Explore Business Loans with fast funding, flexible terms, and expert support from trusted credit unions in the US, UK, Canada, and Australia.

Each ambitious entrepreneur eventually hits a ceiling where the next level of growth can only be financed through external capital. Whether you run a tech startup in San Francisco, a retail shop in London, a logistics business in Toronto, or a construction company in Sydney, the fuel of growth is capital. You see a market opportunity, but you are practically handcuffed by your cash flow. This gulf between vision and necessary means is where the proper business loan can become a game-changer.

Tier One Finance is not letting just anyone through the door. Lenders in developed economies search for certain signals of stability and promise. But the terrain is sometimes sheerly overwhelming. You have a dizzying number of options: classic term loans, government-backed programs such as the US’s SBA or Canada’s CSBFP, and fast-moving fintech lenders. One false step results in rejection, or even worse, a loan with interest rates so high they eat into your profit margins.

This guide separates the signal from the noise. We delve into what it really takes to qualify, apply for, and get the cash. We dissect secured versus unsecured lending and how successful business owners are using debt to create equity. You will understand how to navigate the world of credit score lenders and provide documentation that says “yes.” Quit allowing the lack of funds to be your growth rate. Keep reading and learn how to navigate the world of business financing and get your organization the capital it deserves.

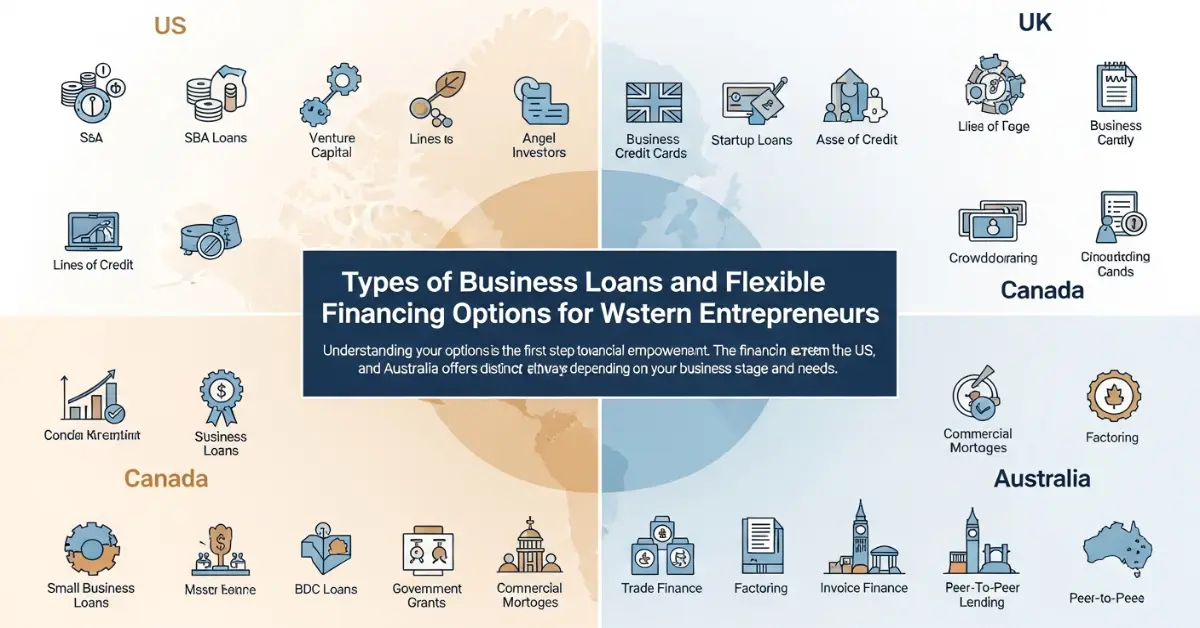

Types of Business Loans and Flexible Financing Options for Western Entrepreneurs

Understanding your options is the first step toward financial empowerment. The financing ecosystem in the US, UK, Canada, and Australia offers distinct pathways depending on your business stage and needs.

