Secure a trusted personal loan for credit card debt from credit unions in the US, UK, Canada & Australia. Lower rates, flexible terms, proven relief.

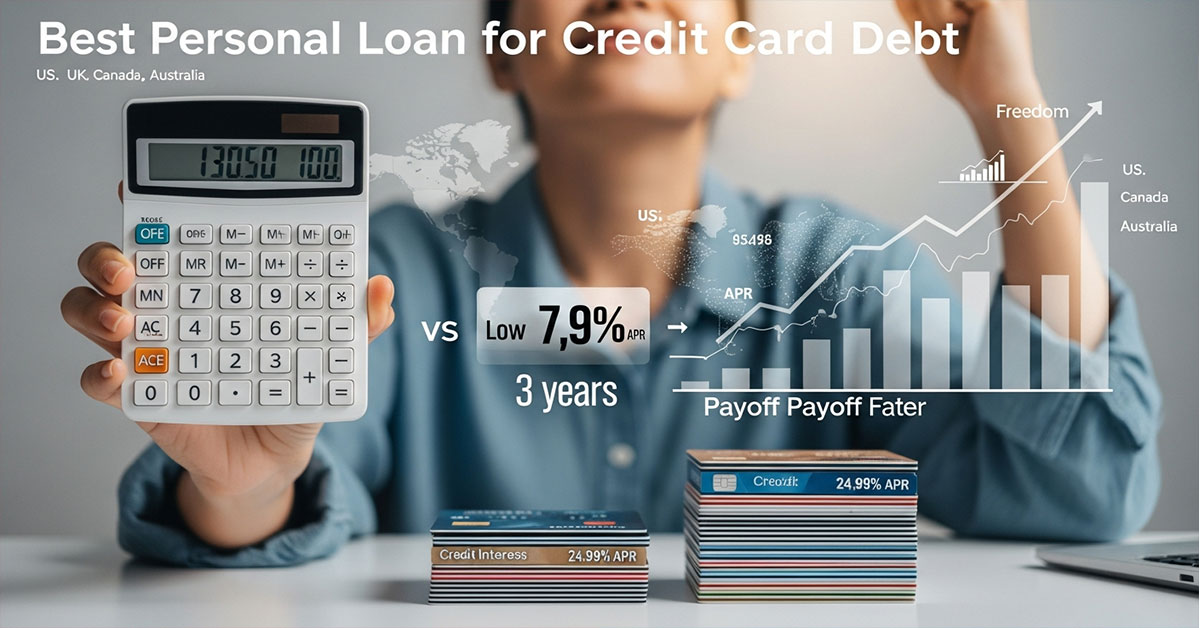

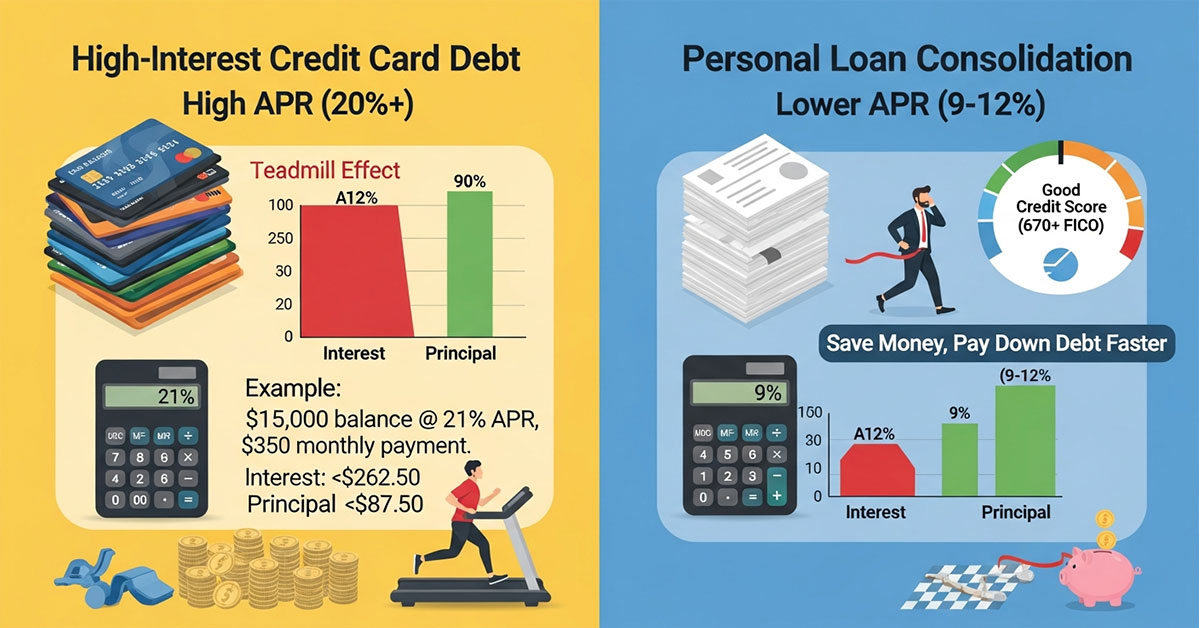

Do you feel like you’re drowning in high-interest credit card debt? You are not alone if you live in the US, UK, Canada or Australia. The endless cycle of paying, only to watch balances barely nudge is one of the areas that stresses people out most. With astronomical interest rates — often more than 20% — one would have to pay more than the minimum each month for decades to pay off even a modest balance, as your entire minimum payment gets gobbled up by interest and hardly any goes toward paying down the actual amount you owe. It can seem like a no-win scenario, a treadmill that you can’t stop.

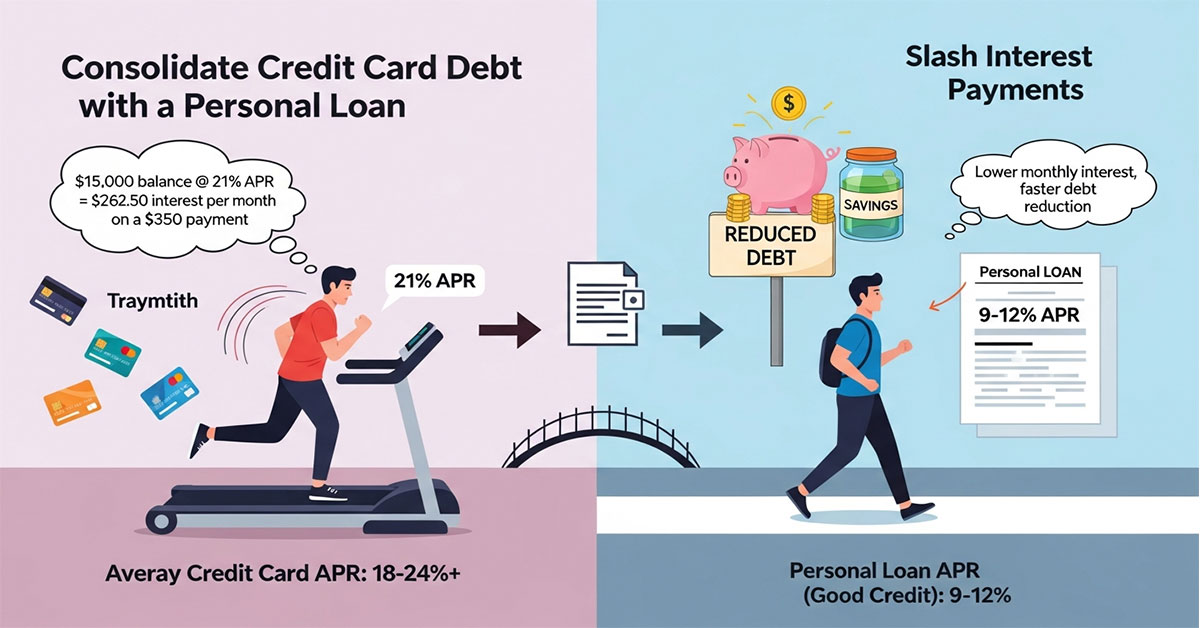

But there is a stronger, more strategic way to break this cycle: a personal loan for debt consolidation.

This isn’t a matter of moving debt around; it’s about reducing it with an easily understandable, structured plan. One personal loan can pay off all your high-interest credit cards. In a single move, this action can change your entire financial world. You’ll exchange several incomprehensible payments for one clear, fixed monthly payment.

More important, you’ll exchange those high, variable credit card APRs for a single lower, fixed interest rate. That one switch means more of your payment is applied directly to your principal. You’re no longer simply treading water; you are making a routine payment on your debt. This guide will show you how a personal loan for credit card debt works, how it can save you thousands, and why you can qualify in your country so you can reach a faster payoff and actual financial freedom at last.

