Student Loans from credit unions: secure, low-rate options in the US, UK, Canada & Australia — affordable, flexible terms to unlock financial freedom.

Choosing to pursue higher education is an exhilarating, life-altering decision. It’s your route to new skills, a rewarding career and developmental growth. But let’s face it: the price can be terrifying. With tuition fees, living costs and funding applications to contend with for most students in the US, UK, Canada and Australia can be a minefield that seems at worst insurmountable. You are concerned about acquiring “bad debt,” puzzled by words such as “interest rates” and “forgiveness,” and frightened that you could make a mistake that would dog you for decades.

It’s a common fear, and yet it doesn’t have to be that much of your reality. Student loans are not a form of debt, they’re an absolute best-in-class financial product to help you achieve a better tomorrow. If you take care of them properly, they are one of the greatest investments you’ll ever make — in YOURSELF.

It’s not the loan that’s the issue; it’s the missing map. This guide is your map. We are going to make the whole thing, from applying to paying it off, easier. We will illustrate the key distinctions between federal and private student loans, help you gain an understanding of the powerful loan forgiveness and assistance programs being offered in your country, and give you confidence in how to borrow smart. The goal is to help you see student loans as a strategic asset rather than a burden. Your journey to financial freedom begins here — and is way simpler than you would ever think.

Understanding Student Loans: A Beginner’s Guide to Borrowing and Repayment in the US

For Americans enrolled in college, the student loan market is largely a tale of two lenders: the United States government and private banks. The difference is the most important act you can take to secure your financial future.

One way to think of it: Federal loans are like a program of structured financial aid with its own safety nets. Private loans are a traditional consumer product, akin to a car loan, offered by banks and credit unions.

Meet Maya, a prospective engineering major. Her university runs $40,000 a year. She has to take out $25,000 in loans after scholarships.

- Step 1: She fills out the FAFSA (Free Application for Federal Student Aid).

- Step 2: The government offers her a package:

- $5,500 in Direct Subsidized Loans: The government pays the interest on these while she’s in school. This is the best loan you can get.

- $2,000 in Direct Unsubsidized Loans: She is responsible for the interest, but she can let it build up (capitalize) or pay it while in school.

- Step 3: She still has a gap. She could ask her parents to take out a Direct PLUS Loan (another federal loan) or she could seek a private student loan. She compares a PLUS loan with a 8.94% interest rate to a private bank loan. Because her parents have excellent credit, the private bank offers 7.5%.

In this case, Maya decides to take the federal subsidized and unsubsidized loans (the best deal) and her parents take the private loan to fill the gap. She made an informed choice by always starting with federal options first.

US Federal vs. Private Loans: A Head-to-Head Comparison

| Feature | Federal Direct Loans (for Students) | Private Student Loans (from Banks) |

| How to Apply | FAFSA (Free Application for Federal Student Aid) | Direct application with the lender (e.g., Sallie Mae, SoFi) |

| Interest Rates | Fixed for life. Set by Congress annually (e.g., 6.39% for undergrads in 2025-26). | Fixed or variable. Based on your (or your cosigner’s) credit score. Can be lower or much higher. |

| Need a Cosigner? | No. Based on financial need, not credit. | Almost always for undergraduates. |

| Key Benefits | Access to loan forgiveness (PSLF), Income-Driven Repayment (IDR) plans, and generous deferment/forbearance. | Can borrow higher amounts (up to 100% cost of attendance). Potentially lower rates if you have exceptional credit. |

| The Catch | Loan limits are relatively low. | No forgiveness. Far less flexible repayment options. They are not required to help you if you lose your job. |

Key Takeaway: Always exhaust your federal student loan options first before even considering a private loan. The government-backed safety nets, like the SAVE plan and Public Service Loan Forgiveness, are invaluable and do not exist in the private market.

