Explore affordable personal loans for teachers with flexible terms, low rates, and trusted credit union options across US, UK, Canada & Australia.

Our educators are the heart of our communities and yet too often carry a burden all their own. A stable, professional salary can be stretched in multiple directions courtesy of out-of-pocket classroom expenses, the desire to achieve ongoing professional certifications, and something as mundane as life’s common emergencies. Maybe you’re a teacher in the United States who spends $800 of your own money on supplies, or an educator in the UK saving up for a certification, or even a Canadian teacher struggling with finding enough summer pay. In such cases, flexible and cost-efficient financing is very important.

That’s where personal loans for teachers can be handy: Lenders in the US, UK, Canada, and Australia know that schoolteachers are a solid bet with their reliable employment. As a result, many financial institutions—most notably credit unions and educator-focused banks—have set up special programs, lower interest rates, and more flexible terms specifically for you.

This guide offers you a treasure trove of information for navigating the world of educator financing. I’ll delve into why teachers require such loans, where you can find the best lenders in your country, and how to ensure the best rates on the market. We’ll also touch on the important subject of student loan refinancing for teachers and offer expert tips on how to get a managerial grip on your loan. You’re passionate about teaching—your finances shouldn’t be a class with a failing grade.

Why Teachers May Need Personal Loans to Manage Professional and Personal Expenses

Teaching is not a 9 5 job; it is an investment. While the job is very meaningful, it sometimes means that teachers have to put a lot of their own money into expenses that aren’t covered by the school budget. A personal loan is a straightforward, one-time solution to cover these hefty (often irregular) costs.

The following is a list of the most typical reasons teachers use personal loans:

· Bridging the ‘Summer Pay Gap’: In the U.S. and Canada, many educators are employed on 9- or 10-month contracts. Although pay can be stretched over 12 months in some districts, it can’t in many. A personal loan might serve as a known-quantity bridge to maintaining your standard of living during the unpaid summer months, with repayment scheduled to begin when the new school year (and paychecks) starts.

· Classroom supplies and technology Statistics don’t change: teachers are still shelling out hundreds of their own dollars (or pounds or euros) each year. A small personal loan could be the difference in paying for a major classroom upgrade—like flexible seating, a new set of tablets, or specialized software—that the school’s budget falls short on.

· Professional Development and Certifications: To climb up the pay scale or become a specialist (say, in special education or administration), teachers need to obtain advanced degrees or certifications. These programs can cost thousands. A personal loan for professional development is an investment in your earning potential.

· Debt Consolidation: This is one of the best uses. Many teachers end up with high-interest credit card debt—usually from using it to pay for smaller classroom expenses or unexpected emergencies. You can streamline all of these payments with a personal loan, which typically has a lower, fixed interest rate—and less daunting payment amounts—if you’ve been in the workforce long enough to qualify.

· Life Used To (Again): From Posting to PayPal: A broken-down car, an emergency home repair, a surprise medical bill—these things can happen to anyone and throw any budget out of whack. A personal loan from a trustworthy lender will get you the cash you need more quickly than many other types of loans, so that a little issue doesn’t turn into a complete catastrophe.

Mini Case Study: Consolidating for Clarity

· Educator: Mark, a high school science teacher in the UK.

· Problem: Mark had accumulated approximately £7,000 in credit card debt across three different cards. The debt came from a mix of moving expenses for his first teaching job and buying lab equipment his school wouldn’t fund. The average 22% APR was costing him nearly £130 a month just in interest.

· Solution: He applied for a debt consolidation personal loan through a UK online lender known for working with public sector employees.

· Result: Mark secured a £7,000 loan with a 5-year term at a fixed 7.9% APR. His new, single monthly payment was £141. He not only simplified his finances but is now on track to be debt-free in five years, saving thousands in potential interest.

Table: Common Teacher Expenses vs. Financing Solutions

| Expense Category | Typical Cost (USD/AUD/GBP) | Recommended Financing | Why It Works |

| Classroom Setup | $500 – $1,500 | Small Personal Loan / 0% APR Card | A small loan provides immediate funds. A 0% card works if you can pay it off before the promo period ends. |

| Professional Certification | $2,000 – $10,000 | Personal Loan / Career Dev. Loan | A fixed-term loan allows you to invest in your career and budget for a predictable payment. |

| Credit Card Debt | $5,000 – $30,000+ | Debt Consolidation Loan | This moves high-interest, variable-rate debt to a lower-interest, fixed-rate installment loan, saving money. |

| Summer Income Gap | $3,000 – $6,000 | Personal Loan / Line of Credit | A loan provides a lump sum, while a line of credit offers more flexibility to draw funds as needed. |

| Emergency Repair | $1,000 – $4,000 | Emergency Fund / Fast Personal Loan | If your emergency fund is short, a fast-approval online personal loan is a much better option than a payday loan. |

Top Lenders Offering Personal Loans for Teachers in Tier One Countries

Finding a lender who understands the unique financial profile of an educator can lead to better rates and more suitable products. While any bank offers personal loans, some institutions actively cater to teachers. We’ve broken down the top sources by country.

United States (US)

In the US, the market is rich with options, from massive online lenders to local credit unions.

· Educator-Specific Credit Unions: This is often the best starting point. Institutions like Teachers Federal Credit Union (TFCU), Affinity Plus Federal Credit Union (Minnesota), and SchoolsFirst Federal Credit Union (California) are member-owned and exist to serve educators. They typically offer lower-than-average APRs and more personalized service.

· Online Lenders: Companies like SoFi, LightStream, and Upstart are popular with teachers. SoFi often markets to professionals and has strong debt consolidation products. LightStream is known for low rates for those with excellent credit, while Upstart’s AI-based model may help new teachers with a limited credit history.

· Union-Affiliated Programs: The National Education Association (NEA) has a Member Benefits program that includes personal loans, often in partnership with major banks like First National Bank of Omaha (FNBO). These loans may come with specific perks for members.

United Kingdom (UK)

The UK market is dominated by high-street banks and agile online lenders.

· High-Street Banks: Lenders like HSBC, Barclays, and Santander are common choices. If you are an existing customer, you may be eligible for pre-approved offers or loyalty rate discounts.

· Online & P2P Lenders: Zopa and Lendable are known for quick online applications and fast decisions. They compete heavily on interest rates, which benefits you as a borrower.

· Public Sector Specialists: While less common for personal loans, some lenders specialize in financing for public sector workers, including teachers. Check for building societies or lenders who highlight “key worker” or “public sector” programs.

Canada

In Canada, the “Big 5” banks are the most visible lenders, but educator-specific financial groups provide a valuable alternative.

· Major Banks: RBC, TD Bank, Scotiabank, BMO, and CIBC control most of the market. They offer stable, predictable personal loans, and having a pre-existing relationship can simplify the application process.

· Educator-Specific Financial Groups: The Educator’s Financial Group is a key player. They provide financial planning, mortgages, and loans specifically tailored to the needs (and pay cycles) of Canadian educators.

· Credit Unions: Provincial credit unions like Vancity (BC) or Meridian (Ontario) often have deep community roots and may offer more flexible terms than the national banks.

Australia

Australia has a robust “mutual bank” system, with several banks founded by and for teachers.

· Teacher-Specific Banks: Teachers Mutual Bank is the premier example. They offer a full suite of banking products, including personal loans, and explicitly state their mission is to serve educators and their families. Beyond Bank is another mutual bank with strong ties to the education community.

· The “Big 4” Banks: Commonwealth Bank (CBA), Westpac, ANZ, and NAB are the largest lenders and offer competitive, mainstream personal loans.

· Online Lenders: Fintech lenders like Pepper Money and Plenti offer fast, digitally-native loan applications, similar to their counterparts in the US and UK.

Table: Lender Type Comparison for Educators

| Lender Type | Best For | Typical APR Range (Example) | Countries |

| Teacher Credit Union / Mutual Bank | Low Rates, Member Service, Flexibility | 5.99% – 12.99% | US, CAN, AUS |

| Online Lenders (Fintech) | Speed, Convenience, Flexible Underwriting | 6.99% – 29.99% | All (e.g., SoFi, Zopa, Plenti) |

| Major National/High-Street Banks | Existing Customers, In-Person Service | 7.99% – 18.99% | All |

| Union-Affiliated Programs | Member-Only Perks, Trusted Brand | 7.49% – 15.49% | US (NEA) |

Mini Case Study: Finding a Niche Lender

· Educator: David, a new teacher in Sydney, Australia.

· Problem: David needed a $15,000 AUD loan to buy a reliable car for his commute to a regional school. His limited credit history as a recent graduate meant his application at one of the “Big 4” banks was given a high interest rate.

· Solution: A colleague recommended he try Teachers Mutual Bank.

