Get a Personal Loan Online with instant approval and low interest rates. Compare trusted lenders in the US, UK, Canada & Australia and apply in minutes today.

When you need to take control of your finances—whether it’s to tackle high-interest credit card debt, fund a major home improvement, or cover an unexpected life event—a personal loan can be a powerful tool. Yet, the path to getting one often feels confusing and intimidating. You might worry about damaging your credit score just by applying, facing rejection due to strict criteria, or getting stuck with a high interest rate that makes your situation worse. This uncertainty can be paralyzing, preventing you from moving forward with your financial goals.

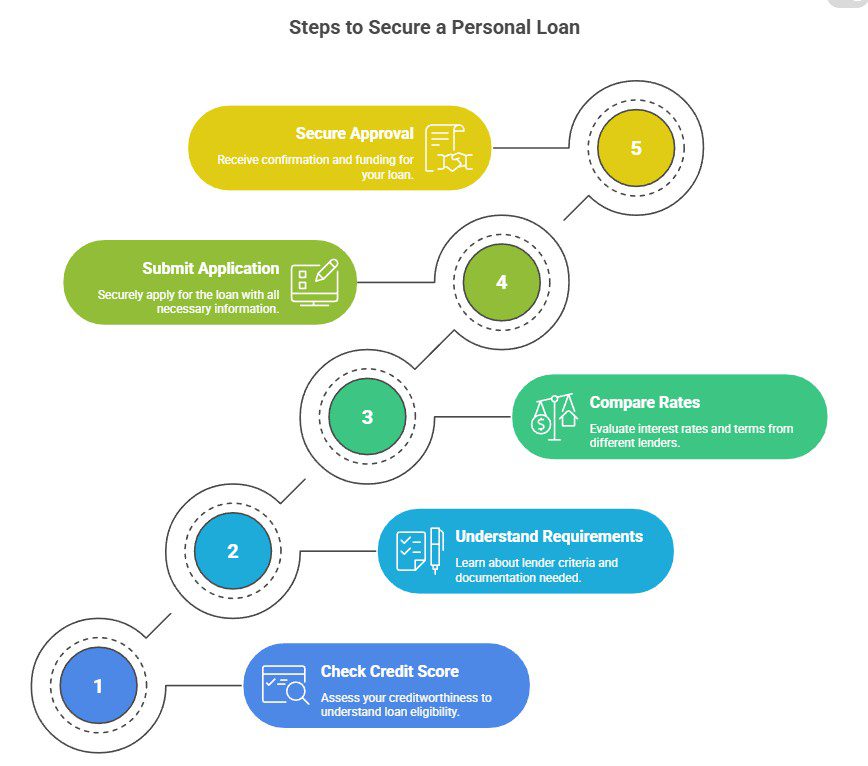

This guide is designed to eliminate that confusion. We provide a clear, step-by-step roadmap to help you get a personal loan online with confidence. We will walk you through everything from checking your credit score and understanding lender requirements to comparing rates and submitting your application securely. Our promise is to empower you with the knowledge to find a loan that not only meets your needs but also fits comfortably within your budget. Discover how to navigate the online lending landscape in the US, UK, Canada, and Australia to secure fast approval, a competitive interest rate, and the funding you need to achieve your goals.

Check Your Credit Score Before Applying for a Personal Loan

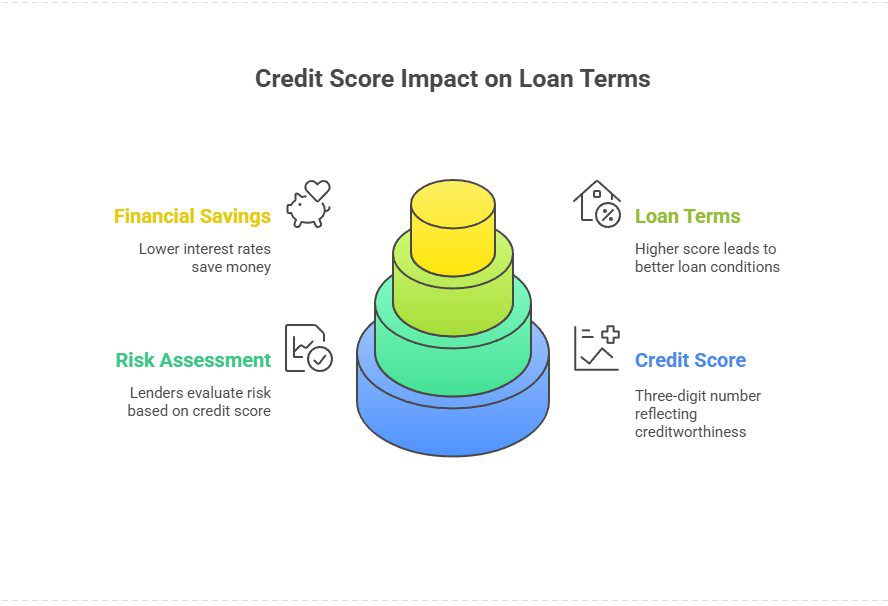

Before you even start looking at lenders, your very first step should be to check your credit score and review your credit report. This three-digit number is the single most important factor that lenders in the US, UK, Canada, and Australia use to determine your creditworthiness. It acts as a financial snapshot, telling them how responsibly you have managed debt in the past. A higher credit score signals to lenders that you are a low-risk borrower, which qualifies you for lower interest rates, higher loan amounts, and more favorable terms. Applying for a loan without knowing your score is like taking a test without studying—you’re leaving the outcome entirely to chance.

Mini Case Study: Liam’s Credit Report Correction in the UK

Liam, a marketing manager from Manchester, wanted a £15,000 loan for a wedding. He assumed his credit was good, but when he checked his report on Experian UK, he was shocked to find a default from a mobile phone contract he believed he had closed years ago. The default was an error. He immediately filed a dispute with the credit reference agency. It took a few weeks, but the error was removed, and his score jumped by nearly 60 points. When he then applied for the loan, the interest rate he was offered was 4% lower than what he would have received with the incorrect default on his record, saving him over £1,200 in interest.

Key Takeaway: Checking your credit report for errors before you apply is a crucial step that can directly save you a significant amount of money.

