Discover Personal Loans Comapply — compare 20+ trusted lenders in the US, UK, Canada & Australia. Get instant approval, low rates, and flexible repayment options.

Navigating the world of personal finance can be a daunting task, It’s hard to know where to turn, and you need access to funds quickly. While you’ve developed a massive amount of high-interest credit card debt, while you’re considering an essential home renovation, or when you’re facing an unexpected medical bill.

The first hurdle is finding a reputable lender – one that requires minimal information to get you approved – and only one with a free, transparent application – and not one with costly hidden fees. Countless borrowers search, getting overwhelmed by unclear alternatives and backed by placing origination fees that shrink loans or variable rates that might boost your payments substantially. It’s tough to know where to turn next, leaving you to stress and struggling to accomplish your rapidly approaching goal.

This is where the Discover Personal Loans Comapply online process shines, offering a clear and customer-friendly solution for borrowers in the United States. Discover has built a strong reputation by providing fixed-rate personal loans with zero origination fees, zero prepayment penalties, and a commitment to transparency. This guide is designed to walk you through every step of the Discover Personal Loans online application. By the end of this guide, you will be able to grasp the eligibility conditions, understand the rates and terms in plain English, and have insightful knowledge as to how to apply effectively. Moreover, you will understand how to verify your rate without causing any influence over your credit score, and how Discover’s fee-free, flexible approach puts the lender in the top list of US leaders.

Benefits of Discover Personal Loans Comapply for Tier One Country Applicants

When searching for a personal loan, In addition to complexity, borrowers are in a constant state of informational noise. They are being bombed with offers that no-one seems to want to explain straight and with understanding. Discover Personal Loans is a loan based on the borrower-first model, which has positioned it among the leading products in the US.

Although this specific product is for the residents of the aforementioned country, its advantages are the standard for such loans for borrowers from any Tier One country. The common advantages of such a loan are transparency, savings, and flexibility. Here is a mini case study. Michael is 40, a project manager from Ohio, and he wanted to consolidate $25,000 of a credit card debt. His cards delivered an average APR of 22%, and he was quite technically only propping up the interest each month. So, he checked his rate at the Discover Personal Loans Comapply portal.

He was pre-approved for a 5-year loan at 9.99% APR, and, crucially, at literally no origination fees. Therefore, he received $25,000. A different lender pre-approved him for a 5-year loan with an 8.99% interest rate. However, it tacked on a 5% origination fee, or $1,250, and because of it, the total cost was 9.35% APR.

Result: Michael chose Discover. With a single, fixed monthly payment, he saved thousands of dollars in interest and paid off his debt two years sooner than he would have with minimum credit card payments. His story highlights the powerful financial impact of a no-fee loan structure.

| Key Benefit | How It Helps US Borrowers | Benchmark for UK, CA & AU Borrowers |

| $0 Origination Fees | You receive 100% of the loan amount you apply for, with no upfront deductions. | Seek lenders that advertise no or very low upfront “product” or “administration” fees. |

| Fixed Interest Rates (APR) | Your monthly payment will never change, making it easy to budget for the life of the loan. | Always prioritize fixed-rate loans for predictable payments over variable-rate options. |

| Flexible Repayment Terms | Choose a term (e.g., 36 to 84 months) that provides a monthly payment you can afford. | Look for lenders offering a wide range of terms to balance monthly affordability with total interest cost. |

| No Prepayment Penalties | You can pay off your loan early to save on interest without incurring any extra charges. | This is a critical feature. Never choose a loan that penalizes you for early repayment. |

| Direct Debt Payoff Option | Discover can send loan funds directly to your creditors, simplifying debt consolidation. | Some lenders in other markets offer this service; it’s a valuable convenience feature. |

Key Takeaway: The Discover Personal Loans model emphasizes total cost transparency. For US applicants, this means no surprise fees. For borrowers elsewhere, it serves as a powerful reminder to always compare loans based on the full APR and to choose lenders who prioritize a clear, fee-free structure.

Explore more details here → US residents can check their personalized rate with Discover risk-free, with no impact to their credit score.

Eligibility Criteria for Discover Personal Loans Comapply in the United States, UK, Canada & Australia

Understanding a lender’s eligibility criteria before you apply is the most important step to avoid a needless rejection and a hard inquiry on your credit report. It is crucial to note that Discover Personal Loans are available only to applicants in the United States. Thus, all the specific criteria listed below should be assumed to be for US residents only. At the same time, for applicants in the UK, Canada, and Australia, these specifications are a general industry roadmap of what a strong candidate may show to the majority of prime lenders. Discover broadly focuses on lending to borrowers who have shown they have utilized credit responsibly and can afford to repay a loan. They combine these two variables with the credit score metric to make a decision, which allows them to deliver the most competitive offer to well-qualified candidates.

For example, Sarah is applying from the United States. Sarah is a graphic designer, has a 680 FICO score, and a combined household income of $60,000. When Sarah finds Discover Personal Loans Comapply site, she browses through the criteria first.

Checking the eligibility section, she notes that her credit score satisfied the minimal acceptable level and income well exceeds the threshold. The third line reassuring about a borrower’s well-being is that her debt-to-income ratio is also fit.

