Get a trusted personal loan for debt consolidation from credit unions in the US, UK, Canada & Australia. Low rates, flexible terms, proven relief.

Balancing multiple debts with different interest rates and due dates can feel like juggling flaming torches. The worst part about constantly being on top of several different payment dates to your credit card companies and personal loan providers or other creditors is how tired you can get. They owe an average of over $5,000 on their credit cards in the US – and multiple high-interest loans are a frequent feature of United Kingdom life. Households in Canada and Australia too are seeing high debt. And financial pressure can result in missed payments, late fees and a lower credit score — factors that make it even more difficult to get ahead.

Picture having one, easy-to-manage monthly payment streamline your financial life. A debt consolidation personal loan gives you the opportunity to do just that. By consolidating all your current debt under one credential, you often can get a lower interest rate with the result that more of your money services principal rather than servicing interest. This isn’t just about how to simplify your finances though – it’s a way you can start taking charge of your financial life and get out from under debt. With a specific date as to when your loan will be paid off, you have something to look forward and you are back in control of your financial life. This guide will break down everything you need to know about using a personal loan to consolidate debt in the US, UK, Canada, and Australia so that you can streamline your payments and get further ahead.

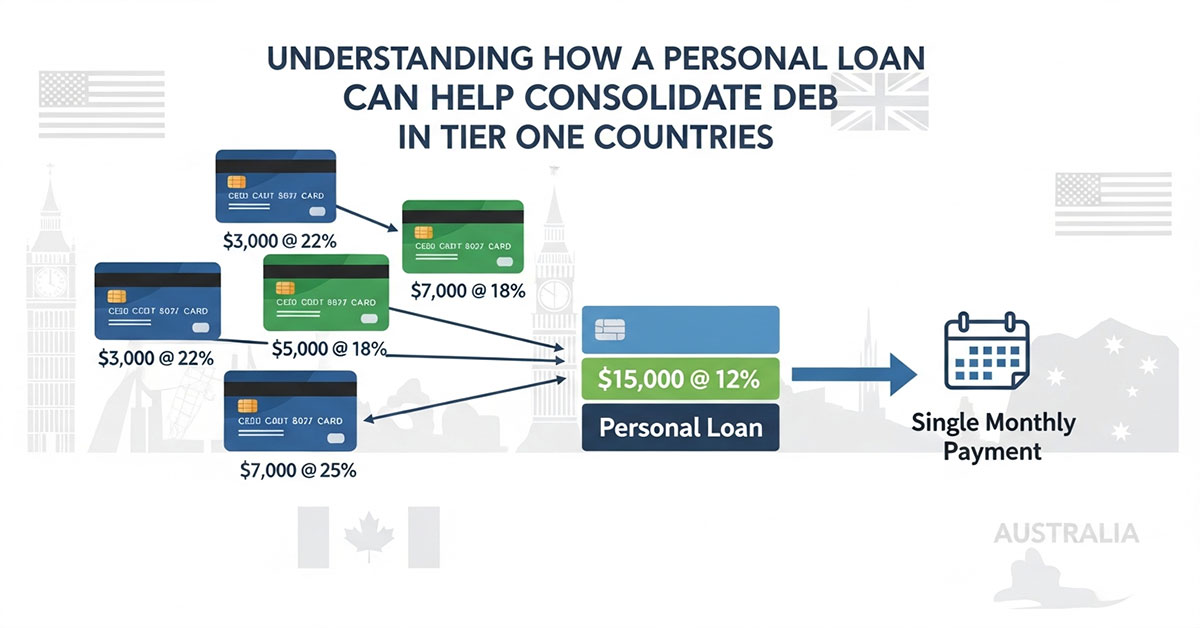

Understanding How a Personal Loan Can Help Consolidate Debt in Tier One Countries

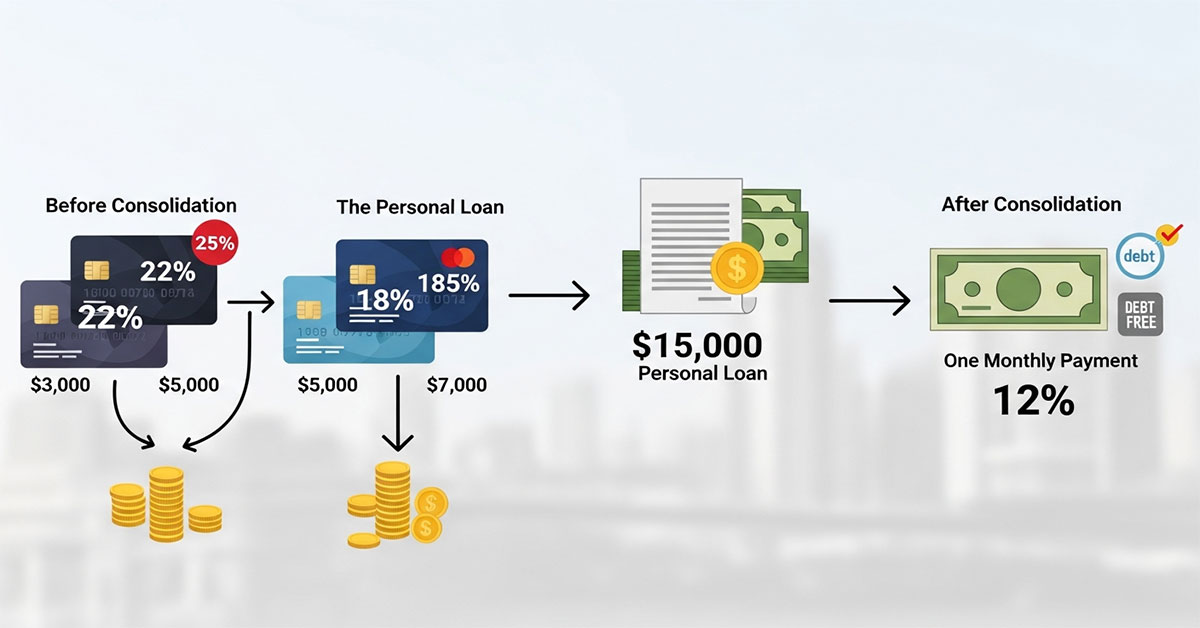

A personal loan for debt consolidation is when you apply for a new loan in order to use the money to pay off existing debts. Instead of making payments to multiple lenders every month, you’ll have a single, fixed monthly payment. It’s a way to streamline your finances, and it often translates into substantial savings, especially if you’re bringing interest rates down on high-interest debt like credit cards. It’s quite simple: after you’re approved for the personal loan, you use it to pay your other creditors. This leaves you with one lender and one payment to keep track of.

