Get Same Day Personal Loans with instant approval. Compare top lenders in the US, UK, Canada & Australia for fast funding—cash in your account within 24 hours.

When an unexpected expense hits, the last thing you have is time. A sudden car repair in Chicago, an urgent medical bill in Manchester, a broken appliance in Toronto, or a last-minute flight needed from Sydney—these situations create immediate financial stress. Waiting days or weeks for a traditional bank loan approval isn’t an option. You need a solution that moves as fast as life does. This is where same-day personal loans offer a critical lifeline.

Imagine applying for funds from your laptop or phone and receiving the cash in your bank account before the day is over. This isn’t a far-off promise; it’s the reality for millions of borrowers in Tier One markets. Same-day personal loans, also known as emergency loans or same-day payday loans, are designed specifically for speed and convenience. Lenders in the US, UK, Canada, and Australia use advanced technology to assess your application instantly, providing a decision in minutes.

Our guide breaks down everything you need to know to navigate this process with confidence. We will show you how to apply, what lenders look for, and how to secure the fast cash you need responsibly. Say goodbye to lengthy paperwork and anxious waiting periods. Get ready to solve your financial emergency today.

Benefits of Same-Day Personal Loans for Quick Financial Relief

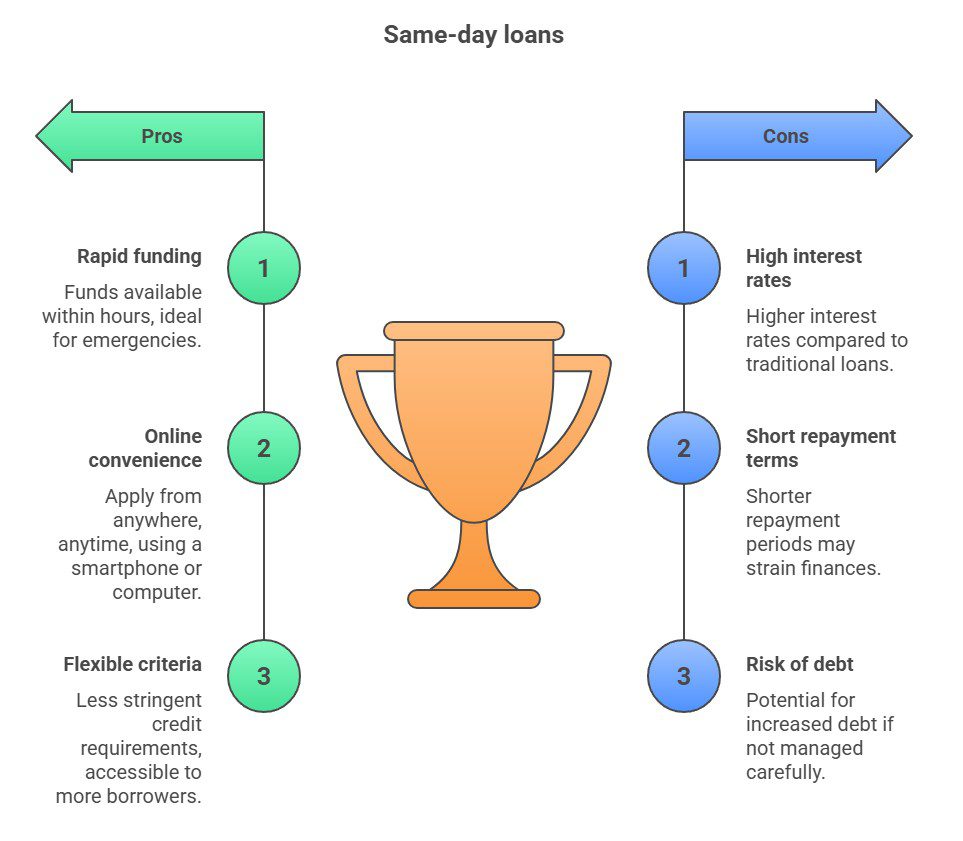

The primary advantage of a same-day personal loan is its incredible speed, which is a game-changer during a financial emergency. Unlike traditional loans that can take days or even weeks to process, these loans provide funds when you need them most—today. This rapid access to cash can prevent a small problem from spiraling into a major crisis, such as avoiding late fees on critical bills or covering an essential repair without delay.

Another key benefit is the unparalleled convenience of the online application process. You can apply from anywhere, at any time, using a computer or smartphone. There is no need to schedule an appointment, stand in line at a bank, or deal with mountains of physical paperwork. Most lenders have streamlined their platforms to make the application take just a few minutes. This accessibility is vital for those with busy schedules or limited mobility.

Finally, same-day lenders often have more flexible eligibility criteria compared to major banks. While a strong credit history is always beneficial, many providers specialize in working with borrowers who have less-than-perfect credit. They may place more emphasis on your current income and ability to repay the loan, opening up financial options for individuals who might otherwise be declined.

Mini Case Study:

Meet Sarah, a graphic designer from London, UK. Her car failed its MOT test and needed an immediate £500 repair. Without her car, she couldn’t commute to client meetings. Her savings were tied up, and a credit card cash advance came with sky-high fees. Feeling stuck, Sarah researched “emergency loans UK” and found a reputable same-day lender regulated by the FCA. She completed the online application in ten minutes, providing her employment details and banking information. Within an hour, she received an approval notification. The £500 was in her bank account that afternoon, allowing her to authorize the repairs and get back on the road the next day without disrupting her work.

Result: Sarah solved her urgent cash-flow problem in hours, not weeks, avoiding professional setbacks and excessive fees.

| Feature | Same Day Personal Loan | Traditional Bank Loan |

| Approval Time | Minutes to a few hours | 2–10 business days |

| Funding Time | Same business day | 3–14 business days |

| Application | Fully online, 24/7 access | In-person or lengthy online forms |

| Credit Check | Often flexible (soft/hard check) | Rigorous hard credit check |

| Documentation | Minimal, digital uploads | Extensive paperwork required |

How to Apply for Same-Day Personal Loans Online in Tier One Countries

Applying for a same-day personal loan is designed to be a straightforward and user-friendly experience across the US, UK, Canada, and Australia. The entire process happens online, eliminating the friction and delays associated with traditional lending. Lenders leverage technology to verify your information quickly and provide an instant decision, making it a powerful tool for urgent financial needs. The core steps are consistent across all four countries, with minor variations based on local regulations.

