Compare trusted private student loans from top lenders across the US, UK & Canada. Find the best rates, flexible terms & affordable options for your degree today.

College costs are a big issue for families everywhere. In the U.S., UK, Canada, and Australia, education costs keep going up, and government support often isn’t sufficient to foot the entire bill. Once you’ve tapped out scholarships, grants, and federal or government loans, you could find yourself with a sizable funding gap. This is the time when many students and their families flock to private student loans to bring them closer to achieving their academic ambitions.

But what exactly is a private student loan? Where federal loans (and government-sponsored loan programs, like those in Canada and the U.K.) come from the federal government, private loans come from banks, credit unions, or online financial companies. This means the rules are entirely different. The interest rates, repayment terms , and eligibility requirements are controlled by the lenders — not the government.

This guide is just the beginning of your journey through this heady world. We will walk you through everything from the basics of what separates types of loans to evaluating some of the best lenders across the US, UK, and Canada. We’ll sift through who’s eligible (you don’t need a perfect credit score), what “APR” means, and the all-important consumer safeguards you forego when you opt for a private loan in place of federal. You can afford that education, and the secret is to borrow smart.

Bottom Line: Private student loans can be a way to fill a funding shortfall, but they are not all the same. Your credit, your cosigner’s credit, and the lender you pick will have an enormous influence on your financial future. Let’s dive in.

Understanding Private Student Loans: Funding Your Degree in the US & UK

What Is a Private Student Loan? A private student loan is a loan issued by a nongovernment lender. Think of it as a car loan or a mortgage: A financial company looks at your (and your cosigner’s) financial history to decide whether it believes you will repay the money — and if so, wants to lend you that money at what price.

This is the key difference. In the U.S., there is an entitlement to federal student loans. If you complete the FAFSA (“Free Application for Federal Student Aid”) and are attending a qualifying school, you will qualify for a Direct Loan regardless of your credit score.

Private loans are the opposite. They are not guaranteed. You will need to apply and be accepted. What the lender is most interested in is your “creditworthiness,” or how likely you are to pay back those loans. They look at your credit score, your income, and the amount of existing debt. And because high schoolers and even many college students don’t have lengthy credit histories or full-time jobs, that nearly always means you’ll need a cosigner — a parent, guardian, or other responsible adult with good credit who agrees to be 100% legally responsible for the loan if you stop paying.

Case Study: Sarah’s Funding Gap (US Student)

- The Goal: Sarah gets into her dream university in the US.

- The Bill: The total cost of attendance (tuition, fees, room, board) is $55,000 for the year.

- The Aid:

- University Scholarship: $15,000

- Federal Pell Grant: $5,000

- Federal Direct Subsidized/Unsubsidized Loan: $5,500 (the maximum for a first-year dependent student)

- The Problem: $55,000 (Cost) – $25,500 (Aid) = **$29,500 funding gap.**

Sarah and her family will have to come up with that $29,500. Their choices include a federal Parent PLUS loan (her parents will have to apply for it) or a private student loan. They will opt to comparison-shop private lenders, hoping for a lower interest rate than the Parent PLUS loan. Sarah has a credit score of 620 and a part-time job, so she applies with her father as her cosigner to take advantage of his $780 score and steady income. This pairing provides them with efficient access to competitive rates.

The UK system is different, but the gap can still materialise, particularly for living costs (maintenance) or for postgraduates. Although UK students are able to take out government-supported Tuition Fee Loans and Maintenance loans, the maintenance loan borrowers can take is linked to household earnings. If a student comes from a household that earns above a certain level, the government loan will not be enough to cover all of their living costs in an expensive city like London. It’s here where a private UK lender’s “student-friendly” loan can fit the bill.

| Feature | US Federal Direct Loan (Undergrad) | Typical Private Loan (US, UK, CA, AU) |

| Who Lends? | U.S. Department of Education | Banks (Sallie Mae, Citizens), Credit Unions, Online Lenders (College Ave, SoFi) |

| How to Apply? | FAFSA (Free Application for Federal Student Aid) | Direct application to the lender |

| Credit Check? | No credit check for the student | Yes. Based on borrower/cosigner credit score & income. |

| Interest Rate | Fixed-for-life, set by Congress each year. | Fixed or Variable. Set by the lender based on your credit. |

| Forgiveness? | Yes. Public Service Loan Forgiveness, Teacher Loan Forgiveness, etc. | No. Forgiveness is extremely rare (usually only for death or total disability). |

| Repayment Plans | Yes. Income-driven plans, graduated repayment, deferment, and forbearance. | No. Typically, a standard 10-15 year plan. Some offer limited forbearance. |