The method of doing this is common in US, UK, Canada and Australia because it clears the runway for people to get debt-free. For instance, if you have three credit card balances of $3,000, $5,000 and $7,000 with interest rates of 22 percent, 18 percent and 25 percent respectively then you could get a personal loana amounting to the sum of those three debts (approximately $15,000), at a lower interest rate — say 12 percent. This not only makes your monthly payments more manageable, but also lowers the total amount of interest you’ll ultimately pay over the life of the loan.

Mini Case Study:

She from Toronto, Canada had racked up an outstanding $20,000 worth of credit card bills on four cards. The loan carried high interest, so her monthly payments were hardly making a dent in the principal. She completed an application for a debt consolidation personal loan, and was approved to borrow $20,000 with a fixed interest rate of 10% on a five-year term. This enabled her to pay off all of her credit cards at once. Her new single monthly payment was much lower than the sum of all her old credit card payments, and she had an end date for when she would be debt free.

| Country | Average Credit Card Interest Rate | Average Personal Loan Interest Rate (Good Credit) | Potential Savings |

| United States | 21.19% | 8% – 12% | High |

| United Kingdom | 20.5% | 5% – 10% | High |

| Canada | 19.99% | 7% – 11% | High |

| Australia | 19.94% | 8% – 13% | High |

Key Takeaway: By consolidating your debts with a personal loan, you can potentially lower your overall interest rate, which can lead to substantial savings and a faster path to becoming debt-free.

Top Benefits of Using a Personal Loan for Debt Consolidation

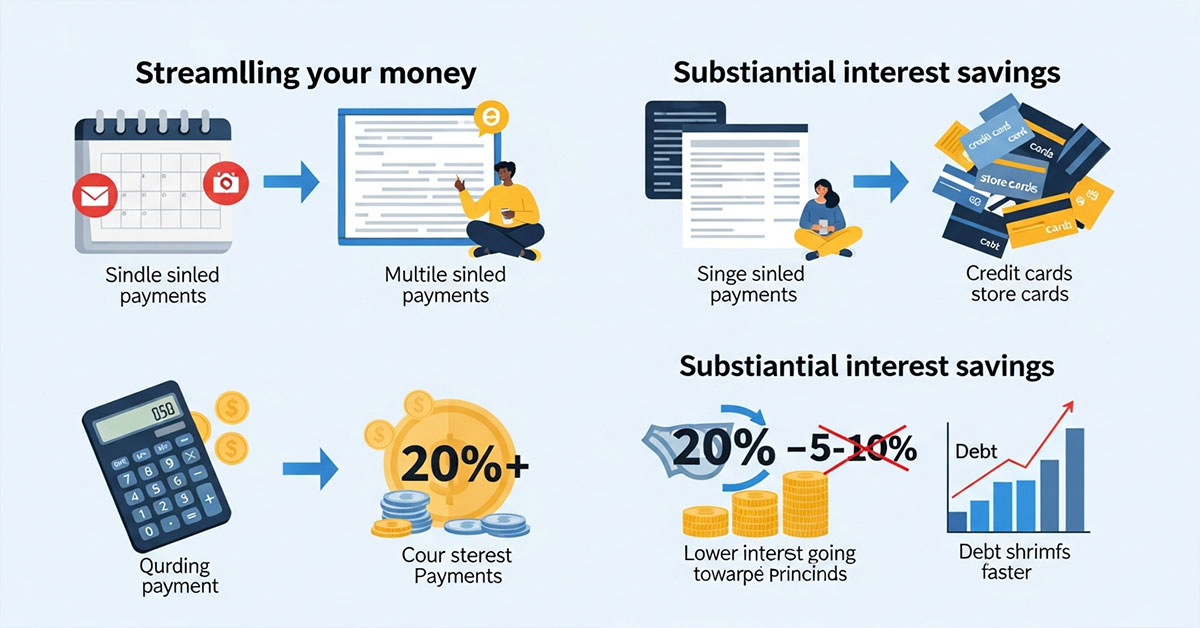

One of the biggest benefits of taking out a personal loan for debt consolidation is streamlining your money. Rather than deal with multiple due dates and payment amounts for numerous creditors, you have one monthly payment. This predictability makes it easier to budget and lowers the chances of missing a payment, which can damage your credit score. For many, this simplified process can eliminate the stress of managing money and bring a greater level of control to their finances.

Another advantage is there could be substantial interest savings. APRs on credit and store cards are often eye-watering, in excess of 20 per cent. A personal loan — particularly for a borrower with an excellent credit history — can have a far lower interest rate. By paying off your higher interest debt with a personal loan that has a lower rate, you can save on interest charges overall. This translates to more of your payment going toward paying down the principal, and in turn, helps you get out of debt faster.

Mini Case Study:

Mark, from Manchester, UK, was struggling with £15,000 in debt spread across three credit cards and a store card, with an average interest rate of 23%. He was making monthly payments of £500, but his balances were decreasing very slowly. He opted for a personal loan for debt consolidation at an 11% interest rate with a four-year term. His new monthly payment was £387, saving him £113 each month. More importantly, he was on a clear path to being debt-free in four years, saving thousands in interest.

| Benefit | How It Helps You | Impact on Your Finances |

| Single Monthly Payment | Simplifies your bill management. | Reduces stress and the chance of missed payments. |

| Lower Interest Rate | Reduces the cost of borrowing. | Saves you money and helps pay off debt faster. |

| Fixed Repayment Term | Provides a clear end date for your debt. | Makes it easier to budget and plan for the future. |

| Potential Credit Score Improvement | Can lower your credit utilization ratio. | A better credit score can lead to better loan terms in the future. |

Key Result: Using a personal loan for debt consolidation can lead to lower monthly payments, significant interest savings, and a clear timeline for becoming debt-free.