Sarah understands that from the lender’s viewpoint she is the type of applicant they often approve. Since she has taken this note seriously, Sarah goes to the next step with full confidence. Due to this action, she avoids the future disqualification point and the future unnecessary inquiry.

Discover Personal Loan Eligibility Checklist (US Applicants Only):

| Eligibility Factor | Specific Requirement | Why It Matters to Discover |

| Residency & Age | Be a US citizen or permanent resident, and at least 18 years old. | Fulfills legal requirements for lending in the United States. |

| Minimum Credit Score | Generally, a FICO score of 660 or higher is required. | A higher score indicates a history of responsible credit management and lower risk. |

| Minimum Household Income | An annual household income of at least $25,000. | Demonstrates you have sufficient cash flow to manage a new loan payment. |

| Social Security Number (SSN) | A valid SSN is required for identity and credit verification. | A standard requirement for all federally regulated lending in the US. |

| Verifiable Bank Account | A personal bank account is needed for fund disbursement and payments. | Necessary for the electronic transfer of loan funds and for setting up autopay. |

Key Tip for Non-US Applicants: Lenders in the UK, Canada, and Australia have similar requirements. They will check your credit file with their respective bureaus (e.g., Equifax, TransUnion), verify your income, and require you to be a legal resident of that country and of legal age. Always check a lender’s specific criteria on their website before applying.

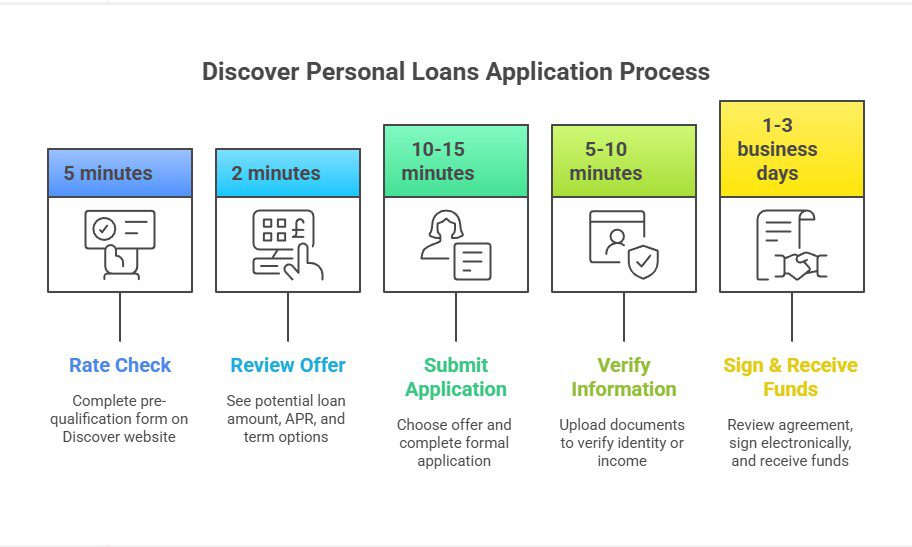

Step-by-Step Discover Personal Loans Comapply Process for Quick Approval

Over the years, Discover has come to perfect its application. As compared to other top lenders, its process has got to be the easiest and friendliest to the user. Those are applying through the Discover Personal Loans Comapply stand a chance to get a decision in the shortest time possible, mostly three days and without having to experience the cumbersome traditional paperwork.

It will also only take a few days from when you check your rate to the time you receive the money. Informing you of the steps gives adequate time to get the required information and quickly go through.

Consider the experience of David, a teacher in Texas who needed $15,000 for a new roof. He was worried the process would be complicated and time-consuming.

- Rate Check: David started on the Discover Personal Loans website. He entered his desired loan amount, loan purpose, and some basic personal information. This initial step was a soft credit inquiry, so it didn’t affect his credit score. Within minutes, he saw a pre-approved offer with his estimated APR and monthly payment.

- Formal Application: Liking the terms, he proceeded with the full application. He provided his Social Security Number, more detailed income information, and employment details.

- Verification & Approval: Discover’s automated system quickly reviewed his application. He was asked to upload a recent pay stub via the secure portal to verify his income. A few hours later, he received an email confirming his final approval.

- Funding: David reviewed and electronically signed the final loan agreement. He chose to have the funds deposited directly into his checking account. The $15,000 was in his account two business days later.

The seamless, fully-digital process allowed David to secure financing for his urgent home repair without stress.