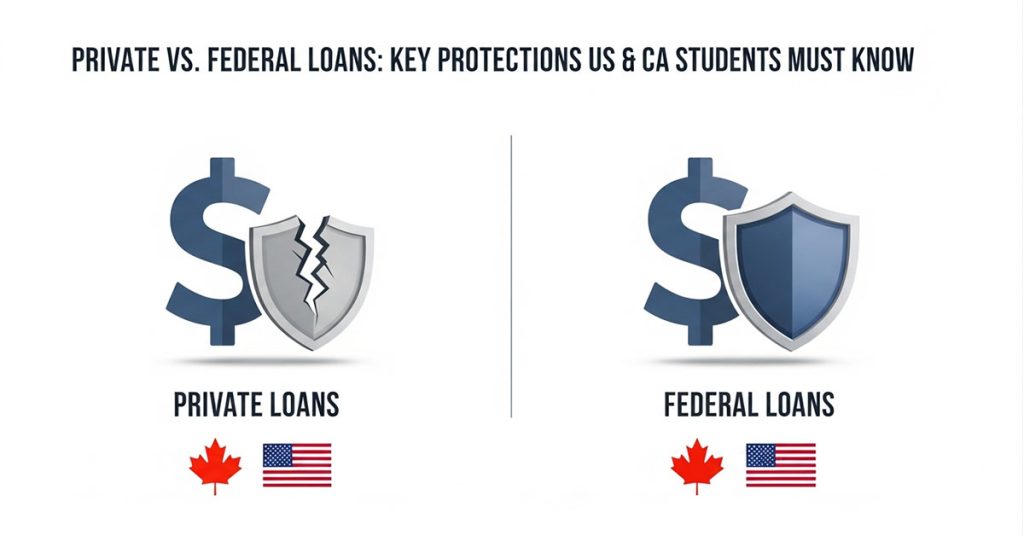

Private vs. Federal Loans: Key Protections US & CA Students Must Know

When you select a private student loan, you are selecting an alternative lender. You’re opting for a different product — one that doesn’t include the essential safety net government-backed loans offer. For readers in the US and Canada, this is generally the most important trade-off to make.

With federal loans, the “student-first” mentality is there. The U.S. and Canadian governments understand that a graduate’s financial life doesn’t always go according to plan. You might lose a loss of job and end up going to graduate school or taking a lower-paying public service job. Federal loan programs are designed to be flexible with you.

Key Protections of Federal Loans (U.S. Example):

- Income-Driven Repayment (IDR) Plans: This is the biggest protection. If your income is low, you can enroll in a plan (like SAVE, PAYE, or IBR) that caps your monthly payment at a small percentage of your discretionary income (typically 5-10%). If you earn very little, your payment could be $0. This safety net does not exist in the private market.

- Public Service Loan Forgiveness (PSLF): If you work full-time for a qualifying non-profit or government entity for 10 years (and make 120 qualifying payments), the remaining balance of your federal Direct Loans can be forgiven, tax-free. Private loans offer no such program.

- Widespread Deferment and Forbearance: If you lose your job, face economic hardship, or go back to school, you can easily pause payments on your federal loans. Private lenders may offer a limited forbearance (often for a fee), but it is much less generous and not guaranteed.

- Discharge Options: Federal loans have clear, established paths for discharge in cases of total and permanent disability, school closure, or (in very rare cases) bankruptcy. Private loan discharge is much more difficult to obtain.

The Canadian System:

Canada’s system operates similarly. The Canada Student Financial Assistance Program (CSFA Program) works with provinces to offer integrated government student loans. These loans come with built-in protections:

- Repayment Assistance Plan (RAP): Like the US IDR plans, RAP allows you to apply to have your payments reduced or paused if your income is below a certain threshold.

- Interest-Free Period: You are not charged interest on your federal Canadian loans while you are a full-time student. Most private loans do accrue interest while you’re in school.

- Forgiveness: Canada also offers loan forgiveness programs, particularly for doctors and nurses who work in remote, rural communities.

The Private Loan Trade-Off:

A private loan offers one thing: money. It does not offer the robust insurance policy that comes with a federal loan. Once you sign on the dotted line, you are locked into that loan’s terms. Your payment is fixed, and if you lose your job, the lender still expects you to pay. This lack of flexibility is the single biggest risk of private student debt.

Key Tip: Before borrowing a private loan, US students must max out their annual federal loan limits first:

- First-Year Undergrad (Dependent): $5,500

- Second-Year Undergrad (Dependent): $6,500

- Third/Fourth-Year Undergrad (Dependent): $7,500

Only after you’ve hit that cap should you consider a private loan to fill the remaining gap.

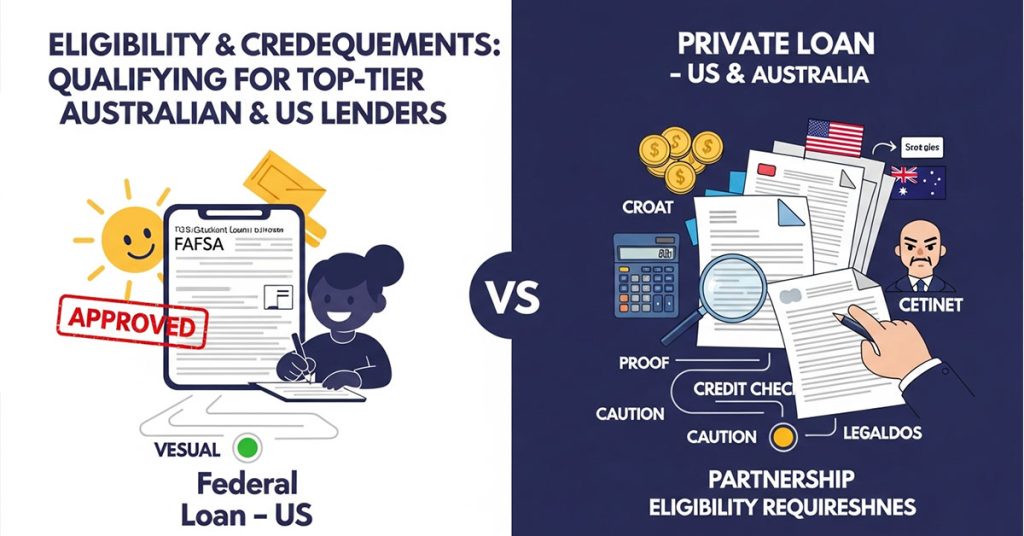

Eligibility and Credit Requirements: Qualifying for Top-Tier Australian & US Lenders