How to Qualify for a Debt Consolidation Personal Loan in the US, UK, Canada, and Australia

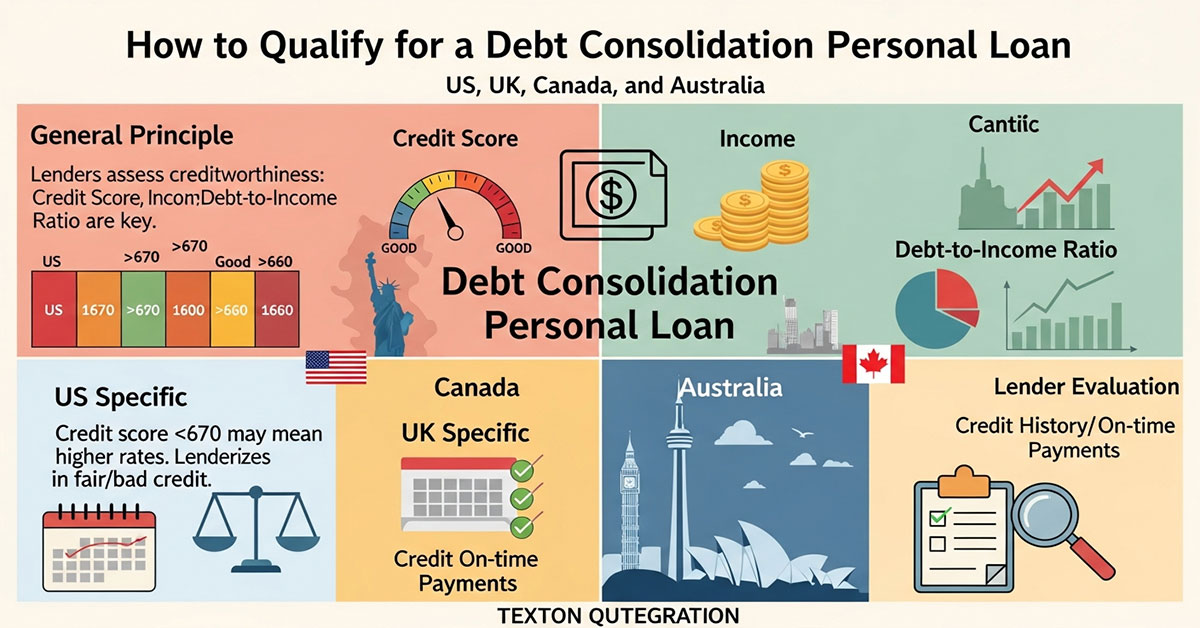

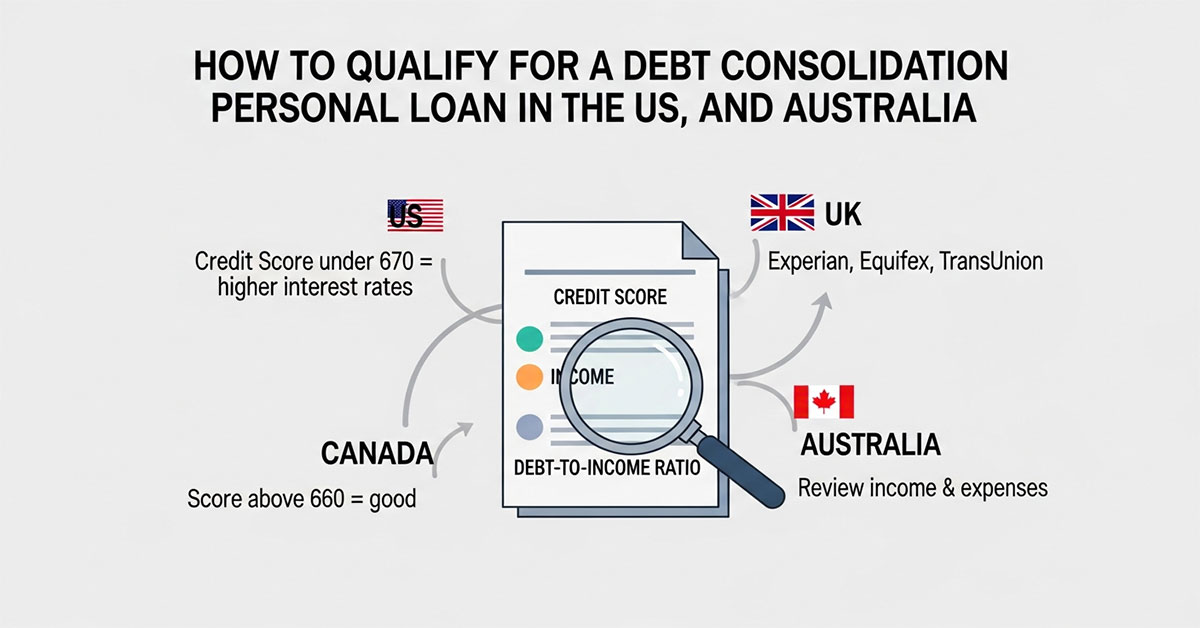

But to qualify for a personal loan for debt consolidation, you need to meet certain criteria that are generally evaluated by lenders in Tier One nations to assess your credit worthiness. Of course there are different rules per lender and per country but the basics are always the same. Lenders need to know you’re in a good financial position to pay back the loan. They’re going to focus especially on your credit score, income and debt-to-income ratio. Having a solid credit history that includes reliable on-time payments will greatly increase your chances of being approved and obtaining the lowest possible interest rate.