· Result: Teachers Mutual Bank looked at his full-time teaching contract as a sign of stability, not just his credit score. They approved him for the $15,000 loan at a rate nearly 3% lower than the major bank’s offer, saving him over $1,000 in interest over the life of the loan.

Key Takeaway: Don’t just apply to the biggest bank. Niche lenders that serve your profession, like a teacher’s credit union, often provide the best value.

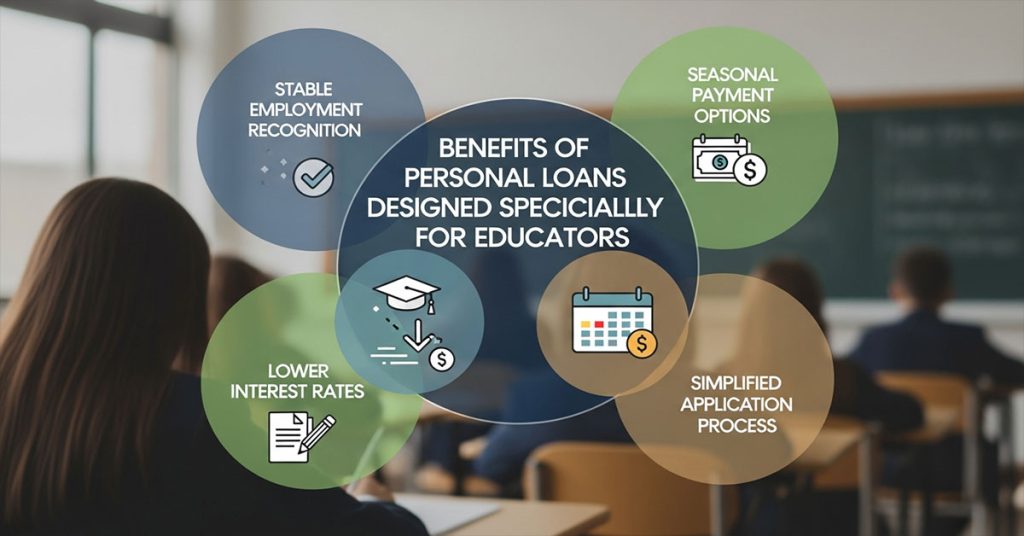

Benefits of Personal Loans Designed Specifically for Educators

While a “teacher loan” is often a standard personal loan marketed to educators, some lenders provide tangible, specific benefits that recognize the stability and seasonality of the teaching profession. These perks can make a significant financial difference.

The primary benefit is preferred underwriting. Lenders love teachers because they have:

· Stable, predictable income.

· High job security (tenure, union contracts).

· A track record of responsibility.

This low-risk profile is often rewarded. But the specific, advertised benefits are where the real value lies.

1. “Summer Skip-a-Payment” Options

This is perhaps the most useful—and teacher-specific—benefit. A few credit unions (mainly in the US and active in Canada) provide small ‘deferred payment’ personal loans. That way, you can take a one ortwo-monthh break in the summer (i.e., July and/or August) when you may not be getting paid. This is a boon for cash flow management if one’s pay schedule is 10 months. Interest continues to accumulate, but the flexibility is fantastic.

2. Lower Interest Rate Discounts

Most educator-based credit unions provide a “relationship” or “public service” discount. This might be a 0.25% to 0.50% cut from their standard advertised APR. For example, in the US, SchoolsFirst FCU provides rate means for certain loans to members who meet certain criteria. You are directly benefiting from the hard work you perform in your community.

3. Higher Loan Amounts for Specific Needs

Some lenders offer designated loan products for educators. For example, you might find a “Classroom Supply Loan” or a “Professional Development Loan.” These may come with special terms, such as a smaller loan amount for supplies (e.g., $500 – $2,000) with a 12-month repayment or a larger loan for a master’s degree with a deferred payment start date.

4. Bundled Perks and Financial Wellness

Lenders who target teachers, like Educators Financial Group (Canada) or Teachers Mutual Bank (Australia), don’t just sell you a loan. They often bundle it with free access to financial wellness resources, budgeting workshops, and retirement planning advice tailored to your profession (e.g., understanding your state or provincial pension plan). This holistic approach helps you manage the loan and your overall financial health.

Table: General Loan vs. Educator-Specific Loan

| Feature | Standard Personal Loan | Educator-Focused Loan (Example) |

| Underwriting | Based purely on credit score & DTI | Considers stable teaching contract & union membership |

| Interest Rate | Standard market rate | Often 0.25% – 0.50% APR discount |

| Repayment Plan | Fixed monthly payments, 12 months/year | May offer “skip-a-payment” option for summer |

| Loan Purpose | “Personal Use,” “Debt Consolidation” | May have “Classroom Loan” or “Certification Loan” |

| Extra Benefits | None | Access to free financial counseling for educators |

Mini Case Study: Using Flexibility to Your Advantage

· Educator: Maria, a special education teacher in Texas (US).

· Problem: Maria’s district pays 10-month contracts over 12 months, but her co-curricular stipend is paid in a lump sum in May. She needed a $10,000 loan for a new HVAC system.

· Solution: She chose a loan from her teacher credit union that had no prepayment penalties.

· Result: Maria took the 5-year loan for the low monthly payment. However, she used her large stipend check in May to make a significant $4,000 principal payment. She’s on track to pay off her 5-year loan in less than three, saving her hundreds in interest. This flexibility is a key, if often overlooked, benefit.

Key Takeaway: The best “teacher loan” isn’t always the one with the lowest rate. It’s the one with the features (like summer skips or no prepayment penalties) that match your unique pay cycle.

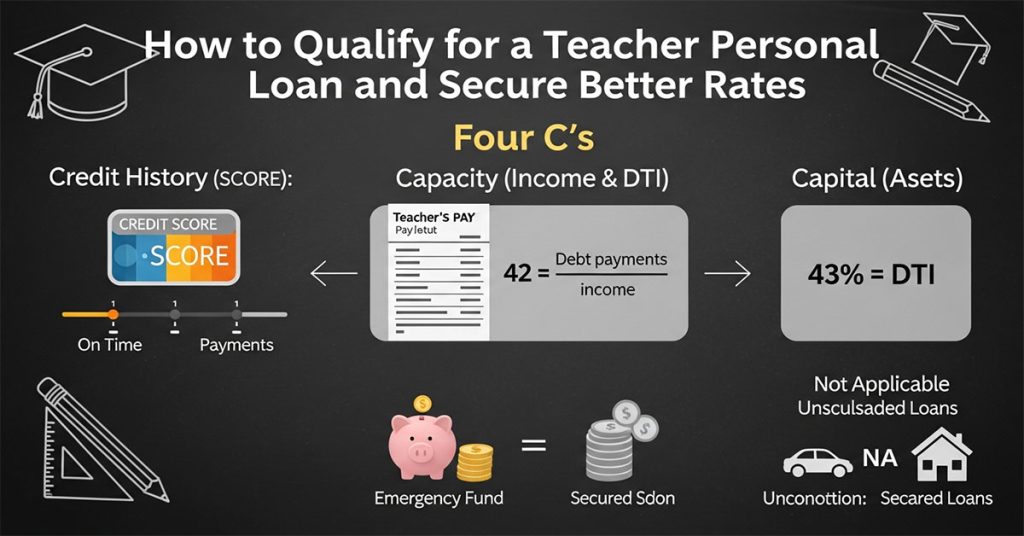

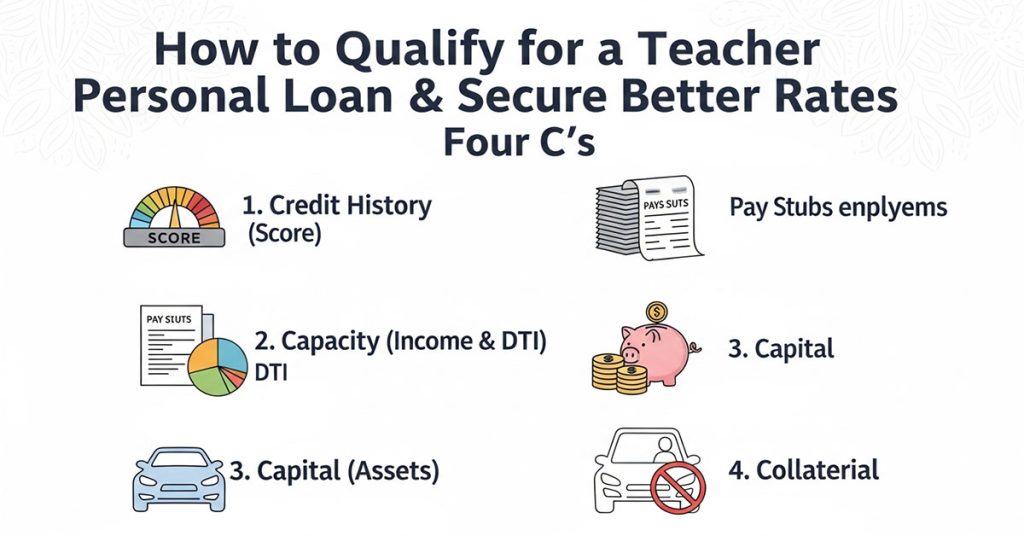

How to Qualify for a Teacher Personal Loan and Secure Better Rates

Qualifying for a personal loan as a teacher is generally straightforward due to your stable employment. However, qualifying is different from securing the best possible rate. A low rate is the single most important factor in saving you money. Here’s how to navigate the process.