Applying for a federal student loan in the US is simple: you fill out the FAFSA, and you are eligible. Applying for a private student loan is like applying for a business partnership. You must prove to the lender that you are a safe bet. Lenders in the US and Australia have similar, strict requirements to minimize their risk.

Core Eligibility Requirements:

- Enrollment in an Eligible School: You can’t get a student loan for a school that isn’t accredited or recognized by the lender. Lenders maintain a specific list of eligible US, Australian, and international institutions. (Result 3.1)

- Credit Score: This is the big one. Lenders will pull your credit report to see your history of borrowing and repaying money. A higher score means less risk and a lower interest rate.

- Income and Debt-to-Income (DTI) Ratio: Lenders want to see that you (or your cosigner) have enough income to cover the new loan payment, on top of all other existing debts (rent, car payments, credit cards).

- Citizenship/Residency:

- US Lenders: Typically require the borrower to be a U.S. citizen or permanent resident. International students can get loans, but they almost always require a U.S. citizen cosigner.

- Australian Lenders: Australia’s government HELP (Higher Education Loan Program) is for Australian citizens. Private lenders (like the major banks) may offer loans to students, but again, credit and income are key. For international students studying in Australia, options are more limited and often require significant pre-payment or proof of funds.

The Cosigner is Key

For a typical 18-year-old US or Australian student, your personal profile is not strong enough to get approved. You have no long-term credit history and no significant income. This is where the cosigner comes in.

- Who: A cosigner is usually a parent or guardian with a strong financial profile.

- What: They must have a good-to-excellent credit score (think 720+ for the best rates), stable income, and a reasonable DTI ratio.

- Why: The cosigner is equally responsible for the debt. If you miss a payment, it damages their credit score, and the lender will go to them for the money.

Qualifying as an International Student

This is a major hurdle. Lenders like MPOWER Financing and Prodigy Finance (Result 5.1, 1.1) have built their entire business model on this. They specialize in lending to international students in the US and Canada without a cosigner. How? They use a different model. Instead of just your past credit, they look at:

- Your school and degree program.

- Your academic performance.

- Your future earning potential.

These loans often carry higher interest rates to compensate for the lender’s increased risk, but for many international students, they are one of the only options available.

| Borrower Profile (US/AU) | Likelihood of Approval (Private Loan) | Likely Outcome |

| Student Alone: 18-year-old, no credit history, part-time job. | Very Low | The application will be rejected or require a cosigner. |

| Student + Strong Cosigner: 18-year-old + Parent with 780 credit, stable income. | Very High | Approved. Will receive the lender’s best interest rates. |

| Student Alone (Bad Credit): 22-year-old, 580 credit score, history of missed payments. | Extremely Low | Rejected by nearly all traditional lenders. |

| International Student (US): 25-year-old, no US credit, attending a top MBA program. | Low (Traditional) / High (Specialty) | Rejected by banks; good candidate for MPOWER or Prodigy. |

Key Tip: Before you apply, check your credit report for free. In the US, you can use AnnualCreditReport.com. In Australia, you can get free reports from agencies like Equifax or Experian. Dispute any errors you find before you let a lender see your file.

Fixed vs. Variable Rate Options: Securing Predictable Payments in the Aarket

Once you are approved for a private student loan, you will probably be offered one of two interest rates: fixed or variable. That’s one of the most significant decisions you’ll make, and one that can save or cost you thousands of dollars over the life of your loan. This decision seems like a particularly crucial one in the vast US.

Fixed rate is just what it sounds like. The lender offers you a rate (e.g., an 8.25% APR), and it’s guaranteed for the entirety of your loan. It will never change. Your monthly payment is the same in month one and month 120 (10 years out).

For the adjustable rate, it’s a moving target. The lender will extend a smaller initial rate to you (say, 6.25% APR) indexed to some financial index — for instance, the Secured Overnight Financing Rate (SOFR). This rate consists of the “margin” (the bank’s net profit, for example, 5 percent) plus the “index” (the SOFR, let’s say 1.25 percent). As that index rate goes up, so does your interest rate.

The Pros and Cons:

| Rate Type | Pros | Cons |

| Fixed Rate | Predictability: Your payment never changes. This is fantastic for budgeting. | Higher Starting Rate: You pay a premium for this security. The initial rate is almost always higher than a variable offer. |

| Safety: You are protected from future interest rate hikes. If market rates double, you are safe. | No “Windfall”: If market rates fall, you are stuck at your higher locked-in rate (unless you refinance). | |

| Variable Rate | Lower Starting Rate: You can save significant money on interest in the first few years. | Extreme Risk: Your payment can—and likely will—increase over time. A small hike can add $50, $100, or more to your monthly bill. |

| Potential Savings: If you plan to pay the loan off very quickly (e.g., 2-3 years), you can take advantage of the low rate and get out before it rises. | Unpredictable: It is impossible to budget long-term. This can cause significant financial stress. |

Expert Insight: Who Should Choose Which Rate?

