Get a trusted personal loan to pay taxes from credit unions in the US, UK, Canada & Australia. Low rates, flexible terms, proven tax relief solutions.

That pit in your stomach is all too familiar. Tax return time has come and gone, and now you’re just looking at a hefty bill from the IRS (US), HMRC (UK), Canada Revenue Agency (CRA) or Australian Taxation Office (ATO) to settle that you can’t get rid of. The dread is real. You picture penalties accruing, interest adding up, and the stress of a government agency on your back. This “tax gap” is a high-anxiety problem confronting millions of freelancers, small business owners and individuals every year.

But what if you were able to clear the slate with one payment? What if you could stop the interest and penalties on this from accumulating today?

That’s the prospect with using a personal loan to pay taxes. Instead of trying to navigate a complex, and usually still costly, payment plan with a tax authority, you can get a simple fixed-rate loan from a private lender. It’s a strategy to push your debt from a government agency (which has tremendous collection powers) to a bank or financial services company. You receive a monthly payment you can depend on, a specific date when your debt will end and immediate relief from the taxman. This guide will take you through the benefits, drawbacks and considerations on using a personal loan for IRS debt or other tax bills in the world’s leading economies.

Can You Use a Personal Loan to Pay Your Taxes Legally and Effectively?

Yes, you can definitely cover your taxes with a personal loan and it’s completely legal. Tax authorities such as the IRS, HMRC, CRA and ATO are generally not that interested in how bad you think they’re in. By and large, they are not going to have rules about what you can do with that money as long as the payment clears.

The actual question isn’t legality — it’s whether the approach works. A personal loan is a valuable resource when its total cost is less than the cost of not paying or using an alternative.

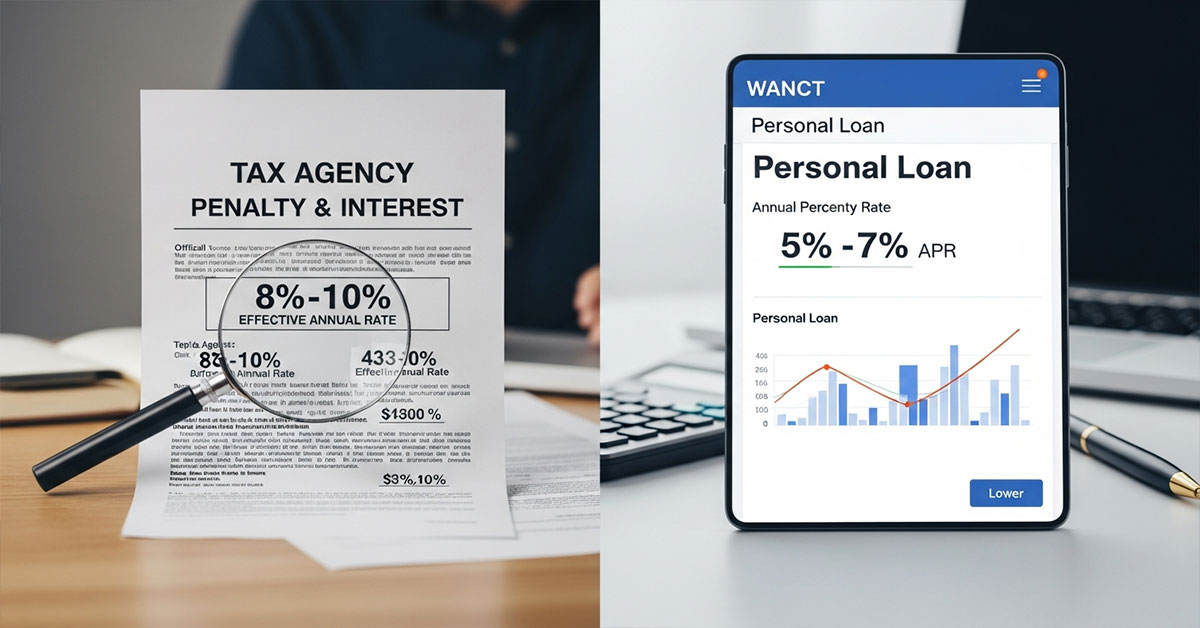

The effectiveness hinges on one key comparison:

- Tax Agency Cost: The combined rate of “failure to pay” penalties plus the interest charged on your outstanding balance. This can be surprisingly high. For example, the IRS penalty and interest rate combined can often exceed an 8%–10% effective annual rate.

- Personal Loan Cost: The Annual Percentage Rate (APR) on your loan. This rate, which includes interest and any origination fees, is what you’ll compare against the tax agency’s rate.

If you have good credit, you can often secure a personal loan with an APR that is significantly lower than the compounding penalties and interest from the tax agency. In this scenario, using a loan isn’t just effective; it’s the financially smarter move.

📈 Mini Case Study: Sarah’s Smart Move

Sarah, a graphic design freelancer in the US, ended the year owing the IRS $12,000 more than she expected. Panicked, she looked at the IRS penalties: a 0.5% failure-to-pay penalty per month (up to 25%) plus interest (which was recently around 8% annually). She was looking at a combined rate of over 13% APR.

Instead, Sarah, who has a 740 credit score, applied for a personal loan. She was approved for a $12,000 loan with a 7.99% APR and a three-year term.

- Result: Sarah paid the IRS in full immediately, stopping all penalties and interest. Her new loan had a fixed monthly payment and a lower interest rate, saving her over $1,000 in potential penalties and interest over the life of the debt. She swapped a stressful, growing government debt for a predictable, manageable private loan.

Table: Tax Agency Penalties vs. Personal Loan Rates (Example)

| Country | Agency | Typical Failure-to-Pay Penalty (Monthly) | Interest Rate (Variable) | Est. Combined APR | Avg. “Good Credit” Personal Loan APR |

| USA | IRS | 0.5% (up to 25% of tax owed) | ~8% (Annual,compounds daily) | ~10% – 14% | 7% – 12% |

| UK | HMRC | Varies; starts after 30 days | ~7.75% (Annual) | ~9% – 13% | 6% – 11% |

| Canada | CRA | 1% (on balance owing) + compounding daily interest | ~10% (Annual) | ~12% – 15% | 8% – 13% |

| Australia | ATO | General Interest Charge (GIC) | ~11.15% (Annual) | ~11.15% | 8% – 14% |

Note: Agency rates are estimates and can change quarterly. Always check current rates.

Key Takeaway: If you can get a personal loan APR that is lower than your tax agency’s combined penalty and interest rate, you can save a significant amount of money.

Explore more details here $\rightarrow$ Ready to see what rates you could qualify for? Compare personal loan offers from top-rated lenders.

How Personal Loans Help Clear Tax Debt Without IRS Penalties

The single most powerful advantage of a personal loan is that it stops the clock on tax agency penalties.

When you owe the IRS, HMRC, CRA, or ATO, your debt isn’t static. It grows. Every day or month you are late, two things happen:

- Penalties are added for failing to pay on time.

- Interest is charged on both the original tax and the penalties.

This creates a snowball effect, where your debt can swell much faster than you anticipate. An agency payment plan can slow this, but it doesn’t always stop all penalties from accruing.

A personal loan acts like a full-stop. Here’s the process:

- You Apply: You apply for a personal loan for the full amount of your tax bill (e.g., $15,000).

- You’re Funded: The lender approves you and deposits the $15,000 directly into your bank account, often within 1-3 business days.

- You Pay: You immediately go to the tax agency’s website (e.g., IRS Direct Pay, HMRC’s portal) and make a single, lump-sum payment for the full $15,000.

- Debt is Cleared: From the tax agency’s perspective, your 2024 tax liability is paid in full. The case is closed. All future penalties and interest associated with that debt are immediately stopped.

You have effectively converted a high-stress, variable-rate, and high-penalty government debt into a standard, fixed-rate, unsecured installment loan. You now have one predictable monthly payment, a clear payoff date, and the peace of mind that comes from being “square” with the government.

