How many personal loans can you have at once? Discover the ultimate guide with smart borrowing strategies for US, UK, Canada & Australia. Manage multiple loans wisely.

Picture this: last year, you finally took out a personal loan to renovate your kitchen. The decision was well-thought-out, and the monthly payments don’t put too much strain on your budget. Some time passes, and suddenly you’re facing a hefty medical bill, or your car breaks down beyond repair. You start thinking, “Can I even take out another personal loan? How many are too many?” Financially speaking, this is a familiar dead-end for many households in the US, the UK, Canada, and Australia. You are in debt and grappling with a sudden, pressing need for cash, but the way forward is foggy, unclear.

The fear of rejection and ruined credit score, or even the sheer idea of being buried beneath debt again, is very valid. This guide will clear away that fog for you. The number of personal loans you can have at once is not set in stone. It all depends on a handful of factors: your income, your current debt, and your creditworthiness. We will walk you through the lender’s assessment process of the borrower’s ability to pay back multiple loans. You will understand the way to calculate your debt-to-income ratio, its perks and perils, and the best strategies to manage a few debts. By the end of this article, you will have all the information and confidence you need to make a well-informed decision that works for your financial well-being, not against it.

Understanding How Multiple Personal Loans Work in Tier One Countries

There are no laws in principle in the US, UK, Canada, or Australia that would restrict the total number of personal loans you could have. Technically, the number could be two, three, or more. Practically, however, the total number of loans is one hundred percent reliant on lenders and their evaluation of your ability to pay and benefit from the lending. By getting the second and third loans, you do not “reset the score.” On the contrary, their respective issuance and processing require an even more intense audit of your financial situation.

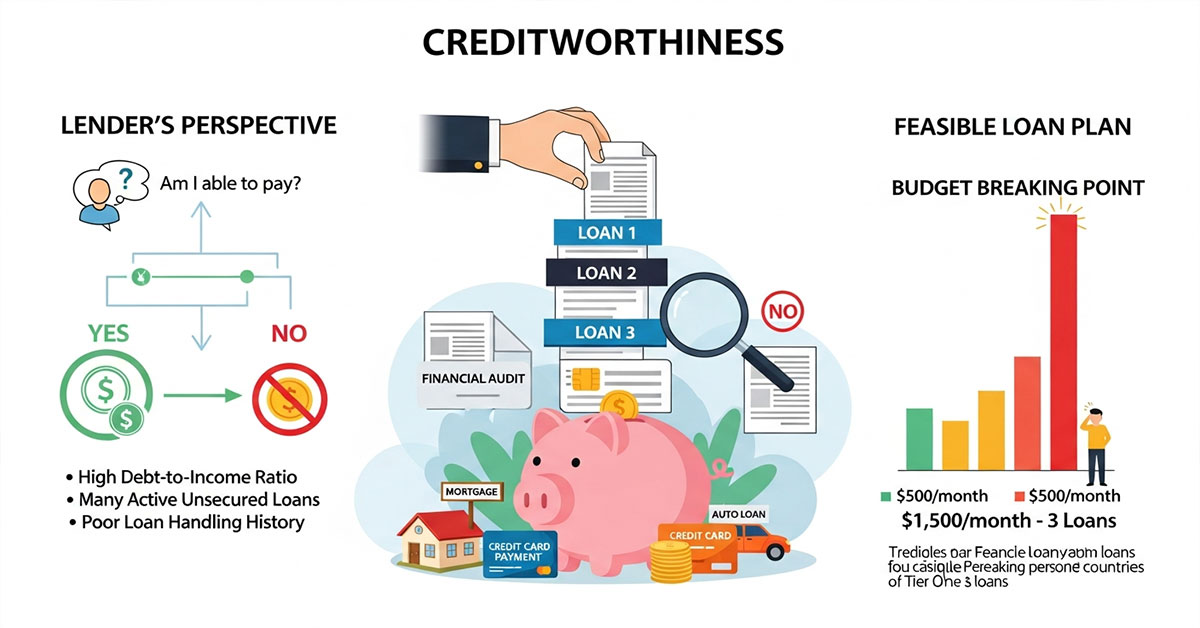

The central idea here is “creditworthiness.” With each new loan, your total monthly debt liability grows. From the lender’s perspective, they want to make sure that your income can safely keep up with your current debts—your mortgage, your credit card payment, your auto loans, and your present personal loan, and the additional loan you are requesting. Your new loan would be another level of danger in their eyes.

To offer an example, while a $500 monthly loan plan might be feasible, if you had three of these, summing up to $1,500 each month, it would undoubtedly push your budget to its breaking point. Lenders use a range of sophisticated default risk metrics to ascertain who is most likely to default on a loan. The presence of many active unsecured loans is a key indicator. Before giving you more money, they will want to see that you truly know how to handle a loan.

How Many Personal Loans Can You Have at Once?

Mini Case Study:

Liam is a graphic designer from Manchester, UK. He took out a £5,000 personal loan from his bank to take a professional development course. He has been making monthly payments of £150 for six months. For months, his teeth started aching due to the consumption of nuts and a piece of ice. A dentist recommended emergency surgery, which required taking out another £3,000. He turned to yet another online lender, which found a record of his existing loan on his credit report.

They still approved his application but offered a slightly higher interest rate. Why? His income and credit score remained strong, but his second loan increased his total unsecured debt; thus, he became only slightly riskier as a borrower. Liam now has to manage two payments, which means that he has to plan his budget carefully.

This illustrates that getting a second loan is possible, but the terms can be influenced by your existing debt.

| Feature | Single Personal Loan | Multiple Personal Loans |

| Lender Scrutiny | Standard assessment of income and credit. | Higher scrutiny of affordability and total debt load. |

| Impact on DTI | Increases your Debt-to-Income (DTI) ratio. | Significantly increases your DTI ratio. |

| Credit Score Effect | One hard inquiry, a new account, lowers the average age. | Multiple hard inquiries, multiple new accounts. |

| Monthly Budgeting | One fixed payment to manage. | Multiple payments, possibly on different dates. |

| Interest Rates | Based on your credit profile at the time of application. | Subsequent loans may have higher rates due to increased risk. |

Key Takeaway: While you can legally hold multiple personal loans, your financial profile must be strong enough to convince each new lender that you can handle the additional debt.

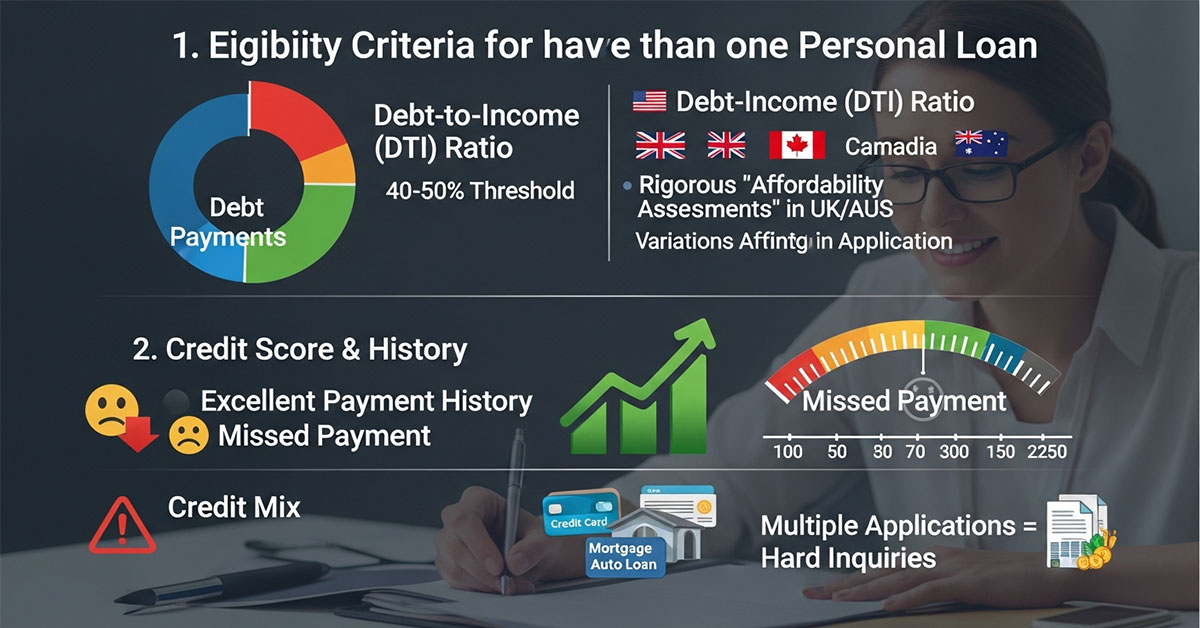

Eligibility Criteria for Having More Than One Personal Loan

When you apply for an additional personal loan, lenders are essentially re-evaluating your financial stability from the ground up, with the added weight of your existing loan payments. The eligibility criteria become stricter because the lender’s risk is higher. While the specifics can vary between the US, UK, Canada, and Australia, the fundamental pillars of assessment remain consistent across these Tier One markets.