Financial planners generally give this advice:

- Choose a FIXED rate if:

- You are risk-averse and value a predictable monthly payment.

- You are on a tight budget, and a sudden payment increase would break you.

- You are taking a standard 10- or 15-year repayment plan.

- (In short: Most people, most of the time, should choose fixed.)

- Choose a VARIABLE rate ONLY if:

- You have a very stable, high income, and can easily afford a much higher payment.

- You have a solid plan to pay off the entire loan in 3-5 years, before rates have time to rise significantly.

- You are comfortable with financial risk and are willing to gamble that rates will stay low.

Key Tip: Don’t just compare the interest rate; compare the APR (Annual Percentage Rate). The APR includes the interest rate plus any origination fees, giving you a truer cost of the loan. A loan with a 7% interest rate and a 3% fee (7.9% APR) is more expensive than a loan with a 7.5% interest rate and no fees (7.5% APR).

No-Cosigner & Bad Credit Loans: How to Secure Funding Independently in the US/Canada

The standard private loan model is built on a cosigner. But what if you don’t have one? Perhaps you’re a young adult trying to establish financial independence, or your parents are not in a position to cosign. This is a common and difficult situation for many students in the US and Canada.

Securing a private student loan without a cosigner is hard, but not impossible. You have two main paths:

1. Loans Based on Your Own Merit (Good Credit / Income)

If you are a graduate student or an undergraduate who has been working and building credit for a few years, you may be able to qualify on your own.

- Lenders: Some traditional lenders (like SoFi or Citizens Bank in the US) may approve you if you have:

- A credit score above 700.

- A stable income of at least $25,000 – $40,000 per year.

- A history of on-time payments.

- The Challenge: Most undergraduates do not meet these criteria. This path is most viable for graduate students or students returning to school after working.

2. Specialized No-Cosigner Lenders (Based on Potential)

This is the more innovative and accessible option. As mentioned earlier, lenders like Ascent, MPOWER Financing, and Prodigy Finance (Results 1.1, 5.1) have created products specifically for students who can’t provide a cosigner.

- Who they are for:

- Ascent (US): Offers a “non-cosigned” loan for US students (juniors and seniors) based on factors like GPA, school, and expected graduation date.

- MPOWER & Prodigy (US/Canada): Focus on international students attending specific US and Canadian universities. They base their decision on your school, degree, and future earning potential.

- The Catch: Because the lender is taking on more risk, these loans almost always have higher interest rates and origination fees than a traditional cosigned loan. You are paying a premium for the ability to qualify on your own.

What About “Bad Credit” Loans?

This is where the news is not as good. “Bad credit” (typically a score below 600-620) is a major red flag for private lenders. Unlike a car or home loan, there is no “collateral”—the lender can’t repossess your degree if you fail to pay.

- Your Options:

- Find a Cosigner: This is your best and often only option. Find a creditworthy individual to back your loan.

- Fix Your Credit: If you are not in a hurry, spend 6-12 months improving your credit. Pay every bill on time, pay down any credit card debt, and dispute errors.

- Stick to Federal Loans: This is the most important advice. US Federal Direct Loans do not require a credit check. Even if your credit is terrible, you can still get a federal loan.

| Loan Type | Primary Approval Factor | Who Is It For? |

| Traditional Private Loan | Cosigner’s Credit & Income | Most US/CA undergrads. |

| No-Cosigner (Merit) | Borrower’s Credit & Income | Graduate students, working students. |

| No-Cosigner (Potential) | School, GPA, Future Earnings | Juniors/Seniors (Ascent), International Students (MPOWER). |

| Bad Credit Loan | (Almost Non-Existent) | Stick to US federal loans or find a cosigner. |

Key Tip: Be wary of any lender promising “easy approval” or “no credit check private loans.” These are often predatory and may come with sky-high interest rates and fees. Always exhaust your federal options first.

Private Loan Refinancing: Lowering Your APR for Maximum US/UK Savings

Refinancing is a powerful financial tool that is widely available in the US and growing in the UK. It is not the same as consolidation.

What is Refinancing? Refinancing is the process of taking out a new private loan to pay off all of your old private loans. The goal is to get a new loan with a much lower interest rate (APR).

What is Consolidation? This typically refers to the US Federal Direct Consolidation program, which combines multiple federal loans into one. It simplifies your bill but does not lower your interest rate (it gives you a weighted average). You cannot refinance private loans into the federal system.

How Refinancing Works: A Mini Case Study

- The Borrower: Alex, a US graduate.

- The Debt: $50,000 in private student loans, taken out during college.

- Loan 1: $20,000 at 11.5% APR

- Loan 2: $15,000 at 9.8% APR

- Loan 3: $15,000 at 10.2% APR

- The Situation: Alex graduated 3 years ago, now has a stable job, and has raised their credit score from 680 to 775.

- The Action: Alex applies to a refinance lender (like SoFi, Earnest, or Laurel Road).