💼 Mini Case Study: David’s Peace of Mind

David, a small business owner in Manchester, UK, miscalculated his VAT and self-assessment tax, owing HMRC a combined £18,000. He was terrified of “Time to Pay” negotiations and the threat of aggressive collection. The daily compounding interest was keeping him up at night.

David opted for a personal loan from a digital bank. He was funded in two days. He paid HMRC the full £18,000, and the menacing letters stopped. His new loan had a £350/month payment over 5 years. While he still had the debt, it was now on his terms. He told his accountant it was “the best money he ever spent” just for the peace of mind and predictable budgeting.

Table: The “Stop the Clock” Advantage (Example: $10,000 Debt)

| Scenario | Day 1 | Month 6 | Month 12 | Month 24 | Total Cost (24 Mo) |

| Agency Payment Plan (Est. 12% APR) | $10,000 | ~$10,600 (Balance) | ~$11,200 (Balance) | Paid Off | ~$11,250 |

| Personal Loan (Est. 9% APR) | $10,000 (Paid to IRS) | $8,500 (Loan Balance) | $6,900 (Loan Balance) | Paid Off | ~$10,950 |

| Ignoring the Debt (Penalties Pile Up) | $10,000 | $10,900+ | $11,900+ | $14,000+ | $14,000+ (and collections) |

This table shows how the personal loan not only stops penalties but can also result in a lower total cost paid.

Key Result: A personal loan immediately halts all government-imposed penalties and interest, giving you a clear path out of debt.

Take the first step $\rightarrow$ See if you pre-qualify for a personal loan to stop tax penalties today.

Pros and Cons of Using a Personal Loan for Tax Payments in Tier One Countries

Using a personal loan to pay your taxes is a powerful financial move, but it’s not a magic wand. It’s a strategic trade-off. Understanding the full picture—both the good and the bad—is essential for taxpayers in the US, UK, Canada, and Australia.

The Upside: Why It’s a Smart Move

- Stops Penalties & Interest: As covered, this is the #1 benefit. You cap the damage from tax agency penalties, which are almost always higher than a good loan rate.

- Predictable Payments: You get a fixed monthly payment and a fixed repayment term (e.g., 36 or 60 months). This makes budgeting infinitely easier than an opaque agency plan where interest is still accruing.

- Potentially Lower Interest Rate: If your credit is good (generally 670+ in the US, or the equivalent “good” rating in the UK, Canada, or Australia), your loan APR will likely be lower than the agency’s combined penalty+interest rate.

- Clears Your Government Record: Paying your tax bill in full prevents further collection actions. This means no tax liens (a public record that you owe), no wage garnishments (where the IRS takes money from your paycheck), and no bank account levies.

- Speed and Convenience: Modern online lenders can approve you in minutes and fund your loan in 1-3 business days. This is often much faster and less bureaucratic than setting up a formal agency installment plan.

The Downside: What to Be Cautious About

- You Still Have Debt: You haven’t erased the debt; you’ve just moved it. You must be disciplined about making the new loan payments.

- Requires Good Credit for Good Rates: The strategy only works if your loan rate is low. If you have “fair” or “bad” credit, the APR on a personal loan might be 20%–35%. This is likely higher than the tax agency’s rate, making it a very bad deal.

- Origination Fees: Some lenders charge an “origination fee,” which is a percentage of the loan amount (e.g., 1%–6%) deducted from your funds. You must factor this fee into your APR to calculate the true cost.

- Credit Score Impact: The application will result in a “hard inquiry” on your credit report, which can temporarily dip your score by a few points.

🇦🇺 Mini Case Study: A Tale of Two Taxpayers

Michael (Canada): Owed the CRA $14,000. He had a 760 credit score. He secured a personal loan at 8.5% APR with no origination fee. The CRA’s interest rate was 10% plus penalties. Michael will save over $1,000 and avoided the stress of dealing with the CRA. Result: Win.

Chloe (Australia): Owed the ATO $9,000. Her credit score was 620 (“Fair”). The only personal loans she could find had APRs starting at 18.99%. The ATO’s General Interest Charge was only ~11%. For Chloe, the personal loan was a worse deal. She correctly chose to set up a payment plan directly with the ATO instead. Result: Smartly avoided a bad move.

Table: Pros vs. Cons of a Personal Loan for Taxes

| Pros (The Advantages) | Cons (The Risks) |

| ✅ Stops all penalties & interest from the tax agency immediately. | ❌ Requires good credit to get an APR lower than the agency’s rate. |

| ✅ Provides a fixed, predictable monthly payment for easy budgeting. | ❌ You still owe the same amount of debt, just to a new creditor. |

| ✅ Prevents tax liens, wage garnishments, and bank levies. | ❌ Some loans have origination fees that increase the total cost. |

| ✅ Often faster and more convenient than setting up an agency plan. | ❌ A new loan will add a hard inquiry to your credit report. |

| ✅ You deal with a bank’s customer service, not a tax agent. | ❌ Defaulting on the loan severely damages your credit. |

Key Tip: Always compare the loan’s full APR (which includes fees) to your tax agency’s combined penalty + interest rate. Choose the lower number.

Weigh your options $\rightarrow$ Get a no-obligation quote to see your potential APR.

Alternatives to Personal Loans for Paying Off Tax Balances

A personal loan is a powerful option, but it’s not the only one. Before you apply, you must compare it against the other tools available. For many people, one of these alternatives might be a better fit, especially if you have fair or poor credit.

1. Tax Agency Payment Plan (Installment Agreement)

This is the most common alternative. All major agencies offer plans for taxpayers who can’t pay in full.

- US: The IRS offers Installment Agreements (long-term payment plans) and Offers in Compromise (OIC), where you may settle for less, though OICs are hard to get.

- UK: HMRC offers a “Time to Pay” (TTP) arrangement. You must contact them and explain why you can’t pay.

- Canada: The CRA allows for “payment arrangements” to be made online or over the phone.

- Australia: The ATO provides “payment plans” that can often be set up via your MyGov account.

Pro: They are relatively easy to get, even with bad credit.

Con: Penalties and interest may still continue to accrue (though at a lower rate) until the debt is paid.

2. 0% APR Introductory Credit Card

This is a high-risk, high-reward strategy. You open a new credit card that offers a 0% APR on purchases for an introductory period (e.g., 12-21 months). You then pay your taxes with this card.

Pro: You get to pay 0% interest for the entire intro period.

Con:

- You must pay a processing fee (usually 1.85%–2%) to the tax agency to use a card.

- If you don’t pay off the entire balance before the intro period ends, you’ll be hit with a very high “go-to” interest rate (often 20%–30%) on the remaining amount. This can be a devastating debt trap.

3. Home Equity Loan or HELOC

Homeowners who have equity in their property can leverage it to pay taxes, through a Home Equity Loan (a lump sum) and/or Home Equity Line of Credit (a revolving credit line).

Pro: These are secured loans, so their interest rates are much lower than those of personal loans — typically in the 6% to 9% range.

Con: And that goes for this as well; Your home is the collateral. If you default on the payments for the HELOC, the bank can foreclose on your house. You are exchanging unsecured tax debt for secured debt, a highly risky exchange.

4. 401(k) Loan (US-Specific)

Many 401(k) plans in the US allow you to borrow from your own retirement savings.

Pro: You’re “paying yourself back” with interest. And the interest rate is typically low, and it doesn’t include a credit check.

Con: This is a terrible idea 99 percent of the time. You take money off the table, depriving it of the opportunity to grow in value. You pay back that loan with money you earned and already paid tax on — so you’ll be taxed again on that same cash in retirement. And even worse, as soon as you leave your job, the entire loan is typically due immediately.