First and foremost is your Debt-to-Income (DTI) Ratio. This metric is the cornerstone of affordability checks. Lenders calculate the percentage of your gross monthly income that goes toward paying your total monthly debt obligations. If your first loan already pushed your DTI near the lender’s threshold (often around 40-50% in the US and Canada), securing another loan will be challenging. In the UK and Australia, while a specific DTI percentage is less of a hard rule, lenders conduct rigorous “affordability assessments” to ensure you can manage payments without financial hardship.

Second is your credit score and history. Lenders need to see a flawless payment history on your existing debts, especially your current personal loan. A single missed payment can be a major red flag. They also look at the age of your credit history and the mix of credit you use. A strong, established credit profile shows you have experience managing debt responsibly. Applying for multiple loans in a short period can also be detrimental, as each application typically results in a hard inquiry, which can temporarily lower your score.

Mini Case Study:

Consider Chloe, an IT project manager in Sydney, Australia. She has a personal loan with a $300 monthly payment. Her gross monthly income is $7,000, and her other debts (student loan, credit card) total $700 per month. Her current DTI is ($300 + $700) / $7,000 = 14%. She applies for a second loan for a wedding, which would add a $400 monthly payment. Her new DTI would be ($300 + $700 + $400) / $7,000 = 20%. Because her DTI remains low and she has an excellent credit score of 850, her lender approves the second loan. She demonstrated she could easily afford the new payment.

| Eligibility Factor | What Lenders Look For | Why It Matters |

| Debt-to-Income (DTI) Ratio | A low DTI, ideally below 40%, including the new loan. | Shows you have enough income to cover all your debts. |

| Credit Score | Excellent (e.g., 720+ FICO in the US) | Indicates a history of responsible credit management. |

| Payment History | 100% on-time payments on all existing credit accounts. | Proves you are reliable and will not default on the new loan. |

| Income Stability | A steady, verifiable source of income. | Assures the lender you have the means to make future payments. |

| Existing Relationship | A positive history with the current lender. | May increase trust and lead to better terms. |

Result: Meeting these criteria doesn’t guarantee approval, but it significantly improves your chances of qualifying for another personal loan.

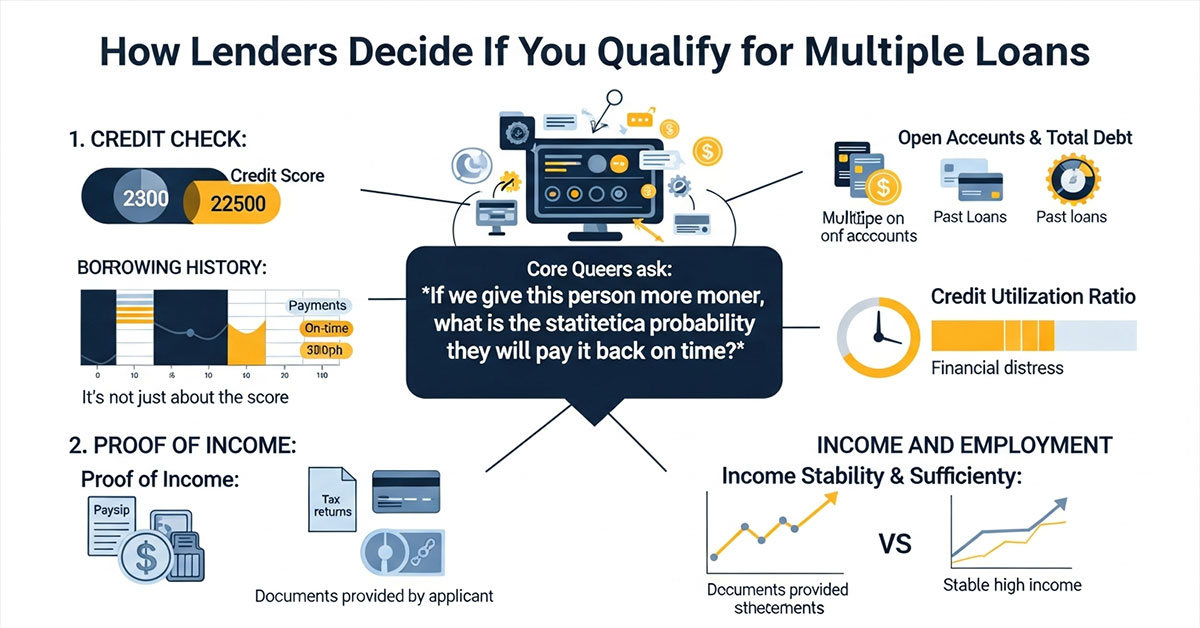

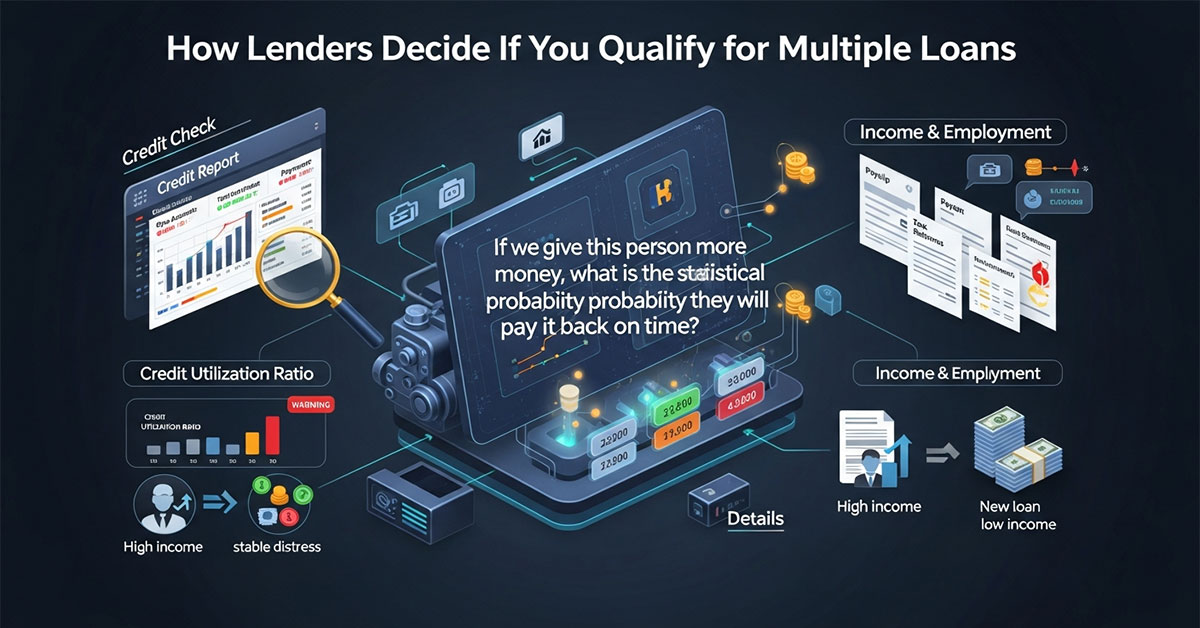

How Lenders Decide If You Qualify for Multiple Loans

And now the decision-making engine behind getting a second or third personal loan. It is a data-driven risk assessment. Lenders in the US, UK, Canada, and Australia will use automated algorithms and manual underwriting to find out if you are a “safe bet.” Here’s the question they are comparing you against: “If we give this person more money, what is the statistical probability they will pay it back on time?” That question spreads across two points: a Credit check is always the first one.