Your credit score directly impacts the Annual Percentage Rate (APR) you will be offered. This table shows typical credit score ranges in the US and the corresponding APRs you might expect.

| Credit Score Range (FICO Score US) | Borrower Profile | Typical Personal Loan APR Range |

| Excellent (800–850) | Highly reliable borrower, extensive credit history. | 5% – 10% |

| Very Good (740–799) | Dependable borrower with a strong payment history. | 8% – 14% |

| Good (670–739) | Generally responsible, meets most lender criteria. | 12% – 20% |

| Fair (580–669) | May have some past credit issues, considered higher risk. | 18% – 30% |

| Poor (Below 580) | Significant credit challenges, may need a specialist lender. | 28% – 36% or higher |

In the UK, Canada, and Australia, similar tiers exist (e.g., Excellent, Good, Fair) with credit agencies like Experian, TransUnion, and Equifax. Knowing where you stand allows you to manage your expectations and target the right lenders. You can obtain a free copy of your credit report annually from the major credit bureaus in your country.

Understand Lender Requirements and Eligibility Criteria in Tier One Markets

After you know your credit score, the next step is to understand what lenders are looking for. While every lender has a unique set of criteria, they all evaluate a few core factors to assess your ability to repay a loan. Meeting these basic requirements is essential for getting your application approved. In Tier One markets, lenders prioritize stability and a clear capacity to handle new debt. They want to see a consistent track record of financial responsibility. Understanding these metrics will help you determine if you’re a strong candidate for a loan before you even apply.

Mini Case Study: Chloe’s Debt-to-Income Calculation in Australia

Chloe, a graphic designer in Sydney, wanted a $20,000 AUD loan to consolidate her debts. Before applying, she read that lenders look closely at the Debt-to-Income (DTI) ratio. She calculated hers: her monthly debt payments (student loan, car payment, credit card minimums) totaled $1,500 AUD. Her gross monthly income was $5,000 AUD. Her DTI was $1,500 / $5,000 = 30%. Knowing that most Australian lenders prefer a DTI below 40%, she felt confident moving forward. This simple calculation gave her the assurance that her finances were in a healthy position to take on a new loan, and she was approved quickly.

Result: By proactively calculating her DTI, Chloe understood her financial standing from a lender’s perspective and applied with confidence.

Lenders across the US, UK, Canada, and Australia share similar core requirements, but there are slight variations.

| Eligibility Factor | United States (US) | United Kingdom (UK) | Canada (CAN) | Australia (AUS) |

| Minimum Credit Score | Often 600+, with 670+ for better rates. | Fair to Good credit profile required. | Generally 650+ for prime lenders. | A good credit history is essential. |

| Debt-to-Income Ratio (DTI) | Preferably under 43%, with under 36% being ideal. | Lenders assess overall affordability and debt levels. | Lenders prefer a Total Debt Service (TDS) ratio below 44%. | Generally prefer a DTI below 40%. |

| Stable Income | Verifiable income from employment, self-employment, or other sources. | Proof of regular income is required. | Consistent and verifiable income is key. | Proof of stable, ongoing income is necessary. |

| Age and Residency | 18+ years old, US citizen or permanent resident, with a valid SSN. | 18+ years old, UK resident. | Age of majority in your province, Canadian resident, with a valid SIN. | 18+ years old, Australian resident or citizen. |

| Bank Account | A valid checking account is required for funding. | A UK bank account is needed. | A Canadian bank account is required. | An Australian bank account is necessary. |

Beyond these numbers, lenders also look for a stable employment and residence history. If you frequently change jobs or move, lenders may view you as a higher risk. By ensuring you meet these fundamental criteria, you significantly increase your chances of a successful loan application.

Compare Personal Loan Rates and Terms from Trusted Banks and Online Lenders

Once you’ve confirmed your credit is in good shape and you meet the eligibility criteria, it’s time to start shopping for a loan. This is the most critical stage for saving money. Never accept the first loan offer you receive. Interest rates, fees, and terms can vary dramatically between lenders, and even a small difference in the Annual Percentage Rate (APR) can add up to hundreds or thousands of dollars over the life of your loan. You should compare offers from three main sources: traditional banks, credit unions, and online lenders. Each has distinct advantages, and the best choice for you will depend on your priorities.

Mini Case Study: David’s Smart Comparison in the US

David needed a $15,000 loan for a car repair. His local bank, where he had been a customer for ten years, offered him a loan at 11.5% APR. He almost accepted it for the convenience, but his friend urged him to check online. David spent 30 minutes prequalifying with two online lenders and a national credit union. The credit union offered him 10.2% APR, and one of the online lenders came back with an offer of 8.9% APR with no origination fee. By taking a little extra time to compare, David chose the online lender and saved over $700 in interest on a three-year loan.

Key Tip: The convenience of your primary bank rarely outweighs the potential savings from comparing multiple lenders.

This table illustrates how offers for the same $10,000 loan over 3 years can differ.

| Lender Type | Typical APR Range | Origination Fee | Monthly Payment (at 10% APR) | Key Benefit |

| Traditional Bank | 9% – 22% | Often 1% – 5% | ~$322.67 | In-person service and existing relationships. |

| Credit Union | 8% – 18% | Often lower or none | ~$322.67 | Member-focused, often have lower rates and fees. |

| Online Lender | 7% – 25% | Varies (many have none) | ~$322.67 | Speed, convenience, and highly competitive rates. |

When comparing, always use the APR, as it includes both the interest rate and any mandatory fees, giving you the true cost of borrowing. Also, look at the loan term. A longer term will give you a lower monthly payment but will cost you more in total interest. Online comparison tools can help you see multiple offers side-by-side, making it easy to spot the best deal.

Determine the Loan Amount and Repayment Plan That Fits Your Budget

Getting approved for a personal loan is only half the battle; ensuring it fits comfortably within your budget is what leads to long-term financial success. A common mistake borrowers make is accepting the maximum amount a lender offers them. Just because you can borrow a certain amount doesn’t mean you should. Responsible borrowing means calculating the exact amount you need for your specific purpose and structuring a repayment plan with a monthly payment that you can afford without straining your finances. This prevents the loan from becoming a burden and ensures you can meet your obligations without stress.

Mini Case Study: Sophia’s Precise Budgeting in Canada

Sophia wanted to renovate her kitchen in Ottawa and estimated it would cost around $25,000 CAD. A lender pre-approved her for up to $40,000 CAD. The temptation to take the extra money for new furniture was strong. However, Sophia created a detailed spreadsheet with quotes from contractors and suppliers, which came to a total of $23,500 CAD. She decided to borrow exactly $24,000 CAD to give herself a small buffer. By sticking to her budget instead of taking the maximum offered, her monthly payment was $150 lower, allowing her to continue contributing to her savings each month without feeling squeezed.

Result: By borrowing only what she needed, Sophia kept her loan manageable and maintained her financial health.

