Refinance a personal loan for trusted, flexible, and secure terms. Discover proven ways to lower rates with credit unions in the US, UK, Canada & Australia.

Are you looking at a bank statement for a personal loan every month, annoyed by an interest rate that you locked in years ago? That sense of being “stuck” is a common one. Maybe you borrowed money when your credit wasn’t perfect, or perhaps market rates were higher. Now, you want to pay off that high-interest debt, and the weight of it feels like a financial anchor holding your progress back. It erodes your monthly budget and adds thousands of dollars in unnecessary interest charges over the life of the loan. That financial “pain” is crippling, affecting your ability to save, invest, or simply enjoy the fruits of your labor.

But what if you had the opportunity to replace that old, high-maintenance loan with a new one—a smarter, cheaper loan designed to work for you, not against you?

It is the anticipation of refinancing. You can pay off old debt and immediately lower your monthly payments, or shorten the life of your loan by getting a new personal loan at a lower rate. This isn’t some esoteric secret of high finance; it’s a simple trick that millions of borrowers in the US, UK, Canada, and Australia are using to stay ahead of their finances. Whether your credit has gotten better, you want to eliminate debt payments by consolidating high-interest debt, or you just wish to lower the cash flow requirements from month to month, there are numerous reasons why refinancing could lead to substantial savings. We’ll walk you through how to navigate the refinance process, find the best lenders, and lock in the savings you deserve.

When to Refinance a Personal Loan and Maximize Savings in Tier One Regions

Timing is everything. Refinancing a personal loan doesn’t always make sense, but when conditions are right, it can save you some serious cash. The “when” boils down to a handful of triggers.

The biggest argument in favor of refinancing is that your finances have changed for the better. Did you have a “fair” credit score when you applied for the loan, but now it’s “good” or even “excellent”? This is your golden ticket. Your interest rate is based on risk—the higher your credit score, the less of a risk you are and the lower your rate will be.

Another inflection point is when market interest rates have fallen. Central banks, including the Federal Reserve in the United States or the Bank of England elsewhere, set rates of their own. If rates are lower now than when you originally borrowed, you probably can secure a less expensive deal, even without an improved personal credit profile.

Finally, consider refinancing when your goal shifts. You may need to:

· Lower monthly payments: If your budget is tight, refinancing for a lower rate or a longer term can free up crucial monthly cash flow.

· Consolidate debts: If you’re juggling multiple personal loans or credit cards, you can use one new refinance loan to pay them all off, simplifying your life with a single (hopefully) lower-interest payment.

Mini Case Study: Sarah’s Credit Score Win (US)

Sarah, who is based in the US, borrowed $15,000 with a personal loan three years ago to do work on her home. Her credit score was 640, and she was given a three-year loan at a high 18.99% APR. For two years, she’s been toiling and making every bill payment on time, gradually seeing her credit score rise to 760.

This time, she opted to refinance what was left—$10,500. With her beautiful new credit score, she was able to secure a 22-year loan at the low, low interest rate of 7.99% APR on May 1st, 2015.

The Result: Sarah’s monthly payment dropped slightly, but more importantly, she will save over $1,800 in interest and be debt-free a full year earlier than her original plan.

Before vs. After Refinancing: A Snapshot

| Metric | Original Loan | Refinance Loan (Example) | Result |

| Original Amount | $20,000 | N/A | |

| Remaining Balance | $12,000 | $12,000 | Transferred the debt |

| Interest Rate (APR) | 17.5% | 9.5% | 8% reduction |

| Remaining Term | 36 months | 36 months | Kept the same payoff time |

| Monthly Payment | ~$430 | ~$385 | $45 in monthly savings |

| Total Future Interest | ~$3,480 | ~$1,840 | $1,640 in total savings |

Key Takeaway: The single best time to check your refinance rates is 6-12 months after you see a significant (30+ point) jump in your credit score.

How Refinancing a Personal Loan Works and What It Means for You

Refinancing a personal loan sounds complex, but it’s a simple concept: you are getting a new loan to pay off your old loan. That’s it. The goal is for the new loan to have better terms, saving you money.

The process is nearly identical to applying for your first personal loan. Here is the step-by-step breakdown:

1. Define Your Goal: Why are you refinancing? To get a lower monthly payment? To pay off the loan faster? To consolidate debt? Your goal will determine the loan term (shorter or longer) you seek.

2. Check Your Credit: Before you do anything, pull your credit report and check your score. In the US, this is your FICO score. In the UK, Canada, and Australia, you can get scores from agencies like Experian, Equifax, or TransUnion. This score dictates the rates you’ll be offered.