Baseline Qualification Requirements

Lenders in the US, UK, Canada, and Australia all look at the same core “Four C’s”:

1. Credit History (Score): This is a snapshot of your reliability as a borrower. Lenders want to see a history of on-time payments.

2. Capacity (Income & DTI): This is your ability to repay. Lenders will verify your teaching salary (via pay stubs or your contract) and calculate your Debt-to-Income (DTI) ratio. DTI is your total monthly debt payments divided by your gross monthly income. Most lenders want to see a DTI below 43%.

3. Capital (Assets): While less important for unsecured personal loans, lenders like to see that you have some savings (an emergency fund), which shows financial discipline.

4. Collateral: This only applies to secured loans (e.g., a car loan or HELOC). Most personal loans for teachers are unsecured, meaning your contract and credit are your promise to pay.

How to Secure the Best Rates

Getting approved is the first hurdle; getting the lowest APR is the goal.

· Check and Boost Your Credit Score: Before you even think about applying, get a free copy of your credit report. In the US, use AnnualCreditReport.com. In the UK, use ClearScore or Experian. In Australia, use Canstar. If you see errors, dispute them. If your score is low, spend 3-6 months paying every bill on time and paying down credit card balances to below 30% of their limits.

· Calculate Your DTI Ratio: Add up your monthly rent/mortgage, car payment, student loan payment, and minimum credit card payments. Divide this by your gross (pre-tax) monthly salary. If the number is high (e.g., 45%+), try to pay off a small loan or credit card before you apply.

· Shop Around and Get Pre-Qualified: This is the most crucial tip. Never take the first offer you get. Get pre-qualified from at least three lenders:

1. A Teacher Credit Union (US, CAN, AUS)

2. An Online Lender (e.g., SoFi, Zopa)

3. Your primary bank

“Pre-qualification” uses a soft credit check, which does not hurt your credit score. It gives you a real estimate of the rate you’ll receive.

· Ask for an Autopay Discount: Almost all online lenders (and many banks) will knock 0.25% to 0.50% off your APR if you set up automatic payments from your checking account. It’s the easiest discount you’ll ever get.

Mini Case Study: The Power of Pre-Qualification

· Educator: Tom, a Canadian teacher in Ontario.

· Problem: Tom needed a $20,000 CAD loan for a home renovation. He went to his “Big 5” bank, where he’s been a customer for 15 years. They approved him at 10.99% APR.

· Solution: Before accepting, he applied for pre-qualification with his provincial teacher credit union and one online lender.

· Result: The online lender offered him 9.99%. The teacher credit union, seeing his stable DTI and long-term employment, offered him 8.49%. By shopping around, Tom saved 2.5% on his APR, which will save him over $1,400 in interest over the 5-year loan term.

Table: Impact of Credit Score on a $15,000 Loan (5-Year Term)

This table shows why improving your score before you apply is so critical. These are illustrative rates for the US market, but the principle is universal.

| Credit Score Tier | Assumed APR | Monthly Payment | Total Interest Paid |

| Excellent (760+) | 7% | $290 | $2,394 |

| Good (700-759) | 12% | $334 | $5,014 |

| Fair (640-699) | 19% | $388 | $8,299 |

| Poor (<640) | 28% | $463 | $12,797 |

Key Takeaway: The difference between “Good” and “Excellent” credit on this single loan is over $2,600. It pays to be patient and improve your credit before borrowing.

H2: Best Loan Options and Competitive Interest Rates for Teachers

When you seek a “teacher loan,” you’ll find several different financial products. The “best” one depends entirely on your goal. A loan for debt consolidation has a different ideal structure than a loan for student debt.

Let’s break down the primary options.

1. Unsecured Personal Loans (The Standard)

This is the most common option. You borrow a fixed amount of money (e.g., $10,000) and pay it back in fixed-rate monthly installments over a set term (e.g., 3, 5, or 7 years).

· Best For: Debt consolidation, large one-time purchases (car repair, home improvement), or professional development.

· Source: Credit unions, online lenders, banks.

· Interest Rates: Highly variable based on your credit. As of late 2024/early 2025, rates can range from 7% for excellent credit to 30%+ for poor credit. Educator credit unions will be on the lowest end of this spectrum.

2. Personal Line of Credit (LOC)

Unlike a loan, which gives you a lump sum, a line of credit gives you a limit (e.g., $15,000) that you can draw from as needed. You only pay interest on the amount you’ve used.

· Best For: Ongoing projects (like a home renovation where you pay contractors in stages) or as a more flexible “summer gap” fund.

· Source: Mostly banks and credit unions.

· Interest Rates: Often variable (they can change), and slightly higher than a fixed-rate loan.

3. Home Equity Line of Credit (HELOC) or Home Equity Loan

If you are a homeowner, you can borrow against the equity in your home. This is a secured loan.

· Best For: Very large expenses ($25,000+) like a major home addition or college tuition, as they offer the lowest interest rates.

· Source: Banks and credit unions.

· Interest Rates: Very low, often tied to the prime rate.

· CRITICAL WARNING: Your home is the collateral. If you fail to repay the loan, the lender can foreclose on your home. This is not to be used for classroom supplies or debt consolidation.

4. Student Loan Refinancing (US-Specific Focus)

This is a specialized loan product that pays off your existing federal and/or private student loans and replaces them with a new private loan.

· Best For: Teachers with high-balance private student loans or those with federal loans who have high credit scores, stable jobs, and are NOT pursuing Public Service Loan Forgiveness (PSLF).

· Source: Specialized lenders like SoFi, Laurel Road, CommonBond.

· Interest Rates: Can be very low (fixed or variable) if you have strong financials.

Mini Case Study: The PSLF Refinancing Trap

· Educator: Jennifer, a public school teacher in the US with $65,000 in federal student loans.

· Problem: She was paying 6.8% on her federal loans. A private lender offered to refinance her entire balance at 4.5%, saving her significant money on interest.

· Solution: Before accepting, she spoke with a nonprofit financial counselor.

· Result: The counselor pointed out she was 7 years into her 10-year requirement for Public Service Loan Forgiveness (PSLF). If she refinanced, her loans would become private, and she would be ineligible for forgiveness. By not refinancing, her remaining balance (likely over $50,000) would be forgiven, tax-free, in 3 years. She kept her federal loans.

Key Takeaway: NEVER refinance federal student loans into a private loan if you are, or ever plan to be, on the Public Service Loan Forgiveness (PSLF) track.

Table: Loan Option Comparison for Teachers

| Loan Type | Repayment | Interest Rate | Key Risk | Best Use Case |

| Unsecured Personal Loan | Fixed | Fixed | None (unsecured) | Debt Consolidation, One-Time Cost |

| Personal Line of Credit | Variable | Variable | Overspending | Ongoing Projects, Summer Bridge |

| HELOC (Secured) | Variable | Variable (low) | Losing Your Home | Major Home Renovation ($25k+) |

| Student Loan Refinance | Fixed | Fixed or Variable | Losing PSLF | Reducing the rate on PRIVATE student loans |

Expert Tips for Managing and Repaying Your Personal Loan Efficiently

You’ve been approved, and the funds are in your account. The next step is to create a smart repayment plan. Managing your loan well not only gets you out of debt faster but also significantly boosts your credit score, opening doors for better financial products in the future.

Tip 1: Set Up Autopay (The “Set-it-and-Forget-it” Win)

This is the simplest and most effective tip.

· Why: First, you will never miss a payment, which is the #1 factor in your credit score. Second, as mentioned earlier, most lenders offer a 0.25% – 0.50% interest rate discount for using it. This is free money.

Tip 2: Use the “Bi-Weekly” Payment Method

Instead of making one monthly payment, split it in half and pay that amount every two weeks.

· Why: Since there are 52 weeks in a year, you’ll make 26 “half-payments.” This equals 13 “full” monthly payments instead of 12. You make one extra payment per year without feeling the pinch.