First, you will need to choose a reputable lender. It is crucial to select a provider that is licensed to operate in your specific state, province, or country. For instance, in the UK, lenders must be authorized by the Financial Conduct Authority (FCA). In Australia, they are regulated by the Australian Securities and Investments Commission (ASIC). Look for transparent websites that clearly display terms, interest rates, and contact information.

Once you have selected a lender, you will fill out a simple online application form. This typically asks for personal details (name, address, date of birth), employment information (employer, income), and banking details (for identity verification and fund transfer). The accuracy of this information is vital for a quick approval. After submitting the form, the lender’s automated system will perform a quick assessment, which may include a credit check and an affordability analysis. If approved, you will receive a loan offer detailing the amount, interest rate, and repayment terms. You can then digitally sign the agreement, and the lender will initiate the fund transfer directly to your bank account.

Mini Case Study:

David, a resident of Calgary, Canada, needed to book a last-minute flight to visit a sick relative. The ticket cost C1,200 via e-Transfer just two hours later, allowing him to book the flight immediately.

Takeaway: The modern online application process makes securing emergency funds faster and more efficient than ever before.

| Step | Action Required | Typical Timeframe |

| 1. Choose Lender | Research and select a reputable online lender. | 10–20 minutes |

| 2. Fill Application | Complete the secure online form with your details. | 5–15 minutes |

| 3. Instant Decision | Lender’s system assesses your eligibility. | 1–5 minutes |

| 4. Review & Sign | Receive the loan offer and digitally sign the agreement. | 5–10 minutes |

| 5. Receive Funds | Lender transfers cash directly to your bank account. | 1–24 hours |

Eligibility Requirements and Criteria for Same-Day Approval

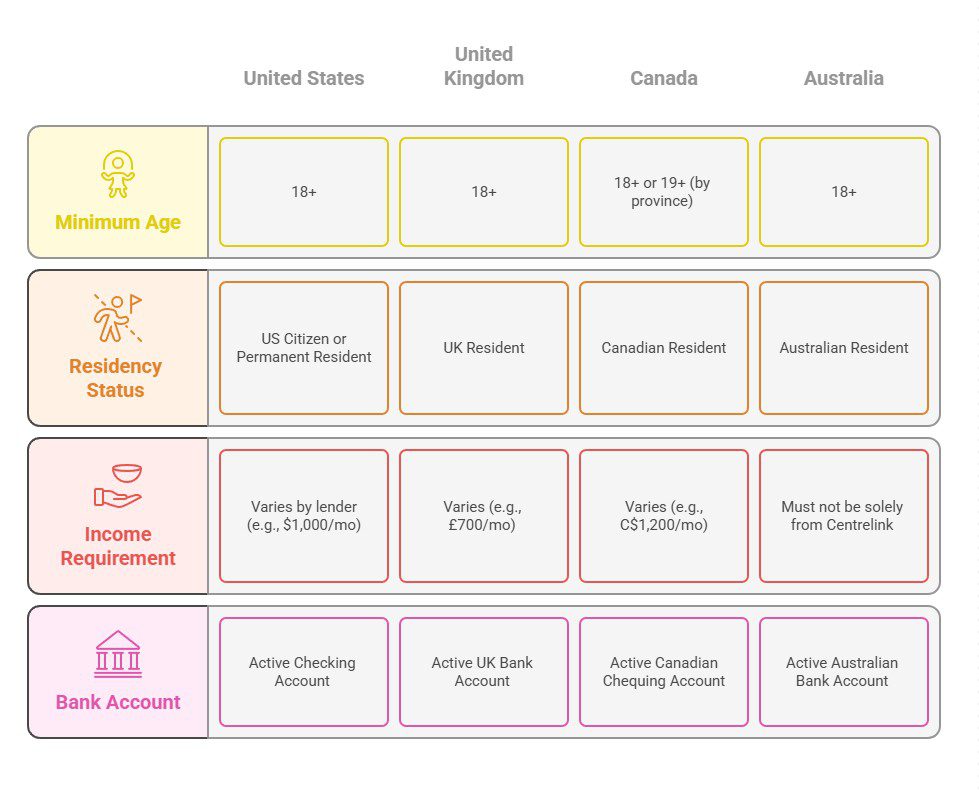

To qualify for a same-day personal loan, lenders in the US, UK, Canada, and Australia have a set of core eligibility requirements. While these can vary slightly between providers and countries, they generally focus on ensuring you have the identity, residency, and income to repay the loan responsibly. Meeting these basic criteria is the first step toward securing instant approval for the funds you need.

The most fundamental requirement is age. You must be at least 18 years old in the US, UK, and Australia, and the age of majority in your specific Canadian province (which is 18 or 19). Secondly, you must be a legal resident or citizen of the country you are applying. Lenders will verify this using your address and other personal identification. You cannot, for example, apply for a loan in the UK while residing in the US.

A consistent source of income is arguably the most critical factor. Lenders need to see that you have a regular paycheck or other reliable income (such as benefits or self-employment earnings) to cover the loan repayments. Many lenders have a minimum monthly income threshold, for example, 1,200 in Canada. You will also need an active checking or current account in your name. This account is essential for two reasons: it’s where the lender will deposit your loan funds, and it’s where they will typically debit the repayments from on the due dates.

Mini Case Study:

Chloe, a 22-year-old retail worker in Sydney, Australia, needed A2,000 per month. She provided her bank details through a secure portal, which allowed the lender to verify her income and affordability automatically. Because she met all the key criteria, she was approved within an hour.

Key Takeaway: Lenders prioritize your current ability to repay. Having a stable income and an active bank account are crucial for same-day approval.

| Country | Minimum Age | Residency Status | Income Requirement | Bank Account |

| United States | 18+ | US Citizen or Permanent Resident | Varies by lender (e.g., $1,000/mo) | Active Checking Account |

| United Kingdom | 18+ | UK Resident | Varies (e.g., £700/mo) | Active UK Bank Account |

| Canada | 18+ or 19+ (by province) | Canadian Resident | Varies (e.g., C$1,200/mo) | Active Canadian Chequing Account |

| Australia | 18+ | Australian Resident | Must not be solely from Centrelink | Active Australian Bank Account |

Fast Funding and Approval Process for Same-Day Personal Loans

The “same day” promise of these loans is made possible by a highly efficient and technology-driven approval and funding process. Lenders have invested heavily in financial technology (FinTech) to automate the traditionally slow and manual steps of loan underwriting. This innovation allows them to assess risk and deliver funds at a speed that traditional banks simply cannot match. Understanding this process can give you confidence when you apply.

