401k loan vs personal loan: Discover 5 key benefits, potential risks, and expert tips for Americans, Canadians & Australians to make smart financial choices.

When a financial emergency strikes or a major expense looms, you need access to cash quickly. For many, this creates a confusing dilemma: should you borrow from your future or from a bank? The choice between taking a loan from your 401k retirement plan and applying for a traditional personal loan is a critical one, with long-term consequences for your financial health. Each path offers distinct advantages and carries significant risks that can impact everything from your credit score to your retirement nest egg.

This guide is designed to cut through the complexity. While the 401(k) loan is a uniquely American financial product, we will explore similar retirement borrowing considerations for Canadians with their Registered Retirement Savings Plans (RRSPs) and for Australians navigating their superannuation funds. We will compare these options against personal loans, which are a universal tool available across all Tier One markets.

Making the right decision depends entirely on your financial situation, your discipline, and your goals. Are you looking for the lowest interest rate? The fastest funding? Or the option that best protects your future? We will provide a clear, comprehensive comparison of costs, rules, and risks to help you confidently decide whether a 401k loan or a personal loan is the smarter choice for you.

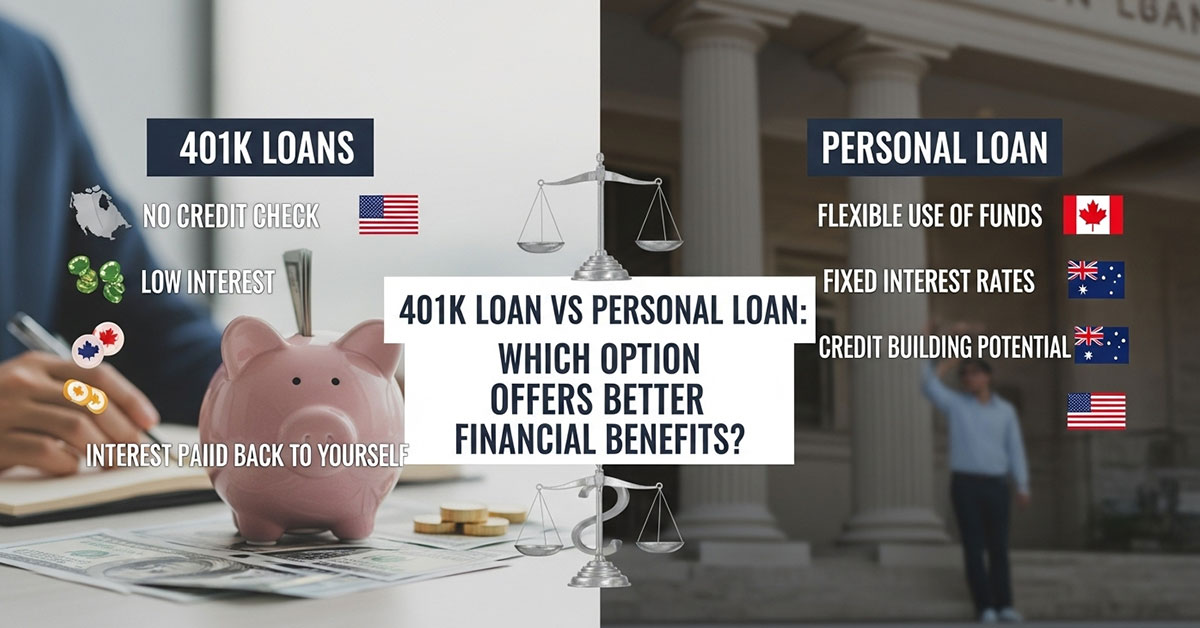

How a 401k Loan Works Compared with Personal Loans in the US and Canada

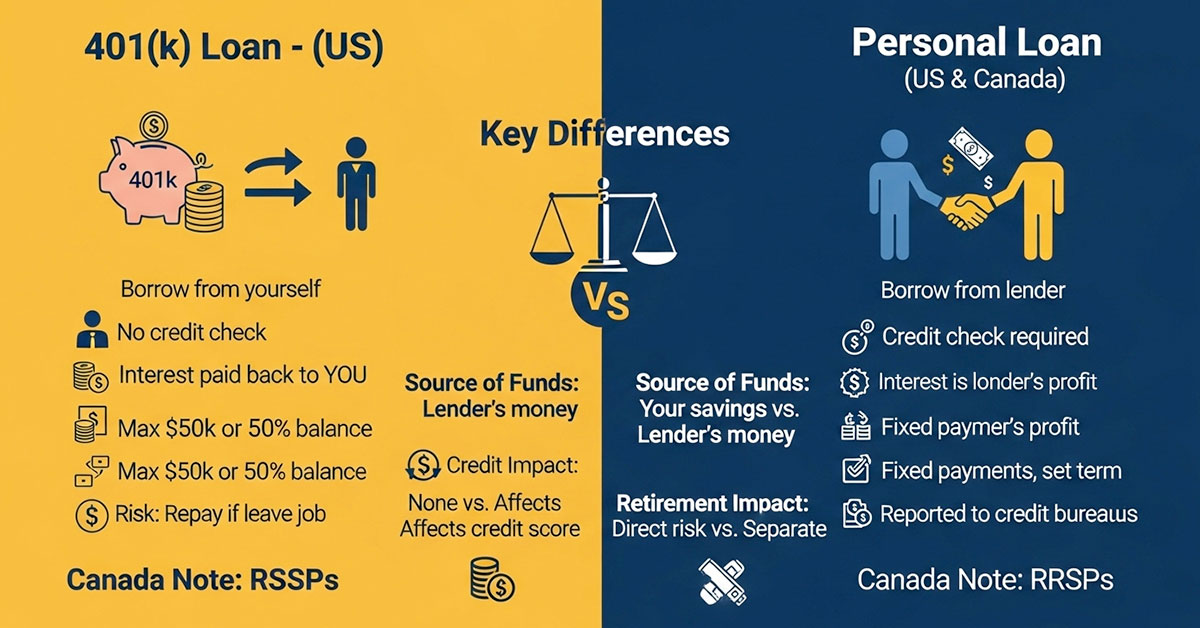

When you need to borrow money, understanding the fundamental mechanics of your options is the first step. A 401(k) loan and a personal loan operate on completely different principles. One involves borrowing from yourself, while the other means borrowing from a financial institution.

A 401(k) loan, available to American workers, is not a loan in the traditional sense. You are not borrowing money from a lender who assesses your creditworthiness. Instead, you are borrowing your own retirement savings from your 401(k) account. The plan administrator liquidates a portion of your investments and gives you the cash. You then repay the loan, with interest, through automatic payroll deductions. A key feature is that the interest you pay goes back into your own retirement account. In essence, you are paying yourself interest. Typically, you can borrow up to 50% of your vested account balance, capped at $50,000. There is no credit check, and the loan does not appear on your credit report.

In Canada, the concept is different. You generally cannot take a “loan” from your Registered Retirement Savings Plan (RRSP). Any money taken out is considered a withdrawal and is subject to significant withholding taxes and permanently loses that contribution room. The common “RRSP loan” in Canada is a product used to contribute money to your RRSP to get a tax deduction, not to take money out for personal use. For borrowing, Canadians would typically consider a personal loan or a line of credit.

A personal loan, whether in the US or Canada, is a straightforward lending product. You apply with a bank, credit union, or online lender. The lender evaluates your credit score, income, and debt-to-income ratio to determine your eligibility and interest rate. If approved, you receive a lump sum of money that you agree to pay back in fixed monthly installments over a set term (usually 2 to 7 years). The interest you pay is the lender’s profit. The loan and your payment history are reported to credit bureaus, affecting your credit score.

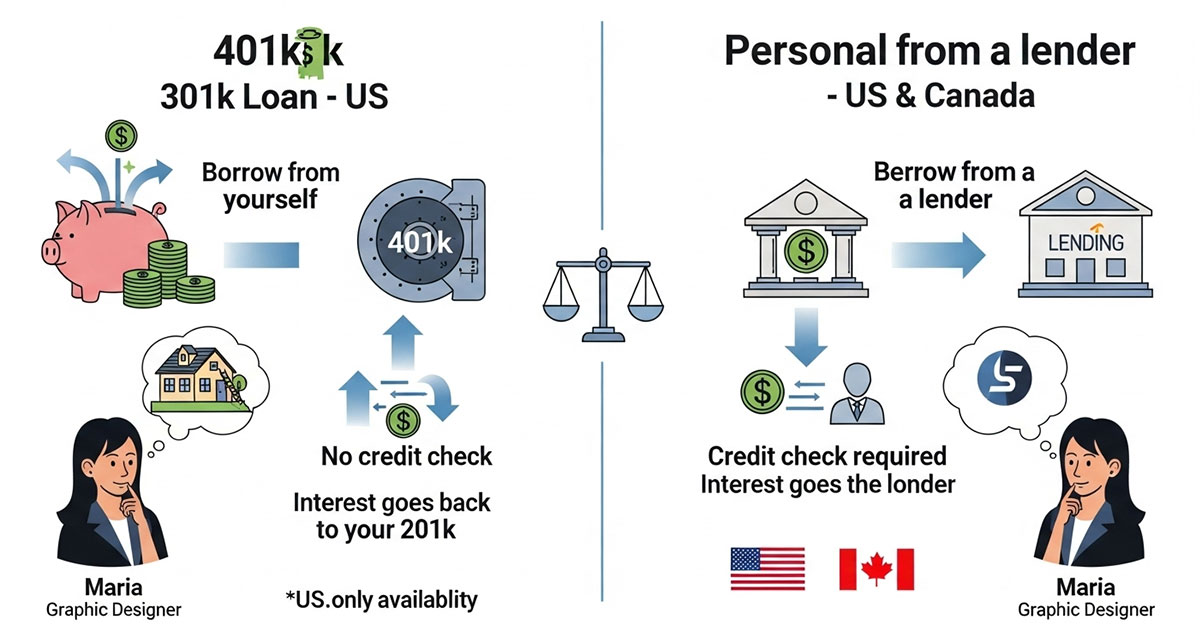

Mini Case Study: Maria’s Decision

Maria, a graphic designer in the US, needed $15,000 for a critical home repair. She had a strong 401(k) balance and a good credit score.