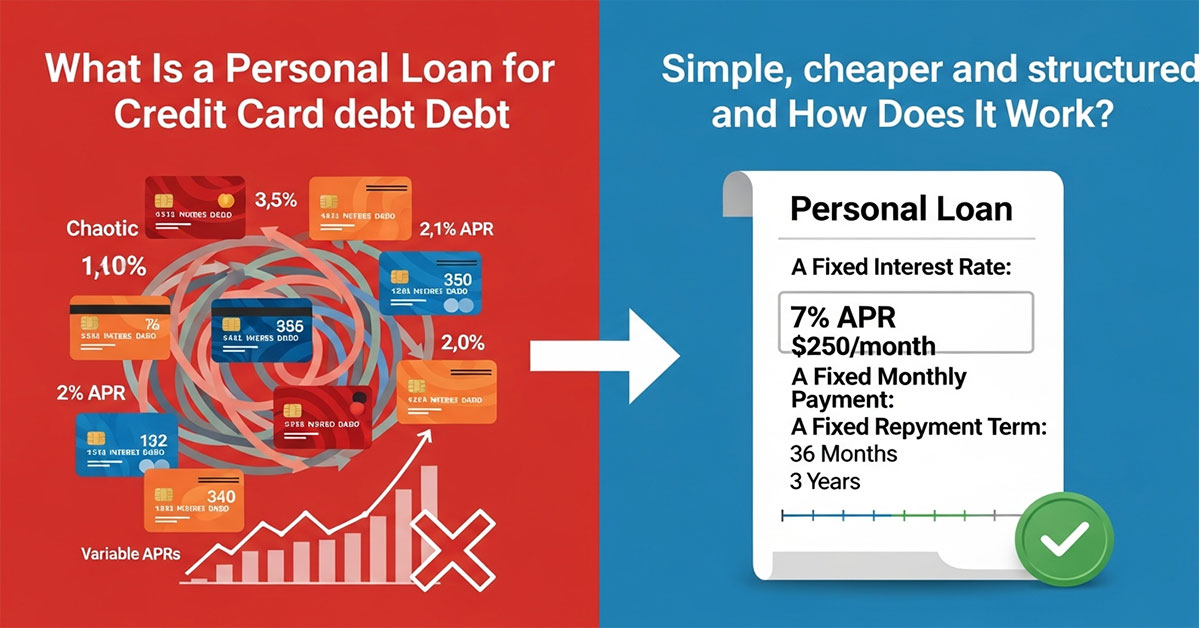

What Is a Personal Loan for Credit Card Debt and How Does It Work?

A personal loan for credit card debt, also called a debt consolidation loan, is essentially the “once and for all” solution of its category. You apply for a new loan balance from a bank, credit union or online lender in the amount of your total existing balances. If you qualify, the lender provides a one-time infusion of money. You use this money to fully pay off your all of credit card balances and set everything to zero.

And when you do that, you no longer owe the credit card companies. Instead, you’ll be responsible for one debt payment to the personal loan lender. This new loan is novel in three important ways, which set it apart from credit card debt:

1. A Fixed Interest Rate: Unlike credit card APRs, which are often variable and can rise, your personal loan rate is locked in. This rate is typically much lower than your card rates, especially if you have fair to good credit.

2. A Fixed Monthly Payment: You know exactly what you will pay every single month. This predictability makes budgeting a breeze.

3. A Fixed Repayment Term: You know the exact date your debt will be paid off (e.g., in 36, 48, or 60 months). This “debt-free date” is a powerful motivator.

In short, you are trading a chaotic, expensive, and seemingly endless debt cycle for a simple, cheaper, and structured payoff plan.

Case Study: Sarah’s Path to Control

· The Problem: Sarah, a graphic designer in Toronto, Canada, had $18,000 CAD in debt spread across three different credit cards.

o Card 1: $7,000 at 19.99% APR

o Card 2: $6,000 at 21.49% APR

o Card 3: $5,000 at 22.99% APR

· Her combined minimum payments were nearly $550, but her balances were barely shrinking. She felt stressed and disorganized, fearing she would miss a payment.

· The Solution: Sarah applied for a $18,000 personal loan from an online lender. With her “good” credit score, she was approved for a 3-year (36-month) loan at a 9.5% fixed APR.

· She received the funds and paid off all three cards immediately.

· The Result: Sarah’s financial life simplified overnight. Her new, single monthly payment was $576. While slightly higher than her minimums, this new payment guaranteed she would be completely debt-free in 36 months. By swapping her ~21% average APR for a 9.5% APR, she was set to save over $7,000 in interest and get out of debt nearly a decade faster than if she had only paid the minimums.

| Feature | Before (Multiple Credit Cards) | After (Personal Consolidation Loan) |

| Total Debt | $18,000 CAD | $18,000 CAD |

| Average Interest Rate | ~21.3% (Variable) | 9.5% (Fixed) |

| Number of Payments | 3 | 1 |

| Monthly Payment | $550 (minimums) | $576 (fixed payment) |

| Payoff Timeline | 10+ years (if paying minimums) | 3 years (guaranteed) |

| Estimated Total Interest | $10,000+ | ~$2,736 |

Key Takeaway: A personal loan for debt consolidation doesn’t magically erase debt. It replaces complex, high-interest debt with a simple, lower-interest, structured plan that gives you control.

How Consolidating Credit Card Debt with a Personal Loan Helps You Save Money

The primary way a personal loan saves you money is by slashing the amount of interest you pay. High-interest credit cards are designed to be profitable for banks, not to help you pay off debt quickly.

Let’s look at the math. The average credit card interest rate in the US can be over 20%. In the UK, Australia, and Canada, rates are similarly high, often ranging from 18% to 24% or more.

When your APR is 20%, a huge portion of your payment is consumed by interest.

· Example: Imagine you have a $15,000 balance at 21% APR. If your monthly payment is $350, your first month’s interest charge alone is approximately $262.50. This means only $87.50 of your $350 payment actually goes to reducing your $15,000 debt.

This is the “treadmill” effect. You’re running hard but staying in the same place.

Now, let’s see what happens when you use a personal loan. If you have a “good” credit score (e.g., 670+ FICO in the US or an equivalent in the UK/AU/CA), you could qualify for a personal loan with an APR between 9% and 12%.

Let’s re-run the numbers from our $15,000 debt example:

| Debt Scenario | Average APR | Monthly Payment | Payoff Time | Total Interest Paid |

| Credit Cards (Aggressive Payment) | 21% (Variable) | $350 | ~78 Months (6.5 years) | ~$12,250 |

| Personal Loan (Structured Plan) | 11% (Fixed) | $491 | 36 Months (3 years) | ~$2,675 |

In this scenario, by choosing the personal loan, you get out of debt 3.5 years faster. Even with a higher monthly payment, you save $9,575 in interest. The loan forces you to pay the debt off quickly and efficiently, while the lower rate ensures your money goes to the principal, not the bank’s profit.

Case Study: David’s $25,000 AUD Debt Solution

· The Problem: David, a project manager in Sydney, Australia, had accumulated $25,000 AUD in debt across two major bank credit cards, with average interest rates of 19.99% p.a. He was only managing the minimum payments and his balance felt static.

· The Solution: He shopped around and found a local credit union that offered him a $25,000 debt consolidation loan with a 4-year term at 10.5% p.a. (fixed). The loan included a small setup fee, which was rolled into the total.

· The Result: David’s new single payment was approximately $640 per month. This was more than his previous combined minimums, but he now had a clear plan. By the end of the 4-year term, he will have paid his debt in full. The total interest paid on his loan will be around $5,680. If he had continued trying to pay off his 19.99% cards with the same payment, it would have taken him longer and cost him over $11,500 in interest. He saved nearly $6,000 and, in his words, “got his sleep back.”

Key Tip: The savings are directly tied to the difference between your current credit card APRs and the new personal loan APR. The bigger the difference, the more you save.

Top Benefits of Using a Personal Loan to Pay Off Credit Card Balances in Tier One Countries

While saving money is the biggest motivator, the other benefits of consolidating with a personal loan can have an even greater impact on your daily life and long-term financial health. This strategy is popular in the US, UK, Canada, and Australia precisely because it solves multiple problems at once.