In the United States, borrowers with a credit score under 670 risk paying higher interest rates from lenders, although there are lenders who specialize in people who have fair or even bad credit. In the U.K., your credit report from companies such as Experian, Equifax or TransUnion will be an important part of your application. Lenders in Canada also look at your credit score, with a score of above about 660 seen as good. In Australia, a healthy credit score is important too, and what lenders will do is review your income and expenses to make sure that you can accommodate the repayments without experiencing financial hardship.

Mini Case Study:

Emily, an accountant based in Sydney, Australia, was looking to roll $30,000 of debt from different places into a single loan. She had a strong credit score of 750 and a steady income. She gathered all of the documents she would need, such as her proof of income, bank statements and a list of the outstanding debts that were weighing on her. Her good financial position meant that she was eligible for a loan at an attractive interest rate, which could be used to consolidate her debts and pay less in interest.

| Country | Typical Minimum Credit Score | Key Qualification Factors | Common Lenders |

| United States | 640+ | Credit history, income, DTI ratio. | Banks, credit unions, online lenders. |

| United Kingdom | “Good” credit rating | Credit report, affordability check. | High-street banks, building societies, online lenders. |

| Canada | 660+ | Credit score, income stability. | Major banks, credit unions, alternative lenders. |

| Australia | “Good” credit score | Income verification, credit history. | Banks, credit unions, non-bank lenders. |

Key Tip: Before applying for a debt consolidation loan, check your credit report for any errors and take steps to improve your score if necessary. This can significantly increase your chances of approval and help you get a better interest rate.

Step-by-Step Guide to Applying for a Personal Loan for Debt Consolidation

Getting a personal loan is just one part of the debt consolidation process. With a well-defined workflow you will quickly work through the application process and be on your way to get an affordable loan that suits your long-term needs. Step 1: Evaluate your financial position. This means totaling the amount of debt you want to consolidate and reviewing your budget to see how much you can actually afford to pay each month. Understanding your financial situation can help you determine the best amount of money to borrow and how long to repay it.

The next step once you clearly understand your finances is to find out your credit score. Your credit score, as you know by now, is critical when applying for the loan. Knowing your score in advance can help you gauge the interest rates for which you may qualify. Once you’ve reviewed your credit, it’s time to research and compare lenders. Shop around for debt consolidation lenders and compare their interest rates, fees and terms before choosing a lender that specializes in these types of loans. Many online lenders have a prequalification process to help you see potential rates without impacting your credit score.

Mini Case Study:

David, a teacher from London, UK, decided to consolidate his £18,000 in credit card debt. He started by listing all his debts and calculating his total monthly payments. He then used a free online service to check his credit score. After comparing several online lenders, he chose one that offered a competitive interest rate and positive customer reviews. He completed the online application, uploaded the required documents, and was approved within 24 hours. The funds were transferred to his bank account, and he used them to pay off his credit cards.

| Step | Action to Take | Why It’s Important |

| 1. Assess Your Finances | Calculate total debt and determine your budget. | Ensures you apply for the right loan amount and can afford the repayments. |

| 2. Check Your Credit Score | Review your credit report from a major credit bureau. | Gives you an indication of your eligibility and potential interest rates. |

| 3. Research and Compare Lenders | Look at interest rates, fees, and loan terms from multiple lenders. | Helps you find the most affordable and suitable loan for your needs. |

| 4. Gather Necessary Documents | Prepare proof of income, identification, and details of your debts. | Speeds up the application process and avoids delays. |

| 5. Complete and Submit the Application | Fill out the application form accurately and honestly. | Provides the lender with the information they need to make a decision. |

| 6. Receive Funds and Pay Off Debts | Once approved, use the loan funds to pay off your existing creditors. | Completes the debt consolidation process and leaves you with one manageable payment. |

Key Tip: When comparing lenders, pay close attention to the Annual Percentage Rate (APR), which includes both the interest rate and any fees. This will give you a more accurate picture of the total cost of the loan.

Comparing Trusted Lenders and Loan Options for Debt Consolidation

When weighing the various options available for a lender of your debt consolidation loan, you will want to consider every advantage and disadvantage. There are primarily three types of lenders in the financial market, namely traditional banks, credit unions and online lenders. Knowing the distinctions between each will enable you to make an informed choice that is in your best financial interests. Traditional banks are one option and could be a good idea if you already have a checking or savings account there, which means they may possess preferential rates for current customers.

Credit unions are nonprofit institutions that can offer more personalized service and possibly even lower interest rates than traditional banks. They have members, so instead of trying to maximize profits like a business they can focus on serving their members. This can result in improved loan terms and a wider range of qualification criteria. Online lenders continue to grow in popularity because of their easy application process and quick funding. They tend to have laxer credit requirements than traditional banks and can be a great option for those with less-than-stellar credit.

Mini Case Study:

A borrower with a good credit score in the United States may be able to find a competitive interest rate at a large national bank there. But someone with a slightly lower credit score could find better results with a more flexible credit union that’s willing to take the applicant’s specific situation into account. A borrower who needs access to money fast may choose an online lender whose approval and funding comes in a day or two.

| Lender Type | Pros | Cons | Best For |

| Traditional Banks | Established reputation, in-person service, potential relationship discounts. | Stricter credit requirements, slower application process. | Borrowers with excellent credit and an existing banking relationship. |

| Credit Unions | Lower interest rates, more flexible terms, personalized service. | Membership requirements, fewer branches. | Members of the credit union or those who value personalized service. |

| Online Lenders | Fast application and funding, often more lenient credit requirements. | Can have higher interest rates for less qualified borrowers, no in-person support. | Borrowers who need funds quickly and are comfortable with an online-only experience. |

Key Tip: Don’t just focus on the interest rate. Consider other factors such as origination fees, prepayment penalties, and the lender’s customer service reputation.