3. Gather Your Old Loan Details: Find your current loan statement. You need to know your exact payoff amount (this may include a few days of interest) and whether your old lender charges a prepayment penalty (a fee for paying it off early). Warning: A high prepayment penalty can wipe out your potential savings.

4. Shop Around (The Smart Way): This is the most important step. Compare 3-5 lenders. Use “soft pull” pre-qualification tools, which most online lenders in the US, UK, and Australia now offer. This lets you see your potential rate and terms without impacting your credit score.

5. Apply and Submit Documents: Once you’ve chosen the best offer, you’ll formally apply. This will trigger a “hard pull” on your credit. You’ll need to submit documents like proof of identity (e.g., driver’s license), proof of income (e.g., pay stubs), and your old loan’s payoff statement.

6. Close the Loan & Pay Off Debt: If approved, you’ll sign your new loan agreement. The new lender will then either send the money directly to your old lender to pay off the loan or deposit the funds in your account for you to complete the payoff. Do not skip this step! You must ensure the old loan is paid in full.

7. Start Your New Payments: Your old loan is gone. You now only make payments to your new, better loan.

Top Lenders & Marketplaces for Personal Loan Refinancing

While the “best” lender depends on your credit profile, here are some top-tier options in each region known for competitive rates and clear processes.

| Region | Top Lenders & Marketplaces (Examples) | Typical Features |

| United States (US) | SoFi, Discover Personal Loans, LendingClub, PenFed | Often no origination fees (Discover). Strong online platforms. Rates for good credit can start at 6-9%. |

| United Kingdom (UK) | Lloyds Bank, Zopa, M&S Bank | Lenders look for UK residency and stable income. Rates are compared using APR. Comparison sites like Finder are popular. |

| Canada (CA) | Borrowell, Mogo, Fairstone | Marketplaces like Borrowell are very common for comparing lenders. Rates and terms vary widely. |

| Australia (AU) | Pepper Money, ANZ, CommBank, RateCity | Lenders must show a “Comparison Rate,” which includes the interest rate plus most fees, giving a truer cost. |

Key Takeaway: The process is simple: New Loan > Pays Off Old Loan > You Save Money. The entire timeline, from shopping to payoff, can be as fast as one to two weeks, especially with online lenders.

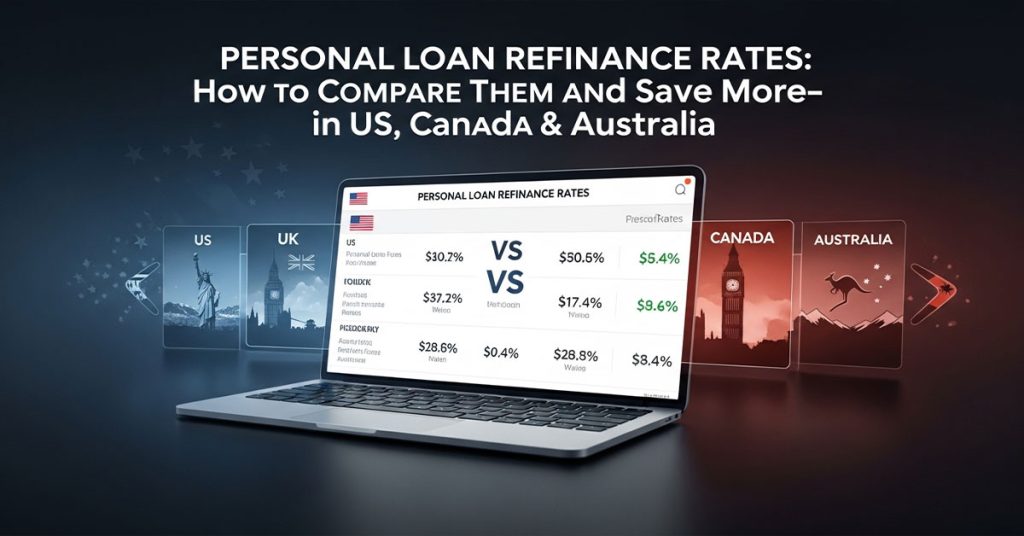

Personal Loan Refinance Rates: How to Compare Them and Save More

Knowing personal loan refinance rates is the key to your savings. If you’re correct about this, you’ve won. Get it wrong and you could wind up paying even more.

You’re likely to hear first about the interest rate. But the number that really matters is the Annual Percentage Rate (APR). By adding the interest rate to most required fees, such as an origination fee, the APR spreads all costs associated with the loan over its term. This provides you with a more precise, apples-to-apples comparison of offers.