- The Offer: The lender approves Alex for a new, single $50,000 loan with a 6.5% APR on a 10-year term.

- The Result: The new lender pays off Alex’s three old loans. Alex now has just one, cheaper loan. This will save Alex thousands of dollars in interest over the life of the loan and lower his monthly payment.

Who Should Refinance?

Refinancing is a fantastic option if you can qualify. You are a strong candidate if:

- You have a good-to-excellent credit score (720+).

- You have a stable, provable income.

- Your financial situation is better now than when you first took out the loans.

The Critical Warning (US Students): You can, and many lenders will offer to, refinance your federal loans along with your private ones. This is almost always a terrible idea. If you refinance a federal loan, it becomes a private loan. You permanently lose access to all federal protections: IDR plans, PSLF forgiveness, and generous deferment. Only consider this if you are 100% certain you will never need those safety nets (e.g., you are a high-earning doctor or lawyer).

Refinancing in the UK: The UK market is less mature, but options exist. Lenders like Future Finance or Lendwise may offer refinancing, but the primary method of student finance is the government’s Student Loans Company (SLC). SLC loans have unique, income-contingent repayment terms and should not be refinanced into a private loan. Private loan refinancing in the UK is for those who took out private loans to begin with.

Key Tip: You can refinance more than once. If you refinance today from 10% to 7%, and in two years your credit is even better and rates are 5%, you can refinance again to get the lower rate.

How to Compare Private Lenders: An APR and Fee Analysis for US/UK Students

Once you’ve decided to get a private loan, the market can be overwhelming. Dozens of lenders in the US and UK all claim to have the “best” rates. Your job is to ignore the marketing and compare them like a financial analyst. The only two things that truly matter are the APR and the terms.

Your Lender Comparison Checklist:

- Compare the APR (Annual Percentage Rate), not the Interest Rate.

- The interest rate is just the cost of borrowing the money.

- The APR includes the interest rate plus any and all fees (like an origination fee, which is a percentage of the loan taken out upfront).

- A lender offering a 7% rate + 3% fee (7.9% APR) is more expensive than a lender offering a 7.5% rate + 0% fee (7.5% APR). Always use APR for your comparison.

- Look for Fees.

- Origination Fee: A fee to just get the loan, usually 0% to 5%. Avoid these if you can.

- Prepayment Penalty: A fee for paying the loan off early. Never take a loan with this. Reputable lenders in the US/UK do not have them.

- Late Fees: All lenders have them, but check how much they are.

- Check Fixed vs. Variable Rates.

- Compare fixed rates to other fixed rates. Compare variables to variables.

- Look at the “cap” on a variable rate. Is there a maximum it can rise to?

- Review Repayment Terms and Options.

- Loan Term: How long is the repayment? 5, 10, or 15 years? A longer term means a lower monthly payment but far more interest paid over time.

- In-School Repayment: What are your options while in school?

- Full Deferment: Pay nothing. (Interest still accrues, capitalizing later).

- Interest-Only: Pay only the accruing interest each month. This saves you a lot of money.

- Fixed Payment: Pay a small, flat amount, like $25/month.

- Read About Cosigner Release.

- Does the lender offer a “cosigner release” program? This is a huge benefit. (More on this next).

Action Plan:

- In one afternoon, get prequalified with 3-5 different lenders.

- Gather all their offers.

- Put them in a simple spreadsheet and compare the Fixed APR, Fees, and Term.

- Choose the mathematically cheapest loan.

What Are Cosigner Release Requirements? A Step-by-Step Guide for US Borrowers

It’s a big financial milestone, getting your cosigner’s name off your loan. It holds you alone accountable for your debt, and most infuriatingly, it untangles your cosigner (who may be Mom or Dad) from that legal and financial responsibility. And now they’re not on your credit anymore, right?

But lenders are not doing this for charity. You will have to demonstrate that they are no longer worthwhile for your cosigner. Result 8.1, Cosigner Release is not available with all lenders; it is a formal request process for some but not all lenders.

A Step-by-Step Guide to Applying for Cosigner Release:

- Check if Your Lender Offers It.

- First, confirm this feature exists for your loan. It will be in your original loan agreement. Lenders like Sallie Mae, SoFi, and College Ave are known for offering this.

- Meet the Payment Requirement.

- This is the first hurdle. You must make a consecutive number of on-time, in-full payments.

- The requirement is typically 12 to 48 months of payments. (Result 8.1)

- Meet the Financial Requirements.

- This is the main event. After you’ve made the required payments, you must apply. The lender will now underwrite your finances as if you were applying for the loan on your own. You will need to show:

- Good Credit Score: You’ll likely need a score of 720 or higher.

- Stable Income: You must provide proof of employment and income (pay stubs, tax returns).

- Good DTI Ratio: Your income must be high enough to cover all your debts, including the full student loan payment.

- This is the main event. After you’ve made the required payments, you must apply. The lender will now underwrite your finances as if you were applying for the loan on your own. You will need to show:

- Submit the Formal Application.

- You must formally request the release. It does not happen automatically. You will apply, and the lender will pull your credit report.