· Option 1 (401k Loan): Her plan offered a loan at a 6% interest rate (Prime Rate + 1%). Her payments would be deducted from her paycheck over five years. The interest paid would go back into her 401(k).

· Option 2 (Personal Loan): She was approved for a $15,000 personal loan at an 8% annual percentage rate (APR) from her local credit union.

Maria chose the 401(k) loan because of the lower interest rate and the fact that she was “paying herself back.” However, she understood the risk: if she lost her job, she would have to repay the loan quickly to avoid taxes and penalties.

Key Takeaway: The core difference is the source of the funds. A 401(k) loan uses your own retirement assets, bypassing credit checks but putting your nest egg at risk. A personal loan uses a lender’s money, involving credit checks but shielding your retirement savings.

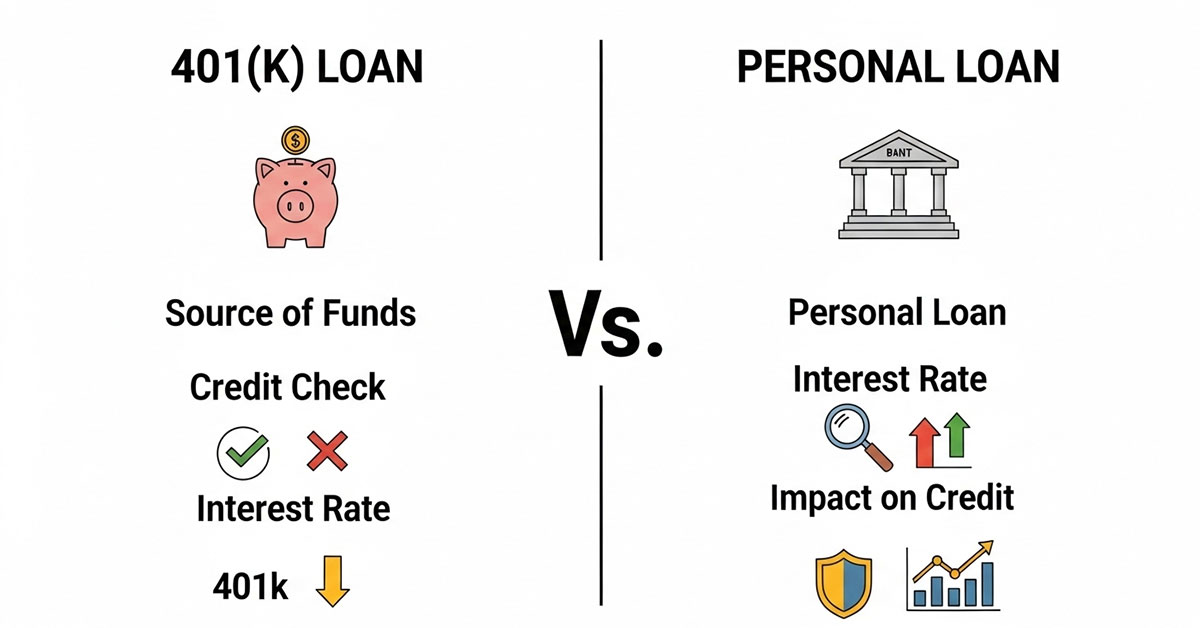

Key Differences Between a 401k Loan and a Personal Loan: Which is Best for Your Financial Situation?

Choosing between a 401(k) loan and a personal loan requires a careful comparison of their core features. While a lower interest rate on a 401(k) loan might seem tempting, it’s crucial to look at the entire picture, including credit impact, repayment terms, and the hidden costs. The best choice depends on your financial stability, credit history, and tolerance for risk.

For most people, the decision boils down to a few key areas: the cost of borrowing, the impact on your credit, and the safety of your retirement savings. Someone with poor credit might find a 401(k) loan is their only option, while someone with an excellent credit score might secure a personal loan with a competitive rate and better terms, without putting their future at risk.

Let’s break down the primary differences in a simple table.

| Feature | 401(k) Loan (US) | Personal Loan (US, UK, Canada, Australia) |

| Source of Funds | Your own retirement savings | A bank, credit union, or online lender |

| Credit Check | No | Yes, a hard credit inquiry is required |

| Impact on Credit | None (unless you default after leaving your job) | Yes, payment history is reported to credit bureaus |

| Interest Rate | Typically, Prime Rate + 1-2%. You pay it to yourself. | Varies widely based on credit score (e.g., 6% to 36% APR) |

| “Real” Cost | Includes lost market growth (opportunity cost) on borrowed funds | The Annual Percentage Rate (APR), including any fees |

| Collateral | Your 401(k) account balance | Usually unsecured (no collateral) |

| Repayment Term | Typically up to 5 years (longer for home purchase) | Typically, 2 to 7 years, fixed monthly payments |

| Job Loss Impact | The loan may become due in full shortly after job termination | No impact; repayment schedule remains the same |

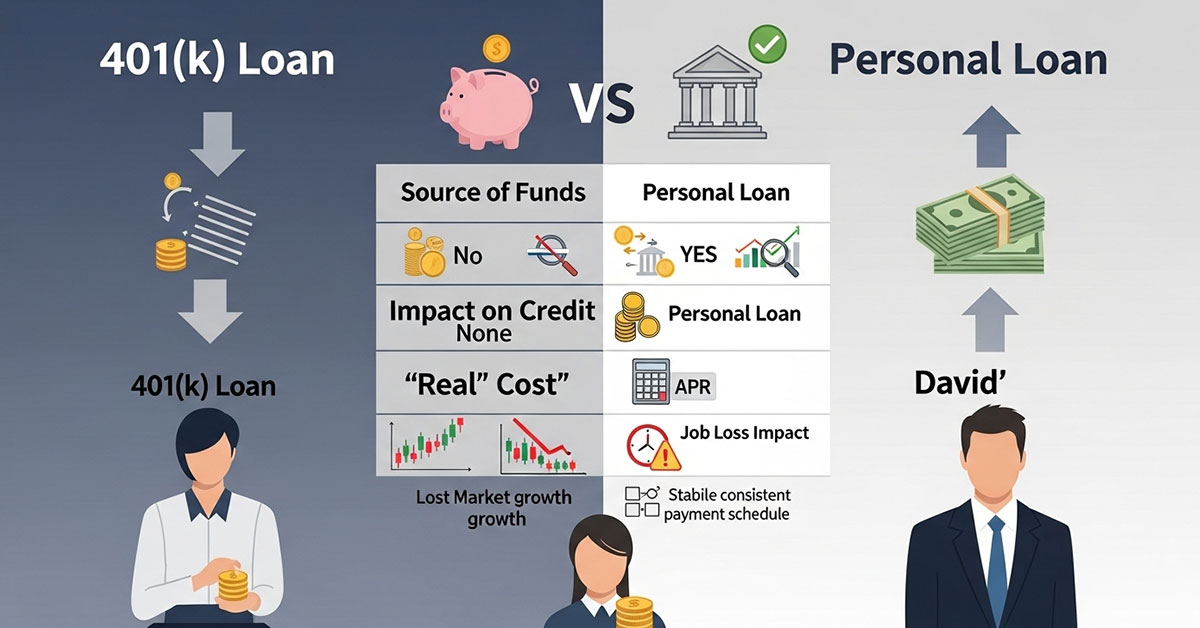

Mini Case Study: David’s Dilemma

David, an IT professional in the US, needed $25,000 to consolidate high-interest credit card debt. His credit score was fair (650), and personal loan offers came with high interest rates of around 18% APR. His 401(k) plan allowed him to borrow the money at 5.5%.

· The 401(k) Loan Path: David saw the 5.5% rate as a huge saving compared to 18%. He could eliminate his credit card debt immediately.

· The Personal Loan Path: An 18% loan was expensive, but it forced a disciplined repayment schedule and kept his retirement money invested in the market, which was performing well.

David chose the personal loan. He was worried about a potential layoff at his company and knew that a job loss would make his 401(k) loan due almost immediately. The higher interest rate was the price he was willing to pay for peace of mind and to keep his retirement savings safe and growing.

Result: A personal loan can be a better option when job security is uncertain or when you want to avoid disrupting the compounding growth of your retirement investments.

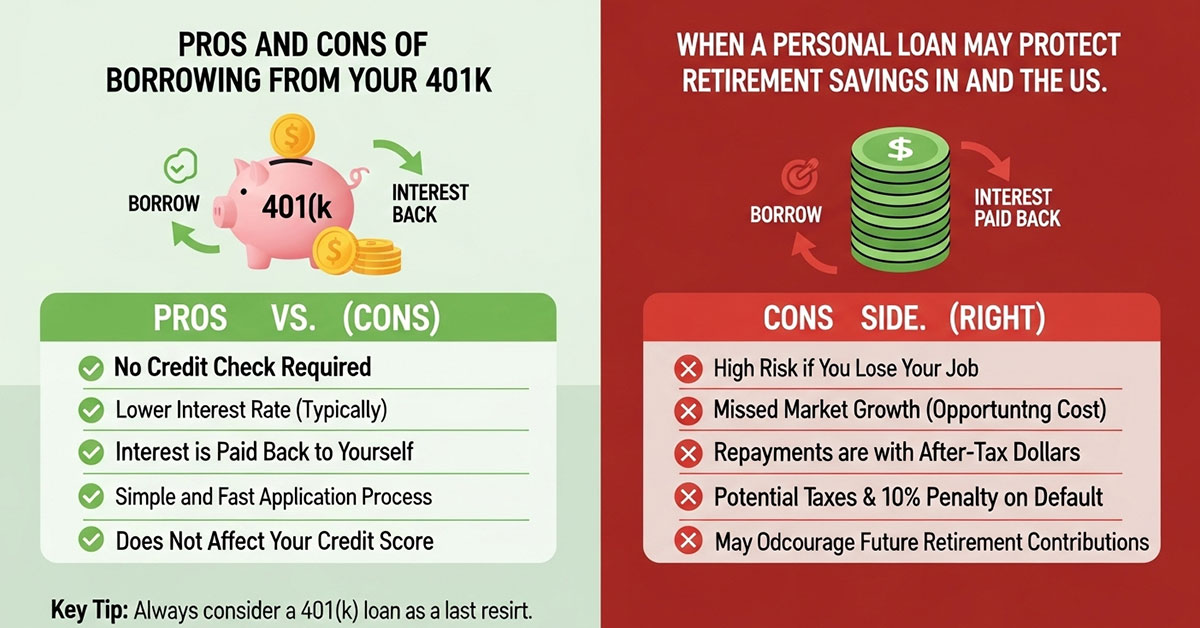

Pros and Cons of Borrowing from Your 401k: What You Need to Know

Borrowing from your 401(k) can feel like a simple solution. It’s your money, after all. The process is fast, and the interest rate looks attractive. However, this convenience masks significant risks that can derail your long-term financial security. Before you decide, it’s essential to weigh the benefits against the potentially severe drawbacks.