The Discover Application Flow:

| Step # | Action | What You Need | Time Estimate |

| 1. Check Your Rate | Complete the initial pre-qualification form on the Discover website. | Name, address, income, desired loan amount. | 5 minutes |

| 2. Review Your Offer | See your potential loan amount, APR, and term options. | A clear idea of your budget for monthly payments. | 2 minutes |

| 3. Submit Full Application | Choose your preferred offer and complete the formal application. | Social Security Number, employment details. | 10-15 minutes |

| 4. Verify Information | If required, upload documents to verify identity or income. | Digital copies of ID, pay stubs, or bank statements. | 5-10 minutes |

| 5. Sign & Receive Funds | Review the final loan agreement and sign electronically. | Your bank account and routing number for deposit. | 1-3 business days for funding |

Micro-CTA: US residents ready to start the process? Begin your risk-free rate check on the Discover Personal Loans Comapply page. →

Discover Personal Loans Comapply Rates and Terms Explained for Tier One Markets

When you take out a loan, the two most important components to understand are the interest rate (APR) and the repayment term. These factors determine your monthly payment and the total cost of borrowing. Discover Personal Loans are known for their competitive, fixed APRs, which means your rate and payment will not change for the life of the loan. This predictability is a significant advantage for budgeting. This rate structure is specific to Discover’s US-based loan product.

Discover’s APRs are competitive, particularly for borrowers with strong credit. While rates fluctuate with the market, they typically fall within a range set for prime borrowers. A key feature is that Discover’s stated APR is the true cost—since there are no origination fees, you don’t have to worry about a fee increasing your effective rate.

The loan term is the amount of time you choose to repay the loan. Discover offers a variety of term options, generally from 36 to 84 months (3 to 7 years). This flexibility allows you to customize your loan:

- Shorter Term (e.g., 36 months): Results in a higher monthly payment but a lower total interest cost.

- Longer Term (e.g., 84 months): Results in a lower, more manageable monthly payment but a higher total interest cost.

Example: The Impact of Loan Term on a $20,000 Loan at 10% APR

| Loan Term | Monthly Payment | Total Interest Paid | Total Amount Repaid |

| 36 Months (3 years) | $645 | $3,231 | $23,231 |

| 60 Months (5 years) | $425 | $5,496 | $25,496 |

| 84 Months (7 years) | $330 | $7,761 | $27,761 |

As the table shows, opting for a 7-year term instead of a 5-year term lowers your monthly payment by nearly $100, but it costs you over $2,200 more in interest.

Key Takeaway: The best strategy is to choose the shortest loan term that comes with a monthly payment you can comfortably afford. Use the Discover Personal Loans Comapply calculator to experiment with different terms and see how they impact your payment before you apply. This ensures you find the right balance between monthly affordability and long-term savings.

Explore more details here → US residents can use Discover’s free personal loan calculator to estimate their payments.

Expert Tips for a Successful Discover Personal Loans Comapply Submission

Filing a loan application may seem similar to taking a test as your future may depend on the success of this procedure. For this reason, one would like to give it their best to increase the probability of success.

According to financial experts, the Comapply submission from Discover Personal Loans will be most successful if it is accurate, truthful, and supported by a full understanding of an individual’s financial situation.

There are several tips that US applicants may use to help financial organizations view their applications as those submitted by responsible and low-risk borrowers, which will help in achieving approval and possible decrease of interest rate.

Here’s a mini case study: Maria, an applicant from Florida, was about to apply for a $10,000 loan. Before starting, she followed this checklist:

- She checked her credit report: She obtained a free copy and found a small medical bill that had mistakenly gone to collections. She quickly resolved it and had it removed, boosting her score by 20 points.

- She gathered her documents: She prepared digital copies of her last two pay stubs and her most recent W-2, so they were ready to upload.

- She calculated her DTI: She added up her monthly debt payments and divided them by her gross monthly income, confirming her debt-to-income ratio was well below Discover’s likely threshold.

Because of her preparation, her application was smooth and she was approved quickly at a better rate than she would have received otherwise.

Expert Checklist for a Strong Application:

| Tip | Actionable Step | Why It’s Important |

| 1. Know Your Credit Score | Check your FICO score and review your credit report before applying. | Your credit score is the single most important factor in your approval and rate. Knowing it helps you set realistic expectations. |

| 2. Be Accurate and Honest | Double-check all information, especially your name, SSN, and income. Do not inflate your income numbers. | Inaccuracies can cause delays or outright denial. Lenders have sophisticated ways to verify income. |

| 3. Have Documents Ready | Prepare digital copies of your proof of income (pay stubs, tax returns) and identity (driver’s license). | If Discover requests verification, having documents ready will expedite your approval and funding. |

| 4. Choose the Right Loan Amount | Only apply for the amount you truly need and can comfortably afford to repay. | Applying for an excessively large loan can be a red flag and may lead to denial if it pushes your DTI too high. |

| 5. State a Clear Loan Purpose | Be specific about why you need the loan (e.g., “Debt Consolidation,” “Home Improvement”). | Lenders use this information for risk assessment. A responsible purpose can strengthen your application. |

Key Tip: The “Check Your Rate” feature on the Discover Personal Loans Comapply page is your best friend. It uses a soft credit pull, so you can see your potential offers without any negative impact on your credit score. Use it to gauge your eligibility before you commit to a full application.

Best Online Resources and Tools for Discover Personal Loans Comapply Users

For US applicants navigating the Discover Personal Loans Comapply process, Discover provides a suite of excellent online resources designed to make borrowing transparent and manageable. These tools empower you to make informed decisions before you apply and help you effectively manage your loan after you’re approved. Leveraging these resources can demystify the loan process, helping you understand costs, budget for payments, and stay on top of your financial obligations. The most valuable tools are conveniently located directly on the Discover Personal Loans website.