A personal loan calculator is your best tool for finding the right balance. You can adjust the loan amount and term to see the immediate impact on your monthly payment and total interest paid.

| Loan Amount | Term | APR | Monthly Payment | Total Interest Paid |

| $20,000 | 3 Years (36 months) | 9% | $635.90 | $2,892.40 |

| $20,000 | 5 Years (60 months) | 9% | $415.17 | $4,910.20 |

| $25,000 | 5 Years (60 months) | 9% | $518.96 | $6,137.75 |

| $25,000 | 7 Years (84 months) | 9% | $399.73 | $8,577.32 |

This table shows that while a longer term lowers your monthly payment, it dramatically increases the total interest you pay. The ideal approach is to choose the shortest loan term that comes with a monthly payment you can comfortably afford. To determine that, review your monthly budget and calculate how much disposable income you have after all your essential expenses are paid.

Prequalify with Multiple Lenders to Secure the Best Rate

Prequalification is the most powerful tool a borrower has during the loan shopping process. It allows you to get a personalized rate quote from a lender based on your specific financial profile without affecting your credit score. This works because lenders use a soft credit inquiry (or “soft pull”) for prequalification. A soft inquiry gives the lender a high-level view of your credit history but is not visible to other lenders and has zero impact on your score. This is in sharp contrast to a formal application, which triggers a hard credit inquiry that can temporarily lower your score by a few points.

By prequalifying with several lenders—ideally a mix of banks, credit unions, and online lenders—you can collect multiple real offers and compare them side-by-side. This data-driven approach ensures you are choosing the loan with the absolute best rate and terms available to you. It takes the guesswork out of the process and puts you in a position of power.

Mini Case Study: Emily’s Strategic Prequalification

Emily from Austin, Texas, wanted to consolidate $10,000 in debt. She prequalified with her local bank, a national credit union, and two well-known online lenders. The offers she received were:

- Bank: 12.1% APR

- Credit Union: 10.9% APR

- Online Lender A: 9.5% APR

- Online Lender B: 9.8% APR

Armed with this information, Emily confidently chose Online Lender A. The entire process of prequalifying with all four took her less than an hour, and because it only involved soft inquiries, her credit score remained untouched. She proceeded with the formal application only after knowing she had found the most competitive offer.

Key Takeaway: Prequalifying is a no-risk, high-reward activity. Never skip this step.

Prequalification provides a wealth of information to guide your decision.

| What Prequalification Tells You | What It Doesn’t Tell You |

| ✅ Your estimated interest rate and APR. | ❌ A final, guaranteed approval. |

| ✅ The potential loan amount you could borrow. | ❌ Your exact final terms (they can change after full verification). |

| ✅ The available repayment term lengths. | ❌ Confirmation of any fees until the final offer. |

| ✅ Whether you are likely to be approved by that lender. | ❌ The specific reason for denial if you don’t prequalify. |

Think of prequalification as a dress rehearsal. It gives you a clear picture of what to expect without any negative consequences, allowing you to proceed to the main event—the formal application—with complete confidence.

Decide How to Use Your Personal Loan for Maximum Financial Impact

A personal loan provides you with a lump sum of cash, and while you can use it for almost anything, the most financially savvy borrowers use it strategically. The best uses for a personal loan are those that either improve your financial situation or add tangible value to your assets. Using a loan as an investment in your financial future yields a much higher return than simply using it for discretionary spending. Before you borrow, create a clear plan for how the funds will be used and what the expected outcome will be.

Mini Case Study: Mark’s Debt Consolidation Success in the UK

Mark, a junior doctor in London, had accumulated £18,000 in credit card debt across four cards during his studies, with an average APR of 21%. The multiple payments were confusing, and the high interest meant his balances were barely decreasing. He took out a personal loan for £18,000 at 7.5% APR over five years. He immediately used the funds to pay off all four credit cards in full. This move not only simplified his finances into a single, manageable monthly payment but also saved him over £5,000 in interest. Furthermore, by lowering his credit utilization ratio, his credit score improved significantly within six months.

Result: Mark used his personal loan to restructure his debt, save a substantial amount of money, and improve his long-term financial health.

Strategically using a loan can provide a positive return on investment (ROI). Let’s compare the financial impact of different loan uses.

| How You Use the Loan | Potential Financial Impact (ROI) | Description |

| Debt Consolidation | High ROI | Reduces total interest paid, simplifies payments, and can improve your credit score by lowering credit utilization. |

| Home Improvement | High ROI | Can increase the market value of your home, providing a direct return on your investment when you sell. |

| Business Investment | High ROI | Funds used to start or grow a small business can generate future income and long-term wealth. |

| Education/Certification | Medium to High ROI | Can increase your earning potential over your career, though the return is not immediate. |

| Vehicle Purchase | Low ROI | A car is a depreciating asset, meaning it loses value over time. The loan provides utility but not financial growth. |

| Vacation or Wedding | No Financial ROI | While providing personal value, these expenses do not improve your financial position or create tangible assets. |

While it’s perfectly acceptable to use a loan for a major life event like a wedding, it’s crucial to weigh the long-term cost of interest against the benefit. Prioritizing uses that strengthen your financial foundation is always the wisest choice.

Gather the Necessary Documentation to Streamline Your Loan Application

Once you have prequalified and chosen a lender, the next step is the formal application. The single biggest cause of delays in this stage is missing or incorrect documentation. To ensure a fast, smooth process, you should gather all the required documents before you begin. Most online lenders allow you to upload digital copies (like PDFs or photos) directly to their secure portal. Having these files organized and ready in a folder on your computer can turn a multi-day ordeal into a 15-minute task.

The documents lenders need serve to verify three key things: your identity, your address, and your income. This verification is a legal requirement in Tier One markets to prevent fraud and to confirm that you have the financial means to repay the loan. Being prepared shows the lender you are organized and serious, which can only help your case.

Expert Insight:

“Create a ‘loan application kit’ before you even start,” advises Sarah Chen, a senior underwriter for a major US online lender. “Scan your driver’s license, download your last two payslips as PDFs, and save your most recent utility bill. When our system prompts you for these documents, you can upload them instantly. Applicants who do this are often the ones who get approved and funded the fastest.”

The documents required can vary slightly based on your employment status.

| Document Type | For Salaried Employees | For Self-Employed / Freelancers |

| Proof of Identity | Government-issued photo ID (Driver’s License, Passport) | Government-issued photo ID (Driver’s License, Passport) |

| Proof of Address | Recent Utility Bill, Bank Statement, Tenancy Agreement | Recent Utility Bill, Bank Statement, Tenancy Agreement |

| Proof of Income | Last 2-3 months of payslips, W-2 (US) / T4 (Canada) | Last 2 years of tax returns (e.g., Form 1040 in the US) |

| Supporting Financials | Last 2-3 months of bank statements | Last 3-6 months of business and personal bank statements |

By preparing these standard documents in advance, you eliminate the back-and-forth communication with the lender that can slow down your approval. You demonstrate that you are a reliable applicant and put yourself on the fast track to getting funded.