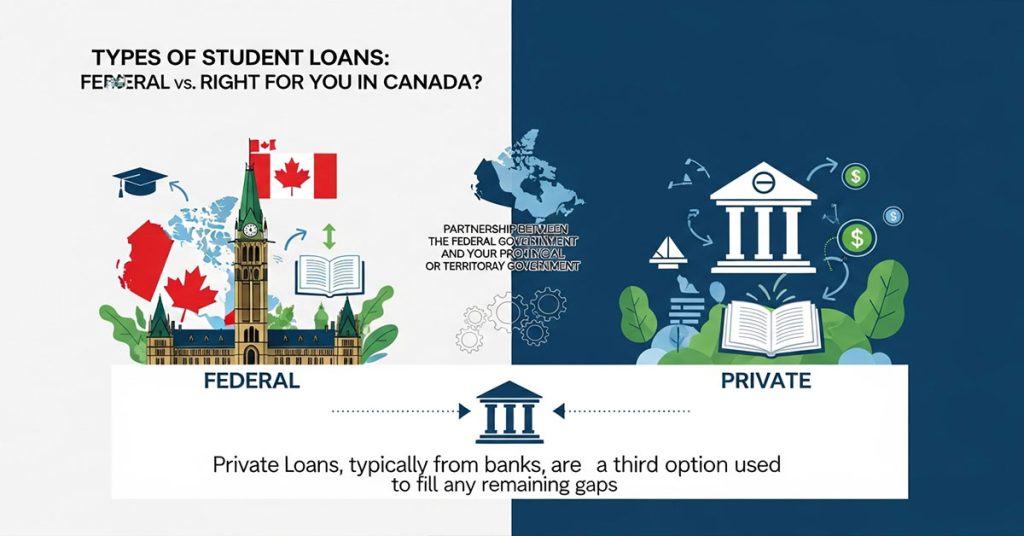

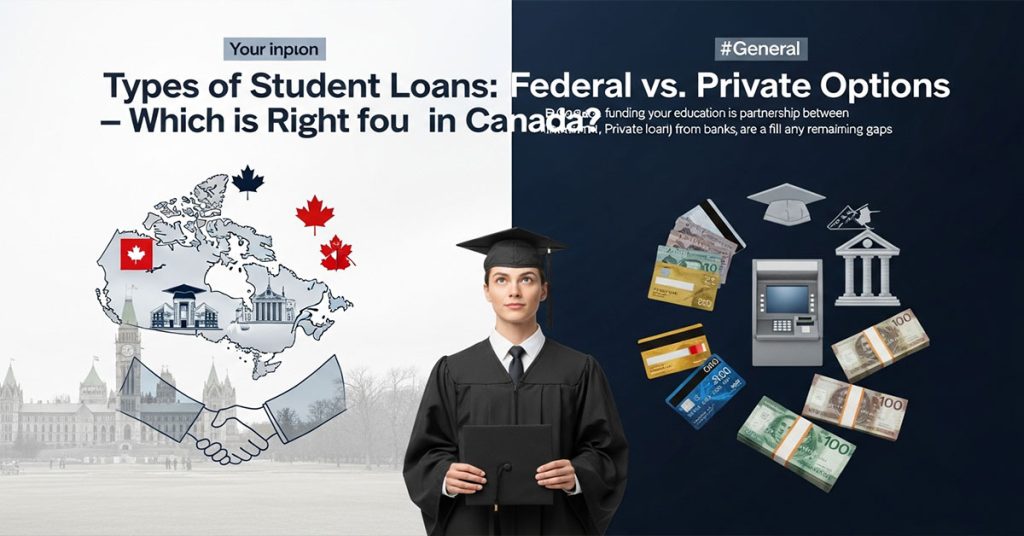

Types of Student Loans: Federal vs. Private Options – Which is Right for You in Canada?

In Canada, funding your education is a partnership between the federal government and your provincial or territorial government. Private loans, typically from banks, are a third option used to fill any remaining gaps.

The main source of funding is the Canada Student Loans Program (CSLP). When you apply for aid through your province (e.g., OSAP in Ontario, StudentAid BC), you are automatically assessed for both federal and provincial loans and grants. This integrated system is a huge advantage.

Key Tip → The best part? You’re also assessed for Canada Student Grants, which is money you do not have to pay back. This is free money. By not applying, you are leaving free money on the table.

Private loans in Canada often come in the form of a Student Line of Credit from a major bank (like RBC, Scotiabank, or CIBC). This is very different from a government loan:

- It’s a revolving credit limit, like a credit card. You can draw and repay funds as needed.

- It’s credit-based, meaning you’ll likely need a parent to cosign.

- Most require you to pay the interest (at a minimum) every month, even while you’re still in school.

- They have no forgiveness programs and no Repayment Assistance Plan (RAP).

Case Study: Liam’s Smart Funding Strategy

Liam is starting a 4-year program at the University of Toronto.

- Tuition + Living Costs: $28,000 per year.

- He applies via OSAP (Ontario’s integrated system).

- Result: He’s awarded a total of $18,000 for the year:

- $7,000 in Canada Student Grants (free money!).

- $11,000 in integrated loans (part federal, part provincial).

- The Gap: He still needs $10,000. He and his parents secure a Student Line of Credit from their bank for $10,000.

- Smart Move: Liam works part-time on campus and uses his earnings to pay the monthly interest on his $10,000 line of credit, preventing the balance from growing. He doesn’t touch his government loans, which are interest-free while he studies.

Liam successfully combined the best of both systems: he maximized his grants and interest-free government loans, and used a private line of credit responsibly to cover the rest.

Canada: Government Loans vs. Private Lines of Credit

| Feature | Government Loans (CSLP & Provincial) | Private Student Lines of Credit |

| How to Apply | One application through your provincial portal. | Directly at a bank (e.g., CIBC, BMO). |

| Interest | Interest-free while in school (federal part). Repayment begins 6 months after graduation. | Interest is charged immediately. Most require interest-only payments while in school. |

| Repayment Help | Yes. Access to the Repayment Assistance Plan (RAP), which can lower or pause payments. | No. Repayment terms are set by the bank. |

| Forgiveness | Yes. Potential for loan forgiveness for doctors, nurses, or social workers in rural/remote areas. | None. |

| Best For | Everyone. This should be your first and primary source of funding. | Filling the gap left after government aid and for students who may not qualify for CSLP (e.g., some international students). |

How Student Loans Affect Your Financial Future: Expert Insights for UK Students

If you’re a student in England or Wales, your relationship with student loans is fundamentally different—and in many ways, better—than in the US or Canada. It’s crucial to understand this: a UK student loan does not behave like a normal “debt.”

You should think of it as a “graduate contribution” or a “graduate tax.”

Here’s why:

- You only repay if you earn enough. You only make payments if your income is over a specific threshold. For new students on Plan 5 (starting after August 2023), this threshold is £25,000 per year.

- Payments are tied to your income. You pay 9% of whatever you earn above that threshold. If you earn £30,000, you pay 9% of £5,000 (which is £450/year, or £37.50/month). If your income drops, your payments stop.

- It’s collected automatically. The payment is deducted from your paycheck via PAYE, just like income tax and National Insurance. You never “miss a payment.”

- The debt is written off. The government doesn’t expect most people to repay the full amount. Under Plan 5, whatever is left after 40 years (from the April after you graduate) is completely forgiven.

Case Study: How Freya’s Loan Impacts Her Life

Freya is a new graduate from Manchester who studied history.

- Total Loan Balance: £60,000 (from tuition and maintenance loans).

- Job 1: Her first job is a part-time role at a museum paying £22,000. She pays £0 toward her student loan, as she is under the £25,000 threshold.

- Job 2: Two years later, she gets a promotion and earns £32,000.

- Her repayment is calculated: £32,000 – £25,000 = £7,000.

- Her payment is: 9% of £7,000 = £630 per year (or £52.50 per month).

- The Big Question: Does her £60,000 balance “look bad” when she applies for a mortgage?

- No. As we’ll see in H5, the loan does not appear on her credit file. The mortgage lender only sees the £52.50 monthly payment as a deduction from her income, just like a pension contribution. It reduces her affordability slightly, but the £60,000 “debt” total is largely irrelevant.