Best Alternatives to a Personal Loan for Managing Debt Efficiently

While debt consolidating with a personal loan is a great option for lots of people, it’s not the only solution to managing your debt. Depending on your money situation and the amount int debt you’re in, one of these alternatives could be a better choice.

Another popular option is a balance transfer credit card. They typically feature a 0% introductory APR for a set period, typically 12 to 21 months. That way you can move your high-interest balances from your old card to the new one and pay them down without accruing any interest for the promotional period. But it can be useful as long as you have a plan to pay down the balance before the intro period expires (at which point your interest rate would jump significantly). Transfer cards are usually best suited for consumers with good to excellent credit and a manageable amount of debt that they can eliminate within the promotional period.

Another possibility are home equity loans or home equity lines of credit (HELOCs). These let you make a one-time draw on the value of your home. Since these loans are backed by your property, they generally have much lower interest rates than unsecured personal loans. But they come with a major risk: If you are unable to make the payments, you will lose your home. This is not a decision to take lightly and in most cases shouldn’t be utilized by people who don’t have a proven ability repay their loans.

Mini Case Study:

Michael, 27, from Brisbane Australia has $12,000 in credit card debt. He had a great credit score, so he took out a balance transfer credit card that offered 0 percent APR for 18 months. He moved the entire balance to his new card and made a budget to pay off the debt within the promotion period. He was able to pay off his debt with a monthly routine of $400 and didn’t pay any interest.

| Debt Management Option | How It Works | Best For | Potential Risks |

| Balance Transfer Credit Card | Transfer high-interest credit card debt to a card with a 0% introductory APR. | Good to excellent credit; debt that can be paid off within the promotional period. | High interest rate after the introductory period; balance transfer fees. |

| Home Equity Loan/HELOC | Borrow against the equity in your home to pay off debt. | Homeowners with significant equity and a stable income. | Risk of foreclosure if you default on the loan. |

| Debt Management Plan (DMP) | Work with a credit counseling agency to create a repayment plan with your creditors. | Those who are struggling to make their minimum payments. | Can negatively impact your credit score in the short term. |

| Debt Settlement | Negotiate with your creditors to pay a lump sum that is less than the total amount you owe. | Individuals with a large amount of debt who are unable to make payments. | Significant negative impact on your credit score; forgiven debt may be taxed. |

Key Takeaway: It’s essential to explore all your options for debt management and choose the one that best aligns with your financial goals and risk tolerance.

Why Debt Consolidation Can Simplify Your Monthly Financial Commitments

Ease of organization is the top reason to use debt consolidation. It can be overwhelming to manage multiple debts with their own due dates, interest rates and minimum payments. The mental load of juggling all that can be large and the risk of forgetting to make a payment is real. A missed payment triggers late fees and can put a negative blemish on your credit report, potentially making it even more difficult to achieve financial stability. Debt consolidation simplifies that complexity by merging all your debts into just one loan, with one monthly payment.

Underpinning this simplification is a cascading reduction in your overall financial well-being. You can more easily plan a budget for yourself when you only have one payment to plan around. You will know the exact amount you need to put aside for your debt repayment each month, which can help free up mental bandwidth and alleviate financial stress. This newfound clarity might give you the confidence to adopt a more active strategy for your finances, say of setting up an emergency fund or saving for longer-term goals.

Expert Insight:

“The psychological impact of debt consolidation tends to be underrated,” says a financial planner at one of the UK’s biggest consumer champion. “Going from financial confusion to being in control can be really empowering. It’s not just about the money; it’s about reclaiming a sense of agency over your financial future.”

| Before Debt Consolidation | After Debt Consolidation |

| Multiple monthly payments to various creditors. | One single monthly payment to one lender. |

| Different interest rates and due dates to track. | One fixed interest rate and one due date. |

| High risk of missed payments and late fees. | Lower risk of missed payments and associated fees. |

| Financial stress and uncertainty. | Increased financial clarity and peace of mind. |

How Interest Rates Impact Your Total Debt Payoff and Long-Term Savings

One of the most significant aspects to consider when taking out a debt consolidation loan is the interest rate – it has a direct impact on the amount you will end up paying back in total. A slight variation in interest rates can lead to a major difference in the total amount you’ll have to pay over the life of your loan. If you bundle high-interest debt — like credit-card balances — into a personal loan with a lower interest rate, it can save you big money. This is because more of your monthly payment is applied to the principal balance and not just going to cover interest charges.

As an example, let’s say that you have $25,000 of credit card debt and the average interest rate is 20%. If you were to instead pay this back over five years, then you’d pay something like $14,700 in interest. But if you had combined this debt into a personal loan at 10% for the same five years then you’d have been charged around $6,800 in interest. That’s a discount of almost $8,000. This is a great example of how much of a long-term difference even just one percent lower interest rate can make to your bottom line.

Expert Insight:

Shop around for a better interest rate “Borrowers should never take the bank’s first offer,” says a senior analyst at one of Canada’s big banks. The 1st offer is not the best offer. “If you shop around for rates from several lenders, you can save thousands of dollars over the life of your loan.”

| Debt Amount | Interest Rate | Loan Term | Total Interest Paid | Monthly Payment |

| $25,000 | 20% | 5 years | $14,722 | $662 |

| $25,000 | 10% | 5 years | $6,881 | $531 |

Credit Score Requirements for a Debt Consolidation Loan in Tier One Markets

Your credit score is a numerical representation of your creditworthiness and is one of the most important factors that lenders consider when you apply for a debt consolidation loan. A higher credit score indicates to lenders that you are a responsible borrower who is likely to repay your debts on time. As a result, a good credit score will not only increase your chances of being approved for a loan but will also help you secure a lower interest rate, which can save you a significant amount of money over the life of the loan.

In the United States, a FICO score of 670 or above is generally considered good, while a score of 740 or higher is considered very good to excellent. In the United Kingdom, credit scores are generated by different credit reference agencies, and there isn’t a single universal score. However, a “good” or “excellent” rating from Experian, Equifax, or TransUnion will put you in a strong position. In Canada, a credit score of 660 or higher is typically seen as favorable by lenders. In Australia, a credit score above 625 is generally considered good.