Shop Online and In-Person for the Best Personal Loan Interest Rates

When it comes to shopping for a personal loan, you have two primary channels: online lenders and traditional in-person institutions like banks and credit unions. Both have distinct pros and cons, and the best approach for you may involve exploring both. Online lenders have revolutionized the industry with speed and competitive rates, while traditional banks offer the comfort of familiarity and face-to-face interaction. Understanding the trade-offs will help you shop more effectively.

Online shopping allows you to use comparison websites to view dozens of offers in minutes. The entire process, from prequalification to funding, can be done from your home. This convenience and the fierce competition among online lenders often lead to lower interest rates and fees. In-person shopping at a bank or credit union allows you to ask detailed questions and build a relationship with a loan officer. This can be particularly helpful if you have a complex financial situation or are less comfortable with technology.

Expert Insight:

“I always advise clients to get at least one quote from an online lender and one from a brick-and-mortar institution,” says Mark Foster, a Canadian financial planner. “This gives you a baseline. Sometimes, your local credit union can beat an online offer, especially if you’re a long-standing member. But without the online quote, you’d have no leverage and no way of knowing if your bank’s offer is truly competitive.”

Here’s a comparison of the two shopping experiences.

| Feature | Shopping Online | Shopping In-Person |

| Speed | Pro: Prequalify in minutes, get funded in 1-2 days. | Con: Requires appointments, longer processing times. |

| Convenience | Pro: Apply 24/7 from anywhere. | Con: Limited to branch hours and locations. |

| Rate Competitiveness | Pro: Often lower rates due to less overhead. | Con: Can be less competitive unless you have a strong relationship. |

| Personal Support | Con: Support is via phone, chat, or email. | Pro: Face-to-face guidance from a loan officer. |

| Comparison | Pro: Easy to compare multiple lenders quickly. | Con: Comparing requires visiting multiple locations. |

The optimal strategy is a hybrid one: start online to get a sense of the best rates available, then see if your local bank or credit union can match or beat the best offer you find. This ensures you leave no stone unturned in your search for the lowest interest rate.

Fill Out and Submit the Loan Application Securely Through Verified Portals

After you have gathered your documents and chosen your preferred lender, it’s time to complete the formal application. This step is critical, as accuracy and security are paramount. Always submit your application directly through the lender’s official website or secure online portal. Look for the padlock icon and “https://” in your browser’s address bar, which indicates that the connection is encrypted and your data is protected. Never submit sensitive personal information through email or an unverified third-party site.

The application form will ask for detailed information, building on what you provided during prequalification. This includes your full legal name, address, Social Security Number (US) or Social Insurance Number (Canada), employment details, and income. Be meticulous and double-check every entry before submitting. A simple typo in your name or income figure can cause delays or even lead to a denial, as the information may not match the records the lender pulls from credit bureaus and other verification services.

Expert Insight:

“The application is where accuracy matters most,” notes a fraud prevention specialist from a major UK bank. “Our automated systems cross-reference the data you enter with your digital footprint. If your stated income is wildly different from what we can verify through your bank statements or payroll data, it raises a red flag for manual review. Honesty and accuracy are the fastest paths to approval.”

Common Application Sections and What They Mean:

- Personal Information: Verifies your identity.

- Housing Information: Assesses your stability (rent vs. own, time at address).

- Employment & Income: Confirms your ability to repay the loan.

- Loan Request: You specify the amount you want to borrow and the purpose of the loan.

- Document Upload: The secure portal where you will upload your prepared documents.

Take your time with the application. Rushing through it is the most common cause of avoidable errors. Once you click “submit,” the lender will perform a hard credit inquiry and begin the final underwriting process.

Review Loan Offers, APR, and Repayment Terms Before Accepting

Congratulations, you’ve been approved! The lender will now send you a formal loan offer, often called a Loan Agreement or Disclosure Statement. This is the most important document you will receive. It is legally binding, and you must review it with extreme care before signing. This agreement contains the final, confirmed details of your loan. Do not assume the terms are identical to your prequalification offer, as they can sometimes change after the lender’s full verification process.

The most critical figure to check is the Annual Percentage Rate (APR). This is the all-in cost of your loan, including the interest rate and any mandatory fees, expressed as an annual percentage. This is the number you should use to compare this final offer against any others you may have. Next, confirm the loan amount, the monthly payment, and the total number of payments (the loan term). Make sure these all align with your budget and financial goals.

Expert Insight:

“Read every line of the loan agreement before you sign,” warns financial literacy coach, Jennifer Lee. “Pay special attention to the sections on fees, particularly prepayment penalties and late fees. What seems like a great APR can be soured by restrictive terms. You are signing a multi-year contract, so taking 30 minutes to read it thoroughly is one of the highest-ROI activities you can do.”

Here’s a breakdown of what to look for in a sample loan offer.

| Section of Loan Agreement | What to Check For |

| Principal Loan Amount | The exact amount of money you will receive. |

| Annual Percentage Rate (APR) | The total annual cost of the loan. This is the key comparison figure. |

| Interest Rate | The base rate used to calculate interest charges. |

| Monthly Payment | The fixed amount you will pay each month. Ensure it fits your budget. |

| Loan Term | The total number of months you will be making payments. |

| Total Finance Charge | The total dollar amount of interest you will pay over the loan’s life. |

| Total of Payments | The sum of the principal and the finance charge. |

If anything in the offer is unclear or different from what you expected, contact the lender immediately for clarification. Do not sign until you are 100% comfortable with every term in the agreement.

Consider Fees, Origination Costs, and Repayment Flexibility for Better ROI

A low APR is the headline attraction of any loan offer, but the fine print on fees and flexibility can have a major impact on the loan’s overall value and your return on investment (ROI). A seemingly great loan can become expensive if it’s loaded with fees or rigid terms. Smart borrowers look beyond the APR to evaluate the complete financial picture.

The most common fee to watch for is the origination fee. This is a one-time charge for processing your loan, typically calculated as a percentage of the loan amount (usually 1% to 8%). This fee is often deducted from the loan proceeds, meaning if you borrow $10,000 with a 5% origination fee, you will only receive $9,500. Another critical factor is repayment flexibility. A lender that charges a prepayment penalty is penalizing you for paying off your loan early. Avoiding this fee is essential if you plan to make extra payments or pay off the debt ahead of schedule.

Expert Insight:

“A no-origination-fee loan with a 9% APR is almost always better than a loan with a 5% origination fee and an 8% APR,” explains Australian financial advisor David Chen. “The upfront fee significantly eats into your principal and can take years to ‘earn back’ through the slightly lower interest rate. Always calculate the total cost, including fees, to see the true winner.”