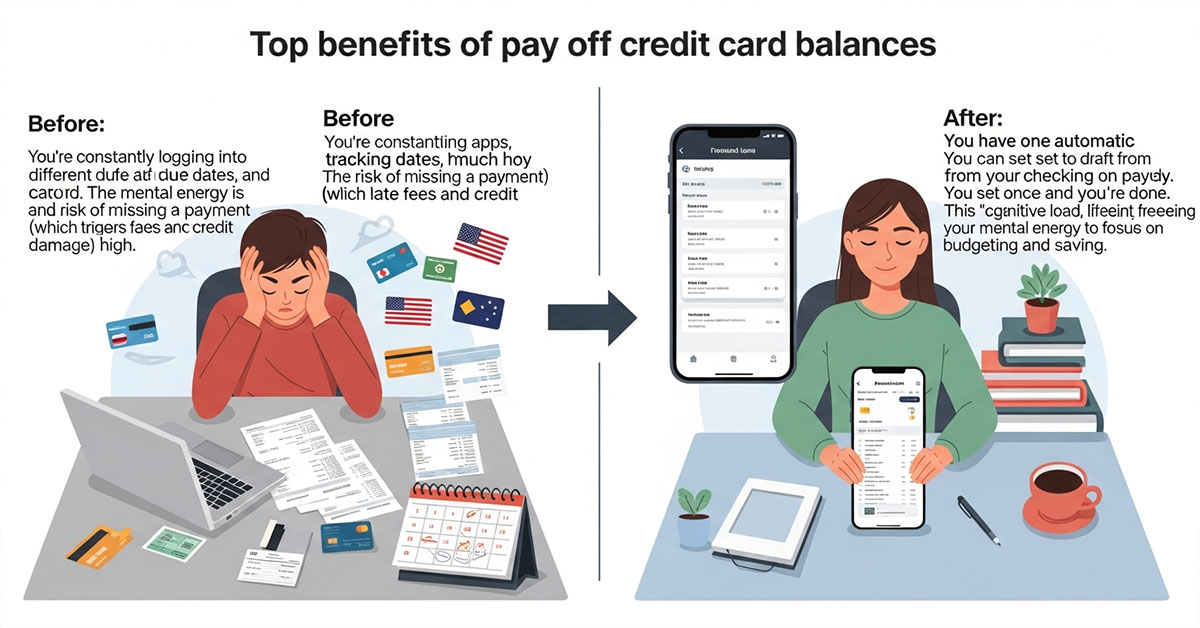

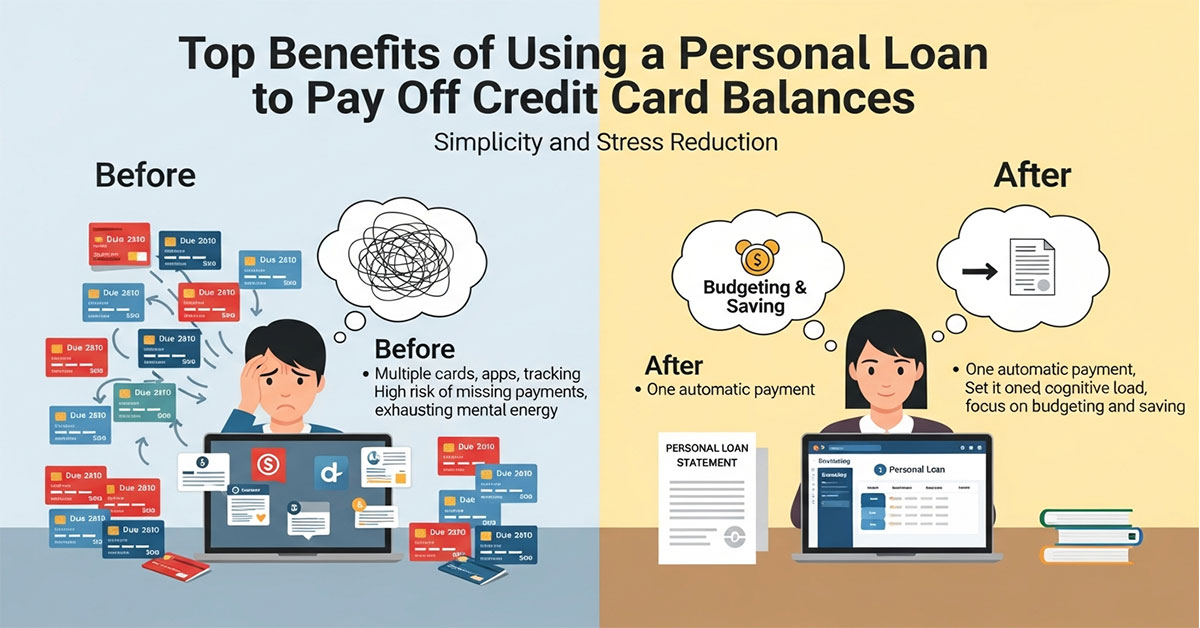

1. Simplicity and Stress Reduction

This is a massive psychological victory. Instead of juggling 3, 4, or 5 different due dates, minimum payments, and statements, you have one payment.

· Before: You’re constantly logging into different apps, tracking due dates, and deciding how much to pay on each card. The mental energy is exhausting, and the risk of missing a payment (which triggers late fees and credit damage) is high.

· After: You have one automatic payment. You can set it up to draft from your checking account on payday. You set it once and you’re done. This “cognitive load” is lifted, freeing up your mental energy to focus on budgeting and saving.

2. A Fixed Rate and a Fixed Term

Credit card debt is “revolving debt” with a variable interest rate. This means the bank can (and does) raise your APR, especially when central banks (like the US Federal Reserve or the Bank of England) raise baseline rates. Your debt can become more expensive without you doing a thing.

A personal loan is “installment debt.”

· Fixed-Rate: Your 9% APR will still be 9% three years from now, regardless of what the market does. This predictability is crucial for long-term planning.

· Fixed-Term: You have a guaranteed payoff date. When you sign your 3-year loan, you know that in 36 payments, you are 100% debt-free. A credit card’s minimum payment is calculated to keep you in debt for as long as possible—often 15-20 years.

3. A Potential Boost to Your Credit Score

This often surprises people. While there is a small, temporary dip when you first apply (due to a “hard inquiry”), the long-term effects are overwhelmingly positive. This is especially true in score-sensitive markets like the US and Canada.

· The Big Win: Credit Utilization. This is the single biggest factor you can control. It measures how much of your available credit you are using. If you have $20,000 in limits and $18,000 in balances, your utilization is 90% (which is “very high” and damaging to your score).

· After Consolidation: You pay those cards down to $0. Your utilization ratio plummets from 90% to 0%. This signals to credit bureaus (like Experian, TransUnion, and Equifax) that you are no longer “maxed out” and are managing your debt. This action alone can cause a significant jump in your credit score within a few months.

· Credit Mix: Lenders like to see that you can responsibly manage different types of debt. Adding an “installment loan” (the personal loan) to your file, which was previously only “revolving debt” (credit cards), can improve your “credit mix” and help your score over time.

Case Study: Emily and Mark’s Credit Score Win (UK)

· The Problem: Emily and Mark, a couple in London, UK, had £16,000 in credit card debt from moving and furnishing their flat. They were making payments on time, but their high balances kept their credit scores (from Experian and Equifax) “fair.”

· The Solution: They took out a joint personal loan for £16,000 from their high-street bank at 8.5% APR over 4 years.

· The Result: They automated their single new payment. Six weeks later, after all their credit card companies reported the £0 balances, they checked their credit reports. Emily’s score had jumped 42 points, and Mark’s had jumped 35 points. This significant boost put them in a much stronger position to apply for a future mortgage.

| Benefit Category | Description of Benefit | Why It Matters for You |

| Financial | Lower, fixed interest rate (APR). | You save hundreds or thousands of dollars/pounds in interest. |

| Psychological | A single monthly payment. | Drastically reduces stress, disorganization, and the risk of late fees. |

| Structural | A fixed “debt-free date” (e.g., 3-5 years). | Provides a clear light at the end of the tunnel; motivates you to finish. |

| Credit Score | Lowers your credit utilization ratio. | Can cause a significant increase in your credit score over time. |

Key Result: The most powerful benefits are control and certainty. You are taking control of your finances and giving yourself a certain, predictable path out of debt.

How to Qualify and Apply for a Personal Loan for Credit Card Debt in the US, UK, Canada, or Australia

The application process is similar across all Tier One countries. Lenders are all looking for the same thing: proof that you have the stability and ability to repay the loan. Here is a step-by-step guide to qualifying and applying.

Step 1: Know Your Financial Snapshot (Before You Apply)

Before you shop for a loan, you must know what lenders will see when they look at you.

1. Check Your Credit Score & Report: This is the single most important factor.

o US: Check your FICO score (most lenders use this). Scores range from 300-850. A score of 670+ is “good” and will get you decent offers. 740+ is “excellent.”

o UK: Check your score from all three agencies (Experian, Equifax, TransUnion). Scores are often 0-999 or 0-710.

o Canada: Check your score from Equifax and TransUnion (300-900). A score of 660+ is “good.”

o Australia: Check your score (often 0-1000 or 0-1200). A score of 622+ is “good.”

o Key Action: Get your full credit report and check it for errors. A mistake (like a debt that isn’t yours) could get you denied.

