Best Place to Get a Personal Loan 2025: Low Rates & Fast Approval. Compare trusted lenders in the US, UK, Canada & Australia to find your perfect loan today.

Do you feel the pressure of a big event on your wallet? Planning a wedding, a doctor’s bill, or perhaps seeking to get out of a high-interest credit card debt? Getting a personal loan that is suitable for your requirements appears to be as difficult as getting out of a maze.

There is so much to choose from, so many unfamiliar words, and constantly lurking under the surface, the nightmare of an application denial. In the US, UK, Canada, and Australia, so many citizens get trapped in their analysis paralysis, concerned with picking a sneaky financier or an interest rate that will secure them in debt. They are spending hours cerebrally tormented, and when they finally find the ideal website, they are even less sure about their choice.

We have written this guide to clear up this confusion and provide you with the skills you need to borrow smoothly and confidently. We will show the truth you need to find the best personal loan in 2025. Put aside all that noise and follow our simple, clear instructions.

This article will arm you with the power to use Tier One markets to explore top lenders’ options, compare rates accurately, and unlock insider secrets to fast-tracking approval. Learn how to identify your exact needs, boost your application, and choose a loan that will fit your overall path. By the end of this reading, you will be prepared to find the exact personal loan you need at superior rates, with the quick funding you need to take the lead.

Best Place to Get a Personal Loan in 2025: A Comprehensive Guide

So, choosing the right lender is the single most important part of your personal loan journey. The market has options for high-street banks with long traditions to nimble online fintech companies. Each of them provides a unique balance of interest rates, fees, funding speed, and customer service.

The wrong choice can cost you thousands of dollars in additional interest payments or prop you up to the stringent terms. So, to find the best match, you need to understand the landscape, and m atch your personal financial needs to their strengths. Consider a mini case study. Sarah is a homeowner in Sydney, Australia, who needed $25,000 for a kitchen remodel. Her credit score was good but not perfect, and she wanted the money in a week to pay her contractor. Her first stop, her long-time traditional bank. But the application process was slow, and she could only make an in-person appointment.

She was irritated and decided to check online lenders. Thanks to a comparison site, she could gain pre-approval with three different online lenders in minutes without harming their credit score. One was slightly cheaper but promised funding in a day versus 24 hours for the most attractive one. Sarah weighed the minuscule difference in price against her need for speed. She filed the entire application online and got it 2 days later.

Result: Sarah’s story highlights that the “best” lender is subjective. For her, speed was paramount. For someone else, securing the absolute lowest interest rate might be worth a longer wait. The key is to identify your priorities before you start shopping.

| Lender Type | Typical APR Range (Illustrative) | Funding Speed | Best For |

| Online Lenders | 6% – 36% | 1-3 business days | Borrowers seeking speed, convenience, and competitive rates with good-to-excellent credit. |

| Traditional Banks | 7% – 25% | 3-7 business days | Customers with an existing banking relationship and a strong credit history. |

| Credit Unions | 5% – 18% | 2-5 business days | Members looking for lower interest rates and more flexible terms, especially those with fair credit. |

| Peer-to-Peer (P2P) Lenders | 8% – 30% | 3-7 business days | Borrowers who may not qualify for traditional loans but have a compelling story or profile. |

Key Takeaway: Don’t limit your search to just one type of lender. Online platforms have revolutionized the borrowing process, often providing faster and more competitive offers than traditional institutions. Always get quotes from at least three different sources to ensure you are getting the best possible deal.

How to Compare Personal Loan Rates Effectively and Secure the Best Deal in the US, UK, Canada, and Australia

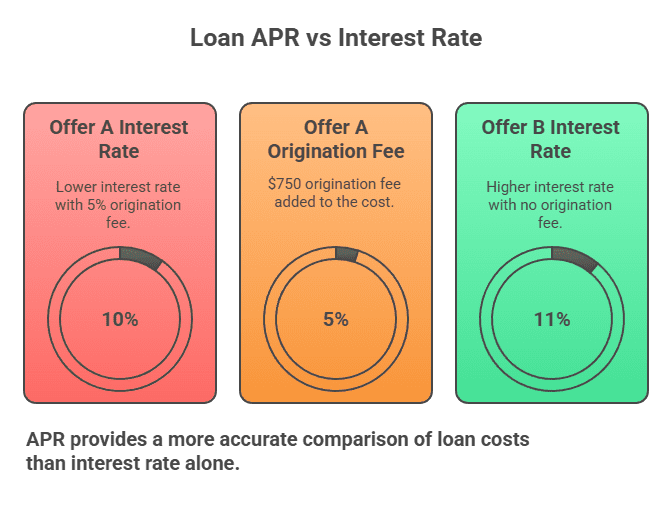

When you compare personal loans, it’s easy to focus only on the advertised interest rate. However, the true cost of a loan is reflected in its Annual Percentage Rate (APR). The APR includes not only the interest rate but also most of the fees associated with the loan, such as origination fees.

Ignoring the APR is a common mistake that can lead you to choose a loan that looks cheaper upfront but costs more over its lifetime. To secure the best deal, you must learn to look beyond the headline number and analyze the complete loan offer.

Imagine David, a software developer in Toronto, Canada, with $15,000 in high-interest credit card debt. He received two personal loan offers to consolidate it.

- Offer A: 10% interest rate with a 5% origination fee.

- Offer B: 11% interest rate with no origination fee.

Of course, at first glance, Offer A appears to be preferable due to the lower interest rate. Nevertheless, the 5% origination fee, amounting to $750, as well as the cost of the loan, must be taken into account.

Once these factors have been considered, the APR for Offer A will exceed that of Offer B by a large margin. David went with Offer B and saved himself several hundred dollars overall in the event of a five-year loan. He knew that a higher interest rate combined with fees would be more expensive than a fraction of an interest with zero fees. This example demonstrates the importance of APR-based loan comparisons.