This is not something possible in Australia with their “Comparison Rate”—a wonderful tool designed specifically for borrowers. You won’t find the APR on offer listed in the U.S., U.K., or Canadian products, and you’ll have to hunt for it in the fine print.

Rates are not one-size-fits-all. They are based on:

· Your Credit Score: The #1 factor. Excellent credit (e.g., 760+ in the US) gets the lowest rates, sometimes as low as 6-9%. Fair credit (e.g., 600-650) will see rates from 18-30%+.

· Loan Term: A shorter-term loan (e.g., 2 years) typically has a lower interest rate than a longer-term loan (e.g., 5-7 years).

· Loan Amount: Some lenders offer rate discounts for larger loan amounts.

· The Lender: A credit union (like PenFed or Navy Federal in the US) may offer lower rates than a traditional bank or online-only lender, but will have membership requirements.

Mini Case Study: David’s Fee vs. Rate Dilemma (UK)

David, in the UK, wants to consolidate $12,000 in existing debt. He gets two offers:

· Lender A: Offers an 8.9% APR. It has no setup fee.

· Lender B: Offers a 7.5% interest rate, which looks cheaper. But it also has a 4% “arrangement fee” ($480).

When David looks at the true APR for Lender B, the 4% fee pushes its APR up to 9.2%.

The Result: David correctly chose Lender A. Even though its advertised rate looked higher, its APR was lower, making it the cheaper loan. He avoided the fee trap.

How Fees Impact Your “Real” Rate (APR)

Never judge a loan by its interest rate alone. An origination fee (a fee to create the loan, common in the US) can dramatically change your costs.

| Loan Amount: $10,000 | Term: 3 Years | Interest Rate | Origination Fee | Real APR (Cost) |

| Offer 1 (No-Fee) | 36 months | 11.0% | $0 (0%) | 11.0% |

| Offer 2 (Fee-Based) | 36 months | 9.0% | $500 (5%) | 12.4% |

Key Takeaway: As seen in the table, the 9.0% rate looks cheaper, but after the 5% fee, it’s significantly more expensive than the 11.0% no-fee loan. Always compare the APR.

Decide How Much Money You Need to Refinance Your Personal Loan and Optimize Your Budget

You need to establish exactly how much you need to borrow before you can go shopping for a new loan. Not just your current balance.

First, get in touch with your existing lender and tell them you need the 10-day payoff amount. This number is so important because it’s your principal plus any interest that will accrue until the date you get the money. This is the exact bull’s-eye your new lender is aiming for.

Second, look over your original loan for prepayment penalties. This is a charge some lenders assess if you repay your loan early.

· In the US, these are less common on personal loans but still exist.

· In the UK and Australia, they are often called “early repayment charges” (ERCs) and can be equal to 1-2 months of interest.

If your prepayment penalty is $500, but your new loan will only save you $300 in interest, refinancing is a bad deal. You must ensure your total interest savings are greater than any fees you pay to exit the old loan and open the new one.

Pros and Cons of Refinancing

| Pros | Cons |

| Lower Interest Rate: The primary benefit. Saves you money on total interest paid. | Origination Fees: A new loan may have a fee (1-6% in the US) that eats into savings. |

| Lower Monthly Payment: Achieved by a lower rate or a longer term. Improves cash flow. | Longer-Term Risk: Extending your term (e.g., 3 years left to a new 5 years) lowers payments but means you pay more total interest over time. |

| Debt Consolidation: Simplifies your finances from multiple payments to one. | Temporary Credit Dip: The “hard pull” from your new application can temporarily drop your score by a few points. |

| Faster Payoff: You can refinance to a shorter term, increasing your payment but saving thousands. | Effort & Paperwork: It takes time to research, apply, and submit documents. |

Expert Insight: Calculate Your “Break-Even Point”

“Don’t just look at the monthly savings,” say financial planners. “Calculate your break-even point. If your new loan has a $300 origination fee, but it saves you $30 per month, your break-even point is 10 months. You only really start saving money in month 11. Make sure you plan to keep the loan long enough for the savings to become real.”

Check Your Credit Score and Credit Report to Ensure You Get the Best Refinance Deal

Think of your credit score as your financial report card. When you ask to refinance, it’s the very first thing a lender will check. A high score proves you are a reliable, low-risk borrower, and lenders will fight for your business with their best rates.

Before you apply, you must know what’s on your report.

1. Pull Your Report: In the US, you can get free reports from AnnualCreditReport.com. In the UK, Canada, and Australia, you can get free statutory reports from the main bureaus (Experian, Equifax, and TransUnion).

2. Check for Errors: Look for any late payments you know you made on time, accounts that aren’t yours, or incorrect balances. A single error could be costing you 50+ points and thousands of dollars. Dispute any errors immediately.