This swipe gives them a casual view into your borrowing past. They are not just looking at your score, but also spend some time analyzing the details. How many open accounts do you have? What is your total outstanding debt? Have you paid everything on time? Another key metric is your credit utilization ratio on revolving accounts like credit cards – if your limit is reached, you are in financial distress.

They see your existing personal loan problems and their payment health. Your income and employment are reported. You must provide them with a recent payslip, tax returns, or even bank statements. The lender must see evidence that your income is stable and high enough to cover your current obligations and pay back the new loan. A high-income applicant assessed equally with a fluctuating or low-income borrower will always have a better chance, no matter what their credit score is.

Here is a mini-case study:

Let’s look at James from Toronto, Canada. He has one personal loan and applies for a second one to consolidate high-interest credit card debt.

· Loan 1: $10,000 with a $250/month payment.

· Credit Score: 750 (Good).

· Income: $80,000/year ($6,667/month).

· Other Debts: $450/month (car loan).

· Current DTI: ($250 + $450) / $6,667 = 10.5%.

The lender sees his low DTI, excellent payment history on the first loan, and stable job. They also note that the purpose of the new loan is debt consolidation, which is often viewed positively as a responsible financial move. They approve his application for a second loan because their analysis shows he has ample free cash flow to manage the additional payment. His application would likely be less successful if he were seeking a loan for a speculative investment or a luxury purchase.

| Decision Factor | Positive Signal for Lender | Negative Signal (Red Flag) |

| Loan Purpose | Debt consolidation, home improvement, and medical emergency. | Vacation, gambling, speculative investments. |

| Recent Credit Activity | Few or no new applications in the last 6 months. | Multiple recent credit applications (“credit seeking”). |

| Free Cash Flow | High disposable income after all expenses and debts. | Low or negative cash flow after obligations are met. |

| Credit History Length | Long and established credit history (5+ years). | Thin or new credit file. |

| Lender’s Internal Score | High internal score based on past relationship (if any). | No history or a poor history with that specific lender. |

Key Tip: Before you apply, review your credit report and gather your income documents. Presenting a clear and organized financial picture makes the lender’s decision easier and can work in your favor.

Risks and Benefits of Holding Multiple Personal Loans

Taking on more than one personal loan can be a double-edged sword. On one hand, it can provide the immediate cash needed to achieve a goal or handle an emergency. On the other hand, it can complicate your finances and increase your risk of falling into a debt spiral. Carefully weighing the pros and cons is essential before you sign on the dotted line for another loan.

The Benefits:

The most significant benefit is access to capital. If you need funds for separate, distinct purposes—say, one loan for a planned home renovation and a later one for an unexpected car repair—multiple loans can be a structured way to finance these needs without liquidating assets. Unlike a single, larger loan, taking a second, smaller loan means you only borrow what you need at that moment, potentially saving on interest. If you manage the payments responsibly, it can also positively impact your credit score over time by adding to your history of on-time payments and diversifying your credit mix.

The Risks:

The primary risk is over-indebtedness. Each loan adds a fixed monthly payment to your budget. Juggling multiple payment dates, interest rates, and lenders can become confusing and stressful. A simple mistake, like forgetting a due date, can lead to late fees and damage your credit score. More importantly, it significantly increases your Debt-to-Income (DTI) ratio. A high DTI can make it incredibly difficult to qualify for future credit, such as a mortgage or a car loan, as lenders will see you as “overleveraged.” There is also the risk of “loan stacking”—taking out new loans to cover payments on old ones—a dangerous cycle that often leads to financial distress.

Mini Case Study:

Meet Olivia from Houston, Texas. She took out a $15,000 loan for debt consolidation. A year later, she took another $5,000 loan for a family emergency.

· Benefit: She successfully managed the emergency without using her high-interest credit cards.

· Risk: Her total monthly loan payments jumped from $350 to $500. A few months later, her company reduced overtime hours, cutting her income by 15%. The combined loan payments, once manageable, became a major strain on her budget, forcing her to cut back on essential savings. Her story highlights how multiple loans reduce your financial flexibility to handle unexpected income shocks.

| Aspect | Benefits of Multiple Loans | Risks of Multiple Loans |

| Financial Management | Access funds for specific needs as they arise. | Complicates budgeting with multiple payment dates. |

| Cost | Potentially borrow only what you need, saving interest. | Subsequent loans may have higher interest rates. |

| Credit Impact | It can build a positive payment history if managed well. | Increases risk of missed payments and credit score damage. |

| Long-Term Goals | It can help finance important life events or investments. | High DTI can prevent future borrowing (e.g., mortgages). |

| Flexibility | Provides liquidity without selling assets. | Reduces monthly cash flow and ability to absorb income shocks. |

Takeaway: Only consider a second personal loan if you have a clear purpose, a stable income, and a solid budget that can comfortably accommodate the additional payment.

How Existing Debt Affects New Loan Approvals

When you apply for a new personal loan, your existing debt is the single most important factor in the lender’s decision, second only to your income. Lenders in the US, UK, Canada, and Australia are legally and financially obligated to lend responsibly. This means they must assess your ability to repay the new debt on top of all your current financial commitments. Your existing debt portfolio paints a detailed picture of your financial habits and capacity.

Lenders look at two main aspects of your debt: the amount and the type. The total amount of your outstanding debt—including mortgages, auto loans, student loans, credit card balances, and existing personal loans—is used to calculate your Debt-to-Income (DTI) ratio. As this ratio climbs, your perceived risk to the lender skyrockets. Most mainstream lenders have a hard DTI cap, often around 43% to 50% in the US, beyond which they will not approve an application.

The type of debt also matters. A mortgage or a student loan is often viewed more favorably than high-interest, unsecured debt like credit card balances. Having significant revolving debt suggests you might be living beyond your means. An existing personal loan is a neutral factor if you’ve been paying it diligently. However, having multiple unsecured personal loans can be a red flag, signaling to the lender that you are increasingly reliant on borrowed money to manage your finances.

Mini Case Study:

Consider two applicants, both earning $75,000 a year in Canada and applying for a $10,000 loan.

· Applicant A (Maria): Has a $2,000/month mortgage payment and a $200/month car loan. Her total existing debt payment is $2,200. Her DTI is 35%. She has no other unsecured loans.

· Applicant B (David): Has a $1,500/month rent payment (not typically counted in DTI), a $400/month car loan, a $300/month existing personal loan, and $5,000 in credit card debt. His monthly debt payments are $700. His DTI is only 11%.

Who is more likely to be approved? Surprisingly, Maria might face more scrutiny despite her higher DTI, but her debt is secured and structured. David’s DTI is low, but his mix of unsecured debt (personal loan + credit cards) might concern the lender. If David has been paying everything on time, he will likely be approved. However, if he had two existing personal loans and maxed-out credit cards, he would almost certainly be denied, regardless of his DTI.

| Type of Existing Debt | How Lenders Typically View It | Impact on New Loan Approval |

| Mortgage / Rent | A standard, expected living expense. Secured debt. | Moderate impact; factored into overall affordability. |

| Auto Loan | Common secured debt. | Low to moderate impact if the payment is reasonable. |

| Student Loans | Seen as an investment in future earnings. | Moderate impact; the monthly payment is key. |

| Credit Card Debt | High-interest, revolving debt. | High negative impact, especially if balances are high. |

| Existing Personal Loan(s) | Unsecured debt. | High impact; payment history is scrutinized heavily. |

Key Tip: The best way to improve your chances of approval is to pay down high-interest debt, particularly credit card balances, before applying for a new personal loan. This directly lowers your DTI and signals financial discipline.

Alternatives to Applying for Multiple Personal Loans

Before you rush to apply for another personal loan, it’s crucial to pause and consider if it’s truly the best option for your financial situation. Juggling multiple loans can be complex and risky. Fortunately, several alternatives are available in Tier One markets that might be more suitable, affordable, or easier to manage.

One of the most popular alternatives is a Debt Consolidation Loan. This involves taking out a single, larger personal loan to pay off all your other existing debts, including your first personal loan and any credit card balances. The goal is to simplify your finances into one monthly payment, potentially at a lower overall interest rate. This is not the same as adding another loan; it’s about replacing multiple debts with one.