Here’s how a small difference in APR can impact the total cost of a $15,000 loan over five years:

| Annual Percentage Rate (APR) | Monthly Payment | Total Interest Paid | Total Cost of Loan |

| 8.0% | $304 | $3,249 | $18,249 |

| 8.5% | $308 | $3,475 | $18,475 |

| 9.0% | $311 | $3,704 | $18,704 |

| 9.5% | $315 | $3,898 | $18,898 |

Key Tip: Always use the APR as your primary comparison point. Lenders in the US (Truth in Lending Act), UK (Consumer Credit Act), and other Tier One markets are legally required to disclose the APR, giving you a standardized way to compare the total cost of different loan products. Also, be sure to ask about prepayment penalties, which are fees charged if you pay off your loan early. An ideal loan has no such penalty.

When Is the Right Time to Apply for a Personal Loan? Timing Your Application for Optimal Rates in Tier One Regions

Getting the right deal on the best personal loan is not just a matter of where you apply but when. Your money situation is not the only factor to take into account; general economic conditions also play a role in how much interest you will be charged.

Even waiting a few weeks to apply for a loan can save you thousands of pounds. Hitting submit while your financial profile is weak or central banks are considering locking the loan at ever-increasing rates for years would make you pay more for it. Although timing is a part of the loaning process, it is also essential, but most people do not have it in mind. Consider Maria from Manchester, UK.

She’d like to receive a £10,000 loan to take a postgraduate course at the University of Manchester. Her initial check showed she would likely qualify for a rate of around 12% APR due to a credit score that was “fair” but not “good.” Instead of applying immediately, she decided to wait six months. During that time, she focused on two things:

- Making all her payments on time.

- Paying down the balance on her highest-limit credit card to reduce her credit utilization ratio.

After six months, her credit score jumped by 40 points, moving her into the “good” credit category. When she applied again, she was offered a rate of 8.5% APR. This strategic delay saved her over £800 in interest over the life of her five-year loan.

| Scenario | Credit Score | Offered APR | Monthly Payment (5-Year Term) | Total Interest Paid |

| Apply Now | Fair (650) | 12.0% | £222 | £3,347 |

| Wait 6 Months | Good (690) | 8.5% | £205 | £2,305 |

| Result | +40 points | -3.5% | -£17/month | £1,042 Savings |

Key Takeaway: Your credit profile is the single most important factor you can control. If your loan is not urgent, investing a few months to improve your credit score can yield significant savings. Keep an eye on economic trends as well. When central banks like the U.S. Federal Reserve or the Bank of England are lowering interest rates, lenders often pass those savings on to consumers, making it a more favorable time to borrow.

Key Factors That Affect Your Personal Loan Eligibility and Improve Your Chances of Approval

Did you ever wonder what the lenders are really looking at when reviewing your personal loan application? It is not a mystery. Lenders in the United States, United Kingdom, Canada, and Australia look at a consistent set of data points that help them understand your risk as a borrower.

Knowing these factors is the first step towards creating a stronger application. More importantly, it increases your chances of getting approval by an order of magnitude. By successfully managing these key metrics, you go from a borderline applicant to a prime finance solution that lenders are eager to engage. Okay, let’s take Liam, who lives in Austin, Texas.

The first time Liam had applied for a $10,000 debt consolidation loan, he got a rejection from the lender, whose feedback mentioned Liam’s high DTI or debt-to-income ratio. Liam’s DTI was 45%, which meant nearly half of his gross monthly income had gone to paying off existing debt. Liam was disappointed, but he didn’t give up. He utilized a small bonus received at work to pay off a $3,000 credit card balance. This move alone sent his DTI to 38%.

In just two months, Liam reapplied with the same lender and scored the loan at a competitive rate. Liam’s example proves a simple, targeted financial move can make all the difference. Lenders want to see that you are comfortable paying back their money on top of your existing obligations.

Here is a checklist of the primary factors lenders evaluate:

| Eligibility Factor | What It Is | Ideal Range (General Guideline) | How to Improve It |

| Credit Score | A number representing your creditworthiness based on your payment history. | 670+ (US), “Good” or “Excellent” rating (UK/AU) | Pay all bills on time, keep credit card balances low. |

| Debt-to-Income (DTI) Ratio | The percentage of your gross monthly income that goes to debt payments. | Below 36% | Pay down existing debts, increase your income. |

| Employment History & Income | The stability and amount of your income. Lenders need to see you can afford payments. | Stable employment for 1-2 years | Maintain steady employment, document all sources of income. |

| Credit History Length | The age of your credit accounts. A longer history shows more experience managing credit. | 7+ years | Avoid closing old credit card accounts, even if you don’t use them. |

Key Tip: Before you submit a formal application, use a lender’s free pre-qualification tool. This process uses a soft credit check, which does not impact your credit score, to give you an idea of the loan amount and rate you might qualify for. It’s a risk-free way to gauge your eligibility.

How Quickly Can You Get Approved for a Personal Loan? Fast-Tracking Your Application in the US, UK, and Canada

If you need the money urgently, for any reason – be it a medical emergency or a unique opportunity that you cannot afford to miss, you will often find that time is of the essence.

Nowadays, with the personal loan spaces evolving rapidly, you do not have to wait for weeks to receive a decision. Numerous online lenders will confirm your application within minutes and transfer the funds to your account in under 24 hours. Therefore, understanding the process while preparing all the necessary documents in advance can help you access the cash you need with no delays.

For example, Chloe is an entrepreneur from Vancouver, Canada. Her primary and the only business computer suddenly failed. As a result, she needed $3,500 to replace it, and it had to be refilled in no time to maintain business continuity. If she went to her usual bank, she would likely have been without any instrument for several days.

However, Chloe relied on an online lender that specialized in efficient funding. The woman filed an application on her smartphone iPhone for 15 minutes, attached photos of recent paychecks and her ID, and received a notification of approval within 60 minutes. She signed the consent contract electronically; the funds reached her account the next day.

Chloe’s case highlights the efficiency of the modern online lending process. For borrowers who are prepared, the path from application to funding can be incredibly swift.

Here’s a comparison of typical funding timelines:

| Lender Type | Application Process | Approval Time | Funding Time |

| Online Lenders | Fully digital, automated verification. | Minutes to a few hours. | Same day to 3 business days. |

| Traditional Banks | Often requires branch visits, manual review. | 2 to 5 business days. | 3 to 7 business days. |

| Credit Unions | Mix of online and in-person, member-focused review. | 1 to 3 business days. | 2 to 5 business days. |

How to Fast-Track Your Application:

- Gather Your Documents: Have digital copies of your government-issued ID (driver’s license, passport), recent pay stubs or tax returns, and bank statements ready to upload.