· Result: This trick alone can shave 6-8 months off a 5-year loan and save you hundreds in interest. Important: Check with your lender to ensure extra payments go toward the principal, not future interest.

Tip 3: Attack the Principal with Windfalls

As a teacher, you might get a tax refund, a bonus for coaching a team, or a stipend for running a club.

· Why: Any payment you make on top of your regular monthly amount should be designated “principal-only.” This reduces the loan balance that interest is calculated on, accelerating your payoff. A $1,00A-0 principal payment can be more powerful than three regular payments.

Tip 4: Consolidate Your View, Not Just Your Debt

If you have your loan, a car payment, and a credit card, use a free budgeting app (like YNAB, Rocket Money, or your bank’s tool) to see all your debts in one place.

· Why: This visual reminder keeps your goal (debt freedom) front and center. It helps you see how your extra payments are reducing the balance and motivates you to keep going.

Mini Case Study: Bi-Weekly Payments in Action

· Educator: The Smith family, two teachers in Australia.

· Problem: They took out a $30,000 AUD personal loan at 9% APR over 5 years for a new (used) family car and to consolidate some old credit card debt. Their monthly payment was $622.

· Solution: They aligned their paychecks to a bi-weekly schedule. They automated a payment of $311 every two weeks.

· Result: They paid $311 every two weeks, totaling $8,096 per year instead of the $7,464 from monthly payments. They are on track to pay off their 60-month loan in just 52 months and will save over $850 AUD in interest.

Table: Payoff Acceleration on a $10,000 Loan (5 Years, 10% APR)

| Repayment Strategy | Monthly Payment | Payoff Time | Total Interest Paid |

| Standard Payment | $212.47 | 60 Months | $2,748.23 |

| Bi-Weekly Plan ($106.24 every 2 weeks) | $229.84 (effective) | 54 Months | $2,408.17 |

| “Round Up” (Paying $250/mo) | $250.00 | 48 Months | $2,001.07 |

Key Takeaway: Small, consistent changes to your payment have a massive impact. Rounding up your payment by just $38 a month on this loan saves you over $700 and gets you out of debt a full year faster.

Common Expenses Teachers Cover Using Personal Loans in the US and UK

While educator salaries vary, the financial pressures are universal. In the US and UK, teachers often use personal loans as a strategic tool to manage specific, and often predictable, large expenses.

In the United States

US teachers face a unique combination of high student debt, significant out-of-pocket classroom spending, and stagnant wages in some districts.

· Classroom “Startup” Costs: New teachers, or those moving to a new classroom, can spend $1,000 – $2,000 before the first bell rings on books, furniture, and supplies.

· Professional Development: A “Master’s bump” (a salary increase for getting a Master’s degree) is common. A $10,000 – $20,000 personal loan to pay for the degree can have a direct, positive ROI.

· Student Loan Debt: While refinancing federal loans is risky (due to PSLF), many teachers also have private student loans. A personal loan can be used to consolidate or refinance these private loans at a better rate.

In the United Kingdom

In the UK, while student loan systems are different, cost-of-living and professional expenses create similar needs.

· Relocation for Jobs: Moving to a new council or city for a teaching post (especially in or near high-cost areas like London) can require a “rental deposit” loan to cover the first month’s rent and security deposit, which can easily exceed £2,000 – £3,000.

· Car Purchase/Repair: Outside of major cities, teaching often requires a car. A personal loan is the primary way to finance a reliable used car to ensure you can get to work.

· Debt Consolidation: UK educators also use personal loans to manage “buy now, pay later” (BNPL) debt and store card debt, consolidating them into a more manageable, lower-rate payment.

Table: US vs. UK Teacher Expense Priorities

| Expense Priority | United States (US) | United Kingdom (UK) |

| #1 Professional Cost | Classroom Supplies (avg. $860/yr) | Professional Development / Certifications |

| #1 Personal Cost | Debt Consolidation (Credit Card) | Car Purchase / Repair |

| #2 Professional Cost | Master’s Degree / Certification | Classroom Technology & Resources |

| #2 Personal Cost | Emergency Repair (Home/Auto) | Relocation / Rental Deposit |

Expert Insight:

“We see many educators in the US use small personal loans as an ’emergency fund’ replacement. They know they’ll spend $1,000 on their classroom in August, so they take a 12-month loan to spread that cost, rather than putting it on a 22% APR credit card. It’s a smart cash-flow move. In the UK, it’s more about mobility—financing the car or the rental deposit that unlocks the new, better-paying teaching job.” — Financial Advisor for Public Sector Employees.

Eligibility Criteria and Required Documentation for Teacher Loans

Applying for a loan is a digital-first process in 2025. Lenders in all Tier One markets need to verify two things: who you are and your ability to repay. As a teacher, your stable employment is your biggest asset.

Core Eligibility Criteria:

· Age: You must be a legal adult (18+ in all four countries; 19+ in some Canadian provinces).

· Residency: You must be a legal resident (or citizen) of the country you’re borrowing in (e.g., US citizen, UK resident).

· Bank Account: You must have an active checking/current account for the funds to be deposited and payments to be withdrawn.

· Verifiable Income: This is key. Your teaching job.

Required Documentation (Have this ready!)

Gathering these documents before you apply will make the process take minutes instead of days.

1. Proof of Identity:

o US/CAN: Driver’s License, State ID, Passport

o UK: Driving Licence, Passport

o AUS: Driver’s Licence, Passport, Medicare Card

2. Proof of Address:

o Utility Bill (electricity, water, gas)

o Council Tax Bill (UK)

o Bank Statement (with your address)

3. Proof of Income (The Most Important Part):

o Recent Pay Stubs: Your last 2-3 pay stubs (or payslips in the UK/AUS).

o Teaching Contract: This is your secret weapon, especially if you’re a new teacher without a long pay history. Your signed contract stating your annual salary is often the strongest proof you can provide.

o Tax Returns: Your most recent tax return (T4 in Canada, P60 in the UK, US 1040, or AUS Notice of Assessment).

Table: Lender Focus by Document

| Document | What the Lender Sees | How it Helps You (as a Teacher) |

| Teaching Contract | A long-term agreement for a set salary. | Proves future income and job stability, even if you’re new or it’s the summer break. |

| Pay Stub / Payslip | Your gross vs. net pay, deductions, and YTD income. | Confirms your DTI ratio and that you are an active employee. |

| Bank Statement | Your cash flow, recurring payments, and spending habits. | Shows you manage your money responsibly and don’t have excessive overdrafts. |

| Credit Report | Your history of paying other lenders back. | Your high “character” and “capacity” as a stable teacher can offset a slightly lower score. |

Expert Insight:

“Don’t just upload your pay stub; upload your teaching contract. Many automated systems will just read the year-to-date income. If you apply in September, your YTD will look tiny. The contract shows the lender your full $55,000 salary, not the $4,500 you’ve been paid so far. This simple step can be the difference between approval and denial for new teachers.” — Credit Union Loan Officer.

Fixed vs. Variable Interest Rates — Which Option Saves More Money?

When you get a loan offer, you’ll see two main types of interest rates: fixed or variable. Choosing the right one is critical to your long-term savings and financial predictability.

Fixed Interest Rates

A fixed rate is locked in for the entire life of your loan. If you borrow $10,000 at 8% for 5 years, your payment will be the exact same amount for all 60 months.

· Pros:

o Predictability: Your payment never changes. You can budget perfectly.

o Safety: You are protected if market interest rates rise.

o Simplicity: Easy to understand and manage.

· Cons:

o Slightly Higher Start: The “starting” rate for a fixed loan is often 0.5% – 1% higher than the starting rate for a variable loan, as the lender is taking on the risk of rates rising.

Variable Interest Rates

A variable rate is tied to a market index (like the Prime Rate in the US/Canada or the Bank of England Base Rate in the UK). When that index changes, your interest rate can change, too.

· Pros:

o Lower Starting Rate: You might get an initial “teaser” rate that is very low, which is tempting.

o Potential for Savings: If market interest rates fall, your payment could go down.

· Cons:

o High Risk: If market interest rates rise (as they have recently), your payments will go up. This can break your budget.

o Unpredictability: You don’t know what your payment will be in 2 years.