The journey to fast funding begins the moment you submit your online application. The lender’s system instantly begins a series of automated checks. First, it verifies your identity and address against national databases to prevent fraud. In countries like the US, this may involve checking your Social Security Number. Next, the system performs an affordability assessment. Instead of just looking at a credit score, many modern lenders use secure, read-only access to your bank account statements. This allows them to verify your income in real-time and analyze your spending habits to ensure the loan repayment is manageable for you. This is a standard and regulated practice in places like the UK and Australia.

If the automated checks are successful and you meet the lender’s criteria, you receive an instant decision on-screen. This is followed by a digital loan agreement. Once you review the terms and e-sign the contract, the final step is triggered: the fund transfer. In the US, this is often done via an ACH transfer. In Canada, Interac e-Transfer® allows for nearly instantaneous funding. The UK uses the Faster Payments Service (FPS), and Australia has the New Payments Platform (NPP). These systems enable money to move between banks in minutes or hours, rather than days, ensuring the cash arrives in your account on the same business day.

Mini Case Study:

Mark, an IT consultant in Austin, Texas, had his laptop die on him. He needed a new one immediately for a project deadline, costing $1,500. He applied for a same-day loan at 10 AM on a Tuesday. The lender’s system verified his identity and used a secure third-party service to confirm his bi-weekly direct deposits from his employer. He was approved for the full amount by 10:15 AM. He signed the digital agreement immediately. The lender initiated an ACH transfer, and the $1,500 was in his checking account by 4 PM that same afternoon. He was able to purchase his new laptop and meet his project deadline without any issues.

Result: The automated process turned a potential work crisis into a minor inconvenience, with funding secured in just six hours.

| Process Stage | Technology Used | Purpose | Speed |

| Identity Verification | Digital ID Checks, SSN/SIN Verification | Fraud prevention, meet legal requirements | Seconds |

| Affordability Check | Open Banking / Bank Statement Analysis | Assess income, expenses, and repayment ability | 1-2 minutes |

| Credit Assessment | Soft or Hard Credit Pulls | Evaluate creditworthiness and history | Seconds |

| Contract & Signature | E-Sign Technology | Legally secure the loan agreement | Minutes |

| Fund Transfer | ACH, FPS, Interac, NPP | Move money from the lender to the borrower | 1-24 hours |

Loan Amounts, Terms, and Interest Rates for Tier One Borrowers

When you seek a same-day personal loan, it’s essential to understand the financial components: how much you can borrow, how long you have to repay it, and how much it will cost. These factors vary significantly based on the lender, your individual financial profile, and the specific regulations in your country. Lenders in the US, UK, Canada, and Australia must all operate within legal frameworks designed to protect consumers.

Loan amounts for same-day personal loans are typically smaller than traditional bank loans, designed to cover short-term emergencies. In the US and Canada, amounts can range from $100 to 2,000. The amount you are approved for will depend on your income, creditworthiness, and the lender’s policies. First-time borrowers may be offered a smaller amount initially.

Loan terms, or the repayment period, are also short. They can range from a few weeks (for a classic “payday loan”) to several months or even a couple of years for larger installment loans. A shorter term means you’ll be out of debt faster, but will have higher individual payments. A longer term will lower your payments but increase the total interest paid over the life of the loan.

Interest rates are the most critical cost factor. Due to the speed, convenience, and higher risk associated with these loans (especially for borrowers with bad credit), interest rates and fees are higher than those of mainstream lenders. Rates are expressed as an Annual Percentage Rate (APR), which includes both interest and fees. Regulations in the UK and Australia cap the total cost of credit to protect borrowers from excessive charges. It is vital to compare APRs from different lenders to find the most affordable option.

Mini Case Study:

Emily from Vancouver, Canada, needed C1,000 over 3 months with a 46% APR. Lender B offered the same amount over 6 months but with a 39% APR. While Lender B’s monthly payments were lower, she calculated that the total interest paid would be higher due to the longer term. She chose Lender A because she was confident she could afford the higher payments and wanted to clear the debt as quickly and cheaply as possible.

Takeaway: Always look at both the APR and the total amount repayable when comparing loan offers.

| Country | Typical Loan Amount | Typical Loan Term | Interest Rate/Fee Regulation |

| United States | $100 – $5,000 | 2 weeks – 24 months | Varies significantly by state |

| United Kingdom | £100 – £2,500 | 1 – 24 months | FCA price caps on interest and fees |

| Canada | C5,000 | 2 weeks – 24 months | Regulated by individual provinces |

| Australia | A5,000 | 16 days – 2 years | ASIC caps on fees for SACCs |

Repayment Options and Flexible Plans for Same-Day Loan Customers

Repaying your same-day loan effectively is just as important as securing the funds quickly. Lenders in Tier One markets offer several repayment options designed for convenience and to help you stay on track. Understanding these options before you borrow allows you to choose a plan that aligns with your budget and financial schedule, preventing missed payments and additional fees.

The most common repayment method is the pre-authorized debit (also known as Direct Debit in the UK or an ACH debit in the US). When you sign your loan agreement, you authorize the lender to automatically withdraw the payment amount from your bank account on the scheduled due dates. This “set it and forget it” approach is highly effective because it aligns with your payday and eliminates the risk of forgetting to make a manual payment. It ensures you pay on time, which is crucial for protecting and even improving your credit score.

Some lenders offer more flexible repayment plans, recognizing that financial situations can change. This might include the ability to make extra payments to clear the loan faster without penalty. Paying off your loan early can save you a significant amount in interest charges. Conversely, if you foresee difficulty making a payment, it is crucial to contact your lender immediately. Many responsible lenders in the UK, Canada, and Australia will work with you to find a solution, which could involve adjusting your payment date or setting up a temporary arrangement. Proactive communication is key to avoiding default and negative marks on your credit report.

Mini Case Study:

Liam, a self-employed plumber in Melbourne, Australia, took out an A500. For his final payment, he adjusted the date by three days to align with a client’s payment clearing his account. This flexibility allowed him to manage his unique cash flow and repay the loan without stress.

