Get trusted personal loan consolidation options from credit unions in the US, UK, Canada & Australia. Lower rates, flexible terms, and proven debt relief.

Seeing a life with only one debt payment per month, and a payment that’s smaller than what you’re currently shelling out each month on all your credit cards and old personal loans. That is the empowering legacy of personal loan and debt consolidation loans. While this strategy won’t work for everyone, it’s more than just a financial hack to help consumers who are drowning in high-interest debt in the US, UK, Canada and Australia regain control.

It can feel like a nightmare: the agony of multiple due dates, unclear minimum payments, and perpetual high interest rates from credit card consolidation loans. A representative U.S. family, for example, may be dealing with three credit cards and a small personal loan — at rates between 18% and 30%-plus APR. They’re paying hundreds in interest each month, with little to show for it when it comes to the principal.

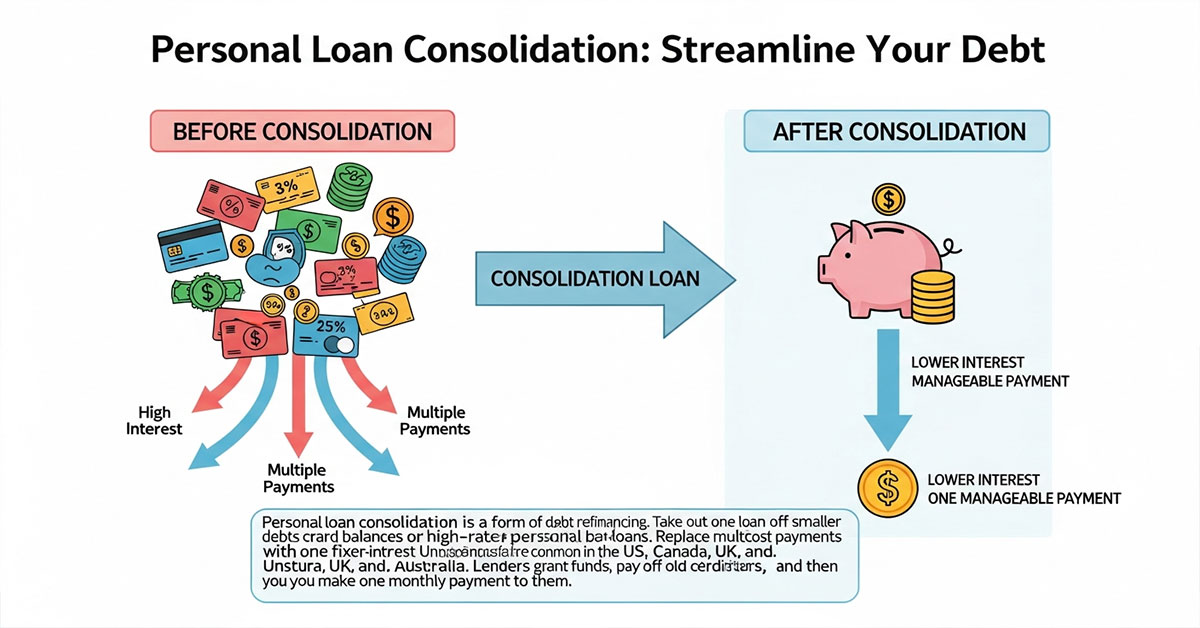

A personal loan consolidation is a new loan that combines multiple high-interest debts. You end up locking in an interest rate and fixed monthly payment that may be lower — a tidy end date to go with it. This simplifies your financial life, and important savings money because you pay a great deal less in interest over the life of the loan. Think of it as you hitting the reset button on your debt.

In 2025, it’s all about that lower annual percentage rate (APR). Tier 1 market lenders are vying for highly qualified applicants driven by competitive terms on debt consolidation loans. Whether you want to avoid high rates on revolving credit, or send your existing installment loans through the financial washing machine to make payments more manageable; now is a great time take a look at your options. You have the opportunity to save hundreds of dollars on your total monthly debt payments and get out of debt years sooner.

What is Personal Loan Consolidation? How It Helps in Debt Management in the US, UK, Canada, and Australia

Personal loan consolidation is a form of debt refinancing where you take out a single, large personal loan to pay off several smaller debts. These smaller debts often include high-interest credit card balances, payday loans, or existing high-rate personal loans. The ultimate goal is to replace multiple confusing, high-cost payments with one fixed, manageable payment that features a lower overall interest rate.

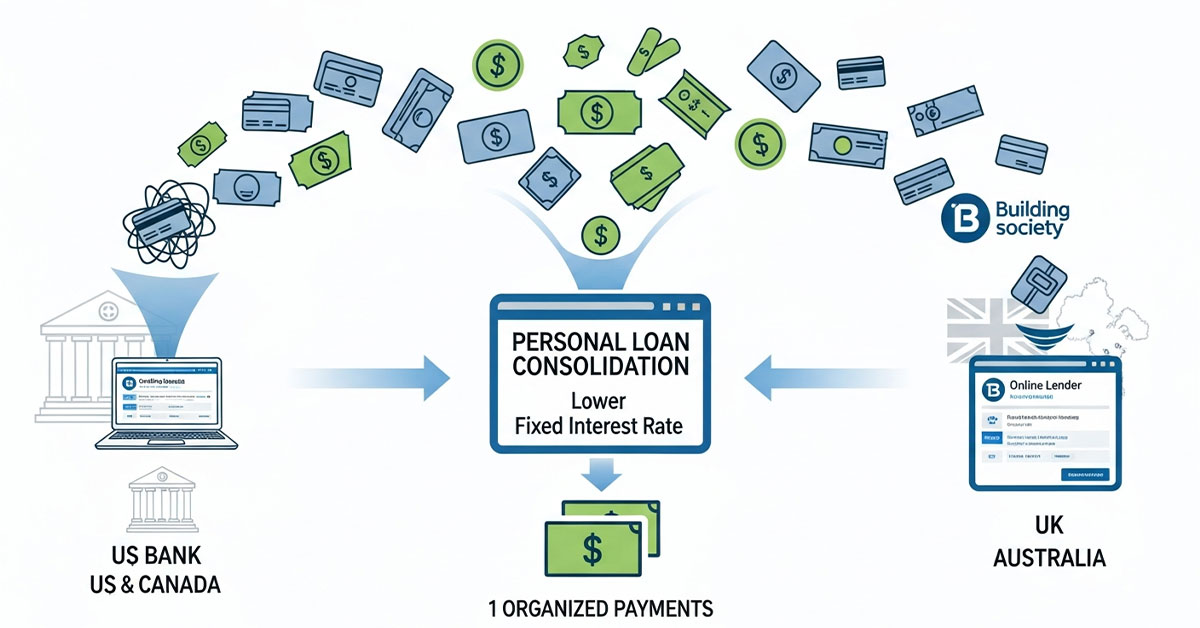

In the US and Canada, unsecured personal loans are the most common tool for consolidation. In the UK and Australia, the process is much the same, where banks, building societies and online lenders will give unsecured loans. The process is this: a consolidation lender grants you the money, transfers it to pay off your old creditors directly (in many cases), then starts charging you for one payment each month to them.

Case Study: Sarah’s Debt Transformation in Sydney, Australia

Sarah, a marketing professional in Sydney, was struggling with $25,000 AUD in debt spread across three credit cards (average APR 20.5%) and a car repair loan (15% interest). Her total minimum monthly payments were hitting $1,250 AUD.

Sarah applied for a debt consolidation loan and was approved for $25,000 AUD at a fixed APR of 10.99% over a 5-year term.

| Old Debts | Balance (AUD) | APR (%) | Old Monthly Payment (Approx.) |

| Credit Card 1 | $10,000 | 22.99% | $350 |

| Credit Card 2 | $8,000 | 18.99% | $275 |

| Credit Card 3 | $3,000 | 20.00% | $100 |

| Repair Loan | $4,000 | 15.00% | $525 |

| Total Old Debt | $25,000 | ~20.5% | $1,250 |

| New Consolidation Loan | $25,000 | 10.99% | $543 |

Compiling the debt meant Sarah’s total monthly payment shrank from $1,250 to $543 AUD. She saved more than $700 a month, and, more significantly, her interest payments over the life of the debt from thousands of dollars to a fixed amount she could easily manage. Any debt she now holds comes with a clear expiration date.

That’s the advantage of a successful personal loan consolidation: It turns high-cost revolving debt (from credit cards) into low-cost installment debt. It simplifies debt management and accelerates your financial freedom. A strong credit score is necessary to get the best rates, but there are options in all Tier One markets for different credit profiles.

Key Result: Sarah saved over $700 AUD monthly and secured a 10% lower interest rate by moving to a debt consolidation loan.

How Personal Loan Consolidation Works: Step-by-Step Guide for US, UK, and Canadian Borrowers

Successfully executing a personal loan consolidation is a strategic process, not just a simple transaction. For borrowers in the US, UK, and Canada, following a clear step-by-step guide can maximize your savings and approval chances.

Step 1: Tally Your Debts and Goals

Before approaching any lender, you need a precise picture of your financial reality. List every high-interest debt—especially credit card consolidation loans candidates—including the creditor name, current balance, and the current APR.

· US Tip: Focus on balances with APRs above 15% to maximize your savings.

· UK Tip: Include high-interest store cards and overdrafts in your tally.

· Canadian Tip: Check if your existing loans have prepayment penalties, which could offset some savings.

Your goal is not just to simplify, but to secure a new loan with an APR that is significantly lower than your average existing APR.

Step 2: Check Your Credit Score

Your credit score (FICO in the US, credit rating in the UK, Equifax/TransUnion in Canada) is the single most important factor determining the rate you qualify for. A good to excellent score (e.g., 670+ FICO in the US, 700+ Equifax in Canada, or 600+ Experian in the UK) typically unlocks the most competitive rates from the best personal loan consolidation lenders. Check your score and credit report for errors before applying.