2. Calculate Your Debt-to-Income (DTI) Ratio:

o How: Add up all your monthly debt payments (rent/mortgage, car loan, student loans, and your new potential loan payment). Divide this total by your gross (pre-tax) monthly income.

o Example: Your gross monthly income is $5,000. Your debts (mortgage + car) are $1,500. Your new loan payment will be $500. Your total debts are $2,000.

o Calculation: $2,000 / $5,000 = 0.40, or 40% DTI.

o Why it matters: Most lenders want to see a DTI below 43-50%. It shows you have enough “room” in your budget to afford the new payment.

3. Total Your Debts: Get a precise, to-the-penny total of all the credit card balances you intend to pay off. You will apply for this exact amount.

Step 2: Shop Around and Pre-Qualify

Do not just apply at one place! Rates can vary wildly between lenders.

· Where to Look:

o Online Lenders (Fintech): Often the fastest, with slick online applications. Great for “fair” to “excellent” credit. (e.g., SoFi in the US, Zopa in the UK, Fairstone in Canada).

o Credit Unions: Local, non-profit institutions. They often offer the best interest rates and more personal service, especially if you are already a member.

o Major Banks: (e.g., Chase, Barclays, RBC, NAB). Can be a good option if you have an excellent credit history and a long-standing relationship with them.

· Use “Pre-qualification” Tools: This is the most important part of shopping. Almost all online lenders and many banks offer a “check your rate” or “pre-qualify” button. This asks for your basic info and performs a “soft credit pull,” which does NOT affect your credit score. This allows you to see your likely APR and payment from 3-5 different lenders so you can compare them.

Step 3: Gather Your Documents (The Checklist)

Once you’ve chosen the best offer, you’ll move to the formal application. Have these documents scanned and ready:

· Proof of ID: Driver’s license, passport.

· Proof of Address: A recent utility bill, bank statement, or council tax/lease agreement.

· Proof of Income:

o US: Recent pay stubs, last 1-2 years of W-2s.

o UK: Recent payslips, P60.

o Canada: Recent pay stubs, T4 slip.

o Australia: Recent payslips, income statement from myGov.

· List of Debts: A list of the credit card account numbers and exact payoff balances.

Step 4: Formal Application, Approval, and Funding

This is when you complete the full application. The lender will perform a “hard credit pull” (which temporarily dips your score 3-5 points).

· Approval: If your documents, credit, and DTI match your pre-qualification, you’ll be approved. You will sign your loan agreement digitally. Read the fine print! Check for origination fees or prepayment penalties.

· Funding: This is fast. Online lenders can often fund your loan (deposit the cash into your bank account) in as little as 1-2 business days.

Step 5: Pay Off Your Credit Cards (The Final Move)

· Option A (Most Common): The lender deposits the $18,000 (or your total) into your checking account. It is your responsibility to log in to each of your credit card accounts and make the full payoff payment. DO THIS IMMEDIATELY. Do not wait. The temptation to spend that cash is the biggest risk.

· Option B (Safer): Some lenders (like Discover in the US) offer “direct payment.” You provide them your card account numbers, and they send the money directly to your creditors for you. This is a fantastic, foolproof feature if it’s available.

Key Tip: Comparing 3-4 pre-qualified offers is the single best way to save money. A 2% difference in APR on a $20,000 loan over 5 years could save you over $1,100.

Personal Loans vs. Balance Transfer Credit Cards — Which Option Is Better for Debt Consolidation?

A personal loan isn’t your only option. The other main strategy, especially for those with good to excellent credit, is a 0% APR balance transfer credit card. Understanding the difference is key to picking the right tool for your specific situation.

A balance transfer card is a new credit card that offers an introductory period (usually 12 to 21 months) with 0% interest on balances you transfer from other cards.

· How it works: You get approved for a new card with, say, a $15,000 limit and a 0% APR for 18 months. You then “transfer” your $14,000 in high-interest debt to this new card. You must pay a one-time balance transfer fee, typically 3% to 5% of the amount transferred (e.g., $420 – $700 on $14,000). For the next 18 months, 100% of your payment goes to principal, as you are not charged any interest.

Let’s compare this head-to-head with a personal loan.

| Feature | Personal Loan | Balance Transfer Card |

| Best For | Large debts (e.g., >$10k) or needing a long time (2-5 years) to repay. | Smaller debts (e.g., <$10k) and disciplined borrowers who can pay it all off within the intro period. |

| Interest Rate | A low, fixed rate (e.g., 8-15%) for the life of the loan. | 0% introductory APR (for 12-21 months). |

| Key Fee | May have an “Origination Fee” (0-6%) deducted from the loan. | A “Balance Transfer Fee” (3-5%) added to your new balance. |

| The “Catch” | You pay interest from day one (though it’s a low rate). | If you don’t pay off the entire balance by the end of the intro period, the “go-to” rate (often 22%+) applies to the remaining balance. |

| Required Credit | “Fair” to “Excellent” (e.g., 630+ FICO). | “Good” to “Excellent” (e.g., 690+ FICO). Lenders must trust you with a large new limit. |

Case Study: Chloe’s Decision (UK)

· The Problem: Chloe, an administrator in Manchester, UK, has £6,000 in credit card debt at an average 21.9% APR. Her credit score is “good.” She’s trying to decide between two options.

· Option 1: The Personal Loan. She’s pre-approved for a £6,000 loan at 10% APR over 3 years.

o Monthly Payment: £193.50

o Total Interest Paid: £966

o Total Cost: £6,966

· Option 2: The Balance Transfer Card. She’s approved for a card with a 0% APR for 18 months. It has a 3% balance transfer fee.

o Balance Transfer Fee: 3% of £6,000 = £180.

o New Balance: £6,180.

o To pay it off in 18 months, her payment must be: £6,180 / 18 = £343.33 per month.

o Total Cost: £6,180 (if paid on time).

· The Decision: The balance transfer card is $800 cheaper! But, Chloe looks at her budget. She cannot afford the £343 payment. The £193 payment from the personal loan is much safer and more manageable for her. She chooses the personal loan because she knows she can make the payment every month without stress. If she could have afforded the higher payment, the 0% card would have been the clear winner.

Key Takeaway: A balance transfer card is a sprint. It’s the cheapest route if you have the discipline and budget to pay off the entire debt before the 0% intro period expires. A personal loan is a marathon. It’s a structured, safe, and predictable plan that gives you more time and a fixed payment, even if it costs a bit more in interest.

Explore more details here → See our picks for the “Best 0% APR Balance Transfer Cards” this month.

Key Risks and Considerations Before Consolidating Your Credit Card Debt with a Loan

A personal loan is a powerful tool, but it is not a magic wand. It’s crucial to go into this process with your eyes open. If misused, a consolidation loan can put you in an even worse financial position. Here are the key risks to understand and avoid.

Risk 1: Not Solving the Root Problem (The “Reload” Risk)

This is the single biggest danger. The loan does not fix the spending habits, budgeting issues, or income problems that led to the credit card debt in the first place.

· The Trap: You get a $20,000 loan. You pay off your five credit cards. You feel amazing! Your cards all have a $0 balance. You suddenly have $20,000 in newly available credit.

· The “Reload”: A small emergency happens. You put $500 on a card. Then you book a “small” vacation for $1,500. You justify it because the “balances are zero.”

· The Spiral: One year later, you are stuck with the $20,0s00 personal loan payment AND $8,000 in new credit card debt. You are in a debt spiral, and your situation is now far worse.

How to Avoid It: A personal loan must be paired with a firm commitment to a new budget. You must track your spending and, for many people, you should freeze or close your old credit cards to remove the temptation completely.

Risk 2: Ignoring the Total Cost (Fees and Interest)

You must read the loan agreement carefully.

· Origination Fees: Many lenders, especially those for “fair” credit, charge an “origination fee.” This is a setup fee of 1% to 6% of the loan amount, and it’s deducted from your funds. For a $20,000 loan, a 5% fee means you only receive $19,000. You are now paying interest on a $20,000 loan but only got $19,000 to pay your debts. You must factor this fee into your calculation. (The APR legally includes this fee, which is why you must compare APRs, not just “interest rates.”)

· Prepayment Penalties: Avoid any loan that charges you a fee for paying it off early. This is less common in the US, UK, CA, and AU for unsecured loans, but you must check. You want the flexibility to pay extra if you get a bonus.

Risk 3: Taking a Bad Deal

Not all loan offers are good ones. If your credit score is “poor” (e.g., < 600 FICO in the US), your personal loan offers might come with APRs of 25%, 30%, or even 36%. If your current credit cards are at 22%, taking a 28% APR loan is a terrible financial move. You would be locking in a higher rate.

How to Avoid It: Calculate your weighted average APR on your current cards. If your new loan’s APR isn’t at least a few percentage points lower, it’s not worth it.

Risk 4: The “Low Payment” Trap (Extended Terms)

A lender might offer you a “comfortably low” payment of $250 a month. This looks great, but they achieved it by extending the loan term to 7 years (84 months). A longer term means a lower payment, but you will be in debt for much longer and will pay far more in total interest.