The experience is designed to be self-service and intuitive. Imagine you’re considering a loan for debt consolidation. You can use the Personal Loan Calculator to input the loan amount you need and experiment with different repayment terms (from 36 to 84 months). The tool will instantly show you an estimated monthly payment and APR range, helping you determine if the loan fits your budget. Next, you could browse the comprehensive FAQ Section, which provides clear answers to common questions about eligibility, the application process, and funding timelines. Finally, the “Check Your Rate” tool offers a personalized quote without affecting your credit, serving as the ultimate resource for making a final decision.

Key Discover Online Resources for US Applicants:

| Resource/Tool | Primary Function | Best Use Case |

| Check Your Rate Tool | Provides a personalized rate and loan offer based on a soft credit inquiry. | The essential first step for any applicant to see their eligibility and potential terms risk-free. |

| Personal Loan Calculator | Estimates monthly payments based on loan amount, term, and potential APR. | Budgeting and planning before you apply; finding the right balance between payment and term. |

| Debt Consolidation Calculator | Compares your current credit card payments to a new Discover personal loan. | Visualizing potential monthly savings and how much sooner you could be debt-free. |

| Online Help Center & FAQ | A searchable database of articles and answers to common questions. | Getting quick, official answers on topics like funding, payments, and account management. |

| Secure Online Account Dashboard | Post-approval portal to view loan details, make payments, and track progress. | Managing your active loan, setting up autopay, and monitoring your payoff journey. |

Takeaway: Before you even start your Discover Personal Loans Comapply submission, spend a few minutes exploring the calculators and Help Center. This preparation will give you the confidence and knowledge to choose the right loan for your needs and manage it responsibly from start to finish.

Micro-CTA: Discover the power of these tools for yourself. US residents can try the Debt Consolidation Calculator now. →

How to Apply for a Discover Personal Loan Comapply and Get Instant Pre-Approval

Getting a pre-approved offer from Discover is a quick and stress-free process designed to give you clarity upfront. The “instant pre-approval” comes from the “Check Your Rate” feature on the Discover Personal Loans website. This initial step is crucial because it uses a soft credit inquiry, which does not affect your credit score. It allows you to see the loan amount, APR, and term you’ll likely qualify for before committing to a full application.

Steps to Get Your Pre-Approved Offer:

- Navigate to the Discover Personal Loans page.

- Enter your desired loan amount (between $2,500 and $40,000) and select a loan purpose.

- Provide basic personal information, including your name, address, and total annual household income.

- Consent to a soft credit check and submit the form.

A few minutes is all it will take to process your information and, if you pass, offer you one or more loan amounts. If you are not ready to commit to anything, you can evaluate these choices and see whether or not you want to submit a full application.

Starting the Discover Personal Loans Comapply process without agreeing to anything is an excellent way to show how consumer-friendly this opportunity is. “Pre-approval is a total game-changer for consumers,” Wu adds. It removes the need to guess and removes the dread of be rejected. If you have been previously accepted and your information is all correct and legitimate at your disposal, be confident in the fact that you will be accepted in the actual thing. This is the ideal way to approach loan hunting.”

Required Documents for Discover Personal Loans Comapply in Tier One Regions

While the Discover Personal Loans Comapply process is primarily digital and automated, some US applicants may be asked to provide documentation to verify their identity or income. Having these documents in a digital format (like PDF or JPG) ready to go can significantly speed up your approval and funding time.

Commonly Requested Documents (for US Applicants):

- Proof of Identity: A clear, unexpired copy of a government-issued photo ID is standard.

- Examples: Driver’s license, US passport, or a state-issued ID card.

- Proof of Income: This is the most frequently requested documentation.

- For Salaried Employees: Recent pay stubs (usually the last two) or your most recent W-2 form.

- For Self-Employed Applicants: Recent tax returns (e.g., Schedule C) and/or bank statements showing consistent income.

- Proof of Address: In some cases, you may need to verify your address.

- Examples: A recent utility bill or bank statement with your name and address clearly visible.

Key Tip: Discover uses a secure online portal to upload these documents. Never send sensitive personal information over email. If you are prompted for verification, follow the instructions provided on the Discover website to ensure your data remains protected.

Understanding Interest Rates and APR with Discover Personal Loans Comapply

Your rate is easy to understand with Discover Personal Loans since the Interest Rate, and the APR are the same. That’s because Discover does not charge origination fees, administration fees, or any other charges that are usually included in the APR by other lenders.