Step 3: Prequalify and Compare Lenders

Many top lenders offer a pre-qualification process that involves a “soft” credit check. This allows you to see the potential interest rate and monthly payment without impacting your credit score. Compare offers based on:

· APR: The true annual cost of the loan.

· Loan Term: The repayment length (usually 3 to 7 years). A shorter term means less interest paid, but higher monthly payments.

· Origination Fees: A fee some lenders charge for processing the loan (usually 1% to 6% of the loan amount). Zero origination fee loans are often the most cost-effective.

| Lender Feature | US Market | UK Market | Canadian Market |

| Typical APR Range | 6.5% to 36% | 3.5% to 49.9% | 6.99% to 46.96% |

| Key Lenders | SoFi, Discover, Marcus by Goldman Sachs | M&S Bank, Nationwide, Tesco Bank | RBC, BMO, Desjardins |

| Best Rates for | FICO 740+ | Excellent Credit Score | Credit Score 800+ |

Step 4: Formal Application and Direct Payout

Once you select the best offer, complete the formal application. Many lenders specializing in debt consolidation online will offer direct creditor payment. This is a huge benefit: the lender sends the funds directly to your old credit card companies or loan providers, ensuring the debt is cleared and you don’t accidentally spend the funds. This also simplifies the payment process.

Step 5: Start Your New Payment Plan

After the loan funds, you begin making one fixed monthly payment to your new lender. It’s crucial to keep up with this payment. If you’ve consolidated credit card debt, cut up or freeze those cards to avoid running up new balances and falling back into the debt cycle.

Key Tip: Prioritize lenders that offer direct creditor payments and zero origination fees. These two features maximize your savings and simplify the consolidation process.

Pros and Cons of Personal Loan Consolidation in 2025: Which Option is Right for You?

Deciding on a personal loan consolidation involves weighing the significant benefits against potential drawbacks. It’s a powerful tool, but it requires discipline to be truly effective.

The Pros: Simplify, Save, and See the Finish Line

1. Lower Interest Rate and Cost Savings: This is the primary driver. By securing a lower APR, you ensure more of your monthly payment goes toward the principal balance, not just interest. A borrower consolidating $15,000 of high-interest credit card debt at 24% to a debt consolidation loan at 10% can save thousands in interest over a 5-year term.

2. Simplified Payments: Juggling multiple due dates, minimum payments, and different interest rates is a common cause of missed payments. Consolidation reduces this to a single, predictable fixed monthly payment.

3. Clear Repayment Timeline: Unlike revolving credit card consolidation loans, a personal loan has a fixed repayment term (e.g., 3, 5, or 7 years). You know the exact date you will be debt-free.

4. Potential Credit Score Improvement: As your debt-to-income ratio improves and your old accounts are paid off, your credit utilization ratio decreases—a major factor in credit scoring. This can boost your score over time.

The Cons: Risks and Requirements

1. The Risk of New Debt: The biggest risk is using the newly freed-up credit cards or lines of credit, creating a new layer of debt on top of the consolidation loan. This puts you in a far worse financial position.

2. Origination Fees: Some lenders charge an upfront fee (1%–6% of the loan amount), which is often deducted from the loan proceeds. This slightly increases the effective APR and reduces the amount you have to pay off old debts.

3. Extending the Debt Term: If you choose a long repayment period (e.g., 7 years) to secure a lower monthly payment, you may pay more total interest than if you aggressively paid off the original debts, even with a lower APR.

4. Credit Score Requirements: To get the absolute best rates, you need a high credit score. If you have poor or bad credit, the consolidation loan APR offered might not be low enough to generate significant savings.

The Verdict: Is It Right for You?

Personal loan consolidation is the right move if you:

a) Qualify for an APR substantially lower than your current average rate.

b) Are confident in your ability to manage the single new payment.

c) Are committed to not running up new debt on the paid-off accounts.

| Scenario | Recommendation | Rationale |

| High Credit Score | Proceed Immediately | You will qualify for the lowest APRs and maximize your interest savings. |

| Low Credit Score | Explore Secured Loans | Unsecured rates might be too high. Consider a debt management plan or a secured loan if you have collateral. |

| Lack of Discipline | Avoid Consolidation | You risk compounding your debt. Focus on creating a strict budget first. |

Key Takeaway: A consolidation loan is a tool, not a solution. The loan provides the path to savings, but financial discipline ensures you reach the goal of being debt-free.

How to Apply for Personal Loan Consolidation: Fast Approval Tips for US, UK, and Australian Borrowers

A swift and successful application for a personal loan consolidation requires preparation and an understanding of what lenders in the US, UK, and Australia prioritize. Fast approval is often a result of having all your financial ducks in a row.

Tip 1: Nail the Pre-qualification Stage

Before you submit a formal application that triggers a “hard” credit inquiry (which can temporarily lower your score), use the pre-qualification tools offered by online lenders like SoFi or Discover Debt Consolidation. This gives you an accurate rate and term estimate based on a “soft” pull. Apply to 2–3 different lenders in a short window (14–45 days, depending on the credit bureau) to compare rates without a significant credit impact.

Tip 2: Document Everything Clearly

Lenders need proof of income, identity, and residence to approve a debt consolidation loan. Having digital copies of these documents ready speeds up the underwriting process:

· Proof of Income: Pay stubs (last 2-3 months), T4s (Canada), P60s (UK), or recent tax returns (US/Australia).

· Proof of Identity: Driver’s license, passport, or national ID.

· Debt Details: A clear list of the creditors you intend to pay off, including account numbers and payoff amounts.

Tip 3: Highlight Your Low Debt-to-Income (DTI) Ratio

Your DTI ratio is a critical metric. It’s the percentage of your gross monthly income that goes toward monthly debt payments. Lenders prefer a DTI of 35% to 40%. While the new personal loan consolidation will increase the DTI temporarily, the goal is to show the lender you have more than enough income to comfortably handle the new, lower consolidated payment.

Mini Case Study: David’s Rapid Approval in London, UK

David in London needed to consolidate £12,000 of high-interest debt. He spent one afternoon gathering all his documents, checking his credit report for errors, and comparing four lenders. He applied to a UK building society that offered zero origination fees and a 7.9% APR. Because he had a high credit score and all his documents were uploaded instantly, he received a conditional approval within 24 hours. The entire process, from application to direct fund transfer to his creditors, was completed in four business days.

| Lender Requirement | Why It’s Important | US/UK/AU Target |

| Credit Score | Determines the APR and loan eligibility. | Good to Excellent (700+/600+/750+) |

| DTI Ratio | Shows ability to repay the new loan. | Below 40% (ideally 35%) |

| Income Stability | Proof that you will maintain payments. | Minimum 1–2 years of employment history |

| Low Credit Utilization | Indicates responsible use of credit. | Below 30% (ideally 10% or less) |

Key Tip: Use the lender’s online portal to upload documents immediately. Delayed documentation is the number one cause of slow loan approval timelines.

Is Personal Loan Consolidation Right for You? Benefits for US and Canadian Consumers