UK Loan Repayment Plans: A Comparison

This table shows the different repayment plans for English students.

| Plan Type | Who It’s For | Repayment Threshold (2025-26) | Pay 9% on Income Above… | Loan Written Off After… |

| Plan 1 | Started before 2012 | £24,990 | £24,990 | 25 years (or age 65) |

| Plan 2 | Started 2012 – 2023 | £27,295 | £27,295 | 30 years |

| Plan 5 | Started after Aug 2023 | £25,000 | £25,000 | 40 years |

| Postgraduate | Master’s or Doctoral | £21,000 | £21,000 | 30 years |

Key Takeaway: Do not be afraid of the large headline number of your UK student loan. Your repayment is linked to your success, not to the total amount you borrowed.

How to Apply for Federal Student Loans: A Step-by-Step Guide for US Students

In the United States, the journey to federal financial aid begins with one form: the FAFSA (Free Application for Federal Student Aid). This single application determines your eligibility for all federal aid, including grants (which you don’t repay), work-study programs, and federal loans.

Think of the FAFSA as the master key that unlocks all the best funding options. You must fill it out, even if you think you won’t qualify. Many scholarships and state-level grants also require a completed FAFSA.

The process was recently simplified, but it still requires careful attention. Here is your step-by-step guide for the 2025-2026 academic year.

Step 1: Create Your FSA ID

Before you can even start, you and anyone who must provide information on your FAFSA (called “contributors”) must each have their own FSA ID.

- Who is a contributor? This can include you (the student), your spouse (if married), and your parents (if you’re a dependent student).

- What it is: Your FSA ID (a username and password) acts as your legal electronic signature.

- Action: Go to StudentAid.gov to create your accounts. Do this at least 3-5 days before you plan to fill out the FAFSA, as it can take time to verify.

Step 2: Gather Your Documents

Have these items ready for yourself and your contributors:

- Social Security Numbers (SSNs).

- Records of income (W-2s or tax returns from the specified year).

- Records of assets (bank account balances, investments).

- Your list of schools you’re applying to (even if you’re not accepted yet).

Step 3: Complete the FAFSA Form Online

Log in at StudentAid.gov to start the FAFSA.

- Student Section: You’ll fill out your demographic information.

- Invite Contributors: You will then be prompted to invite your contributors (like your parents) via email to fill out their sections.

- Parent/Spouse Section: Your contributors will log in with their own FSA IDs and provide their financial information. A major change is that they must now provide consent for the IRS to directly share their tax data with Federal Student Aid. This makes the process much faster. If they do not provide consent, your application will be incomplete, and you will not be eligible for aid.

- School List: Add every school you are considering, even if you’re not sure you’ll apply. You can add up to 20 schools.

Step 4: Sign and Submit

Once all sections are complete, you and all contributors must sign the FAFSA electronically using your individual FSA IDs. After submission, you’ll receive a FAFSA Submission Summary.

Step 5: Review Your Aid Offers

You’ll shortly receive what is known as your Student Aid Index (SAI), the number that school use to gauge your financial need. Schools will then send you individualized financial aid “packages,” explaining the grants, scholarship and loans that they are offering you. Your task is to weigh these offers and determine which school — and the aid being offered there — feels right.

Expert Take: “The number one mistake I would say that students make is not applying for FAFSA — and it’s mainly because they think their parents make too much income,” a financial aid counselor at a college says. “This is a myth. The FAFSA is the building block for Direct Unsubsidized Loans and PLUS loans, which don’t rely on financial need. If you’re not getting it, you’re cutting yourself off from the best loan options out there.

Top Mistakes to Avoid When Taking Out Student Loans: Tips for Canadian Borrowers

Navigating the Canadian student loan system (a mix of federal CSLP and provincial aid) is generally straightforward, but it’s easy to make costly mistakes. Here are the top pitfalls to avoid.

1. Not Applying for Government Loans (and Grants!)

This is the single biggest mistake. Many students assume “I’ll just get a line of credit from the bank” or “My parents will cover it.”

- Why it’s a mistake: When you apply for government aid, you are automatically assessed for grants. These are non-repayable. That’s free money! Reports show millions of dollars in scholarships and grants go unclaimed every year. By not applying, you are turning down free cash.

- Key Tip → Even if you only take a small portion of the loan, completing the application gets you in the system, registers you for grants, and protects your interest-free status.

2. Taking Out More Than You Need

When your loan or line of credit is approved, you might see a large number ($15,000 or $20,000) deposited into your account. It’s tempting to see this as “my money” and use it for a new laptop, a spring break trip, or new clothes.

- Why it’s a mistake: This isn’t a bonus; it’s expensive debt. Every dollar you spend on non-essentials is a dollar you’ll have to pay back with interest.

- Action: Create a strict budget. Calculate your exact tuition, books, and essential living costs. Transfer only that amount from your loan account to your checking account each month. Leave the rest untouched.

3. Misunderstanding Private Lines of Credit

Banks are very happy to offer students a “Student Line of Credit.” They often market it as a flexible, easy solution.

- Why it’s a mistake: Unlike government loans, a private line of credit starts charging interest immediately. Most also require you to make “interest-only” payments while you are still in school. If you ignore these payments, the interest adds to the principal, and your debt can balloon before you even graduate.

- Key Tip → A line of credit should be your last resort, not your first. Use it only to fill the gap after you have maxed out all your government grants and loans.

4. Ignoring Your Provincial Aid

Canada’s system is integrated, but the rules and generosity of aid vary by province.

- Why it’s a mistake: A student from Ontario (OSAP) may have different grant eligibility and loan limits than a student from British Columbia (StudentAid BC) or Alberta. Don’t just read federal guides; you must understand the specific rules for your province of residence.

Expert Insight: “The goal is to graduate with a degree, not with a lifestyle,” says a Canadian financial advisor. “The financial habits you build during university will set the stage for your entire life. Treat your loan like a surgical tool: use it precisely, for its intended purpose, and put it away when you’re done. Don’t use it like a hammer.”

Student Loan Refinancing: Save Money and Lower Your Interest Rates in Australia

For Australian students, the conversation about student loans is unique. The vast majority of students use the HECS-HELP program. This is, without a doubt, one of the best student funding systems in the world.

HECS-HELP is not a typical loan:

- It has no interest rate.

- The balance is simply indexed to inflation (indexation) once a year.

- You repay it automatically through the tax system (like in the UK) once you earn above a certain threshold (e.g., $54,345 for 2025-26).