Result: The flexible repayment options gave Liam the control he needed to manage his loan responsibly around his variable income.

| Repayment Option | How It Works | Key Benefit | Best For |

| Pre-Authorized Debit | Automatic withdrawal from your bank account. | Convenience reduces the risk of missed payments. | Borrowers with a regular payday. |

| Online Portal Payments | Manually pay via debit card on the lender’s site. | More control over when the payment is made. | Those who prefer to manage payments actively. |

| Early Repayment | Pay off the full loan balance ahead of schedule. | Saves money on future interest charges. | Borrowers who receive a financial windfall. |

| Payment Arrangement | Contacting the lender to adjust a due date. | Avoids default and late fees during hardship. | Anyone facing a temporary financial setback. |

Step-by-Step Application Process for Same-Day Personal Loans

Navigating the application for a same-day loan is quick and secure. Lenders have refined the process to be as simple as possible. Following these steps will help ensure your application is smooth and successful.

1. Pre-Application Check: Before you apply, gather your information. You’ll need your government-issued ID (like a driver’s license), proof of income (recent pay stubs or bank statements), social security/insurance number, and active bank account details. Having these ready will speed things up significantly.

2. Compare Lenders: Do not apply to the first lender you see. Use comparison websites to check interest rates (APRs), loan terms, and customer reviews. Ensure the lender is licensed and regulated in your region (e.g., FCA-authorised in the UK).

3. Complete the Online Form: Fill out the application on the lender’s secure website. Be meticulous and double-check all information for accuracy. Typos in your name, address, or income can cause instant rejection or delays.

4. Consent to Checks: You will be asked to consent to identity, credit, and affordability checks. Modern lenders often use secure Open Banking technology to quickly verify your income and expenditures directly from your bank, which is much faster than uploading documents.

5. Receive and Review Your Offer: If you pass the automated checks, you’ll receive a loan offer almost instantly. This is the most crucial step. Do not rush. Carefully read the loan amount, APR, total repayable amount, and the repayment schedule.

6. E-Sign and Get Funded: If you are happy with the terms, you will digitally sign the loan agreement. Once signed, the lender will process the final approval and initiate the transfer of funds to your bank account.

| Pros of Online Application | Cons of Online Application |

| Fast and convenient (apply 24/7) | Risk of dealing with unregulated lenders |

| Instant decision-making | Requires a stable internet connection |

| Minimal paperwork required | Lack of face-to-face interaction |

| Easy to compare multiple offers | Potential for data security risks on unsecured sites |

Expert Insight: Sarah Brown, a financial advisor, notes, “The biggest mistake applicants make is submitting multiple applications to different lenders simultaneously. Each application can trigger a hard credit check in the US and Canada, which can lower your credit score. It’s better to use pre-qualification tools, which use soft checks, to gauge your chances before formally applying.”

Required Documents for Approval in the US, UK, Canada, and Australia

While the goal is a paperless process, lenders still require you to verify the information you provide. Thanks to technology, this is often done by uploading digital copies or using secure data-sharing services. Having these documents ready will prevent delays.

The core required documents are consistent across Tier One countries, but the specific names may differ.

1. Proof of Identity: Lenders need to confirm you are who you say you are to prevent fraud. This is a non-negotiable legal requirement.

2. Proof of Address: This confirms your residency within the country and state/province where the lender is licensed to operate.

3. Proof of Income: This is the most critical part of the affordability check. Lenders must verify you have sufficient, stable income to make repayments.

4. Bank Account Details: You need an active account in your name for the loan deposit and repayments.

Key Tip: To speed up the process, save clear photos or PDF copies of these documents on your computer or phone before you start the application.

| Document Type | US Examples | UK Examples | Canada Examples | Australia Examples |

| Proof of Identity | Driver’s License, Passport, State ID | Driving Licence, Passport | Driver’s Licence, Passport, Provincial ID Card | Driver’s Licence, Passport, Proof of Age Card |

| Proof of Address | Utility Bill, Bank Statement, Lease Agreement | Utility Bill, Council Tax Bill, Bank Statement | Utility Bill, Bank Statement, Government Mail | Utility Bill, Bank Statement, Tenancy Agreement |

| Proof of Income | Recent Pay Stubs, Bank Statements, Tax Return | Recent Payslips, Bank Statements showing income | Recent Pay Stubs, Bank Statements, Letter of Employment | Recent Payslips, Bank Statements, Centrelink Income Statement |

Expert Insight: Mark Foster, a credit analyst, states, “The rise of Open Banking in the UK and Australia, and similar services like Plaid in North America, is a game-changer. By securely linking their bank account, applicants can bypass the need to manually upload pay stubs and bank statements. This not only speeds up approval to mere minutes but also gives lenders a more accurate picture of affordability, potentially leading to better loan offers.”

Qualifying Criteria for Borrowers Seeking Instant Loan Funding

Beyond the basic eligibility of age and residency, lenders use specific qualifying criteria to assess your application for instant funding. These criteria help them measure the risk associated with your loan and determine your ability to repay it. Understanding these factors can help you position your application for success.

First, a stable and sufficient income is paramount. Lenders look for a consistent income stream, usually from employment. A minimum monthly income is often required, such as $1,000 in the US or £700 in the UK. Applicants who are self-employed or rely on benefits may still qualify but will need to provide clear proof of regular income.

Second is your debt-to-income (DTI) ratio. This is a key metric, especially in the US and Canada. It’s the percentage of your gross monthly income that goes toward paying your monthly debt obligations (rent, mortgage, credit cards, other loans). A lower DTI ratio suggests you have more disposable income to handle a new loan payment, making you a less risky borrower. Most lenders prefer a DTI below 40%.

Third, your credit history plays a role, though its importance varies. While some same-day lenders cater to bad credit, they will still likely perform a credit check. A recent bankruptcy, defaults on other loans, or a high number of recent credit applications can be red flags. A history of timely payments, even on a limited credit file, works in your favor.