Table: Tax Debt Solution Comparison

| Method | Best For… | Key Risk / Downside | Typical Cost (APR / Fees) |

| Personal Loan | Good credit (670+); quick payment | Credit check; origination fees | 7% – 15% (Good Credit) |

| Agency Payment Plan | Fair/Poor credit; no other options | Penalties/interest may still accrue | 8% – 15% (Variable) |

| 0% APR Credit Card | High discipline; small tax bills | High “go-to” APR after 12-21 mo. | 0% (Intro) then 20%+ |

| HELOC / Home Equity | Homeowners; large tax bills | You risk losing your home | 6% – 9% (Secured) |

| 401(k) Loan (US) | Last resort; need funds fast | Stunts retirement; “double tax” | 5% – 7% (plus lost growth) |

Key Tip: For most people with good credit, the choice is between a Personal Loan and an Agency Plan. For those with poor credit, the Agency Plan is almost always the safer, cheaper option.

Not sure which path is right? $\rightarrow$ Read our in-depth guide on the top tax relief options.

How to Qualify for a Personal Loan to Cover Tax Bills Fast

When you are staring down your tax-return deadline or that growing number in penalties, “fast” is the crucial word. To get a loan fast, knowing what creditors are looking for is paramount — and your papers better be in order.

By and large, the quickest way to get a loan is from an online lender or fintech company. Traditional banks and credit unions may offer superior rates (especially for those with existing accounts), but their underwriting process can sometimes take days, or even weeks. Online lenders connect algorithms and computers with your need for a pre-approval decision in minutes, but shortly after getting you approved they just as quickly deposit funds into your account.

Here are the key factors lenders will scrutinize to approve your loan:

- Credit Score: This is the most important factor. A higher score shows a history of responsible borrowing. To get the best rates (under 10% APR), you’ll likely need a score above 720 (US), or the “Excellent” equivalent in the UK, Canada, or Australia. You can still get loans with a “Fair” score (e.g., 600-660), but the APR will be significantly higher.

- Debt-to-Income (DTI) Ratio: Lenders want to see that you can afford a new monthly payment. They calculate your DTI by dividing your total monthly debt payments (mortgage, car loans, credit cards) by your gross monthly income. Most lenders look for a DTI below 40%.

- Income and Employment: You must prove you have a stable, verifiable source of income. This can be from a W-2/T4 job, or if you’re self-employed, from bank statements and tax returns (the irony!).

- Loan Amount: A request for a $5,000 loan is much easier to approve than a $50,000 loan. The amount you request must be reasonable and supported by your income and credit history.

🏃♀️ Mini Case Study: Jenna’s 48-Hour Funding

Jenna, an e-commerce seller in Ontario, Canada, owed the CRA $8,500. The deadline was a week away.

- Day 1 (9 AM): She realized she was short.

- Day 1 (10 AM): She gathered her documents: her last two bank statements, her 2023 T4 slip, and her driver’s license.

- Day 1 (10:15 AM): She used an online loan comparison site, which “soft-pulled” her credit (no impact) and showed her 3 pre-qualified offers.

- Day 1 (10:30 AM): She chose the lender with the best APR (9.2%) and a 2-day funding guarantee. She completed the full application and uploaded her documents.

- Day 2 (4 PM): She received the final approval email.

- Day 3 (11 AM): The $8,500 was in her checking account.

- Day 3 (11:05 AM): She paid the CRA in full.

Jenna’s success came from being prepared. She had her documents ready, knew her credit score, and used fast-moving online tools.

Table: What Lenders Look For (Tier One Markets)

| Factor | US (Good) | UK (Good) | Canada (Good) | Australia (Good) |

| Credit Score | 670 – 739 (FICO) | 881 – 960 (Experian) | 660 – 724 (Equifax) | 670 – 799 (Equifax) |

| DTI (Goal) | Under 40% | Under 40% | Under 40% (TDS) | Under 40% |

| Key Documents | Pay stubs, W-2, ID | Payslips, Bank Statements, ID | Pay stubs, T4, ID | Payslips, Bank Statements, ID |

Key Tip: Check your credit score before you apply. If it’s lower than you thought, you may be better off with an agency payment plan while you work on improving your score.

Check your status $\rightarrow$ See if you pre-qualify for a personal loan with no impact on your credit score.

H2: Best Lenders Offering Personal Loans for Tax Payments in the US, UK, and Canada

While we can’t recommend a single “best” lender—as the right choice depends entirely on your personal credit profile, location, and needs—we can highlight the types of lenders to look for and provide prominent examples in each region.

When seeking a loan for tax payments, your main goal is to find the lowest APR from a reputable source that can fund you quickly.

1. Online Lenders (Fintech Companies)

These companies operate entirely online, which allows them to have lower overhead and faster processes. They are often the best choice for speed and convenience.

- Pros: Fast application (minutes), quick funding (1-3 days), good mobile apps, often competitive rates for strong credit.

- Cons: Can be less flexible than a local bank, may have higher rates for “fair” credit.

Prominent Examples:

- United States: SoFi, LightStream, Marcus by Goldman Sachs, Upgrade, Upstart.

- United Kingdom: Zopa, Monzo, Starling Bank (often offer loans to existing customers), Lendable.

- Canada: Fairstone, easyfinancial, borrowell (a marketplace).

- Australia: Plenti, Wisr, MoneyMe, Harmoney.

2. Traditional Banks

Your own bank is always a good place to start. They have an existing relationship with you and can see your entire financial picture, which can sometimes lead to a “relationship discount.”

- Pros: May offer lower rates for existing customers, strong brand trust, physical branches for in-person help.

- Cons: Application process is often slower (can take several days to a week), may have stricter credit requirements.

Prominent Examples:

- United States: Bank of America, Chase, U.S. Bank, Truist.

- United Kingdom: Barclays, Lloyds Bank, HSBC, NatWest.

- Canada: RBC (Royal Bank of Canada), TD Bank, Scotiabank, BMO.

- Australia: Commonwealth Bank (CBA), Westpac, ANZ, NAB.

3. Credit Unions

Credit unions are non-profit organizations owned by their members. This structure often allows them to offer lower interest rates and fees than for-profit banks.

- Pros: Often have the lowest APRs available, more member-focused customer service, more willing to work with less-than-perfect credit.

- Cons: You must be a member to get a loan, which may have eligibility requirements (e.g., live in a certain area, work in a certain industry).

Prominent Examples:

- United States: Alliant Credit Union, PenFed, Navy Federal Credit Union (NFCU).

- UK: (Known as “Building Societies,” e.g., Nationwide, or smaller local credit unions).

- Canada: Vancity, Meridian Credit Union.

- Australia: Great Southern Bank, Heritage Bank.

🏦 Mini Case Study: Mark’s Comparison Shopping

Mark, in Toronto, needed $10,000 to pay his CRA bill.

- He first went to TD Bank, his primary bank. After a 2-day review, they offered him a loan at 11.5% APR as an existing client.

- He then checked an online lender, Fairstone. They pre-approved him instantly for a loan at 13.99% APR but could fund it the next day.

- Finally, he checked his local Meridian Credit Union. As a member, he was ableto apply and, after a 3-day review, was approved for a 9.9% APR loan.

Result: Mark chose the credit union. He sacrificed a little speed for a significantly lower rate, saving him hundreds of dollars.

Table: Comparing Lender Types for Tax Loans

| Lender Type | Speed (Funding Time) | Best For (APR) | Great For… |

| Online Lenders | ⚡️ Fast (1-3 days) | Good Credit (700+) | Convenience and speed |

| Traditional Banks | 🐢 Slow (3-7 days) | Existing Customers | Relationship discounts |

| Credit Unions | 🏃 Medium (2-5 days) | ✅ Best Rates (Members) | Lowest total cost |

Key Tip: Don’t just take the first offer. Compare at least three lenders—one online, one bank, and one credit union—to ensure you get the best possible APR.

Start your search $\rightarrow$ Compare offers from a network of trusted lenders.

Comparing Personal Loans vs IRS or HMRC Payment Plans for Tax Debt Relief

When you’re short on tax day, you have two primary “payment” options: get a plan from the tax agency or get a loan from a bank. Choosing the right one can save you thousands.