Because of this, a critical fact must be understood:

You cannot, and should not, ever “refinance” your HECS-HELP debt.

No bank or private lender can offer you a better deal than an interest-free, inflation-indexed government loan. Any company that offers to “refinance your HECS” is likely misleading you.

So, Who is Refinancing For?

Refinancing in Australia is limited for the few students who rely on private student loans. This is common for:

· Students not entitled to HECS-HELP (for example some international students or those not approved courses).

· People who wanted additional cash for rent, to live on or a laptop and borrowed from the bank in the form of a personal loan or “education loan” (such as signing up with Westpac, CommBank etc).

These private loans do carry a high interest rate (usually 8%–15%) and are perfect for refinancing.

How Refinancing Works: A Mini Case Study

- The Borrower: Ethan, who studied in Melbourne. He had a HECS-HELP loan for his tuition, but he also took out a $20,000 private “personal loan” from a bank during his second year to cover his rent.

- The Problem: The private loan has a 12.5% fixed interest rate. His payments are high, and the interest is eating him alive.

- The Solution: Ethan now has a stable job as a graphic designer. His credit score is good. He applies to a new lender (a credit union or a “fintech” lender) to refinance.

- The Result: The new lender approves him for a $20,000 loan at a 7.5% fixed interest rate. They pay off his old 12.5% loan, and he now makes his payments to the new lender.

Pros and Cons of Refinancing (Private Loans Only)

| Pros | Cons |

| Lower Interest Rate: This is the #1 reason. A lower rate means more of your payment goes to the principal. | Loss of Benefits: If you (rarely) have a private loan with unique perks, you might lose them. |

| Lower Monthly Payment: You can get a lower payment by securing a lower rate or extending the loan term. | Longer Term = More Interest: Be careful. Extending your loan from 3 years to 7 years will lower your payment but may cost you more in total interest. |

| Simplicity: You can combine multiple private loans into one single payment (this is also called consolidation). | Requires Good Credit: You must have a good income and credit score to qualify for the best rates. |

| Fixed Rate: You can switch from a risky variable rate to a predictable fixed rate. | Fees: Some lenders may charge origination or application fees, though this is rare. |

Expert Insight: “In Australia, the strategy is simple: guard your HECS-HELP loan and never let it go. But if you were forced to take on high-interest private debt to survive, you should absolutely shop for a better rate the second you graduate and have a stable income. A 3-4% rate reduction can save you thousands.”

How to Consolidate Student Loans: Pros and Cons for US Borrowers

As if that weren’t enough, for a US borrower with multiple federal student loans through the years you’ll have had different servicers managing your loans (all because the Department of Education has outsourced collections to private companies), often with different due dates and interest rates. One way to do the latter is with a Direct Consolidation Loan, a program of the federal government that combines your existing loans into one big loan. You effectively roll all your current federal loans into one new, single loan with a single servicer — the U.S. government.

This is different from refinancing. Refinancing is a private market product that aims to give you a lower rate. Consolidation is a federal program that streamlines your loan payments.

The new interest rate is the weighted average of your old loans, rounded to the nearest one-eighth of a percent — up to 8.25 percent. Which is to say, consolidation doesn’t save you money on interest. It is simply a matter of pragmatism and bureaucracy.

Pros of Federal Consolidation:

- One Simple Payment: This is the main benefit. One loan, one servicer, one due date.

- Unlocks Repayment Plans: If you have older federal loans (like FFEL), you must consolidate them into a Direct Loan to become eligible for Income-Driven Repayment (IDR) plans like SAVE or PAYE.

- Eligibility for PSLF: Consolidation is often a necessary step to make all your loans eligible for Public Service Loan Forgiveness (PSLF).

Cons of Federal Consolidation:

- No Interest Rate Savings: Your rate will be a weighted average, so you won’t save money this way.

- Resets Forgiveness Clock (Sometimes): This is a critical danger. If you are already making payments toward PSLF or IDR forgiveness, consolidating can reset your count of “qualifying payments” back to zero. (Note: Temporary waivers sometimes fix this, but you must check StudentAid.gov.)

- Loses Subsidized Benefits: If you consolidate subsidized and unsubsidized loans, you lose the “grace period” subsidy on the subsidized portion.

Key Takeaway: You should consolidate your federal loans only if you need to simplify your payments or (more importantly) to gain eligibility for powerful programs like PSLF or an IDR plan.

Income-Driven Repayment Plans Explained: How to Choose the Best Option for UK Students

In the UK, you don’t really “choose” a repayment plan. You are automatically assigned one by the government based on when you started your course.

These plans are all “income-driven” (or “income-contingent”) by default. This is a core feature of the UK system. The main differences between them are the repayment thresholds and how long you repay before the loan is written off.

Here is a simple checklist to find your plan:

- [ ] You are from Scotland or Northern Ireland: You are likely on Plan 1 or Plan 4.

- [ ] You are from England/Wales and started university between 2012 and 2023: You are on Plan 2.

- [ ] You are from England and started university after August 1, 2023: You are on the new Plan 5.

How to Calculate Your Monthly Payment:

The formula is always the same: You pay 9% of your income above the threshold for your plan.

Here’s an example for a graduate earning £35,000 per year:

- If you are on Plan 2 (Threshold: £27,295):

- £35,000 – £27,295 = £7,705 (your “taxable” loan income)

- 9% of £7,705 = £693.45 per year

- Your monthly payment: £57.79

- If you are on Plan 5 (Threshold: £25,000):

- £35,000 – £25,000 = £10,000

- 9% of £10,000 = £900 per year

- Your monthly payment: £75.00

As you can see, the new Plan 5 is more expensive per month for most graduates, and the 40-year repayment term (vs. 30 for Plan 2) means more people will repay their loans in full.

Key Tip: You never need to “choose” a plan or “manage” your payment. It’s all handled automatically via PAYE (your payroll). The only time you need to act is if you move overseas, in which case you must contact the Student Loans Company (SLC) to arrange payments.

What Are Federal Student Loan Forgiveness Programs? A Complete Guide for Canadian Graduates

In Canada, “loan forgiveness” isn’t a single, broad program like the one discussed in the US. Instead, it’s a set of highly targeted programs for specific professions, plus a robust safety net for all borrowers called the Repayment Assistance Plan (RAP).