Finally, having a positive bank account history is crucial. Lenders may check for recent bounced payments or periods with a negative balance, as these can indicate financial distress and a higher risk of default.

| Qualifying Factor | What Lenders Look For | Why It Matters |

| Income Stability | Regular, verifiable income deposits | Shows you have the means to make repayments. |

| Debt-to-Income Ratio | A low percentage of income is going to debts | Indicates you are not over-leveraged financially. |

| Credit History | Recent payment history and credit events | Predicts future repayment behavior. |

| Bank Account Health | Consistent positive balance, no bounced payments | Demonstrates responsible financial management. |

Expert Insight: Dr. Emily Vance, an economist specializing in consumer credit, explains, “Lenders are moving towards a more holistic review of applicants. While credit scores are still used, real-time banking data is becoming more influential. It provides a current, practical snapshot of an individual’s financial health, which is often more predictive for short-term loans than a credit report that might be weeks out of date.”

Common Mistakes to Avoid When Applying for Same-Day Personal Loans

Applying for a loan in a hurry can lead to simple mistakes that cause delays, rejections, or unfavorable loan terms. Avoiding these common pitfalls will significantly improve your chances of a fast and positive outcome.

1. Providing Inaccurate Information: This is the most common reason for rejection. A simple typo in your name, address, or bank account number can halt the automated verification process. Always review your application carefully before submitting it.

2. Not Reading the Fine Print: In your rush to get cash, it’s tempting to skim the terms and conditions. This is a major mistake. You must understand the APR, the total amount repayable, the repayment schedule, and any fees for late or missed payments.

3. Applying with Multiple Lenders Directly: Shotgunning applications to numerous lenders can be harmful. In the US and Canada, each formal application can result in a hard credit inquiry, which can lower your credit score. Use comparison sites that perform soft checks first.

4. Borrowing More Than You Need: It can be tempting to accept the maximum amount offered, but this leads to higher interest costs and a bigger debt burden. Calculate exactly what you need for your emergency and borrow only that amount.

5. Using Unregulated or Predatory Lenders: Be wary of lenders promising “guaranteed approval” or “no credit check.” Legitimate lenders in Tier One countries are required by law to perform credit and affordability checks to ensure you can afford the loan. Unregulated lenders often charge exorbitant fees and use aggressive collection tactics.

| Mistake | Consequence | How to Avoid |

| Application Errors | Delays, rejection, or fraud alerts | Double-check every field before submitting. |

| Ignoring T&Cs | Unexpected fees, high costs, default | Read the loan agreement carefully before signing. |

| Multiple Hard Inquiries | Lowered credit score | Use soft-check comparison tools first. |

| Over-borrowing | Unmanageable debt, higher interest payments | Create a budget and borrow the minimum required. |

| Choosing a Bad Lender | Scams, illegal interest rates, harassment | Verify the lender is regulated in your country/state. |

Expert Insight: David Chen, a consumer rights advocate, advises, “The phrase ‘guaranteed approval’ is the biggest red flag in the lending industry. Responsible lending regulations in the US, UK, Canada, and Australia exist to protect consumers from being given loans they cannot afford to repay. Any lender bypassing these checks is likely operating outside the law.”

Tips to Get Faster Approval and Better Loan Offers

While same-day loans are already fast, there are several things you can do to accelerate the process and potentially secure more favorable terms. Lenders value applicants who appear organized, stable, and low-risk.

1. Apply During Business Hours: While you can apply 24/7, applications submitted during standard business hours (e.g., 9 AM – 5 PM on a weekday) are more likely to be processed and funded on the same day. This is because bank transfers and final manual reviews (if needed) typically happen during this window.

2. Have Your Documents Ready: As mentioned before, having digital copies of your ID, proof of income, and address on hand before you start can turn a 20-minute process into a 5-minute one.

3. Use Your Main Bank Account: Apply using the primary bank account where your salary is paid. This makes it much easier and faster for lenders to verify your income and affordability through automated systems.

4. Improve Your Credit Score (Long-Term): If your need isn’t immediate, taking a few months to improve your credit score can unlock better offers. This involves paying all bills on time, reducing credit card balances, and correcting any errors on your credit report. A higher score translates to lower risk for lenders, which can result in a lower APR.

5. Check for Pre-Approval Offers: Many lenders and comparison sites offer a pre-approval or “eligibility check” feature. This uses a soft credit check (which doesn’t impact your score) to see if you’re likely to be approved and what terms you might be offered.

| Action | Impact on Speed | Impact on Offer |

| Apply during business hours | Faster funding time | No direct impact |

| Prepare documents in advance | Faster application completion | No direct impact |

| Maintain a healthy bank balance | Faster affordability check | May improve approval chances |

| Improve credit score | No impact on speed | Can lead to lower APRs |

| Use pre-approval tools | Saves time by avoiding rejections | Helps find the best potential offer |

Expert Insight: Jessica Riley, a FinTech consultant, suggests, “To get the best offer, demonstrate financial stability. Lenders’ algorithms look for patterns. A bank account with regular income deposits and no recent overdrafts or bounced payments is far more appealing than a high credit score with erratic cash flow. Consistency is key.”

Customer Testimonials and Experiences with Same-Day Loan Providers

Real-world experiences can provide valuable insight into the process and impact of same-day personal loans. Here are a few anonymized testimonials reflecting common scenarios in Tier One markets.

Michael P., Toronto, Canada:

“My furnace broke down in the middle of a Canadian winter. A repair was quoted at C$1,800, and I just didn’t have it. I was hesitant about online loans, but I was desperate. I used a comparison site to find a lender with good reviews that was licensed in Ontario. The application was surprisingly simple. I linked my bank account for verification, and I had the money via e-Transfer in about three hours. It was a lifesaver, honestly. The interest was high, but the repayment plan was clear, and for the speed and convenience, it was worth it to keep my family warm.”

Chloe T., Manchester, UK:

“I had to pay a deposit for a new flat rental sooner than expected, and my next paycheck was a week away. I needed £750 quickly. I applied for a same-day loan with an FCA-regulated lender. The process was very transparent; they showed me the total amount repayable before I signed anything. I got the funds that evening. I made sure to repay it on my next payday as agreed. It was a perfect bridge for a short-term cash flow gap. My advice is to check that the lender is regulated and to have a solid plan to pay it back.”

James R., Houston, USA:

“My son had a minor medical emergency, and even with insurance, the co-pay was $1,200. I have fair credit, so my bank wasn’t an option for a quick loan. I found an online installment lender that specializes in same-day funding. They did a credit check, but they also focused heavily on my income from my job. I was approved and signed the contract online. The money was in my account the next morning. It wasn’t ‘instant,’ but it was fast enough. It allowed me to pay the clinic without stress.”