Expert Insight:

A credit expert from an Australian credit reporting agency advises, “Regularly monitoring your credit report is crucial, especially if you’re planning to apply for a loan. Look for any errors or inaccuracies that could be dragging down your score and dispute them with the credit bureau.”

| Country | Credit Score Considered “Good” | Impact of a Good Credit Score |

| United States | 670+ (FICO) | Higher approval odds, lower interest rates. |

| United Kingdom | “Good” or “Excellent” rating | Increased likelihood of approval, more competitive offers. |

| Canada | 660+ | Better loan terms and lower borrowing costs. |

| Australia | 625+ | More lender options and favorable interest rates. |

Essential Documents Needed to Apply for a Personal Loan for Debt Consolidation

If you’re applying for a personal loan for debt consolidation, lenders will ask for certain documents to confirm your identity, income and current debts. While presumably you’ve already informed yourself about these matters online, having all this in hand upon arrival can speed up the process and prevent delays. Although the individual documents could change slightly by lenders and countries, there is a list of common docs that you will most probably have to hand over.

The typical documentation that is needed are proofs of identity ( Driver’s license, passport, government issued photo ID), and address. And you will need to be able to demonstrate where you live, usually by way of a recent utility bill or bank statement. You will probably be required to produce recent pay stubs, bank statements or tax returns to verify your income. And lastly, you will also need to list your debts that you want included in the consolidation and also name of your creditors, account numbers for them and the amount balances.

Expert Insight:

“Being organized with your documentation is key to a smooth loan application process,” notes a loan officer at a US-based credit union. “Lenders appreciate when borrowers have all their paperwork in order, as it demonstrates responsibility and makes the verification process much more efficient.”

| Document Category | Examples of Required Documents | Purpose |

| Proof of Identity | Driver’s license, passport, national ID card. | To verify that you are who you say you are. |

| Proof of Address | Utility bill, bank statement, lease agreement. | To confirm your current residential address. |

| Proof of Income | Pay stubs, tax returns, bank statements. | To ensure you have a stable source of income to repay the loan. |

| Details of Existing Debts | Credit card statements, loan agreements. | To determine the total amount of the consolidation loan needed. |

Online vs. Traditional Lenders: Which Offers Better Debt Consolidation Terms?

For those in the US, UK, Canada, and Australia with debt consolidation on their agenda; there are two options when it comes to obtaining a loan – online lending companies or traditional banks/credit unions. Both have specific pros and cons — the one that’s right for you depends on your financial situation and preferences. For decades, consumers have turned to traditional lenders, which provided the security of an in-person presence and face-to-face consultations. You may be able to get favorable loan terms if you already have a relationship with a bank or credit union.

On the other hand, online lenders have shaken up lending with quick application processes and fast funding times. They also tend to have less overhead than banks and other traditional lenders, so that may mean it’s easier for SuperMoney-qualified lenders to offer lower interest rates. The online lenders may also have less stringent requirements, which could make it easier for borrowers with bad credit to qualify. But the absence of in-person assistance may be a downside for certain borrowers who value that personal touch.

Expert Insight:

A financial technology analyst in the US observes, “The competition between online and traditional lenders is ultimately a win for the consumer. It has driven innovation, increased transparency, and forced lenders to be more competitive with their rates and terms.”

| Feature | Online Lenders | Traditional Lenders (Banks/Credit Unions) |

| Application Process | Typically fast, entirely online. | Can be slower, may require an in-person visit. |

| Funding Speed | Often within 1-2 business days. | Can take several days to a week or more. |

| Interest Rates | Can be very competitive, especially for good credit. | May offer relationship discounts to existing customers. |

| Credit Requirements | Can be more flexible and cater to a wider range of credit scores. | Often have stricter credit score requirements. |

| Customer Service | Primarily online or via phone. | In-person support available at branches. |

Secured vs. Unsecured Personal Loans: Choosing the Best Option for Your Situation

As you research personal loans for debt consolidation, you’ll come across two categories: secured and unsecured loans. The only distinction between them is a collateral. There are two types of personal loans, and an unsecured one is the usual type that doesn’t have you putting up a piece of property as collateral for the loan. Lenders for unsecured loans approve you entirely at their own risk, factoring in your credit score, income and debt-to-income ratio. Without the assurance of collateral, these loans may be less risky to the borrower but riskier to the lender, and therefore often have a slightly higher interest rate.

On the other hand, a secured personal loan makes you put up an asset (like a car or savings account) as collateral. Since the lender has an asset to recover if you don’t pay back the loan, it assumes less risk. This can potentially improve the odds of qualifying for a secured loan — particularly if your credit score is on the lower side, not to mention you could be offered an interest rate that’s less than what you’d pay for an unsecured loan. But the downside is that your collateral may be forfeited if you can’t repay your loan.

Expert Insight:

A personal finance expert in Canada advises, “While the lower interest rates of a secured loan can be tempting, borrowers should be extremely cautious. Only consider a secured loan if you are absolutely confident in your ability to make the monthly payments. The risk of losing a valuable asset, like your car, is a serious one.”

| Feature | Unsecured Personal Loan | Secured Personal Loan |

| Collateral | Not required. | Required (e.g., car, savings account). |

| Risk to Borrower | Lower – no risk of losing a specific asset. | Higher – risk of losing the collateral if you default. |

| Interest Rate | Typically higher than secured loans. | Typically lower than unsecured loans. |

| Credit Requirements | Generally stricter. | Can be more lenient due to the collateral. |

| Best For | Borrowers with good credit who don’t want to risk their assets. | Borrowers with fair credit who are confident in their ability to repay. |

How to Calculate Savings When Consolidating Debt with a Personal Loan

To accurately calculate your potential savings from a debt consolidation loan, you need to compare the total cost of your existing debts with the total cost of the new loan. Start by listing all your current debts, including the outstanding balance, the interest rate, and the monthly payment for each. Then, use an online debt consolidation calculator or a spreadsheet to determine the total interest you would pay if you continued with your current repayment plan. Next, research potential debt consolidation loans and find the interest rate and loan term you are likely to qualify for. Calculate the total interest you would pay on the new loan. The difference between these two figures represents your potential savings.