A tax agency plan (like an IRS Installment Agreement or HMRC Time to Pay) is an agreement you make directly with the government to pay your debt over time.

A personal loan is a new, private debt you take on to pay the government debt in one lump sum.

Here’s how they stack up.

Cost and Interest

- Agency Plan: This is the most misunderstood part. You will pay interest and, in many cases, penalties continue to accrue. The IRS interest rate (Federal short-term rate + 3%) and failure-to-pay penalty (0.5% per month) combine to an effective APR that is often 8-12% or higher. The CRA and ATO are similar.

- Personal Loan: If you have good credit, you can often find a fixed-rate loan with an APR between 7% and 12%. You may also pay an origination fee (1-6%).

Winner: It’s a toss-up, entirely dependent on your credit. If your loan APR (including fees) is lower than the agency’s combined rate, the personal loan wins.

Collections and Risk

- Agency Plan: This is the scary part. If you default on an agency plan, they have extraordinary collection powers. They can place a tax lien on your property (making it hard to sell), garnish your wages, or levy your bank accounts—all without a court order.

- Personal Loan: Once you pay the tax agency, they are out of your life. Your new debt is with a bank. If you default, they cannot garnish your wages or levy your accounts without first suing you and winning a judgment. You have significantly more consumer protections.

Winner: Personal Loan (for your peace of mind and protection).

Approval and Convenience

- Agency Plan: Almost everyone is eligible. Setup is often simple and done online. There is no credit check to set up a basic plan (though the IRS may file a lien on larger debts). This is the best option for those with poor credit.

- Personal Loan: You must apply and be approved. This requires a good credit score and verifiable income. If your credit is poor, you won’t be approved or will be offered a rate far too high to be useful.

Winner: Agency Plan (for simplicity and accessibility).

Expert Insight: A UK-based chartered accountant states: “I advise clients to view HMRC’s ‘Time to Pay’ as a last resort. While it’s available, it keeps you under their close watch. A personal loan, if you can get a good rate, severs that tie. It draws a line in the sand, which is invaluable for your peace of mind and financial planning.”

Table: Showdown: $15,000 Tax Debt over 3 Years

| Metric | IRS Installment Agreement (Est. 10% APR) | Personal Loan (Est. 8% APR + 3% Fee) |

| Initial Debt | $15,000 | $15,000 |

| Setup Fee | $31 – $149 (for IRS) | $450 (3% Origination Fee) |

| Monthly Payment | ~$484 | ~$470 |

| Total Paid | ~$17,424 | ~$17,370 ($16,920 payments + $450 fee) |

| Key Risk | Risk of lien; wage garnishment if you default. | Credit score damage if you default. |

| Benefit | No credit check. | Stops penalties immediately. |

Result: In this scenario for a good-credit borrower, the costs are nearly identical, but the personal loan offers superior protection and peace of mind by removing the risk of IRS liens or garnishments.

H3: Expected Interest Rates and Hidden Fees on Tax Payment Loans

When shopping for a personal loan, the “interest rate” is only half the story. The “APR” (Annual Percentage Rate) is the true number you must focus on.

- Interest Rate: This is the base cost of borrowing the money, expressed as a percentage.

- APR: This is the total cost of the loan. It includes the interest rate plus any mandatory fees, expressed as an annual rate.

A loan with a “low” 8% interest rate could be more expensive than a loan with a 9% interest rate if the first one has a high fee.

Common Fees to Watch For:

- Origination Fee: This is the most common fee. Lenders charge it to cover the cost of processing your application. It typically ranges from 1% to 8% of the total loan amount and is often deducted from the loan before you receive it. (e.g., on a $10,000 loan with a 5% fee, you would only receive $9,500).

- Prepayment Penalty: This is a fee for paying the loan off early. It’s less common today, especially with online lenders, but always ask. Never take a loan with a prepayment penalty. You want the flexibility to pay it off if you get a bonus or tax refund.

- Late Payment Fee: All loans have these. Know the amount and the grace period (e.g., $35 if more than 10 days late).

Table: How Fees Impact a $10,000 Loan (3-Year Term)

| Lender | Interest Rate | Origination Fee | APR | Funds Received | Monthly Payment | Total Cost |

| Lender A | 8.0% | 0% | 8.0% | $10,000 | $313.36 | $11,281 |

| Lender B | 7.0% | 5% ($500) | 10.5% | $9,500* | $308.77 | $11,615 |

*In this case, you’d need to borrow $10,527 to get $10,000 after the fee.

Expert Insight: “Taxpayers in the US, especially, must always compare the APR,” warns a US-based Certified Financial Planner. “A lender can lure you with a low-sounding interest rate, but a high origination fee can make it a worse deal than an IRS installment plan. Always use the APR as your single point of comparison.”

Key Takeaway: The APR is the only number that matters for comparison. Always ask the lender to confirm the APR and to state, “Are there any origination fees or prepayment penalties on this loan?”

Loan Terms, Repayment Flexibility, and Financial Planning Benefits

Securing a personal loan to pay taxes does more than just solve an immediate crisis; it can be a positive step in your long-term financial plan, if you use it correctly.

The key lies in choosing the right loan term. A personal loan term is the amount of time you have to pay it back, typically ranging from 24 to 84 months (2 to 7 years).

- Short-Term Loan (e.g., 24-36 months):

- Pro: Higher monthly payment, but you pay significantly less interest over the life of the loan. You get out of debt faster.

- Con: The high payment can strain your monthly budget.

- Long-Term Loan (e.g., 60-84 months):

- Pro: Lower, more affordable monthly payment, which frees up cash flow.

- Con: You will pay much more in total interest. The 5- or 7-year term can feel like a long time to be paying for a past tax bill.

The Financial Planning Benefit

The true benefit is predictability. A personal loan moves your tax debt from a variable, high-stakes “problem” pile into your normal monthly “bills” pile. You can add the fixed payment (e.g., “$285/month”) into your budget. This allows you to stop worrying and start planning. You can focus on building an emergency fund or, more importantly, start saving for next year’s tax bill so you never end up in this situation again.

Expert Insight: A Canadian credit counselor in Toronto explains, “The power of a consolidation loan for CRA debt is psychological. It creates a single, fixed payment. This breaks the ‘debt spiral’ mentality. We have clients who, once they consolidate, are suddenly ableto find an extra $50 a month to start a ‘tax-savings’ account. They couldn’t do that when they were just staring at the scary, growing CRA balance.”

Table: Impact of Loan Term on a $12,000 Loan at 9% APR

| Loan Term | Monthly Payment | Total Interest Paid | Total Repayment |

| 3 Years (36 mo) | $381.42 | $1,731.12 | $13,731.12 |

| 5 Years (60 mo) | $249.10 | $2,946.00 | $14,946.00 |

| 7 Years (84 mo) | $195.70 | $4,238.80 | $16,238.80 |

Result: Choosing the 3-year term over the 7-year term saves you $2,507 in interest and gets you debt-free 4 years sooner, if you can afford the higher payment.

Key Takeaway: Choose the shortest loan term you can comfortably afford. This will save you the most money in the long run.

Impact of Using a Personal Loan on Your Credit Score and Tax Record

Taking out a loan to pay taxes has two distinct impacts: one on your credit file and one on your tax file.

Impact on Your Credit Score (US, UK, CA, AU)

This is a multi-step process:

- The Application (Small Dip): When you apply for the loan, the lender will perform a “hard inquiry” (or “hard pull”) on your credit report. This can cause your score to dip temporarily by 3-5 points.

- The New Loan (Small Dip): Once the loan is approved and on your report, it will

- Add to your “total debt.”

- Lower your “average age of accounts.”

This can also cause a slight temporary dip.

- The Long-Term (Big Benefit): This is the good part. As you make your on-time monthly payments, you are building a positive payment history, which is the most important factor in your credit score. Every on-time payment demonstrates responsibility and will help increase your score over the life of the loan. It also adds to your “credit mix,” which is a positive.