Expert Insight: The Verdict for Teachers

“For 99% of teachers, a fixed-rate personal loan is the superior choice. Period. Teachers have fixed, predictable salaries. You need a fixed, predictable payment. A variable rate introduces risk you don’t need to take. The only time a variable rate might make sense is on a HELOC for a short-term project you plan to pay off in 6-12 months, but for a 3-to-5-year personal loan? Always go fixed.“

Table: Fixed vs. Variable on a $15,000 5-Year Loan

This scenario assumes a “rising rate” environment.

| Feature | Fixed-Rate Loan | Variable-Rate Loan |

| Starting Rate | 9.0% | 7.5% (Starts lower) |

| Monthly Payment (Year 1) | $311 | $297 (Seems cheaper!) |

| Monthly Payment (Year 3) | $311 | $330 (After rates rose) |

| Monthly Payment (Year 5) | $311 | $345 (After another rise) |

| Total Paid | $18,674 | $19,650 (You lost the gamble) |

| Best For | Budgeting, Peace of Mind | Short-Term Borrowing (Risky) |

Result: The initial savings from the variable rate were a trap. The predictable fixed-rate loan saved over $900 and caused zero stress.

Teacher-Specific Discounts, Rebates, and Loyalty Perks Explained

Lenders who want your business will compete on more than just the interest rate. They use a variety of discounts and perks to attract low-risk borrowers like educators. When you compare loan offers, make sure you’re factoring in these “hidden” savings.

The most common discounts are:

1. Autopay Discount (0.25% – 0.50%): The easiest win. Almost every online lender (and many credit unions) will lower your APR if you let them debit the payment from your bank account automatically.

2. “Public Service” or “Educator” Discount (0.25% – 1.00%): This is common at teacher-specific credit unions (like Teachers Mutual Bank in AUS or SchoolsFirst in the US). It’s a direct rate reduction as a thank-you for your profession.

3. Existing Customer / Loyalty Discount (0.10% – 0.25%): Major banks (RBC in Canada, Barclays in the UK) often offer a small rate discount if you already have a checking/current account with them.

4. No Origination Fees: This isn’t a “discount,” but it’s a huge cost-saver. An “origination fee” is a charge for processing the loan, often 1% – 5% of the loan amount, and is taken out of your funds.

o Example: You borrow $10,000, but a 5% origination fee means you only get $9,500. Good lenders (especially credit unions and LightStream) do not charge origination fees.

Table: Comparing Two $10,000 Loan Offers

| Feature | Lender A (Online Lender) | Lender B (Teacher Credit Union) |

| Advertised APR | 8.50% | 9.25% (Looks higher) |

| Origination Fee | 3% ($300) | 0% ($0) |

| Autopay Discount | Yes (0.25%) | Yes (0.25%) |

| Educator Discount | No | Yes (0.50%) |

| Actual APR (Lender A) | 8.25% | 8.50% |

| Funds Received (Lender A) | $9,700 | $10,000 |

| Winner (Lender B) | Lender B is the better deal. |

Takeaway: Lender A looked cheaper, but their 3% origination fee made them the worst deal. Lender B’s final APR was slightly higher, but the $0 fee and full loan amount made them the clear winner.

Expert Insight:

“Borrowers are trained to only look at the APR. Lenders know this. They hide costs in the origination fee. As a teacher, your best bet is almost always a credit union that offers a $0 origination fee and a 0.25% educator discount. That fee-free structure is a loyalty perk that shows they respect your business, rather than trying to profit from it upfront.”

H3: Comparing Loan Terms and Repayment Periods for Educator Borrowers

The “loan term” is the amount of time you have to repay the loan. The most common terms are 3 years (36 months) and 5 years (60 months), though some lenders offer terms up to 7 or even 10 years.

Choosing your term is a critical balancing act:

· Short Term (e.g., 3 Years):

o Pro: You pay significantly less total interest.

o Pro: You get out of debt faster.

o Con: Your monthly payments will be much higher.

· Long Term (e.g., 7 Years):

o Pro: Your monthly payments will be very low and easy to manage.

o Con: You will pay dramatically more in total interest.

o Con: You will be in debt for a long time.

The Sweet Spot for Teachers

For most educators, a 5-year (60-month) term is the best starting point for a loan over $5,000. It provides a balance between a manageable monthly payment and a reasonable interest cost.

A 3-year (36-month) term is ideal for smaller loans (under $5,000) or for “investment” loans, like a professional certification, that you want to pay off quickly before your new, higher salary kicks in.

Avoid 7-year or longer terms for unsecured personal loans. The interest cost is too high. If you can’t afford the 5-year payment, you are likely borrowing too much.

Table: Impact of Loan Term on a $15,000 Loan at 9% APR

| Loan Term | Monthly Payment | Total Interest Paid | Total Repaid |

| 3 Years (36 Months) | $477 | $2,185 | $17,185 |

| 5 Years (60 Months) | $311 | $3,674 | $18,674 |

| 7 Years (84 Months) | $242 | $5,326 | $20,326 |

Expert Insight:

“Look at the table. Stretching the loan from 3 to 7 years drops your payment by $235, which feels great. But it costs you an extra $3,141 in interest. That’s a new laptop or a vacation!

The Pro-Teacher Strategy: Take the 5-year loan to get the manageable $311 payment. Then, use the ‘bi-weekly’ or ‘windfall’ repayment tips to pay it off in 3.5 or 4 years. You get the safety of the low payment but the savings of a shorter term. This is the best of both worlds.”

How Credit Score Impacts Loan Approval and Interest Rates for Teachers

Your credit score (or credit file in the UK/AUS) is the single most important number in your loan application. It’s a 3-digit summary of your financial trustworthiness. Lenders use it to decide if they will lend to you and, more importantly, how much it will cost you.

As a teacher, your stable job provides a huge “soft” benefit, but it cannot override a poor credit score. A “good” job might get you approved with a “fair” score, but you will pay a high interest rate for the privilege.

Credit Score Tiers (US Example)

· Excellent (800+): You are a prime borrower. You will be offered the best, lowest-advertised rates from all lenders.

· Very Good (740-799): You will get very low rates and be easily approved.

· Good (670-739): You will be approved by most lenders, but your rate will be 3-5 percentage points higher than the “excellent” tier. This is a common tier for many teachers.

· Fair (580-669): This is the “subprime” bubble. You can get a loan, but it will be from specialized (and expensive) lenders. Your APR could be 20-30%+.

· Poor (<580): It will be very

difficult to get an unsecured loan.

The Real-World Cost

Let’s look at the cash difference between “Good” and “Excellent” credit on a $20,000 loan for 5 years.

Table: Credit Score vs. Total Cost ($20,000 Loan)

| Credit Score Tier | Assumed APR | Monthly Payment | Total Interest Paid |

| Excellent (780) | 7.99% | $406 | $4,332 |

| Good (710) | 11.99% | $445 | $6,693 |

| Fair (650) | 18.99% | $519 | $11,137 |

Takeaway: The teacher with “Good” credit pays $2,361 more for the exact same loan than their colleague with “Excellent” credit. The teacher with “Fair” credit pays $6,805 more.

Expert Insight:

“If your score is below 740, stop. Don’t apply for a loan yet. Spend the next six months focused on two things: 1) Pay every single bill on time, and 2) Pay down your credit card balances to under 30% of their limits. I’ve seen teachers boost their scores by 50 points in six months. That 50-point jump can be the difference between a 12% loan and an 8% loan. On a $20,000 loan, that’s thousands of dollars saved. Be patient.”

How to Use Personal Loans for Classroom Supplies or Professional Certification

Using a loan for your career is an investment. A $1,000 loan for classroom supplies “buys” a better learning environment. A $10,000 loan for a certification “buys” a $5,000/year pay increase. But you must be strategic.

For Classroom Supplies: The “Small Loan” Strategy

· Problem: You need $1,500 for flexible seating and a STEM kit now, but the school’s budget is gone.

· Bad Solution: Putting it on a 22% APR credit card and paying the minimum.

· Good Solution:

1. Check Grants First: Use DonorsChoose (US) or similar platforms.

2. If a loan is needed: Get a small, 12- or 24-month personal loan.

3. Why: A $1,500 loan at 9% for 12 months has a payment of ~$131 and costs only $74 in interest. That same $1,500 on a credit card, if you only pay $75/month, will take 27 months to pay off and cost $360 in interest. The loan is faster, cheaper, and more disciplined.

For Professional Certification: The “ROI” Strategy

· Problem: A Master’s or specialist certification costs $15,000, but it will move you up the pay scale by $4,000 per year.

· The Math: This loan has a clear Return on Investment (ROI).

· The Strategy:

1. Take out a $15,000 personal loan at 8% for 5 years. Monthly payment: ~$364.

2. Your new take-home pay (after the certification) will be ~$250/month higher.

3. This means the “real” cost to your budget is only ~$114/month.

4. After 5 years, the loan is gone, but you keep that $4,000/year raise forever.

Key Tip: Before taking a loan for professional development, get a copy of your district’s or council’s “salary schedule.” Confirm in writing exactly how much your pay will increase with the new certification.