The primary appeal is ease and cost. Because you are not being evaluated by a lender, there is no credit check, making it accessible even if your credit is poor. The interest rate is often one or two points above the prime rate, which is typically much lower than the rate on an unsecured personal loan, especially for borrowers without excellent credit. Furthermore, the interest you pay isn’t going to a bank; it’s replenishing your own retirement account. This makes it feel less like a cost and more like a transfer.

However, the downsides are substantial and can have lasting negative effects. The biggest risk is the potential for your loan to be treated as a withdrawal. If you leave your job for any reason—whether you quit or are laid off—your plan may require you to repay the entire outstanding loan balance within a short period, often by the tax filing deadline of the following year. If you can’t, the remaining balance is considered a taxable distribution. This means you’ll owe income tax on the amount, plus a 10% early withdrawal penalty if you’re under age 59½. This can turn a manageable loan into a sudden and massive financial burden.

Another major con is the opportunity cost. The money you borrow is no longer invested, meaning you miss out on any potential market gains. If the market performs well while your loan is outstanding, your retirement account balance will be significantly lower than it would have been otherwise, a loss that can be very difficult to recoup. Finally, you repay the loan with after-tax dollars, meaning the money gets taxed twice: once when you earn it to repay the loan, and again when you withdraw it in retirement.

| Pros of a 401(k) Loan | Cons of a 401(k) Loan |

| ✅ No Credit Check Required | ❌ High Risk if You Lose Your Job |

| ✅ Lower Interest Rate (Typically) | ❌ Missed Market Growth (Opportunity Cost) |

| ✅ Interest is Paid Back to Yourself | ❌ Repayments are with After-Tax Dollars |

| ✅ Simple and Fast Application Process | ❌ Potential Taxes & 10% Penalty on Default |

| ✅ Does Not Affect Your Credit Score | ❌ May Discourage Future Retirement Contributions |

Key Tip: Always consider a 401(k) loan as a last resort. The risk to your long-term retirement security often outweighs the short-term benefit of a lower interest rate.

When a Personal Loan May Protect Your Retirement Savings in Australia and the US

Protecting your retirement nest egg should be a top priority. While tapping into it via a 401(k) loan in the US might seem like an easy way to get cash, a personal loan often acts as a crucial firewall, separating your current financial needs from your future security. This is especially true in countries like Australia, where accessing retirement funds before you retire is nearly impossible.

In the United States, the biggest argument for choosing a personal loan is the separation it creates. When you take out a personal loan, your repayment obligation is with a lender, not your employer or your retirement plan. This means if you change jobs, get laid off, or decide to pursue a new opportunity, your loan terms don’t change. Your monthly payment remains the same, and there is no risk of the entire balance suddenly becoming due. This stability is invaluable in a dynamic job market. A personal loan keeps your retirement funds invested and working for you, allowing you to benefit from compound growth, which is the most powerful force in building long-term wealth. Sacrificing even a few years of market growth can leave you with tens of thousands of dollars less in retirement.

In Australia, the choice is much simpler. The government has extremely strict rules around accessing your superannuation (the Australian equivalent of a 401(k)). You generally cannot borrow from your super or withdraw from it until you reach your “preservation age.” Early access is only granted in very specific, limited circumstances, such as terminal illness or severe financial hardship, and it is a permanent withdrawal, not a loan. Therefore, for almost all borrowing needs—from debt consolidation to funding a large purchase—a personal loan is the standard and often only viable option for Australians. This legal framework effectively forces the protection of retirement savings, a principle that US borrowers should consider adopting voluntarily.

Mini Case Study: An Australian’s Approach

Chloe, an engineer in Sydney, needed $20,000 AUD for a wedding. Accessing her superannuation was not an option. She researched personal loans and found one with a competitive fixed rate from a major Australian bank. The loan had a clear four-year repayment schedule. By choosing a personal loan, Chloe was able to budget for the fixed monthly payments without ever considering her retirement fund as a source of cash. Her super remained fully invested, benefiting from market performance while she managed her loan separately.

Takeaway: A personal loan provides predictability and protection for your retirement assets. In the US, it’s a strategic choice to avoid risk; in Australia, it’s the required standard that reinforces wise financial planning.

Explore more details here → Discover top-rated personal loan lenders in Australia and the US.

Comparing Costs, Fees, and Penalties for 401k Loans and Personal Loans

When you borrow money, the interest rate is only part of the story. To understand the true cost, you need to look at all associated fees, potential penalties, and hidden expenses. Both 401(k) loans and personal loans have unique cost structures that can significantly alter which option is more affordable.

Personal Loan Costs

The primary cost of a personal loan is the Annual Percentage Rate (APR). The APR includes the interest rate plus any mandatory fees, making it the most accurate measure of a loan’s cost. Common fees include:

· Origination Fees: Some lenders charge an upfront fee to process the loan, typically 1% to 8% of the total loan amount. This fee is often deducted from the loan proceeds. For a $10,000 loan with a 5% origination fee, you would only receive $9,500.

· Late Payment Fees: If you miss a payment due date, you will be charged a penalty, which can range from $25 to $50 or a percentage of the payment amount.

· Prepayment Penalties: While less common today, some lenders charge a fee if you pay off your loan early. It’s crucial to choose a lender that does not have this penalty.

401(k) Loan Costs and Penalties

At first glance, a 401(k) loan appears cheaper. The interest rate is usually low (e.g., Prime Rate + 1%), and you pay that interest back to yourself. However, the true costs are less direct but far more damaging.

· Administrative Fees: Many 401(k) plans charge a loan origination fee (e.g., $50–$100) and an ongoing annual maintenance fee (e.g., $25–$75) for as long as the loan is active.

· Opportunity Cost: This is the biggest hidden cost. The money you borrow is removed from your investment portfolio. If the stock market returns 10% while your money is out, you have effectively lost that 10% growth. On a $20,000 loan, that’s a $2,000 loss in one year alone.

· Default Penalties: This is the most severe cost. If you leave your job and cannot repay the loan on time, it defaults. The outstanding balance is then treated as a taxable distribution. For a $20,000 outstanding loan, a person in a 22% tax bracket who is under 59½ would face:

o Federal Income Tax: $4,400

o 10% Early Withdrawal Penalty: $2,000

o State Income Tax (e.g., 5%): $1,000

o Total Cost of Default: $7,400

This turns your “low-cost” loan into an immediate 37% loss.

| Cost Component | Personal Loan | 401(k) Loan |

| Primary Cost | APR (Interest + Fees) | Opportunity Cost (Lost Market Gains) |

| Upfront Fees | Origination Fee (0%–8%) | Origination Fee ($50–$100) |

| Ongoing Fees | None (besides interest) | Annual Maintenance Fee ($25–$75) |

| Penalty for Default | Hits credit score, collection fees | Taxable event + 10% penalty |

Result: While a personal loan’s APR is a clear and direct cost, the hidden opportunity costs and severe default penalties of a 401(k) loan often make it the more expensive and riskier option in the long run.

Which Loan Option Makes Sense Based on Your Financial Goals in Canada and the UK?

Your long-term financial goals should always guide your borrowing decisions. Whether you’re trying to achieve debt freedom, build wealth, or maintain financial stability, the type of loan you choose can either support or undermine those objectives. The regulatory environments in Canada and the UK make this choice significantly different from that in the US.

In Canada: Focusing on Wealth Building

In Canada, the conversation around borrowing and retirement is centered on preserving the tax-sheltered growth within a Registered Retirement Savings Plan (RRSP). As mentioned, you generally cannot take a loan from your RRSP. Any funds taken out are considered a permanent, taxable withdrawal. This structure strongly discourages using retirement funds for current expenses.

Therefore, for a Canadian with a financial need, a personal loan is the standard tool. This aligns with the goal of wealth building for several reasons:

1. Protects Compounding: Your RRSP investments remain untouched, continuing to grow tax-deferred. This is critical for meeting long-term retirement goals.

2. Maintains Contribution Room: Withdrawing from an RRSP means you permanently lose that contribution room. Using a personal loan keeps this valuable space intact for future savings.

3. Builds Credit History: Responsible management of a personal loan can improve your credit score, making it easier and cheaper to borrow in the future for major purchases like a home.

For a Canadian, the choice is clear: a personal loan supports the goal of long-term wealth accumulation, while tapping into an RRSP directly undermines it.

In the United Kingdom: Prioritizing Pension Security

The UK has even stricter rules regarding pensions. It is almost always illegal to borrow money from your pension pot before age 55. Any scheme that offers to help you do this is likely a form of “pension liberation fraud” and can result in massive tax penalties (often over 55% of the borrowed amount) and the loss of your savings.