Overall Credit Impact: A small, short-term dip followed by a steady, long-term increase (assuming you make all payments on time).

Impact on Your Tax Record

This is simple: it’s all positive.

- As soon as your payment is processed, your account with the IRS, HMRC, CRA, or ATO is marked as “Paid in Full.”

- This stops all collection activity.

- It prevents a Notice of Federal Tax Lien (US) or an equivalent “charge” from being filed against your property. A tax lien is a public record that destroys your credit and can remain for 7-10 years, even after you pay the debt.

- By paying with a loan before a lien is filed, you avoid this “credit kiss of death” entirely.

Expert Insight: “A tax lien is one of the most damaging entries you can have on your credit report,” notes a US-based credit specialist. “It’s worse than a credit card charge-off. I’ve seen scores drop 100 points overnight. Using a personal loan to pay the IRS before the debt gets to the lien stage is one of the smartest defensive moves a taxpayer can make for their credit.”

Table: Credit & Tax File: Loan vs. Agency Plan

| Action | Impact on Credit File | Impact on Tax Record |

| Take Personal Loan | Small dip (hard inquiry), then long-term positive build from on-time payments. | Positive: Account is “Paid in Full.” Prevents liens. |

| Use Agency Plan | Neutral (at first). Does not get reported to credit bureaus. | Negative Risk: Account remains “Delinquent.” Risk of lien/garnishment if you miss a payment. |

| Default on Agency Plan | Catastrophic: A filed tax lien will appear on your report and plummet your score. | Catastrophic: Triggers aggressive collections (liens, levies, garnishments). |

Key Takeaway: A personal loan protects your credit score from the “catastrophic” risk of a tax lien, even if it causes a small dip upfront.

Step-by-Step Guide to Applying for a Personal Loan to Pay Taxes

If you’ve compared the options and decided a personal loan is the right move, acting quickly and methodically is key. Here is the process from start to finish.

Step 1: Know Your Numbers (The “Prep” Phase)

- Your Tax Bill: Get the exact, final “payoff” amount from the IRS, HMRC, CRA, or ATO. Include all penalties and interest calculated up to today. Call them if you have to.

- Your Credit Score: Pull your credit score from a free source (like Credit Karma, or check your credit card’s app) to know what to expect.

- Your Income: Calculate your gross monthly income.

- Your DTI: Add up your monthly debts (rent/mortgage, car, credit card minimums) and divide by your income.

Step 2: Gather Your Documents (The “Proof” Phase)

Have digital copies (PDFs or photos) of these ready to upload:

- Government-Issued ID: Driver’s license or passport.

- Proof of Income: Your two most recent pay stubs, W-2/T4, or last year’s tax return (if self-employed).

- Proof of Address: A recent utility bill or bank statement.

- Bank Information: Your bank’s routing and account number for funding.

Step 3: Pre-Qualify with Multiple Lenders

This is the most important step for rate shopping.

- Go to the websites of 3-5 lenders (e.scss, a bank, a credit union, an online lender).

- Look for a “Check My Rate” or “Pre-Qualify” button.

- This process uses a “soft inquiry,” which does not affect your credit score.

- You will receive conditional offers (APR, term, loan amount) in minutes.

Step 4: Compare Your Offers

Look at the APR and the origination fee for each offer. A 7% APR with a 0% fee is better than a 6% APR with a 5% fee. Choose the loan that has the lowest total cost and a monthly payment you can confidently afford.

Step 5: Formally Apply and Get Funded

- Choose your best offer and proceed with the full application.

- This is when you will upload your documents and consent to a “hard inquiry.”

- After verification (often 1-3 business days), you’ll sign the loan agreement.

- The funds will be deposited into your bank account.

Step 6: PAY YOUR TAXES

This is not the time to celebrate. As soon as the money hits your account, go directly to the tax agency’s website and pay the entire bill. Do not spend the money on anything else. Get a payment confirmation receipt and save it forever.

Choosing Between Secured and Unsecured Personal Loans for Tax Obligations

When you seek a loan, you will encounter two main types: unsecured and secured. For tax debt, this choice is critical.

Unsecured Personal Loans

This is the most common type of personal loan.

- How it works: The loan is granted based solely on your creditworthiness (your credit score, income, and DTI).

- Collateral: There is no collateral. You are not pledging any asset.

- Pros:

- Your assets (home, car) are not at risk if you default.

- The application and funding process is very fast.

- Cons:

- Interest rates are higher because the lender has more risk.

- Requires a good credit score for approval.

This is the right choice for 95% of people paying tax debt.

Secured Personal Loans

This type of loan requires you to pledge an asset as collateral.

- How it works: You offer your car (a “car title loan”) or your savings account (a “savings-secured loan”) as a guarantee.

- Collateral: Your asset. If you default, the lender takes it.

- Pros:

- Lower interest rates because the lender has no risk.

- Easier to get approved for with bad credit.

- Cons:

- You can lose your asset (e.g., your car) if you miss payments.

- (A Home Equity Loan is also a form of secured loan, and you risk losing your home).

Expert Insight: An Australian credit specialist is emphatic: “We never advise a client to convert an unsecured tax debt into a secured personal debt. You are taking a problem (ATO debt) and attaching it to your car or, worse, your home. It’s a terrible trade. The higher interest rate on an unsecured loan is the ‘price’ you pay for safety and to keep your assets protected.”

Table: Secured vs. Unsecured Loan for a $7,000 Tax Bill

| Feature | Unsecured Loan | Secured Loan (e.g., Car Title) |

| Collateral | None | Your car |

| Primary Risk | Credit score damage | Losing your car |

| Typical APR | 8% – 36% (based on credit) | 6% – 25% (based on asset) |

| Best For… | Taxpayers with good credit | Taxpayers with bad credit who are willing to risk their asset (Not Recommended) |

| Recommendation | Strongly Preferred | Avoid for tax debt |

Key Takeaway: Always opt for an unsecured personal loan when paying tax debt. The risk of losing your car or home is not worth the slightly lower interest rate.

Understanding IRS and HMRC Rules on Using Personal Loans for Tax Debt

When you owe taxes, it can feel like the government is watching your every move. Many taxpayers worry, “Am I allowed to use a loan? Will it get me in more trouble?”

Let’s be perfectly clear: Yes, you are allowed.

Tax agencies like the IRS (US) and HMRC (UK) have no rules against how you pay your tax bill. You can use your savings, sell stocks, or get a personal loan. Their primary concern is that your payment clears and your balance is reduced to zero.

What you are doing is moving your debt from the “public” sector to the “private” sector.

- IRS Debt: This is a statutory debt, meaning it’s created by law. The IRS has powerful, legally-granted collection tools (liens, levies).

- Personal Loan Debt: This is a civil debt, created by a contract you sign. The lender has to follow standard consumer protection laws and must sue you to collect.

By paying the IRS with a loan, you are effectively “buying” yourself out of the IRS’s aggressive collection system and into a more predictable, consumer-friendly system. The IRS encourages this! They would much rather receive a lump-sum payment today than manage a multi-year installment plan.

Key Tip: Paying your tax bill with a loan is not a “loophole” or a “grey area.” It is a standard, legitimate, and often financially wise transaction.

Explore your options $\rightarrow$ See what personal loan rates you qualify for.

When a Personal Loan Makes Financial Sense for Tax Settlement

A personal loan is a tool. Like any tool, it’s great for some jobs and bad for others. A loan makes financial sense only when it saves you money or provides invaluable peace of mind.

Use a personal loan IF:

- ✅ Your credit is “Good” to “Excellent” (e.g., 670+ FICO in the US).

- ✅ You are offered a loan with an APR that is lower than the tax agency’s combined penalty and interest rate (e.g., your loan is 8% APR, the IRS is 11%).

- ✅ You want to stop the risk of liens or garnishments immediately.

- ✅ You can comfortably afford the new, fixed monthly payment.

- ✅ You want the psychological relief of being “done” with the tax agency.