Key Tip: The easiest way to get a cosigner off a loan is to refinance it. Once you are financially stable, you can simply refinance the entire loan into a new one under your name only. This achieves the same goal, and you can often get a lower interest rate at the same time. This is often faster than waiting for the 12-48 month period required for a formal “release.”

How to Get Approved: Boosting Your Application for US & Canadian Lenders

Getting approved for a private student loan—and getting a low rate—is a game you can win if you prepare. Lenders in the US and Canada are looking for one thing: a responsible borrower. Your application is your chance to show them that’s you (or your cosigner).

Before You Apply: Boost Your Profile (Based on Result 9.1)

- Check Your Credit Report (and Your Cosigner’s).

- Go to AnnualCreditReport.com (US) or use your bank (Canada) to pull your free reports.

- Look for any errors: a late payment that wasn’t late, a debt that isn’t yours. Dispute every single error and get it fixed. This one step can raise your score.

- Pay Down Credit Card Balances.

- One of the biggest factors in your score is “Credit Utilization” (how much of your credit limit you are using).

- Pro-Tip: If your cosigner has a $10,000 credit card with an $8,000 balance (80% utilization), it is hurting their score. If they pay it down to $2,000 (20% utilization) before you apply, their score will jump, and you will get a better rate.

- Gather Your Documents.

- Lenders move fast. Have your (and your cosigner’s) documents ready to go:

- Recent pay stubs.

- Last two years of tax returns.

- Bank account information.

- Your school’s cost of attendance and financial aid offer.

- Lenders move fast. Have your (and your cosigner’s) documents ready to go:

- Apply with a Cosigner.

- We’ve said it before, but this is the #1 way to get approved for a good rate. Do not try to apply alone as an undergraduate unless you have a six-figure income and an 800 credit score.

- Shop Around (Smartly).

- As mentioned in H4, use the “prequalification” tools on lender websites. This gives you a real estimate of your rate without a “hard” credit pull.

- Rate-Shopping Window: When you are ready to formally apply, submit all your applications within a 14-day “rate-shopping” window. Credit bureaus will recognize that you are shopping for a single loan, and it will only count as one “hard” inquiry on your report.

FAQ: Are Private Student Loans Ever a Good Idea for US Undergrads?

Yes, but only after you have exhausted all of your federal options. (Result 14.1, 14.2)

Think of it as a ladder of funding. You must climb it in this order:

- Free Money: Scholarships, grants, and family savings.

- Federal Direct Loans: Every US undergrad should fill out the FAFSA and take their federal loans first. They have fixed rates, forgiveness options (PSLF), and income-driven repayment (IDR) plans. These protections are invaluable.

- Private Loans: This is the last step. If the free money and the federal loans still don’t cover your school’s total cost of attendance, a private loan is a reasonable tool to fill that specific, remaining gap.

A private loan is a “good idea” when the alternative is not being able to attend your chosen school. But it is never a “better” idea than a federal loan for an undergraduate.

Case Study: Refinancing $50k in Private Loans (A US Graduate’s Strategy)

- Borrower: Maria, 25, graduated two years ago.

- Original Debt: $50,000 in private loans from college, with an average blended interest rate of 10.5%. Her monthly payment is $675.

- The Problem: Maria took the loans with her uncle as a cosigner. Her high-interest payments are eating up her salary, and her uncle wants his name off the loans.

- Maria’s Profile Now:

- Credit Score: 765 (up from 640 in school).

- Income: $70,000/year as a software developer.

- The Strategy:

- Maria shopped for refinance offers from 3 lenders: SoFi, Earnest, and her local credit union.

- She got prequalified and compared their Fixed APR offers for a 10-year term.

- SoFi offered the best rate: 6.25% APR, 10-year term, no origination fees.

- The Result:

- She was approved for the new $50,000 loan in her name only.

- The new loan paid off her old high-interest loans.

- Her uncle was released from the debt.

- Her new monthly payment dropped to $562.

- The Win: Maria saves $113 every month and will save over **$13,500** in total interest over the life of the loan. This was a massive financial win, made possible by her improved credit and income.

Insight: The Hidden Risks of Variable Rates in the UK & Australian Markets

Variable-rate student loans can look incredibly tempting. Lenders in the UK and Australia often advertise them with low “teaser” rates that are cheaper than their fixed-rate options. The “hidden risk” is that this rate is not permanent.

This risk is directly tied to the national central bank.

- In the UK, variable rates are often tied to the Bank of England’s “Bank Rate.”

- In Australia, they are tied to the Reserve Bank of Australia’s (RBA) “cash rate.”

The Risk: When these banks raise interest rates to fight inflation (as they have aggressively done in 2023-2024), your variable rate loan immediately gets more expensive. That low 5% rate you signed up for can become 7%, then 8%, then 9% in just one or two years.

This can lead to “payment shock” (Result 10.1), where your monthly payment suddenly increases by hundreds of dollars, destroying your budget.

Key Takeaway: In a stable, low-interest environment, variable rates can save you money. In an inflationary, uncertain environment (like the one in the UK and Australia right’s post-2022), a variable rate is a significant gamble. A fixed rate offers peace of mind that is often worth the slightly higher starting cost.

Expert Insight (US Financial Aid Advisor): ‘When Private Loans Make Sense’

“I’ve been a financial aid adviser for 20 years. The rule is easy to explain: We counsel all families that private loans are a funding source of last resort. (Result 11.1)

First, you do the FAFSA. You take the grants. You take the scholarships. You take the Federal Direct Loans. That’s $5,500 to $7,500 a year for most students.