The Major Loan Categories

1. Traditional Term Loans: You receive a lump sum and repay it over a set period with interest. These are ideal for specific, one-time investments like renovations.

2. Lines of Credit: This acts like a credit card with a high limit. You only pay interest on what you use. It is the ultimate safety net for cash flow gaps.

3. Government-Backed Loans:

o US: SBA 7(a) loans reduce lender risk.

o Canada: Canada Small Business Financing Program (CSBFP).

o UK: Recovery Loan Scheme (and successors).

o Australia: SME Recovery Loan Scheme equivalents.

4. Equipment Financing: The machinery or vehicle you buy serves as collateral, often making approval easier.

Case Study: The Inventory Dilemma

Meet Sarah, owner of “Urban Threads,” a fashion retailer in Manchester, UK.

Sarah faced a classic problem. She needed to order £50,000 of winter stock in August, but her cash was tied up in summer inventory. A traditional term loan took too long. Instead, Sarah applied for a Business Line of Credit. She drew down the £50,000, paid her suppliers, and repaid the line in December once holiday sales peaked. She only paid interest for four months. By choosing the right product, she avoided a long-term debt burden for a short-term need.

Comparison of Financing Options by Region

| Loan Type | Best Used For | Typical Interest Rates | Approval Speed |

| Term Loan | Expansion, Renovations | 6% – 15% | 2 – 6 Weeks |

| Line of Credit | Working Capital, Payroll | 8% – 20% | 1 – 2 Weeks |

| SBA / Gov-Backed | Real Estate, Buying a Business | Prime + 2% – 4% | 60 – 90 Days |