Let’s compare two $15,000 loan offers over 5 years.

| Feature | Loan Offer A | Loan Offer B |

| APR | 8.5% | 9.0% |

| Origination Fee | 4% ($600) | 0% ($0) |

| Amount Disbursed | $14,400 | $15,000 |

| Monthly Payment | $307.78 | $311.38 |

| Total Repaid | $18,466.80 | $18,682.80 |

| True Cost of Borrowing | $3,466.80 + $600 Fee = $4,066.80 | $3,682.80 |

Even though Loan A has a lower APR, its total cost is nearly $400 higher because of the origination fee. Furthermore, look for flexibility features like the ability to change your payment date or make penalty-free extra payments. These features can provide valuable peace of mind and save you money over the long run.

Select the Right Lender and Complete Final Approval Steps Confidently

You’ve done the hard work: you’ve checked your credit, gathered your documents, compared offers, and reviewed the fine print. Now it’s time to make your final decision and accept the loan. This final step should be taken with confidence, knowing you have made a well-informed choice. The right lender for you is the one that offers the best combination of a low APR, minimal fees, flexible terms, and trustworthy customer service.

Once you have selected your winning offer, the final approval process is usually very quick. You will need to formally accept the loan by electronically signing the loan agreement. This is a legally binding act, so it serves as your final opportunity to ensure you are comfortable with all the terms. Read it one last time before signing. After you sign, the lender will typically conduct a final, quick verification.

The Final Steps:

- E-Sign the Loan Agreement: Use the secure link provided by the lender to review and electronically sign your contract.

- Confirm Bank Details: Double-check that the bank account and routing/sort code information you provided for the fund disbursement is correct. A typo here can cause significant delays.

- Wait for Disbursement: The lender will initiate the fund transfer. As per your agreement, this typically happens within one to two business days, but some online lenders can fund the same day.

Expert Insight:

“The moment you sign, shift your mindset from ‘borrower’ to ‘manager’,” advises US-based credit counselor Maria Rodriguez. “Your next thought should be, ‘How will I manage this responsibly?’ Set up automatic payments immediately to ensure you never miss a due date. This is the first and most important step in using the loan to build, not harm, your credit.”

By following a structured and diligent process, you can move from needing a loan to receiving the funds with the assurance that you have secured the best possible deal for your financial situation.

How to Get a Personal Loan with Bad Credit and Still Save on Interest

Getting a personal loan with bad credit (a score below 630 in the US or equivalent in other Tier One markets) is challenging, but not impossible. While you should expect to pay a higher interest rate than someone with good credit, there are strategies you can use to improve your approval odds and minimize the cost.

First, focus on lenders that specialize in serving borrowers with less-than-perfect credit. Many online fintech lenders use advanced algorithms that look beyond just your credit score, giving more weight to your income and employment stability. Second, consider a secured loan. By backing the loan with collateral, such as a car title or savings account, you drastically reduce the lender’s risk. In return, they can offer you a much lower interest rate than you’d get for an unsecured loan.

Checklist for Bad Credit Borrowers:

- Apply with a Co-signer: Adding a trusted friend or family member with good credit to your application can help you qualify and secure a better rate.

- Check with Credit Unions: As member-owned institutions, credit unions are often more willing to work with borrowers who have challenging credit histories.

- Borrow a Smaller Amount: Requesting only what you absolutely need increases your chances of approval.

- Focus on Improving Your Score: Before applying, pay down existing debt (especially credit cards) and ensure you have a history of on-time payments.

Steps to Get a Personal Loan Quickly with Same-Day or Next-Day Funding

When you need money urgently, the speed of funding becomes the top priority. Many online lenders are built for this need, offering streamlined processes that can take you from application to funding in as little as 24 hours. To achieve this speed, you need to be prepared and strategic.

The Fast-Funding Action Plan:

- Target the Right Lenders: Search specifically for lenders that advertise “same-day funding” or “next-day funding.” These fintech companies have the automated systems in place to make this happen.

- Prepare Your Documents in Advance: Have digital copies (PDFs or JPEGs) of your ID, proof of income (payslips), and proof of address ready to go. Delays are most often caused by applicants having to search for paperwork.

- Apply Early on a Business Day: Lenders have daily cut-off times for processing same-day transfers (often around midday). Submitting your application in the morning on a weekday (Monday-Friday) significantly increases your chances of getting funded the same day.

- Ensure All Information is Accurate: Double-check every field on your application form for typos. An incorrect bank account number or a misspelled name will cause delays.

- Be Ready to Respond: Keep an eye on your email and phone after submitting. If the lender needs any additional clarification, a quick response from you will keep the process moving.

How to Get a Personal Loan with No Collateral or Guarantor

The vast majority of personal loans offered today are unsecured, which means they do not require any collateral or a guarantor (co-signer). When you get an unsecured loan, the lender is approving you based solely on your creditworthiness—your promise and demonstrated ability to repay the debt. This is the most common and convenient type of personal loan.

To qualify for an unsecured loan, lenders focus heavily on a few key metrics:

- Credit Score and History: A strong history of on-time payments and responsible credit management is the most important factor. Lenders want to see that you have successfully paid back debts in the past.

- Income and Employment Stability: You must have a regular, verifiable source of income that is sufficient to cover your existing expenses plus the new loan payment. A stable job history is a major plus.

- Debt-to-Income (DTI) Ratio: Lenders will calculate your DTI to ensure you aren’t overextended with debt. A lower DTI indicates you can comfortably afford the new payment.

If you have a good to excellent credit profile, you will likely have no trouble qualifying for a competitive unsecured loan. If your credit is fair, you may still qualify, but at a higher interest rate.

Understanding Prepayment Options, Penalties, and Early Payoff Benefits

Paying off your personal loan ahead of schedule is a fantastic financial move. It can save you a significant amount of money in interest and free up your cash flow sooner. However, before you commit to a loan, you must understand the lender’s policy on prepayment.

A prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the end of the term. This fee is designed to compensate the lender for the interest they will lose. Fortunately, in the competitive personal loan market across the US, UK, Canada, and Australia, most reputable online lenders and many banks do not charge prepayment penalties.

Key Benefits of Early Payoff:

- Interest Savings: Every extra payment you make goes directly toward the principal balance, reducing the amount of interest that accrues over time.

- Improved DTI Ratio: Paying off a loan early lowers your total debt, which improves your DTI ratio and strengthens your financial profile.

- Financial Freedom: Eliminating a monthly payment frees up money in your budget for other goals, like saving or investing.