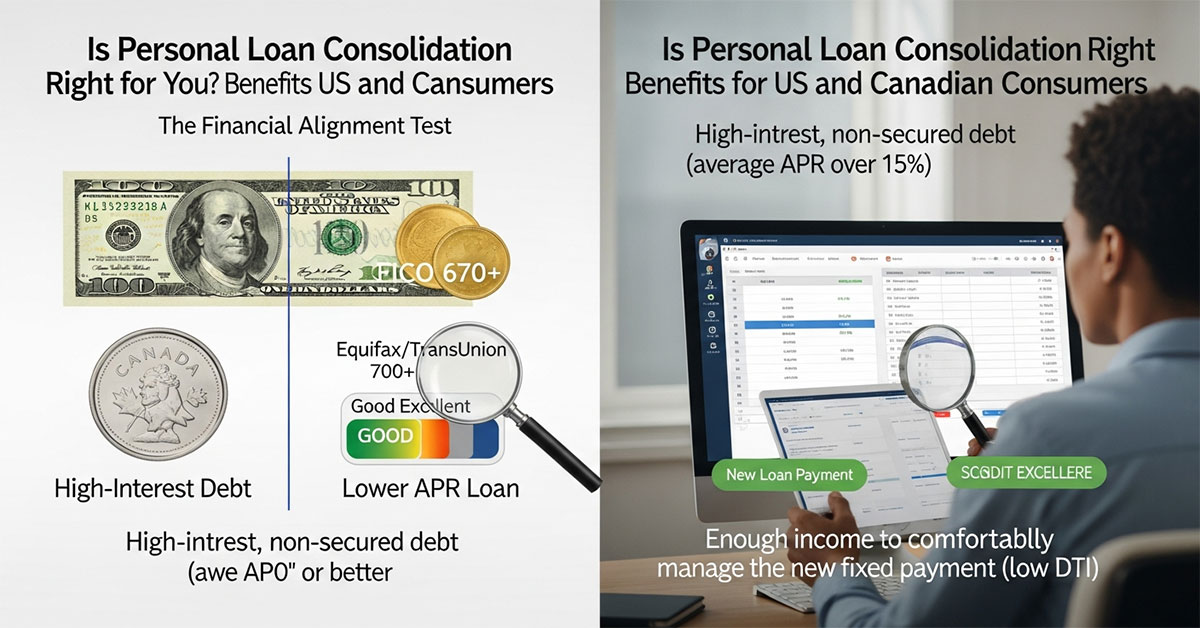

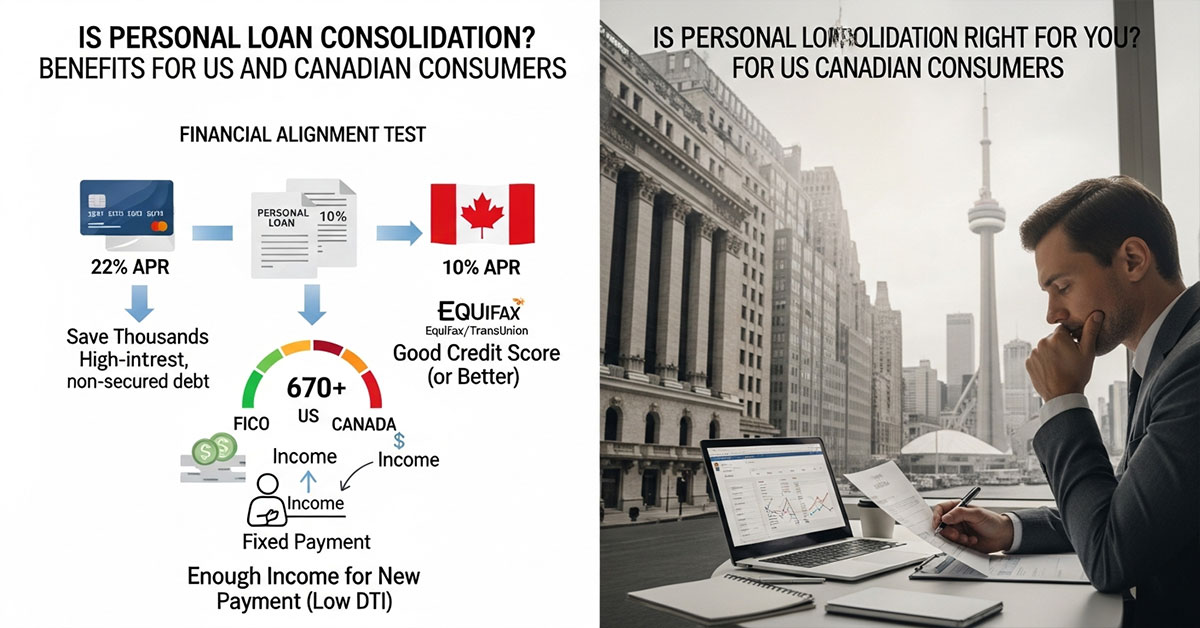

For consumers in the US and Canada, the high cost of credit card debt and other revolving credit makes personal loan consolidation an exceptionally attractive strategy. The key is determining if your financial profile aligns with the loan’s core benefits.

The Financial Alignment Test

Personal loan consolidation is likely the right choice if:

1. You have high-interest, non-secured debt: If your average APR is over 15%, a consolidation loan could save you thousands. The cost difference between a 22% credit card and a 10% personal loan is significant and immediate.

2. Your credit score is “Good” or better: Lenders in the US (FICO 670+) and Canada (700+ Equifax/TransUnion) reserve their lowest interest rates for creditworthy applicants. This is where you maximize your savings.

3. You have enough income to comfortably manage the new fixed payment: You need a DTI ratio that reassures lenders of your repayment capacity.

The Key Benefits for US and Canadian Borrowers

| Benefit | Impact on US Consumers | Impact on Canadian Consumers |

| Tax Simplification | Personal loan interest is typically not tax-deductible, simplifying tax filing compared to mortgage interest. | Similar non-deductibility simplifies taxes; focus remains on the lower APR. |

| Credit Utilization | Paying off credit cards lowers your credit utilization ratio, the second most important factor in FICO scoring, leading to a score jump. | Helps lower the debt-to-credit ratio, positively impacting Equifax and TransUnion credit scores. |

| Predictability | Escaping variable credit card interest rates to a fixed-rate debt consolidation loan provides budgeting certainty. | Fixed payments help manage the often-fluctuating prime rates set by major Canadian banks. |

Case Study: Mark’s Success in Toronto, Canada

Mark, a US expat living and working in Toronto, had $20,000 CAD in credit card debt at an average 19.99% APR. His minimum payments were $800 CAD. He secured a debt consolidation loan from a Canadian bank for $20,000 CAD at a fixed 8.99% APR over 4 years.

Result: Mark’s new monthly payment dropped to $497 CAD, saving him over $300 CAD per month. Over the 4-year term, he saved over $5,800 CAD in interest payments compared to continuing with the credit cards. His single fixed payment also completely eliminated the stress of multiple due dates.

Key Result: Mark reduced his debt payment by 37.8% and cut his interest rate by 11 percentage points, proving the effectiveness of personal loan consolidation for Canadian consumers.

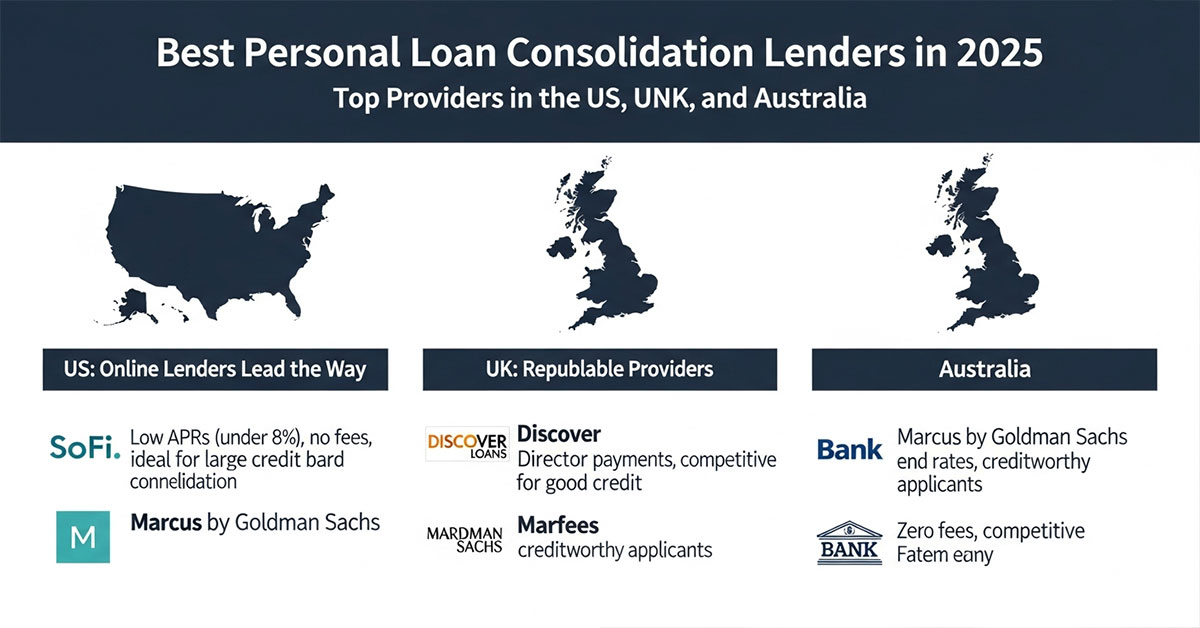

Best Personal Loan Consolidation Lenders in 2025: Top Providers in the US, UK, and Australia

The landscape for personal loan consolidation in the US, UK, and Australia is competitive, with a mix of traditional banks, credit unions, and fintech lenders offering specialized debt consolidation loans. Choosing the right lender is crucial for securing the lowest APR and most favorable terms.

US: Online Lenders Lead the Way

In the US, online lenders often provide the fastest funding and most competitive rates for highly qualified borrowers.

· SoFi Debt Consolidation: Known for low APRs (starting under 8%) and no fees for well-qualified borrowers. Ideal for consolidating large amounts of credit card loans.

· Discover Personal Loans: Offers direct creditor payments, simplifying the process and ensuring the old debts are cleared quickly. They are competitive for borrowers with good credit.

· Marcus by Goldman Sachs: Zero fees and competitive rates make them a strong contender, focusing on creditworthy applicants seeking personal loan consolidation.

UK: Banks and Building Societies Offer Security

UK borrowers often turn to established financial institutions for their consolidation needs.

· Nationwide: Offers competitive rates and is highly trusted, especially for existing customers.

· M&S Bank: Known for strong customer service and competitive APRs on their personal loans.

· Sainsbury’s Bank: Provides competitive fixed rates and often has offers for existing customers.

Australia: A Mix of Banks and Fintechs

Australian consumers have excellent choices from both major banks and innovative financial technology companies.

· NAB (National Australia Bank): A major bank offering competitive unsecured personal loans for debt consolidation.

· RateSetter (Plenti): A popular peer-to-peer lender offering quick, flexible, and often lower-rate loans.

· Westpac/Commonwealth Bank: Traditional banking powerhouses that provide reliable and structured debt consolidation loan products.

Lender Comparison at a Glance

| Country | Lender Type | Best For | Key Feature |

| US | Online/Fintech | High credit, low fees | Lowest APRs, rapid funding |

| UK | Banks/Building Societies | Established trust, existing customers | Competitive fixed-rate products |

| Australia | Major Banks/P2P | Stability vs. flexibility | Structured loan terms, competitive rates |

Case Study: Finding the Best Deal in the US

Michael in Texas had a FICO score of 765 and was consolidating $30,000. He checked three lenders and received the following offers for a 60-month loan:

1. Local Bank: 12.5% APR, $500 Origination Fee

2. Fintech Lender: 9.99% APR, 3% Origination Fee

3. SoFi: 8.5% APR, 0% Origination Fee

Michael chose SoFi. By avoiding the origination fee and securing the lowest APR, he saved thousands compared to the next best option, illustrating the need to Compare Personal Loan Lenders and Offers.