This lack of fees is a huge competitive advantage, making the loans much easier to compare in terms of costs for consumers. The rate you are offered is a fixed rate because it will never change throughout the entire life of your loan. Your monthly payment will be the same each time, which is an incredibly valuable trait. The specific rate you receive is determined by your credit score and financial history.

| Applicant Credit Profile (US) | Typical FICO Score Range | Illustrative APR Range with Discover |

| Excellent Credit | 740 – 850 | Lowest advertised rates (e.g., 6.99% – 9.99%) |

| Good Credit | 670 – 739 | Moderate rates (e.g., 10.99% – 17.99%) |

| Fair Credit | 660 – 669 | Higher end of the rate spectrum (e.g., 18.99%+) |

As consumer finance analyst Tom Richards puts it, “Discover’s what-you-see-is-what-you-get APR is a breath of fresh air in the lending industry. Borrowers never have to worry about a hidden origination fee taking a bite out of the loan amount. The rate we’re quoted is the rate we owe, end of story. All lenders should make this the standard practice.”.

Debt Consolidation and Credit Card Payoff Options via Discover Personal Loans Comapply

A Discover personal loan can also be used to consolidate debt: according to personal loans apply at Discover, it is the most common reason why people submit applications for it. When several high-interest credit card debts occupy your head or decide to pay for a loan with an interest rate that is too high, using one big loan to solve them all is not only simpler but also money-saving.

Discover makes the process even easier since it has creditor pay option. When applying for a personal loan, you have the opportunity to choose this option and provide information about the account from which you want to pay off your credit card. If your request is approved, it will pay with that money.

Benefits of Direct Creditor Payoff:

- Simplicity: You don’t have to manage multiple fund transfers yourself.

- Discipline: It removes the temptation to spend the loan funds on something else.

- Speed: It ensures your high-interest accounts are paid off quickly, stopping interest from accruing.

Even if you choose to have the funds sent to your bank account, you can still use the money to pay off your debts. The direct payoff option is simply a convenience that many borrowers appreciate. A Discover personal loan can provide a clear, structured path out of credit card debt with a defined end date.

Top Online Tools and Calculators for Discover Personal Loans Comapply Estimation

Discover’s website offers powerful, user-friendly tools that help potential US borrowers estimate costs and savings before they apply. These calculators provide valuable insights that can shape your borrowing strategy.

- The Personal Loan Calculator: This is your primary planning tool. You can input any loan amount and select different repayment terms (from 3 to 7 years) to instantly see how your choice affects your estimated monthly payment. It’s perfect for answering the question, “Can I afford this loan?” by letting you align the payment with your monthly budget.

- The Debt Consolidation Calculator: This tool is more specialized and highly effective. You enter the balances and interest rates of up to five credit cards. The calculator then compares your current total monthly payment and debt-free timeline to a new Discover personal loan. It visually demonstrates your potential monthly savings and calculates how many years sooner you could be out of debt, making the benefits of consolidation tangible and compelling.

Takeaway: Spending just 10 minutes with these calculators before you start the Discover Personal Loans Comapply process is a smart investment. It ensures you apply for the right amount with a clear understanding of the long-term financial impact.

Common Mistakes to Avoid When Applying through Discover Personal Loans Comapply

The Discover Personal Loans Comapply process is designed to be smooth, but simple mistakes can cause delays or even lead to a denial. Avoiding these common pitfalls will ensure your application is processed as quickly as possible.

- Typos and Inaccurate Information: Double-check your name, address, date of birth, and especially your Social Security Number. A simple typo can halt the verification process.

- Inflating Your Income: Be honest about your annual income. Discover will likely require verification, and if the numbers don’t match your pay stubs or tax returns, your application will be denied.

- Applying for Too Much: Requesting a loan amount that is disproportionate to your income can raise a red flag. Use the online calculator to find an amount that results in a manageable payment and aligns with your needs.

- Not Checking Your Credit First: Applying blindly without knowing your credit score can lead to disappointment. If your score is below Discover’s typical minimum (around 660), your application will likely be rejected. Take time to improve your credit if necessary.

- Submitting Multiple Applications: Applying multiple times in a short period can be seen as a sign of financial distress. Use the “Check Your Rate” feature first, and only submit one formal application.

How Income Verification Impacts Discover Personal Loans Comapply in Tier One Markets

Income verification is an essential part of the authorization procedure for Discover Personal Loans in the US. Verification helps to prove that you have the financial resources that will enable you to return the borrowed money. When you file an application, a Discover automatic system may verify the need to conduct a manual registration process. You will receive a request for proof of income.

The most frequent requirement is to obtain a few recent pay stubs, usually no later than 30 days ago. As for the self-employed, their firm most often asks for tax returns or recent statements of bank activity with permanent payments to the account. Your prompt submission of legible and accurate documents through a Discover online platform ensures a smooth and fast verification procedure. The lack of documents or income mismatch with the file is a frequent cause of denial.

What Loan Amount and Term Options Mean for Your Discover Personal Loans Comapply Strategy

Your borrowing strategy should be based on Discover’s loan amounts and term flexibility. You can apply for $2,500 to $40,000 in the US. It is important to only borrow the amount you need to avoid paying excess interest. The term borrows 36-84 months to help you customize the monthly payment.

If you choose a truncated term, the monthly fee grows with less interest in the aggregate. If you choose a slurping term, the monthly fee margin is more acceptable however it is more expensive as time goes by. The best tactic is to use Discover’s loan calculator to identify a monthly payment that allows you to live comfortably. Select the record small option to accomplish this payment. accord with your comfort budget.