- Check Your Credit: Review your credit report beforehand to ensure there are no errors that could cause delays.

- Provide Accurate Information: Double-check all personal details (name, address, income) on your application to avoid verification issues.

- Be Responsive: Keep an eye on your email and phone after applying in case the lender needs additional information.

Understanding Interest Rates and APR for Personal Loans: What You Need to Know for Smart Borrowing

When you take out a personal loan, you’re not just repaying the amount you borrowed; you’re also paying for the service of borrowing that money. The two most important terms that define this cost are the Interest Rate and the Annual Percentage Rate (APR). While they sound similar, they represent different things, and understanding the distinction is crucial for making an informed financial decision. Mistaking one for the other can lead you to underestimate the total cost of your loan.

Think of it like this: the Interest Rate is the price of the product itself—the direct cost of borrowing the money. The APR, on the other hand, is the total price tag after you add in “shipping and handling”—it includes the interest rate plus most of the lender’s fees, such as origination fees or closing costs. This makes APR the more accurate and comprehensive measure of a loan’s true cost.

Let’s break down a hypothetical $10,000 loan to see how this works:

| Loan Component | Description | Example Cost |

| Principal | The amount you borrow. | $10,000 |

| Interest Rate | The percentage charged on the principal. Let’s say it’s 9%. | Varies over the loan term |

| Origination Fee | An upfront fee deducted from the loan amount or added to the principal. Let’s say it’s 3% ($300). | $300 |

| Annual Percentage Rate (APR) | The total cost, including the interest rate and the origination fee, expressed as an annual percentage. | ~10.2% |

In this example, even though the interest rate is 9%, the upfront fee makes the loan more expensive. The APR of 10.2% reflects this and gives you a much clearer picture of what you’ll actually pay.

Another key concept is Fixed vs. Variable Rates.

- Fixed Rate: The interest rate remains the same for the entire loan term. Your monthly payments are predictable and won’t change. This is the most common type for personal loans and is ideal for budgeting.

- Variable Rate: The interest rate can fluctuate over time based on changes in a benchmark index rate. Your monthly payments could rise or fall, introducing uncertainty. These are less common for unsecured personal loans but are sometimes offered.

Key Takeaway: Always use the APR to compare loan offers from different lenders. It provides an apples-to-apples comparison of the total borrowing cost. And for predictable budgeting, a fixed-rate loan is almost always the safer choice.

Online Lenders vs. Traditional Banks: Which is Best for Personal Loans in the US, UK, and Australia?

In conclusion, deciding between an online lender and a traditional bank is one of the major points of choice when it comes to a personal loan. For years, banks were the only way out, but with the development of financial technology, a new class of online-only lenders emerged, offering faster and more convenient loan options.

At the same time, traditional banks have their advantages, especially the developed relationships with their clients and in-person service. As a result, the perfect choice can only be made based on personal priorities, credit profile, and the desired time frame for having the funding at hand.

Online Lenders operate entirely on the internet, which means they have lower overhead costs than banks with physical branches. They often pass these savings on to borrowers in the form of competitive interest rates. Their application processes are streamlined and automated, allowing for near-instant decisions and funding within 1-2 business days. This makes them ideal for tech-savvy borrowers who value efficiency and speed.

Traditional Banks, on the other hand, offer the benefit of a personal relationship. If you already have a checking or savings account with a bank, you might be eligible for loyalty rate discounts. They provide face-to-face service, which can be comforting for those who prefer to discuss their finances in person. However, their approval processes are typically slower and may involve more stringent underwriting criteria.

Here’s a direct comparison:

| Feature | Online Lenders | Traditional Banks |

| Application Process | 100% online, fast and convenient. | Often requires an in-person visit or phone call. |

| Approval & Funding Speed | Minutes to hours for approval; 1-3 days for funding. | Days to a week for approval; up to 7 days for funding. |

| Interest Rates (APR) | Often more competitive, especially for excellent credit. | Can be competitive, particularly for existing customers. |

| Customer Service | Primarily via email, chat, or phone. | In-person branch support and dedicated loan officers. |

| Flexibility | May have more lenient criteria for some borrowers. | Often have stricter, more traditional requirements. |

Expert Insight:

According to financial advisor Jane Mitchell, “For the majority of borrowers with good credit in 2025, online lenders are the superior choice for unsecured personal loans. The convenience and rate competition are hard to beat. However, if you have a complex financial situation or a long-standing, positive relationship with your local bank, it’s always worth starting there to see if they can offer you preferential terms.”

Result: Start your search with online lenders to benchmark the best rates and fastest service available, but don’t rule out your current bank, especially if you’re a long-term customer in good standing.

Steps to Check Your Credit Before Applying for a Personal Loan and Increase Your Approval Odds

Applying for a personal loan without knowing your credit score is akin to embarking on a road journey without a map – you do not understand where you are standing or whether you are making ground.

Credit reports and the scores produced from them are the primary instruments used by creditors to figure out whether they are ready to lend you their money and to what rate of interest. It is imperative that you examine your credit before you apply.

It is your sole means of identifying bugs before they impact your credit, assessing your financial footing, and addressing whatever weak points that may lead to outright rejection or a high-interest proposal. This one move can result in more than doubled odds of success and could save you hundreds upon thousands.

The process is straightforward and, in most Tier One countries, you are entitled to free access to your reports.

Step-by-Step Guide to Checking Your Credit:

- Identify Your Region’s Credit Bureaus:

- United States: Equifax, Experian, and TransUnion. Get free reports from all three at AnnualCreditReport.com.

- United Kingdom: Equifax, Experian, and TransUnion. You can access reports through services like Credit Karma, ClearScore, and MoneySuperMarket.

- Canada: Equifax and TransUnion. You can request free reports by mail or access them online through various partner services.

- Australia: Equifax, Experian, and Illion. You are entitled to a free report from each bureau once per year.

- Request Your Free Reports: Visit the official websites or recommended services for your country. The process is secure and requires you to verify your identity.