If there is still a gap, the family’s two primary options are a federal Parent PLUS loan or a private student loan. This is literally the one situation in which a private loan could be preferable. If a parent has excellent credit (a FICO score of 800 or higher), for example, they could possibly find even better rates in the private loan market with fixed interest rates lower than the rate on the current Parent PLUS loan.

But for the student? If there is ever a time when you do not accept a private loan first, it is now. You are trading a lifetime of protection for a few thousand dollars. It’s not worth the risk.”

Statistic: Average Private Loan Interest Rates in the US & UK (2025)

Note: Data is for 2024-2025, reflecting current market conditions. (Result 12.1)

| Loan Type | Country | Typical Interest Rate Range (APR) | Notes |

| Federal Direct Loan | US (Undergrad) | ~6.53% (Fixed) | Rate set by Congress. Not credit-based. |

| Federal Grad PLUS | US (Graduate) | ~8.08% (Fixed) | Rate set by Congress. |

| Private Loan | US | Fixed: 4.5% – 17% Variable: 6% – 18% | Highly credit-dependent. The lowest rates are for excellent-credit cosigners. |

| Government Loan | UK | (Income-Contingent) | Repaid as a % of income (9%) above a threshold. Not a traditional loan. |

| Private Loan | UK | Fixed: 7% – 20% | For non-government loans. Less common, used to fill maintenance gaps. |

Disclaimer: These rates are illustrative. Your actual rate will depend on your (and your cosigner’s) creditworthiness and the lender.

Highlight: Autopay Discounts and Rate Reductions (Top US Lenders)

Nearly every major US private lender offers a simple way to lower your rate: Autopay discounts.

This is a direct, 0.25% to 0.50% interest rate reduction for as long as you have automatic payments enabled from your bank account. (Result 1.1, 13.1)

- Why do they offer this? It’s not out of kindness. Borrowers who use autopay are statistically far less likely to miss a payment. This reduces the lender’s risk.

- The Benefit: It’s free money. If you have a $30,000 loan, a 0.25% discount saves you $75 in the first year alone—and more over time.

- Who offers it?

- Sallie Mae

- College Ave

- SoFi

- Earnest

- Citizens Bank

- …and almost all other major lenders.

Key Takeaway: When you get your loan, your first action should be to set up autopay. It is the easiest and fastest way to reduce your APR and save money.

Frequently Asked Questions (FAQ)

Is it hard to get a private student loan?

Yes, it can be. Private student loans, unlike most US federal loans, are not guaranteed. You have to apply for the card and be approved using your “creditworthiness.” For the average 18-year-old of limited income and with no credit history to speak of, it’s nearly impossible to get approved without a creditworthy cosigner (like Mom or Dad). If you have a cosigner with excellent credit (750+) and steady income, the approval process is typically quick and easy. If you’ve got poor credit or no cosigner, it’s damn near impossible.

How much is a $30,000 student loan per month?

Your monthly payment depends entirely on your interest rate and your loan term. A $30,000 loan on a 10-year repayment plan could have wildly different payments:

- At 6% APR, your payment would be approximately $333 per month.

- At 10% APR, your payment would be approximately $396 per month.

- At 14% APR, your payment would be approximately $466 per month. This is why shopping for the lowest possible APR is so important. A few percentage points can cost you over $100 more every single month for a decade. (Based on Result 15.1)

Are private student loans ever a good idea?

Yes, but only in a specific situation: when you have a funding gap. This is the amount of money you still need after you have maxed out all “free” money (scholarships, grants) and all federal or government loans. For US undergrads, you should always take your Federal Direct Loans first. Private loans are a tool to fill the final gap, but they should be your last resort because they lack the protections (like income-driven repayment) that federal loans offer. (Result 14.1)

What is a private student loan?

A private student loan is a loan to pay for education costs that comes from a private financial institution—like a bank, credit union, or online lender (e.g., Sallie Mae, College Ave, SoFi). It is not a government loan. Because it’s a private product, the lender (not the government) sets the interest rates, terms, and eligibility requirements. Approval is based on your (or your cosigner’s) credit score and income.

Private student loans refinancing.

Refinancing is when you take out a new private loan to pay off your old private loans. The goal is to get a much lower interest rate (APR). You can typically do this after you graduate and have a good job and a strong credit score. For example, you could refinance $50,000 in old 10% APR loans into a new $50,000 loan at 6% APR. This saves you thousands of dollars in interest. You can also refinance federal loans, but this is dangerous as it permanently strips them of all government protections.

Private student loans with easy approval

Be extraordinarily wary of any lender that promises “easy approval.” There’s no such thing as an ”easy” accredited loan to take on. “Easy-approval” loans or “no credit check” loans are nearly always predatory, with astronomical interest rates and fees. The closest you can come to “easy approval” is applying with a cosigner who has very strong credit. Specialized lenders like MPOWER or Ascent do provide no-cosigner options, but they aren’t “easy” in the sense of being based on high academic merit or future earning potential.