1. The Repayment Assistance Plan (RAP)

This is the most important program for Canadian borrowers. It is not “forgiveness,” but it is the primary way to manage debt if you’re struggling.

- What it is: A program that lowers your monthly payment based on your income and family size.

- How it works: If you qualify, your payment is capped at 20% (or less) of your income. The government (federal and provincial) pays the interest that your payment doesn’t cover.

- Key Feature (RAP Stage 2): If you are on RAP for 60 months, or it’s been 10 years since you graduated, the government starts paying your principal as well.

- The Result: The loan is gradually paid off for you. If you have a permanent disability (RAP-D), this happens immediately.

2. Targeted Loan Forgiveness Programs

These programs forgive a portion of your loan in exchange for working in a specific job and location.

- Canada Student Loan Forgiveness for Family Doctors and Nurses:

- Who: Family doctors, residents in family medicine, nurses, and nurse practitioners.

- What: You can get up to $60,000 for doctors or $30,000 for nurses forgiven over 5 years.

- How: You must work in a designated rural or remote community.

- Loan Forgiveness for Social Workers (New):

- Who: In 2024, the government expanded the program to include more professions. This now includes social workers, psychologists, and other eligible health professionals working in rural/remote areas.

Checklist: Are You Eligible for Forgiveness?

- [ ] Do you have a Canada Student Loan (CSLP)?

- [ ] Are you a family doctor, nurse, nurse practitioner, social worker, or psychologist?

- [ ] Do you work in a designated rural or remote community?

- [ ] Have you completed a full year of work in that community?

Key Takeaway: For 99% of Canadian borrowers, the “safety net” is the Repayment Assistance Plan (RAP). Forgiveness is a separate, targeted benefit for medical and social service professionals who serve underserved communities.

Case Study: How Refinancing Saved $10,000 on Student Loans in Canada

- Borrower: Sarah, a graduate from a private college in Ontario.

- The Debt: Sarah couldn’t get enough from OSAP (government loans) to cover her program, so she used a bank’s student line of credit to fill a $40,000 gap.

- The Problem: She graduated into a tough job market. Her line of credit had a 9.95% variable interest rate (Prime + 3%). Her minimum payments were over $350/month, and most of it was just covering interest.

- The Action: After two years of stable work at a marketing firm, her credit score improved. She applied to refinance her $40,000 line of credit with a new lender (a credit union).

- The Result: She was approved for a 5-year fixed-term loan at 5.95%.

- Old Payment (Interest-Only): ~$331/month (and the principal never went down).

- New Payment (Principal + Interest): ~$772/month (a high payment, but she was now aggressively paying it off).

- The Savings: By securing the lower rate and an aggressive term, Sarah paid off the loan in 5 years and saved over $10,000 in interest compared to staying on the high-interest variable line of credit.

Insight: How Student Loan Default Affects Your Credit Score in the UK

This is a trick question. It doesn’t.

This is the most critical difference between the UK and US systems.

- In the United States, your student loan is a normal debt. If you default (don’t pay), your credit score is destroyed. It’s a catastrophic financial event.

- In the United Kingdom, a Student Loans Company (SLC) loan is not a normal debt. It does not appear on your credit file with Experian, Equifax, or TransUnion.

Because your repayments are taken automatically from your paycheck (PAYE) like a tax, it’s impossible to “miss a payment” or “default” in the traditional sense.

- If you earn enough, you pay.

- If you lose your job and earn nothing, you pay nothing.

- In all cases, your credit score remains unaffected.

The Only Way It Impacts Your Finances:

The only time it matters is when you apply for a very large loan, like a mortgage. The mortgage lender can’t see the debt on your credit file, but they will ask to see your payslips.

- They will see the “Student Loan” deduction.

- They will treat this deduction as a regular outgoing expense (like a car payment or pension contribution).

- This reduces your disposable income, which in turn slightly reduces the total amount you can borrow for a mortgage.

Key Takeaway: Do not worry about your UK student loan “hurting your credit score.” It won’t. Focus on your career and income, as that’s the only thing that controls your payments.

FAQ: How to Manage Student Loan Debt After Graduation in the US

Graduating is exciting, but your 6-month “grace period” will end quickly. Here is your 3-step plan:

- Know Your Loans: Log in to StudentAid.gov. Find out:

- Who is your servicer (e.g., Nelnet, MOHELA)?

- What do you owe?

- What are your interest rates?

- Pick a Plan (This is the big one): You will be automatically put on the 10-Year Standard Plan. This may not be your best option. You must proactively choose a plan.

- If you can afford it: Stick with the 10-Year Plan. You’ll pay the least interest.

- If you’re struggling: Immediately apply for an Income-Driven Repayment (IDR) plan like IBR or PAYE. This caps your payment at 10-15% of your discretionary income.

- If you work in public service: Get on an IDR plan and start certifying your employment for Public Service Loan Forgiveness (PSLF) immediately.

- Automate Your Payment: Set up autopay with your servicer. This is the easiest way to never miss a payment, and most servicers give you a 0.25% interest rate discount for doing it.

Key Takeaway: Don’t be passive. The “Standard” plan is often the worst choice for new graduates. Be proactive, log in, and enroll in an Income-Driven plan if your payment is too high.

Expert Advice: Navigating Student Loan Forgiveness Programs in the US

The US student loan forgiveness landscape is complex but incredibly powerful. Here’s what you need to know in 2025.

The Golden Rule: The only legitimate path to forgiveness is through federal programs. Never pay a “consulting” company to help you—what they do, you can do for free at StudentAid.gov.

Your Main Options:

- Public Service Loan Forgiveness (PSLF):

- Who it’s for: Government and non-profit employees (teachers, nurses, firefighters, city workers, etc.).

- The Deal: Make 120 qualifying monthly payments (10 years) while working for an eligible employer. The remaining balance is forgiven, tax-free.

- Expert Tip: You must be on an Income-Driven Repayment (IDR) plan for your payments to count. You must also certify your employment with the government annually.

- Income-Driven Repayment (IDR) Forgiveness:

- Who it’s for: Everyone with federal loans.