For borrowers in the UK, the only legitimate choice is a personal loan. This system is designed to protect individuals from draining their retirement funds and becoming dependent on the state in their later years.

Mini Case Study: A UK Borrower’s Perspective

Liam, a teacher in Manchester, UK, wanted to consolidate £12,000 in credit card debt. He explored his options online and saw warnings about pension loans. He realized that protecting his teacher’s pension was non-negotiable for his future. He worked with a credit union to secure a debt consolidation personal loan at a fair interest rate. This allowed him to have one manageable monthly payment, a clear end date for his debt, and the peace of mind that his pension was secure.

| Goal | Canadian Approach | UK Approach |

| Debt Consolidation | Personal Loan to protect RRSP | Personal Loan (Pension borrowing is not an option) |

| Major Purchase | Personal Loan or Line of Credit | Personal Loan or Secured Loan |

| Emergency Fund | Personal Loan, Line of Credit | Personal Loan, Credit Card |

| Protect Retirement | Priority: Keep RRSP invested | Priority: Pension is legally protected from loans |

Takeaway: In both Canada and the UK, the financial systems and regulations are structured to ring-fence retirement savings. For borrowers in these countries, a personal loan is not just the better option—it is often the only safe, legal, and financially prudent choice.

Repayment Rules and Timing for 401k Loans: Avoid Penalties and Protect Your Savings

The repayment structure of a 401(k) loan is one of its most critical—and riskiest—features. Unlike a personal loan with its predictable monthly schedule, a 401(k) loan is directly tied to your employment. Understanding these rules is essential to prevent a manageable loan from becoming a devastating tax event.

Typically, the maximum repayment term for a general-purpose 401(k) loan is five years. Repayments are made automatically through payroll deductions, usually on a bi-weekly or monthly basis, depending on your pay cycle. This automated process is convenient and reduces the risk of missed payments as long as you remain employed. The interest rate is fixed for the life of the loan. Some plans allow for a longer repayment term, often 10 to 15 years, if the loan is used specifically for the purchase of a primary residence.

The biggest risk comes when your employment ends. Whether you resign, are terminated, or retire, this event can trigger an acceleration of your loan repayment. Historically, you had only 60 days to repay the full balance. However, the Tax Cuts and Jobs Act of 2017 extended this deadline. Now, you have until the due date of your federal income tax return for that year (including extensions) to roll over the outstanding loan balance to an IRA or another qualified retirement plan to avoid default.

If you fail to repay the loan within this window, the entire outstanding balance is reclassified as a taxable distribution. This means it will be added to your income for the year and taxed at your marginal tax rate. If you are under age 59½, you will also be hit with a 10% early withdrawal penalty from the IRS, plus any applicable state taxes.

Expert Insight: Financial advisor Clara Bennett states, “I always advise clients to think of a 401(k) loan as being ‘due on termination.’ Even with the extended repayment window, most people who lose a job don’t have a lump sum of cash ready to pay off a loan. This is the single biggest risk that turns a seemingly good deal into a financial catastrophe.”

| Situation | Repayment Rule | Consequence of Failure |

| While Employed | Automatic payroll deductions over a 5-year term. | None; payments are automatic. |

| Leaving Your Job | The full loan balance must be repaid or rolled over. | Loan defaults are becoming a taxable distribution. |

| Loan Purpose | The standard term is 5 years. | N/A |

| Primary Home Purchase | The term can be extended (e.g., 10-15 years). | N/A |

Key Tip: Before taking a 401(k) loan, have a concrete plan for how you would repay the full balance immediately if you were to lose your job tomorrow. If you don’t have a plan, a personal loan is a much safer alternative.

Eligibility and Credit Considerations for Personal Loans in Tier One Markets

Unlike a 401(k) loan that bypasses credit checks, a personal loan is entirely dependent on your financial profile. Lenders in the US, UK, Canada, and Australia assess your creditworthiness to decide if they will lend you money and at what interest rate. Understanding the key eligibility factors can help you prepare your application and secure the best possible terms.

The most important factor is your credit score. This three-digit number is a summary of your credit history.

· In the US (FICO Score): Lenders typically look for a FICO score of 670 or higher for the best rates. Scores between 600 and 670 may qualify, but with higher interest. Below 600, options are limited and expensive.

· In the UK (Equifax, Experian, TransUnion): Scores are not standardized, but lenders assess your credit report for a history of timely payments, low credit utilization, and stability.

· In Canada (Equifax, TransUnion): Scores range from 300 to 900. A score above 660 is generally considered good and will open up more lending options.

· In Australia (Equifax, Experian, Illion): Scores generally range from 0 to 1200 or 0 to 1000. A higher score indicates lower risk.

Beyond your credit score, lenders closely examine your Debt-to-Income (DTI) Ratio. This metric compares your total monthly debt payments to your gross monthly income. Most lenders prefer a DTI below 40%, and many have a strict cutoff at 50%. A lower DTI shows that you have enough cash flow to handle a new loan payment.

Other key considerations include:

· Stable Income: Lenders need to see proof of consistent income through pay stubs, tax returns, or bank statements.

· Employment History: A stable job history demonstrates reliability.

· Credit History Length: A longer history of responsible credit management is favorable.

Expert Insight: According to Mark Stewart, a Canadian credit counselor, “Your credit report tells a story. It’s not just about the score. Lenders want to see that you have a consistent track record of paying bills on time and that you aren’t overextended. If you’re preparing to apply for a loan, get a copy of your report first. Check for errors and see where you can make improvements, like paying down credit card balances.”

| Eligibility Factor | What Lenders Look For | How to Improve |

| Credit Score | High score (e.g., US FICO > 670) | Pay all bills on time, every time. |

| Debt-to-Income (DTI) | Preferably below 40% | Pay down existing debt, increase income. |

| Income | Consistent and verifiable | Organize pay stubs and tax documents. |

| Credit History | Positive payment history, low utilization | Keep credit card balances below 30% of limits. |

If your credit isn’t perfect, you still have options. Credit unions often have more flexible lending criteria than large banks. Secured personal loans, which require collateral like a car, can also be an option for those who don’t qualify for an unsecured loan.

Prepayment, Default, and Tax Risks for 401k Loans Explained

The risks associated with a 401(k) loan extend far beyond the initial borrowing. The implications of prepayment, default, and taxes are unique and can have a much greater financial impact than with a traditional personal loan.

Prepayment

One of the few positive aspects of a 401(k) loan’s structure is that you can typically prepay it without a penalty. If you receive a bonus or come into extra money, you can pay off the loan balance early. This is beneficial for two reasons: it restores your full retirement account balance sooner, and it gets your money back into the market to resume earning potential investment returns. However, you must check your specific plan’s rules, as some may have restrictions on how prepayments can be made.

Default: The Greatest Risk

Default is the catastrophic risk of a 401(k) loan. As previously mentioned, this usually happens when you leave your job and cannot repay the loan within the prescribed timeframe. When a 401(k) loan defaults, it is not treated like a default on a personal loan. It doesn’t go to collections, and it doesn’t directly damage your credit score.

Instead, the IRS steps in. The outstanding loan balance is reclassified as a “deemed distribution.” This has two major financial consequences:

1. Income Tax: The entire amount is added to your taxable income for that year. If you had a $15,000 outstanding loan and are in the 22% federal tax bracket, you immediately owe an additional $3,300 in federal taxes, plus any applicable state taxes.

2. Early Withdrawal Penalty: If you are under the age of 59½, you will also be assessed a 10% penalty on the distribution. On that $15,000, that’s another $1,500 owed to the IRS.

In this scenario, the $15,000 “loan” has cost you $4,800 in immediate taxes and penalties, effectively a 32% loss.

Tax Risks: The Double Taxation Trap

A less immediate but still significant tax risk is “double taxation.” You repay your 401(k) loan using after-tax dollars from your paycheck. This means you earned the money, paid income tax on it, and then used it to repay the loan. Later, when you retire and withdraw that same money from your traditional 401(k), you will pay income tax on it again. This contrasts with your pre-tax contributions, which are only taxed once upon withdrawal in retirement. While the interest portion you paid to yourself avoids this issue, the principal repayment does not.

Expert Insight: “The double taxation argument is real but often misunderstood,” explains a US-based CPA. “It’s the principal repayment that gets taxed twice. Over the life of a loan, this may not be a huge sum, but it’s an inefficiency you don’t have with a personal loan. The far greater tax risk is a loan default, which can wipe out a significant portion of the borrowed amount in one fell swoop.”

Interest, Fees, and Total Cost of Personal Loans in the US, UK, and Australia

When considering a personal loan, it’s crucial to look beyond the advertised interest rate and understand the total cost of borrowing. The Annual Percentage Rate (APR) is the most important number, as it includes both the interest rate and any mandatory fees, giving you a comprehensive view of what you’ll pay. Let’s explore how these costs break down in key Tier One markets.

United States:

Personal loan APRs in the US can range dramatically, from as low as 6% for borrowers with excellent credit to over 30% for those with poor credit. A common fee is the origination fee, which can be 1% to 8% of the loan amount and is taken from the proceeds. For example, a $20,000 loan with a 5% origination fee means you only get $19,000 in cash.

United Kingdom:

The UK personal loan market is highly competitive. Rates are often advertised as a “representative APR,” which means only 51% of accepted applicants will get that rate or a better one. Your actual rate depends on your personal credit history. Origination fees are less common in the UK for prime borrowers, but late payment fees are standard.

Australia:

In Australia, personal loan interest rates are often quoted alongside a “comparison rate,” which, similar to APR, includes the interest rate plus most fees. This makes it easier to compare the true cost of different loan products. Australian lenders also charge establishment fees (origination fees) and ongoing monthly account-keeping fees.

