division of Truist Bank in the US, is renowned for offering some of the market’s most competitive interest rates on personal loans. Their target audience is borrowers with strong credit profiles, typically demonstrated by a credit score well above 700, a long credit history, and stable income. LightStream offers a completely online process with no origination fees, prepayment penalties, or appraisal fees.

A key feature is their “Rate Beat Program,” where they promise to beat a competitor’s interest rate by 0.10 percentage points if you are approved for a lower rate elsewhere under the same terms. They also offer a wide range of loan amounts and long repayment terms. If you have excellent credit and want to secure a low, fixed-rate loan for a significant expense like a major home renovation or vehicle purchase, LightStream is a top-tier option to consider.

Rocket Loans: Fast Online Application with Same-Day Funding

Rocket Loans, part of the same family as Rocket Mortgage, is a US-based online lender focused on providing a fast and simple borrowing experience. Their main selling point is speed. They offer a fully digital application that can be completed in minutes, and for many qualified borrowers, they can provide funding on the same day the loan is approved. This makes them an excellent choice for urgent financial needs.

Rocket Loans offers fixed-rate personal loans for a variety of purposes, including debt consolidation and home improvement. While their interest rates may not always be the absolute lowest on the market compared to lenders catering exclusively to excellent credit, their value lies in the combination of competitive rates and exceptional speed. Applicants with fair to good credit may find them to be a very accessible and convenient option for securing funds quickly.

Find a Personal Loan Online from Trusted Lenders

To find a personal loan online from trusted lenders, start with reputable loan comparison platforms. These sites partner with a network of vetted lenders and allow you to compare rates, terms, and fees in one place. Look for lenders that are well-established and have a large volume of positive customer reviews on independent sites like Trustpilot or the Better Business Bureau.

A trusted lender will always be transparent about its fees and APR. Their website should be secure (with “https://” in the URL) and feature a clear privacy policy. They should also offer a pre-qualification process with a soft credit check, so you can see your potential offers without harming your credit score. Avoid any lender that promises guaranteed approval, demands upfront fees before the loan is disbursed, or pressures you into making a quick decision.

Find a Personal Loan with Bad Credit — What Are Your Best Options?

Finding a personal loan with bad credit (typically a score below 630 in the US) is challenging but not impossible. Your best options are lenders that specialize in serving this market. Start by looking for online lenders and credit unions that explicitly advertise “bad credit” or “fair credit” loans. These lenders often look beyond just the credit score, considering factors like your income, employment stability, and DTI ratio.

Another strong option is a secured personal loan, where you provide collateral like a car or savings account. This reduces the lender’s risk and significantly increases your approval chances while also helping you secure a lower interest rate. You could also consider applying with a co-signer who has good credit. Their strong credit history can help you qualify and get better terms. Be prepared for higher APRs than those offered to good-credit borrowers.

Capital One Personal Loan Alternatives for 2025

As of now, Capital One is no longer offering new personal loans. However, if you were attracted to Capital One for its reputation as a major, tech-savvy bank, there are many excellent alternatives to consider in 2025. For a similar big-bank experience with a strong online platform, you might look at personal loans from Discover or Wells Fargo. Both offer competitive rates, clear terms, and a user-friendly application process.

If your priority is the digital-first experience that Capital One championed, top online lenders like SoFi, LightStream, and Marcus by Goldman Sachs are fantastic choices. These fintech companies provide highly competitive rates, often with no origination fees, and boast some of the fastest funding times in the industry. For those with less-than-perfect credit, lenders like Upstart and Avant use AI-driven underwriting that may offer more flexible approval criteria.

SoFi Personal Loan: Flexible Terms and No Hidden Fees

SoFi (Social Finance) is a leading online lender in the US known for its competitive rates and borrower-friendly features. They are a top choice for individuals with good to excellent credit. A key differentiator for SoFi is their commitment to transparency: they charge no origination fees, no late fees, and no prepayment penalties. This “no-fee” approach means the APR you see is a true reflection of the interest you’ll pay.

SoFi also offers a high degree of flexibility, with a wide range of loan amounts and repayment terms that can extend up to seven years. Additionally, they provide unique member benefits, such as unemployment protection, which temporarily pauses your payments if you lose your job through no fault of your own. Their mobile app and fully online process make managing your loan simple and convenient, making them ideal for debt consolidation or funding large projects.

Discover Personal Loans: Fixed Rates and Simple Online Process

Discover is a well-regarded financial institution in the US that offers a very straightforward and consumer-friendly personal loan product. They are an excellent option for borrowers with good credit who value simplicity and transparency. Discover personal loans come with fixed interest rates, so your monthly payment will never change, making budgeting easy and predictable.

One of their standout features is the absence of any origination fees, which can save you a significant amount of money compared to other lenders. They also provide flexible repayment terms and a quick online application process with a decision in minutes. Furthermore, Discover is known for its excellent, US-based customer service. For borrowers who want the security of a major financial brand combined with the ease of an online lender, Discover is a compelling choice, especially for debt consolidation.

How to Get a Personal Loan from a Bank vs. Online Lender

Getting a loan from a bank often starts with an inquiry, either online or by visiting a branch. It typically involves a more formal, paper-intensive process. You may need to schedule an appointment with a loan officer and provide physical copies of documents. The approval process can take several days to over a week as it involves manual underwriting. This route is best for those who already have a strong relationship with their bank or prefer face-to-face guidance.

In contrast, getting a loan from an online lender is a fully digital, 24/7 experience. You begin with a soft-check pre-qualification on their website. The application is completed online, and documents are uploaded electronically. Approval can happen in minutes due to automated underwriting, with funding often delivered in just one to two business days. This path is ideal for those who prioritize speed, convenience, and comparing rates easily.

Wells Fargo Personal Loan: Compare Rates and Apply Securely Online

Wells Fargo is one of the largest banks in the United States and offers unsecured personal loans to new and existing customers. A key benefit of applying with Wells Fargo, especially if you are already a customer, is the potential for relationship-based interest rate discounts. They provide fixed-rate loans with no origination or prepayment fees, which is a strong competitive advantage over many other traditional banks.

Their online application process is secure and relatively streamlined, allowing you to check your rates and apply from home.

Loan amounts are flexible, making them suitable for various needs, from debt consolidation to financing a large purchase.

While their funding speed might not always match the fastest online-only lenders, Wells Fargo offers the trust and stability of a major financial institution, along with the option of in-person support at thousands of branch locations across the country.