| Equipment Finance | Machinery, Vehicles | 5% – 15% | 2 – 5 Days |

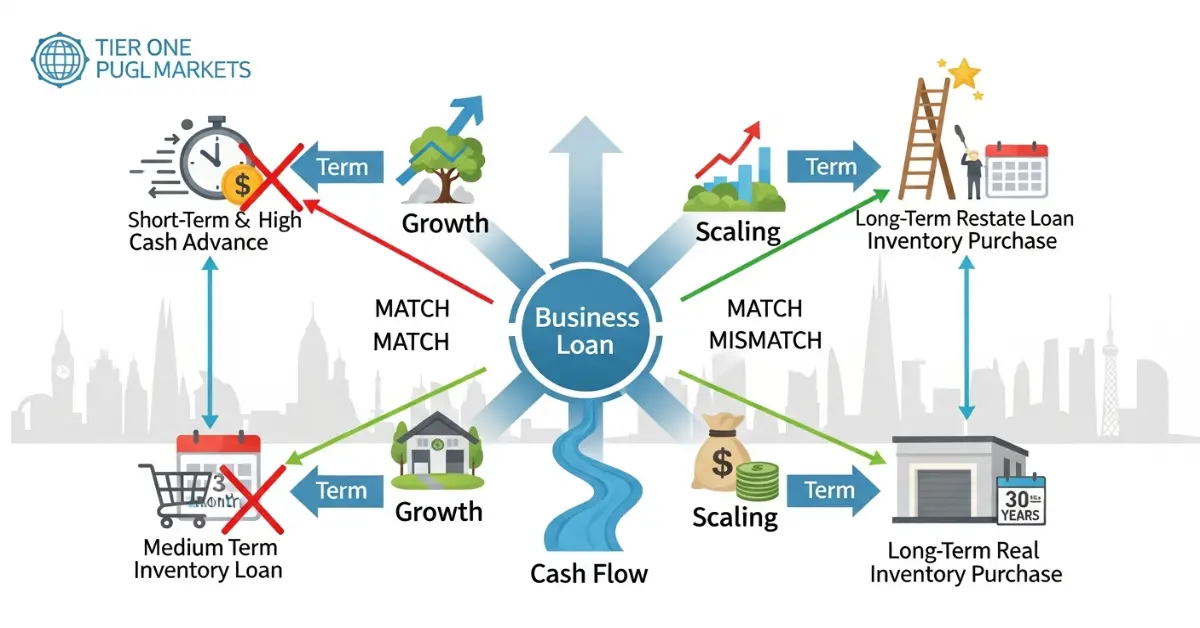

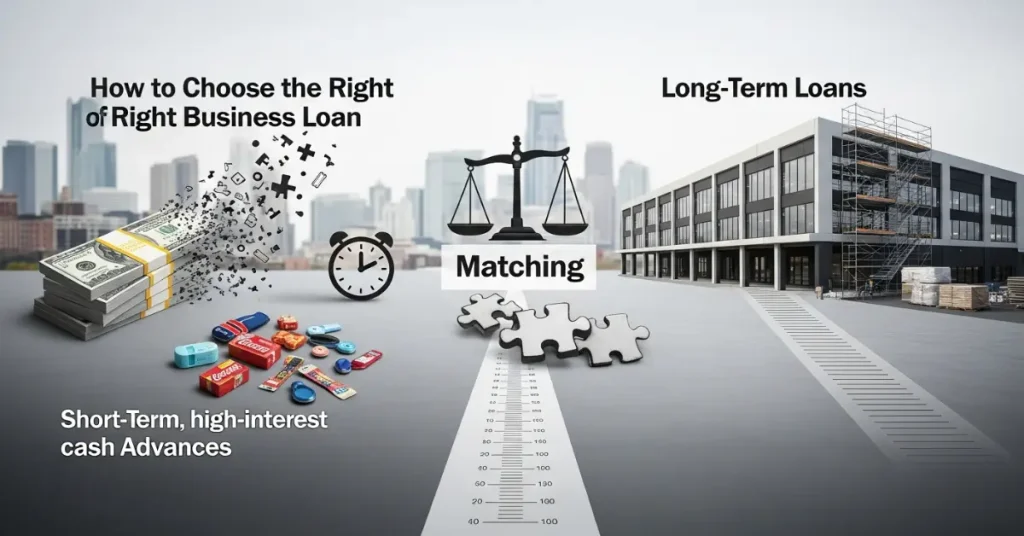

How to Choose the Right Business Loan for Growth, Cash Flow, and Scaling Goals in Tier One Markets

Selecting a loan isn’t just about getting money; it is about matching the “term” of the loan to the “life” of the asset. You should never use a short-term, high-interest cash advance to buy a warehouse that takes 30 years to pay off. Conversely, you shouldn’t take a 10-year loan to buy inventory you will sell in three months.

The Matching Principle

· Long-Term Assets (Real Estate): Use long-term mortgages (15-25 years).

· Medium-Term Assets (Equipment/Trucks): Use medium-term loans (3-7 years).

· Short-Term Needs (Inventory/Payroll): Use lines of credit or invoice factoring (6-12 months).

Case Study: Scaling Up in Sydney

Meet Liam, founder of “TechBuild”, a software firm in Australia.

Liam was looking to bring on three developers as he built a SaaS product. He projected that it would be able to start making money in 12 months. He also looked into a Merchant Cash Advance (MCA) since it was quick. The effective APR was, however, well over 40%, which would consume any future profits he could make. He decided to go with a Medium-Term Business Loan after consulting with the broker. And the three-year payback term allowed him to keep monthly payments low as the software gained traction. The call saved his business more than $30,000 AUD in interest payments.

ROI Calculation Strategy

Before signing, calculate the Return on Investment (ROI) of the loan.

$$ROI = \frac{Net Profit from Loan – Cost of Loan}{Cost of Loan} \times 100$$

If the loan costs you 10% in interest, but the project generates a 25% return, the debt is “good debt.” If the project only generates 5%, you are losing money.

| Business Goal | Recommended Loan Type | Why? |

| Buying Competitor | Government-Backed (SBA/CSBFP) | Long terms allow for easier cash flow management. |

| Seasonal Staffing | Revolving Line of Credit | is flexible; repay immediately when revenue hits. |

| Urgent Repairs | Short-Term Online Loan | Speed is prioritized over cost. |

| New Machinery | Equipment Financing | The asset secures the loan, lowering rates. |