3. Know Your Score: Your score will place you in a “tier.” These tiers directly impact the rates you’re offered.

How Credit Tiers Impact Your Rate (Example)

Lenders have different score “buckets.” While the exact numbers vary, the principle is universal: a better score unlocks a cheaper loan.

| Credit Tier | Score Range (US FICO Example) | Potential APR Offer |

| Excellent | 760 – 850 | 6% – 11% |

| Good | 700 – 759 | 10% – 17% |

| Fair | 640 – 699 | 18% – 25% |

| Poor | < 640 | 26% – 36% (or denied) |

Expert Insight: The 30-Point Difference

“The difference between a 690 ‘fair’ score and a 720 ‘good’ score is massive. On a $15,000 loan, that 30-point jump could be the difference between a 17% APR and an 11% APR. That’s a savings of over $1,500 over three years. If you are on the borderline, spend 3-6 months improving your score before you apply. Pay down your credit card balances, make every payment on time, and then apply. Your patience will be rewarded.”

Compare Personal Loan Refinance Rates and Fees for Maximum Savings

You’ve pulled your credit and figured out what you owe to pay it off. Now, the hunt begins. Your objective should be to receive 3-5 loan offers to compare. Aim to never accept the first offer you get.

Pre-qualifying is your best friend in this stage. The “Check Your Rate” feature is offered by lenders such as those in the US, and many of the online personal loan providers in both the UK and Australia. This requires a soft credit pull, which does not affect your credit score. Your estimated rate and term are minutes away. So you can comparison shop with confidence.

If you decide to submit a formal application, which you should only do once you’ve identified the best offer, that will prompt a hard credit pull and can cause your score to drop temporarily.

Key Comparison Points: The Lender “Scorecard”

When you have multiple offers, don’t just look at the rate. Use this table as a “scorecard” to find the true winner.

| Comparison Point | What to Look For | Why It Matters |

| APR | The lowest number. | This is your total annual cost, including interest and fees. |

| Origination Fee | Ideally $0. | A 5% fee on a $20,000 loan costs you $1,000 instantly. A no-fee loan (even at a slightly higher APR) is often better. |

| Prepayment Penalty | None. | You want the flexibility to pay the new loan off early without being penalized. |

| Loan Term | The term that matches your goal (e.g., 3 years to save interest, 5 years to lower payments). | Don’t let a lender push you into a 7-year term if you don’t need it. |

| Lender Reputation | Good customer reviews, easy online access. | You’ll be dealing with this company for years. Are they easy to work with? |

Expert Insight: The Autopay Discount

“A simple but effective trick: always ask about an autopay discount. Many lenders in the US, like PenFed and SoFi, will knock 0.25% to 0.50% off your APR just for setting up automatic payments from your checking account. It’s a win-win: you’re less likely to miss a payment, and you get a guaranteed rate reduction. Always check that box.”

Understanding Fees When You Refinance a Personal Loan and How to Minimize Them

Fees are the hidden traps of refinancing. A great-looking interest rate can be a mask for high, upfront charges that erase your savings. Your mission is to identify and minimize them.

1. Origination Fee:

· What it is: A fee for processing your loan, taken directly from the loan proceeds. If you refinance $10,000 with a 5% origination fee, you only get $9,500. This is very common in the US market.

· How to minimize it: Shop for no-fee lenders. Lenders like Discover Personal Loans (US) and many UK banks build their profit into the interest rate, not an upfront fee. Always compare the APR, which includes this fee.

2. Prepayment Penalty (or Early Repayment Charge):

· What it is: A fee on your OLD loan for paying it off early. It can also be a fee on your NEW loan, restricting you from paying it off early.

· How to minimize it: You can’t change your old loan’s terms, but you must factor this cost into your savings calculation. For your new loan, only accept an offer that has zero prepayment penalties. This is standard for most reputable lenders in Tier One markets.

3. Late Payment Fees:

· What it is: A fixed fee charged if your payment is even a day or two late.

· How to minimize it: This is the easiest one to avoid. Sign up for automatic payments (and get that autopay discount we mentioned).

Key Tip → Before you sign, ask the lender for a full breakdown of charges. Ask them, “Besides the interest, what other fees will I pay ever?” A good lender will give you a clear, simple answer.

Documents You’ll Need to Refinance a Personal Loan in the US, UK, Canada & Australia

Being prepared can speed up your loan approval from days to mere hours. Lenders need to verify who you are, where you live, and how much you earn.

Gather these documents before you apply:

· Proof of Identity:

o US: Driver’s License, Social Security Number (SSN), or Passport.

o UK: Passport or UK Driver’s License.

o Canada: Driver’s License, Provincial ID, or Passport.

o Australia: Driver’s License or Australian Passport.