How to Avoid It: Always choose the shortest loan term you can comfortably afford. A higher payment over 3 years is thousands of dollars cheaper than a “low” payment over 7 years.

| Risk | The Potential Negative Outcome | How to Prevent It |

| The “Reload” | You end up with the loan and new card debt. | Create a strict budget. Freeze or close your paid-off credit cards. |

| High Fees | An origination fee eats up your savings. | Compare APRs (not just interest rates), which include fees. Prioritize “no-fee” loans. |

| A Bad Rate | Your new loan is more expensive than your cards. | Only accept a loan if the APR is significantly lower than your cards’ average APR. |

| Long-Term Trap | You choose a 7-year term and pay 3x more in interest. | Choose the shortest term (e.g., 3-5 years) with a payment you can realistically afford. |

Key Takeaway: A consolidation loan is a commitment. It only works if you simultaneously commit to changing the financial habits that created the debt.

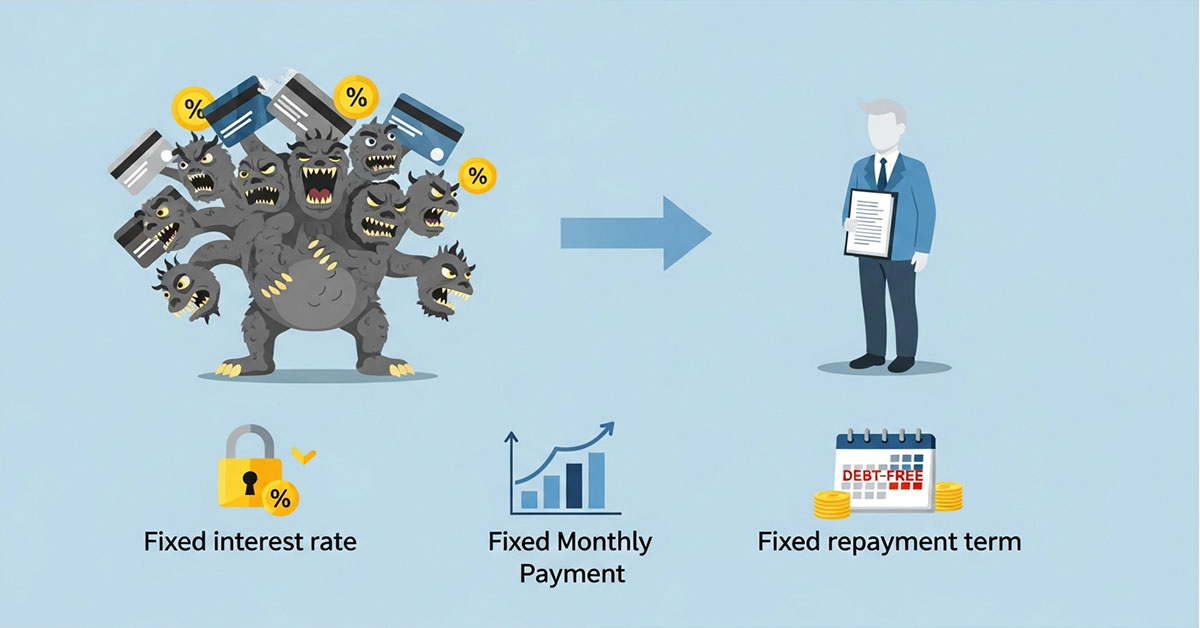

How Debt Consolidation Loans Help Reduce High-Interest Credit Card Payments

The mechanics of a debt consolidation loan are simple but powerful. They work by performing interest rate arbitrage: you are using a low-cost debt product (a personal loan) to pay off a high-cost debt product (credit cards).

Credit card interest is a “revolving” and “compounding” monster. The interest you don’t pay one month gets added to your principal balance, and then you’re charged interest on that interest the next month. At 20%+ APR, this is a financial fire that spreads quickly.

A personal loan is an “amortizing” loan. This means each payment is a calculated split of principal and interest. From your very first payment, a portion is guaranteed to chip away at your original balance.

Let’s look at the first-month payment on a $15,000 debt:

| Debt Product | APR | Monthly Payment | Interest Paid (Month 1) | Principal Paid (Month 1) |

| Credit Card | 21% | $350 | ~$262.50 | ~$87.50 |

| Personal Loan | 11% | $491 | ~$137.50 | ~$353.50 |

Look at the difference. With the personal loan, over $350 of your payment goes directly to killing your debt. On the credit card, less than $90 does. The personal loan is over 4x more effective at paying down your principal from Day 1, even though the payment is not 4x larger. This is the power of a lower interest rate. You are redirecting your money from the bank’s “interest” profit column to your own “principal” equity column.

Expert Insight: A financial planner will tell you that the goal is to stop paying compound interest and start paying down principal. A consolidation loan is the most direct way to do this. You are changing the rules of the game to be in your favor.

Why Managing a Single Fixed Monthly Payment Simplifies Your Finances

The psychological benefit of a single payment is often more valuable than people realize. Our brains are not designed to juggle multiple, high-stakes, “must-not-miss” deadlines. This creates “decision fatigue” and chronic, low-level stress.

· Reduces “Cognitive Load”: Instead of a mental spreadsheet tracking “Card 1 is due on the 5th, Card 2 on the 14th, Card 3 on the 23rd,” you have one date. You know your loan is due on the 1st, period.

· Makes Budgeting Simple: A fixed payment is a “known quantity.” It becomes just like your rent, mortgage, or car payment. You build your monthly budget around this fixed, non-negotiable cost. It’s no longer a variable you have to guess at.

· Eliminates Late Fee Risk: It is incredibly easy to automate one payment. It’s much harder to perfectly automate five. By automating your single loan payment, you virtually eliminate the risk of missing a payment, which saves you from $30-$50 late fees and, more importantly, protects your credit score from the severe damage a 30-day-late-payment report can cause.

| Aspect | Before (Multiple Cards) | After (Single Loan) |

| Budgeting | Chaotic. Payments are variable and due all month. | Simple. One fixed payment on one due date. |

| Stress Level | High. Constant worry about due dates and high interest. | Low. “Set it and forget it” automated payment. |

| Risk | High risk of missing a payment, incurring fees and credit damage. | Low risk. Automation makes it almost foolproof. |

Expert Insight: Behavioral economists call this “reducing friction.” The easier you make it to do the right thing (pay your debt), the more likely you are to succeed. A single payment is the ultimate friction-reducer.

Expert Tips to Boost Your Approval Chances for a Personal Loan

Getting approved for the best rate is the goal. A “fair” credit score might get you a 19% APR, while a “good” score might get you 11%. Here’s how to put your best foot forward.

1. Check Your Credit Report for Errors: This is the #1 first step. A simple mistake—a closed account showing as open, a late payment that wasn’t yours—can tank your score. Get your free reports (from annualcreditreport.com in the US, or directly from agencies in UK/CA/AU) and dispute any errors immediately.

2. Lower Your Utilization (If You Can): This is a catch-22, as you need the loan to lower your utilization. But if you have any savings, consider paying down one card to get it below 50% utilization before you apply. This can provide a small, quick score boost.

3. Do NOT Apply for Any Other New Credit: In the 1-3 months before you apply, do not apply for a new store card, a new car loan, or anything else. You want your credit file to look stable.

4. Use Pre-qualification: Do not go on an “application spree.” Every formal application is a “hard inquiry” that dings your score. Shop using “soft pull” pre-qualification tools to find the best offer, then submit one single, formal application to the lender you’ve chosen.

5. Consider a Co-signer or Credit Union: If your credit is “fair” (e.g., low 600s FICO), your approval chances are slim. Applying with a co-signer (in the US/Canada) who has excellent credit can get you approved with a great rate. Alternatively, your local credit union is more likely to look at your whole financial picture (not just your score) if you’re a member.

Expert Insight (from a former loan underwriter): “We look for stability above all else. A ‘fair’ credit score with a 5-year history at the same job and stable income is often more appealing than an ‘excellent’ score from someone who just started a new business and has erratic income. Show us you are a stable, reliable borrower.”

How to Choose the Right Lender, Loan Amount, and Term for Maximum Savings

Choosing the wrong loan details can cost you thousands. Follow this simple framework.

· Lender:

o Credit Unions: Start here. They are non-profits and typically offer the best APRs to their members.

o Online Lenders: Best for speed, convenience, and comparing multiple pre-qualified offers in minutes.

o Major Banks: A good option only if you have excellent credit and an existing, long-term relationship with them.

· Loan Amount:

o Borrow exactly what you need to pay off the cards, plus any balance transfer fees.

o The Trap: A lender pre-approves you for $25,000, but you only have $18,000 in debt. They’ll say, “Why not take the extra and have a cushion?” This is a costly mistake. You’re now paying interest on $7,000 you didn’t need. Borrow only what you owe.