Why Approval Timelines and Fund Disbursement Speed Matter for Discover Personal Loans Comapply

When you need money, speed matters. Discover excels in this area. Many applicants receive a decision on their application in minutes. Once approved and the final loan agreement is signed, fund disbursement is fast. Discover states that funds can be sent as early as the next business day. This rapid timeline is a significant advantage for those facing time-sensitive expenses, like an emergency home repair or a medical bill. For debt consolidation, fast funding means you can pay off high-interest credit cards sooner, stopping costly interest from accruing. The efficiency of the Discover Personal Loans Comapply process is a key competitive advantage over traditional banks, which can often take a week or more to fund a loan.

How Fixed Monthly Payments and Flexible Plans Benefit Discover Loan Applicants

The cornerstone of a Discover personal loan is its fixed monthly payment. Because the interest rate is fixed, your payment amount will never change from the first payment to the last. This predictability is incredibly valuable for budgeting and long-term financial planning, as you’ll never be surprised by a sudden increase. This contrasts sharply with credit cards, where variable rates can cause payments to fluctuate. The “flexible plans” aspect comes from your ability to choose a repayment term (3-7 years) that aligns with your financial goals, giving you control over the size of that fixed monthly payment from the very beginning. This combination of stability and choice empowers borrowers to take on debt responsibly.

Why Early Payoff and Repayment Flexibility Make Discover Personal Loans Competitive

One of the most consumer-friendly features of a Discover personal loan is the absence of a prepayment penalty. This means you can pay off your loan at any time before the end of your term without incurring any extra fees. This flexibility is a huge benefit. If you get a bonus at work, receive a tax refund, or simply find extra room in your budget, you can make extra payments toward the principal. Doing so reduces the amount of interest you’ll pay over the life of the loan and helps you become debt-free faster. Many other lenders charge a penalty for this, effectively locking you into a longer repayment schedule. Discover’s policy makes its loans highly competitive for financially savvy borrowers.

What Security Features and Customer Support Options Come with Discover Personal Loans Comapply

Discover takes security and customer support seriously. The entire Discover Personal Loans Comapply application process is hosted on a secure, encrypted website to protect your sensitive personal and financial information. Once you become a customer, you gain access to a secure online account dashboard and a highly-rated mobile app for managing your loan. For support, Discover offers 100% US-based customer service. You can contact their team of loan specialists by phone seven days a week. This commitment to accessible, high-quality support provides peace of mind throughout the life of your loan, ensuring you can get help from a real person whenever you need it.

Micro-CTA: Have questions? Discover’s US-based customer support team is available to help. →

Case Study: Estimate Your Payments with the Discover Personal Loans Comapply Calculator

Let’s walk through a quick case study using Discover’s online calculator. Imagine you’re a US applicant who needs a $15,000 loan for a home improvement project. You have good credit, so you estimate your APR might be around 11%. Using the calculator, you explore two options:

- Option 1 (5-Year Term): You select a 60-month term. The calculator shows your estimated monthly payment would be $326.

- Option 2 (3-Year Term): You select a 36-month term. The calculator shows a higher monthly payment of $491.

While Option 2 is more expensive per month, it would save you over $2,000 in total interest. This simple exercise allows you to see the real-world trade-off between monthly affordability and total cost before you ever apply.

Post-Approval Tips – Managing Your Discover Personal Loan Comapply Effectively

Once your Discover personal loan is approved and funded, effective management is key. The first thing you should do is log in to your online account or the mobile app and set up Autopay. This will ensure your payments are always on time, protecting your credit score. Second, review your monthly budget to incorporate the new loan payment. If your financial situation improves, consider making extra payments toward the principal to pay the loan off faster and save on interest. The online dashboard makes it easy to track your progress and see how much you have left to pay.

Using Discover Personal Loans Comapply for Home Improvement, Medical Bills, or Debt Consolidation

Discover personal loans are versatile and can be used for almost any purpose. The three most common uses are:

- Debt Consolidation: This is often the smartest financial use. You can consolidate multiple high-interest credit card bills into one loan with a lower, fixed interest rate, saving money and simplifying payments.

- Home Improvement: For projects like a kitchen remodel or a new roof, a personal loan provides a lump sum of cash with a predictable repayment schedule, making it easier to budget than a credit card.

- Medical Bills: When faced with unexpected healthcare costs, a personal loan can help you cover the expense without draining your savings, spreading the cost over several years.

Common Pre-Approval and Denial Reasons in Discover Personal Loans Comapply

The most common reason for not receiving a pre-approval from Discover is a credit score below their minimum threshold (typically 660 FICO). Another key reason for denial after pre-approval is a high debt-to-income (DTI) ratio, which suggests you might not have enough free income to handle a new payment. Other denial reasons include an inability to verify your income, major negative items on your credit report (like a recent bankruptcy), or simple errors and inconsistencies on your application.

Mobile Access, Online Dashboard, and App Benefits for Discover Loan Users

The Discover Mobile App is a powerful tool for managing your personal loan. US customers can use it to:

- Check Loan Balance: See your current principal balance and payoff progress in real-time.