· Proof of Income:

o Recent pay stubs (or “payslips” in the UK/AU) from the last 30-60 days.

o Tax returns from the last 1-2 years (e.g., W-2s or 1099s in the US, T4s in Canada, P60 in the UK).

o Bank statements showing regular income.

· Proof of Address:

o A recent utility bill (gas, electric, water).

o A council tax bill (UK) or bank statement with your current address.

· Existing Loan Information:

o Your most recent statement from your old lender.

o The 10-day payoff statement, which you must request from the old lender.

Qualification Requirements to Refinance a Personal Loan: What Lenders Look For

When you apply to refinance, you are being judged on your current financial health, not your past. Lenders want to answer one question: “How likely is this person to pay us back?”

They use three main criteria to decide:

1. Credit Score: This is the shortcut for your credit history. While some lenders accept “fair” credit (600-650 in the US), you will unlock the best rates with a “good” or “excellent” score (680+). If your score is low, your application may be denied, or you may be offered a rate that’s no better than your current one.

2. Debt-to-Income (DTI) Ratio: This is a crucial metric, especially in the US and Canada. Lenders calculate all your monthly debt payments (mortgage, car, student loans, and the proposed new loan) and divide them by your gross monthly income. Most lenders want to see a DTI below 40%. If your DTI is too high, it signals to lenders that you are “over-leveraged” and may struggle to make payments.

3. Verifiable Income: You must prove you have a stable job or income source sufficient to cover the new payment. Self-employed individuals may need to provide more documentation (like 2 years of tax returns) than salaried employees.

Key Takeaway: If your credit score has improved, your income has gone up, or you’ve paid off other debts since you took out your original loan, your chances of qualifying for a great refinance deal are excellent.

Refinance a Personal Loan to Lower Monthly Payments and Improve Your Cash Flow

This is the most common reason people refinance. If your monthly budget feels like a tightrope walk, lowering your loan payment can give you critical breathing room.

You can achieve this in two ways:

1. Securing a Lower Interest Rate: This is the ideal scenario. By cutting your interest rate (e.g., from 18% to 10%), your monthly payment will automatically decrease, even if the term stays the same.

2. Extending the Repayment Term: This is a powerful but tricky tool. You can refinance a loan with 2 years left into a new 5-year loan. Your monthly payment will drop dramatically.

Warning: Be very careful with extending your term. While it solves a short-term cash-flow problem, you will be in debt for longer and will almost certainly pay more in total interest over the life of the loan. This strategy should only be used to avoid financial hardship, not just for casual savings.

Refinance a Personal Loan to Shorten Your Term and Save on Interest

This is the “power move” for people whose financial situation has improved. Perhaps you got a raise or paid off your car. You can now afford to pay more per month.

In this scenario, you refinance your loan with 4 years left into a new loan with a 2-year term.

· Your monthly payment will go up.

· Your interest rate will likely go down (lenders love shorter terms).

· You will be debt-free years earlier.

· You will save thousands of dollars in total interest.

Result: This strategy accelerates your path to financial freedom. You are actively choosing to get rid of your debt faster and smarter, saving the maximum amount of money in the long run.

Refinance a Personal Loan for Debt Consolidation: Combine Your Payments for Simplicity

Refinancing isn’t just for a single loan. Its most powerful use is often debt consolidation.

Imagine you have:

· One personal loan: $5,000 at 15% APR

· A second personal loan: $3,000 at 19% APR

· A credit card: $4,000 at 22.99% APR

You’re juggling three different payments, three due dates, and three high-interest rates. It’s stressful and expensive.

With a refinance, you apply for one new debt consolidation loan for $12,000. If your credit is good, you might get a 10% APR. You use the funds from this single new loan to pay off all three old debts.

The Result:

· You now have one payment to one lender.

· You have one due date.

· Your new, blended interest rate (10%) is far lower than the 15-22% you were paying before.

· You save money and dramatically reduce your financial stress.

Refinance a Personal Loan Timeline: What to Expect and How to Stay on Track

Refinancing a personal loan is much faster than refinancing a mortgage. With most online lenders, the entire process can take as little as one to two weeks.

Here’s a typical timeline:

· Day 1: Research & Prequalify

o Your Action: Pull your credit report. Get your old loan’s payoff amount. Shop at 3-5 lenders using “soft pull” pre-qualification tools.

· Day 2: Select & Apply

o Your Action: Choose the best offer (lowest APR for your desired term). Formally apply and upload your documents (ID, proof of income, etc.). This triggers the “hard pull.”