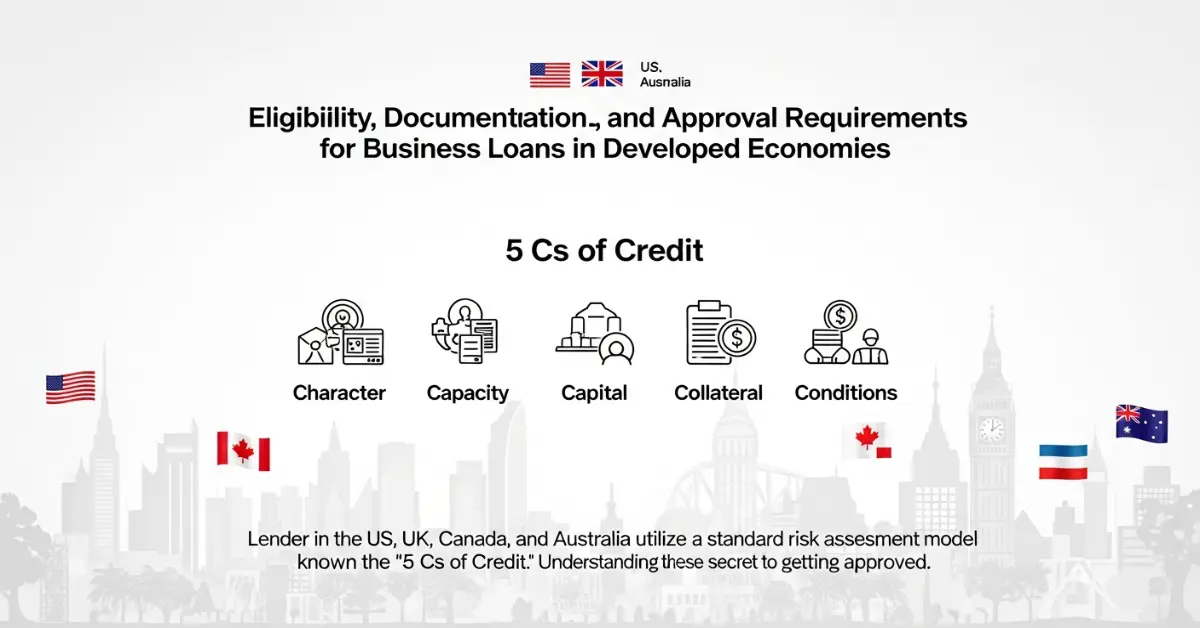

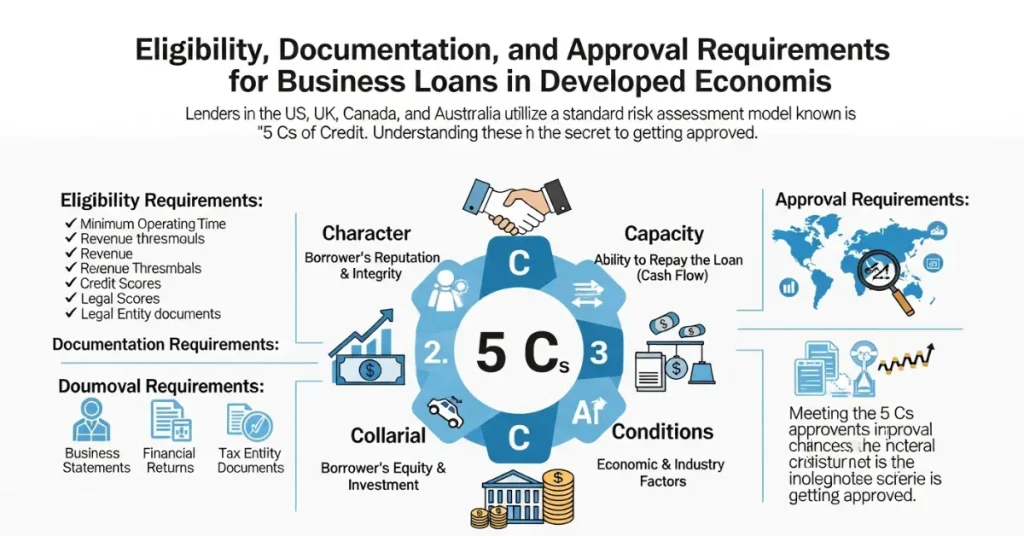

Eligibility, Documentation, and Approval Requirements for Business Loans in Developed Economies

Lenders in the US, UK, Canada, and Australia utilize a standard risk assessment model known as the “5 Cs of Credit.” Understanding these criteria is the secret to getting approved.