Illustrative Total Cost of a Loan

Let’s compare the total cost of a $10,000 (in local currency) personal loan over three years at different APRs, assuming no prepayment.

| APR | Monthly Payment (USD) | Total Repaid (USD) | Total Interest Paid (USD) |

| 7% (Excellent Credit) | $308.77 | $11,115.72 | $1,115.72 |

| 15% (Average Credit) | $346.65 | $12,479.40 | $2,479.40 |

| 25% (Fair/Poor Credit) | $397.60 | $14,313.60 | $4,313.60 |

| 32% (Poor Credit) | $435.53 | $15,679.08 | $5,679.08 |

Note: Table uses USD for illustration; the principle applies to GBP, AUD, and CAD.

Expert Insight: Financial journalist Martin Lewis from the UK’s MoneySavingExpert frequently advises, “Never just look at the headline interest rate. Always check the APR and use a total cost calculator. A loan with a slightly lower interest rate but a high upfront fee can easily end up costing you more. The goal is to pay the least amount possible over the term, so do the math before you sign anything.”

The total interest paid demonstrates how critical your credit score is. A borrower with excellent credit could save over $3,000 compared to a borrower with fair credit on the exact same loan amount. This highlights the importance of maintaining a healthy credit profile to keep borrowing costs low.

Impact of 401k Loans on Long-Term Retirement Savings and Financial Security

The most deceptive aspect of a 401(k) loan is that it feels safe because you’re “paying yourself back.” However, this ignores the primary engine of retirement growth: compound interest. By taking money out of your account, you are not just borrowing capital; you are stealing from your future self by forfeiting potential investment gains. This opportunity cost can have a staggering impact on your final nest egg.

When you take a 401(k) loan, the borrowed amount is no longer invested. If you borrow $25,000 and the market gains 8% that year, you have missed out on $2,000 of tax-deferred growth. This loss isn’t just a one-time event; you lose all future compounding on that $2,000 as well. Over the decades, this can create a massive deficit in your retirement savings.

Consider this scenario: A 35-year-old takes a $25,000 loan from their 401(k) for five years. They repay it on time. However, during those five years, the market averaged a 7% annual return.

· Lost Growth During Loan: The $25,000 would have grown to approximately $35,064 in those five years, a gain of over $10,000. This growth is lost forever.

· Long-Term Impact: That missed $10,064, if left to grow for the next 25 years until retirement at age 65 (at the same 7% return), would have become nearly $55,000.

In this example, the five-year, $25,000 loan ultimately cost the borrower over $55,000 in future retirement money.

Chart: Growth of $25,000 Over 30 Years

· Blue Line (Uninterrupted Investment): Shows the initial $25,000 growing at 7% for 30 years, reaching approximately $190,300.

· Orange Line (5-Year Loan Period): Shows the balance at $0 for the first five years, then starting again at $25,000 and growing for the remaining 25 years, reaching only $135,750.

(A visual chart would be displayed here showing the significant gap between the two growth trajectories.)

Expert Insight: “People focus on the loan’s interest rate, which might be 6%,” says a US-based financial planner. “But if the market returns 10%, your net loss is 4%. More importantly, you disrupt the compounding snowball. The first 10 years of savings are the most powerful because they have the longest time to grow. Interrupting that, even for a few years, does irreversible damage that is very difficult to repair.”

Furthermore, studies by major 401(k) administrators have shown that many people reduce or stop their regular 401(k) contributions while they are repaying a loan, as their budget is squeezed by the loan payment. This compounds the damage, as they lose out on new savings and any potential employer match during that period.

Using Loans for Consolidation or Major Expenses: How to Choose Between a 401k Loan and a Personal Loan

When faced with high-interest credit card debt or a major expense like a home renovation, both a 401(k) loan and a personal loan can seem like attractive solutions. However, they are designed for different risk profiles and financial situations. The right choice depends on which goal you prioritize: the lowest possible interest rate or the highest level of financial security.

For Debt Consolidation:

The goal of debt consolidation is to simplify payments and reduce the total interest you pay.

· Personal Loan: A debt consolidation personal loan is specifically designed for this purpose. You get a fixed interest rate, a fixed monthly payment, and a clear end date for your debt. This structure imposes discipline. Because it is separate from your retirement, it forces you to manage the debt from your current cash flow without endangering your future. If you have a good credit score, you can often secure a rate that is significantly lower than your credit card APRs.

· 401(k) Loan: A 401(k) loan might offer an even lower interest rate. This can be tempting, as it would save you more money in interest payments. However, you are using long-term assets to solve a short-term cash flow problem. This strategy carries the immense risk that if you lose your job, your unresolved debt problem could trigger a tax crisis, making your situation far worse.

Recommendation: For debt consolidation, a personal loan is almost always the safer and more structurally sound choice. It addresses the debt without introducing new risks to your retirement security.

For Major Expenses (e.g., Home Remodel, Medical Bills):

For a one-time, planned expense, the calculation is slightly different.

· Personal Loan: This remains the safest option. It allows you to finance the expense with a predictable repayment plan that doesn’t touch your investments. The cost is clear (the APR), and there are no hidden opportunity costs or employment-related risks.

· 401(k) Loan: This can be considered if you meet a very strict set of criteria:

1. Your job is exceptionally stable.

2. The amount you need to borrow is relatively small compared to your total savings.

3. You have a clear plan to repay the loan ahead of schedule.

4. You have sufficient emergency savings to cover the loan balance if you do lose your job unexpectedly.

Expert Insight: “Ask yourself this: is this expense a ‘want’ or a ‘need’?” advises a financial coach. “Using a 401(k) loan for a kitchen remodel is a terrible idea. You’re risking your future financial independence for a depreciating asset. For an unexpected and critical medical bill, it might be a last resort, but only after exploring all other options, including payment plans with the provider and personal loans.”

| Factor | Best Choice for Debt Consolidation | Best Choice for Major Expense |

| Safety of Principal | Personal Loan | Personal Loan |

| Lowest Interest Cost | 401(k) Loan (potentially) | 401(k) Loan (potentially) |

| Risk Mitigation | Personal Loan | Personal Loan |

| Disciplined Repayment | Personal Loan | Both offer structured repayment |

| Overall Recommendation | Personal Loan | Personal Loan (401k loan only in rare cases) |

Steps to Request a 401k Loan from Your Plan Administrator: A Practical Guide

Requesting a 401(k) loan is typically a straightforward process, as it doesn’t require underwriting or a credit check. Your eligibility is based solely on your plan’s rules and your vested account balance. Here’s a practical step-by-step guide to the process.

Step 1: Review Your Plan’s Summary Plan Description (SPD)

Before doing anything else, find and read your SPD. This document is the rulebook for your 401(k) plan. It will tell you if loans are permitted, the maximum amount you can borrow (usually 50% of your vested balance, up to $50,000), the interest rate formula (e.g., Prime Rate + 1%), the available repayment terms, and any associated fees.

Step 2: Contact Your Plan Administrator or Log In to Your Online Portal

Most large 401(k) providers (like Fidelity, Vanguard, or Prudential) have online portals where you can manage your account. You can often model a loan, see the estimated payments, and complete the entire application process online. If not, you will need to contact your HR department or the plan administrator directly to request the necessary paperwork.

Step 3: Complete the Loan Application

The application is usually a simple one-page form. You will need to specify the loan amount and, in some cases, the reason for the loan (though this is often not required for a general-purpose loan). You will also need to agree to the terms, including the repayment schedule via payroll deduction. If you are married, your spouse may need to sign a consent form, as the loan affects marital assets.

Step 4: Receive and Manage Your Funds

Once the application is approved (which is usually automatic if you meet the criteria), the funds will be disbursed. The plan administrator will sell a portion of your investments to generate the cash. You can typically receive the money via direct deposit or a check within a few business days to a week. Your loan repayments will begin automatically on your next one or two pay cycles.

Key Tip: While modeling a loan online, pay close attention to the projected impact on your retirement savings. Most calculators will show you how much lower your estimated final balance will be as a result of the loan. This can be a powerful deterrent.

Explore more details here → Ready to apply? Find the login page for your 401(k) provider and look for the “Loans & Withdrawals” section.

How to Get and Compare Personal Loan Offers Across the US, UK, and Australia

Shopping for a personal loan is like shopping for any other major purchase—comparing offers is key to getting the best deal. Thanks to online marketplaces and digital lenders, the process is faster and more transparent than ever. Here’s how to effectively get and compare offers in Tier One markets.

Step 1: Check Your Credit Score

Before you start applying, get a free copy of your credit report and score. This will give you a realistic idea of the interest rates you can expect. In the US, you can use AnnualCreditReport.com. In the UK, clearscore.com or similar services are popular. In Australia, you can get free reports from official credit reporting bodies. Knowing your score helps you target lenders that cater to your credit profile.

Step 2: Use Online Comparison Marketplaces

These websites are the most efficient way to see multiple offers at once without affecting your credit score. You enter your basic information, and the platform performs a “soft” credit pull to show you pre-qualified offers from various lenders.

· US: Sites like Credit Karma, NerdWallet, and LendingTree are popular.

· UK: MoneySuperMarket, Compare the Market, and Uswitch are leading platforms.

· Australia: Canstar, Finder, and RateCity are widely used comparison sites.

Step 3: Check with Your Own Bank and Local Credit Unions

Don’t forget traditional options. Your own bank may offer loyalty discounts or preferred rates to existing customers. Credit unions are non-profits and often provide some of the most competitive interest rates and lowest fees available, especially for borrowers with less-than-perfect credit.

Step 4: Compare Offers Based on APR, Not Just Interest Rate

When you have several offers, line them up and compare the key terms:

· Annual Percentage Rate (APR): This is the most important number. It includes the interest rate and any origination fees, giving you the true cost.

· Loan Term: A shorter term means higher monthly payments but less total interest paid. A longer term lowers your payment but increases the total cost.

· Monthly Payment: Ensure the payment fits comfortably within your budget.

· Fees: Look for origination fees, late payment fees, and especially prepayment penalties. Ideally, choose a loan with no prepayment penalty.