· Loan Term (The Most Important Choice):

o Shorter Term (e.g., 3 years): Higher monthly payment, but you pay far less total interest and get debt-free faster.

o Longer Term (e.g., 5-7 years): Lower, more “comfortable” monthly payment, but you pay far more total interest and stay in debt longer.

Look at the difference on a $15,000 loan at 10% APR:

| Loan Term | Monthly Payment | Total Interest Paid | Total Cost of Loan |

| 3 Years (36 months) | $484 | $2,424 | $17,424 |

| 5 Years (60 months) | $319 | $4,140 | $19,140 |

| 7 Years (84 months) | $243 | $6,012 | $21,012 |

Expert Insight: The 7-year loan has the “lowest” payment, but it costs you $3,588 more than the 3-year loan. The rule is: Choose the shortest term with a monthly payment you can comfortably and consistently afford. Don’t stretch yourself too thin, but don’t fall for the “low payment” trap of a 7-year term.

Best Alternatives to Personal Loans for Paying Off Credit Card Debt

A personal loan is just one tool. Depending on your credit and discipline, these alternatives might be better.

1. 0% APR Balance Transfer Card:

o As discussed in H2.5, this is the cheapest way to pay off debt if your credit is excellent and you can pay the entire balance before the 0% intro period ends. It’s a sprint, not a marathon.

2. Debt Management Plan (DMP):

o This is not a loan. You work with a non-profit credit counseling agency (like NFCC in the US, StepChange in the UK, or Credit Counselling Canada).

o How it works: They consolidate your debts without a new loan. They negotiate with your card companies to get your interest rates dramatically lowered (e.g., from 22% down to 8%). You make one single monthly payment to the agency, and they distribute it to your creditors.

o Best for: People who are overwhelmed, have fair/poor credit (and can’t get a good loan), and need the accountability of a structured program.

o Con: You must agree to close your credit cards. It takes 3-5 years.

3. Home Equity Loan or HELOC:

o This involves borrowing against the equity in your home.

o Pro: The interest rates are very low (often 6-9%) because the loan is secured by your house.

o Con: EXTREME RISK. You are trading unsecured debt (credit cards) for secured debt. If you fail to pay your HELOC, the bank can foreclose on your home. This is only for the most disciplined borrowers who are 100% certain they can make the payments.

| Solution | Best For | Key Risk |

| Personal Loan | Good credit; needing 2-5 years to pay. | Racking up new card debt (the “reload”). |

| 0% BT Card | Excellent credit; can pay off < 21 months. | High “go-to” APR if not paid off in time. |

| DMP (Non-Profit) | Fair/Poor credit; need accountability. | Must close cards; takes 3-5 years. |

| HELOC | Homeowners; need the lowest rate. | You could lose your home if you default. |

How Consolidating Credit Card Debt Impacts Your Credit Score Over Time

Many people fear a consolidation loan will hurt their credit. The reality is that, when managed correctly, it is one of the best things you can do for your credit score. Here is the timeline:

· The First Month (The Dip): Your score will likely drop 5-15 points. This is normal and temporary. It’s caused by two things:

1. Hard Inquiry: The lender’s formal application.

2. New Account: The new loan lowers your “average age of accounts,” which is a scoring factor.

· Months 2-6 (The Jump): Your score will likely rise significantly, often 20-50+ points above where you started. This is driven by one huge factor:

1. Credit Utilization: Your credit report updates to show all your cards are at a $0 balance. Your utilization ratio plummets from (for example) 90% down to 0%. This is a massive positive signal to all credit scoring models (FICO, VantageScore, etc.).

· Months 6-36 (The Climb): Your score will continue to grow steadily. This is driven by:

1. On-Time Payment History: Every on-time payment you make on the new loan builds a perfect, positive payment history.

2. Credit Mix: You now have an “installment loan” on your file, which diversifies your credit profile.

Expert Insight: “Do not panic at the initial, temporary drop in your score. It is a tiny, short-term price to pay for the massive, long-term gain you get from slashing your credit utilization. Paying off maxed-out cards is the fastest way to build your score.”

Loan Eligibility and Minimum Credit Score Requirements Explained

Lenders place you into tiers based on your credit score. These scores (and the “good” / “bad” labels) vary slightly by country, but the concept is universal.

· Excellent Credit (e.g., 740+ FICO in US): You are a “prime” borrower. You will get the best offers from all lenders, with the lowest APRs (e.g., 6-10%) and no origination fees.

· Good Credit (e.g., 670-739 FICO in US): You are a solid candidate. You will get many competitive offers, especially from online lenders and credit unions. Expect APRs from 10-16%.

· Fair Credit (e.g., 580-669 FICO in US): You are a “subprime” or “near-prime” borrower. Your options are limited. Major banks will likely deny you. Online lenders who specialize in “fair credit” are your best bet. Expect high APRs (18-30%) and origination fees. The loan is only worth it if this is still lower than your card APRs.

· Poor Credit (e.g., <580 FICO in US): It is very difficult to get an unsecured personal loan. Your best options are a DMP, a secured loan (using a car as collateral), or a loan with a co-signer.

Remember: Your Debt-to-Income (DTI) ratio is just as important. You can have an 800 credit score, but if your DTI is 60%, you will be denied. Lenders must see that you have enough income to cover your existing bills plus the new loan.

Comparing Interest Rates, Fees, and Repayment Terms Across Major Lenders

When you have 3-4 loan offers, don’t just look at the monthly payment. You must compare them apples-to-apples. Use this checklist.

1. What is the APR (Annual Percentage Rate)?

o This is the only rate that matters. It includes the interest rate plus most fees (like origination fees), giving you the “true” cost of the loan. A 10% rate with a 5% fee is a worse deal than a 12% APR with no fee.

2. Is there an Origination Fee?

o If so, is it deducted from the loan amount? (e.g., you borrow $20k, they give you $19k). Make sure you borrow enough to cover this and your debts.

3. Is there an Early Repayment Penalty?

o Avoid these! You want the freedom to pay extra (e.g., from a tax refund or bonus) to get out of debt even faster. Most reputable online lenders and credit unions do not have these.

4. What is the Term (Length)?

o As shown in H3.4, a 3-year vs. 5-year term changes the total cost dramatically.

Take Action → Create a simple spreadsheet. Put your 3 best offers in columns and these 4 questions in rows. The best loan will have the lowest APR for the shortest term you can afford, with no early repayment penalty.

Best Practices for Managing Consolidated Debt Responsibly

You got the loan. The cards are paid off. The hard work starts now.

1. Automate Your Loan Payment: This is non-negotiable. Set up an automatic transfer from your checking account for the day after you get paid. This makes it impossible to be late.

2. Build a Starter Emergency Fund: Your #1 priority is to save $1,000 (US/CA/AU) or £500 (UK) as fast as possible. This “buffer” is what will pay for the next flat tire or emergency, preventing you from using a credit card and starting the cycle all over again.

3. Decide What to Do With the Old Cards:

o Don’t just carry them in your wallet.

o Good: Close all but your oldest credit card. Keep that one open (to preserve your “average age of accounts”), put it in a sock drawer, and use it once every 6 months for a tank of gas (and pay it off immediately) to keep it active.

o Better (for most): Freeze them all. Literally, put them in a Tupperware container, fill it with water, and put it in your freezer.

o Best (if you lack discipline): Call and close the accounts. A slight, temporary hit to your credit score is far better than the risk of $20,000 in new debt.

Common Mistakes Borrowers Make When Using Personal Loans for Consolidation

Here are the traps that catch smart people.

· The “Reload” Mistake: Racking up new card debt. (See H2.6)

· The “Low Payment” Mistake: Choosing a 7-year loan instead of a 3-year loan to get a lower payment, which costs thousands more in interest.

· The “Cash Out” Mistake: Borrowing $25,000 for a $20,000 debt “just to have extra.” This is not a “cushion”; it’s just more debt at 12% interest.

· The “Closing All Cards” Mistake: Closing your oldest credit card (the one you’ve had for 10 years) can shorten your credit history and lower your score. It’s better to keep that one open with a $0 balance.

· The “Not Reading the Fine Print” Mistake: Getting blindsided by a 6% origination fee or an early repayment penalty.

Fixed-Rate vs. Variable-Rate Personal Loans — Which Is Right for You?

This is an easy choice.

· Fixed-Rate Loan: The interest rate and monthly payment are locked in for the life of the loan. If central banks raise interest rates, your payment does not change. 99% of personal loans offered for debt consolidation are fixed-rate.

· Variable-Rate Loan: The interest rate is tied to a financial index (like SOFR). It may start slightly lower than a fixed rate, but it can (and will) rise over the 3-5 years of your loan. This means your monthly payment could go up.

The Verdict: Always choose a fixed-rate loan for debt consolidation. The entire point of this strategy is to gain certainty, predictability, and control. A variable-rate loan introduces uncertainty and risk, which is the very thing you are trying to escape.