DO NOT use a personal loan IF:

- ❌ Your credit is “Fair” or “Poor.”

- ❌ The loan’s APR is higher than the tax agency’s rate (e.g., your loan is 19% APR, the CRA is 12%). In this case, the agency plan is cheaper.

- ❌ You cannot afford the new monthly payment. Taking a loan you can’t pay just creates a new crisis.

- ❌ The loan has a prepayment penalty (you should never accept this).

- ❌ You are borrowing to pay a very small tax bill (e.g., under $1,000) that you could pay off in 2-3 months on your own.

Practical Tips to Avoid Future Tax Penalties or Late Payment Charges

Using a loan to pay your tax bill is a great solution, but the best strategy is to never need one in the first place. Here’s how to break the cycle.

For Employees (W-2, T4, PAYE):

- Do a Paycheck Checkup. Use the IRS’s Tax Withholding Estimator (or the UK’s “Check your Income Tax” service) in the middle of the year. If you got a big raise or bonus, you may be under-withholding.

- Adjust Your Withholding. File a new W-4 (US) or update your tax code (UK) to have a little extra tax taken from each paycheck. It’s better to get a small refund than to owe $5,000.

For Freelancers & Self-Employed (1099, Sole Trader):

- Open a Separate “Tax” Savings Account. This is the #1 rule.

- Follow the 25% Rule. Every time you get paid by a client, immediately transfer 25%–30% of that payment into your “Tax” savings account. This is not your money; it belongs to the government.

- Make Quarterly Estimated Payments. The IRS, CRA, HMRC, and ATO all require you to pay your taxes throughout the year, not all at once. Pay your estimated quarterly taxes from your “Tax” savings account. This prevents the giant bill and the “failure to pay estimated tax” penalty.

Take control of your finances $\rightarrow$ Read our guide on “How to Start Saving for Your 2025 Tax Bill Today.”

Documents Required to Get Approved for a Personal Loan Quickly

Preparation is the key to speed. Lenders must verify your Identity, Income, and Address (VIA). Having these documents saved as PDFs on your computer can turn a multi-day process into a multi-hour one.

Checklist of Documents:

- Identity:

- Driver’s License

- Passport

- Social Security Card (US) / Social Insurance Number (Canada)

- Income (If you are an employee):

- Your last two pay stubs (payslips).

- Your most recent W-2 (US) or T4 (Canada).

- Income (If you are self-employed):

- Your last two years of tax returns (e.g., Schedule C).

- Your last 3-6 months of bank statements (to show cash flow).

- Address:

- A recent utility bill (gas, electric, water).

- A recent bank or credit card statement.

- The Debt:

- A copy of your official tax bill (e.g., IRS notice, ATO assessment). This confirms the “purpose” of the loan.

Key Tip: If you are self-employed, your loan application will take 1-2 days longer than a W-2 employee’s. Lenders must manually review your bank statements and tax returns to verify your income, so be patient.

Typical Timelines for Loan Approval, Funding, and Tax Payment Submission

Here is a realistic timeline for the entire process, from “Oh no!” to “Paid in full.”

- Day 1: Research & Pre-Qualification (1-2 Hours)

- You receive your tax bill and realize you’re short.

- You check your credit score.

- You get pre-qualified offers from 3-5 lenders online.

- You choose the best offer.

- Day 1-2: Application & Verification (1-3 Days)

- You submit the full application and upload your documents (ID, pay stubs, etc.).

- The lender’s underwriting team reviews your file. They may call you or your employer to verify information.

- Day 2-3: Approval & Funding (1-2 Days)

- You receive the final approval and e-sign your loan agreement.

- The lender initiates the ACH/EFT transfer.

- Result: The cash (e.g., $11,000) arrives in your checking account.

- Day 3-4: Tax Payment (15 Minutes)

- You immediately log on to the tax agency’s payment portal (e.g., IRS Direct Pay, CRA My Payment).

- You submit the full payment from your checking account.

- Day 5-10: Confirmation (Peace of Mind)

- You receive an email confirmation of your tax payment.

- You log in to your tax agency account and see a beautiful $0.00 balance owed.

Total Elapsed Time: Typically 3 to 5 business days.

Start the clock $\rightarrow$ Get your pre-qualified rates in minutes.

How to Calculate the Right Loan Amount to Match Your Tax Liability

This sounds simple, but it’s a place many people make a mistake.

Mistake #1: Borrowing too little.

If you owe $12,500, don’t borrow $12,000. You’ll still have a $500 balance, which will continue to accrue penalties and interest. You’ll have two problems: a loan and a tax bill.

Mistake #2: Forgetting about fees.

If you need $10,000, and the loan has a 5% origination fee ($500), the lender will only deposit $9,500 into your account. You’ll be $500 short.

How to Do It Right:

- Get the Payoff Amount: Log in or call the tax agency for the 100% payoff amount, including all interest and penalties, as of a specific date (e.g., one week from today). Let’s say it’s $10,800.

- Get Your Loan Offer: You are approved for a loan with a 3% origination fee.

- Do the Math (Gross-Up): You need to “gross up” your loan amount so that after the fee, you have $10,800.

- Formula: Loan Amount = Payoff Amount / (1 – Fee Percentage)

- Example: $10,800 / (1 – 0.03)

- Example: $10,800 / 0.97

- Required Loan Amount: $11,134

You must apply for a loan of $11,134. The lender will take their 3% fee ($334) and deposit the remaining $10,800—the exact amount you need.

Common Mistakes to Avoid When Borrowing to Pay Taxes

- Ignoring Origination Fees: Focusing only on the interest rate. A 6% rate + 8% fee is a terrible deal. Always compare the APR.

- Borrowing Too Little: As mentioned above, borrowing $9,500 to pay a $10,000 tax bill is a critical error.

- Using the “Loan” as an Emergency Fund: The money is not for you. It’s a “pass-through” transaction. When the funds land in your account, immediately pay the tax agency. Do not use it for “just one other bill.”

- Choosing a 0% APR Credit Card (and Failing): This is the biggest trap. If you don’t pay it off before the intro period ends, the retroactive, high-interest rate will be financially devastating.

- Not Fixing the Original Problem: The biggest mistake is taking the loan, paying the tax, and then not changing your withholding or savings habits. You’ll be right back in the same spot next year, but now you’ll have a loan and a new tax bill.

Online Lenders vs Traditional Banks: Which Is Better for Tax Loans?

There’s no single “best” answer, but one is usually “better” for your specific situation.

- Online Lenders (Fintech):

- Best for: Speed. Their entire process is digital. You can be approved and funded in 24-48 hours.

- Best for: Comparison. It’s easy to pre-qualify on 3-5 sites in 30 minutes.

- Best for: Fair Credit. Their algorithms are often more flexible than a traditional bank’s.

- Traditional Banks (Your Bank):

- Best for: Relationship Rates. If you’ve been a loyal customer for 10+ years with a checking, savings, and mortgage account, you are their ideal customer. They may offer you a rate 0.25%–0.50% lower as a “relationship discount.”

- Best for: In-Person Service. If you are nervous and want to talk to a human loan officer, a bank branch is your best bet.

Tiny Table: Bank vs. Online Lender

| Feature | Traditional Bank | Online Lender |

| Speed | Slow (3-7 days) | Fast (1-3 days) |

| Best Rates | For Existing Customers | For Good Credit (720+) |

| Convenience | Low (In-branch visit) | High (All online) |

| Recommendation | Start here if you’re a long-time customer. | Start here if you need money fast. |

How to Improve Your Personal Loan Approval Chances for Tax Payments

- Check Your Credit Report: Before you apply, get your free report from annualcreditreport.com (US) or your local bureau (Equifax, TransUnion, Experian). Dispute any errors. A $50 medical bill in collections you didn’t know about can kill your approval.

- Pay Down Credit Card Balances: The single fastest way to boost your score. If you have $5,000 in savings and a $4,000 credit card balance, use the savings to pay the card down before you apply. This lowers your “credit utilization,” which massively boosts your score and DTI.