- Review Each Report Carefully: Look for three key things:

- Personal Information Errors: Ensure your name, address, and social security/insurance number are correct.

- Account Inaccuracies: Check that all listed accounts are yours. Look for late payments that you believe were made on time or accounts that are not yours (a sign of fraud).

- Negative Items: Note any collections, charge-offs, or bankruptcies and ensure the details are accurate.

- Dispute Any Errors: If you find a mistake, you have the legal right to dispute it. Contact the credit bureau and the creditor directly to have the error investigated and removed. This single step can sometimes boost your score significantly.

Expert Insight:

“The most common surprise for first-time loan applicants is an error on their credit report they never knew existed,” notes consumer finance expert David Chen. “A 20-minute review a few months before applying can be the difference between a 7% APR and a 15% APR. It’s the highest-return investment of time a borrower can make.”

Takeaway: Checking your credit is a free and powerful way to take control of your financial narrative before presenting it to a lender.

Budgeting for Monthly Personal Loan Payments and Finding the Right Loan Amount for Your Needs

Borrowing money is easy; paying it back is the hard part. Before you even apply for a personal loan, it’s essential to determine exactly how much you need and confirm that you can comfortably afford the monthly payments. Over-borrowing can strain your budget and lead to financial distress, while under-borrowing may not solve the problem you needed the funds for in the first place. A careful and honest assessment of your budget is the foundation of responsible borrowing.

The first step is to calculate the precise amount you need. If it’s for debt consolidation, add up all the balances you intend to pay off. For a home improvement project, get detailed quotes from contractors. Don’t just guess—a specific number prevents you from borrowing too much.

Next, determine how a new loan payment fits into your monthly budget. A popular guideline is the 50/30/20 rule:

- 50% of your after-tax income for Needs (housing, utilities, transportation, groceries).

- 30% for Wants (dining out, entertainment, hobbies).

- 20% for Savings & Debt Repayment (retirement, emergency fund, credit cards, and your new loan payment).

Your new personal loan payment should fit comfortably within that 20% category alongside your other savings and debt obligations. If a new payment pushes you far beyond this threshold, you may be taking on too much debt.

The loan term also plays a huge role in the monthly payment amount. A longer term means lower monthly payments, but you’ll pay more in total interest. A shorter term results in higher payments but saves you significant interest.

Impact of Loan Term on a $15,000 Loan at 9% APR:

| Loan Term | Monthly Payment | Total Interest Paid | Total Repaid |

| 3 Years (36 Months) | $477 | $2,183 | $17,183 |

| 5 Years (60 Months) | $311 | $3,704 | $18,704 |

| 7 Years (84 Months) | $242 | $5,364 | $20,364 |

As you can see, extending the term from 3 to 5 years lowers the payment by $166 per month, but costs you an extra $1,521 in interest.

Expert Insight:

“Always choose the shortest loan term you can comfortably afford,” advises financial planner Maria Rodriguez. “It forces discipline and saves you a substantial amount of money in the long run. The goal should be to get out of debt as efficiently as possible, not to stretch it out.”

Finding the Best Personal Loans for Debt Consolidation to Save Money and Reduce Interest

Chances are if you are keeping up with them, or even if you are not, keeping track between the minimum monthly payments and the interest charges is a losing battle. For those with daunting amounts of high-interest debt, such as credit cards or store cards, a debt consolidation loan is one solution to help one take back control and save one money along the way.

The concept is straightforward: you get a personal loan that is new and at a lower rate and utilize the cash to pay off all your high-interest debts. You have a singular, low-interest monthly payment to make as a result of this.

The primary benefit is cost savings. The average credit card interest rate in markets like the US and UK can hover around 20% or more. A personal loan for a borrower with good credit could have an APR between 7% and 12%. This difference in rates can translate into thousands of dollars saved over the life of the loan. It also helps protect your credit score by making it easier to manage payments and avoid missed deadlines.

Let’s look at a simple before-and-after scenario:

| Before: Multiple Debts | Balance | APR | Monthly Payment |

| Credit Card 1 | $6,000 | 22% | $200 |

| Credit Card 2 | $4,000 | 19% | $150 |

| Store Card | $2,000 | 25% | $100 |

| Total | $12,000 | ~21.5% (Avg.) | $450 |

Now, let’s consolidate this with a personal loan:

| After: One Consolidation Loan | Balance | APR | Monthly Payment (5-Year Term) |

| Personal Loan | $12,000 | 9% | $249 |

| Monthly Savings | $201 | ||

| Total Interest Savings (approx.) | ~$4,500 |

Expert Insight:

“The key to successful debt consolidation is commitment,” warns credit counselor John Davis. “Once you’ve paid off your credit cards with the loan, you must resist the temptation to run up new balances. Cut up the old cards or put them away. The loan gives you a clear path out of debt, but only if you change the spending habits that created the debt in the first place.”

Takeaway: A debt consolidation loan can be an excellent strategy to lower your interest costs and simplify your finances. Look for lenders that offer direct payment to creditors, as this streamlines the process and ensures the old debts are closed out efficiently.

Loans for Home Improvement and Major Expenses: How to Finance Your Project with Personal Loans

Creating the cash upfront needed to take on massive home renovations, cash a wedding, or finance significant medical treatment may be difficult. A personal loan is a simple and fast approach to finance large projects without utilizing home equity.

A personal loan is not secured, unlike a home equity line of credit or a home equity loan. These are loans that you do not need to make a pledge. As a result, they are less risky, making them an attractive option for most homeowners and an option for renters. Projects with a specific cost are ideal for personal loans.

Remodeling a bathroom, replacing an outdoor, or landscaping an outdoor backyard are all good examples. Because you are given the funds all at once, you will know how much you can spend. Interest rates and payments are set, which means you can get the project cost over a specified period. Typically, personal loans are in the range of 2 to 7 years. Given that credit cards have variable rates and easy access to overspending can be a dangerous mix, this is a significant benefit.