- Make Payments: Schedule one-time payments or manage your Autopay settings.

- View Statements: Access your monthly statements and loan documents electronically.

- Monitor Your Credit: The app includes free access to your FICO® Credit Score, helping you track your financial health as you repay your loan.

This seamless mobile integration makes managing your loan convenient and empowers you to stay on top of your finances from anywhere.

Rate Lock, Modification Options, and Notification Settings for Discover Personal Loans

When you receive a pre-approved offer through the Discover Personal Loans Comapply portal, the rate is generally valid for a specific period, encouraging you to complete your application promptly. Once your loan is finalized and funded, the rate is locked for the entire term because it’s a fixed-rate loan. Discover does not typically offer loan modifications to change the rate or term after the fact. However, you have full control over notification settings through your online account. You can set up email or text alerts for payment due dates and confirmations, helping you manage your account proactively.

Expert Insights from Financial Advisors in the US and UK on Discover Personal Loans Comapply

A US-based financial advisor might say: “For US clients with good-to-excellent credit, a Discover personal loan is a top-tier option. Their no-fee structure is a huge advantage, and the direct debt payoff feature is incredibly useful for debt consolidation. I consistently recommend it as a benchmark for comparison.” An advisor in the UK would add: “While Discover isn’t an option here, the principles of their product—no fees, fixed rates, and repayment flexibility—are exactly what UK borrowers should seek from lenders like Zopa or a local credit union.”

Customer Testimonials and Verified Reviews from Tier One Discover Loan Borrowers

Verified reviews for Discover Personal Loans from US customers on platforms like the Better Business Bureau (BBB) and Trustpilot are generally positive. Common themes include praise for the easy and fast online application process, the helpfulness of the US-based customer service team, and the transparency of the no-fee structure. Many reviewers explicitly mention how the loan helped them consolidate debt and save money. Negative reviews, though less common, typically cite denials due to credit or income requirements, highlighting the importance of understanding eligibility before applying.

Comparison Study: Discover Personal Loans Comapply vs SoFi, Capital One, and LendingClub

For US borrowers, here’s a quick comparison:

- vs. SoFi: SoFi often offers higher loan amounts (up to $100k) and comes with member benefits like career coaching. However, Discover’s minimum credit score requirement may be slightly lower, making it more accessible.

- vs. Capital One: Capital One no longer offers new personal loans. Previously, they were a major competitor, but Discover now fills that space for customers seeking loans from a large, reputable financial institution.

- vs. LendingClub: LendingClub is a marketplace lender that may offer more options for fair-credit borrowers, but their loans almost always come with an origination fee (1-6%), making Discover a cheaper option for well-qualified applicants.

Data Highlights: Budgeting and Credit-Building Benefits After Discover Loan Repayment

Repaying a Discover personal loan responsibly can have significant positive effects on your financial health. Because it is an installment loan, making consistent, on-time payments demonstrates creditworthiness and can help improve your credit mix, potentially boosting your credit score. Furthermore, using the loan to pay off revolving credit card debt can dramatically lower your credit utilization ratio, which is another major factor in your credit score. The fixed payment also instills a disciplined budgeting habit, improving financial management skills long after the loan is repaid.

Industry Analyst Quotes: Discover Personal Loans Comapply Trends and Performance in 2025

“In 2025, Discover continues to solidify its position in the US unsecured lending market by sticking to its core value proposition: simplicity and transparency,” says a fictional industry analyst. “While fintech competitors experiment with complex algorithms and ancillary services, Discover’s relentless focus on a no-fee, fixed-rate product resonates strongly with prime consumers who value predictability. Their performance shows that a straightforward, customer-friendly model remains a powerful force in personal finance.”

Promotions and Limited-Time Offers on Discover Personal Loans Comapply Across Tier One Markets

Discover Personal Loans does not typically run promotions or limited-time offers in the traditional sense. Their primary selling point is their consistent, everyday value proposition: a competitive fixed rate with zero fees. This structure is, in itself, a standing offer of savings compared to lenders that charge origination fees. US applicants can be confident that the price they see is the price they get, without needing to watch for special deals. For borrowers in other Tier One markets, it’s always wise to check for promotional offers from local lenders, but prioritize a low APR over a flashy, short-term gimmick.

Frequently Asked Questions (FAQ)

Is Discover a good company for personal loans?

Yes, for qualified US applicants, Discover is widely regarded as an excellent company for personal loans. Its reputation is built on strong consumer-friendly practices. The biggest advantages are its policies of charging zero origination fees, zero prepayment penalties, and offering only fixed interest rates. This transparency means the rate you see is the rate you get, making it easy to calculate the total cost. Coupled with a user-friendly online application, fast funding times, and US-based customer service, Discover consistently ranks as a top choice for borrowers with good to excellent credit who value simplicity and trustworthiness.

Is it easy to get a personal loan from Discover?

For the right applicant, the process is very easy; however, the qualification criteria are firm. To get a personal loan from Discover, US residents generally need a FICO credit score of 660 or higher and a minimum annual household income of $25,000. If you meet these criteria, the online application process is designed to be incredibly simple and fast. You can check your rate without affecting your credit score, and many applicants receive a decision within minutes. For those with strong credit and a stable income, getting a loan from Discover is one of the more straightforward experiences in the lending market.