Micro-CTA: Use a personal loan calculator to input the APR and term from each offer to see the total interest you’ll pay over the life of the loan. This makes the true cost crystal clear.

Interest Rate and Borrowing Limits: A Comparison of 401k Loans vs Personal Loans

The interest rate and the amount you can borrow are two of the most significant factors when choosing a loan. Here, 401(k) loans and personal loans differ dramatically, with each having distinct advantages depending on your financial standing.

Borrowing Limits

· 401(k) Loan: The borrowing limit is set by the IRS for American workers. You can borrow the lesser of:

1. $50,000, or

2. 50% of your vested 401(k) account balance.

For example, if you have a vested balance of $80,000, your maximum loan is $40,000 (50% of your balance). If you have $120,000, your maximum loan is capped at $50,000. This is a hard limit, regardless of your income or credit score.

· Personal Loan: The borrowing limit is determined by the lender based on your individual creditworthiness. Lenders assess your credit score, income, and debt-to-income ratio. Limits can range from as little as $1,000 to as much as $100,000 in the US, or equivalent amounts in the UK, Canada, and Australia. A borrower with a high income and excellent credit can access a much larger amount through a personal loan than they could from their 401(k).

Interest Rates

· 401(k) Loan: The interest rate is typically set by the plan administrator, not the market. The standard formula is the Wall Street Journal Prime Rate + 1% or 2%. If the Prime Rate is 4%, your loan rate would be 5% or 6%. This rate is the same for all participants in the plan, regardless of their credit score. The interest you pay goes back into your own retirement account.

· Personal Loan: The interest rate is highly variable and risk-based. Lenders use your credit score to determine the rate.

o Excellent Credit (e.g., FICO > 760): You might qualify for rates from 6% to 10% APR.

o Good Credit (e.g., FICO 670-759): Rates typically range from 11% to 17% APR.

o Fair or Poor Credit (e.g., FICO < 670): Rates can soar from 18% to 36% APR.

Comparison Table

| Feature | 401(k) Loan | Personal Loan |

| Max Borrowing Amount | Capped at $50,000 / 50% of balance | Varies by lender, up to $100,000+ |

| Interest Rate Basis | Prime Rate + 1-2% (Fixed for all) | Based on your credit score (Risk-based) |

| Who Gets a Better Rate? | A borrower with poor credit. | A borrower with excellent credit. |

| Who Can Borrow More? | Limited by 401(k) balance. | A high-income earner with good credit. |

Takeaway: If you have a poor credit score, a 401(k) loan offers a much lower interest rate. If you have excellent credit, you may find a personal loan rate that is competitive with a 401(k) loan, without any of the associated retirement risks.

Calculating Net Benefit: 401k Loan vs Personal Loan – What You Need to Know

Deciding between these two loan types isn’t just about comparing interest rates. To find the true net benefit, you must account for all the factors: direct costs, hidden costs, and risks. A simple calculation can help you frame the decision, though it requires some estimation.

The core formula for comparing the two is:

Net Benefit = (Total Cost of Personal Loan) – (Total Cost of 401k Loan)

A positive result suggests the 401(k) loan is cheaper; a negative result suggests the personal loan is cheaper.

1. Calculate the Total Cost of a Personal Loan:

This is the most straightforward calculation.

· Total Cost = (Total Interest Paid over the loan term) + (Origination Fees)

· You can find the total interest from any online loan amortization calculator.

Example: On a $15,000, 5-year personal loan at 9% APR with no origination fee, the total interest paid is $3,623.

2. Calculate the Total Cost of a 401(k) Loan:

This is more complex because it includes the “opportunity cost.”

· Total Cost = (Loan Fees) + (Opportunity Cost) – (Interest Paid to Self)

· Loan Fees: Add up any origination and annual maintenance fees. (e.g., $75 origination + $50/year * 5 years = $325).

· Opportunity Cost: This is the critical estimate. What return do you expect your investments to make over the loan term? Be conservative. If you expect a 7% market return and your loan rate is 5%, your net opportunity cost is 2% per year on the outstanding balance.

· Interest Paid to Self: The interest you pay on a 401(k) loan goes back to you, so it offsets the cost.

Example: On a $15,000, 5-year 401(k) loan at 5%, let’s assume a 7% market return.

· Loan Fees: $325

· Opportunity Cost (simplified): Roughly 2% per year on the borrowed amount, which is significant. This could easily amount to $1,500+ in missed growth over 5 years.

· The “interest paid to self” is a wash against the interest charge, but it doesn’t overcome the opportunity cost.

· Estimated Total Cost: $325 (fees) + $1,500 (opportunity cost) = $1,825.

3. Don’t Forget the Risk Factor:

The calculation above doesn’t include the massive, unquantifiable risk of job loss. You must assign a personal value to this risk. If your job is unstable, the risk is high, and the personal loan’s safety firewall is worth a lot more.

Net Benefit Calculation:

· Personal Loan Cost: $3,623

· 401(k) Loan Cost: $1,825

· Result: $3,623 – $1,825 = $1,798.

On paper, the 401(k) loan looks nearly $1,800 cheaper. But is that savings worth the risk of a potential tax bomb if you lose your job and the guaranteed loss of market gains? For most people, the answer is no.

Micro-CTA: Before deciding, search for a “401k loan vs personal loan calculator” online. These tools can do the math for you and help visualize the long-term impact.

Planning for Unexpected Repayment Events with 401k and Personal Loans

Life is unpredictable. A sudden job loss, a medical emergency, or an unexpected move can disrupt even the best-laid financial plans. How you prepare for these events is critical, especially when you have outstanding debt. The strategies for managing unexpected repayment events differ significantly between 401(k) loans and personal loans.

Planning for a 401(k) Loan Repayment Crisis

The single biggest unexpected event affecting a 401(k) loan is job loss. If you leave your employer, your loan could become due much sooner than planned.

Protective Strategies:

1. Build a “Loan Payoff” Fund: Before you even take the 401(k) loan, you should ideally have enough cash in a separate high-yield savings account to cover the entire loan balance. This is your insurance policy. If you lose your job, you can use this fund to pay off the loan immediately and avoid taxes and penalties.

2. Secure a Backup Loan Option: Proactively research personal loan options. If you were to lose your job, you could potentially take out a personal loan to pay off the 401(k) loan. This converts the high-risk, employment-tied debt into predictable, non-catastrophic debt.

3. Understand Your Plan’s Grace Period: Know exactly how long you have to repay the loan after termination. The law allows until the next year’s tax filing deadline, but you must confirm your specific plan’s rules.

Planning for a Personal Loan Repayment Crisis

With a personal loan, your repayment terms do not change if you lose your job. However, you still need to make your monthly payments.

Protective Strategies:

1. Maintain a Robust Emergency Fund: This is the universal rule of personal finance. Your emergency fund should cover 3 to 6 months of essential living expenses, including your loan payments. This fund is your primary buffer during a period of unemployment.

2. Communicate with Your Lender: If you anticipate trouble making a payment, contact your lender before you miss the due date. Many lenders offer hardship programs that might allow for temporary payment deferrals or a modified payment plan. This proactive communication can protect your credit score.

3. Consider Loan Payment Protection Insurance: Some lenders offer this type of insurance, which covers your payments for a period if you lose your job or become disabled. However, weigh the cost of the insurance premiums against the benefits.

Key Takeaway: The strategy for a personal loan is defensive (using an emergency fund to continue payments). The strategy for a 401(k) loan must be absolute (having a way to pay it off in full). The need for this absolute payoff plan makes the 401(k) loan inherently riskier for anyone without a large cash reserve.

Alternatives to 401k Loans and Personal Loans: Safer Financial Strategies

Before you commit to either a 401(k) loan or a personal loan, it’s wise to explore other, often safer, alternatives. Borrowing should not always be the first course of action. Depending on your needs and financial situation, one of these strategies might be a better fit and help you avoid unnecessary debt or risk.

1. Home Equity Line of Credit (HELOC)

If you are a homeowner with significant equity, a HELOC can be a powerful tool. It functions like a credit card secured by your home, allowing you to draw funds as needed.

· Pros: HELOCs typically have much lower interest rates than personal loans. The interest may also be tax-deductible if used for home improvements.

· Cons: Your home is the collateral. If you default, you could lose your house. The application process is also longer than for a personal loan.

2. 0% APR Credit Card Introductory Offer

For smaller expenses or debt consolidation, a balance transfer credit card with a 0% introductory APR offer can be an excellent choice.

· Pros: You can borrow money interest-free for a promotional period, typically 12 to 21 months.

· Cons: You must pay off the balance before the promotional period ends, or a high interest rate will be applied retroactively. A balance transfer fee of 3% to 5% is also common. This is best for disciplined individuals who are certain they can clear the debt in time.

3. Negotiating a Payment Plan

If your financial need is due to medical bills or taxes, don’t rush to borrow. These organizations are often willing to negotiate.

· Pros: You can arrange a monthly payment plan directly with the hospital or government agency, often with very low or no interest. This avoids creating new debt with a third party.

· Cons: This option is only available for specific types of debt.

4. Tapping Your Emergency Fund

This is precisely what an emergency fund is for. If you have 3-6 months of expenses saved, use it before taking on new debt.

· Pros: It’s your own money, so there’s no interest, no credit check, and no risk.

· Cons: You must be disciplined about replenishing the fund as quickly as possible once the emergency has passed.

Final Takeaway: Always view your 401(k) as the absolute last resort, reserved for dire emergencies like preventing foreclosure or bankruptcy. Exploring safer alternatives first can protect both your credit and your retirement.

Protecting Retirement Contributions While Borrowing from Your 401k: Case Studies from the US

One of the secondary dangers of taking a 401(k) loan is the temptation to reduce or pause your regular retirement contributions to make the loan repayment more affordable. This is a critical mistake that compounds the loan’s damage. The best practice is to maintain—or even increase—your contribution rate.