Steps to Ensure Long-Term Financial Success After Debt Consolidation

Your debt-free date on the loan is not the finish line; it’s the starting line for building wealth.

1. Month 1: Create a Budget. You must have a plan for your income. A zero-based budget (where every dollar/pound is given a “job”) is the most effective.

2. Months 1-6: Build Your Emergency Fund. After your $1,000 starter fund, keep going. Your goal is to have 3-6 months’ worth of living expenses saved. This is your permanent shield against future debt.

3. Month 37 (After Your Last Loan Payment): This is the magic moment. You are now 100% debt-free. Your first act should be to take that $484 (or whatever your loan payment was) and automate a new transfer for that same amount from your checking account to a retirement or investment account. You are already used to living without that money. Now, make that money work for you. This is how you build real, lasting financial freedom.

Prequalification and Required Documentation Checklist for Personal Loans

Before you get to the formal application, you’ll “pre-qualify.”

· Prequalification: This is a “soft credit pull” (no impact on your score) where you provide basic info:

o Name & Address

o Gross Annual Income

o Estimated Credit Score

o Loan Amount Requested

o Reason for Loan (select “Debt Consolidation”)

· This will give you an estimated APR and payment.

· Formal Application (Required Documents): To get the final, “firm” offer, you will need to upload:

o Identity: Driver’s License or Passport (US, UK, CA, AU).

o Address: A recent utility bill, bank statement, or council tax bill (UK) that matches your application address.

o Income: Your last two pay stubs/payslips.

o Tax Info: Last 1-2 years of W-2s (US), T4s (Canada), P60 (UK), or ATO income statement (AU).

o Debts: A list of the creditors you’re paying off (sometimes with account numbers).

H5: How to Evaluate Total Loan Cost vs. Credit Card Interest Over Time

Don’t guess at your savings. Prove it to yourself with this 5-minute math.

1. Find Your “Current” Total Interest:

o Go to an online “Credit Card Payoff Calculator.”

o Enter your total balance (e.g., $20,000), your average APR (e.g., 21%), and your current total monthly payment (e.g., $600).

o The calculator will tell you your payoff time (e.g., 48 months) and your Total Interest Paid (e.g., $8,550).

2. Find Your “New” Total Interest:

o Go to a “Personal Loan Calculator.”

o Enter your new loan offer: $20,000 balance, 11% APR, and a 36-month (3-year) term.

o It will tell you the monthly payment (e.g., $655) and your Total Interest Paid (e.g., $3,450).

3. Compare:

o In this scenario, your savings are $8,550 – $3,450 = $5,100.

o Result: You are paying $55 more per month, but you get out of debt 12 months faster and save over $5,000. This is a clear, mathematical win.

Smart Budgeting Strategies After Consolidating Credit Card Debt

Your new, simplified loan payment makes budgeting easy. Here are the top strategies.

· The 50/30/20 Rule: A simple guide for your take-home pay.

o 50% on Needs: Rent/mortgage, utilities, groceries, car/transit, and your new consolidation loan payment.

o 30% on Wants: Dining out, entertainment, subscriptions, hobbies.

o 20% on Savings: This is your #1 priority. Build your emergency fund first, then invest.

· The Zero-Based Budget (Best for discipline):

o Use an app like YNAB (You Need A Budget) or a simple spreadsheet.

o List your total monthly income. Then, assign every single dollar/pound to a category (e.g., $1,500 rent, $400 loan, $500 groceries, $100 fun, $200 savings… until the “left to assign” is $0).

o This forces you to be intentional with your money.

H5: Proven Techniques to Avoid New Debt While Repaying Your Loan

This is all about fighting temptation and breaking old habits.

1. The “72-Hour Rule”: For any non-essential purchase over $50 (or £50), you must wait 72 hours before buying it. Put it in your online cart, but don’t check out. After 3 days, the “must-have” impulse will have faded, and you can make a logical choice.

2. Unlink Your Cards: Go to Amazon, Uber, Apple Pay, PayPal, and your web browser. Manually delete all your saved credit card information. This “adds friction.” If you have to get up, find your wallet, and type in the 16-digit number, you’re less likely to make an impulse buy.

3. Use a “Digital Envelope” System: Use your bank’s app to create separate savings “pots” or “envelopes.” Label them “Car Repair,” “Vacation,” “Gifts.” Put small amounts in each payday. When you need to buy a gift, you pull from that “envelope” instead of a credit card.

H5: Debt Snowball vs. Avalanche Method — Which Strategy Pays Off Faster?

These are two DIY methods for paying off debt without a loan. They can also be used to pay off extra on your loan.

· Debt Snowball (Psychological Win):

o How: Pay minimums on all debts. Use all extra money to attack the debt with the smallest balance first, regardless of its interest rate.

o Why: You get a “quick win.” Paying off that $500 card in 2 months feels good and gives you the motivation to keep going.

o Best for: People who need to build momentum and feel motivated.

· Debt Avalanche (Mathematical Win):

o How: Pay minimums on all debts. Use all extra money to attack the debt with the highest interest rate first.

o Why: This is pure math. You are eliminating your most “expensive” debt first.

o Best for: People who are disciplined and motivated by numbers. This method will save you the most money and get you out of debt the fastest.

Responsible Borrowing Habits to Rebuild and Strengthen Credit

Your credit score is a long-term asset. Protect it.

1. Pay Every Bill On Time, Every Time. This is the #1 rule. It accounts for 35% of your FICO score. Automate everything (loan, utilities, phone) so you are never late.

2. Keep Credit Utilization at 0%. After you pay off your cards, do not carry a balance again. Use one card for a small, recurring purchase (like Netflix) and set up an automatic payment to pay the full statement balance every month. This shows lenders you can use credit responsibly without living on it.

3. Keep Your Oldest Account Open. Do not close your 15-year-old credit card. Keep it open with a $0 balance. This “Average Age of Accounts” is a key scoring factor.

4. Be Patient. Good credit isn’t built in a day. It’s built by demonstrating months and years of consistent, responsible behavior.

Financial Advisor Insights: Monitoring Loan Payments and Credit Utilization Ratios

A good financial advisor will tell you to “trust, but verify.”

· Automate your loan payment, but still log in once a month to ensure it went through.

· Monitor your credit utilization ratio using a free service (like Credit Karma in the US/UK/CA, or ClearScore in the UK/AU). Your goal is to see your loan balance (installment debt) go down while your credit card balances (revolving debt) stay at or near $0.

· Advisor Insight: “Your credit utilization on your revolving accounts is what matters most. After consolidation, this number should drop to near-zero. Your job is to keep it there. That single habit—paying your cards in full every month—is the key to a 800+ credit score.”

H6: Tracking Your Progress Toward Becoming Completely Debt-Free

This is the fun part. Stay motivated by making your progress visual.

· Use a Debt-Free Chart: Print out a “thermometer” or a chart with 36 boxes (one for each loan payment). Color in a box every time you make a payment. This simple visual cue is incredibly motivating.

· Watch the Principal Shrink: Look at your loan statement each month. Don’t look at the total amount; look at the “Principal” vs. “Interest” breakdown. In the first few months, a lot goes to interest. By the last year, almost all of your payment is going to principal. You’re building momentum.

· Celebrate Milestones: When your balance drops below $10,000… When you hit the 1-year mark… When you have 10 payments left… Treat yourself to a (small, budgeted-for) celebration.

Understanding Loan Origination Fees, Hidden Charges, and Early Repayment Penalties

Always read the “Loan Agreement” or “Truth in Lending” disclosure.

· Origination Fee: A one-time setup fee (0-6%). This is not a deal-breaker if the APR is still the lowest you’ve been offered. Lenders with “no fees” often just charge a slightly higher interest rate to make up for it. Always compare the APR.

· Hidden Charges: Look for “late payment fees” (which are standard) or more obscure things like “check processing fees” (if you don’t use autopay).

· Early Repayment Penalties (or “Prepayment” Penalties): This is the #1 fee to avoid. You must have the right to pay extra on your loan, or pay it off completely, at any time with no penalty. If a loan has one of these, do not take it. Reputable lenders in Tier One markets do not charge these on unsecured personal loans.

How to Manage Late or Missed Loan Payments Without Damaging Credit

Life happens. If you know you’re going to miss a payment, be proactive.

1. Call Your Lender Immediately. Do not wait until you are 30 days late. Call them the day before it’s due if you have to.

2. Explain the Situation: “I lost my job,” “I had a medical emergency.” Be honest and brief.

3. Ask for Help: Ask, “Can I defer this month’s payment to the end of the loan?” or “Can I make a partial payment now and the rest next week?” or “Can you waive the late fee just this once?”

4. Understand the 30-Day Window: A payment is not reported as “late” to the credit bureaus (Equifax, Experian, TransUnion) until it is 30 days past due. You will get a late fee from the lender if you’re 5 or 10 days late, but this does not damage your credit score. The 30-day mark is the “red line” you cannot cross.