Expert Insight: Dr. Alex Carter, a sociologist studying consumer finance, observes, “These testimonials highlight the core use-case for same-day loans: bridging unexpected, time-sensitive financial gaps. While users are aware of the higher costs, the value they place on speed, convenience, and solving the immediate problem often outweighs the expense. The key to a positive experience is borrowing for a genuine emergency and having a clear repayment strategy.”

Flexible Loan Terms Explained for Tier One Applicants

Understanding loan terms is key to choosing the right product. “Term” simply refers to the length of time you have to repay the loan. For same-day personal loans, terms can be very short (a few weeks) or longer (up to two years).

· Short-Term (Payday Style): These are typically due in full on your next payday (2-4 weeks). They are for very small amounts and designed to be repaid quickly.

· Installment Loans: These are more common and allow you to repay the loan in a series of fixed payments (installments) over a set period, such as 3, 6, or 12 months. This makes larger loan amounts more manageable.

Checklist for Choosing a Loan Term:

· [ ] Can I afford the monthly payment? A shorter term means higher payments. Use a loan calculator to check.

· [ ] How much will I pay in total interest? A longer term means lower payments but more interest paid overall.

· [ ] Does the lender charge a penalty for early repayment? If not, you can save money by clearing the debt early if your situation improves.

Key Tip: Choose the shortest loan term that has a monthly payment you can comfortably afford. This strategy minimizes the total interest you’ll pay.

Interest Rates Explained – How to Compare and Save on Same Day Loans

The interest rate determines the cost of borrowing money. For short-term loans, this is best understood through the Annual Percentage Rate (APR). The APR represents the total annual cost of the loan, including interest and any mandatory fees, expressed as a percentage.

· APR in Tier One Markets: In the US, APRs can vary wildly by state. In the UK and Australia, there are regulatory caps on the total cost of credit to protect consumers. For example, the UK’s FCA ensures you never repay more than double the amount you borrowed.

· Why are APRs high? They reflect the lender’s risk. Same-day loans are often unsecured (no collateral) and cater to a wider range of credit profiles, increasing the risk of default. The administrative cost of a small, short-term loan is also proportionally higher.

Checklist for Comparing Interest Rates:

· [ ] Always compare the APR, not just the interest rate. APR gives you the full picture.

· [ ] Look at the ‘Total Amount Repayable’. This is the ultimate number—the loan principal plus all interest and fees.

· [ ] Check for fixed vs. variable rates. Most same-day loans have fixed rates, meaning your payment won’t change.

· [ ] Use comparison websites to see offers from multiple lenders side-by-side.

Key Tip: Even a small difference in APR can save you significant money, especially on larger loan amounts or longer terms. Always shop around.

Loan Amounts You Can Borrow and Eligibility Limits

The amount you can borrow depends on a combination of lender policy, local regulations, and your personal financial situation. Lenders want to ensure you can afford to repay the loan without falling into financial hardship.

· Typical Ranges: As a general guide, you can expect to borrow between $100 and 5,000 in Australia.

· How Lenders Decide:

o Income: This is the biggest factor. The more you earn, the more you can typically borrow.

o Creditworthiness: A stronger credit history may unlock higher loan amounts at better rates.

o Affordability: Lenders will analyze your income vs. expenses to determine how much you can realistically afford to repay each month.

o Lender’s Policy: First-time borrowers may be limited to smaller amounts until they establish a positive repayment history with that lender.

Checklist Before Choosing a Loan Amount:

· [ ] What is the exact amount I need for my emergency? Avoid the temptation to borrow more.

· [ ] Have I created a budget to see how the repayment will fit?

· [ ] Is this amount manageable based on my income and other expenses?

Micro-CTA: Need a specific amount? → See what you could be eligible for today.

Repayment Options Overview for Managing Your Loan Effectively

Modern lenders provide several ways to repay your loan, giving you flexibility and control. The most important thing is to make your payments on time, every time.

· Automatic Debit: This is the standard method. You authorize the lender to withdraw payments from your bank account on the due date. It’s convenient and helps you avoid missing a payment.

· Manual Online Payment: Most lenders have a customer portal where you can log in and make a payment with a debit card at any time. This is useful for making extra payments.

· Early Repayment: Most lenders in the UK, Canada, and Australia allow you to pay off your loan early without penalty. This is a fantastic way to save on interest. Check the terms and conditions, as some US state laws may permit prepayment penalties.

Checklist for Effective Repayment:

· [ ] Set up payment reminders in your calendar, even with auto-debit.

· [ ] Ensure sufficient funds are in your account the day before a payment is due.

· [ ] Contact your lender immediately if you think you might miss a payment. Don’t wait.

· [ ] Consider making extra payments if you can afford to, to reduce the total interest cost.

Key Tip: Communication is everything. Responsible lenders would rather work with you on a solution than have you default on the loan.

Understanding Fees Before Signing Your Loan Agreement

Beyond the interest rate, some loans can come with additional fees. Transparent lenders will disclose all potential charges upfront in the loan agreement. You must read this section carefully.

· Origination Fees: Some lenders (more common in the US for installment loans) charge a fee to process your loan, which is often deducted from the loan amount you receive.

· Late Payment Fees: This is the most common fee. If your payment is late or if an automatic debit fails due to insufficient funds, you will be charged a penalty. These fees are capped in the UK and Australia.

· Prepayment Penalties: As mentioned, this is a fee for paying off your loan early. It’s uncommon for short-term loans in the UK, Canada, and Australia, but they can exist elsewhere. Always confirm.

Checklist for Fees:

· [ ] Have I read the fee schedule in the loan agreement?

· [ ] Do I understand the cost of a late or missed payment?

· [ ] Is there an origination fee? If so, how much will I actually receive in my bank account?

· [ ] Is there a penalty for early repayment?

Micro-CTA: Want to learn more about responsible borrowing? → Read our full guide to understanding loan costs.

Additional Resources and Guides for Responsible Borrowing

Making informed financial decisions is crucial. Each Tier One country has excellent government-backed and non-profit organizations that provide free, impartial financial advice.

· United States: The Consumer Financial Protection Bureau (CFPB) website (consumerfinance.gov) offers tools and resources for borrowing smartly. The National Foundation for Credit Counseling (NFCC) provides free budget and debt counseling.