Key Result: Michael saved the most by choosing the zero-fee, lowest-APR option, highlighting the importance of comparing the total cost, including understanding origination fees and hidden costs.

Benefits of Personal Loan Consolidation: Simplify Your Payments and Save Money in the US, UK, and Canada

The decision to pursue a personal loan consolidation is primarily driven by two core advantages: simplification and savings. These benefits are universally impactful for consumers in the US, UK, and Canada who are managing multiple high-interest debts.

The Dual Power: Savings and Simplicity

1. Financial Savings Through Lower Interest

The most tangible benefit is the reduction in the total cost of your debt. Credit card consolidation loans typically replace revolving debt with a fixed-rate installment loan that has a substantially lower Annual Percentage Rate (APR).

· US Example: Moving from an average 20% credit card APR to a 9% personal loan can shave over 10 points off your interest rate, drastically reducing the total interest paid over the life of the loan.

· UK Example: Securing a fixed-rate personal loan from a building society helps UK consumers hedge against potential Bank of England rate increases affecting variable-rate debts.

· Canadian Example: A lower interest rate means more of the substantial monthly payment goes directly to reducing the principal balance, accelerating the debt-free date.

2. Simplified Debt Management

Consolidation eliminates the headache of tracking multiple minimum payments and due dates.

· One Fixed Payment: You replace five or six separate bills with a single, predictable monthly payment to one lender. This makes budgeting far easier and significantly reduces the risk of missed payments (and the resulting late fees and credit score damage).

· Clear End Date: Unlike minimum credit card payments that can drag on for decades, the debt consolidation loan has a defined term (e.g., 3, 5, or 7 years). This psychological boost of seeing the finish line is invaluable for maintaining financial discipline.

Pros and Cons Summary

| Feature | Pros (The Good) | Cons (The Risk) |

| Interest Rate | A much lower fixed APR can save thousands in interest. | If you have bad credit, the consolidation APR might not be low enough to create substantial savings. |

| Payment Structure | One predictable, fixed monthly payment and a set end date. | Choosing a very long repayment term (e.g., 7 years) can lead to more total interest paid despite a lower APR. |

| Credit Impact | Lowers credit utilization, potentially boosting your score. | The initial application (hard inquiry) slightly lowers your score temporarily. |

| Discipline | Easier to manage and budget. | High temptation to use paid-off credit cards, leading to compounded debt. |

Expert Insight: “Consolidation is a behavioral reset. The loan structure is the mechanism, but the commitment to not use the paid-off credit cards is the real leverage point for long-term financial success. Without that discipline, you’re merely delaying the problem.”

Compare Personal Loan Lenders and Offers: Find the Best Deals in 2025

Finding the “best deal” on a personal loan consolidation isn’t just about securing the lowest advertised APR; it’s about comparing the total cost of the loan, including fees, and matching the loan term to your budget. Competition among lenders in the US, UK, Canada, and Australia means a few minutes of comparison shopping can save you thousands.

The Three Critical Comparison Points

1. The True APR (Annual Percentage Rate)

The APR is the most important number because it represents the total cost of the loan, including the interest rate and any mandatory fees. Don’t be fooled by a low interest rate if the APR is high due to substantial origination fees.

2. Origination Fees and Hidden Costs

An origination fee (common in the US and Canada, but less so in the UK) is an upfront charge, usually 1% to 6% of the loan amount, deducted from the principal.

· Example: On a $20,000 loan with a 5% origination fee, the lender takes $1,000, and you only receive $19,000. You must ensure the net amount received is enough to cover all your existing debt. Prioritize zero origination fee lenders whenever possible.

3. Repayment Term

Loan terms typically range from 24 to 84 months (2 to 7 years).

· Shorter Term: Higher monthly payment, significantly less total interest paid. Best for borrowers prioritizing total savings.

· Longer Term: Lower monthly payment, more total interest paid. Best for borrowers prioritizing a low monthly budget.

Comparative Analysis Table

Let’s look at a $15,000 debt consolidation loan over a 5-year (60-month) term:

| Lender Offer | APR | Origination Fee | Monthly Payment | Total Interest Paid |

| Lender A | 9.0% | 0% | $311.38 | $3,682.80 |

| Lender B | 8.0% | 5% ($750) | $304.17 | $3,950.20 |

| Lender C | 10.5% | 0% | $319.98 | $4,198.80 |

Result: Despite having a higher APR than Lender B, Lender A is the superior choice because the lack of an origination fee results in the lowest overall Total Interest Paid and a lower initial outlay. This shows why a low APR alone isn’t the final answer.

Expert Insight: “Always calculate the total cost over the full term, not just the monthly payment. A zero-fee loan with a slightly higher interest rate can easily beat a low-rate loan with a hefty origination fee. This is especially true for US borrowers.”

Debt Consolidation Calculator: Estimate Your New Monthly Payment in the US, UK, and Australia

A debt consolidation calculator is the essential first tool for any borrower in the US, UK, or Australia considering a personal loan consolidation. It turns confusing debt averages and potential APRs into a clear, actionable number: your new monthly payment and total savings.

How the Calculator Works: The Simple Math

The calculator primarily performs two key functions:

1. Determining the New Payment: It takes the total amount you want to consolidate, the potential new lower APR, and the chosen loan term (e.g., 5 years) and calculates your single fixed monthly payment.

2. Calculating Savings: It compares your current total monthly debt payments and the total interest you would pay on those debts versus the new consolidated loan payment and total interest. The difference is your potential monthly and long-term savings.

Input Variables You Need

To use any reputable debt consolidation calculator online, you need three primary pieces of information from the consolidation loan offers you receive:

| Variable | Description | Why It Matters |

| Total Loan Amount | The sum of all debts you are consolidating. | Determines the principal of the new loan. |

| New APR | The Annual Percentage Rate offered by the lender. | The single largest factor in determining total interest cost. |

| Loan Term (Months) | The length of time you have to repay the loan. | Dictates the size of the monthly payment and the total interest paid. |

Example Calculation: A Canadian Perspective

Let’s assume a Canadian borrower is consolidating $30,000 CAD of credit card consolidation loans at an average 20% APR. Their current minimum payments total $950 CAD. They find a debt consolidation loan for 5 years at a new 10.5% APR.

| Metric | Old Debt (20% APR) | New Loan (10.5% APR) |

| Monthly Payment | $950 (Minimums) | $643.08 (Fixed) |

| Total Interest Paid | $17,800 (Estimated) | $8,584.80 |

| Total Monthly Savings | N/A | $306.92 CAD |

| Total Interest Savings | N/A | $9,215.20 CAD |

The result shows the power of the calculator: a clear monthly budget reduction of over $300 and nearly $10,000 in lifetime interest savings.

Expert Insight: “Before even formally applying, use the calculator to run different scenarios—a 3-year term versus a 7-year term, and a 10% APR versus a 12% APR. This simple step empowers you to negotiate or select the term that truly aligns with your financial capacity and long-term goals.”

Credit Score and Income Requirements for Personal Loan Consolidation in 2025

To unlock the most competitive rates for a personal loan consolidation in the US, UK, Canada, and Australia, two factors are paramount: your credit score and your income/debt-to-income (DTI) ratio. Lenders use these criteria to assess risk and determine your eligibility for the debt consolidation loan.

1. The Credit Score Requirement

Your credit score directly correlates with the APR you are offered. The higher your score, the lower your risk profile to the lender, and thus the lower your cost of borrowing.

| Credit Score Tier | US (FICO) | UK (Experian) | Canada (Equifax/TransUnion) | Typical APR Range |

| Excellent | 760+ | 961–999 | 800+ | The best rates (e.g., 6%–10%) |

| Good | 670–739 | 881–960 | 690–799 | Competitive rates (e.g., 10%–18%) |

| Fair/Average | 580–669 | 721–880 | 660–689 | Higher rates, limited options (e.g., 18%+) |

While options exist for borrowers with bad credit, the rates are often significantly higher, which can negate the financial benefit of consolidating high-interest credit card loans.

2. The Income and Debt-to-Income (DTI) Requirement

Lenders in every Tier One market need assurance that you can comfortably afford the new monthly payment. This is assessed via your stable income and your DTI ratio.

· Income Stability: Lenders generally require a consistent employment history (often 1–2 years) and a minimum verifiable income. The amount varies widely, but it is necessary to prove you can maintain the new loan commitment.

· DTI Ratio: This is the ratio of your total monthly debt payments (including the new consolidation loan payment) to your gross monthly income. Most prime lenders look for a DTI of 40% or lower. A DTI above this is a major red flag for lenders.

$$\text{DTI} = \frac{\text{Total Monthly Debt Payments}}{\text{Gross Monthly Income}}$$

Strategy for Approval

If your credit score is borderline, you can significantly increase your approval chances and secure a better APR by:

1. Applying with a Co-signer: A joint application with a co-signer who has excellent credit and a low DTI can compensate for your weaker profile.

2. Reducing Existing Debt: Pay down small balances before applying to slightly improve your credit utilization and DTI.

Expert Insight: “Lenders view a low DTI as a sign of financial stability, even more so than just a high income. By consolidating high-APR debt into a lower-payment loan, you immediately improve your DTI, making you a better candidate for future credit opportunities.”

Personal Loan Consolidation vs. Balance Transfer: Which Strategy Works Best for You?

When tackling high-interest credit card consolidation loans, borrowers in the US, UK, Canada, and Australia typically choose between two main strategies: a personal loan consolidation or a balance transfer credit card. While both aim to reduce interest costs, they operate very differently.

Personal Loan Consolidation: The Fixed Solution

A personal loan consolidation is an installment loan. It pays off your existing debts and replaces them with a single, fixed monthly payment over a set term (e.g., 3-7 years).