Case Study: Sarah’s Disciplined Approach

Sarah, a 40-year-old marketing manager, took a $20,000 401(k) loan to cover unexpected medical bills. Her bi-weekly loan payment was $210. She was contributing 8% of her salary to her 401(k), and her employer matched the first 5%.

· The Wrong Way: Sarah could have reduced her contribution to 3% to “free up” cash, but this would mean losing a portion of her employer match and drastically slowing her savings.

· Sarah’s Smart Way: Sarah reviewed her budget and cut back on discretionary spending (like daily coffees and streaming services) to comfortably afford the loan payment. She continued contributing her full 8%.

Result: By continuing her contributions, Sarah ensured she still received her full 5% employer match, which is essentially a 100% return on her money. While the $20,000 loan principal was out of the market, her new contributions were still being invested, practicing dollar-cost averaging and capturing market growth. She minimized the long-term damage to her retirement goals.

Replacing or Repaying a 401k Loan After Leaving Your Job: Real-Life Scenarios

Leaving a job with an outstanding 401(k) loan creates a ticking clock. You must repay the loan to avoid taxes and penalties. This is where other financial products can serve as a bridge.

Real-Life Scenario: Mark’s Job Change

Mark had a $15,000 outstanding 401(k) loan when he accepted a job offer at a new company. He didn’t have $15,000 in cash to repay the loan before the deadline.

· Step 1: Assessed the Situation: Mark confirmed with his old plan administrator that he had until April of the following year to repay the loan.

· Step 2: Secured a Personal Loan: With his good credit and new job offer in hand, he applied for and was approved for a $15,000 personal loan with a 3-year term. The interest rate was 8%, higher than his 401(k) loan rate, but the cost was worth it.

· Step 3: Executed the Repayment: He used the personal loan funds to pay off his 401(k) loan in full, well before the deadline.

Result: Mark successfully avoided the disastrous tax consequences of a loan default. He converted the high-risk, employment-linked debt into a standard, manageable installment loan. While he now pays a slightly higher interest rate to a bank, his retirement savings are safe, and he can roll over his full 401(k) balance to his new employer’s plan or an IRA.

Using a Personal Loan for Consolidation or Emergency Cash: Success Stories from UK Borrowers

In the UK, where pension loans are not a viable option, personal loans are a common and effective tool for managing finances. They provide a structured way to handle debt or emergencies without touching long-term savings.

Success Story: The Davies Family’s Renovation

The Davies family in Bristol wanted to renovate their kitchen but didn’t want to remortgage their home. They had excellent credit and shopped for personal loans on a comparison website. They found a £15,000 loan with a 5-year term and a competitive fixed APR of 4.5%.

· The Process: They applied online and were approved within 24 hours. The funds were in their bank account two days later.

· The Outcome: The fixed monthly payment of £279 was easy to budget for. They completed their renovation, increasing their home’s value. Most importantly, their pension pots and other investments remained untouched, continuing to grow for their retirement. The personal loan provided the exact financial structure they needed to achieve their goal without compromising their future. This clear separation between a specific project and its retirement is a hallmark of sound financial planning in the UK.

Strategies to Rebuild Savings After Taking a Loan: Insights from Financial Experts

Whether you took a 401(k) loan or a personal loan, the debt represents a temporary setback to your savings goals. Once the loan is paid off, it’s crucial to have a strategy to get back on track and make up for lost time. Financial experts recommend a two-pronged approach.

1. Immediately Increase Your Contribution Rate:

“The moment your loan is paid off, redirect that payment amount directly into your savings,” advises one expert. If you were paying $300 per month on your loan, increase your 401(k) or pension contribution by that same amount. Since you’re already used to that money being gone from your budget, you won’t feel the pinch. This instantly accelerates your savings and helps recoup lost ground from both missed contributions and lost market growth.

2. Utilize Catch-Up Contributions:

For older savers, governments provide a mechanism to supercharge savings.

· In the US: If you are age 50 or older, you can make additional “catch-up” contributions to your 401(k) (the 2025 limit is projected to be around $8,000 above the standard limit).

· In the UK: You can use your “carry forward” allowance to contribute more than the annual limit, using up unused allowances from the previous three tax years.

By combining these strategies, you can aggressively rebuild your nest egg and mitigate the long-term impact of having taken on debt.

Questions to Ask Your Plan Administrator Before Borrowing from Your 401k

Before signing the paperwork for a 401(k) loan, you must be fully informed. Your plan administrator is required to provide you with this information. Treat it like an interview; you are gathering the critical intelligence needed to make a safe decision.

Here are five essential questions to ask:

1. What is the exact interest rate, and are there any loan origination or maintenance fees? This helps you understand the direct cost of the loan.

2. What is the repayment term, and can I prepay the loan at any time without a penalty? This confirms your flexibility in paying it back faster.

3. What happens if I leave my job? What is the exact policy and deadline for repaying the loan balance? This is the most important question. Get the answer in writing.

4. How will the loan be funded? Will the funds be pulled proportionally from all my investments, or can I choose which funds to sell from? This can impact your investment strategy.

5. Can I continue to make my regular 401(k) contributions while the loan is outstanding? The answer should be yes, but confirming ensures you can keep saving and receiving any employer match.

When Refinancing or Consolidation May Beat Your Initial Loan Choice in the US Market

Your initial loan choice isn’t necessarily your final one. Market conditions and your personal financial situation can change, creating opportunities to refinance or consolidate your debt into a better product. This is particularly relevant for those with personal loans.

If you took out a personal loan when your credit score was fair, you likely received a high interest rate. If you’ve spent a year or two making on-time payments, your credit score has probably improved. Now, you may qualify for a new personal loan at a much lower interest rate. You can use this new, cheaper loan to pay off the original, more expensive one. This is called refinancing, and it can lower your monthly payment and save you hundreds or thousands of dollars in interest.

This strategy can also be a lifesaver for someone who has left their job with an outstanding 401(k) loan. As discussed previously, taking out a personal loan to pay off the 401(k) loan before it defaults is a form of consolidation that swaps high-risk debt for manageable, lower-risk debt. Always be on the lookout for a better deal as your financial health improves.

Expert Insights on Documentation and Lender Requirements for 401k Loans and Personal Loans

The documentation process for a 401(k) loan versus a personal loan highlights their fundamental differences. Experts note that the ease of one can mask its risks, while the diligence of the other provides consumer protection.

For a 401(k) loan, the process is internal. The only “lender” is your own retirement plan. Documentation is minimal: usually a simple one- or two-page application form confirming the amount and your agreement to the payroll deductions. Proof of income or a credit check is not required because the loan is secured by your vested balance. This simplicity is a major draw for borrowers.

For a personal loan, the requirements are more rigorous because an external lender is taking on risk. You will typically need to provide:

· Proof of identity (e.g., driver’s license).

· Proof of income (e.g., recent pay stubs, tax returns).

· Proof of address (e.g., utility bill).

· Your Social Security Number (in the US) for a hard credit check.

An expert in lending compliance states, “The personal loan application process forces a financial health check-up. The lender verifies you can afford the payments. A 401(k) loan asks no such questions, placing the entire burden of affordability and risk assessment on the borrower.”

Monitoring Your Credit and Retirement Account Impacts After Taking a Loan

After taking a loan, your job isn’t done. Active monitoring is key to ensuring you stay on track and minimize any negative impacts.

If you took a personal loan, monitor your credit score. Your score may dip slightly after the hard inquiry and the new account opening, but it should rebound and grow stronger as you make consistent, on-time payments. Set up payment alerts to never miss a due date. A well-managed personal loan will ultimately have a positive impact on your credit history.

If you took a 401(k) loan, the focus is on your retirement account. Log in to your portal quarterly. Look at the “lost earnings” or “loan impact” projection that most platforms provide. Seeing the real numbers of how much potential growth you are missing can be a powerful motivator to pay the loan back ahead of schedule. Ensure your regular contributions are still being invested correctly and that you’re not missing out on your employer match. This active monitoring turns a passive risk into a manageable project.

Final Decision Checklist for Borrowers Considering 401k Loans or Personal Loans

Making the right choice requires a clear-eyed assessment of your situation. Before you sign any paperwork, run through this final checklist. If you can’t confidently answer “yes” to the questions in the 401(k) loan column, a personal loan is likely your safer and better option.

Personal Loan Checklist:

· [ ] Have I checked my credit score?

· [ ] Have I used a comparison tool to shop for the best APR?

· [ ] Does the fixed monthly payment fit comfortably in my budget?

· [ ] Does the loan have no prepayment penalty?

401(k) Loan Checklist:

· [ ] Is my job extremely secure?

· [ ] Do I have enough cash in a separate savings account to pay off the entire loan immediately if I lose my job?

· [ ] Have I calculated the potential lost market growth (opportunity cost)?

· [ ] Am I committed to continuing my regular 401(k) contributions (and getting my full employer match) while repaying the loan?

· [ ] Is the reason for this loan an absolute, critical need rather than a want?

If you hesitate on any point in the 401(k) checklist, it is a strong signal that the risks outweigh the benefits.

Long-Term Effects on Retirement from Borrowing: Expert Analysis from Canadian Financial Advisors

In Canada, financial advisors are resolute in their guidance against touching retirement funds. The structure of the Registered Retirement Savings Plan (RRSP) makes withdrawals—not loans—the primary way to access funds early, and the consequences are severe and irreversible.

A leading Canadian financial advisor explains: “When a client withdraws from their RRSP, they face an immediate withholding tax of up to 30%. But the real damage is twofold. First, that contribution room is lost forever. You can never put that money back. Second, you steal from your 80-year-old self to help your 40-year-old self. The power of tax-deferred compounding is greatest on the dollars invested earliest. Removing them from the plan, even for a short time, creates a ripple effect of lost growth that can result in a nest egg that is tens, or even hundreds, of thousands of dollars smaller.”