Refinancing Options If Market Interest Rates Drop in the Future

Your consolidation loan is not a life sentence. You can—and should—refinance it if you get a better offer.

· The Scenario: You take a $20,000 consolidation loan today. Your credit is “fair,” so your APR is 18%.

· 18 Months Later: You have made every single payment on time. You’ve also kept your credit card balances at $0. Your credit score has jumped from “fair” (650) to “excellent” (760).

· The Action: You go shopping for a new personal loan. With your new excellent score, you are now offered a loan at 8% APR.

· The Result: You take the new 8% loan and use it to pay off the 18% loan in full. You just refinanced your debt, and your new, lower payment will save you thousands more.

Maintaining Strong Credit Habits After Successfully Consolidating Debt

You’ve run the marathon and paid off your loan. You are 100% debt-free. How do you stay that way?

· The Golden Rule: Never carry a credit card balance again. Ever.

· How: Your credit cards are now just a payment tool, not a loan. You use them to buy groceries or gas (to get the rewards points), and you have an automatic payment set to pay the full statement balance every month. You never pay a penny in interest.

· Live on a Budget: Your budget is not a prison; it’s your freedom plan. It tells your money where to go, instead of you wondering where it went.

· Build Savings: Your new #1 goal is to build your 3-6 month emergency fund, and then start investing for your future. This is the final step: from debt, to “0,” to “wealth.”

Frequently Asked Questions (FAQ)

“Can I Take Out a Personal Loan to Pay Off Credit Card Debt?”

Yes, absolutely. This is one of the most common and smartest reasons to get a personal loan. The entire process is called debt consolidation. You are simply swapping multiple, high-interest, variable-rate debts (your credit cards) for a single, lower-interest, fixed-rate installment loan (the personal loan). The benefits are a simplified, single monthly payment, significant savings on interest, and a clear “debt-free date.” To be successful, you must have a fair-to-good credit score to qualify for a low enough interest rate, and you must be disciplined enough to not rack up new debt on the newly paid-off cards.

“Is $20,000 in Credit Card Debt a Lot?”

Yes, $20,000 is a significant amount of credit card debt, well above the average for a single individual in the US, UK, Canada, or Australia. The real problem isn’t just the amount; it’s the cost. At a typical 21% APR, a $20,000 balance generates $4,200 in interest charges alone every year. This means you’d have to pay $350 every month just to cover the new interest and keep the balance from growing. This “interest treadmill” is why this level of debt is so difficult to pay off without a consolidation strategy, like a lower-interest personal loan or a 0% balance transfer card.

“How to Pay Off $30,000 in Debt in 1 Year?”

Paying off $30,000 in one year is extremely aggressive and requires a very high income, drastic lifestyle cuts, or both. The math is simple: you must pay $2,500 every single month toward your debt. A loan won’t change this math. Your strategy would be:

1. Dramatically Increase Income: Get a second job, do gig work (Uber, freelance), sell items, and put 100% of this extra income toward the debt.

2. Ruthlessly Cut Expenses: Go on a “scorched earth” budget: no dining out, no vacations, no subscriptions, no new clothes.

3. Use the Avalanche Method: Attack the highest-interest-rate card first with all your extra cash to save the most money.

A 0% balance transfer card could help you if you could get a $30,00V limit, but you would still need to pay $2,500/month.

“How Much Would a $30,000 Personal Loan Cost per Month?”

The monthly cost depends entirely on the APR (interest rate) and the Term (loan length) you are approved for. Here are a few common examples:

· Aggressive 3-Year (36-month) Term:

o At 9% APR: ~$954 per month

o At 14% APR: ~$1,025 per month

· Standard 5-Year (60-month) Term:

o At 9% APR: ~$623 per month

o At 14% APR: ~$700 per month

· Extended 7-Year (84-month) Term:

o At 9% APR: ~$482 per month

o At 14% APR: ~$570 per month

Key Tip: Notice the 7-year loan costs thousands more in total interest. Always choose the shortest term with a monthly payment you can comfortably afford in your budget.

“Best Personal Loan for Credit Card Debt with Bad Credit”

Having “bad credit” (e.g., a FICO score below 600 in the US, or the equivalent “poor” rating in the UK/AU/CA) makes it very hard to get an unsecured personal loan that is actually cheaper than your credit cards. Your options will be limited and expensive, but you still have a few paths:

1. Credit Unions: Start here. If you are a member, they may be more willing to look at your whole financial picture.

2. Online Lenders for “Fair Credit”: Lenders like Upgrade or Avant (in the US) specialize in this area, but expect very high APRs (25-36%). Only accept if this is still lower than your card APRs.

3. Get a Co-signer: Applying with someone (like a parent or spouse) who has “excellent” credit is your best bet for a good rate.

4. Consider a Debt Management Plan (DMP): A non-profit credit counselor can negotiate your rates down without a new loan.

“Personal Loan for Credit Card Debt Calculator — Estimate Savings”

You don’t need a special calculator. You just need to compare the “Total Interest Paid” in two different scenarios:

1. “Before” (Your Current Debt): Use a Credit Card Payoff Calculator. Enter your total balance (e.g., $15,000), your average APR (e.g., 20%), and the total monthly payment you are making now (e.g., $400). Note the “Total Interest Paid” (e.g., $6,800).

2. “After” (The New Loan): Use a Personal Loan Calculator. Enter the loan offer you’re considering: $15,000 balance, a new APR (e.g., 10%), and a new term (e.g., 36 months). Note the “Total Interest Paid” (e.g., $2,380).

3. Your Savings: The difference between the two. In this example, $6,800 – $2,380 = $4,420 in estimated savings.

“Is It Worth It to Get a Personal Loan to Pay Off Credit Card Debt?”

It is 100% worth it under two conditions:

1. You secure a new loan with an APR that is significantly lower than the average APR of your credit cards.

2. You are fully committed to changing your spending habits, sticking to a budget, and not racking up new debt on the now-empty credit cards.

If you can get a 10% loan to pay off 22% cards, you will save thousands of dollars, simplify your life with one payment, and get out of debt years faster. If you also use this as a chance to fix the underlying spending problem, it can be the single best financial decision you ever make.

“Pros and Cons of Using a Personal Loan for Credit Card Consolidation”

· Pros:

o Saves Money: A lower, fixed APR means you pay far less in total interest.

o Simplicity: One fixed monthly payment is easier to manage than 3-5 variable ones.

o Clear End Date: A fixed term (e.g., 3 years) gives you a guaranteed “debt-free date.”

o Credit Score Boost: Paying off cards slashes your “credit utilization,” which can significantly increase your credit score in the long run.

· Cons:

o Risk of “Reloading”: The biggest risk. You get the loan, pay off the cards, then run up new debt on the empty cards, putting you in a worse position.

o Fees: Some loans have “origination fees” (1-6%) that reduce your savings.

o Requires Qualification: You need fair-to-good credit to get a rate low enough to be worthwhile.

“Credit Card Consolidation Loan vs. Debt Management Plan — Which Works Better?”

They work for different people.

· A Consolidation Loan is a new financial product you get from a lender (bank, credit union). It’s best for people with fair-to-good credit who can qualify for a low APR. It gives you the “lump sum” and you are responsible for paying off the old cards. It offers more flexibility but requires more self-discipline.

· A Debt Management Plan (DMP) is a service you get from a non-profit credit counseling agency. It’s best for people with poor-to-fair credit who can’t qualify for a good loan. They negotiate with your creditors to lower your rates, and you pay the agency one monthly payment. It’s more restrictive (you must close your cards) but provides more accountability.

“SoFi, Upgrade & Discover Debt Consolidation Loans — Which Offers Best Rates for Tier One Markets?”

These three lenders are primarily US-based, so this comparison is for the US market.

· SoFi: Best for excellent credit (700+ FICO) and high earners. They offer very competitive, low rates, high loan amounts (up to $100k), and typically have no origination fees. They are a top-tier “prime” lender.

· Upgrade: Best for fair credit (600-670 FICO). Upgrade is more accessible if your score isn’t perfect. However, you will pay for that accessibility. Expect higher APRs and origination fees (1.85%-9.99%) that are built into the loan.

· Discover: A strong all-around option for good credit (660+ FICO). A major benefit is that Discover can pay your creditors directly, which removes the “reload” temptation. Their rates are competitive and they are a trusted, established brand.

For UK, Canada, & Australia: You would compare lenders in your country.

· UK: Compare high-street banks (Barclays, Lloyds) vs. online lenders (Zopa, Lendable).

· Canada: Compare major banks (RBC, TD) vs. credit unions vs. online lenders (Fairstone, easyfinancial).

· Australia: Compare the “Big Four” banks (CBA, NAB) vs. online “fintech” lenders (Plenti, Harmoney).