The 5 Cs of Credit

1. Capacity: Can you repay the loan? Lenders look at your Debt Service Coverage Ratio (DSCR).

2. Capital: How much of your own money is in the deal? (Skin in the game).

3. Collateral: What assets can they take if you default?

4. Conditions: How is the economy? How is your specific industry performing?

5. Character: Your personal and business credit history.

Essential Documentation Checklist

To speed up approval, have these digital folders ready:

· Identity: Passport/Driver’s License (All owners with >20% stake).

· Financials: Last 2-3 years of Business Tax Returns (IRS, CRA, HMRC, ATO).

· Bank Statements: Last 6-12 months of business bank statements.

· Legal: Articles of Incorporation, Business Licenses.

· The Plan: A solid business plan with financial projections (essential for startups).

Case Study: The Paperwork Win

Meet Elena, owner of a bakery in Toronto, Canada.

Elena applied for a generic bank loan but was rejected due to “lack of information.” She didn’t give up. She organized her P&L statements, updated her balance sheet to show recent equipment purchases, and wrote a one-page executive summary explaining exactly how the loan would increase revenue by 20%. She reapplied with a credit union. The loan officer noted that her clear documentation made the underwriting process easy. She received $75,000 CAD within ten days.

Common Eligibility Thresholds by Region

| Requirement | USA | UK | Canada | Australia |

| Time in Business | 2 Years+ | 1-2 Years | 2 Years+ | 1-2 Years |

| Credit Score | FICO 650+ | Experian 80+ | Equifax 650+ | Equifax 600+ |

| Annual Revenue | $100k+ | £50k+ | $75k+ | $75k+ |

Key Tip: New businesses (under 2 years) often need strong personal credit and collateral to compensate for the lack of business history.

SBA Loans, Term Loans, and Revolving Credit Lines Compared for Cost Efficiency and Risk Control

When you analyze cost efficiency, you must look beyond the monthly payment. You must look at the Total Cost of Capital.

SBA Loans (US Specific): The Small Business Administration guarantees a portion of the loan, which encourages banks to lend to “riskier” small businesses.

· Pros: Lowest interest rates and longest repayment terms (up to 10-25 years).

· Cons: The paperwork is intense, and approval can take months.

Traditional Term Loans: Offered by major banks (Chase, Barclays, RBC, Commonwealth Bank).

· Pros: Predictable monthly payments. Good for planned growth.

· Cons: Requires strong collateral and high credit scores.

Revolving Credit Lines:

· Pros: You pay interest only on what you use. Once you repay, the funds are available again.

· Cons: Variable interest rates can rise if the central bank raises rates.

Cost Efficiency Comparison Table

| Loan Type | Cost of Capital | Risk to Cash Flow | Best For… |

| SBA 7(a) | Low | Low (Long-term) | Large acquisitions, Real Estate. |

| Bank Term Loan | Medium | Medium | Expansions, Renovations. |

| Credit Line | Medium/High | Low (Flexible) | Inventory, Payroll, Emergencies. |

| Merchant Advance | Very High | High (Daily deductions) | Last resort / Ultra-fast needs. |

Expert Insight: “Don’t treat a line of credit like a piggy bank. It is for working capital smoothing, not for buying a new company car. Misuse leads to a debt trap.”

Business Loan Qualification and Digital Application Process for Faster Funding Decisions

The world of lending has split into two: Traditional Banks vs. Fintech Lenders.

Traditional Banks: They value relationships and history.

· Process: In-person meetings, physical paperwork, 4-8 weeks for funding.

· Best for: Established businesses seeking the lowest rates.

Fintech / Online Lenders: They value data and speed.

· Process: Connect your accounting software (QuickBooks, Xero) and bank account. Algorithms analyze your cash flow in real-time.