Actionable Tip: When comparing loan offers, make “no prepayment penalty” a non-negotiable requirement. This gives you the flexibility to pay off your debt on your own timeline without being punished for your financial discipline.

Compare Loan Offers for the Best Value and Long-Term Savings

When you receive multiple loan offers, it can be tempting to focus only on the monthly payment. While affordability is important, the best loan is the one that offers the lowest total cost over its lifetime. To find the best value, you need to look beyond a single number and evaluate the complete package.

Checklist for Comparing Loan Offers:

- Compare the APR: This is the most crucial step. The Annual Percentage Rate includes interest and fees, giving you the true cost of borrowing. A lower APR always means a cheaper loan, all else being equal.

- Calculate the Total Cost: Multiply the monthly payment by the number of months in the term. This gives you the total amount you will repay. The offer with the lowest total repayment amount is the most affordable one.

- Factor in Origination Fees: An offer with a low APR but a high origination fee might be more expensive than a no-fee loan with a slightly higher APR. Do the math to see the true cost. (See the table in H3 for an example).

- Check for Prepayment Penalties: Choose a loan that allows you to pay it off early without any fees. This flexibility adds significant value.

- Consider the Lender’s Reputation: Look at customer reviews to gauge the lender’s service quality and transparency.

By taking a holistic view, you ensure that you are not just choosing a loan that is affordable today, but one that provides the best value and saves you the most money in the long run.

Check for Hidden Costs, Processing Fees, and Origination Charges Before Signing

A great advertised interest rate can be misleading if the loan is packed with hidden costs and fees. Reputable lenders in Tier One markets are required by law to be transparent about their charges, but it is your responsibility to read the loan agreement carefully to understand them. The most visible fee is the origination charge, which is an upfront cost for processing the loan.

Beyond that, here are other potential costs to look for in the fine print:

- Late Payment Fees: All lenders charge these, but the amount can vary. Understand how much you will be charged and when the fee is applied.

- Prepayment Penalties: As discussed, this is a fee for paying off your loan early. Always choose a loan that does not have one.

- Returned Payment Fees (NSF Fees): If your automatic payment bounces due to insufficient funds, the lender will charge a fee.

- Check Processing Fees: Some lenders may charge a fee if you choose to pay by check instead of an electronic transfer.

The best personal loans are simple and transparent. They often have no fees other than the interest itself and a standard late fee. When in doubt, ask the lender for a complete list of all potential fees associated with the loan before you sign the agreement.

Tips to Improve Your Chances of Personal Loan Approval in the US and Canada

In the credit-centric markets of the US and Canada, improving your loan approval odds comes down to demonstrating stability and reliability. Lenders want to see a clear pattern of responsible financial behavior.

- Lower Your Credit Utilization: This ratio is the amount of revolving credit you’re using divided by your total credit limits. Lenders in the US and Canada like to see this below 30%. Paying down credit card balances is the fastest way to improve this and can give your credit score a quick boost.

- Maintain a Stable Employment History: Lenders value consistency. If you’re considering applying for a loan, it’s best to stay with your current employer rather than switching jobs right before. A history of at least one to two years with the same employer is viewed favorably.

- Consolidate Your Banking: Having a primary checking and savings account where your income is regularly deposited makes income verification easier for lenders and can sometimes lead to relationship-based benefits, especially with traditional banks.

| Action Item | Impact in US/Canada |

| Pay down credit cards | Lowers credit utilization, boosts score. |

| Avoid job hopping | Shows income stability. |

| Have a clear payment history | Demonstrates reliability. |

How to Get a Personal Loan Online Safely from Verified Lenders

Getting a loan online is incredibly convenient, but you must prioritize safety. The digital world has its share of scams, so it’s crucial to ensure you are dealing with a legitimate, verified lender.

- Look for Secure Websites: Always check that the lender’s website URL begins with “https://”. The “s” stands for secure and means the data you enter is encrypted.

- Verify the Lender: Do a quick search for the lender’s name plus the word “reviews.” Look for feedback on trusted third-party sites like Trustpilot or the Better Business Bureau. Legitimate lenders will have an established online presence.

- Beware of Red Flags: Be wary of any lender that:

- Guarantees approval without checking your credit.

- Asks you to pay an upfront “insurance” or “processing” fee before you receive the loan funds.

- Pressures you to act immediately with an exploding offer.

- Has a website with poor grammar and spelling.

Stick with well-known, reputable banks and online lenders to ensure your personal and financial information remains protected.

Managing Your Personal Loan After Disbursement for Financial Stability

Your responsibility doesn’t end once the loan funds hit your account. Proper management of your loan is key to ensuring it remains a financial tool, not a burden, and helps to improve your credit score over time.

- Set Up Automatic Payments: The single most important action you can take is to set up autopay from your checking account for the loan’s due date. This virtually guarantees you will never miss a payment, which is crucial for building a positive payment history.

- Incorporate the Payment into Your Budget: Immediately add the new monthly loan payment as a fixed expense in your monthly budget. Acknowledge the reduction in your disposable income and adjust your spending in other areas if necessary.

- Monitor Your Loan Progress: Occasionally check your loan balance to see your progress. Watching the principal decrease can be a great motivator to continue making on-time payments or even to pay extra when possible.

Proper management ensures a stress-free repayment period and a positive mark on your credit report.

Strategies to Reduce Interest Costs and Pay Off Your Loan Faster

If your loan has no prepayment penalty, you have a golden opportunity to save money and get out of debt sooner. The goal is to pay more than the minimum monthly payment whenever possible, as every extra dollar goes directly toward reducing the principal balance.

- Make Bi-Weekly Payments: Split your monthly payment in half and pay it every two weeks. This results in 26 half-payments a year, which equals 13 full payments instead of 12. This one extra payment can shave months off your loan term.

- Round Up: If your payment is $311, round it up to $350. This small, consistent extra amount adds up significantly over time.

- Apply Windfalls: Use any unexpected money—a work bonus, a tax refund, or a cash gift—to make a lump-sum extra payment on your loan.

Before starting, confirm with your lender that extra payments are applied directly to the principal. This simple discipline can save you hundreds or even thousands in interest.

How to Get a Personal Loan When Self-Employed or Freelancing

Getting a personal loan when you’re self-employed or a freelancer is entirely possible, but it requires more documentation than for a salaried employee. Lenders need to verify your income is stable and sufficient, and since you don’t have traditional payslips, you’ll need to provide alternative proof.

The key is to have impeccable financial records. Lenders in the US, UK, Canada, and Australia will want to see a history of consistent earnings, typically over at least two years.

Key Documents for the Self-Employed:

- Tax Returns: Your last two years of personal (and business, if applicable) tax returns are the most important documents.

- Bank Statements: Lenders will want to see 3-6 months of business and personal bank statements to verify cash flow.