· United Kingdom: The MoneyHelper service (moneyhelper.org.uk), backed by the government, provides free guidance on all aspects of borrowing. Charities like StepChange offer expert debt advice.

· Canada: The Financial Consumer Agency of Canada (FCAC) (canada.ca/en/financial-consumer-agency) has resources and tools to help you understand credit and debt.

· Australia: The Australian government’s MoneySmart website (moneysmart.gov.au) offers guidance on personal loans and managing debt. The National Debt Helpline provides free financial counseling.

Key Tip: Before taking on debt, consider exploring these resources. They can provide alternative solutions or help you create a budget to manage your loan effectively.

Tips for Faster Approval from Tier One Financial Experts

· Check Your Credit Report: Before applying, get a free copy of your credit report from the main bureaus (Experian, Equifax, TransUnion). Correct any errors, as they can cause automated systems to flag your application.

· Apply with Your Primary Employer: If you have multiple jobs, list the one with the longest history and where your pay is directly deposited. Lenders’ algorithms favor stability.

· Provide Accurate Income Details: Don’t estimate your income. State the exact amount that appears on your pay stub. Mismatches between your stated income and what the lender verifies can lead to rejection.

· Keep Your Bank Account Healthy: In the days leading up to your application, avoid having your account balance go into the negative. A clean, positive balance demonstrates financial responsibility.

| Tip | Rationale |

| Clean Credit Report | Prevents delays from data errors. |

| Apply on a Weekday | Ensures staff are available for manual review if needed. |

| Use the Main Income Source | Shows stability and simplifies verification. |

H5: Avoiding Hidden Fees in Same-Day Personal Loans

Reputable lenders in Tier One markets are legally required to be transparent about fees. “Hidden fees” are often just charges that borrowers overlooked in the contract.

· Read the Fee Schedule: The loan agreement will have a specific section outlining all potential charges. Read it twice.

· Ask About Prepayment: Explicitly ask or look for the clause about early repayment. Never assume it’s free.

· Understand ‘Rollovers’: Be cautious of offers to “roll over” your loan into a new one if you can’t pay. This can trap you in a cycle of debt with compounding fees. This practice is heavily restricted in the UK and Australia but may still exist elsewhere.

· Confirm the Total Amount Repayable: This single number includes the principal, interest, and all mandatory fees. If it seems too high, ask for a breakdown.

Application Best Practices for Quick and Secure Approval

· Use a Secure Connection: Only apply on websites that use “HTTPS” (look for the padlock in your browser’s address bar). Never apply over public Wi-Fi.

· Verify the Lender: Do a quick search for the lender’s name plus “reviews” or “scam.” Check their physical address and phone number. Legitimate lenders are easy to find and contact.

· Don’t Pay Upfront Fees: A legitimate lender will never ask you to pay an “insurance” or “processing” fee before you receive your loan funds. This is a common sign of an advance-fee loan scam.

· Trust Your Gut: If the website looks unprofessional, the language is full of errors, or the offer seems too good to be true (“100% Guaranteed Approval!”), Close the tab and look elsewhere.

H5: Common Borrower Questions About Same-Day Loans

· Will applying affect my credit score? A formal application usually results in a hard inquiry, which can temporarily dip your score by a few points. Using eligibility checkers first minimizes this.

· Can I get a loan if I’m unemployed? It’s difficult but not impossible. If you have a steady income from other sources like benefits, a pension, or investments, some lenders may consider you.

· What if I have bad credit? Many same-day lenders specialize in loans for bad credit. They will focus more on your current income and affordability. However, you should expect to pay a higher interest rate.

· Can I have more than one loan at a time? This depends on the lender and local regulations. However, taking on multiple short-term loans simultaneously is extremely risky and not recommended.

Customer Support and Assistance for Online Loan Applicants

A lender’s customer support quality is a strong indicator of their legitimacy and customer focus.

· Availability: Look for lenders that offer support through multiple channels: a phone number, live chat, and email. Check their hours of operation.

· Responsiveness: Before applying, you could test their support by asking a simple question via live chat or email. A quick and clear response is a good sign.

· Knowledge: Support staff should be able to clearly explain loan terms, fees, and the repayment process without being evasive.

· Hardship Assistance: Check if the lender has a dedicated process or team for customers experiencing financial difficulty. Responsible lenders will have policies to help you.

H5: Loan Management Tips for Maintaining a Strong Credit Profile

Getting the loan is only half the journey. Managing it well can positively impact your financial future.

· Automate Payments: The best way to build a positive credit history is to never miss a payment. Automatic debit is your best tool for this.

· Create a Loan Budget: Adjust your budget to account for the new loan payment. Cut back on non-essential spending to ensure you can comfortably afford it.

· Repay Early if Possible: If you receive a bonus at work or a tax refund, consider using it to pay off your loan early. This saves you money and quickly improves your debt-to-income ratio.

· Monitor Your Credit: After taking out the loan and making payments, check your credit report to ensure the lender is reporting your positive payment history to the credit bureaus.

Contact Support for Assistance with Same-Day Personal Loans

If you have questions at any stage of the application or repayment process, do not hesitate to contact the lender’s support team. Reputable companies have trained staff ready to assist you. They can clarify terms, explain the funding process, or help you if you encounter any issues with your online account. Keeping an open line of communication ensures a smoother, more transparent borrowing experience. A good lender wants you to succeed and repay your loan without issue.

Frequently Asked Questions on Instant Loan Approvals

Borrowers often have similar questions about the speed and reality of “instant” approvals. While decisions are automated and take minutes, final funding times depend on your bank’s processing speeds. A common query is whether approval is guaranteed; no legitimate lender can guarantee approval, as they must perform affordability checks. Understanding that “instant approval” refers to the decision, not a guarantee of funds, sets realistic expectations.

Privacy and Terms Information for Online Applicants

Your data privacy is paramount. Before applying, review the lender’s Privacy Policy and Terms of Service. These documents explain how your personal and financial information is collected, used, and protected. Lenders in Tier One countries must comply with strict data protection laws, such as the GDPR in the UK and PIPEDA in Canada. Ensure the lender uses secure, encrypted connections to protect your data during the application process.