Another strong option is a Home Equity Line of Credit (HELOC) or a Home Equity Loan, if you are a homeowner. These allow you to borrow against the equity you’ve built in your property. Because the loan is secured by your home, interest rates are typically much lower than those for unsecured personal loans. However, this option comes with a significant risk: if you fail to make payments, the lender can foreclose on your home.

A 0% APR Credit Card can be an excellent choice for smaller borrowing needs. Many cards offer introductory periods of 12-21 months where you pay no interest on new purchases or balance transfers. If you are confident you can pay off the full amount before the promotional period ends, this can be the cheapest way to borrow money.

Mini Case Study:

Sarah from the UK has a £4,000 personal loan. She now needs an additional £2,000 for car repairs.

· Option 1 (Second Loan): She could apply for a £2,000 loan. She would then have two separate monthly payments to manage.

· Option 2 (Consolidation): She could apply for a new £6,000 personal loan. She would use it to pay off the original £4,000 loan and keep the remaining £2,000 for her car. She would now have only one, slightly larger monthly payment.

· Option 3 (0% Card): She could apply for a credit card with a 0% APR offer for 18 months. She pays for the repairs with the card and focuses on paying off the £2,000 balance within the 18-month window, paying no interest at all. For a smaller, short-term need, this is likely her most cost-effective solution.

| Alternative | Best For… | Key Risk |

| Debt Consolidation Loan | Simplifying multiple high-interest debts into one payment. | May have origination fees; requires discipline not to rack up new debt. |

| HELOC / Home Equity Loan | Large expenses (e.g., major renovation) when you have home equity. | Your home is used as collateral, risk of foreclosure. |

| 0% APR Credit Card | Smaller, short-term borrowing needs that you can repay quickly. | Interest rate skyrockets after the introductory period ends. |

| Borrowing from Family/Friends | When you need flexible terms and have a strong relationship. | It can strain personal relationships if not handled formally. |

| Secured Loan | When you have a poor credit score but have a valuable asset (like a car) to use as collateral. | Risk of losing the asset if you default on the loan. |

Result: Exploring these alternatives can save you money, simplify your financial life, and reduce the risk associated with managing multiple unsecured loans.

Debt-to-Income Ratio and Its Impact on Loan Approval in the US and UK

Your Debt-to-Income (DTI) ratio is one of the most critical numbers lenders examine when you apply for a loan. It’s a simple percentage that shows how much of your monthly income is already committed to debt payments. Lenders use it as a quick gauge of your ability to handle new debt. While the concept is universal, its application differs slightly between markets like the US and the UK.

In the United States, DTI is a hard-and-fast metric. Lenders calculate it using a precise formula:

DTI=Gross Monthly IncomeTotal Monthly Debt Payments×100%

Your total monthly debt includes rent/mortgage, minimum credit card payments, auto loans, student loans, and existing personal loan payments. Most US lenders prefer a DTI below 36%. While some may go up to 43% or even 50% for applicants with excellent credit, anything higher is a major red flag for an unsecured personal loan.

In the United Kingdom, the approach is less about a single DTI number and more about a holistic “affordability assessment,” as mandated by the Financial Conduct Authority (FCA). UK lenders will still calculate your debt-to-income ratio, but they also factor in your regular living expenses, such as utilities, council tax, transportation, and food costs, to get a clearer picture of your disposable income. They are more interested in what’s left over each month than the raw DTI percentage. An applicant might have a low DTI but high living expenses, leaving little room for a new loan payment, and could still be denied.

| DTI / Affordability Level | US Lender View | UK Lender View |

| Below 20% (Excellent) | Very low risk. Highly likely to be approved. | Strong position. Affordability is clearly demonstrated. |

| 20% – 36% (Good) | Ideal range. Considered a responsible borrower. | Positive indicator, but other expenses will be checked. |

| 37% – 43% (Acceptable) | Borderline. Approval depends on a high credit score/income. | Requires a deeper look into disposable income and budget. |

| Above 43% (High Risk) | Very unlikely to be approved for an unsecured loan. | Very high risk. Unlikely to pass affordability checks. |

Expert Insight:

“Borrowers often focus too much on their credit score and forget about DTI,” notes financial advisor Emily Carter. “You can have a perfect 800 credit score, but if your DTI is over 50%, no mainstream lender will touch you for an unsecured loan. Before you even think about applying for a second loan, calculate your DTI. If it’s high, your first step should be to pay down existing debt, not take on more.”

This shows that managing your DTI is a proactive step. If you anticipate needing another loan, focus on reducing your current debt burden first to make your application more attractive to lenders in both the US and the UK.

Credit Score Requirements for a Second or Third Personal Loan

When you seek an additional personal loan, your credit score is placed under a microscope. Lenders view a second loan as an increase in their risk exposure, so they logically demand a higher level of confidence in your ability to repay. This means the credit score requirement for a second or third loan is often higher than it was for your first.

For your first personal loan, you might qualify with a “fair” credit score (e.g., around 640 FICO in the US). However, when you apply for another loan, lenders will want to see that you have managed the first loan perfectly. They will look for a score that is not just stable, but has ideally improved. A credit score in the “good” to “excellent” range (typically 700+ in the US and Canada, or a high rating from agencies like Experian in the UK and Australia) becomes much more important. A high score demonstrates a history of responsible borrowing and signals that adding another loan is unlikely to overwhelm you.

Lenders will also analyze the details of your credit report. They want to see:

· On-time payment history: No late payments on any account, especially the existing personal loan.

· Credit utilization: Your credit card balances should be low relative to your limits (ideally below 30%).

· Recent inquiries: Not too many recent applications for new credit.

| Credit Score Tier | Likelihood of Approval for a Second Loan | Potential Terms |

| Excellent (760+) | Very High | Lenders will compete for your business; best rates and terms. |

| Good (700-759) | High | Should qualify with multiple lenders at competitive rates. |

| Fair (640-699) | Moderate to Low | May need to apply with specialist lenders; rates will be higher. |

| Poor (<640) | Very Low | Extremely difficult; may only qualify for high-cost or secured loans. |

Expert Insight:

According to credit analyst John Miller, “The biggest mistake people make is applying for a second loan too soon after the first. A new loan temporarily lowers your score because of the hard inquiry and the reduced average age of your accounts. Give it at least 6-12 months. Make every payment on time for the first loan, and let your score recover and even grow before you apply again. This patience shows lenders’ maturity and stability.”

Essentially, your credit score is your borrowing reputation. To get a second loan on good terms, you need to prove that you’ve enhanced that reputation since you took on your first one.

How Loan Stacking Works and When It Becomes Risky

“Loan stacking” is the practice of taking out multiple personal loans from different lenders in a short period. Sometimes it happens for legitimate reasons—one lender doesn’t offer enough, so you apply to another to cover the shortfall. However, it often occurs when a borrower gets a loan and then quickly seeks another before the first loan has been fully reported to all credit bureaus. This can give a temporary, misleading picture of their true debt load.

How It Works:

Imagine you apply for a $10,000 loan from Lender A on Monday. It gets approved. On Wednesday, before Lender A’s new account information is visible on your credit report, you apply for another $10,000 loan from Lender B. Lender B pulls your credit report, which doesn’t yet show the loan from Lender A, and they approve you based on this incomplete information. You have now “stacked” $20,000 in new debt very quickly.

When It Becomes Risky:

Loan stacking is extremely risky for both the borrower and the lender. For the borrower, it’s a fast track to becoming over-indebted. You suddenly have double the monthly payments you may have budgeted for, dramatically increasing your risk of default. This can lead to a debt spiral where you consider taking a third loan (often a high-interest payday loan) just to make payments on the first two. This behavior is a massive red flag for lenders and can severely damage your credit score for years. Many lenders have systems in place to detect this behavior and will deny applications if they suspect stacking.

| Aspect | Legitimate Multiple Loans | Risky Loan Stacking |

| Timing | Loans are taken out months or years apart. | Multiple loans are taken out within days or weeks. |

| Lender Knowledge | Each new lender is fully aware of the previous loans. | New lenders may be unaware of other recent applications. |

| Borrower’s Intent | To finance separate, planned expenses. | To acquire cash quickly, potentially beyond one’s means. |

| Financial Outcome | Manageable payments within a stable budget. | A sudden, unmanageable spike in monthly debt payments. |

Expert Insight:

“Loan stacking is a classic sign of financial distress,” warns debt counselor Maria Sanchez. “It’s often a precursor to serious financial trouble. Lenders see it as deceptive behavior, even if unintentional. If you need more money than one lender will provide, the responsible path is to ask your first lender for a higher amount, seek a cosigner, or consider a secured loan—not to quietly take on a second loan from someone else. Honesty and transparency are key to sustainable borrowing.”