- The Deal: You make payments based on your income for 20-25 years. Whatever is left at the end is forgiven.

- The Catch: The forgiven amount is generally treated as taxable income. This is a “tax bomb” you must plan for.

- Note on SAVE Plan: The new SAVE (Saving on a Valuable Education) plan is the most generous IDR plan, but its full implementation has faced legal challenges. As of late 2025, borrowers can enroll in other plans like PAYE or IBR, which still offer forgiveness.

Key Takeaway: Forgiveness is not a handout; it’s a contract. You fulfill your end of the bargain (10 years of public service, or 20 years of income-based payments), and the government fulfills its end. Your first step is to get on the right repayment plan (IDR).

Source: Top Strategies to Pay Off Student Loans Faster and Save Money in Canada

If you’re a Canadian graduate with government loans (CSLP) or private lines of credit, your goal is to pay them off efficiently. The 6-month “grace period” on your CSLP is not interest-free; interest starts racking up the day you graduate.

Here are the top strategies:

- Use the “Debt Avalanche” Method:

- What it is: Make your minimum payments on all your loans. Then, take all your extra money and throw it at the loan with the highest interest rate. This is almost always your private line of credit or a credit card.

- Why: This method saves you the most money in interest.

- Make Bi-Weekly Payments:

- What it is: Instead of paying $500 once a month, pay $250 every two weeks.

- Why: You end up making 26 bi-weekly payments, which equals 13 “monthly” payments per year instead of 12. You’ll barely feel the difference, but this one extra payment per year shaves significant time and interest off your loan.

- Claim the Tax Credit:

- What it is: You can claim a non-refundable tax credit for the interest you pay on your government student loans (CSLP and provincial).

- Why: This reduces the amount of income tax you have to pay. It’s a direct reward for paying your loans. You’ll get a T4A slip with the amount—don’t forget to include it in your tax return!

- Don’t Use Windfalls:

- What it is: Get a tax refund, a bonus from work, or a cash gift for your birthday? Don’t “treat yourself.”

- Why: Apply that lump sum directly to your highest-interest loan’s principal. This is the fastest way to make a dent in your debt.

Expert Analysis: How Student Loans Impact Your Credit Score in the UK

As covered in H5, the impact of a UK student loan on your credit score is zero.

- It does not appear on your credit file.

- Your repayments are not reported.

- You cannot “default” and damage your score.

However, it’s a mistake to think it has no impact on your financial life. The impact is on affordability.

Expert Analysis: The “Affordability” Squeeze

When you apply for a mortgage, a lender’s primary concern is your Debt-to-Income (DTI) ratio. In the UK, this is more of a simple “affordability” check.

- Lender’s View: They see your payslip.

- Gross Pay: £3,000

- Deductions:

- Tax: -£500

- National Insurance: -£250

- Pension: -£150

- Student Loan (Plan 2): -£58

- Net Pay: £2,032

The lender doesn’t care that the £58 is a “loan.” They see it as a mandatory, tax-like deduction. This £58 reduces your monthly disposable income, which means the maximum mortgage they can offer you is slightly lower.

The Real Impact:

The average UK graduate’s student loan payment is relatively small. Its effect on a mortgage application is minimal—far less than a £200/month car payment or a large credit card balance.

Key Takeaway: Your UK student loan is not a “credit score” problem. It’s an “affordability” problem, and a very minor one at that. The best way to improve your financial future is to focus on increasing your income, which has the dual benefit of making your loan payments (and mortgage applications) feel even smaller.

Frequently Asked Questions (FAQ)

Disbursement Process: How Does the Student Loan Money Reach You?

The disbursement process (how you get the money) is different in each country.

- For Tuition (US, UK, Canada, Australia): In almost all cases, the money for your tuition and university fees is paid directly to your school. You never touch this money. Your loan provider (e.g., the US Dept. of Education, Student Loans Company in the UK) confirms your enrollment and sends the funds straight to the university’s bank account.

- For Living Costs (Maintenance/Stipends): This money is for you. It is typically deposited directly into your personal bank account in one or more installments (e.g., once per term). This is the money you use for rent, food, books, and other living expenses.

How Do I Get My Student Loan Money? A Step-by-Step Guide for US Students

For US federal loans, the money follows your application.

- You complete the FAFSA.

- You accept the Financial Aid Offer from your chosen school. This “offer” will list the specific loans (Subsidized, Unsubsidized, PLUS) you are eligible for.

- You complete Entrance Counseling and sign a Master Promissory Note (MPN) at StudentAid.gov. This is a mandatory legal document where you promise to repay the loan.

- Your school confirms your enrollment.

- Disbursement:

- Tuition: The loan money is first applied directly to your school account to pay for tuition, fees, and on-campus room and board.

- Your “Refund”: If there is any money left over (e.g., you borrowed extra for living costs), the school’s financial office will send you the remaining balance. This is called a “refund,” and it’s sent to you via direct deposit or check.

How Much Can You Borrow in Student Loans? Insights for UK and Canadian Borrowers

- United Kingdom (England):

- Tuition Fees: You can borrow up to £9,535 per year (for the 2025-26 academic year) to cover your full tuition fee. This is paid directly to the university.

- Maintenance Loan (Living Costs): This is the tricky one. The amount depends on your household income and where you live while studying. For 2025-26, the maximums are:

- Living at home: £8,877

- Living away from home (outside London): £10,544

- Living away from home (in London): £13,762

- Canada:

- Canada Student Loans Program (CSLP): The federal government provides up to 60% of your assessed need, up to a maximum amount (e.g., $300 per week of study).

- Provincial Loans: Your province provides the other 40%.

- Total Amount: The final amount depends entirely on your assessed financial need, which is your (Tuition + Living Costs) – (Your Expected Contribution). There are also lifetime limits (e.g., 340 weeks of funding for most students).

Requirements for Student Loans: What You Need to Know in the US, UK, and Canada

- United States (Federal): You must be a US citizen or eligible non-citizen, have a valid Social Security number, be enrolled at least half-time in an eligible program, and have a high school diploma or equivalent. You must also complete the FAFSA. Most federal loans for students do not require a credit check.