- Don’t “Shop” Too Much: Pre-qualifying (soft pulls) is fine. But submitting 5 full, official applications (hard pulls) in one day will make you look desperate and can lower your score.

- Show Stable Income: Lenders love stability. If you’re a gig worker, make sure you’ve deposited your income into the same bank account for 6+ months.

- Ask for a Reasonable Amount: Don’t ask for $25,000 if you only owe $10,000. Ask for the exact (grossed-up) amount you need.

Debt Consolidation Options to Simplify Tax-Related Expenses

If your tax bill is just one of your high-interest debts, a personal loan can serve a dual purpose.

What is a tax consolidation loan? It’s just a personal loan that you use to pay off multiple debts at once.

Example:

- You owe $8,000 to the IRS (at 11% APR).

- You owe $6,000 on a credit card (at 22% APR).

- Your total debt is $14,000.

Instead of just getting an $8,000 loan, you apply for a $14,000 debt consolidation loan. You get approved for a 5-year loan at 9% APR.

The Result:

- You use $8,000 to pay the IRS.

- You use $6,000 to pay off the credit card.

- You have now replaced two high-interest, stressful debts with one single, lower-APR, fixed monthly payment.

This strategy simplifies your finances, saves you significant money on interest (especially from the credit card), and helps you pay off your debt faster.

H5: How Interest Compounding Affects Total Loan Repayment Over Time

“Compounding” is what makes tax agency debt so dangerous. They often charge interest on your interest and penalties, not just the original tax. This is why the balance grows so fast.

A personal loan, on the other hand, almost always uses simple interest.

- Simple Interest: Interest is calculated only on the principal balance.

- Amortization: Your fixed payment is split. Part of it pays the new interest, and the rest (the “amortization” part) pays down the principal.

- The Benefit: Your payment never changes. You know that on “Payment #36,” your loan will be gone.

With an agency plan, a change in the federal interest rate can change your balance, and penalties can keep being added. A personal loan’s simple-interest, fixed-payment structure gives you a 100% predictable target to hit. It’s a “set it and forget it” payment that you can budget for.

H5: Evaluating Short-Term vs Long-Term Personal Loans for Tax Relief

The choice between a 3-year loan and a 7-year loan is a personal, financial one.

- Choose a Short-Term Loan (e.g., 3 Years) if:

- Your primary goal is to pay the least amount of interest.

- You have high, stable cash flow and can afford the higher payment without stress.

- You are highly disciplined and want to be debt-free ASAP.

- Choose a Long-Term Loan (e.g., 7 Years) if:

- Your primary goal is cash-flow management.

- You need the lowest possible monthly payment to fit your tight budget.

- You understand you will pay more in total interest but accept that as the “cost” of having a manageable payment.

- Crucial: You’ve confirmed the loan has no prepayment penalty, so you can make extra payments and pay it off early if you get a bonus.

The Hybrid Approach (Recommended): Take the 5- or 7-year loan to get the comfort of the low required payment, but then voluntarily pay extra on it each month (as if you had the 3-year loan). This gives you the savings of a short-term loan with the flexibility of a long-term one.

Tax Experts in the US Warn: Always Compare APR, Not Just Interest Rate

Financial experts in the United States are clear: the “interest rate” is just a marketing number. The APR (Annual PercentageRate) is the legal number. The APR includes the interest rate plus all origination fees, rolled into a single percentage. A loan at 7% interest with a 5% fee (10.5% APR) is a worse deal than a loan at 8% interest with no fee (8.0% APR). Always compare APR to APR.

Financial Advisors in the UK Recommend Checking Lender Eligibility Carefully

In the United Kingdom, “Time to Pay” arrangements with HMRC are a common fallback. If you opt for a personal loan instead, advisors caution that you must check the lender’s terms. Some lenders may restrict the use of funds for “tax payments” (though this is rare) or for “debt consolidation.” Be upfront about the loan’s purpose. It’s almost always best to select “debt consolidation” if “tax payment” isn’t an option.

Australian Credit Specialists Emphasize Reading the Fine Print in Loan Agreements

Australian credit specialists point out that while the ATO’s General Interest Charge (GIC) is high, it’s also straightforward. Personal loan contracts, however, can contain hidden traps. The biggest one to look for? Prepayment penalties. You must ensure you have the right to make extra payments or pay the loan off in full with a future tax refund without being charged a penalty.

Canadian Loan Consultants Suggest Setting Up Auto Payments to Avoid Late Fees

For Canadians facing a CRA debt, the “set it and forget it” nature of a loan is a key benefit. Consultants universally recommend setting up an automatic “pre-authorized debit” for your new loan payment. This ensures you never miss a payment. Missing a payment on your new loan (which will be reported to Equifax Canada) is just as bad as missing a payment to the CRA.

Global Tax Analysts Advise Monitoring Credit Utilization After Taking a Loan

Taking on a new loan will impact your credit score, as it increases your total debt. Analysts advise monitoring your “credit utilization ratio”—the amount of revolving debt (like credit cards) you have. After taking the loan, it’s more important than ever to keep your credit card balances low (ideally below 30% of their limits) to help your credit score recover quickly.

Experts Recommend Planning for Next Year’s Taxes to Prevent Repeat Borrowing

The final, universal piece of advice from all financial experts is this: a loan is a one-time fix. It is not a strategy. The moment you pay off this year’s tax bill, you must solve the problem that caused it. Open a separate savings account, adjust your W-4/PAYE withholding, or hire an accountant. Do whatever it takes to ensure that next year, you have the cash ready.

Frequently Asked Questions (FAQ)

Can I use a personal loan to pay taxes?

Yes, absolutely. It is 100% legal to use a personal loan to pay your tax debt in full. Tax agencies like the IRS (US), HMRC (UK), CRA (Canada), and ATO (Australia) do not have rules against how you get the funds to pay them. Their primary concern is receiving the payment. A personal loan allows you to pay your tax bill in one lump sum, which immediately stops the agency’s penalties and compounding interest. You then repay the loan to a bank or lender over a fixed term. This strategy makes financial sense if the personal loan’s APR is lower than the tax agency’s combined penalty and interest rate.

What is the $100,000 family loan loophole and how does it affect tax payments?

This “loophole” (which is a legal provision) relates to US tax law and is generally not a tool for paying your tax bill. It refers to IRS Section 7872, which governs low-interest “gift loans” between family members. In short, if you loan a family member more than $10,000, you (the lender) are supposed to report “imputed interest” as income. The $100,000 exception says that if the loan is $100,000 or less, the imputed interest is limited to the borrower’s “net investment income” for the year (and if that’s under $1,000, it’s $0). This is a complex rule for estate planning and wealth transfer; it is not a practical or recommended way to pay an immediate tax bill.

What is the minimum payment the IRS will accept for back taxes?

If you cannot pay your IRS tax bill in full, the IRS offers payment plans. The “minimum payment” depends on the plan you qualify for:

- Short-Term Payment Plan: You can get up to 180 days to pay. There is no setup fee, but penalties and interest continue to accrue.

- Long-Term Installment Agreement: This is for larger debts or those needing more time. The IRS calculates a minimum payment based on the total amount you owe and your ability to pay. The goal is to pay off the debt within the 72-month CSED (Collection Statute Expiration Date). There are setup fees ($31–$225), and penalties/interest continue to accrue.

You can apply for these plans on the IRS website. The “minimum” is what they determine you can afford, with the goal of paying the debt off as quickly as possible.

Is there an IRS or CRA tax forgiveness program?

Yes, but “forgiveness” is a misleading term. These programs are rare and have high standards.

- IRS (US): The main program is the Offer in Compromise (OIC). This is an agreement to let you pay a lower amount than what you owe. You must prove “doubt as to collectibility” (you don’t have the income/assets to pay the full amount) or “doubt as to liability” (the tax owed is incorrect). The IRS accepts very few OIC applications; you must be in significant financial distress.