· Day 2-5: Lender Underwriting

o Lender’s Action: A human (or algorithm) reviews your application and documents to verify everything. They may call you or your employer.

· Day 3-6: Approval & Signing

of Lender’s Action: You get the official approval and the final loan agreement.

o Your Action: Read the terms carefully. Check the APR, fees, and term. If it all looks correct, sign the agreement digitally.

· Day 5-10: Funding & Payoff of Lender’s Action: The lender either sends the funds directly to your old lender or to your bank account.

o Your Action: If the money comes to you, send the payoff to your old lender immediately.

· Day 10-14: Confirmation

of Your Action: Call your old lender and confirm your balance is $0. Your refinance is complete! You will make your first payment on the new loan in about 30 days.

Refinance a Personal Loan Checklist: Everything You Need Before Applying

Use this checklist to ensure you’re ready for a smooth and successful refinance.

Preparation Phase:

· [ ] Define your goal: Lower payment, faster payoff, or consolidation?

· [ ] Pull your credit report: Check your score and dispute any errors. (US: AnnualCreditReport.com; UK/AU/CA: Experian, Equifax).

· [ ] Find your old loan statement: Note the current balance and interest rate.

· [ ] Request a 10-day payoff amount: Call your old lender.

· [ ] Check for prepayment penalties: Read your old loan’s fine print.

Shopping Phase:

· [ ] Get 3-5 pre-qualification offers: Use “soft pulls” to compare rates from online lenders, banks, and credit unions.

· [ ] Compare offers by APR: Don’t be fooled by the interest rate. Look at the APR and origination fees.

· [ ] Calculate your “break-even point”: (Total Fees) / (Monthly Savings) = Months to Break Even.

Application Phase:

· [ ] Gather your documents: ID, proof of income, proof of address.

· [S ] Submit your formal application: Only to the one lender you have chosen.

· [ ] Sign the new loan agreement: Read it first!

· [ ] Confirm the old loan is paid: Get a $0 balance confirmation.

Refinance a Personal Loan Cost Breakdown: What You’ll Pay and What You’ll Save

Let’s make this simple. The “cost” is what you pay in fees. The “savings” are what you gain from a lower rate. Your savings must always be higher than your costs.

Example Cost/Savings Analysis:

· Your Old Loan:

o Remaining Balance: $10,000

o Remaining Term: 36 months

o APR: 18.0%

o Monthly Payment: $361.53

o Total Future Interest: $3,005.48

· Your New Refinance Offer:

o New Loan Amount: $10,000

o New Term: 36 months

o APR: 11.0%

o Origination Fee: $0 (No-fee loan)

o New Monthly Payment: $327.46

o Total Future Interest: $1,788.56

The Result: A Clear Win

· Immediate Monthly Savings: $361.53 – $327.46 = $34.07 per month

· Total Interest Savings: $3,005.48 – $1,788.56 = $1,216.92

In this scenario, with zero fees and a simple 7% rate reduction, you save over $1,200 and free up $34 in monthly cash flow, all while keeping the same payoff date. This is the power of refinancing.

FAQ

Is It a Good Idea to Refinance a Personal Loan?

Yes, it is an excellent idea if it saves you money or makes your finances easier to manage. The best reasons to refinance are:

1. Your credit score has improved significantly since you first took out the loan.

2. Market interest rates have dropped, allowing you to get a lower rate.

3. You want to consolidate multiple debts (like other loans or credit cards) into one simpler, lower-interest payment.

4. You need to lower your monthly payments to free up cash flow (though this may mean extending your term and paying more interest over time).

It’s a bad idea if the fees (like origination fees or prepayment penalties) on the new loan cost more than the interest you’d save. Always do the math first.

Can You Refinance an Existing Personal Loan?

Yes, absolutely. You can refinance an already existing personal loan with just about any lender. You do so by formally borrowing the money and obtaining a new personal loan, which your new lender uses to pay off your old loan balance. You then start paying the new lender.

But a big exception to this rule is that most lenders won’t allow you to refinance an existing loan of theirs. For instance, you usually can’t take out a new Navy Federal personal loan to pay off an old Navy Federal personal loan. You’d have to seek out a different lender (like PenFed, SoFi, or a local bank) to refinance it.

How Much Would a $10,000 Loan Cost Per Month Over 5 Years?