Common Mistakes to Avoid During the Debt Consololidation Process

One of the most common mistakes people make when consolidating debt is not having a clear budget and spending plan in place. It’s crucial to address the spending habits that led to the debt in the first place. Another error is failing to shop around for the best loan terms. Don’t accept the first offer you receive; compare rates and fees from multiple lenders. Also, be wary of closing all your old credit card accounts at once, as this can negatively impact your credit utilization ratio and lower your credit score.

Key Tip: Create a detailed monthly budget before you consolidate your debt and stick to it to avoid falling back into the same patterns.

Using a Personal Loan to Consolidate High-Interest Credit Card Balances

Consolidating high-interest credit card balances is one of the most effective uses of a personal loan for debt consolidation. Credit cards often have some of the highest interest rates, and carrying a balance can be incredibly expensive. By using a personal loan with a lower, fixed interest rate to pay off your credit cards, you can save a significant amount of money on interest and get out of debt much faster. This strategy also simplifies your finances by replacing multiple credit card payments with a single, predictable monthly loan payment.

Understanding the Impact of Debt Consolidation on Your Credit Score

A debt consolidation loan can have both positive and negative short-term and long-term impacts on your credit score. In the short term, applying for a new loan will result in a hard inquiry on your credit report, which can cause a temporary dip in your score. However, in the long term, a debt consolidation loan can improve your credit score in several ways. It can lower your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. Making consistent, on-time payments on your new loan will also have a positive impact on your payment history, which is the most important factor in your credit score.

Loan Repayment Flexibility: Choosing Terms That Fit Your Budget

When choosing a debt consolidation loan, it’s essential to select a repayment term that aligns with your budget and financial goals. A shorter loan term will result in higher monthly payments, but you’ll pay less in total interest and become debt-free sooner. A longer loan term will have lower monthly payments, making it more manageable for your budget, but you’ll end up paying more in interest over the life of the loan. Carefully consider your monthly income and expenses to determine a payment amount that you can comfortably afford without straining your finances.

How to Pick the Right Loan Term for Maximum Financial Stability

To choose the right loan term, start by creating a detailed budget to understand your monthly cash flow. Determine the maximum monthly payment you can comfortably afford. Then, use a loan calculator to see how different loan terms affect your monthly payment and the total interest you’ll pay. While a lower monthly payment from a longer term might be tempting, aim for the shortest term you can afford to minimize the total cost of the loan. Finding the right balance between an affordable monthly payment and the total interest paid is key to achieving financial stability.

Fixed-Rate vs. Variable-Rate Personal Loans: Which Is Right for Debt Consolidation?

A fixed-rate loan has an interest rate that remains the same for the entire loan term, providing predictable monthly payments. A variable-rate loan has an interest rate that can fluctuate based on market conditions. For debt consolidation, a fixed-rate loan is generally the safer and more popular choice because it offers stability and makes budgeting easier.

How to Lower Your Interest Rate with a Strong Credit Profile

A strong credit profile is your best tool for securing a low-interest rate. This includes a high credit score, a long history of on-time payments, a low credit utilization ratio, and a stable income. Before applying for a loan, take steps to improve your credit score, such as paying down existing balances and disputing any errors on your credit report.

Prequalification and Soft Credit Checks: What Borrowers Should Know

Prequalification allows you to see the loan terms you might be offered without impacting your credit score. This involves a soft credit check, which doesn’t appear on your credit report to other lenders. Prequalifying with multiple lenders is a smart way to shop for the best rates and terms without any negative consequences for your credit.

Understanding Origination Fees and Hidden Costs in Personal Loans

Origination fees are a one-time charge that some lenders deduct from the loan amount before you receive the funds. These fees can range from 1% to 8% of the loan amount. It’s crucial to factor in origination fees when comparing loan offers, as a loan with a lower interest rate but a high origination fee might end up being more expensive. Always read the loan agreement carefully to understand all potential costs.

The Benefits of Setting Up Automatic Payments for Debt Repayment

Setting up automatic payments is a simple yet effective way to ensure you never miss a loan payment. This can help you avoid late fees and protect your credit score. Many lenders also offer a small interest rate discount for enrolling in automatic payments, which can lead to additional savings over the life of the loan.

Refinancing Your Existing Consolidation Loan: When and Why It Makes Sense

If your credit score has improved significantly since you took out your original debt consolidation loan, or if interest rates have dropped, you may be able to refinance your loan to get a lower interest rate. Refinancing can help you lower your monthly payments, reduce the total interest you pay, or both. It’s worth considering if you can secure a new loan with significantly better terms.

Using a Debt Calculator to Estimate Potential Savings

A debt calculator is a valuable tool that can help you visualize the financial benefits of debt consolidation. By inputting your current debt balances, interest rates, and potential new loan terms, you can get a clear estimate of how much you could save on interest and how much faster you could become debt-free.

Expert Tips for Managing Spending After Consolidating Debt

Once you’ve consolidated your debt, it’s crucial to manage your spending to avoid accumulating new debt. Create a realistic budget, track your expenses, and identify areas where you can cut back. Avoid using credit cards for non-essential purchases and focus on your long-term financial goals.

Monitoring Your Credit Score Progress During Loan Repayment

Regularly monitoring your credit score during your loan repayment journey can be highly motivating. As you make on-time payments and your loan balance decreases, you should see your credit score gradually improve. This progress can reinforce your positive financial habits and open up better financial opportunities in the future.

Financial Advisors Share How to Avoid Falling Back into Debt

Financial advisors recommend several key strategies to stay out of debt. These include building an emergency fund to cover unexpected expenses, setting clear financial goals, and practicing mindful spending. It’s also important to address the underlying behaviors that led to the debt in the first place.