· Speed: Decisions in minutes, funding in 24-48 hours.

· Trade-off: You pay a premium (higher interest) for this speed and convenience.

Digital Application Steps

1. Pre-Qualification: Fill out a soft-pull form online (doesn’t hurt credit score).

2. Data Sync: Upload PDF bank statements or link your bank API.

3. Offer Review: Receive 2-3 offers with different terms.

4. Verification: Upload ID and corporate documents.

5. Funding: Funds wired via ACH or wire transfer.

Key Result: Digital lenders in the UK and US now fund over 30% of small business loans due to the ease of the application process compared to legacy banks.

Interest Rates, Origination Fees, and Flexible Repayment Terms for Sustainable Business ROI

The interest rate is the headline, but the APR (Annual Percentage Rate) is the real story. The APR includes the interest rate plus all fees.

Common Fees to Watch:

· Origination Fee: Charged upfront for processing the loan (usually 1% – 5%).

· Underwriting Fee: A flat fee for assessing risk.

· Prepayment Penalty: A fee for paying the loan off early (banks lose interest profit). Avoid this if possible.

Factor Rates vs. Interest Rates:

Some alternative lenders use “Factor Rates” (e.g., 1.2x). If you borrow $10,000 at a 1.2 factor rate, you owe $12,000. This sounds like 20% interest. However, if the term is only 6 months, the annualized APR is actually over 40%. Always convert factor rates to APR to compare apples to apples.

Fee Structure Breakdown

| Fee Type | Standard Bank Loan | Online Lender |

| Interest Rate | 7% – 12% | 10% – 35%+ |

| Origination | 0.5% – 2% | 2% – 6% |

| Prepayment Penalty | Common | Varies |

| Processing Time | Slow | Fast |

Expert Insight: “Always ask for the Truth in Lending disclosure. If a lender hides the APR and only talks about ‘daily payments,’ be extremely cautious.”

How Secured vs Unsecured Business Loans Work and Which Option is Best for Your Company

The difference comes down to collateral.

Secured Loans:

You pledge an asset (Real Estate, Inventory, Equipment, Cash Savings). If you default, the lender seizes the asset.

· Benefit: Lower interest rates, higher loan amounts, easier approval.

· Risk: You could lose your property.

Unsecured Loans:

No physical collateral is required. The lender relies on your creditworthiness and cash flow.

· Benefit: Your assets are safe (mostly—see Personal Guarantees). Faster approval.

· Risk: Higher interest rates, lower borrowing limits.

Which is Best?

· Choose Secured if you have assets and want the cheapest money for a large project.

· Choose Unsecured if you are a service business with few assets or need speed.

What to Know About Real Estate, Equipment, Inventory, and Working Capital Financing Models

Different loans serve different physical needs.

1. Commercial Real Estate Loans:

These are to warehouses, offices, or storefronts what home mortgages are to houses. Lenders typically demand a 20-30% down payment. Terms can extend to 25 years.

2. Equipment Financing:

It is the equipment that serves as collateral. This is ideal for a manufacturing, construction, or transportation company. With the lending bank able to simply take back and sell the equipment if you fail to make a payment, it can be easier to qualify for these loans with average credit.

3. Inventory Financing:

A short-term loan or line of credit is used to purchase securities. The inventory serves as collateral. But the lender might have to write down the inventory (e.g., 50% of its value) because stock is tough to liquidate.

4. Working Capital Loans:

For day-to-day operational needs only (Rent, payroll, utilities). They are typically unsecured and short-term.

Checklist:

· Real Estate: Do you have a recent appraisal?

· Equipment: Do you have the vendor invoice?

· Inventory: Do you have a current inventory aging report?

Online Lenders, Merchant Cash Advances, and Invoice Factoring Options for Digital-First Businesses

For businesses with high transaction volume or slow-paying clients, alternative financing shines.

Invoice Factoring:

You sell your unpaid invoices to a lender at a discount (e.g., 97%). You get cash now rather than waiting 60 days for your client to pay. The lender collects from your client.