The monthly cost depends entirely on the APR (Annual Percentage Rate). A 5-year loan has 60 monthly payments. Here’s a simple breakdown based on different interest rates:

· Excellent Credit (e.g., 8% APR): Approximately $202.76 per month. (Total interest paid: ~$2,166)

· Good Credit (e.g., 12% APR): Approximately $222.44 per month. (Total interest paid: ~$3,346)

· Fair Credit (e.g., 18% APR): Approximately $253.93 per month. (Total interest paid: ~$5,236)

· Poor Credit (e.g., 25% APR): Approximately $293.51 per month. (Total interest paid: ~$7,611)

As you can see, a better credit score and lower APR can save you thousands of dollars over the life of the loan.

What Is the 2% Rule for Refinancing?

The “2% rule” is widely used in the mortgage world. It recommends considering refinancing your home loan only if you can secure an interest rate that’s at least 2% below your current one.

That “rule” doesn’t apply quite as well to personal loans. Typically, personal loans are both smaller (and carry shorter terms) and have lower fees, so a 1% rate drop can be especially meaningful. Hell, 1% on a $15,000 loan over 3 years is still a $240 savings. The better “rule” for personal loans would probably be: Refinance if and only if your cumulative interest savings are much larger than all costs associated with the new loan (such as origination fees or prepayment penalties).

Refinance Loan Options: Which One Is Right for You?

You have a few primary options, each suited for a different goal:

1. New Personal Loan: This is the most common option. You get a new, fixed-rate personal loan to pay off the old one. This is best if your goal is to lock in a lower rate, shorten your term, or consolidate a couple of debts.

2. Debt Consolidation Loan: This is just a type of personal loan marketed specifically for paying off multiple debts. The funds are often sent directly to your old creditors.

3. 0% APR Balance Transfer Credit Card: This can be a good option if your debt is small (e.g., under $5,000) and you can realistically pay it off in full during the 0% introductory period (usually 12-21 months). Warning: These cards often have a 3-5% transfer fee, and if you don’t pay it off in time, the interest rate will skyrocket to 20-30%+.

PenFed Refinance Personal Loan: Should You Consider It?

PenFed (Pentagon Federal Credit Union) is a strong option for refinancing, especially for US borrowers with good credit.

· Pros: They are known for very competitive interest rates (APRs), high loan limits (up to $50,000), and are open to all borrowers (you don’t have to be in the military; you can join by opening a simple savings account).

· Cons: As a credit union, their approval process can be slightly slower than online-only lenders, and they have stricter credit requirements.

· Verdict: Yes, you should absolutely include PenFed in your rate-shopping. They are often a top contender for the lowest APR.

How to Get an $11,000 Personal Loan and Refinance It Efficiently

Getting an $11,000 loan follows the same process as any other amount. Lenders like LendingClub, PenFed, and SoFi offer loans well beyond this amount.

To refinance it efficiently later:

1. Take the $11,000 loan and make on-time payments for at least 6-12 months.

2. Actively improve your credit: Pay down other debts (especially credit cards) and ensure your payment history is perfect.

3. Wait for your score to jump. Once your credit score is 30+ points higher than when you applied, or if market rates drop, start shopping for a refinance loan.

4. Refinance to a new loan with a lower APR to pay off the $11,000 (or its remaining balance). The key to efficiency is improving your credit profile so you deserve a better rate.

Best Refinance Personal Loans for Low Rates and Flexible Terms

The “best” loan is the one that offers you the lowest APR and the terms you need. Based on current market data in the US, your search should include:

· For Low Rates (Good/Excellent Credit): SoFi and credit unions like PenFed. They have higher credit standards but reward you with some of the lowest APRs available.

· For No Fees: Discover Personal Loans. Discover famously charges no origination fees, no prepayment penalties, and no late fees on its personal loans. This makes it incredibly easy to calculate your true cost.

· For Flexible Terms (Fair Credit): LendingClub or Upstart. These lenders use more than just a credit score to evaluate you (like your education or job history) and may offer more options if your credit is in the “fair” range.

Personal Loan Checker: How to Qualify and Find the Best Deals

A “Personal Loan Checker” is another term for a pre-qualification tool. These will be your best friends at the store.

You can find them on lenders’ websites (which include Discover, PenFed, SoFi, and so forth). You provide some basic information, such as your name, address, income, and how much you want to borrow. The lender then makes a soft credit pull, one that doesn’t affect your credit score.

The tool will “check” your profile — in 1-2 minutes — and let you know if you’re likely to qualify and what estimated APR and loan terms you might expect. Apply these checkers on 3-5 different lender websites and discover the best deal before you actually apply, which is a “hard pull” on your credit.

Personal Loan Consolidation: Is Refinancing a Good Option?

Yep, they’re pretty much the same plan. Refinancing can mean replacing one loan, while “consolidation” typically refers to replacing multiple debts (like several loans or credit cards).

You consolidate with a new refinance loan. So, for instance, you have one new $20,000 personal loan that pays off an old $10,000 loan and a $5,000 credit card, and a $5,000 store card.