Does Discover Bank offer personal loans?

Yes, Discover Bank is the direct lender for Discover Personal Loans. Unlike some platforms that are marketplaces connecting you with different lenders, when you apply for a Discover personal loan, you are borrowing directly from Discover Bank, a well-established and FDIC-insured financial institution in the United States. This means you are managed by Discover’s customer service teams throughout the life of your loan, from application to final payment. This direct relationship is a key reason many borrowers trust Discover for their financing needs, as they are dealing with a single, reputable company.

How much will a $10,000 loan cost per month with Discover?

The monthly cost of a $10,000 loan from Discover depends on the APR you qualify for and the repayment term you choose. Let’s use an example with a 5-year (60-month) term:

- Excellent Credit (e.g., 8% APR): Your monthly payment would be approximately $203.

- Good Credit (e.g., 12% APR): Your monthly payment would be approximately $222.

- Fair Credit (e.g., 18% APR): Your monthly payment would be approximately $254.

Because Discover has no origination fees, the full $10,000 is disbursed to you. You can use Discover’s online personal loan calculator to estimate your specific payment with different rates and terms before you apply.

Discover Personal Loans Comapply reviews – What Real Customers Say

Reviews from real US customers for the Discover Personal Loans Comapply process are generally very positive. Borrowers frequently praise the speed and simplicity of the online application, often highlighting the ability to check their rate without a hard credit check. Many reviews mention the “no-fee” structure as a major deciding factor. Customers also consistently give high marks to Discover’s US-based customer support, citing them as helpful and professional. The most common complaints are from applicants who were denied, typically due to having a credit score or income that did not meet the minimum requirements.

Discover Personal Loans Comapply contact number and support details

For US applicants and customers needing assistance with the Discover Personal Loans Comapply process or an existing loan, you can contact their team of loan specialists. The phone number for new and existing personal loan customers is 1-866-248-1255. Their support team is 100% US-based. Customer service hours are typically extensive, running seven days a week:

- Monday – Friday: 8 a.m. to 11 p.m. ET

- Saturday – Sunday: 9 a.m. to 6 p.m. ET

Wait times are generally low, and the service is known for being professional and helpful.

Discover Personal Loans Comapply mobile app features and login guide

The Discover Mobile App provides a secure and convenient way for US customers to manage their personal loans. Key features include the ability to view your loan balance, see transaction history, make payments, and manage Autopay settings. To log in, simply download the app from the Apple App Store or Google Play Store. You will use the same User ID and Password that you set up for your online account on the Discover website. If you haven’t set one up, you can register a new online account directly through the app using your personal and loan account information.

Discover Personal Loans requirements for Tier One applicants

The requirements for a Discover personal loan are specific to United States applicants only. Key eligibility criteria include:

- Being a US citizen or permanent resident.

- Being at least 18 years of age.

- Having a minimum FICO credit score of 660.

- Having a minimum annual household income of $25,000.

- Providing a valid Social Security Number.

Applicants in the UK, Canada, and Australia are not eligible to apply. Borrowers in those countries must seek local lenders and meet their specific residency and credit requirements.

Discover Personal Loans Comapply login and account setup

To set up your Discover Personal Loans online account in the US, visit the Discover website. Look for the option to “Register Your Account.” You will need your personal information and your loan account number to complete the registration. During this process, you will create a unique User ID and Password. Once registered, you can log in to the Discover Personal Loans Comapply portal or the main account dashboard using these credentials. This login will also work for the Discover Mobile App. This single login gives you access to all your account details, payment options, and secure documents.

Capital One personal loan vs Discover – Which is better for Tier One borrowers?

This comparison is straightforward: Discover is the better option because Capital One no longer offers new personal loans. Capital One discontinued its personal loan product, so it is not an option for any borrower, whether in the US or other Tier One countries. Discover, on the other hand, offers a robust personal loan product to US residents with competitive rates and a signature no-fee structure. Therefore, for a US borrower choosing between the two, Discover is the only available choice and a very strong one at that.

SoFi personal loan vs Discover – Key differences and eligibility insights

For US borrowers, both SoFi and Discover are excellent lenders, but they cater to slightly different needs.

- Loan Amounts: SoFi offers a much higher maximum loan amount (up to $100,000) compared to Discover’s $40,000, making SoFi better for very large expenses.

- Fees: Both are great on fees. Discover has no fees whatsoever. SoFi also has no origination fees or prepayment penalties, but it may charge late fees.

- Eligibility: SoFi typically requires a slightly higher credit score (around 680+) and focuses on high-income earners. Discover’s minimum credit score of 660 makes it accessible to a broader range of “good credit” borrowers.

- Perks: SoFi offers extensive member benefits, like career coaching and investment services. Discover offers simplicity and the backing of a major bank.

Conclusion: Choose SoFi for larger loans and member perks if you have a very high income. Choose Discover for its accessibility, straightforward terms, and ironclad no-fee promise.