In short, while having multiple loans is not inherently bad, the act of stacking them in a short timeframe is a dangerous financial game that you are likely to lose.

Difference Between Taking Multiple Loans and Refinancing

When you need more money or want better terms on your existing debt, you face a critical choice: should you take out another loan or refinance your current one? While both options involve a new loan application, they serve fundamentally different purposes and have very different impacts on your financial health. Understanding this distinction is key to making a smart borrowing decision.

Taking a Second Personal Loan means you are adding a new, separate debt to your financial portfolio. You will keep your original loan and its payment schedule, and you will now have a second loan with its own terms, interest rate, and monthly payment. You are increasing your total outstanding debt and your total monthly debt obligation. This is typically done when you have a new, separate funding need that is unrelated to your first loan.

Refinancing a Personal Loan, on the other hand, means you are replacing your existing loan with a new one. The new loan is used to pay off the old loan’s balance. You might do this to secure a lower interest rate, which could reduce your monthly payment and save you money over the life of the loan. You could also refinance for a larger amount than your original balance in what’s called a “cash-out refinance,” giving you extra funds while still consolidating into a single loan. Your total number of loans does not increase.

| Feature | Taking a Second Loan | Refinancing a Loan |

| Purpose | To get additional funds for a new expense. | To get a better interest rate or a different term on existing debt. |

| Number of Loans | Increases (You now have two or more). | Stays the same (The new loan replaces the old one). |

| Total Debt | Increases by the amount of the new loan. | Stays the same or increases only if you do a “cash-out.” |

| Monthly Payments | Increases (You have two separate payments). | Changes to a single new payment, which may be lower or higher. |

| Best For | Funding a new, distinct project or emergency. | Saving money on interest when rates have dropped or your credit has improved. |

Expert Insight:

Financial planner David Chen advises, “If your credit score has significantly improved since you took out your first loan, always look into refinancing before you consider a second loan. You may be able to get a much lower rate. If you need extra cash, a cash-out refinance can solve that need while simplifying your debt into one payment, often at a better blended rate than keeping your old loan and adding a new, higher-rate one. A second loan should be your go-to only when refinancing isn’t possible or doesn’t make sense for your situation.”

How Loan Terms and Repayment Overlap Affect Your Finances

Managing one personal loan is straightforward: you have one payment, one due date, and one interest rate to track. When you introduce a second loan, the complexity doubles. The way the terms and repayment schedules of your loans overlap can have a significant impact on your monthly cash flow and overall financial stress.

First, consider the Loan Terms. This refers to the length of the loan, typically expressed in months or years. You might have a 5-year (60-month) term on your first loan and a 3-year (36-month) term on your second. This means for the first three years, you will be making two full payments. After the second loan is paid off, your monthly obligation will drop, freeing up cash flow. It’s crucial to budget for the period of maximum overlap when both payments are due.

Second, the Repayment Schedules can create logistical headaches. Your first loan payment might be due on the 1st of the month, while the second is due on the 15th. This splits your debt obligation across the month, which can be tricky to manage. It requires more vigilant budgeting to ensure funds are available on two separate dates. A mistake is more likely when juggling multiple due dates, and a single late payment can incur fees and damage your credit. Many borrowers try to align their payment dates to simplify this process.

| Overlap Factor | Potential Challenge | Smart Strategy |

| Different Due Dates | Higher risk of forgetting a payment; it complicates cash flow planning. | Set up automatic payments for both loans. Ask lenders if you can change due dates to be the same day. |

| Variable Interest Rates | If one loan is variable, your payment could unexpectedly increase. | Prioritize paying off the variable-rate loan first, or refinance it into a fixed-rate loan. |

| Differing Loan Terms | High combined payment during the overlap period. | Create a detailed budget that accounts for the higher payment period. Plan how you’ll use the extra cash flow once one loan is paid off. |

| Multiple Lenders | Different online portals, customer service, and policies. | Use a budgeting app that links all your accounts in one place for a consolidated view of your finances. |

Expert Insight:

“The psychological burden of multiple payments is real,” says behavioral finance expert Dr. Anna Rodriguez. “Seeing two large debits from your account each month can feel more draining than seeing one larger one. This ‘pain of paying’ can lead to financial fatigue. For this reason, even if the math is slightly less optimal, some people benefit greatly from consolidating their loans. It simplifies their mental accounting and makes them feel more in control of their debt.”

Therefore, when considering a second loan, don’t just look at the rates and amounts. Map out the payment schedules on a calendar and be honest about your ability to manage the added complexity.

Best Practices Before Applying for Another Personal Loan

Applying for another personal loan is a significant financial decision that requires careful preparation. Jumping in without doing your homework can lead to rejection, a higher interest rate, or taking on debt you can’t truly afford. Following a clear set of best practices can dramatically improve your chances of success and ensure the loan helps, rather than harms, your financial situation.

First, conduct a thorough financial self-assessment. Before you even look at lenders, look at your own budget. Calculate your current Debt-to-Income (DTI) ratio. Is it well below the 40% threshold? How much free cash flow do you have each month after all your existing bills and debts are paid? Be brutally honest about whether you can comfortably absorb another monthly payment.

Second, check and clean up your credit report. Request free copies of your credit reports from the major bureaus in your country (e.g., Equifax, Experian, TransUnion). Scrutinize them for any errors, such as incorrect late payments or accounts that aren’t yours. Disputing and correcting these errors can provide a quick boost to your credit score. Also, ensure you have paid down any high-balance credit cards to lower your credit utilization ratio.

Third, define the loan’s purpose and amount precisely. Don’t just ask for a round number. Know exactly what you need the money for and how much that will cost. Lenders are more confident in borrowers who have a clear and responsible plan for the funds, such as consolidating higher-interest debt or funding a critical home repair, rather than a vague request for “extra cash.”

| Pre-Application Checklist | Action Item | Why It’s Important |

| 1. Budget Analysis | Calculate your DTI and monthly surplus cash. | To confirm that you can genuinely afford the new payment. |

| 2. Credit Report Review | Check for errors and high credit utilization. | A higher, accurate score gets you better rates and approval odds. |

| 3. Define Your Need | Determine the exact loan amount and purpose. | Shows the lender you are a responsible and organized borrower. |

| 4. Gather Documentation | Collect recent payslips, bank statements, and tax forms. | Speeds up the application process and proves your income. |

| 5. Pre-Qualify with Lenders | Use soft-pull pre-qualification tools to check rates. | Allows you to shop for the best offers without hurting your credit score with hard inquiries. |

Expert Insight:

“The single best practice is to pre-qualify with multiple lenders,” advises financial journalist Mark Hastings. “In the US, UK, and Australia, most online lenders offer a pre-qualification process that uses a soft credit check, which doesn’t affect your score. This allows you to see the actual rates and terms you’re likely to get. It turns an uncertain process into a transparent shopping experience. Never submit a full application until you’ve compared several pre-qualified offers.”

By following these steps, you transform from a hopeful applicant into a well-prepared, attractive borrower.

Income Verification and Borrowing Limits Set by Major Lenders

Lenders need absolute certainty about your income before they approve a second loan. Since you already have existing debt, they must rigorously verify that your earnings can support an additional payment. This process is standardized across most major lenders in Tier One markets. You will be required to provide clear documentation, such as your last two to three payslips, your most recent tax return (like a W-2 in the US or a P60 in the UK), and sometimes your last few months of bank statements to show consistent deposits. For self-employed individuals, the requirements are even stricter, often demanding two years of tax returns and business bank statements.

Your verified income directly determines your borrowing limit. Lenders use a “multiple of income” approach as a starting point. For example, some lenders might cap total unsecured personal loan exposure at 25-50% of your annual income. If you earn $80,000, they may not be willing to lend you more than $40,000 in total across all personal loans with them. If you already have a $15,000 loan, your maximum for a second loan might be capped at $25,000, assuming your DTI and credit score support it.