· Pros: Lower fixed APR, predictable payment, clear debt-free date, no temptation to run up new debt (as the cards are paid off).

· Cons: Requires a good credit score for the best rates, may have an origination fee, and the interest starts accruing immediately.

Balance Transfer Card: The Promotional Play

A balance transfer credit card involves moving your existing high-interest debt to a new credit card that offers a promotional 0% or low APR for a specific period (e.g., 12 to 21 months).

· Pros: 0% or very low interest for the promotional period, no interest accrues on the transferred amount during that time.

· Cons: Typically has a balance transfer fee (usually 3%–5% of the transferred amount), the promotional period is limited, and the interest rate jumps significantly (often 20%+) if the balance isn’t paid off in time.

The Decision: When to Use Which

The choice depends entirely on the size of your debt, your credit score, and your ability to repay aggressively.

| Factor | Personal Loan Consolidation | Balance Transfer Card |

| Debt Size | Large amounts ($5,000+) | Smaller amounts (< $10,000) |

| Repayment Plan | Need a set, long-term plan (3–7 years) | Can aggressively pay off debt within 12–21 months |

| Interest Rate | Fixed, low APR for the entire term | 0% or low APR for promo period, then high APR |

| Cost | Potential origination fee, fixed interest | 3–5% transfer fee, no interest (initially) |

Expert Insight: The Critical Difference

Expert Insight: “If you can pay off the entire balance within the 0% promotional period, a balance transfer is almost always the cheapest option, despite the transfer fee. However, if you need more than 18 months, or if you struggle with high credit card limits, the personal loan consolidation is safer because it forces the debt to be paid off by a fixed date, preventing the high interest rate shock after the promo ends.”

How to Manage Payments After Personal Loan Consolidation: Stay On Track in 2025

Securing a personal loan consolidation is a huge accomplishment, but the job isn’t finished. Effective payment management is crucial to realizing the full financial benefit and achieving long-term debt freedom. For borrowers in the US, UK, and Canada, staying on track with your new debt consolidation loan requires simple but strict discipline.

1. Set Up Autopay Immediately

This is the single most important step. In all Tier One markets, most lenders offer an autopay option, which deducts the fixed monthly payment directly from your bank account on the due date.

· Benefit: Eliminates the risk of missing a payment, which saves you late fees and prevents negative marks on your credit report.

· Bonus: Many lenders (especially in the US) offer a small interest rate discount (e.g., 0.25%) for setting up autopay. This small Autopay and Loyalty Discount can save you money while ensuring timely payments.

2. Cut Up the Old Cards

Since the credit card consolidation loan has paid off your old balances, you now have open credit card lines with zero balances. The temptation to use them and fall back into debt is high.

· Solution: Cut up or freeze the physical cards. Do not close the accounts, as this can temporarily harm your credit utilization ratio. Keep them open with a $0 balance, but make them inaccessible. This discipline is key to long-term success.

3. Build a Payment Buffer

Ideally, you should have enough funds in your checking account to cover the loan payment, plus a small buffer. Use the savings from your now-lower monthly payment to build an emergency fund or a specific “loan payment” fund.

| Action Item | Why It Matters | Country Focus |

| Activate Autopay | Ensures timely payment and often grants an interest discount. | US, UK, Canada, Australia |

| Destroy Old Cards | Prevents running up new credit card consolidation loans. | All Markets |

| Allocate Savings | Reinvest the monthly savings (from the lower payment) into an emergency fund. | All Markets |

| Monitor Credit | Check for negative reports or identity theft related to old/new accounts. | All Markets |

The Overpayment Strategy

If your budget allows, make extra payments toward the principal of your personal loan consolidation (ensure your loan has no prepayment penalties). Since the interest is front-loaded, every dollar you pay toward the principal early saves you exponentially more in future interest. This is the fastest way to get completely debt-free.

Expert Insight: “View your monthly payment savings as a ‘pay raise’ that you must immediately redirect. If you consolidate and save $400 a month, put $200 into a savings account, and use the other $200 as an extra principal payment on the loan. This accelerates your debt freedom dramatically.”

How Fixed Monthly Payments and Interest Savings Make Personal Loan Consolidation WorthwhileA)

The core value proposition of personal loan consolidation is the structural shift from unpredictable, high-cost revolving debt to a fixed, low-cost installment loan. This is what truly makes a debt consolidation loan worthwhile for borrowers in the US, UK, Canada, and Australia.

The Power of Fixed Payments

With high-interest credit card consolidation loans, your minimum payment is variable, and your debt-free date is nonexistent. A consolidation loan locks in a payment that is:

1. Predictable: The amount never changes for the entire term (e.g., 60 months). This simplifies budgeting and financial planning.

2. Fully Amortizing: Every payment is structured to ensure the principal is completely paid off by the final due date. You know exactly when your debt ends.

Guaranteed Interest Savings

Moving from a high-APR credit card (e.g., 22%) to a competitive personal loan (e.g., 10%) means that less of your monthly payment is swallowed by interest charges. This is not a promotional gimmick; it’s a permanent structural change to the cost of your debt. Over a multi-year term, this can result in thousands saved.

Checklist: When is Consolidation Worthwhile?

· ✅ Your new APR is at least 5 percentage points lower than your average current APR. (This is the minimum threshold for significant savings.)

· ✅ The fixed monthly payment is comfortably affordable within your budget. (Aim for a DTI below 40%.)

· ✅ The loan has either a low or zero origination fee. (Avoids losing a portion of the principal upfront.)

· ✅ You have a clear plan to not use the paid-off revolving credit accounts. (Crucial for avoiding compounded debt.)

Key Tip: If your current minimum payments leave you feeling like you’re treading water, the psychological and financial relief of a fixed monthly payment with a clear end date makes the effort of consolidation highly worthwhile.

What Are the APR Ranges and Repayment Terms for Personal Loan Consolidation in 2025?

Understanding the typical APR ranges and repayment terms for a personal loan consolidation is crucial to setting realistic expectations and identifying a fair offer. These parameters are influenced heavily by the borrower’s credit profile and the lending market in the US, UK, Canada, and Australia.

Typical APR Ranges in 2025

The Annual Percentage Rate (APR) is the true cost of your loan. The range is broad because it is highly credit-score dependent.

| Credit Tier | US/Canada APR | UK/Australia APR | Notes |

| Excellent Credit | 6.5% to 12% | 3.5% to 8% | Reserved for borrowers with the highest scores and stable income. |

| Good Credit | 12% to 18% | 8% to 15% | Standard rate for the majority of approved borrowers. |

| Fair/Poor Credit | 18% to 36% | 15% to 49.9% | Often secured from subprime lenders, consolidation benefits may be minimal. |

Securing an APR below 10% on an unsecured debt consolidation loan is considered an excellent deal in any Tier One market.

Common Repayment Terms

The repayment term dictates how long you have to pay back the loan. Shorter terms mean higher monthly payments but less total interest.

· Short Term (24–36 Months): The fastest route to debt freedom. Best for borrowers with significant cash flow.

· Medium Term (48–60 Months): The most common term. Balances a manageable monthly payment with a reasonable interest cost.

· Long Term (72–84 Months): Leads to the lowest monthly payment but significantly increases the total interest paid. Use this option only if the lower monthly payment is necessary for cash flow.

Maximizing Your Terms

· Tip 1: Always check for prepayment penalties. A good consolidation loan should allow you to pay it off early without penalty, giving you flexibility.

· Tip 2: Use your initial pre-qualification as leverage. If Lender A offers a better rate, ask Lender B if they can match it.

Key Tip: Focus on securing the shortest repayment term you can comfortably afford. A shorter term is the most effective way to minimize the total amount of interest paid, even if the APR is identical.

Fixed vs. Variable Interest Rates: What You Need to Know for Personal Loan Consolidation

When applying for a personal loan consolidation in the US, UK, Canada, or Australia, you will almost always have a choice between a fixed or variable interest rate. This choice is a decision between security and risk, and it impacts your fixed monthly payment for the entire term.

Fixed Interest Rates: Security and Predictability

With a fixed interest rate, the rate of interest on your debt consolidation loan remains exactly the same from the day you take out the loan until the day it is fully repaid.

· Pros: Complete predictability for budgeting. Your monthly payment will never change, regardless of how the central bank rates (like the US Federal Reserve or the Bank of England) move.

· Cons: If market interest rates drop significantly, you won’t benefit unless you refinance the loan.

Fixed rates are overwhelmingly preferred for personal loan consolidation. The goal is to lock in a low rate and payment for the long term.

Variable Interest Rates: Risk and Potential Reward

A variable interest rate is tied to a benchmark rate (like the Prime Rate) and will fluctuate up or down throughout the loan term as that benchmark rate changes.

· Pros: If market interest rates fall, your monthly payment will decrease. Variable rates are sometimes slightly lower than fixed rates at the start of the loan term.

· Cons: If market interest rates rise, your monthly payment will increase. This introduces budgeting uncertainty and could negate all your original interest savings.

Making the Right Choice

| Market Outlook | Recommended Rate Type | Rationale |

| Rates Rising/Volatile | Fixed Rate | Locks in today’s rate and prevents your payment from increasing. (Current scenario for many markets in 2025). |

| Rates Falling | Variable Rate | Allows you to benefit from future rate decreases (high risk). |

| Consolidating Debt | Fixed Rate | The primary goal is stability and a predictable payment to escape high-rate credit card consolidation loans. |

Key Tip: For the purpose of debt consolidation loan stability and achieving a secure fixed monthly payment, always opt for a fixed interest rate unless you have a high tolerance for risk and a very strong cash reserve.