Step-by-Step Guide: Applying for a Teacher Personal Loan Online

The online application process has made borrowing fast and simple. For most lenders, you can go from application to funding in 24-48 hours.

Step 1: Get Your Documents Ready (The “Prep”)

· Goal: To avoid delays.

· Action: Create a folder on your computer. Scan or take clear photos of:

o Your Driver’s License (front and back)

o Your most recent pay stub

o Your signed teaching contract (if you’re new or it’s summer)

o A recent utility bill

Step 2: Get Pre-Qualified (The “Shopping”)

· Goal: To compare rates without hurting your credit.

· Action: Go to the websites of your 3 chosen lenders (e.g., your credit union, SoFi, a local bank). Click “Check My Rate” or “Pre-Qualify.” This uses a soft credit pull and does not affect your score.

· Result: You will get 3 conditional offers showing APR and term.

Step 3: Choose Your Best Offer and Formally Apply (The “Commitment”)

· Goal: To lock in your loan.

· Action: Select the best offer (factoring in APR and origination fees). Proceed with the full application. This is when you will upload the documents from Step 1.

· Result: This step triggers a hard credit inquiry, which may temporarily dip your score by a few points. This is normal.

Step 4: E-Sign Your Loan Agreement (The “Contract”)

· Goal: To accept the loan.

· Action: The lender will send you the final loan agreement. Read it. Look for:

o The final APR

o The total loan amount

o The origination fee (confirm it’s $0)

o The monthly payment

o Any prepayment penalties (make sure it says “none”)

· Once you’re comfortable, you will e-sign the document.

Step 5: Receive Your Funds (The “Funding”)

· Goal: Get your cash.

· Action: The funds will be transferred directly into your bank account, usually within 1-2 business days. If it’s a debt consolidation loan, some lenders will offer to pay off your credit cards for you.

Understanding Loan Repayment Flexibility and Early Payment Options

Flexibility is a key feature for teachers, whose incomes can be lumpy. The two most important flexibility features to look for are forbearance and no prepayment penalties.

1. Forbearance or Hardship Programs

This is your “in case of emergency” button. If you have a major life event—a medical issue, a family crisis, or you’re laid off (unlikely, but possible)—you can call your lender and ask for a hardship forbearance.

· What it is: A temporary pause on your payments, usually for 1-3 months.

· The Catch: Interest still accrues during this time and is added to your loan balance.

· Why it matters: Good lenders, especially credit unions, are more willing to work with a long-time member. This is a huge benefit of “relationship banking” vs. an anonymous online lender.

2. No Prepayment Penalties

This is a non-negotiable feature. A prepayment penalty is a fee a lender charges you for paying off your loan early. This is an outdated practice, and no top-tier lender in the US, UK, Canada, or Australia still does this on unsecured personal loans.

· Why it’s essential: As a teacher, you get “windfalls.” You get a tax refund, a summer school stipend, or a bonus for coaching. You must have the ability to take that $1,500 and apply it directly to your loan’s principal without being fined.

· How to check: Before you sign, search the loan agreement for the “prepayment” or “early payment” clause. It should explicitly state, “There is no penalty for prepaying this loan.”

Key Tip: The “Bi-Weekly Payment” and “Windfall” strategies only work if you have no prepayment penalty. This single feature is what gives you control and allows you to save thousands in interest.

How to Choose the Right Lender for Teachers in the US, UK, and Canada

Choosing a lender is about more than just the lowest rate. It’s about finding a partner that fits your financial style.

Checklist: How to Compare Lenders

Use this checklist when you have your 3 pre-qualified offers:

[ ] 1. The Numbers:

· What is the final APR? (This is the “apples-to-apples” number).

· Is there an Origination Fee? (If yes, this is a big minus. $0 is the goal.

· Is there a Prepayment Penalty? (If yes, reject the offer immediately.)

· Is there an Autopay Discount? (If no, are they competitive enough to make up for it?).

[ ] 2. The Product & Features:

· Is the rate fixed or Variable? (Fixed is strongly preferred.)

· Does the term fit my budget? (e.g., a 5-year term).

· Do they offer any educator-specific perks? (e.g., “Summer Skip-a-Payment”).

[ ] 3. The Lender’s Reputation:

· Are they a credit union? (Generally a pro, as they are member-focused).

· What do online reviews say? (Look for customer service complaints. Was it easy to get someone on the phone?

· Is their app/website easy to use? (You’ll be managing your loan here for 5 years).

The Final Decision

· Go with Lender A (Credit Union) if: They have the best reputation, $0 fees, and flexible perks like a summer skip. It’s worth paying 0.25% more in APR for this level of service.

· Go with Lender B (Online Lender) if: They are the clear winner on cost. If their 7.5% APR beats the credit union’s 9.0%, and they have $0 fees and no prepayment penalty, they are the smart financial choice.

· Go with Lender C (Major Bank) if: They are your existing bank, they pre-approved you with a loyalty discount, and the process is seamless.

Explore more details here → Read our in-depth reviews of the Top 5 Lenders for Educators in 2025.

Pros and Cons of Unsecured vs. Secured Personal Loans for Educators

The primary difference between loan types is collateral. Collateral is an asset you pledge as a guarantee. If you don’t pay, the lender takes the asset.

Unsecured Personal Loans (The Standard)

This is what 99% of teachers should get. Your loan is based only on your creditworthiness and your teaching contract. There is no collateral.

· Pros:

o Safe: You cannot lose your car or home.

o Fast: Approval is quick because there is no asset to appraise.

o Simple: The paperwork is minimal.

· Cons:

o Higher Interest Rate: The lender takes on all the risk, so they charge a higher interest rate than on a secured loan.

o Harder to Qualify: You need good credit (e.g., 670+ in the US).

Secured Personal Loans (The Exception)

With a secured loan, you pledge an asset. The most common examples for teachers are:

· A Car Loan: The car you are buying (or already own) is the collateral.

· A Home Equity Loan (HELOC): Your house is the collateral.

· A “Share-Secured Loan”: Your savings account at a credit union is the collateral.

· Pros:

o Much Lower Interest Rate: The lender’s risk is low, so the rate is low.

o Easier to Qualify: You can get a secured loan with a “fair” credit score.

· Cons:

o EXTREME RISK: If you miss payments, you can lose your home or car.

o Slower: Requires an appraisal of the asset (your home/car).

Comparison: Unsecured vs. Secured

| Feature | Unsecured Loan | Secured Loan (HELOC) |

| Example Use | Debt Consolidation, Classroom Supplies | Major Home Renovation ($50k+) |

| Interest Rate | 8% – 18% | 6% – 10% |

| Risk to You | A hit to your credit score. | You can lose your home. |

| Speed | 1-2 days | 2-4 weeks |

| Recommendation | Strongly Recommended | Use with Extreme Caution |

Key Takeaway: Never use a secured loan for an unsecured need. Do not risk your house to pay off credit cards. Use an unsecured personal loan.

How to Estimate Monthly Payments and Total Loan Costs Before Applying

You should never apply for a loan without knowing exactly what it will cost. Before you even start the pre-qualification process, you should have a clear budget.

You can use any online “personal loan calculator,” or this simple mental math:

The Rule of Thumb:

For a 5-year (60-month) loan, you will pay approximately $20 per month for every $1,000 you borrow.

(This rule assumes a “good credit” APR of around 8-10%).

· Need $5,000? -> 5 * $20 = $100/month

· Need $10,000? -> 10 * $20 = $200/month

· Need $25,000? -> 25 * $20 = $500/month

This simple estimate lets you quickly see if your goal is affordable. If you need $25,000 but know you don’t have $500/month in your budget, you need to borrow less.

Estimating Total Interest

The second step is to see the “total cost.”

· Go to an online calculator. (Google “loan calculator”).

· Enter the 3 numbers:

1. Loan Amount: $15,000

2. Interest Rate (APR): 9% (use a realistic estimate)

3. Loan Term: 5 years (60 months)

· Look at the “Total Interest Paid” number.

· Result: $15,000 at 9% for 5 years = $3,674 in total interest.

This means your $15,000 purchase will really cost you $18,674. Is the purchase (or debt consolidation) worth $3,674? This is the question you must answer.

Key Tip: Use the “Total Interest” number to “shock” yourself into borrowing less. If you find you can get by with a $12,000 loan instead of $15,000, you’ll see you’d save over $700 in interest.

H5: Case Study: How Improving Your Credit Score Can Unlock Better Loan Terms

· Educator: Sarah, a teacher in the US with a “Fair” credit score of 660.

· Problem: She needed a $12,000 loan for debt consolidation. She was pre-qualified, but the best offer she received was a 5-year loan at 21.99% APR.

· The Shocking Cost: Her monthly payment would be $331, and she would pay $7,845 in interest on a $12,000 loan. She declined the offer.