Checklist for Income Verification:

· [ ] Recent Payslips (last 2-3 months)

· [ ] Latest Tax Return Documents

· [ ] Bank Statements (showing payroll deposits)

· [ ] Letter from Employer (if requested)

· [ ] Proof of Other Income (e.g., benefits, rental income)

Waiting Periods Between Loan Applications in Tier One Markets

While there is no universal, legally mandated waiting period between personal loan applications, most lenders have internal policies and best practices that create a de facto waiting period. Applying for multiple loans in quick succession is a significant red flag for “credit-seeking” behavior, which suggests financial instability. Most financial experts recommend waiting at least three to six months between applications.

This waiting period serves two important purposes. First, it gives your credit score time to recover from the hard inquiry of your last application. A single hard inquiry can temporarily dip your score by a few points, and multiple inquiries in a short span can have a cumulative negative effect. Second, it allows you to establish a positive payment history on your new loan. By making 3-6 on-time payments, you demonstrate to the next lender that you are responsibly managing the new debt. Some lenders have explicit rules, for instance, not considering an applicant who has taken out another personal loan within the last 60 or 90 days. Rushing the process almost always works against you.

Key Tip: Instead of applying immediately, use the waiting period to improve your financial standing. Focus on making consistent payments, reducing credit card balances, and letting your credit score rebound.

How Lender Policies Vary on Multiple Personal Loans

Not all lenders view multiple personal loans in the same way. Their policies can vary significantly based on their risk appetite and target customers. Understanding these differences can help you choose the right lender to approach for a second loan.

Large Traditional Banks (e.g., Chase, Barclays, RBC, NAB): These institutions are typically more conservative. They often prefer to lend to existing customers with strong credit scores and stable income. They may have stricter DTI limits and a clear policy against loan stacking. Some may even have a rule limiting customers to only one active personal loan with them at a time.

Credit Unions: As member-owned institutions, credit unions can be more flexible. They may be more willing to look at your entire relationship with them, not just your credit score. If you have a long history of responsible banking with a credit union, they may be more open to approving a second loan, sometimes with more favorable rates than a traditional bank.

Online & Fintech Lenders (e.g., SoFi, Upstart, LendingClub): These lenders often have more sophisticated, data-driven underwriting models. They may be more comfortable with borrowers who have existing debt, provided their algorithm assesses them as low risk. However, they are also very adept at detecting loan stacking and may have higher interest rates to compensate for the perceived risk of unsecured lending.

Interest Rate Considerations for Concurrent Personal Loans

When you take on a second personal loan, you should not expect to get the same interest rate you received on your first one. More often than not, the rate for the second loan will be higher. This is because the lender views you as a riskier borrower than you were before. You now have a larger total debt burden, which increases the statistical chance of a missed payment.

The interest rate you are offered is a direct reflection of this risk. Several factors will influence the new rate:

1. Your Current Credit Score: If your score has improved since the first loan, you might offset the risk and get a good rate. If it has dropped, expect a significantly higher rate.

2. Your DTI Ratio: The higher your DTI is with the first loan factored in, the higher your interest rate on the second loan will be.

3. The Lender: Some lenders specialize in “near-prime” or “subprime” lending and will approve borrowers with multiple loans, but they charge much higher rates to cover potential losses.

4. The Market Environment: If overall interest rates have risen since you took out your first loan, your second loan will naturally be more expensive.

Key Tip: Always calculate the total cost of borrowing for the second loan, not just the monthly payment. A higher interest rate can add thousands to the amount you repay over the life of the loan.

Managing Payment Schedules Across Multiple Lenders

Juggling payments to multiple lenders is one of the biggest practical challenges of having more than one personal loan. A single forgotten payment can trigger late fees and a negative mark on your credit report. Effective organization is not just helpful; it’s essential.

Strategies for Successful Management:

· Create a Master Calendar: Use a digital calendar or a simple spreadsheet to list all your loan details: lender, payment amount, and due date. Set multiple reminders for each payment a few days in advance.

· Automate Everything: The single most effective tool is autopay. Set up automatic transfers from your checking account for each loan’s due date. This “set it and forget it” approach eliminates the risk of human error. Just ensure you always have sufficient funds in your account to avoid overdraft fees.

· Align Your Due Dates: Call each lender and ask if you can change your payment due date. Many will accommodate this request. Having all your loan payments due on the same day (e.g., the 1st or 15th) simplifies budgeting and tracking immensely.

· Use a Financial Aggregator App: Apps like Mint, Personal Capital, or Copilot can link all your financial accounts in one place. They provide a consolidated view of your loan balances and upcoming due dates, giving you a single dashboard to monitor your debt.

How Consolidation Loans Can Simplify Multi-Loan Debt Management

If you find that managing two or more personal loans is becoming a headache, a debt consolidation loan is often the most logical solution. Instead of adding another loan to the pile, a consolidation loan replaces them. The process is simple: you apply for a new, single loan that is large enough to pay off the outstanding balances of all your existing loans.

The primary benefits are:

1. Simplicity: You replace multiple payments, due dates, and lenders with just one. This dramatically reduces the administrative burden and the risk of a missed payment.

2. Potential Cost Savings: If your credit has improved or market rates have dropped, you may secure a lower interest rate on the consolidation loan than the blended average rate of your existing loans. This can lower your new single monthly payment and save you money on total interest paid.

3. Predictable Budgeting: A single fixed payment makes it much easier to budget your monthly expenses and plan for the future.

However, it’s important to be disciplined. After consolidating, you must avoid the temptation to run up new debt on the credit cards or lines of credit you’ve just paid off. Otherwise, you can end up in a worse financial position than when you started.

Strategies to Improve Approval Chances for a Second Personal Loan

Getting approved for a second personal loan requires you to present yourself as an exceptionally reliable borrower. Start by boosting your credit score. Focus on making 100% of your payments on time and paying down credit card balances to below 30% of their limits. Next, consider increasing your income or reducing your non-essential expenses in the months leading up to your application. This will improve your DTI ratio. If possible, apply with the lender of your first loan, as they have a direct view of your positive payment history with them. Finally, when you apply, be very specific about the loan’s purpose, framing it as a responsible need, such as debt consolidation or a value-adding home repair.

Warning Signs You’re Taking On Too Much Unsecured Debt

It’s easy to get in over your head with unsecured debt. The first warning sign is a rising Debt-to-Income (DTI) ratio. If your DTI is climbing above 35-40%, you are entering a high-risk zone. Another red flag is using new debt to pay off existing debt—a classic symptom of a debt spiral, often called “robbing Peter to pay Paul.” If you find yourself constantly stressed about making payments, relying on credit card cash advances to get by, or your savings rate has dropped to zero, these are clear indicators that you have taken on too much. At this point, you should stop considering new loans and seek credit counseling.

How to Maintain a Healthy Credit Profile with Multiple Loans

Managing multiple loans without damaging your credit is a balancing act that hinges on discipline. The absolute number one rule is to never miss a payment. Setting up autopay for all your loans is the best way to ensure this. Second, continue to monitor your credit utilization on your credit cards; keep the balances low, as this has a significant impact on your score. Avoid applying for any other new credit (like a new credit card or auto loan) while you are managing multiple personal loans, as each new hard inquiry can chip away at your score. Over time, as you consistently pay down your loans, your score will benefit from the long history of on-time payments.

When Refinancing Is Smarter Than Taking Another Loan

Refinancing is the smarter move in two key scenarios. First, if your credit score has significantly improved or market interest rates have fallen since you took out your first loan. In this case, you can replace your existing loan with a new one at a much lower rate, saving you money. Second, if you need additional funds, a cash-out refinance is often superior to a second loan. It allows you to borrow more than your current balance, providing you with extra cash while consolidating your debt into a single, potentially lower-rate loan. This prevents the complexity of managing two separate payments. A second loan is only better if you need a small amount of money and don’t want to disturb the great rate on your existing loan.

Financial Tools for Tracking Multiple Loan Payments Effectively

Manually tracking multiple loans can lead to errors. Leverage technology to stay organized.