Here’s how personal loans stack up against other financing options for a home improvement project:

| Financing Option | Collateral Required? | Funding Speed | Interest Rates | Best For |

| Personal Loan | No | 1-5 days | Fixed, can be competitive. | Projects under $50,000/£40,000, speed, and simplicity. |

| HELOC | Yes (Your Home) | 2-4 weeks | Variable, usually lower than personal loans. | Ongoing projects with uncertain costs; access to a revolving credit line. |

| Credit Card | No | Instant (if you have one) | Very high, especially if not a 0% intro offer. | Small expenses under $2,000 or emergency purchases. |

Expert Insight:

“Before you apply for a personal loan for home improvement, get at least three detailed quotes from contractors,” advises construction financing expert Sarah Jenkins. “Lenders will want to know the purpose of the loan, and having a clear, well-defined project scope shows you’re a responsible borrower. It also ensures you borrow the right amount—not too little that you can’t finish, and not so much that you’re left with unused, interest-accruing cash.”

Takeaway: For financing major, one-time expenses, a personal loan provides a perfect blend of speed, simplicity, and predictable repayment terms, making it a popular choice in the US, UK, Canada, and Australia.

Tips to Secure Lower Rates Based on Your Credit Score and Financial Profile

The interest rate you’re offered on a personal loan isn’t set in stone; it’s a direct reflection of how risky a lender perceives you to be. A higher risk profile equals a higher interest rate. The good news is that you have significant control over the factors that build this profile. By taking a few strategic steps before you apply, you can present yourself as a low-risk borrower and unlock the most competitive rates available, potentially saving you thousands of dollars.

Your credit score is the most influential factor. Lenders use it as a quick summary of your financial reliability. Even a small increase in your score can move you into a better rate tier.

Actionable Tips for a Lower APR:

- Boost Your Credit Score:

- Pay Every Bill on Time: Payment history is the largest component of your score.

- Lower Your Credit Utilization: Pay down credit card balances to below 30% of your total limit.

- Check for Errors: Dispute any inaccuracies on your credit reports.

- Decrease Your Debt-to-Income (DTI) Ratio: Lenders want to see that you have ample income to cover a new payment. Pay off smaller debts or increase your income (if possible) before applying.

- Opt for a Shorter Loan Term: A 3-year loan is less risky for a lender than a 7-year loan. If you can afford the higher monthly payment, a shorter term will almost always come with a lower APR.

- Consider a Secured Loan: If you have an asset like a car or savings account, you can offer it as collateral. Secured loans are less risky for lenders and therefore have much lower interest rates, but you risk losing the asset if you default.

- Apply with a Co-signer: If your credit is fair, applying with a co-signer who has excellent credit and a strong income can help you qualify for a much better rate. However, the co-signer is legally responsible for the debt if you fail to pay.

Impact of a Co-signer on a $20,000 Loan Offer:

| Applicant Profile | Credit Score | Offered APR | Monthly Payment (5-Year Term) |

| Applicant Alone | Fair (660) | 15% | $476 |

| Applicant with Co-signer | Excellent (780) | 8% | $406 |

| Result | -7% | $70/month savings |

Takeaway: Don’t just accept the first rate you’re offered. Invest time in strengthening your financial profile before you apply. Even a few small adjustments can lead to significant long-term savings.

Personal Loans Without Tying Up Your Home Equity: How to Access Funds Safely

Many people needing funds for a large expense automatically think of home equity loans. However, using your home as collateral comes with a significant risk: if you fail to make payments, the lender can foreclose on your property. Unsecured personal loans offer a powerful and safer alternative. Because they are not tied to any asset, your home, car, and other possessions are never on the line. This peace of mind is one of the most compelling reasons borrowers in the US, UK, and Australia choose this financing route.

Key Checklist for Safe Borrowing:

- Borrow Only What You Need: Calculate the exact amount required for your project or expense to avoid unnecessary debt.

- Confirm Affordability: Ensure the monthly payment fits comfortably within your budget without straining your ability to cover other essential costs.

- Choose a Fixed Rate: Opt for a fixed-rate loan to guarantee your payments will not increase over time, making budgeting simple and predictable.

- Read the Fine Print: Understand all terms, including the APR and any potential fees for late payments or origination.

- Avoid Prepayment Penalties: Select a lender that allows you to pay off the loan early without incurring extra charges. This gives you the flexibility to become debt-free faster if your financial situation improves.

Top Lenders with Fast Funding and Minimal Fees: Get Your Personal Loan Approved Quickly

In today’s fast-paced world, waiting a week for loan approval is no longer practical for many. Online lenders have capitalized on this need, building streamlined platforms that offer instant decisions and funding in as little as 24 hours. The key to their speed is technology, which automates identity verification, income checks, and credit assessment. Furthermore, the most competitive lenders attract customers by minimizing or eliminating common fees.

What to Look for in a Fast, Low-Fee Lender:

- No Origination Fees: Many top-tier online lenders do not charge this upfront fee, which can save you 1-8% of the loan amount.

- No Prepayment Penalties: This gives you the freedom to pay off your loan ahead of schedule without being penalized.

- Transparent APR: The lender should clearly state the full APR, so there are no surprises about the total cost.

- Same-Day or Next-Day Funding: Look for lenders that explicitly advertise their rapid funding capabilities.

Key Tip: To ensure a speedy process, have digital copies of your ID, proof of address, and recent pay stubs ready to upload when you begin your application.

How Loan Terms Affect Your Repayment Schedule: A Detailed Guide for Smart Borrowing in Tier One Countries

The loan term—the length of time you have to repay your loan—is one of the most important decisions you’ll make. It directly impacts both your monthly payment amount and the total interest you’ll pay over the life of the loan. Lenders in the US, UK, Canada, and Australia typically offer personal loan terms ranging from 24 to 84 months (2 to 7 years).

Short-Term Loans (2-3 Years):

- Pros: You pay significantly less total interest and become debt-free faster.

- Cons: Monthly payments are much higher.

- Best for: Borrowers with strong cash flow who want to minimize borrowing costs.

Long-Term Loans (5-7 Years):

- Pros: Monthly payments are much lower and more manageable, freeing up cash for other needs.

- Cons: You will pay substantially more in total interest over the life of the loan.

- Best for: Borrowers who need the lowest possible monthly payment to fit their budget.

Example: On a $10,000 loan at 10% APR:

- 3-Year Term: Monthly payment is ~$323; total interest is ~$1,616.

- 5-Year Term: Monthly payment is ~$212; total interest is ~$2,748.