This is a great choice if the new loan has an APR less than the weighted average APR on your combined debts. It reduces your life from 3+ payments to one easy payment each month, helping you pay off the loan easier and faster.

How Soon Can You Refinance a Personal Loan After Approval?

You can technically refinance a personal loan at any time—even just a few months after you get it. There is no “waiting period” mandated by law.

However, you must check two things:

1. Prepayment Penalty: Does your current loan have a fee for paying it off early? Many loans have no penalty, but if yours does, you must wait until the penalty period expires or ensure your savings are greater than the fee.

2. Financial Benefit: It only makes sense to refinance if something has changed. Has your credit score gone up? Have market rates dropped? If you apply for a refinance the day after approval, you will get the same (or worse) rate. Most people wait 6-12 months, giving their credit score time to improve.

Do You Get Money When You Refinance a Personal Loan?

Usually, no. The new lender will send the money to your old lender, paying off your old loan. The money never actually goes into your bank account.

The only way, in the end, that you “get money” is when you do a “cash-out” refi. That’s when you owe more than you have borrowed. For example, you may owe $8,000 on your old loan and apply for a new $11,000 loan. The lender would apply $8,000 to the balance of the old loan and deliver an additional $3,000 to you in cash. This is not as commonly available for personal loans as it is for mortgages, and you will receive a higher loan payment.

Can You Refinance a Personal Loan with the Same Bank?

Typically, no. Just about no bank or lender will allow you to use a new loan from them to pay off an old loan from them. They don’t see you as a new customer, and they’re going to lose money if they cut their rate for you.

You can never refinance an existing personal loan directly with the original, old lender. If you have a loan with Discover, for instance, you’ll have to refinance it through SoFi, LendingClub, or a credit union.

Refinance Personal Loan Meaning: What You Need to Know

In the simplest terms, refinancing a personal loan means replacing your current loan with a new one that has better features.

The “better features” you are looking for are:

· A lower interest rate (APR) to save you money.

· A lower monthly payment to improve your cash flow.

· A shorter loan term to get you out of debt faster.

· The ability to combine multiple debts into one single payment.

You are not borrowing more money; you are simply changing the terms of the money you have already borrowed to make it work better for you.

Refinance Personal Loan Calculator: Estimate Your Savings Today

A refinance calculator is a free online tool that does the hard math for you. It helps you decide if refinancing is worth it.

You will need to enter:

1. Your Current Loan: Your remaining balance, your current APR, and your remaining monthly payments.

2. Your New Loan Offer: The new loan amount, the new APR (including any fees), and the new loan term (in months).

The calculator will then instantly show you a side-by-side comparison, answering the most important question: “How much will I save?” It will show your new monthly payment, your total interest paid on both loans, and your total net savings. Never agree to a refinance deal without running the numbers through a calculator first.

Discover Refinance Personal Loan Options for Better Terms

Discover Personal Loans is a very popular option for refinancing in the US, primarily because of its borrower-friendly “no-fee” structure.

· What they offer: You can take out a new personal loan from Discover to pay off your existing loans from other lenders.

· The biggest benefit: Discover charges no origination fees, no application fees, and no prepayment penalties. The APR they quote you is exactly what you get, making it very easy to compare.

· Other features: They also offer a “Check Your Rate” (pre-qualification) tool that uses a soft pull, so you can see your potential rate without hurting your credit score. They are a top-tier choice to include in your comparison shopping.

Can You Refinance a Personal Loan with Lending Club?

Yes. LendingClub (it’s currently a bank) is a large online lender based in the United States and provides personal loans for refinancing and debt consolidation. You may use a new LendingClub loan to pay off an existing loan or credit card from another lender.

Where it gets a little funky is that in some cases, LendingClub may even give you a new loan to pay off an old LendingClub loan. This is the rare exception to the “same bank” rule, as they will frequently be willing to give better terms for recurring customers. They are versatile loan options that can accommodate a wide range of borrowers and credit scores.

Can You Refinance a Personal Loan with Navy Federal Credit Union?

So, this is a hard “no.” Navy Federal Credit Union (NFCU) has amazing personal loan rates, but according to policy, you are not allowed to use a new Navy Federal personal loan to pay off another existing Navy Federal personal loan.

If, then, you have a personal loan with NFCU and need/want to refinance it at better terms (maybe your credit has better), you must engage another lender. Then you could apply at PenFed, SoFi, Discover, LendingClub, or another bank for the loan that pays off your Navy Federal one. You can, however, apply for an NFCU personal loan to use the proceeds to refinance a loan you have with another bank.