- United Kingdom (England): You must be a UK citizen or have “settled status” and have been “ordinarily resident” in the UK for at least 3 years. You must be studying at an approved institution in an approved course. Your eligibility for the amount of the maintenance loan depends on your household income.

- Canada (CSLP): You must be a Canadian citizen, permanent resident, or protected person. You must be enrolled in a designated program at a designated school and demonstrate financial need. You must apply through your specific province of residence (e.g., OSAP for Ontario).

Who Is Eligible for Student Loans? Qualification Criteria for US, UK, and Australian Students

- US (Federal): US citizens and eligible non-citizens enrolled in an eligible program. The key requirement is filling out the FAFSA.

- UK (Tuition & Maintenance): UK citizens (or those with settled status) who have lived in the UK for 3+ years. Your course and university must be eligible.

- Australia (HECS-HELP): You must be an Australian citizen, a New Zealand Special Category Visa holder who meets residency requirements, or a permanent humanitarian visa holder. You must be enrolled in a Commonwealth Supported Place (CSP) at an approved provider. Permanent residents (non-humanitarian) are not typically eligible for HECS-HELP, only FEE-HELP, or must pay upfront.

How Do Student Loans Work? Everything You Need to Know for 2025

A student loan is money you borrow to pay for university or college. It is not free money; you must pay it back with interest (except in Australia’s HECS-HELP system).

Here’s the basic lifecycle:

- Apply: You apply through a government program (FAFSA in the US, your province in Canada, Student Finance in the UK, myGov in Australia) or with a private bank.

- Disbursement: The lender pays the money, usually to your school first for tuition, and then any remainder to you for living costs.

- In-School Period: While you are in school, your loan status is “in deferment.” In the US (subsidized), UK, and Canada, the government pays or waives your interest. In the US (unsubsidized) and with private loans, interest starts building up (accruing) immediately.

- Grace Period: After you graduate, you get a short “grace period” (usually 6 months) before you must start making payments.

- Repayment: You make monthly payments to your “loan servicer” for a set period (e.g., 10-40 years) until the balance is paid off.

How Much Is a $30,000 Student Loan Per Month? Understanding Your Repayment Options

This depends entirely on the interest rate and the repayment term. Let’s look at two common US examples for a $30,000 loan:

- Example 1: US Federal Loan (Standard 10-Year Plan)

- Interest Rate: 6.39% (the 2025-26 undergraduate rate)

- Monthly Payment: ~$339 per month

- Total Paid: $40,655

- Example 2: Private Loan (10-Year Plan)

- Interest Rate: 9.0% (a common rate for a graduate with average credit)

- Monthly Payment: ~$380 per month

- Total Paid: $45,614

- Example 3: Federal IDR Plan (e.g., SAVE/PAYE)

- If you’re a new graduate earning $40,000, your payment wouldn’t be based on the $30,000. It would be based on your income. Your payment might be closer to $75-$150 per month.

Key Takeaway: The interest rate is everything. A 2.6% difference in the examples above costs you an extra $41 per month and over $5,000 in total.

Can I Get a 100% Student Loan? Exploring Full Coverage Options in the US

Yes. It is possible to cover 100% of your university’s “Cost of Attendance” (COA), but rarely with federal loans alone.

- What is COA? This is the official budget set by the university. It includes tuition, fees, room, board, books, and transportation.

- Federal Loan Limits: Federal Direct Loans for students have annual limits (e.g., $5,500 for first-year students). This is often not enough.

- How to Get 100%: You can cover the full COA by “stacking” different loans:

- Your Federal Direct Subsidized/Unsubsidized Loans (you take these first).

- A Federal Direct PLUS Loan (taken out by your parents).

- A Private Student Loan (taken out by you, usually with a parent cosigner).

A PLUS loan or a private loan can be borrowed up to the full COA, minus any other aid you’ve received.

What Is the Meaning of Student Loans? A Complete Guide for First-Time Borrowers

A student loan is a financial product designed to help students pay for higher education. It is an investment in your future earnings.

Think of it like a business loan: A small business owner borrows money to buy equipment, believing the equipment will help them earn more money. You are borrowing money to buy education and skills, believing that education will help you get a better job and earn a higher salary.

The “terms” of this investment (the interest rate, the repayment schedule, the forgiveness options) are what make it a “good” or “bad” deal. That’s why government loans (in the US, UK, Canada, and Australia) are almost always the best deal—they have terms and safety nets that are much better for the “borrower” (you) than anything a private bank will offer.

How Much Student Loan Can You Get in the UK? Breaking Down the Limits

There are two separate loans you can get:

- Tuition Fee Loan:

- Amount: You can get up to £9,535 per year (for 2025-26) to cover the full cost of your course tuition.

- Who gets it: This is not based on your income. Almost every eligible student can get the full amount. It’s paid directly to your university.

- Maintenance Loan (for Living Costs):

- Amount: This is the variable part. It is means-tested based on your household income (i.e., your parents’ income). It also depends on where you live.

- 2025-26 Maximums: £8,877 (at home) to £13,762 (in London).

- 2025-26 Minimums: Even if your parents earn a high income, you are still eligible for the minimum loan, which is £3,907 (at home) to £6,853 (in London).

Student Loans Canada: Your Complete Guide to Borrowing for Education

“Student Loans Canada” refers to the Canada Student Loans Program (CSLP). This is the federal government’s program.

- It’s Integrated: You never apply for a “Canada Student Loan” by itself. You apply for student aid through your home province’s website (e.g., OSAP, StudentAid BC, Student Aid Alberta).

- One Application, Two Loans: Your single application automatically assesses you for:

- Canada Student Grants (Free money!)

- Canada Student Loans (The federal 60% portion)

- Your Provincial Loan (The 40% portion)

- Key Feature: The federal part of your loan (CSLP) is interest-free while you are a full-time student. Repayment begins 6 months after you graduate, and you make one single payment to the National Student Loans Service Centre (NSLSC).

Student Loans Login: Accessing Your Account and Managing Your Loans

This is the #1 point of confusion for graduates. Your “login” will be in one of these places:

- United States: Your main dashboard is StudentAid.gov. This shows all your federal loans. But to make payments, you log in to your loan servicer’s website (e.g., MOHELA, Nelnet, Edfinancial).