· Her 6-Month Plan:

1. She pulled her credit report and found a $200 medical bill she didn’t know was in collections. She paid it.

2. She had two credit cards with $4,000 balances on $5,000 limits (80% utilization).

3. She received her $2,500 tax refund and used it to pay both cards down to $2,750 (55% utilization).

4. For 6 months, she put every extra dollar toward those cards and paid all other bills on time.

· The Result: 6 months later, her score had jumped to 725 (“Good”).

· Her New Offer: She re-applied. Her new offer was a 5-year loan at 11.49% APR.

· The Savings: Her new payment was $264/month. Her total interest was $3,830.

· Final Takeaway: By being patient for six months, Sarah saved $4,015 and $67/month.

Exploring Credit Union and Union-Backed Personal Loans for Teachers

We’ve mentioned credit unions, but why are they consistently better for teachers?

· Structure: A credit union is a not-for-profit cooperative. A bank is a for-profit corporation.

· Motivation: A bank’s goal is to make money for its shareholders. A credit union’s goal is to return value to its members (you).

· The Result: This value is returned to you in the form of:

o Lower interest rates on loans.

o Higher interest rates on savings.

o Fewer and lower fees.

o Better customer service.

Union-Backed Loans (e.g., NEA in the US)

Your teaching union (like the NEA in the US, NEU in the UK, or AEU in Australia) uses its massive collective bargaining power to vet and partner with financial institutions.

· Pros:

o Vetted Partner: You know the loan product has been reviewed by your union and is not predatory.

o Member-Only Perks: You may get a special APR discount or fee waiver.

o Easy to Find: It’s advertised right on your union’s “member benefits” website.

· Cons:

o Not Always the Cheapest: The union’s partner (e.g., FNBO for the NEA) is still a for-profit bank. It’s one good option, but you should still compare it to a true non-profit credit union.

Key Takeaway: You should always get at least one loan quote from a teacher-specific credit union. They are your non-profit advocate in the lending space.

Refinancing or Consolidating Existing Loans — When It Makes Financial Sense

“Refinancing” and “consolidating” are often used interchangeably, but they mean different things.

· Consolidation: Taking multiple debts (e.g., 3 credit cards, 1 medical bill) and combining them into one new personal loan.

· Refinancing: Taking one existing loan (e.g., an old car loan) and replacing it with one new, better loan.

When does it make sense?

It makes sense if you can answer “YES” to at least one of these questions:

1. “Can I get a significantly lower interest rate?”

o This is the #1 reason. If you have $15,000 in credit card debt at 22% APR, consolidating with a personal loan at 9% APR is a massive financial win.

2. “Can I simplify my monthly payments?”

o If you are managing 5 different due dates, you risk missing one. A single payment is easier to budget and manage, reducing stress.

3. “Can I lower my monthly payment (and I understand the cost)?”

o Sometimes your budget is just too tight. Consolidating into a longer-term loan can lower your total monthly outflow and give you breathing room.

o Warning: This often means you pay more interest over time, but it can be a necessary move to avoid default.

When it does NOT make sense:

· If the APR on the new loan is higher than the weighted average of your old debt.

· If the new loan has a high origination fee that eats up all the interest savings.

· If you are refinancing US federal student loans and you want Public Service Loan Forgiveness. (This is worth repeating.)

Budgeting Tips for Teachers: Managing Personal Loan Payments

You’ve got the loan, and you have a new $300 monthly payment. Where does this money come from?

· “Pay Yourself First” – Debt Edition: Treat your loan payment like your rent or mortgage. It’s a non-negotiable. Set up autopay for the day after your paycheck hits.

· The “Line-Item” Method: Open your budget. This $300 payment is a new line item. To “fund” it, you must reduce other line items.

o Example: -$100 from “Restaurants/Takeaway,” -$75 from “Subscriptions,” -$50 from “Clothing,” -$75 from “Groceries.” You have to feel it somewhere.

· Embrace the “Packed Lunch” Culture: As a teacher, this is easy. Making your lunch and coffee at home vs. buying it at school/a cafe can save $150-$200/month in the US, UK, and Australia. That’s half your loan payment.

· Automate Your “Windfalls”: When you get your tax refund or coaching stipend, have a plan for it. “50% will go to the loan principal, 30% to savings, 20% to spend.” If you don’t have a plan, it will disappear.

H5: Common Mistakes Educators Should Avoid When Taking Out Loans

1. The “Summer Mindset” Trap: Applying for a loan in June after your paychecks have stopped. Lenders verify income. Apply in April or May, when you have a recent, steady pay history.

2. Taking the First Offer: Your primary bank loves you. They also know you’re a busy professional who probably won’t shop around. They may not offer you their best rate. Always compare 3 offers.

3. Hiding the “Why”: Don’t tell a lender the loan is for “vacation.” Be honest. “Classroom supplies” or “professional development” sound (and are) more responsible. “Debt consolidation” is the best reason of all—it shows you’re actively fixing a problem.

4. Borrowing More Than You Need: The lender approves you for $20,000, but you only need $15,000. Only take the $15,000. It’s tempting to take the extra “buffer,” but that $5,000 will cost you $1,000+ in interest.

5. Not Reading the Fine Print: You sign the agreement and get hit with a 4% origination fee you didn’t see. Read the “Fees” and “Prepayment” sections of your agreement.

How to Get Faster Loan Approval and Access Lower Interest Rates

You’ve done all the prep. Now it’s time to execute for a fast, low-rate experience.

For Faster Approval (Speed):

· Apply on a Weekday: Apply Monday-Thursday. If you apply on a Friday night, your application won’t be seen by a human underwriter until Monday morning.

· Use a Fintech/Online Lender: Companies like SoFi (US), Zopa (UK), and Plenti (AUS) are built for speed. Their automated systems can approve and fund a loan in 24 hours. A credit union may take 2-3 days because a human is reviewing it.

· Have Your Documents Ready: The #1 cause of delay is the lender emailing you, “We’re still waiting on your pay stub.” Have your PDF folder ready to upload (see H4).

· Apply With Your Primary Bank: If your teaching paycheck is direct-deposited into your HSBC (UK) or RBC (Canada) account, they can verify your income instantly. This can lead to a same-day “instant” approval.

For Lower Interest Rates (Cost):

· Add a Co-Borrower: If you have a spouse or partner (especially if they are also a teacher), applying jointly lets the lender look at your combined income. This lowers your DTI ratio and can unlock a much better rate.

· Improve Your Credit (Even by 20 points): The biggest gains are when you cross a “tier.” Moving from 690 to 710 can open up a whole new, cheaper set of lenders.

· Join a Credit Union: This is the most reliable “hack.” Their advertised rates are often 1-2% lower than a major bank’s.

Expert Insights from Financial Advisors on Teacher Loan Strategies

“The most successful teachers we work with use debt strategically, not emotionally. They don’t take a loan for a new car because they ‘deserve it.’ They take a $10,000 loan for a reliable 5-year-old car so they’re never late for work. They don’t take a loan for a fancy vacation. They do take a loan to consolidate 25% APR credit card debt, saving them thousands. They see loans as a tool to improve their financial position, not just their current one.”

Latest Statistics on Teacher Debt and Personal Loan Usage in the US and UK

· US Student Debt: In the United States, data from the NEA shows that 45% of educators took out student loans, with an average original balance of $55,800. This makes the student loan (and PSLF) conversation a critical part of any teacher’s financial life.

· US Out-of-Pocket Spending: Recent surveys show that 94% of US public school teachers spend their own money on classroom supplies. The average amount spent is $860 per year.

· UK Educator Debt: A 2023 survey by the UK’s NASUWT teaching union found that 12% of teachers had to take out a personal loan just to cover essential monthly costs, like housing and food, due to the cost-of-living crisis. This shows a trend of using loans for survival, not just strategic purchases.

Financial Expert Tips for Protecting Your Credit During the Loan Process

The loan application process involves “hard” and “soft” credit inquiries.

· Soft Inquiry: This is a “background check.” You do it yourself, or a lender does it for a pre-qualification. It has zero impact on your credit score.

· Hard Inquiry: This happens when you formally apply for the loan. The lender pulls your full report. This can temporarily lower your score by 3-5 points.

The Strategy:

“The credit bureaus (Equifax, Experian, TransUnion) know you need to shop for the best rate. They provide a ‘shopping window,’ usually 14-30 days. All ‘hard’ inquiries for the same type of loan (e.g., all personal loan inquiries) within that window will be treated as one single inquiry on your report.

“This means you can—and should—formally apply to your 2-3 finalists (the credit union and the online lender) on the same day to compare their final, locked-in offers, without your score being hit 3 different times.”