· Best for: B2B companies, agencies, and wholesalers.

Merchant Cash Advances (MCA):

The lender advances a lump sum in exchange for a percentage of your future daily credit card sales.

· Best for: Restaurants and retail shops with high daily volume but bad credit.

· Warning: This is the most expensive form of capital. Use only in emergencies.

Online Term Loans:

Fixed-rate loans processed entirely online.

· Best for: E-commerce businesses and digital startups needing quick growth capital.

Pros and Cons of Major Business Financing Options for SMEs and Startups

Every financing option involves a trade-off between cost, speed, and risk.

· Traditional Bank Loans:

o Pros: Cheapest money, builds strong banking relationships.

o Cons: High rejection rates for startups, slow processing.

· Online/Fintech Loans:

o Pros: Fast, high approval rates, less paperwork.

o Cons: Higher APR, shorter repayment terms (pressure on cash flow).

· SBA / Government Schemes:

o Pros: Best terms, capped interest rates, counseling support.

o Cons: Bureaucratic hurdles, strict eligibility.

Bonus Note: Diversifying your financing is smart. Maintain a bank line of credit for emergencies while using equipment financing for machinery. Don’t rely on one source.

Loan Amount Ranges, Credit Score Minimums, and Business Funding Speed Benchmarks

Knowing where you stand helps you apply to the right place.

US Market Benchmarks:

· Bank Loan: $25k – $5M+ | FICO 680+ | 4-8 Weeks.

· Online Loan: $5k – $500k | FICO 600+ | 1-3 Days.

UK Market Benchmarks:

· Bank Loan: £25k – £1M+ | Good Business Credit | 3-6 Weeks.

· Alt Finance: £1k – £250k | Fair Credit | 24 Hours.

Canada/Australia Benchmarks:

· Major Banks: High scrutiny, prefer established businesses (2+ years).

· Alt Lenders: Rapidly growing sector filling the gap for loans under $100k.

Stat: In Tier One markets, alternative lending approval rates are approximately 60-70%, compared to traditional bank approval rates of 20-30% for small businesses.

Understanding Collateral, Personal Guarantees, and Risk Factors in Commercial Lending

Even if you have an LLC or Corporation, many small to medium-sized business lenders require a Personal Guarantee (PG).

What is a Personal Guarantee?

A legal commitment to pay the loan personally if the business is unable. This is the case for almost all small business loans.

UCC Liens (US) / GSA (Canada/Aus):

Lenders place a lien on your business assets. This tells other lenders that your assets have already been pledged. It prohibits you from securing multiple loans against the same collateral (“stacking”).

Risk Mitigation:

· Demand a “Limited” guarantee (limited to a dollar amount) instead of an “Unlimited” guarantee.

· Do not co-mingle business and personal funds to preserve the corporate veil.

Financial Advisors Share Proven Strategies to Build Business Credit for Future Loan Approvals

Building business credit separates your personal identity from your company. Advisors recommend opening a business credit card immediately and paying it off in full every month. Register with credit bureaus like Dun & Bradstreet (US), Experian Business (UK/US), or Equifax. Establish trade lines with vendors (like Uline or Quill) that report payments. A strong business credit profile allows you to secure loans without relying heavily on your personal FICO score, eventually leading to non-guaranteed financing options.

Banking Experts Explain Practical Methods for Improving Business Loan Approval Rates

Bankers want to see that you can manage cash flow, not just generate sales. Experts suggest maintaining a high average daily balance in your business bank account. Avoid overdrafts at all costs; they are red flags for risk. Before applying, pay down existing high-interest debt to improve your Debt Service Coverage Ratio (DSCR). Finally, nurture a relationship with a local branch manager. A human advocate inside the bank can often push a borderline application into the “approved” pile.

Industry Specialists Discuss Long-Term Relationship Building With Commercial Lenders

Lending is a relationship business. Specialists advise checking in with your lender even when you don’t need money. Share quarterly success updates. If you anticipate a cash flow dip, inform them before you miss a payment. This transparency builds trust. When you eventually need a large loan for a major expansion, that historical trust becomes your most valuable asset. Long-term borrowers often gain access to “prime” rates and VIP terms unavailable to new applicants.