Takeaway: Choose the shortest term with a monthly payment you can comfortably afford to save the most money.

Micro-CTA: Use our loan term calculator to see how different repayment schedules impact your monthly budget. →

Understanding Unsecured vs. Secured Personal Loans and Which is Right for You

Personal loans come in two main types: unsecured and secured. The right choice for you depends on your credit profile, your risk tolerance, and the assets you own.

Unsecured Personal Loans:

- How they work: These loans are granted based on your creditworthiness (credit score, income, etc.). They do not require you to pledge any collateral.

- Pros: Your assets are not at risk. The application process is typically faster and simpler. This is the most common type of personal loan.

- Cons: Interest rates are generally higher because the lender takes on more risk. You need a decent credit score to qualify.

- Best for: Borrowers with good to excellent credit who want a fast, straightforward loan without putting their assets on the line.

Secured Personal Loans:

- How they work: You must provide an asset, such as a car or a savings account, as collateral for the loan.

- Pros: They are easier to qualify for, especially with fair or poor credit. Interest rates are significantly lower.

- Cons: If you default on the loan, the lender can seize your collateral. The application process may be longer.

- Best for: Borrowers with less-than-perfect credit or those who want to secure the lowest possible interest rate and are comfortable with the associated risk.

Benefits of Applying Online for Personal Loans: Faster Approval and Convenient Processes

The days of taking time off work to visit a bank branch and fill out stacks of paperwork are over. Applying for a personal loan online has become the preferred method for millions of borrowers in Tier One countries due to its unparalleled convenience, speed, and competitive nature. The entire process, from comparing offers to signing the final agreement, can be done from your computer or smartphone.

Top Benefits of Applying Online:

- Speed: Automated systems can pre-approve you in minutes and deliver funds in as little as 24 hours.

- Convenience: Apply anytime, anywhere, 24/7. There’s no need to schedule appointments or wait in line.

- Easy Comparison: Online marketplaces allow you to receive and compare offers from multiple lenders at once without impacting your credit score.

- Competitive Rates: Lower overhead costs for online lenders often translate into lower APRs and fewer fees for borrowers.

- Transparency: Reputable online lenders clearly display their rates, terms, and fees, making it easy to understand the total cost.

Key Tip: The best way to leverage the online process is to use a loan comparison website. This allows you to fill out one simple form and see potential offers from a network of trusted lenders instantly.

Key Features to Compare When Choosing a Lender: Find the Best Loan Terms for Your Financial Goals

When you’re faced with multiple loan offers, looking beyond the monthly payment is crucial to finding the best deal. A comprehensive comparison involves evaluating several key features that determine the loan’s overall cost, flexibility, and suitability for your financial goals.

Checklist for Comparing Loan Offers:

- Annual Percentage Rate (APR): This is the most important number. It represents the total annual cost of borrowing, including interest and fees. Use it to make a true apples-to-apples comparison.

- Loan Term: How long do you have to repay the loan? Ensure the term provides a monthly payment you can afford but isn’t so long that you pay excessive interest.

- Fees: Are there origination fees (charged upfront), late payment fees, or prepayment penalties (for paying the loan off early)? A loan with zero fees is ideal.

- Funding Speed: How quickly will you receive the money after approval? This is critical if your financial need is urgent.

- Lender Reputation: Read reviews from other borrowers on sites like Trustpilot. Check for customer service ratings and any complaints filed with regulatory bodies.

- Customer Support: Does the lender offer accessible and helpful customer service via phone, chat, or email if you run into any issues?

Borrowers with Excellent Credit: How to Get the Best Rates and Maximize Your Loan Amount

If you have an excellent credit score (typically 760+ in the US or an equivalent high rating in the UK, Canada, and Australia), you are in the driver’s seat. Lenders see you as a very low-risk borrower and will compete for your business. This allows you to command the lowest interest rates, highest loan amounts, and most favorable terms. To leverage this position, shop aggressively. Don’t just accept the first offer. Use online comparison tools to get pre-qualified offers from at least three to five top-tier lenders. You can often use a competitive offer from one lender as leverage to negotiate an even better rate from another. Also, look for lenders that offer exclusive perks for top-tier credit, such as zero origination fees or rate-beat guarantees.

Managing Personal Loan Payments Alongside Other Debts: Practical Tips for Tier One Borrowers

Successfully managing a new personal loan payment requires integrating it into your existing financial landscape. Start by updating your monthly budget to include the new fixed payment. The best strategy is to automate the payment by setting up a direct debit from your checking account. This ensures you never miss a payment, protecting your credit score. If possible, use the “debt avalanche” (paying off highest-interest debt first) or “debt snowball” (paying off smallest balances first) method to tackle your remaining debts. By maintaining a clear view of all your financial obligations, you can stay organized and reduce financial stress.

Using Personal Loans to Consolidate Credit Card Debt: A Smart Financial Move

Consolidating high-interest credit card debt into a single personal loan is one of the most effective strategies for getting out of debt faster and saving money. The average credit card APR can exceed 20%, while a personal loan for a borrower with good credit might be half that. This interest rate reduction means more of your monthly payment goes toward reducing the principal balance rather than just servicing interest. The result is a clear end date for your debt and significant savings. For this strategy to be successful, you must commit to not running up new balances on the now-cleared credit cards.

How the Economy Can Influence Your Loan Options and Impact Your Approval Chances

Broader economic conditions play a significant role in the lending market. When central banks (like the U.S. Federal Reserve or the Bank of England) raise benchmark interest rates to combat inflation, personal loan rates also tend to rise. Conversely, in a weaker economy where central banks lower rates to stimulate growth, loan rates become more affordable. During times of economic uncertainty or recession, lenders may also tighten their approval criteria, making it harder for borrowers with fair or borderline credit to qualify. If possible, try to borrow when rates are low and lender confidence is high.

When Prepayment Penalties Apply and How to Avoid Them for Better Loan Management

A prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan ahead of schedule. Lenders charge this fee to compensate for the interest they lose when you repay the loan early. Fortunately, this practice has become less common, especially among reputable online lenders. To avoid this fee, simply read the loan agreement carefully before signing. The “Truth in Lending” disclosures will clearly state whether a prepayment penalty exists. Always choose a lender that explicitly advertises “no prepayment penalties.” This provides you with the valuable flexibility to pay off your debt faster if you receive a bonus, a raise, or other unexpected income.