Understanding Origination Fees and Hidden Costs in Personal Loan Consolidation Loans

While seeking a low APR is vital, ignoring origination fees and hidden costs can dramatically increase the actual cost of your personal loan consolidation. These fees are a critical component of the loan’s true cost that borrowers in the US, UK, Canada, and Australia must scrutinize.

The Origination Fee

An origination fee is a one-time charge levied by the lender for processing your loan. It is most common among US and Canadian online lenders.

· Range: Typically ranges from 1% to 6% of the total loan amount.

· How it works: The fee is usually deducted before the loan funds are disbursed. If you take out a $10,000 loan with a 5% fee, you only receive $9,500. You still have to repay the full $10,000.

· Impact: A high fee increases the effective APR and means you need a slightly larger loan to cover your existing debt. Always prioritize zero origination fee lenders.

Hidden Costs to Look For

1. Prepayment Penalties: Though less common now, some lenders charge a fee if you pay off the debt consolidation loan early. This negates the benefit of making extra payments. Always ensure your loan has no prepayment penalty.

2. Late Payment Fees: Standard across all markets, but crucial to know the cost (e.g., $25–$35 USD/CAD, or fixed percentage in the UK/AU). Autopay is the best defense.

3. Application/Processing Fees: Rare, but check the fine print for any non-origination fees just for submitting the application.

The Total Cost Calculation

To find the true cost of the loan, you must factor in:

$$\text{Total Cost} = \text{Total Interest Paid} + \text{Origination Fee}$$

| Loan Amount | APR | Term | Origination Fee | Total Interest | Total Cost |

| $15,000 | 9% | 60 months | 0% | $3,682 | $3,682 |

| $15,000 | 8% | 60 months | 5% ($750) | $3,230 | $3,980 |

The loan with the lower APR (8%) actually costs more overall due to the high origination fee.

Key Tip: Focus on the Total Cost of the loan, not just the advertised APR. Lenders with zero origination fees are often the most cost-effective choice for your personal loan consolidation.

How Direct Creditor Payments and Discounts Can Help Save on Personal Loan Consolidation

The best personal loan consolidation lenders often provide features that not only simplify the process but also lead to tangible savings. Two of the most valuable features are direct creditor payments and various discounts, which are common in the highly competitive US, UK, Canada, and Australia markets.

Direct Creditor Payments: Simplification and Security

Direct creditor payment means the lender (after approving your debt consolidation loan) sends the funds directly to your old creditors (e.g., credit card companies, auto lenders) to pay off the old balances.

· Benefit 1: No Temptation: It removes the risk that you’ll receive a large lump sum and be tempted to spend some of it, ensuring the loan is used exactly for its purpose—clearing high-interest debt.

· Benefit 2: Instant Debt Removal: It accelerates the process of clearing your old high-interest credit card consolidation loans, stopping the high interest from accruing sooner.

· Benefit 3: Proof of Payment: The lender handles the disbursement, giving you a clear record that the debt has been officially settled.

Discounts for Savings

Lenders often offer small discounts that, when combined, can shave a meaningful amount off your APR, resulting in significant total savings.

1. Autopay Discount: The most common discount (typically 0.25% or 0.50% off the APR) is offered for setting up automatic deductions from your bank account.

2. Existing Customer/Loyalty Discount: If you take the loan from a bank or credit union where you already have an account (like a checking/savings account), you may qualify for a rate reduction (common in the UK and Canada).

3. Direct Deposit Discount: Some lenders offer a small discount if you set up direct payroll deposit into a linked account.

The Cumulative Effect

A 0.50% discount may seem small, but on a $20,000 loan over 60 months, it can save you hundreds of dollars in interest, while the direct payment feature offers invaluable peace of mind.

Key Tip: When comparing lenders, a zero-fee loan with an autopay discount (which is essentially a lower effective APR) offers the best combination of security and cost savings.

What Is the Credit Impact of Personal Loan Consolidation and How to Minimize Negative Effects?

A personal loan consolidation is a powerful financial tool that generally benefits your credit score in the long run, but it can cause a temporary dip initially. Understanding this credit impact is vital for borrowers in the US, UK, Canada, and Australia.

The Initial Negative Impact (The Dip)

1. Hard Credit Inquiry: When you submit a formal application for a debt consolidation loan, the lender performs a “hard” credit check. This can temporarily drop your credit score by a few points (typically 2–5 points) for a few months.

2. New Account: Opening a brand new loan account slightly lowers the average age of all your credit accounts, which is a small factor in credit scoring.

The Long-Term Positive Impact (The Boost)

The long-term benefits far outweigh the temporary dip:

1. Improved Credit Utilization (Major Factor): When the consolidation loan pays off your high-interest credit card loans, your credit utilization ratio (how much credit you use vs. how much you have available) plummets to near 0%. This is the second-most important factor in credit scoring (after payment history) and can lead to a significant credit score jump.

2. Better Payment Mix: Adding a new installment loan to your credit profile, especially if you previously only had revolving credit, diversifies your credit mix, which can benefit your score.

3. Perfect Payment History: A single, easy-to-manage fixed monthly payment reduces the risk of missed payments, ensuring you maintain a perfect payment history—the most important factor in your score.

Minimizing the Negative Effects Checklist

· ✅ Limit Applications: Only submit a full application after pre-qualifying. Limit hard inquiries to a small window (e.g., 14–45 days) so they count as one shopping event.

· ✅ Do Not Close Old Accounts: Keep the paid-off credit card accounts open with a zero balance to maintain a high available credit limit and maximize the benefit to your credit utilization ratio.

· ✅ Set Up Autopay: Eliminate the risk of a late payment, which is the most damaging thing to your credit score.

Key Tip: The immediate benefit of reducing your credit utilization to near zero is the fastest and most effective way to improve your credit score following a personal loan consolidation.

Autopay and Loyalty Discounts: Save More with Personal Loan Consolidation in 2025

Maximizing the savings from your personal loan consolidation involves leveraging every possible discount. Autopay and loyalty discounts are two simple ways that borrowers in the US, UK, Canada, and Australia can subtly lower the total cost of their debt consolidation loan.

The Autopay Advantage

Most major lenders, especially fintech companies in the US and Canada, offer a small rate reduction for setting up automatic payments.

· Discount Range: Typically 0.25% to 0.50% off the advertised APR.

· Why Lenders Offer It: It guarantees timely payment, reducing the lender’s risk of default.

· Borrower Benefit: For a $25,000 loan, a 0.25% reduction over 5 years saves approximately $180. More importantly, it ensures you never incur a late payment fee or credit damage.

Loyalty Program Savings

Banks and credit unions often reward their existing customers when they apply for a personal loan consolidation.

· UK/Canada: Traditional institutions like RBC, Nationwide, and Commonwealth Bank will sometimes offer a preferred, lower rate to existing clients who have a good banking relationship with them. This can be another 0.25% to 0.50% reduction.

· US/Australia: Some lenders reward customers who already have a mortgage, checking account, or investment account with them.

Combining Discounts

If you can secure a loyalty discount and an autopay discount, the cumulative effect can be significant, potentially lowering your rate by a full 1% on your fixed monthly payment. This is free money for simply managing your account responsibly.

| Discount Type | Typical Rate Reduction | Primary Benefit |

| Autopay | 0.25% – 0.50% | Eliminates late payment risk + lower cost |

| Loyalty | 0.25% – 0.50% | Rewards a good banking relationship |

Key Takeaway: Always ask your potential lender if they offer a discount for autopay or for being an existing customer before accepting the final loan offer.

Avoiding Fees in Personal Loan Consolidation: Tips for US and Canadian Borrowers

For US and Canadian borrowers, avoiding fees is key to maximizing the savings from a personal loan consolidation. The two biggest fees to watch out for are origination fees and prepayment penalties.

Focus on Zero Origination Fees

An origination fee (1% to 6%) is often the biggest cost hurdle for borrowers in the US and Canada.

· Tip: Prioritize online lenders and banks that explicitly advertise zero origination fees for well-qualified borrowers. Companies like Marcus by Goldman Sachs (US) and some large Canadian banks often waive this fee for applicants with excellent credit.

· Reasoning: Paying a 5% fee on a $30,000 loan means losing $1,500 upfront. This fee dramatically reduces the financial benefit of the debt consolidation loan.

Ensure No Prepayment Penalty

While less common than they once were, some subprime lenders or older loan products may still carry a prepayment penalty.

· Tip: Verify in the loan documents that there is absolutely no fee for paying off the loan balance early.

· Reasoning: The goal of personal loan consolidation is often to pay the debt off faster. A penalty defeats the purpose of making extra payments to save on interest.

Other Fee Vigilance

· Late Fees: Always set up autopay to avoid these.

· Insufficient Funds (NSF) Fees: Ensure the account linked for autopay always has the funds available, as both your bank and the loan lender may charge a fee for a bounced payment.

Key Takeaway: A low-APR debt consolidation loan with a 5% origination fee can be significantly more expensive than a slightly higher-APR loan with zero fees. Always calculate the total cost.

Using Personal Loan Consolidation to Improve Your Credit Score in 2025

A major long-term benefit of a successful personal loan consolidation is the positive impact on your credit score in the US, UK, Canada, and Australia. This improvement stems primarily from two key areas: credit utilization and payment history.

The Credit Utilization Drop

Credit utilization is the amount of revolving credit you are using compared to your total credit limit. It accounts for a substantial portion (30-35% in the US FICO model) of your score.

· The Boost: When your debt consolidation loan pays off high-balance credit card consolidation loans, your utilization ratio instantly drops, often from 50%+ to 10% or less.

· Result: A low utilization ratio signals low risk to lenders and is the fastest way to generate a significant credit score jump.

Perfect Payment History

The single largest factor in your credit score (35% in the US) is your payment history.