- Proof of Business: This could include your business registration, articles of incorporation, or professional licenses.

- Invoices or Contracts: In some cases, showing recent client invoices or contracts can help demonstrate future income.

Maintaining a clear separation between business and personal finances will make this process much smoother.

| Income Proof | Salaried Applicant | Self-Employed Applicant |

| Primary | Payslips, W-2/T4 | Tax Returns |

| Secondary | Bank Statements | Bank Statements, Invoices |

Optimizing Loan Terms and Repayment Schedules for Better Financial Planning

Choosing the right loan term is a critical balancing act between monthly affordability and total long-term cost. While a longer term offers a lower, more manageable monthly payment, it always results in paying more in total interest. An optimized repayment schedule is one that you can comfortably afford without sacrificing your ability to meet other financial goals, like saving for retirement or emergencies.

To optimize, use a loan calculator to model different scenarios. Start with the shortest term you think you can handle and look at the monthly payment. If it’s too high, extend the term one year at a time until you find a payment that fits your budget. The ideal choice is the shortest possible term that does not put you under financial stress. This strategy ensures you pay the least amount of interest possible while maintaining a healthy monthly budget.

Financial Experts Reveal Common Mistakes to Avoid When Getting a Personal Loan

Financial experts consistently see borrowers make the same avoidable mistakes. The most common is failing to shop around and accepting the first offer, which can be a costly error. Another major pitfall is borrowing more than you need; the temptation of extra cash can lead to an unmanageable debt burden. Many also focus solely on the monthly payment while ignoring the total interest cost, opting for overly long terms that are much more expensive. Finally, a crucial mistake is not reading the loan agreement thoroughly, which can lead to surprises about fees or restrictive terms down the road. Avoiding these four pitfalls is key to a successful borrowing experience.

Bank Advisor Insights: How to Get a Personal Loan at a Lower APR

Bank advisors suggest that the best way to secure a lower APR is to present yourself as a low-risk borrower. The most direct way to do this is by improving your credit score before you apply. This means paying all your bills on time and lowering your credit card balances. Additionally, leveraging your existing relationship with a bank can be powerful. Banks often offer relationship discounts to long-standing customers who have checking or savings accounts with them. When you speak with an advisor, politely ask if any such discounts are available. Finally, opting for automatic payments can sometimes result in a small rate reduction (e.g., 0.25%) as it provides the bank with greater payment certainty.

Planning Repayment to Avoid Late Fees and Improve Credit Scores

Proactive repayment planning is essential for your financial health. The moment your loan is finalized, set up automatic payments from your primary checking account. This is the single most effective way to avoid late fees and ensure your payments are always on time. On-time payments are the most heavily weighted factor in calculating your credit score, so a consistent record will steadily improve your score over the life of the loan. It’s also wise to set up a calendar reminder or a bank alert a few days before the due date as a backup. This disciplined approach not only saves you money on fees but also builds a positive credit history, opening up better financial opportunities in the future.

How to Get a Personal Loan from Top Tier One Lenders Online and In-Branch

Getting a personal loan from top lenders in the US, UK, Canada, or Australia involves a clear process, whether online or in-branch. The online path prioritizes speed and convenience. You’ll use the lender’s website to prequalify with a soft credit check, complete a digital application, upload documents, and receive funds electronically, often within 1-2 days. The in-branch path at a traditional bank offers personalized service. You will likely schedule an appointment, meet with a loan officer to discuss your needs, fill out a paper or digital application in person, and provide your documents directly. While slower, this method is ideal for those who prefer face-to-face guidance. Both methods require good credit and verifiable income for the best rates.

How to Get a Personal Loan with Different Credit Profiles — From Excellent to Fair

The personal loan you can get is directly tied to your credit profile.

- Excellent Credit (740+ US): You are a top-tier candidate. You can expect the lowest interest rates, highest loan amounts, and zero-fee offers from virtually any lender, online or traditional. Your focus should be on comparison shopping to find the absolute best terms.

- Good Credit (670-739 US): You will qualify with most lenders and receive competitive rates. Online lenders may offer slightly better APRs than traditional banks. You have strong options and should prequalify with several lenders.

- Fair Credit (580-669 US): You can still get an unsecured loan, but your options will be more limited, and your APR will be higher. Focus on online lenders who specialize in fair credit and check with local credit unions. A co-signer could significantly improve your terms.

Advanced Tips from Loan Specialists for Securing the Best Personal Loan Rates

Loan specialists offer several advanced tips for savvy borrowers. First, if you and a partner are borrowing for a shared goal (like a home renovation), consider a joint application. If both of you have strong credit, the combined income can help you qualify for a larger loan amount and potentially a lower rate. Second, time your application strategically. Avoid applying for any other new credit for at least six months before seeking a personal loan to keep your credit report clean of recent hard inquiries. Finally, if you get a good offer, don’t be afraid to use it as leverage. You can sometimes ask your primary bank if they are willing to match or beat a competitive offer you received from an online lender.

FAQ

How Can I Get a $5,000 Loan Today Without Collateral?

To get a $5,000 unsecured loan today, your best bet is to target online lenders that specialize in fast funding. Start early in the morning on a business day. You will need a good credit score (typically 670 or higher) and a stable, verifiable income to qualify for same-day approval and funding.

Prepare your documents—such as a government-issued ID and recent payslips—in digital format before you apply. Use a loan comparison site to find lenders advertising “same-day” or “next-day” funding. Complete the application accurately and respond immediately if the lender requests additional information. Ensure your bank accepts faster payments to receive the funds quickly after signing the loan agreement. While same-day funding is not guaranteed, being highly prepared with a strong credit profile gives you the best possible chance.

How to Get $3,000 Today with Fast Online Approval?

Getting a $3,000 loan today requires speed and preparation. Focus exclusively on online lenders known for rapid processing. You’ll need a fair to good credit score and proof of steady income. Before you start, have digital copies of your ID and most recent proof of income (like a payslip) ready to upload.

Apply first thing on a weekday morning to meet the lender’s cut-off time for same-day transfers. Fill out the application form on the lender’s secure website, ensuring all details, especially your bank account information, are correct. Lenders like Rocket Loans or those on comparison platforms are good places to look. Approval can come within minutes if your application is straightforward. If approved, you can e-sign the loan agreement immediately to trigger the fund disbursement process.

How Can I Get a Personal Loan — Step-by-Step Guide for 2025

Getting a personal loan in 2025 follows a simple, streamlined process:

- Check Your Credit Score: Know where you stand financially. Get your free report and fix any errors.

- Determine Your Needs: Calculate exactly how much you need to borrow and what monthly payment you can afford.