Factors That Determine Loan Approval and Limits: Insights for Borrowers in the US, UK, and Canada

Lenders determine your loan approval and the maximum amount they are willing to lend based on a holistic review of your financial profile. The primary factors are your credit score, which indicates your history of repaying debt, and your debt-to-income (DTI) ratio, which shows your ability to handle new payments. Lenders also look for stable income and employment history as proof that you have the means to repay the loan. The loan purpose can also play a role; for example, a loan for debt consolidation may be viewed more favorably than one for a vacation. To get approved for a higher limit, you need to demonstrate both a strong history of creditworthiness and a low DTI ratio.

Expert Tips on Maximizing Your Loan Amount Safely from Leading Financial Advisors in the US

Financial advisors caution against borrowing the maximum amount offered unless you truly need it. The safest way to maximize your approved amount is to first improve your financial standing. Lower your DTI ratio by paying down existing debts. Ensure your income is well-documented. Applying with a high-credit-score co-signer can also significantly increase your borrowing limit. However, always model the monthly payments in your budget to ensure you are not overextending yourself, regardless of the amount you are approved for. The goal is to solve a financial need, not create a new financial burden.

Credit Score Boosting Tips: Improve Your Chances of Securing a Personal Loan

Boosting your credit score is the most effective way to improve your loan approval odds and lower your offered interest rate. Focus on these three quick wins: First, make sure every single bill is paid on time, as payment history is the biggest factor. Second, pay down your credit card balances to get your credit utilization ratio below 30%. Third, review your credit reports for errors and dispute them immediately. Avoid opening new credit accounts right before applying for a loan, as this can temporarily lower your score.

Strategies to Get Funds Quickly After Approval: How to Speed Up Your Personal Loan Process

Once you’re approved, the final steps to funding involve verification and signing. To speed this up, be prepared. Have digital copies of your government-issued ID and a recent utility bill or bank statement ready to verify your identity and address. Use e-sign features promptly to sign your loan agreement. Ensure your bank account details (account and routing number) are correct, as errors here are a common cause of delays. Finally, apply early in the business day to give the lender enough time to process the fund transfer before daily cutoff times.

Understanding Lender Fees and Hidden Charges: What You Need to Know Before Signing Your Loan Agreement

Always read the loan agreement carefully to understand the full cost. The most common fee is an origination fee, an upfront charge that’s either deducted from your loan proceeds or added to the principal. Look for this in the APR calculation. Also, be aware of late payment fees, which can be steep, and insufficient funds (NSF) fees if your automated payment bounces. The best lenders are transparent about their fee structure. A loan with “no hidden fees” and no origination or prepayment penalties is the gold standard.

Comparing Loan Offers from Multiple Lenders: How to Find the Best Deal in Your Region

The only way to ensure you’re getting the best deal is to shop around. Get pre-qualified offers from at least three different lenders, including an online lender, your bank, and a local credit union. Create a simple spreadsheet to compare the offers side-by-side. The key columns should be: Lender Name, Loan Amount, APR, Loan Term, Monthly Payment, Origination Fee, and Total Interest Paid. This clear comparison will make it obvious which offer provides the most value and best fits your financial situation. Never take the first offer you receive.

Making a Plan to Pay Off Your Personal Loan Efficiently and Avoid Debt Traps

The best way to manage your personal loan is to have a clear payoff plan from day one. Set up automatic monthly payments to avoid ever being late. If your budget allows, consider making bi-weekly payments instead of monthly; this results in one extra full payment per year, shortening your term and saving interest. Another strategy is to round up your monthly payment to the nearest $50 or $100. Any extra amount you pay goes directly toward the principal, accelerating your path to becoming debt-free and helping you avoid the trap of long-term debt.

Frequently Asked Questions (FAQ)

Which Bank is Best to Get a Personal Loan From in the US, UK, or Australia?

The “best” bank for a personal loan is subjective and depends heavily on your individual financial profile and existing relationships. In the US, large banks like Wells Fargo and Citibank are popular choices, especially for existing customers who may receive preferential rates. In the UK, high-street banks such as HSBC and Barclays are strong contenders. In Australia, the “big four” (Commonwealth Bank, Westpac, ANZ, NAB) are the most common options. However, for many borrowers, online lenders and credit unions often offer more competitive rates and faster funding than traditional banks. For example, a credit union might offer a lower APR if you are a member. The best strategy is to compare offers from your current bank alongside top-rated online lenders to see who can provide the most favorable terms for your specific situation.

Which is the Best Place to Take a Personal Loan in 2025?

In 2025, the best place for most people to take a personal loan is from a reputable online lender. Platforms like SoFi, LightStream, and Marcus (in the US), Zopa or M&S Bank (in the UK), and Plenti or Harmoney (in Australia) have revolutionized the market. These online lenders leverage technology to offer a faster, more convenient application process, quicker funding times (often within 24-48 hours), and highly competitive interest rates. Their lower overhead costs compared to traditional brick-and-mortar banks often translate into savings for the borrower. Furthermore, online comparison tools allow you to check rates from multiple lenders at once without impacting your credit score, making it easier than ever to shop for the best possible deal from the comfort of your home.

How Much Will a $10,000 Loan Cost Per Month in Interest and Fees?

The monthly cost of a $10,000 loan depends entirely on the Annual Percentage Rate (APR) and the loan term. Let’s use an example. Assume you get a $10,000 loan with a 5-year (60-month) repayment term.

- With an excellent credit APR of 8%: Your monthly payment would be approximately $203. Over five years, you would pay a total of $2,169 in interest.

- With a fair credit APR of 15%: Your monthly payment would be approximately $238. Over five years, you would pay a total of $4,274 in interest.

- With a bad credit APR of 25%: Your monthly payment would be approximately $293. Over five years, you would pay a total of $7,605 in interest.

This demonstrates how a lower APR, earned through a better credit score, can save you hundreds of dollars per month and thousands over the life of the loan.

Which is the Best Bank to Apply for a Personal Loan From in Tier One Countries?