· The Simplicity: Replacing multiple credit card payments with one single, fixed monthly payment to your debt consolidation loan lender drastically simplifies payment management.

· The Safety: By setting up autopay, you virtually guarantee timely payments, building a strong history of responsibility.

Strategy for Maximum Credit Impact

1. Do NOT close the paid-off credit cards: This preserves your high credit limit, which keeps your utilization ratio low.

2. Avoid new debt: Use your consolidation as a fresh start and refrain from running up new balances.

Key Takeaway: A consolidation loan acts as a powerful lever, transforming high-risk revolving debt (high utilization) into low-risk installment debt (perfect payments), which is highly beneficial for your credit score.

How to Consolidate Personal Loans with Bad Credit: Options for US and UK Borrowers

Consolidating debt is challenging when you have bad credit (e.g., FICO under 580 in the US or poor credit history in the UK), but options for a personal loan consolidation still exist for US and UK borrowers. The key is to manage expectations regarding the APR and explore all available types of loans.

1. Secured Personal Loans

If you own an asset, you can use it as collateral for a secured debt consolidation loan.

· US/UK Option: A Home Equity Line of Credit (HELOC) or a secured personal loan (using a vehicle or savings account) offers a much lower APR than unsecured options, even with poor credit.

· Caution: You risk losing the collateral if you default on the loan.

2. Credit Union and Community Banks

· US: Credit Unions are non-profit and often more willing to work with members who have lower scores, offering lower rates than large national banks.

· UK: Community development financial institutions (CDFIs) and some building societies may have options specifically tailored for those rebuilding their credit.

3. Co-signer/Joint Applications

If a friend or family member with good or excellent credit is willing to co-sign your personal loan consolidation, it significantly lowers the lender’s risk. This will almost certainly secure a better APR.

| Bad Credit Strategy | Benefit | Risk |

| Secured Loan | Lowest available APR. | Loss of collateral upon default. |

| Co-signer | Lower APR, better approval odds. | Co-signer is responsible if you default. |

Key Takeaway: If the only unsecured debt consolidation loan you qualify for has an APR higher than your existing debt, it’s not a good consolidation option. Explore secured loans or work on credit repair first.

Credit Union Options for Personal Loan Consolidation: Benefits for Borrowers in Canada

For Canadian borrowers seeking a low-rate personal loan consolidation, Credit Unions often provide highly competitive and personalized alternatives to the major national banks.

The Credit Union Advantage in Canada

Credit Unions (like Vancity, Desjardins, and local Caisse Populaire branches) are non-profit, member-owned financial institutions. This structure often translates to better rates and terms for their members.

1. Lower Interest Rates: Because they prioritize members over shareholder profit, Canadian Credit Unions are often able to offer lower APRs on debt consolidation loans than for-profit banks.

2. Flexible Underwriting: Credit Unions frequently take a more holistic, relationship-based approach to underwriting. They are more likely to consider a borrower’s full financial history and current situation, not just a strict credit score cutoff, which is beneficial for those with “average” or slightly lower credit.

3. Local Expertise: They understand the specific financial needs and economies of their local communities, leading to more tailored loan products.

Applying to a Credit Union

· Requirement: You must become a member to apply for a personal loan consolidation. This usually involves opening a savings account and paying a small, one-time membership fee.

· Process: The application is similar to a bank, but the relationship manager is often more accessible and helpful through the process of securing the fixed monthly payment.

Key Takeaway: For Canadian borrowers looking to consolidate high-interest credit card loans, exploring a local Credit Union is a highly recommended step to secure a favorable APR and personalized service.

Joint Applications and Co-signers: How They Impact Your Personal Loan Consolidation in 2025

If your credit score or income isn’t strong enough to secure the best APR on a personal loan consolidation, a joint application or using a co-signer can be a game-changer. This is a common strategy in the US, UK, Canada, and Australia to access a lower fixed monthly payment.

The Co-signer Advantage

A co-signer is someone who legally agrees to repay the debt consolidation loan if you default.

· Impact: Lenders assess the credit profile of the person with the better score (usually the co-signer). This dramatically lowers the lender’s risk, resulting in a much lower APR and better terms for the primary borrower.

· Risk: The co-signer is equally responsible for the debt. A late payment or default impacts both credit reports.

Joint Applications

A joint application (common for spouses or partners consolidating shared debts) means both parties are equally responsible for the personal loan consolidation.

· Impact: Lenders consider the combined income and assets of both applicants, which can help meet income requirements and lower the DTI ratio. This is great for securing a larger loan amount or a better rate.

When to Consider a Co-signer

| Borrower Situation | Co-signer Use | Expected Result |

| Low Credit Score/Bad Credit | Essential | Access to loans/rates otherwise unavailable. |

| Low Income/High DTI | Helpful | Lenders use the co-signer’s income to approve the loan. |

Key Takeaway: A co-signer is a serious commitment. While it helps secure the lowest APR on your debt consolidation loan, both parties must fully understand the legal and credit implications if the primary borrower cannot pay.

Expert Advice on Securing Personal Loan Consolidation Approval from Top Lenders in the US, UK, and Canada

Securing approval for a personal loan consolidation from top lenders in the US, UK, and Canada isn’t about luck—it’s about preparation and meeting specific criteria. Expert advice focuses on optimizing your profile to appear as a low-risk borrower.

1. Know Your Numbers

Before applying, use a debt consolidation calculator to determine the exact loan amount you need and the fixed monthly payment you can afford. Top lenders favor applicants who have a clear, realistic plan. Ensure your estimated new payment is low enough to give you comfortable breathing room.

2. Boost Your Creditworthiness

Focus on the two major credit levers:

· Credit Utilization: Pay down the smallest balances on your high-interest credit card consolidation loans before you apply to slightly lower your ratio.

· Payment History: Ensure you have zero late payments in the 6–12 months leading up to the application.

3. Provide Immaculate Documentation

Fast approval depends on providing accurate, verifiable documents instantly. Have digital copies of:

· Proof of income (P60s, W-2s, T4s)

· Proof of residence

· Full list of creditors and exact payoff amounts

4. Apply to the Right Lender

· Good Credit: Target online lenders (US/Canada) or major banks (UK) for the lowest APRs and zero fees.

· Fair/Poor Credit: Target Credit Unions or smaller community banks that offer more personalized underwriting.

Key Takeaway: The successful applicant presents a low DTI, a clear repayment plan for their debt consolidation loan, and a near-perfect payment history.

Personal Loan Consolidation Calculator Tools: How to Use Them to Find the Best Deals

Personal loan consolidation calculator tools are the most powerful, unbiased resource available to borrowers in the US, UK, Canada, and Australia. They are indispensable for comparing offers and proving the financial viability of a debt consolidation loan.

1. Prove Your Savings Potential

The calculator’s primary function is to compare your current total interest payments against the new, lower interest cost of the personal loan consolidation.

· Input: Your total current debt balance, your average existing APR, your potential new APR, and the loan term.

· Result: A clear, dollar-for-dollar number of your total interest savings and your new fixed monthly payment. This figure is the foundation of your decision.

2. Compare Different Loan Terms

Use the calculator to run scenarios for different repayment terms:

· 3-Year Term: What is the maximum monthly payment I can afford to save the most interest?

· 7-Year Term: What is the absolute lowest monthly payment I need to manage cash flow?

3. Evaluate Origination Fees

While the calculator usually doesn’t factor in origination fees, you can simulate the impact by increasing the loan amount you input.

· Example: For a $10,000 loan with a 5% fee, input $10,526 as the loan amount. This ensures you receive enough money (after the fee) to pay off the original $10,000 debt.

Key Takeaway: Use the calculator to compare a minimum of three lender offers, factoring in the APR and the term. This simple, free tool will prevent you from choosing an offer that looks good but is ultimately more expensive.

Approval Timeline and Funding Speed: What to Expect When Applying for Personal Loan Consolidation

The speed of the personal loan consolidation process—from application to funds disbursement—is a key factor for borrowers, especially when high-interest credit card consolidation loans are accruing daily interest.

The Modern Timeline

The timeline has dramatically shrunk, particularly with online-focused lenders in the US, UK, and Australia.

1. Pre-qualification (Soft Check): 5 Minutes. You can get a rate and term estimate almost instantly.

2. Formal Application (Hard Check): 10–15 Minutes. Filling out the full application and uploading documents.

3. Underwriting/Approval: 24 Hours to 3 Business Days. Highly automated for strong credit applicants. It can take up to a week for complex or bad credit applications.

4. Funding/Disbursement: 1 to 5 Business Days.

o Direct-to-You: Funds transferred to your bank account are the fastest, often in 1–3 days.

o Direct Creditor Payments: Funds are sent directly to your old creditors, which can add a day or two to the process, but simplifies the debt consolidation loan process immensely.

What Speeds Up the Process?

· Excellent Credit Score: Top-tier credit enables near-instant, automated approval.

· Complete Documentation: Having pay stubs, ID, and bank statements ready.

· Direct Creditor Payments: Using this option streamlines the final step.

Key Takeaway: If you have all your documents and a good credit score, you can realistically expect your high-interest credit card consolidation loans to be paid off within one week of submitting a formal application.

Choosing the Right Loan Term for Your Budget: Expert Tips for US and UK Borrowers

Choosing the right loan term for your personal loan consolidation is the critical balancing act between managing your monthly budget and minimizing the total cost of interest. This choice dictates the size of your fixed monthly payment.

The Cost vs. Cash Flow Dilemma

1. Shorter Term (e.g., 3 Years):

o Pro: You pay significantly less total interest. For a $20,000 loan, a 3-year term can save thousands compared to a 7-year term.

o Con: Your monthly payment will be much higher.

o Best for: Borrowers with high cash flow who prioritize total savings.