FAQ:

What Is the Easiest Business Loan to Get for a Small Business?

The easiest loans to secure are usually short-term online loans, Merchant Cash Advances (MCAs), or equipment financing. These lenders focus on cash flow or collateral rather than credit history. If you have consistent revenue deposits or valuable equipment to buy, approval is often automated and happens within 24 hours. However, “easy” often means expensive. Always check the interest rates.

How Much Deposit or Equity Is Required for a Business Loan?

For equipment or vehicle loans, lenders often require 0% to 20% down. For commercial real estate, expect to put down 20% to 30%. For startup business loans (like SBA loans), lenders typically want to see a 10% to 20% equity injection from the owner. This “skin in the game” proves you are committed to the business’s success and lowers the lender’s risk.

How Hard Is It to Get Approved for a Business Loan in a Tier One Country?

It depends on the lender. Traditional banks in the US, UK, Canada, and Australia have strict criteria, rejecting about 70-80% of small business applications. They require high credit scores and collateral. However, the alternative lending market is robust. Fintech lenders approve closer to 60-70% of applicants but charge higher rates. Preparation of documents is the biggest factor in success.

Can a Start-Up LLC Qualify for Business Financing With Limited Revenue?

Yes, but options are limited. Traditional banks rarely lend to startups with no revenue. Startups usually rely on SBA microloans (US), government startup schemes (UK/Canada), business credit cards, or personal loans used for business. Lenders will weigh your personal credit score and personal income heavily since the business has no financial track record yet.

What Are Startup Business Loans With No Revenue or Collateral?

These are rare and difficult to find. Typically, they take the form of unsecured business lines of credit or business credit cards based on the owner’s personal creditworthiness (usually requiring a 700+ credit score). Some non-profit micro-lenders and community development financial institutions (CDFIs) offer small loans to startups without collateral to spur local economic growth.

How Do Small Business Loans Work for New Companies?

For new companies, loans operate largely based on the owner’s personal guarantee. You receive a lump sum or credit line. You make monthly payments comprising principal and interest. Because the business is “unproven,” terms are usually shorter (1-5 years) and interest rates are higher than for established firms. Consistent repayment builds the business credit history needed for better loans later.

What Are the Best Easy-Approval Startup Business Loans?

The best options for easy approval include Business Credit Cards (0% intro APR offers are great for startups), Equipment Financing (since the equipment secures the loan), and Microloans from non-profit organizations. In the US, SBA Microloans are accessible. In the UK, the Start Up Loan scheme is government-backed and designed specifically for new businesses with easier approval criteria.

Are There Business Loans Available for Bad Credit Applicants?

Yes. If you have bad credit, you must look at “revenue-based financing” or “asset-based lending.” Merchant Cash Advances (MCAs) do not care about credit scores; they only your daily sales volume. Invoice factoring relies on your customer’s credit, not yours. Equipment financing uses the machine as collateral, making your credit score less relevant. Expect significantly higher fees.

What Are SBA Loans and Who Qualifies?

SBA loans are U.S.-government-backed loans that reduce risk for banks. They offer low rates and long terms. To qualify for the popular 7(a) program, you must operate for profit in the US, have reasonable owner equity to invest, and have used alternative financial resources (including personal assets) before seeking financial assistance. They are the “gold standard” of US business lending.

Are There Guaranteed Startup Business Loans With Bad Credit?

No reputable lender offers a 100% “guarantee.” Beware of scams promising this. However, secured loans (where you pledge cash or a car) are the closest thing to guaranteed approval because the lender takes zero risk. If you have bad credit, offering substantial collateral is the only way to secure financing safely.

What Are No-Doc or Low-Documentation Business Loans?

“No-doc” loans are a misnomer; usually, they are “low-doc.” Instead of tax returns and P&L statements, you provide 3-6 months of bank statements. Algorithms analyze your cash flow to approve the loan. These are typically offered by fintech lenders. They are fast (funded in days) but carry higher interest rates to offset the risk of limited underwriting.