Alternative Financing Options and Grant Programs for Educators

A personal loan is not your only option. For classroom and professional needs, you should always try to get “free money” first.

· DonorsChoose (US): The #1 platform for US teachers. You post a project (e.t, “We need 5 tablets for our reading center”), and the public funds it.

· Local Education Foundations (All Countries): Your local school district or council often has a non-profit “education foundation” that gives out small grants ($500 – $2,000) for innovative classroom projects. Ask your principal.

· Government Grants (e.g., T-LEAP in the US): Look for federal, state, or provincial grants for specific subjects (like STEM or arts) or for teaching in high-needs areas.

· 0% APR Intro Credit Cards: This can be a good tool if you are disciplined. You buy your $1,500 in classroom supplies on a card with a 15-month 0% APR offer. You then divide $1,500 / 15 and pay $100/month. If you fail to pay it off in time, the remaining balance gets hit with a 20-25% interest rate.

Resources for Teachers: Scholarships, Relief Funds, and Loan Assistance Programs

· Public Service Loan Forgiveness (PSLF) (US): This is not a loan program; it’s a forgiveness program. If you have federal student loans, work for a public school, and make 120 (10 years) of on-time payments, the federal government may forgive your entire remaining balance. This is the most valuable financial resource for US teachers.

· Teacher Loan Forgiveness (TLF) (US): A separate US program. If you teach for 5 consecutive years in a low-income school, you may be eligible for $5,000 to $17,500 in forgiveness on your federal loans.

· Union-Run Hardship Funds (All Countries): Your teaching union (NEA, NEU, AEU, etc.) often has a members-only “hardship fund” or “benevolent fund.” This is not a loan. It’s a grant to help members facing a severe, one-time crisis (e.g., a house fire or medical emergency).

· Teach for America / Americorps Awards (US): If you started your career through one of these programs, you likely have an “education award” that can be applied to student loans or future tuition.

Final Thoughts: Choosing the Best Personal Loan for Teachers in 2025

As an educator, you are one of the most reliable and sought-after borrowers a lender can find. You have stable employment, a predictable income, and a strong community commitment.

This means you should never be a “rate-taker.” You should be a “rate-shopper.”

The best personal loan for you is not the one with the flashy TV commercial. It is the one that has:

1. A $0 Origination Fee.

2. A $0 Prepayment Penalty.

3. A Fixed-Rate APR that you have compared against at least two other lenders.

4. Flexible terms that, if possible, align with your professional life (like a summer skip-a-payment).

Your best first step is almost always your local teacher’s credit union or a bank built specifically for educators. They are your non-profit partner in a for-profit world. By using debt strategically, you can manage your expenses, invest in your career, and continue focusing on the job that matters most: teaching.

❔ Frequently Asked Questions (FAQ)

What Is the Personal Debt Relief Program for Teachers in the US?

In the US, “debt relief” for teachers almost always refers to student loan forgiveness programs, not personal loans. The two main programs are:

1. Public Service Loan Forgiveness (PSLF): This is the most powerful. If you have Federal Direct Loans, work full-time for a public school, and make 120 qualifying monthly payments, the rest of your federal student loan balance may be forgiven, tax-free.

2. Teacher Loan Forgiveness (TLF): This program provides up to $17,500 in forgiveness on Federal Direct or Stafford loans after you teach for 5 complete, consecutive years in a low-income school.

There is no federal “personal debt relief program” that cancels personal loans or credit card debt for teachers.

How Much Can a Teacher Borrow with a $3,000 Monthly Salary?

Lenders focus on your Debt-to-Income (DTI) ratio. Your $3,000 gross monthly salary is the starting point. Lenders typically want your total monthly debt payments (including your new loan) to be under 43% of your gross income.

· $3,000 * 43% = $1,290.

· This means your total debt payments (rent/mortgage, car, student loans, and the new loan) cannot exceed $1,290.

· If your rent ($800) and car payment ($200) already total $1,000, a lender will see you only have $290/month of “room” left.

· Based on that, you would likely only be approved for a loan with a monthly payment of ~$290, which is roughly a $15,000 loan on a 5-year term.

How Do Teachers Apply for a Personal Loan with Bad Credit?

Applying with “bad credit” (a FICO score below 600) is difficult but not impossible.

1. Go to a Credit Union: A local credit union (especially one for teachers) is your best bet. They are more likely to listen to your story and look at your stable teaching contract instead of just a 3-digit score.

2. Add a Co-Signer: If you have a spouse, parent, or partner with good credit, adding them as a co-signer on the loan gives the lender a “backup” and greatly increases your chances.

3. Lower Your “Ask”: Don’t ask for $20,000. Ask for the $3,000 you absolutely need.

4. Avoid “No Credit Check” Loans: These are payday loans, which are debt traps with 300%+ APR. They are never a solution.

Which Credit Union Offers the Best Loan Rates for Teachers?

This is highly localized. The “best” one is almost always a closed-charter credit union that you can only join because you are a teacher.

· In the US (Examples): SchoolsFirst Federal Credit Union (California) and Teachers Federal Credit Union (TFCU) (National) are two of the largest and most competitive.

· In Australia, Teachers Mutual Bank is the dominant, educator-focused institution with highly competitive rates.

· In Canada: Educators Financial Group (partnered with Scotiabank) and provincial teacher credit unions are the top choices.

Your best rate will almost always come from the credit union specifically chartered to serve educators in your state, province, or region.

Where to Find the Best Personal Loan Rates in California for Teachers?

For teachers in California, your search should start and end with SchoolsFirst Federal Credit Union. As one of the largest credit unions in the country, it was founded to serve the California school community. They offer “School Employee” loans with rates, terms (like summer skip options), and underwriting designed specifically for your pay cycle. After getting a quote from them, you can compare it against a major online lender like SoFi or LightStream to ensure you’re getting the best deal.

Are There Special Loans Available for School Employees?

Yes, but they are almost exclusively found at teacher-focused credit unions and mutual banks. These aren’t “special” products in a magical sense, but they have special features:

· Summer Skip-a-Payment: The ability to defer payments in July or August.

· Educator Rate Discounts: A 0.25% – 0.50% APR reduction just for being an educator.

· “First Year Teacher” Loans: Small, low-interest loans to help new teachers set up their classroom and bridge the gap until their first paycheck.

· Contract-Based Underwriting: They will approve you based on your signed contract, even if you haven’t started your job yet.

What Are the NEA Personal Loan Requirements for Educators?

The National Education Association (NEA) Member Benefits program offers personal loans, typically in partnership with First National Bank of Omaha (FNBO). To apply, you must:

1. Be a current NEA member.

2. Meet the bank’s credit standards. This is not a “bad credit” loan. You will generally need a “Good” credit score (670+) to be approved.

3. Provide proof of income (your pay stub) and employment (your teaching position).

The main benefit is the convenience and trust of an NEA-vetted program, but you should still compare the rate you’re offered with a local credit union.

How to Get a Hardship Loan for Teachers with Bad Credit?

If you have bad credit and are facing an emergency, a “hardship loan” is a hard path.

1. Your Union: Call your local teaching union first. Ask if they have a “benevolent fund” or “hardship grant.” This is not a loan; it’s assistance.

2. Your Credit Union: As mentioned before, your teacher credit union is the only lender likely to listen to your story. Explain the hardship. They may have a small, “emergency” loan product (e.g., $1,000) with a fair rate.

3. Your School District: Some districts have an employee-run “hardship fund” that can provide small, 0% interest loans to staff facing a crisis.

4. Avoid Payday Lenders: A “hardship loan” from a “no credit check” place is a trap that will make your hardship infinitely worse.

What Is the Best Personal Loan Option for Teachers in Texas or Georgia?

In states like Texas and Georgia, your best option will be a state-wide or regional educator credit union.

· In Texas: Look at TDECU (Texas Dow Employees Credit Union), which serves many educational communities, or Randolph-Brooks Federal Credit Union (RBFCU), which is large and has strong community ties.

· In Georgia: The Georgia United Credit Union is a large credit union that serves all state employees, including teachers. The Delta Community Credit Union is also a very popular and competitive option.

The “best” option is the one that offers you the lowest APR and $0 origination fee, so apply to one of these credit unions and a top-rated online lender to compare.

Can Teachers Get a Personal Loan Without a Credit Check?

No, not from a legitimate lender. Any advertisement for a “no credit check loan” is a predatory payday loan or a title loan, which will charge 200%-500% APR and trap you in a cycle of debt.

The closest alternative is a “share-secured loan” from your own credit union. This is where you borrow against your own savings. For example, if you have $2,000 in a savings account, the credit union will give you a $2,000 loan at a very low (2-3%) interest rate, using your savings as collateral. They don’t need to check your credit because you are borrowing your own money.