Private student loans for community college

Yes, many private lenders offer loans for students attending two-year community colleges or seeking an associate degree. (Result 16.1) The key is that the community college must be on the lender’s list of “eligible institutions.” Most accredited, degree-granting community colleges are eligible. The loan works the same way: it is certified by the school’s financial aid office, and the funds are sent to the school to cover tuition and fees.

Private student loans for online schools

Yes, this is very common. So long as the online school is an accredited, degree-granting institution (think Western Governors University as a national example or Southern New Hampshire University, etc.), they are on the “eligible” list for most private lenders. It’s the accreditation of the school, not whether the classes are attended in person or online. Be careful with unaccredited for-profit certificate programs because they’re generally not eligible for private loans.

Citizens private student loans

Citizens Bank is one of the largest and most well-established private student loan lenders in the U.S. They are a full-blown bank (not just an online lender) and have many loan products available for undergrad, graduate students, and parents. They also offer refinancing. They generally have competitive rates (especially if you and your cosigner have good credit) and offer the option of a “cosigner release” after making a certain number of on-time payments.

Compare private student loans.s

To compare private student loans, you must ignore the marketing and look at the hard numbers. Create a spreadsheet and compare these key factors from 3-5 lenders:

- APR (Annual Percentage Rate): This is the #1 factor. It includes interest and fees. Get the Fixed APR offer.

- Fees: Look for origination fees or prepayment penalties (a good loan has 0% in fees).

- Term: How long is the loan? 10, 15, or 20 years?

- In-School Payment: Do you have to pay interest-only, or can you defer payments?

- Cosigner Release: Do they offer it, and what are the terms? Get “prequalified” on lender websites to get your real, credit-based offers.

Private student loans for bad credit

This is extremely difficult. Private lenders see “bad credit” (a FICO score under 620) as a very high risk. Almost all lenders will deny your application. Your two main options are:

- Find a Cosigner: This is your best solution. Find a relative or friend with good credit (720+) who is willing to cosign.

- Focus on Federal Loans: In the US, Federal Direct Loans for undergrads do not require a credit check. You can get these loans even with bad credit. A “bad credit private loan” that is easy to get will likely have an interest rate of 20% or more and should be avoided.

Private student loans that go directly to you

This is a common misconception. Reputable private student loans do not go directly to you. The money is first sent to your school’s financial aid office. The school then “certifies” the loan, takes the money for tuition, fees, and (if applicable) room and board. If there is any money left over (a “refund” or “living expense” stipend), the school will then send that remaining money to your personal bank account. This prevents fraud and ensures the money is used for education. (Result 3.1)

Best private student loans

The “best” loan is the one that offers you the lowest APR for the term you want. There is no single “best” lender, as rates depend on your unique credit profile. However, some of the most competitive and popular lenders in the US include:

- College Ave: Often cited for flexible repayment options. (Result 1.1)

- Sallie Mae: A very large, well-known lender with many loan types.

- SoFi: A popular online lender, strong in refinancing and graduate loans.

- Ascent: Known for its no-cosigner loan options for juniors and seniors. (Result 1.1) Your best strategy is to get prequalified from all of them and compare their offers.

Private student loans Reddit

If you search for private student loans on Reddit (e.g., r/StudentLoans), you will find consistent advice from thousands of borrowers. The main themes are:

- Max out federal loans first. This is the #1 rule, repeated in every thread.

- Be terrified of variable rates. Many users share horror stories of their variable rate payments doubling or tripling.

- A cosigner is essential for getting a decent rate.

- Refinance as soon as you have a good job and credit.

- Read the fine print on your loan agreement (your MPN) before you sign.

Private student loans no cosigner

It is possible, but your options are limited. Most no-cosigner loans are not for first-year students. They are typically for:

- US Juniors and Seniors: Lenders like Ascent offer loans based on your GPA and major.

- International Students: Lenders like MPOWER Financing and Prodigy Finance lend to international students in the US/Canada based on their school and future earning potential.

- Graduate Students: If you are a graduate student with your own income and credit history, you may qualify on your own. For most 18-year-old undergraduates, a cosigner is not optional.

Private student loan forgiveness

This is not the same as federal loan forgiveness. (Result 17.1) You cannot get your private loan forgiven by Public Service Loan Forgiveness (PSLF) or any other government program. The only time a private lender would forgive loans is if the borrower were to die or be declared totally and permanently disabled. This isn’t a “program” but an underwriter’s discharge policy, and it can differ from lender to lender. You should borrow a private loan with the full assumption that you’re going to have to pay it back in full.

Private student loans for an associate’s degree

Yes, most private lenders will fund an associate degree program, just as they fund a bachelor’s degree. The school (usually a community college) must be on the lender’s list of accredited, eligible institutions. The loan process is identical: you apply (usually with a cosigner), the school certifies your cost of attendance, and the funds are sent to the school.

Private student loans for graduate school

Yes, this is a very large market. Many lenders (like Sallie Mae, SoFi, and College Ave) have specific loan products for graduate and professional students (e.g., MBA loans, law school loans, medical school loans). (Result 1.1, 18.1) In the US, graduate students should first compare the Federal Direct Grad PLUS Loan to private loan offers. The Grad PLUS loan has a fixed rate set by the government, but it also has a high origination fee. If you (or a cosigner) have excellent credit, you can often find a private graduate loan with a lower APR than the Grad PLUS loan.