Recommended Resources for Financial Counseling and Debt Relief

For those who need additional support, there are many reputable non-profit organizations that offer financial counseling and debt relief services. In the US, the National Foundation for Credit Counseling (NFCC) is a great resource. In the UK, StepChange Debt Charity provides free and impartial debt advice. Similar organizations exist in Canada and Australia.

Final Thoughts: How Personal Loans Help Regain Financial Control and Stability

A personal loan for debt consolidation can be a powerful tool for regaining control of your finances. By simplifying your payments, reducing your interest costs, and providing a clear path to becoming debt-free, it can help you move from a state of financial stress to one of stability and confidence.

FAQ

What Is the Best Personal Loan for Debt Consolidation with Bad Credit?

Finding the best personal loan for debt consolidation with bad credit in Tier One markets requires looking beyond traditional banks. Online lenders and credit unions are often more willing to work with borrowers who have less-than-perfect credit. In the US, lenders like Upstart and Avant specialize in loans for borrowers with fair to poor credit. In the UK, specialist lenders may offer “bad credit loans.” In Canada and Australia, credit unions and alternative lenders can be good options. The “best” loan will have the most favorable terms you can qualify for, including the lowest possible interest rate and manageable fees. It’s crucial to compare multiple offers and read the loan agreement carefully.

Are There Guaranteed Debt Consolidation Loans for Bad Credit?

There is no such thing as a “guaranteed” debt consolidation loan, especially for those with bad credit. Any lender that promises guaranteed approval is likely a predatory lender. Legitimate lenders in the US, UK, Canada, and Australia will always assess your creditworthiness and ability to repay the loan before making a decision. While some lenders have more lenient requirements and are more likely to approve borrowers with bad credit, approval is never guaranteed. Be wary of any company that asks for an upfront fee to “guarantee” your loan, as this is a common scam.

How Does a Debt Consolidation Loan Calculator Help Estimate Savings?

A debt consolidation loan calculator is a simple online tool that helps you estimate your potential savings by comparing your current debt situation to a new consolidation loan. You typically enter the outstanding balances and interest rates of your existing debts. Then, you input the potential interest rate and term of a new debt consolidation loan. The calculator will then show you the difference in your monthly payments and the total interest paid over the life of the loans. This provides a clear, quantitative picture of how much you could save, helping you make an informed decision.

Where Can I Find a Personal Loan for Debt Consolidation Near Me?

You can find personal loans for debt consolidation at a variety of financial institutions. Local banks and credit unions in your community are a great place to start, especially if you prefer in-person service. You can search online for “debt consolidation loans near me” to find branches in your area in the US, UK, Canada, or Australia. However, don’t limit your search to local options. Online lenders often offer very competitive rates and can serve customers nationwide, providing a convenient way to apply for and receive a loan from the comfort of your home.

Is Rocket Money Debt Consolidation a Safe Option?

Rocket Money (formerly Truebill) is a personal finance app that offers various services, including bill negotiation and subscription management. While Rocket Money itself does not directly offer debt consolidation loans, it may partner with reputable lenders to provide loan offers to its users. It is a legitimate and well-known app in the US. However, as with any financial product, it’s essential to carefully review the terms and conditions of any loan offer you receive through the platform and ensure that the lender is reputable and regulated.

Are Accredited Debt Consolidation and JG Wentworth Good Choices?

Accredited Debt Relief is a debt settlement company, not a direct lender for consolidation loans. Debt settlement involves negotiating with creditors to pay less than what you owe and can have a significant negative impact on your credit score. JG Wentworth is a financial services company known for purchasing structured settlements and annuities, but they also offer debt relief services, which may include debt settlement. It’s crucial to understand the difference between debt consolidation (taking out a new loan) and debt settlement. For most people with manageable debt, a consolidation loan is a better option for their credit health.

Can I Get a $75k Debt Consolidation Loan with Good Credit?

Yes, it is possible to get a $75,000 debt consolidation loan with good credit in countries like the US, Canada, and Australia. The maximum loan amount varies by lender, but many lenders offer loans up to $100,000 or more. To qualify for a loan of this size, you will need a strong credit score (typically in the “good” to “excellent” range), a stable and sufficient income to support the monthly payments, and a relatively low debt-to-income ratio. Lenders will carefully review your financial profile to ensure you can comfortably handle the repayment of a large loan.

How Do Credit Card Consolidation Loans Work in the US and UK?

In both the US and the UK, credit card consolidation loans work in the same fundamental way. You apply for a personal loan from a bank, credit union, or online lender for an amount that is sufficient to pay off all your existing credit card balances. If your application is approved, the lender will either deposit the funds directly into your bank account, or in some cases, send the payments directly to your credit card companies. You are then left with a single loan to repay over a fixed term, with a single monthly payment.

Which Lenders Offer the Best Debt Consolidation Loans in Canada and Australia?

In Canada, the major banks (RBC, TD, Scotiabank, BMO, CIBC) all offer personal loans for debt consolidation. Credit unions and online lenders like Fairstone and LoanConnect are also popular options, particularly for those who may not qualify at a traditional bank. In Australia, the “Big Four” banks (Commonwealth Bank, Westpac, ANZ, NAB) are common choices. Additionally, there are many reputable non-bank lenders and online platforms, such as SocietyOne and Plenti, that offer competitive debt consolidation loans. The “best” lender will depend on your individual credit profile and financial needs.

Is It Worth Getting a Personal Loan for Debt Consolidation (Reddit Insights)?

On platforms like Reddit, many users in personal finance subreddits share positive experiences with debt consolidation loans, highlighting the benefits of a single, lower monthly payment and a reduced interest rate. They often emphasize the psychological relief of simplifying their finances. However, Redditors also caution that a consolidation loan is not a magic solution. They stress the importance of addressing the underlying spending habits that led to the debt and advise against accumulating new credit card debt after consolidating. The consensus is that it can be a very effective tool if used responsibly as part of a broader financial plan.