- United Kingdom: Your one-and-only login is the Student Loans Company (SLC) website (slc.co.uk). You log in here to check your balance and update your details (especially if you move overseas). You do not log in to make payments, as they are taken from your pay.

- Canada: You manage your loan through the National Student Loans Service Centre (NSLSC) portal. You log in here to check your balance, make payments, and apply for the Repayment Assistance Plan (RAP).

- Australia: You track your HECS-HELP debt through your myGov account, which links to the Australian Taxation Office (ATO).

Student Loan Forgiveness: Eligibility and How to Apply in the US

As of 2025, there are two primary paths to loan forgiveness for US federal loans. Private loans are not eligible.

- Public Service Loan Forgiveness (PSLF):

- Eligibility: You must work full-time for an eligible government or non-profit employer.

- How to Apply:

- Get on an Income-Driven Repayment (IDR) plan.

- Submit a PSLF Employment Certification Form annually (and every time you change jobs) using the official PSLF Help Tool on StudentAid.gov.

- After you make 120 qualifying payments (10 years), you submit the final PSLF application.

- Income-Driven Repayment (IDR) Forgiveness:

- Eligibility: Any borrower on an IDR plan (like PAYE or IBR).

- How to Apply: You don’t “apply” for forgiveness. You simply stay on the IDR plan for 20 or 25 years. After your final qualifying payment, your servicer will automatically process the forgiveness on your remaining balance.

Private Student Loans vs. Government Loans: What You Need to Know in Australia

- Government Loan (HECS-HELP):

- This is the default, best option.

- Interest: 0%. The balance is only indexed to inflation.

- Repayment: Automatic, through the tax system (ATO). You only pay if you earn over the threshold (e.g., $54,345).

- Eligibility: Australian citizens in a Commonwealth Supported Place.

- Private Student Loans:

- These are high-interest personal loans from banks (e.g., Westpac, CommBank) or private lenders.

- Interest: High, fixed or variable (e.g., 8%-15%).

- Repayment: Begins immediately, with fixed monthly payments, regardless of your income.

- Eligibility: Anyone who can pass a credit check (often used by international students or those not in a CSP).

- Verdict: HECS-HELP is one of the best student loan systems in the world. A private loan is a high-cost financial product. Never use a private loan to pay for tuition if you are eligible for HECS-HELP.

Student Loan Repayment Plans: Best Options for Graduates in the UK

You don’t “choose” a plan in the UK; you are assigned one based on when you started your course.

- Plan 5 (Started after Aug 2023): You pay 9% on income above £25,000. The loan is written off after 40 years.

- Plan 2 (Started 2012-2023): You pay 9% on income above £27,295. The loan is written off after 30 years.

The “best option” is not a plan, but a strategy: focus on your career. Since your payments are tied to your income, the best way to manage your loan (and your life) is to focus on increasing your salary. The loan system is designed to take care of itself in the background. Your only job is to update the Student Loans Company (SLC) if you move or work overseas.

Private Student Loans: Are They Right for You? Insights for Canadian Borrowers

A private student loan in Canada, usually a Student Line of Credit from a bank, is never the first choice. It is only “right” for you in two specific situations:

- You have a “Funding Gap”: You have already applied for government aid (CSLP + provincial) and maxed out your grants and loans, but you still don’t have enough to cover your tuition and living costs. You can use a private line of credit to “fill the gap.”

- You Are Not Eligible for Government Aid: This can apply to some international students or students in unaccredited private colleges that are not designated for government aid.

Warning: If you use a private line of credit, you must be extremely disciplined. They charge interest immediately, and most require you to make monthly interest-only payments while you’re still in school.

Government Student Loans: Benefits and Drawbacks in the US

- Benefits (Why you MUST use them first):

- Safety Nets: They offer Income-Driven Repayment (IDR) plans, which can make your payment affordable ($0/month is possible).

- Forgiveness: They are the only loans eligible for Public Service Loan Forgiveness (PSLF) and IDR forgiveness (20-25 year).

- Subsidized Interest: The government pays the interest on Subsidized Loans while you’re in school.

- No Credit Check: Most student loans (Subsidized and Unsubsidized) are based on need, not your credit score.

- Drawbacks:

- Loan Limits: The annual limits (e.g., $5,500 for a first-year) are often not enough to cover the full cost of expensive universities.

- Can’t Escape Them: They are very difficult to discharge in bankruptcy (though not impossible).

- Parent PLUS Loans: These federal loans for parents have high-interest rates and high origination fees, making them less appealing than student-held loans.

Student Loans Reddit: What Borrowers Are Saying About Their Experiences

The “Student Loans” subreddit is a valuable, real-time community for borrowers. Here are the biggest themes:

- US: The community is heavily focused on navigating forgiveness (PSLF), celebrating “forgiveness” posts, and understanding the complex details of the SAVE/IDR plans. There is also a lot of anxiety and confusion about servicers (like MOHELA) and payment counts.

- UK: The most common question is “I have a £60k balance, will this ruin my life?” The community response is always a firm “No,” explaining how it’s a “graduate tax” that doesn’t affect credit scores, much to the amazement of US readers.

- Canada/Australia: These are less common but focus on “HECS indexation shock” (Australia) or “RAP vs. high-interest line of credit” (Canada).

- Overall: The key theme is empowerment through shared knowledge. Borrowers use the community to share success stories, warn each other about scams, and find answers they can’t get from their loan servicers.

Best Student Loans: Top Options for US, UK, and Australian Students in 2025

- United States:

- Best Overall: Federal Direct Subsidized Loans. These are the #1 best loan, period.

- Best Private: After exhausting federal aid, top private lenders for 2025 include Sallie Mae, College Ave, and SoFi. The “best” one is the one that offers you the lowest fixed interest rate.

- United Kingdom:

- Best (and only) Option: A Student Loans Company (SLC) loan (Tuition Fee Loan + Maintenance Loan). There is no “best” option as it’s a single government-run system.

- Australia:

- Best (and only) Option: A HECS-HELP loan. This is one of the best student funding systems in the world.

- Best Private: If you are ineligible for HECS (e.g., an international student), you must shop at major banks (CommBank, Westpac, NAB) for a “personal loan for education,” as the private market is small.