· Budgeting Apps (Mint, YNAB, Copilot): These apps sync with your bank accounts and loan providers, showing all your due dates and balances on one dashboard. They often send payment reminders automatically.

· Calendar Alerts: A low-tech but highly effective method. Create recurring events in your Google Calendar or iCal for each payment due date with alerts set for 2-3 days prior.

· Lender Mobile Apps: Make sure you have the mobile app for each lender installed. Enable push notifications for payment reminders and confirmations.

· Spreadsheets: For those who prefer manual control, a simple spreadsheet can track lenders, balances, interest rates, and payment dates.

Using these tools makes managing debt less stressful and far more accurate.

Working With Trusted Lenders to Avoid Overborrowing in the US & UK

To avoid the trap of overborrowing, it’s crucial to work with reputable lenders who adhere to responsible lending practices. In the US, look for lenders who are transparent about their rates and fees as required by the Truth in Lending Act (TILA). In the UK, ensure your lender is authorized and regulated by the Financial Conduct Authority (FCA). These trusted lenders have robust underwriting processes designed to prevent you from taking on a loan you can’t afford. They will carefully assess your DTI and affordability. Steer clear of “no credit check” lenders or those promising guaranteed approval, as these are often predatory lenders that use excessively high interest rates and fees, making overborrowing almost inevitable.

Expert Insights: Impact of Multiple Loans on Long-Term Credit Health

Taking on multiple personal loans can be a neutral or even positive event for your long-term credit health, but only if managed flawlessly. Each on-time payment adds to your positive payment history, which is the most significant factor in your credit score. However, the initial impact is negative. Multiple hard inquiries and a lower average age of your accounts will cause a temporary drop in your score. The real long-term risk comes from default. A single missed payment can stay on your credit report for seven years in the US. Defaulting on a loan can devastate your credit health, making it nearly impossible to get approved for major credit, like a mortgage, for years to come. The key is perfect, consistent repayment.

Legal Protections and Disclosure Requirements in the US, UK & Canada

Borrowers in Tier One markets are protected by robust consumer protection laws.

· In the US: The Truth in Lending Act (TILA) requires lenders to provide a clear disclosure of the Annual Percentage Rate (APR), finance charges, total payments, and payment schedule. This allows you to accurately compare loan offers.

· In the UK, the Financial Conduct Authority (FCA) mandates that lenders conduct a thorough affordability assessment and provide clear, fair, and non-misleading information to consumers. Lenders must provide a pre-contract credit information document.

· In Canada, Consumer protection is provincially regulated, but all provinces have “cost of credit disclosure” laws. Lenders must clearly state the APR and total cost of borrowing in the loan agreement.

These laws are designed to ensure you have all the critical information before you commit to a loan.

How Hard Inquiries Influence Your Borrowing Power

When you formally apply for a personal loan, the lender performs a “hard inquiry” or “hard pull” on your credit report. This is a record that you applied for new credit. A single hard inquiry typically has a small, temporary impact, often lowering your credit score by 3 to 5 points for a few months. However, multiple hard inquiries in a short period can have a more significant negative effect. Lenders see this as a sign of desperation or “credit-seeking” behavior, which increases your perceived risk. This can reduce your borrowing power by either leading to an outright application denial or causing lenders to offer you higher interest rates. To minimize the impact, use soft-pull pre-qualification tools to shop around before submitting official applications.

State-Specific Rules and Personal Loan Limits Across Tier One Markets

While the principles of lending are similar, specific regulations can vary. In the United States, interest rates and loan terms are governed by state-level usury laws. This means the maximum allowable interest rate for a personal loan can be different in California than it is in Texas. Some states also have specific regulations on loan fees and rollovers. In Canada, regulations are set at the provincial level, with each province having its own Consumer Protection Act that dictates lending rules. In the UK and Australia, lending is regulated at the national level (by the FCA and ASIC, respectively), ensuring more consistent rules across the entire country. Before borrowing, it’s wise to be aware of the specific consumer protection laws in your state or province.

Tips to Reduce Financial Risk When Managing Several Loans

To minimize the financial risk of juggling several loans, your top priority should be building a cash buffer. Aim to have at least one month’s total loan payments set aside in a separate savings account. This emergency fund prevents a minor income disruption from causing a catastrophic missed payment. Second, adopt the “debt avalanche” or “debt snowball” method. Once you have made the minimum payments on all loans, allocate any extra cash to paying off either the loan with the highest interest rate (avalanche) or the smallest balance (snowball). This strategy accelerates your debt repayment, saving you interest and reducing your risk exposure faster. Finally, continuously re-evaluate your budget to cut unnecessary spending and maximize the amount you can put toward your debt.

Understanding Transparency and Accountability in Loan Agreements

A loan agreement is a legally binding contract. True transparency means the lender clearly discloses all key terms upfront: the APR, total interest cost, all fees (origination, late payment, prepayment), the monthly payment amount, and the loan term. There should be no hidden clauses or confusing language. Accountability means the lender adheres to this agreement and follows all consumer protection regulations. Before signing, read every line of the agreement. Do you understand it completely? If not, ask for clarification. Reputable lenders will have no problem explaining their terms. If a lender is evasive or pressures you to sign quickly, consider it a major red flag. Your signature makes you accountable for the debt, so ensure the lender is being transparent and accountable to you.

FAQ

Can you take multiple personal loans at once?

Yes, you can legally have multiple personal loans at once. No law in the US, UK, Canada, or Australia sets a specific limit on the number of loans you can hold. However, the practical limit is determined by lenders. Each time you apply for a new loan, the lender will conduct a thorough assessment of your creditworthiness, focusing heavily on your debt-to-income (DTI) ratio and payment history. They need to be confident that your income can support your existing debt payments plus the new one. If your DTI is too high or your credit history shows signs of risk, you will be denied. Essentially, your ability to take on multiple loans is limited by your financial capacity, not by a legal number.

Is having 3 personal loans bad for your credit?

Having three personal loans is not inherently bad for your credit, but it can be very risky and can negatively affect your score in several ways. Firstly, each application results in a hard inquiry, which can lower your score temporarily. Secondly, three new accounts will lower the average age of your credit history, which is another scoring factor. Most importantly, it significantly increases your total debt load. If you manage all three payments perfectly and never miss a due date, your score can actually benefit over the long term from the positive payment history. However, the high monthly payment burden makes a missed payment more likely. A single late payment across any of the three loans will damage your credit score. It’s a high-risk strategy that requires excellent financial discipline.

How much is a $20,000 loan for 5 years?

The monthly payment for a $20,000 loan over 5 years (60 months) depends entirely on the Annual Percentage Rate (APR). The APR includes the interest rate plus any fees. For example:

· At a good APR of 7%, your monthly payment would be approximately $396. The total interest paid would be $3,760.

· At a fair APR of 15%, your monthly payment would be approximately $476. The total interest paid would be $8,550.

· At a poor credit APR of 25%, your monthly payment would be approximately $585. The total interest paid would be $15,100.

As you can see, the interest rate has a massive impact on the cost. To find out your exact payment, you would need to pre-qualify with lenders to see what APR you are offered based on your credit score and financial profile.

Can I take out a personal loan if I already have one?

Yes, you can absolutely apply for and get another personal loan if you already have one. Lenders are willing to approve a second loan provided you meet their eligibility criteria. When you apply, the lender will review your entire financial situation. They will pay close attention to your payment history on the existing loan—on-time payments will work strongly in your favor. They will also recalculate your debt-to-income (DTI) ratio to include the payment for the new loan you’re requesting. If your income is sufficient to cover all your debts comfortably and you have a good credit score, your chances of approval are high. It’s often a good idea to start with your current lender, as they have a firsthand view of your reliability as a borrower.

What are the best personal loan rates right now?

Personal loan rates are dynamic and change based on the central bank rates (like the Federal Reserve rate or the Bank of England base rate) and the lender’s own policies. As of late 2025, borrowers with excellent credit (scores of 760 or higher) can typically find personal loan rates ranging from 6% to 10% APR from banks, credit unions, and top online lenders. Borrowers with good credit (700-759) might see rates from 10% to 18%. Those with fair credit will likely see rates above 18%. To find the best rates, it is crucial to use online comparison tools and get pre-qualified offers from multiple lenders, including online platforms, local banks, and credit unions. This allows you to see real offers without impacting your credit score.