This perspective underscores a universal principle: retirement accounts are purpose-built for long-term compounding. Using them for short-term needs breaks their primary function. The Canadian system’s punitive structure serves as a stark warning about the long-term damage that borrowing from retirement can inflict.

How to Decide Between a 401k Loan and a Personal Loan: Key Factors for Americans

For Americans, the choice is real and often difficult. The decision hinges on a trade-off between cost and risk. Here are the key factors to weigh:

1. Your Credit Score: This is the starting point. If your credit is excellent, a personal loan can offer a competitive rate without the retirement risk. If your credit is poor, the low interest rate of a 401(k) loan will be tempting, but the risk is also higher.

2. Your Job Stability: Be brutally honest with yourself. Is there any chance of a layoff in your industry or company? Are you thinking about changing jobs? If the answer to either is “yes” or even “maybe,” a personal loan is the far superior choice. The risk of a 401(k) loan default upon job loss is too great.

3. Your Financial Discipline: A 401(k) loan can feel like “easy money.” Do you have the discipline to continue your regular contributions and pay the loan back quickly? A personal loan imposes external discipline, which can be beneficial.

Ultimately, think of it this way: A personal loan is a transaction. A 401(k) loan is a disruption to your most important long-term financial goal. For the vast majority of people, the transaction is the wiser choice.

Real User Experiences with 401k Loan vs Personal Loan: What Borrowers in the UK Say

In the UK, the conversation is less about “pension loan vs. personal loan” and more about which type of personal loan is best. Because pension borrowing is largely off-limits, user forums like Reddit’s /r/UKPersonalFinance and MoneySavingExpert are filled with discussions about personal loan strategies.

Common themes from real UK borrowers include:

· The Power of Comparison Sites: Users consistently report saving significant money by using comparison tools to find the lowest APR rather than just accepting the offer from their primary bank.

· Success with Debt Consolidation: Many share success stories of consolidating multiple high-interest credit cards into a single personal loan, saving them money and reducing stress with a single monthly payment.

· The Value of Good Credit: There is a strong emphasis on the importance of building a good credit history, as users with higher scores share the very low single-digit interest rates they were able to secure.

· Cautionary Tales: The few stories about “pension liberation” schemes are universally negative, with users warning others about scams that resulted in huge tax bills and lost savings.

The overwhelming consensus among UK borrowers is that a standard, unsecured personal loan is the go-to tool for planned borrowing, valued for its simplicity, transparency, and protective separation from retirement funds.

FAQ

What Are the Disadvantages of Borrowing from a 401k?

The primary disadvantages of borrowing from a 401(k) are significant. First, you face a massive opportunity cost. The money you borrow is no longer invested, meaning you miss out on all potential market gains, permanently stunting your retirement nest egg’s growth. Second, there is a major risk associated with job loss. If you leave your employer for any reason, you may have to repay the entire loan balance in a short period. Failure to do so results in the loan being treated as a taxable distribution, subject to income tax and a 10% penalty if you’re under 59½. Finally, you repay the loan with after-tax dollars, which are then taxed again upon withdrawal in retirement—a classic case of double taxation on the principal. These factors often make it a very costly choice in the long run.

How Much Would a $20,000 Loan for 5 Years Cost with Personal Loan Interest Rates?

The cost of a $20,000 personal loan over 5 years depends entirely on the Annual Percentage Rate (APR), which is determined by your credit score. Here are a few examples:

· Excellent Credit (7% APR): Your monthly payment would be approximately $396. Over five years, you would pay a total of $3,760 in interest.

· Average Credit (13% APR): Your monthly payment would be about $455. The total interest paid would be $7,300.

· Poor Credit (22% APR): Your monthly payment would be around $552. You would pay a staggering $13,120 in total interest over the life of the loan.

This illustrates why improving your credit score before applying for a loan is so important. A higher score can save you thousands of dollars in interest charges. Always use a loan calculator to determine the full cost.

Should I Borrow from My 401k to Pay Off Credit Card Debt?

While it can be mathematically tempting to use a low-interest 401(k) loan to wipe out high-interest credit card debt, it’s a very risky strategy. You are solving one financial problem by putting your entire retirement future at risk. A personal loan is a much safer alternative for debt consolidation. It provides a structured repayment plan without threatening your nest egg if you lose your job.

Borrowing from your 401(k) for this purpose should only be considered an absolute last resort if you cannot qualify for a debt consolidation loan or a balance transfer credit card. Even then, you must have a stable job and a concrete plan to repay the loan quickly. For most people, the risk of turning credit card debt into a retirement-destroying tax event is not worth the interest savings.

Is Rocket Loans a Good Personal Loan Option for Borrowers in the US?

Rocket Loans is a well-known online lender in the US and a subsidiary of Rocket Mortgage. It is a legitimate and popular option, known for its fast, streamlined digital application process. Borrowers can often get a decision within minutes and receive funding as soon as the same business day. They offer fixed-rate personal loans for a variety of purposes, including debt consolidation and home improvement.

However, whether it’s a “good” option depends on the rates and terms you are offered. Like all lenders, the APR you receive from Rocket Loans will be based on your credit score and financial profile. While their convenience is a major selling point, you should always compare their offer against those from other lenders, including traditional banks, credit unions, and other online lending platforms, to ensure you are getting the most competitive rate and lowest fees available.

Best Personal Loan Options for Borrowers in Australia and the US

In the US, the market is diverse. The best options often come from:

· Credit Unions: They are non-profits and frequently offer the lowest interest rates and fees, especially for members.

· Online Lenders: Companies like SoFi, LightStream, and Marcus by Goldman Sachs offer competitive rates and fast funding, particularly for borrowers with good to excellent credit.

· Large Banks: Banks like Wells Fargo and Citibank are reliable options, and existing customers may receive preferential rates.

In Australia:

· The “Big Four” Banks: Commonwealth Bank (CBA), Westpac, ANZ, and NAB are the largest lenders and offer a wide range of personal loan products.

· Online Lenders: Fintech companies like Plenti, SocietyOne, and Wisr are disrupting the market with competitive, risk-based pricing.

· Mutual Banks and Credit Unions: Similar to the US, member-owned institutions like Great Southern Bank or Newcastle Permanent often provide excellent value.

For both countries, the best strategy is to use a comparison website to view multiple offers side-by-side.

What Are the Best Personal Loan Rates in the UK?

The best personal loan rates in the UK are typically reserved for borrowers with excellent credit histories who are looking to borrow a mid-range amount (e.g., £7,500 to £15,000) over a 3 to 5-year term. As of late 2025, the most competitive rates from major high-street banks and supermarkets can be as low as 4-5% representative APR.

However, it’s crucial to understand the term “representative.” This rate only needs to be offered to 51% of accepted applicants. Your personal rate could be higher based on your credit file, income, and the loan amount. To find the best rates, you should use a comparison service like MoneySuperMarket or ClearScore, which can perform a soft search to show you the loans and rates you are most likely to be approved for without impacting your credit score. Always compare the total amount repayable to find the cheapest loan overall.

Discover Personal Loans: What You Should Know Before You Apply

Discover is a major financial services company in the US, well-known for its credit cards, and it also offers personal loans. Key features to know before applying include:

· No Origination Fees: This is a significant advantage. Many other lenders charge an upfront fee, but Discover does not, which can save you hundreds of dollars.

· Fixed Rates: Their loans have a fixed interest rate and fixed monthly payment, making them easy to budget for.

· Flexible Loan Amounts and Terms: They typically offer loans from $2,500 to $40,000 with repayment terms from 3 to 7 years.

· Good Credit Required: Discover generally caters to borrowers with good to excellent credit scores (typically FICO scores of 660 or higher).

Before applying, you can check your potential rate on their website with a soft credit pull, which won’t affect your credit score. They are a reputable option, but as always, compare their offer with others.

Prudential 401k Loan: How to Calculate and Apply

If your employer’s 401(k) plan is administered by Prudential, you can typically manage a loan request through their online portal. To calculate and apply, follow these general steps:

1. Log In: Access your retirement account on Prudential’s website (now part of Empower Retirement for many plans).

2. Find the Loan Section: Navigate to the “Loans” or “Withdrawals” section of the dashboard.

3. Use the Loan Calculator/Modeler: Prudential provides tools that allow you to model a loan. You can enter a desired loan amount, and the calculator will show you your maximum eligible amount (based on the 50%/$50,000 rule), the fixed interest rate, the required monthly or bi-weekly payment, and the repayment term. It will also often show the projected impact on your final retirement balance.

4. Apply: If you decide to proceed, you can complete the application online. You will need to confirm the amount, agree to the terms, and set up the direct deposit for the funds.

For specific questions, always refer to your plan’s official documents or call Prudential’s customer service number.

Merrill Lynch 401k Loan Calculator: How It Can Help You Make an Informed Decision

If Merrill Lynch administers your 401(k) plan, their online loan calculator is a crucial decision-making tool. It helps you move beyond simply seeing the monthly payment and understand the true long-term costs. A good calculator, like the one Merrill Lynch provides, typically shows you:

· Your Maximum Loan Amount: Based on your vested balance.

· Estimated Monthly Payments: Calculated based on the loan amount, interest rate, and term.

· Projected Impact on Your Nest Egg: This is the most important feature. It will estimate how much lower your retirement account balance could be at retirement age by taking the loan, factoring in the estimated lost investment growth (opportunity cost).

By visualizing that you might have $50,000 less at retirement just to borrow $15,000 today, the calculator helps you make a fully informed decision. It transforms the abstract concept of opportunity cost into a concrete dollar amount, often leading users to reconsider and seek safer alternatives.

401k Loan vs Personal Loan on Reddit: What Borrowers Are Saying

On Reddit forums like /r/personalfinance, the consensus is overwhelmingly cautious and generally against 401(k) loans. The community heavily favors personal loans for several key reasons repeated in countless threads:

1. Risk of Job Loss: Redditors frequently share cautionary tales of being laid off and having their 401(k) loan suddenly become a massive tax bill they couldn’t afford.