- CRA (Canada): The CRA has the Taxpayer Relief Program, which can cancel or waive penalties and interest, but usually not the principal tax owed. This is only granted for extraordinary circumstances, like a natural disaster, a serious illness, or financial hardship beyond your control.

These are not “get out of jail free” cards and should not be your first option.

How does a tax consolidation loan work?

A “tax consolidation loan” is simply a personal loan used for the purpose of paying taxes. It’s a marketing term, not a separate financial product. It works by “consolidating” your tax debt into a new, single loan. The process is:

- You get a final payoff amount from the tax agency (e.g., $15,000).

- You apply for a $15,000 personal loan from a bank or online lender.

- The lender deposits the $15,000 into your bank account.

- You immediately use that $15,000 to pay the tax agency in full.

Your $15,000 tax debt is now gone. In its place, you have a $15,000 personal loan with a fixed monthly payment and a clear payoff date. You have consolidated your variable-rate tax debt into a simple, fixed-rate loan.

Can I get an $11,000 personal loan for tax payments?

Yes, $11,000 is a very common amount for a personal loan and is an ideal use case. Most lenders offer personal loans ranging from $2,000 to $50,000. An $11,000 loan is large enough to cover a significant tax bill but small enough to be approved quickly for a borrower with good credit and stable income. When applying, be sure to “gross-up” the amount if there is an origination fee. For example, if you need exactly $11,000 and the loan has a 3% fee, you would need to apply for a loan of $11,341 to ensure you receive the full $11,000 after the fee is deducted.

Is Optima Tax Relief a good choice for managing IRS debt?

Optima Tax Relief is a “tax relief company.” These companies are not lenders. They are professional services that you hire to negotiate with the IRS on your behalf. They employ tax attorneys, CPAs, and Enrolled Agents.

They are a “good choice” only for very complex situations, such as:

- You owe $50,000+ and are facing severe collection actions (liens, levies).

- You need to file for an Offer in Compromise (OIC).

- You have many years of unfiled tax returns.

- You are being audited.

These companies charge significant fees, often thousands of dollars. If you simply owe $10,000 from last year and have good credit, Optima Tax Relief is not the right choice. A simple personal loan or an IRS installment agreement is far cheaper and faster.

What are the best tax relief services available in the US and UK?

The “best” service depends on your specific problem.

- For simple, direct debt (e.g., “I owe $12,000”): The best “service” is often a personal loan lender (if you have good credit) or the tax agency’s own installment plan (if you have bad credit). These are the cheapest and most direct solutions.

- For complex, large debt (e.g., “I owe $80,000 and haven’t filed in 5 years”): You need professional help.

- US: Look for a reputable “tax relief” company (like Optima, Tax Defense Network, etc.) but first check their reputation with the Better Business Bureau. An even better option may be to hire a local CPA or Enrolled Agent (EA) who specializes in tax resolution.

- UK: You would hire a chartered accountant or tax advisor who specializes in negotiating “Time to Pay” (TTP) arrangements or handling complex disputes with HMRC.

How do tax debt relief programs compare to personal loans?

They are completely different tools for different problems.

| Feature | Tax Relief Program (Service) | Personal Loan (Product) |

| What It Is | A service you hire (lawyers, CPAs). | A product you get (cash). |

| What It Does | Negotiates with the IRS/HMRC for you. | Gives you cash to pay the IRS/HMRC. |

| The Goal | To lower the total debt (OIC) or get a payment plan. | To pay the debt in full immediately. |

| Cost | High fees (thousands of dollars). | Interest and (sometimes) origination fees. |

| Best For | Complex, large, or disputed tax debts. | Simple, undisputed tax debts for good-credit borrowers. |

Can I use a personal loan to pay taxes with bad credit?

It is very difficult and usually a bad idea. Most reputable lenders will not approve you for an unsecured personal loan with a “bad” credit score (e.g., under 600 in the US). The lenders that do specialize in bad credit will charge “subprime” interest rates (e.g., 25%–36% APR). This APR is almost certainly higher than the combined penalty and interest rate from the tax agency. In this case, you would be losing money. If you have bad credit, your best and cheapest option is to contact the tax agency (IRS, CRA, etc.) and set up an official installment agreement or payment plan.

How does a personal loan to pay taxes calculator work?

A “personal loan to pay taxes calculator” is a tool that helps you compare the cost of a personal loan against the cost of a tax agency’s payment plan. You would typically input:

- Your Tax Debt: (e.g., $10,000)

- Tax Agency Rate: The combined penalty + interest rate (e.g., 11%)

- Loan Offer #1: The loan’s APR, term, and origination fee (e.g., 8% APR, 3 years, 0% fee)

- Loan Offer #2: (e.g., 7% APR, 3 years, 3% fee)

The calculator will then show you the monthly payment and total cost (principal + interest + fees) for all three scenarios. This allows you to clearly see which option is the cheapest over the long run.

Which is better: an IRS payment plan or a personal loan?

It depends entirely on your credit score and financial situation.

- A Personal Loan is better IF:

- You have good to excellent credit.

- You can get an APR that is lower than the IRS’s combined penalty and interest rate.

- You want to avoid the risk of a tax lien and stop penalties immediately.

- An IRS Payment Plan is better IF:

- You have fair or poor credit.

- The only loan offers you get have high APRs (e.g., 15%+).

- Your tax bill is small and you can pay it off within 6 months.

For most people with bad credit, the IRS plan is the safer and cheaper option. For most people with good credit, the personal loan is the smarter and more secure option.

How can I get a loan to pay back taxes quickly?

Speed comes from online lenders and preparation.

- Preparation: Before you apply, gather your documents: your ID, your last two pay stubs, and your official tax bill. Know your credit score.

- Pre-Qualify: Go to 2-3 online lenders (e.g., SoFi, LightStream, Marcus in the US) or loan marketplaces. Use their “Check My Rate” feature, which is a soft pull and won’t hurt your score.

- Apply: Choose the best offer and complete the full application. Because you have your documents ready, you can upload them immediately.

- Funding: Many online lenders can approve you in hours and fund the loan (deposit cash into your account) within 24 to 48 business days.

The process is fast if you are prepared.

Can I take a personal loan specifically to pay the IRS?

Yes. Lenders are very familiar with this. When you apply for a personal loan, the lender will ask for the “purpose” of the loan. Most will have a dropdown menu with options like:

- Debt Consolidation

- Home Improvement

- Major Purchase

- Taxes

- Other

You can select “Taxes” or “Debt Consolidation” (as tax debt is a form of debt). Lenders see this as a responsible use of funds. You are using a loan to pay off a pre-existing, high-priority debt. It is a very common and acceptable loan purpose.

How to get a loan to pay property taxes with bad credit?

This is very difficult. Property taxes (which are paid to your local county or municipality) are a high-priority debt, and if you fall behind, the county can seize your home.

- Unsecured Loan: You will likely not be approved for an unsecured personal loan with bad credit.

- Secured Loan: Your options are “bad” ones. You might find a high-interest “car title loan” or another secured loan, but this is extremely risky.

- Your Mortgage Lender: Your best option is to call your mortgage company immediately. They may be ableto pay the property tax for you (to protect their interest in the home) and then add that amount to your mortgage balance through an “escrow shortage” payment plan.

- Local Programs: Your second-best option is to call your local county tax assessor’s office. Many counties have “tax relief” or “hardship” programs for seniors, veterans, or low-income homeowners to help them manage property tax bills.

Do banks pay taxes on the interest earned from loans?

Yes. The interest you pay on your personal loan, car loan, or mortgage is income for the bank or lender. Just like you pay taxes on your employment income, the bank reports all the interest it earns as revenue and pays corporate income tax on its profits. When you make a $300 loan payment, a portion (e.g., $200) might go to principal, and the other $100 is interest. That $100 is taxable revenue for the bank. This is a primary way that financial institutions generate the profits they report to their shareholders.