2. Longer Term (e.g., 7 Years):

o Pro: The lowest possible fixed monthly payment.

o Con: You pay the maximum amount of total interest over the life of the loan.

o Best for: Borrowers whose primary goal is to lower their current monthly debt obligations to improve cash flow.

The Right Strategy

· Expert Tip for US/UK Borrowers: Choose the shortest term that results in a fixed monthly payment you can comfortably afford, even if you have had a minor financial setback. Use your monthly savings (from the lower payment) to occasionally make extra payments to the principal. This gives you the safety of a lower payment with the speed of a shorter term.

Key Takeaway: The right loan term is the one that minimizes total interest paid without putting a strain on your monthly budget. Start by calculating the monthly payment for a 5-year term and then adjust up or down from there.

Tips for Successful Loan Consolidation: What Lenders Look for in 2025

Successful personal loan consolidation approval comes down to presenting a clean financial profile that meets the lender’s criteria for a low-risk borrower. Knowing what lenders in the US, UK, Canada, and Australia prioritize is the key to a fast approval and the best APR.

The Lender’s Checklist

1. Low Debt-to-Income (DTI) Ratio: Lenders want your total monthly debt payments (including the new debt consolidation loan) to be below 40% of your gross monthly income (ideally 35% or less). This shows you have ample income to manage the new fixed monthly payment.

2. Excellent/Good Credit Score: A high score (e.g., FICO 740+ in the US) proves your history of timely repayment and is the most significant factor in securing the lowest APR.

3. Stable Income/Employment: At least one to two years of consistent, verifiable employment is preferred.

4. Low Credit Utilization: If you are consolidating high-interest credit card loans, your utilization should be under 50% before applying to signal financial awareness.

Final Takeaways for Success

· Comparison Shop: Use pre-qualification to compare at least three lenders to find the lowest total cost (APR + fees).

· Set Autopay: Immediately set up automatic payments for the new loan to protect your credit score.

· No New Debt: Commit to not running up new balances on the paid-off credit cards.

Key Takeaway: A successful consolidation is about preparation (improving DTI and credit score) and execution (choosing the right low-fee, low-APR loan and maintaining perfect payments).

Frequently Asked Questions (FAQ)

Do Consolidation Loans Hurt Your Credit Score? A Look at the Impact

Initially, a personal loan consolidation can cause a small, temporary dip in your credit score due to the “hard inquiry” from the application. However, the long-term impact is overwhelmingly positive. By replacing high-balance credit card consolidation loans with a single installment loan, you drastically lower your credit utilization ratio (a major scoring factor). Furthermore, making consistent, single, on-time payments on the fixed monthly payment builds a strong credit history, ultimately boosting your score significantly over time.

How Much Is the Payment on a $50,000 Consolidation Loan? Find Out Here

The monthly payment on a $50,000 debt consolidation loan depends entirely on the APR and the repayment term. For example, a $50,000 loan at a competitive 9.99% APR over a 5-year (60-month) term would have a fixed monthly payment of approximately $1,062 USD/CAD/AUD/GBP. Over a longer, 7-year term, that payment would drop to around $835. Use a debt consolidation calculator online to input your exact APR and term for the precise monthly figure.

Can Personal Loans Be Consolidated? A Simple Guide for 2025

Yes, absolutely. A personal loan consolidation is essentially a new personal loan used to pay off various existing debts. This can include high-interest credit card consolidation loans, medical bills, and other existing installment personal loans (especially if the new loan offers a substantially lower APR than the old ones). The goal is to bundle multiple existing payments—whether revolving or installment—into one single, more affordable fixed monthly payment with a lower overall interest rate.

Is It Better to Consolidate Personal Loans? Pros and Cons Explained

It is often better to consolidate personal loans and other high-interest debts if you can secure an APR that is at least 5 percentage points lower than your current average rate. Pros: Lower interest cost, one simplified fixed monthly payment, and a clear debt-free date. Cons: Potential for an origination fee, and the risk of running up new debt on the paid-off credit card consolidation loans. Consolidation works best for disciplined borrowers with good credit.

Debt Consolidation Online: How to Apply for a Loan in 2025

Applying for a debt consolidation loan online is the fastest and easiest method in 2025, particularly in the US and Australia. Start by using an online pre-qualification tool (soft credit check) offered by top lenders like SoFi or Discover. Compare the rates and fees (focusing on zero origination fees). Once you choose a lender, complete the formal application by uploading digital copies of your ID, income proof, and creditor details. Approval and funding can often be achieved within 1–5 business days.

Accredited Debt Consolidation Services: What You Need to Know

Accredited debt consolidation services (often referring to credit counselling/debt management) are different from personal loan consolidation. A loan is a self-service solution where you take out a new loan. A debt management service negotiates with your creditors to lower interest rates and create a payment plan. Ensure any service is accredited (e.g., by the NFCC in the US) to avoid scams. Services are often better for those with bad credit who can’t qualify for a low-APR consolidation loan.

Debt Consolidation Loan for Bad Credit: Your Best Options in 2025

For borrowers with bad credit (scores below 620), securing a low-APR unsecured debt consolidation loan is difficult. Your best options are: 1. Secured Loans: Using home equity (HELOC) or a vehicle as collateral, which offers a much lower APR but carries the risk of losing the asset. 2. Co-signer: Applying with a co-signer who has excellent credit to secure the best rates. 3. Credit Unions: Often more flexible with underwriting for members who have a relationship with the institution.

Rocket Money Debt Consolidation: Is It a Good Option for You?

Rocket Money (formerly Truebill) is primarily a financial tracking and budgeting app, not a direct debt consolidation loan provider. While they offer debt-related features, their consolidation is typically facilitated through a third-party partner. Before using any referral service, it is critical to compare the final fixed monthly payment and APR offered by their partner against direct-to-consumer lenders like SoFi or Discover to ensure you’re getting the best deal, particularly regarding origination fees.

JG Wentworth Debt Consolidation: Is It Right for Your Debt Situation?

JG Wentworth focuses on debt relief services, primarily debt settlement, not providing personal loan consolidation directly. Debt settlement involves negotiating to pay less than the full amount owed, but it severely damages your credit score and can have tax implications. If you have the ability to repay your debt and qualify for a low-APR consolidation loan, the latter is always the financially superior choice, as it preserves your credit score and prevents you from defaulting.

Income-Based Debt Consolidation Loan: How It Works in 2025

An income-based debt consolidation loan is not a standard personal loan product. All lenders consider your income to determine your Debt-to-Income (DTI) ratio, ensuring you can afford the new fixed monthly payment. If you have a high income and a low DTI, you are more likely to secure the best rates. If you have low or highly variable income, you may need a co-signer or a secured loan option to satisfy the lender’s income requirements for a debt consolidation loan.

Best Personal Loan Consolidation Lenders in 2025: Top Providers in the US, UK, and Canada

The best personal loan consolidation lenders in 2025 are those offering the lowest APRs and, crucially, zero origination fees. In the US, this includes online lenders like SoFi and Marcus. In the UK, established banks and building societies like Nationwide and M&S Bank are strong contenders. In Canada, major banks (RBC, BMO) and Credit Unions are the top choices. Always use a pre-qualification tool to see the rate you qualify for, as this will determine your best option.

Personal Loan Consolidation Bad Credit: How to Secure a Loan with Poor Credit

Securing an unsecured personal loan consolidation with bad credit (typically FICO below 620) means accepting a higher APR, which may limit your interest savings. To improve approval odds and lower the rate: 1. Apply with a Co-signer: Leverage their good credit. 2. Explore Secured Loans: Use collateral to reduce lender risk. 3. Target Credit Unions: They often offer more flexible terms for members. Focus on a loan with no prepayment penalty so you can refinance to a better rate once your credit improves.

Personal Loan Consolidation Reviews: Top Lenders Compared

When reviewing personal loan consolidation reviews, focus on three key metrics: Transparency of Fees (are origination fees clear?), Customer Service (especially for complex issues), and Funding Speed. Lenders like SoFi (US) score highly for low fees and speed, while traditional banks (UK/Canada) often score well for established customer service. Be wary of reviews that focus only on the lowest advertised rate; the best-reviewed lenders offer a combination of low rates and a seamless application process for the fixed monthly payment.

SoFi Debt Consolidation: Pros and Cons of Choosing SoFi for Loan Consolidation

SoFi Debt Consolidation is a popular choice in the US for its competitive APRs (often starting under 8%) and its signature zero origination fees for well-qualified borrowers. Pros: Low rates, no hidden fees, excellent mobile app, and fast funding (often within a few days). Cons: Strict credit and income requirements (best for borrowers with FICO 700+), and they do not currently offer a direct creditor payment option. If you qualify, SoFi often offers one of the lowest-cost unsecured personal loan consolidation options.

Discover Debt Consolidation: How Discover’s Loans Compare to Others in 2025

Discover Debt Consolidation offers competitive rates and a significant advantage: direct creditor payments. Pros: They pay off your credit card consolidation loans directly, simplifying the process and removing temptation. They are competitive on APR and usually have no origination fees. Cons: The minimum loan amount is often higher than some competitors’, and while competitive, their rates may not always be the absolute lowest available. They are an excellent, trustworthy option for those who value the security and simplicity of direct payment.

Debt Consolidation Loan Calculator: Estimate Your Savings and Monthly Payments

A debt consolidation loan calculator is a free tool that helps you estimate your potential savings and your new fixed monthly payment. To use it effectively, input: 1. Your total debt amount. 2. Your current average APR. 3. The potential new APR and loan term (e.g., 60 months). The calculator will show you your new, lower monthly payment and the total interest you save over the life of the loan. This is the essential first step to proving the financial benefit of a personal loan consolidation.