While “best” varies, certain banks are consistently recognized for their personal loan products in Tier One countries. In the United States, LightStream (a division of Truist Bank) is frequently praised for its low rates for excellent-credit borrowers and no-fee structure. In the United Kingdom, First Direct and M&S Bank often receive high marks for customer service and competitive rates. In Canada, major banks like RBC and TD Bank are reliable options, particularly for existing customers with strong credit histories. In Australia, non-bank lenders and customer-owned banks like P&N Bank often challenge the big four on rates and fees. The key is that the best bank for you is the one that offers you the lowest APR and best terms for your financial situation.

Best Place to Get a Personal Loan Online in the US, UK, or Canada

For online personal loans, the best place is typically a well-regarded digital lender or a loan comparison marketplace.

- In the US: SoFi is a top choice, known for its competitive rates, large loan amounts, and member benefits. Marcus by Goldman Sachs is another excellent option with a focus on no-fee loans.

- In the UK: Zopa, one of the original peer-to-peer lenders, is now a digital bank offering highly competitive personal loans. Lendable is known for its extremely fast funding process.

- In Canada: Fairstone and Easyfinancial are prominent online lenders, serving a wide range of credit profiles. Fintech platforms like Loans Canada allow you to compare offers from numerous lenders at once.

These platforms offer a seamless digital experience, from application to funding, making them a superior choice for convenience and speed.

Best Place to Get a Personal Loan for Bad Credit: Where to Apply for the Best Terms

If you have bad credit (a FICO score below 600 in the US or equivalent), your options will be more limited and expensive, but they still exist. The best place to start is often with a local credit union. As non-profit, member-owned institutions, they are sometimes more willing to work with borrowers with lower scores and may offer more reasonable rates than other subprime lenders. Online lenders that specialize in bad credit loans, such as Upstart or Avant in the US, are another key option. They use AI and alternative data beyond just your credit score to assess eligibility. A final strategy is to apply for a secured personal loan or apply with a co-signer who has good credit, as this can significantly improve your chances of approval and lower your interest rate.

Best Place to Get a Personal Loan on Reddit: Insights from Borrowers in Tier One Markets

Reddit communities like r/personalfinance and r/UKPersonalFinance offer valuable, real-world insights from actual borrowers. When you search for personal loan advice on Reddit, you’ll find a consensus that heavily favors two main sources. First, users consistently recommend credit unions for their low interest rates and member-focused service. Second, highly-rated online lenders like SoFi and Marcus (in the US) are frequently praised for their speed, convenience, and lack of fees. Redditors often caution against payday lenders and high-interest installment loans, sharing personal stories of debt traps. The key takeaway from Reddit is to shop around aggressively, prioritize lenders with no origination or prepayment fees, and always check your rate with a local credit union before making a final decision.

How to Apply for a Personal Loan Online: Step-by-Step Guide for US, UK, and Canadian Applicants

Applying for a personal loan online is a simple, four-step process:

- Get Pre-Qualified: Start on a loan comparison site or a direct lender’s website. Fill out a short form with your personal information, desired loan amount, and income. This triggers a soft credit check that does not affect your score and shows you potential loan offers.

- Compare Offers and Choose a Lender: Review the APR, term, and monthly payment for each offer. Once you select the best one for your needs, you’ll proceed to the lender’s website to complete the formal application.

- Submit Your Application and Documents: Fill out the full application and be prepared to upload supporting documents. This typically includes a copy of your government-issued ID (like a driver’s license), proof of income (like recent pay stubs), and possibly a recent bank statement.

- Sign and Receive Funds: Once your information is verified, the lender will send you a final loan agreement to sign electronically. After you sign, the funds are typically deposited directly into your bank account within 1-3 business days, or sometimes as soon as the same day.

Best Online Loans with Instant Approval: Fast, Secure Personal Loan Options

While true “instant approval” is rare because lenders must perform due diligence, many online lenders offer decisions in just a few minutes. These lenders use automated underwriting systems to rapidly assess your credit, income, and other data. Lenders like LightStream (US), Lendable (UK), and Fairstone (Canada) are known for their speed. To qualify for this fast-track approval, you typically need a good-to-excellent credit score, a stable income, and a low debt-to-income ratio. The process is secure, using encryption to protect your data. If you are a strong candidate and have your documents ready, you can often go from application to approval in under an hour and have funds in your account by the next business day.

Personal Loans for Debt Consolidation: How to Find the Best Deal

To find the best deal on a debt consolidation loan, focus on three key factors. First, calculate the total amount of debt you need to pay off and find a lender that offers that amount. Second, and most importantly, ensure the APR on the new loan is significantly lower than the average APR you are currently paying on your existing debts. The bigger the difference, the more money you will save. Third, look for lenders that offer direct payment to creditors. This feature streamlines the process by having the lender send the loan funds directly to your old credit card companies, ensuring the high-interest accounts are closed promptly and saving you the hassle of transferring the funds yourself.

SoFi Personal Loan: A Comprehensive Review of Terms and Benefits

SoFi is a leading online lender in the US, consistently ranked as one of the best places to get a personal loan. They are known for offering competitive, fixed interest rates and high loan amounts, sometimes up to $100,000. One of their biggest selling points is that they charge no fees: no origination fees, no late fees, and no prepayment penalties. This transparency makes it easy to understand the true cost of the loan. SoFi also provides unique member benefits, including unemployment protection, which allows you to temporarily pause payments if you lose your job. They typically require a good credit score (around 680 or higher) and a strong income to qualify. Their application process is entirely online and known for being fast and user-friendly.

Best Personal Loans with Low Interest Rates in 2025: How to Find the Most Affordable Loans

Finding the most affordable, low-interest personal loans in 2025 requires a strategic approach. The single most important factor is having an excellent credit score (760+). This proves you are a low-risk borrower and will unlock the best rates. Second, use online loan comparison tools to get pre-qualified offers from multiple lenders simultaneously. This lets you see real, personalized rates without impacting your credit score. Third, consider applying at a credit union, as they are non-profits and often pass savings to members through lower rates. Finally, choose the shortest loan term you can comfortably afford. A 3-year loan will almost always have a lower interest rate than a 5- or 7-year loan, saving you a significant amount in total interest paid.