- Prequalify with Multiple Lenders: Get rate quotes from at least three lenders (banks, credit unions, online) using soft credit checks that don’t impact your score.

- Compare Offers: Choose the loan with the lowest APR and most favorable terms (no prepayment penalty).

- Gather Documents: Prepare digital copies of your ID, proof of income, and proof of address.

- Submit the Formal Application: Fill out the application on the lender’s secure website.

- Review and Sign: Carefully read the final loan agreement before signing electronically.

- Receive Funds: The money will be deposited into your bank account, usually within 1-2 business days.

How Hard Is It to Get a $30,000 Personal Loan in the US or UK?

Getting a $30,000 personal loan (or the £ equivalent) is moderately difficult and primarily depends on your financial profile. Lenders consider this a significant amount for an unsecured loan, so they will scrutinize your application closely. To qualify, you will typically need a good to excellent credit score (700+ in the US), a stable and substantial income, and a low debt-to-income (DTI) ratio.

Lenders need to be confident that you can comfortably afford the monthly payments, which will be sizable for a loan of this amount. You will need to provide thorough documentation, including tax returns and several months of bank statements. If your credit or income is borderline, applying with a co-signer with a strong financial profile can greatly improve your chances of approval.

Get a Personal Loan Online — Trusted Platforms and Best Lenders

To get a personal loan online from a trusted source, start with reputable comparison platforms like NerdWallet, Credit Karma, or Bankrate in the US, and MoneySuperMarket or Compare the Market in the UK. These sites allow you to view offers from multiple verified lenders at once.

Some of the best and most trusted online lenders for borrowers with good credit include SoFi, LightStream, and Marcus by Goldman Sachs in the US, and M&S Bank or First Direct in the UK. These lenders are known for competitive rates, transparent terms, and excellent customer service. For those with fair credit, lenders like Upstart, Avant, and Rocket Loans are reliable options. Always verify a lender’s reputation through independent review sites like Trustpilot before applying.

How to Get a Personal Loan from a Bank — Application and Approval Process

To get a personal loan from a bank, start with the one where you have a checking or savings account, as they may offer relationship discounts. The process typically involves these steps:

- Inquire: Check the bank’s website or visit a local branch to see their current rates and terms.

- Prequalify: Many banks now offer online prequalification with a soft credit check.

- Apply: You can often apply online, but some banks may require you to complete the application in person with a loan officer.

- Provide Documents: You will need to submit your ID, proof of income (payslips, tax returns), and proof of address.

- Underwriting: The bank’s underwriting team will manually review your application, which can take several business days.

- Approval and Funding: If approved, you’ll sign the loan documents, and the funds will be deposited into your account, typically within 3-5 business days.

Capital One Personal Loan — What Are the Latest Offers?

As of late 2025, Capital One is not currently offering new personal loans. They have discontinued this product to focus on their core credit card and banking services. Existing Capital One personal loan customers will continue to have their loans serviced as usual, but new applications are not being accepted.

If you are looking for alternatives, consider other major banks with strong digital platforms like Discover, which offers personal loans with no origination fees. Top online lenders such as SoFi or Marcus are also excellent options, providing highly competitive rates and a fast, fully online experience that is similar to what Capital One offered.

Where Can I Get a Personal Loan with Low Rates and Fast Funding?

The best place to find a personal loan with a combination of low rates and fast funding is through online lenders and fintech companies. These lenders have lower overhead costs than traditional banks, which often translates into more competitive APRs. They also use technology to automate the application and approval process, enabling funding in as little as one business day.

To find the best options, use a loan comparison website to see offers side-by-side. Lenders like SoFi and LightStream are known for offering very low rates to borrowers with excellent credit. For pure speed, lenders like Rocket Loans often provide same-day funding to qualified applicants. Prequalifying with several of these online lenders is the most effective way to find the lowest rate you can get with the speed you need.

Wells Fargo Personal Loan — Compare Rates and Eligibility in 2025

Wells Fargo offers unsecured personal loans with competitive, fixed rates, making them a solid option for borrowers who prefer a traditional bank. In 2025, their rates are most competitive for customers with good to excellent credit scores (670+). A key advantage is that they often provide rate discounts for existing customers who set up automatic payments from a Wells Fargo checking account.

Eligibility requires being 18+ with a Social Security number, proof of income, and a solid credit history. They do not charge origination or prepayment fees. Loan amounts typically range from $3,000 to $100,000, with terms from 1 to 7 years. You can check your rate on their website with a soft credit check, and the application can be completed online, over the phone, or at a branch.

U.S. Bank Personal Loan — Application Process and Required Documents

U.S. Bank offers personal loans primarily to its existing customers. To apply, you generally need to have a U.S. Bank checking or savings account. The application process can be started online, but may require a follow-up at a branch.

The required documents are standard for a bank loan:

- Government-Issued ID: Such as a driver’s license or passport.

- Social Security Number: To verify your identity and check your credit.

- Proof of Income: Typically your two most recent payslips or your last two years of tax returns if you are self-employed.

- Employment Information: Your employer’s name, address, and your job title.

U.S. Bank offers fixed rates, no prepayment penalties, and rate discounts for customers who enroll in autopay. Their process is more traditional and may take longer than online-only lenders.

Best Personal Loans for Tier One Borrowers — Compare Rates and Terms

The best personal loans for borrowers in Tier One markets (US, UK, Canada, Australia) depend on your credit profile and priorities.

- For Excellent Credit: Lenders like LightStream (US), M&S Bank (UK), and major banks often provide the lowest APRs, sometimes below 7%. These are ideal for large loans where a low rate is paramount.

- For Speed and Convenience: Online lenders like SoFi (US), Rocket Loans (US), RateSetter (now part of Metro Bank, UK), and Lending Loop (Canada) excel. They offer fast, fully digital applications and funding within 1-2 business days.

- For Fair Credit: Lenders like Upstart (US), Avant (US/UK/Canada), and Fairstone (Canada) specialize in this area, using advanced data to approve a wider range of applicants.

Always use a comparison tool to see real-time offers tailored to your profile.

Get a Loan — Fast, Secure, and Tailored Options for Your Credit Profile

To get a loan that is fast, secure, and tailored to you, follow this modern approach. First, determine your needs and check your credit score. Next, use a secure online comparison platform to prequalify with multiple lenders. This allows you to see personalized offers based on your credit profile without any impact on your score.

For fast funding, prioritize online lenders. For security, ensure any lender’s site is encrypted (https://) and that they have strong positive reviews. For a tailored fit, choose the lender that offers the best combination of a low APR, no unnecessary fees, and a repayment term that results in a manageable monthly payment. This process puts you in control, ensuring you select a loan that truly works for your financial situation.