Are too many personal loans harmful to credit health?

Yes, having too many personal loans can be very harmful to your credit health. While no magic number is “too many,” each loan adds to your total debt obligation and financial risk. A high number of loans, especially if taken out in a short period, signals to lenders that you may be financially overextended or reliant on debt to manage day-to-day expenses. This can make it very difficult to get approved for future credit, particularly a mortgage, as lenders will see you as a high-risk borrower. Furthermore, managing multiple payment due dates increases the likelihood of an accidental missed payment, which would directly harm your credit score. It’s a situation that requires extreme diligence to manage without negative consequences.

Does Wells Fargo allow multiple personal loans?

Wells Fargo’s policies on multiple personal loans can vary based on the applicant’s overall financial relationship with the bank and their creditworthiness. Generally, a major bank like Wells Fargo will consider an application for a second personal loan. However, they are known for being relatively conservative. They will heavily scrutinize your income, existing debt with them and other institutions, and your credit score. They may be more likely to approve an existing customer with a strong track record of on-time payments and a healthy checking account balance. It is not guaranteed, and they may suggest alternatives like a debt consolidation loan to combine your existing debt rather than issuing a separate, second loan. The best way to know for sure is to speak with a Wells Fargo banker or use their online pre-qualification tool.

Where can I apply for a personal loan online?

You can apply for a personal loan online through a wide variety of institutions. The main categories are:

1. Online Lenders/Fintech Companies: Platforms like SoFi, Upstart, LendingClub, LightStream, and Marcus by Goldman Sachs specialize in online lending. They offer quick applications and often fast funding.

2. Traditional Banks: Most major banks, like Chase, Bank of America, and Citibank in the US, or Barclays and HSBC in the UK, have robust online application portals.

3. Credit Unions: Many credit unions, such as PenFed and Alliant, offer online applications for their members and often have very competitive rates.

4. Comparison Marketplaces: Websites like NerdWallet, Credit Karma, and Bankrate allow you to compare pre-qualified offers from multiple online lenders at once after filling out a single form. This is often the most efficient way to shop for the best rates.

Are Amex personal loans easy to get approved for?

American Express (Amex) personal loans are generally considered difficult to get approved for because they are typically reserved for existing Amex cardholders with good to excellent credit. Amex pre-selects customers for offers, so you usually cannot apply unless you have received a pre-approval notification. They target customers with a proven history of responsible credit use, high credit scores (often 700+), and stable income. If you do receive an offer, the application process is very streamlined, and funding is fast. However, due to the pre-selection process and high credit standards, they are not considered “easy” to get for the general public. They are a premium product for a low-risk customer base.

What are the easiest personal loans to qualify for?

The easiest personal loans to qualify for are typically those that accept applicants with fair or bad credit, but they come at a high cost. These include:

1. Secured Personal Loans: These require you to offer collateral, like a car or savings account. Because the lender’s risk is lower, they are easier to get than unsecured loans.

2. Loans from Credit Unions: Some credit unions have more flexible lending criteria than banks, especially for existing members. They may offer products like Payday Alternative Loans (PALs).

3. Online Lenders for Bad Credit: Companies like Upstart, Avant, and OneMain Financial specialize in lending to individuals with less-than-perfect credit. They use alternative data like education and employment to assess risk, but their APRs are significantly higher than prime lenders.

“Guaranteed approval” or “no credit check” loans should be avoided, as they are almost always predatory with extremely high fees and interest rates.

How many personal loans can you have at once, Reddit insights?

Discussions on Reddit forums like r/personalfinance and r/Credit generally reflect what financial experts advise. Users frequently state there is no hard limit on the number of personal loans. The consensus is that it all comes down to your debt-to-income ratio (DTI) and credit score. Redditors often share personal anecdotes, with some successfully managing two or three loans for specific purposes like debt consolidation and a car purchase. However, the overwhelming advice is to be extremely cautious. Common themes include the risk of becoming “loan-stacked” and overleveraged, the damage multiple hard inquiries can do in a short time, and the recommendation to consolidate multiple loans into one for simplicity and a potentially lower rate. The community strongly advises against taking new loans to pay off old ones, identifying this as a sign of a debt spiral.

Can you have multiple personal loans with bad credit?

Having multiple personal loans with bad credit is extremely difficult and generally not advisable. Mainstream lenders are highly unlikely to approve an application for a second personal loan if you already have one and a low credit score. Your high-risk profile is magnified by the existing debt. You might find some subprime or online lenders willing to consider it, but you should expect to face very high interest rates (often 30% APR or more) and significant origination fees. This makes the loan very expensive and increases the likelihood of default, which would further damage your credit. A more viable option for borrowers with bad credit might be a secured loan, where you provide collateral, but this puts your asset at risk. It is a precarious financial situation that should be avoided if possible.

Can you get 2 loans from the same bank?

Yes, it is possible to get two loans from the same bank, but it depends entirely on the bank’s internal policies and your financial profile. Some banks have a strict policy of only allowing one active personal loan per customer. Others are more flexible, especially if you are a long-standing customer with a strong payment history and a healthy overall financial relationship (e.g., checking, savings, investments). Approaching the same bank can be advantageous because they have a complete picture of your financial habits. If they approve a second loan, it might be on favorable terms. However, if your financial situation has worsened since the first loan, they are also in the best position to know this and may deny the application or suggest a consolidation loan instead.

How many personal loans can you have at once with Navy Federal?

Navy Federal Credit Union (NFCU) is known for its member-friendly policies, but it does not publicly state a hard limit on the number of personal loans a member can have. Like other lenders, their decision is based on a member’s entire financial picture, including their credit score, DTI, and relationship with NFCU. Members on forums have reported having more than one personal loan concurrently. However, Navy Federal is also known for being a responsible lender. They are unlikely to approve an additional loan if they believe it will put the member in a financially precarious position. They may have an internal cap on the total amount of unsecured debt they will extend to a single member. The best approach is to apply or speak directly with a loan officer to discuss your specific situation.

Can I take 2 personal loans from different banks?

Yes, you can absolutely take two personal loans from two different banks. This is a very common scenario. When you apply for a second loan at a different bank, that new bank will pull your credit report and will be able to see your existing loan with the first bank. They will factor the monthly payment of your first loan into their calculation of your debt-to-income ratio. Your approval will depend on whether your financial profile (income, credit score, DTI) meets the second bank’s lending criteria. No rule prevents you from borrowing from multiple institutions. However, remember that this means you will have to manage two separate accounts with two different lenders, which requires more organization.

If I already have a personal loan, can I get another one?

Yes, you can get another personal loan if you already have one. Your existing loan does not automatically disqualify you from new credit. Lenders will evaluate your application based on your current financial health. The key factors they will consider are:

1. Your Payment History: Have you made all payments on your existing loan on time?

2. Your Debt-to-Income (DTI) Ratio: Can your current income comfortably support your existing debt payments plus the new loan payment?

3. Your Credit Score: Is your score still strong, or has it improved since you took out the first loan?

If you can demonstrate that you have managed your first loan responsibly and have the capacity to take on more debt, lenders will be open to approving a second loan.

Where can I get a loan if I already have one?

If you already have a loan, you have several options for seeking another one. A great place to start is with your current lender. They have a history with you and can see your reliable payment record, which might make them more willing to lend to you again. You can also explore other banks and credit unions, which will compete for your business if you have a strong profile. Online lenders and fintech platforms (like SoFi, LightStream, or Upstart) are also excellent options, as their streamlined process allows you to quickly check for prequalified offers without impacting your credit score. Finally, using an online loan marketplace can save you time by allowing you to compare potential offers from numerous lenders all at once.

Can I get another loan if I already have one through Upstart?

Yes, Upstart does allow existing borrowers to apply for a second loan. According to Upstart’s platform, you may be eligible for a second loan if you have made your last six consecutive payments on time for your first loan. There must not be a past-due balance on your existing loan, and you cannot have more than one active loan through Upstart at a time (meaning you can’t have two running concurrently). So, the policy is generally that you can take out another loan after paying down the first one for a period, or you can refinance the existing loan with a new, larger one. You will still need to go through the application process and meet their underwriting criteria, which includes an assessment of your DTI and other factors based on their AI model.