Resources for First-Time Borrowers in Tier One Markets

If this is your first time borrowing, it’s wise to be extra cautious. Start by visiting the government financial consumer sites mentioned earlier (CFPB, MoneyHelper, FCAC, Moneysmart). They provide unbiased information and can help you understand your rights and responsibilities as a borrower. These resources are designed to empower you to make sound financial decisions and avoid common pitfalls associated with short-term credit.

Learn More About Same-Day Loans from Trusted Lenders

Trusted lenders focus on transparency. Their websites should have extensive FAQ sections, blog posts about responsible borrowing, and clear explanations of their products. Take the time to read this information. Lenders who invest in educating their customers are generally more reputable and customer-focused. They understand that an informed borrower is a more responsible borrower, which benefits everyone.

Additional Guidance and Tools for Smart Loan Decisions

Beyond lender websites, utilize free online tools to help you make a smart decision. Online loan calculators can help you visualize how different loan amounts, terms, and interest rates will affect your monthly budget and the total cost of the loan. Budgeting apps can help you analyze your spending to confirm you can afford the new repayment. Using these tools gives you a clear, data-driven picture of the loan’s impact before you commit.

FAQ Section

Can you get a personal loan immediately?

While you cannot get a personal loan “instantly” in the literal sense of receiving cash in seconds, you can get approved and funded incredibly quickly. With same-day personal loans, the online application and automated decision-making process can take as little as 15 minutes. If you are approved and sign the digital agreement, many lenders can transfer the funds to your bank account within a few hours or, in most cases, by the end of the same business day. The exact timing depends on the lender’s cut-off times and your bank’s processing speed. So, while not truly “immediate,” it is one of the fastest ways to secure borrowed funds for an emergency.

Which loan can I borrow money instantly?

The closest options to an “instant” loan are same-day personal loans or same-day payday loans. These products are specifically designed for speed. Lenders use automated underwriting systems to verify your identity, income, and affordability in minutes, giving you an approval decision almost right away. Once approved, the funding is prioritized. In countries like Canada with Interac e-Transfer® or the UK with Faster Payments, the money can appear in your account in under two hours. For comparison, a traditional bank loan can take over a week to fund. For the quickest possible access to cash, a same-day online loan from a direct lender is your best option.

Can we get a personal loan instantly with online approval?

Yes, you can absolutely get a personal loan with instant approval online. The “instant” part refers to the decision-making process. When you fill out an online application, the lender’s software analyzes your data in real-time. It checks your details against credit bureaus, verifies your income through secure banking connections, and runs an affordability check. This entire process can be completed in just a few minutes, after which you will see on your screen whether you have been approved and for what amount. The final step of receiving the funds still takes a short while (from one hour to one business day), but the approval itself is effectively instant.

Can you get approved for a loan on the same day?

Yes, getting approved for a loan on the same day is the primary feature of this loan category. The entire business model of same-day lenders is built around speed. To maximize your chances of same-day approval and funding, it is best to apply early on a business day (e.g., Monday to Friday, before 3 PM). This ensures that your application is processed, approved, and the fund transfer is initiated within the operational hours of both the lender and the banking system. Applying late at night or on a weekend might result in an instant approval decision, but the funds may not be transferred until the next business day.

Same-day personal loans online – How do they work?

Same-day personal loans work through a highly streamlined, technology-driven process. First, you complete a short application on the lender’s website. The lender’s automated system then performs rapid checks on your identity, credit, and affordability, often by securely analyzing your digital bank statements. This results in an instant approval decision. If approved, you are presented with a digital loan agreement. Once you e-sign it, the lender initiates the fund transfer directly to your specified bank account using fast payment systems like ACH, Faster Payments, or Interac e-Transfer. The entire process, from the funding application, is designed to be completed within 24 hours, often in just a few hours.

Same day personal loans guaranteed approval – Is it real?

No, “guaranteed approval” is not real for any legitimate loan. It is a misleading marketing term used by predatory lenders or scams. Responsible lenders in the US, UK, Canada, and Australia are required by law to perform affordability and credit checks to ensure you can repay the loan. This is done to protect you from being trapped in a debt cycle. Any lender promising to give you money without checking your income or ability to pay is ignoring these legal obligations and should be avoided. While many lenders have high approval rates for applicants who meet their criteria, no approval is ever 100% guaranteed.

Same-day personal loans for bad credit – What are the options?

There are many options for same-day loans, even if you have bad credit. Numerous online lenders specialize in this area. Instead of focusing solely on your credit score, they place greater weight on your current income, employment stability, and recent banking history to assess your ability to make repayments. While you can get approved, you should expect to be offered a higher interest rate (APR) compared to someone with good credit, as the lender is taking on more risk. It is crucial to compare offers from different bad credit lenders and ensure the repayments are affordable within your budget before proceeding.

Same day personal loans direct lender – Fast and secure funding

Choosing a direct lender for a same-day personal loan offers a more streamlined and secure process. A direct lender is the company that provides the loan funds directly to you. This is different from a broker or loan-matching service, which shares your application with multiple lenders. Dealing with a direct lender means your personal information is shared with only one company, enhancing your data security. The process is also faster because there is no middleman; you communicate and contract directly with the funding source. This leads to clearer communication and quicker funding times, making it an ideal choice for emergency financial needs.

Emergency same-day loans – Get money when you need it most

Emergency same-day loans are specifically designed for urgent, unexpected expenses where time is critical. This could be a medical bill, a crucial car repair, or an emergency home repair. The key benefit is the speed of access to cash, which can prevent a situation from getting worse or incurring additional late fees. The application is entirely online and can be completed quickly from a phone or computer. Because the funds can be in your account the same day, you can address the emergency immediately and without the prolonged stress and waiting period associated with traditional loans from banks or credit unions.

Quick loans same day – Compare trusted lenders in your region

When you need a quick loan on the same day, it’s vital to compare your options rather than accepting the first offer. Using a reputable online loan comparison website is the most efficient method. These platforms allow you to fill out one simple form and see potential offers from multiple trusted lenders licensed in your specific region (e.g., your US state or Canadian province). This lets you easily compare APRs, loan terms, and total repayment amounts side-by-side. Comparing lenders not only helps you find the most affordable loan but also ensures you are dealing with legitimate, regulated companies that adhere to local consumer protection laws.

Same day personal loans guaranteed approval no credit check – What to know

This phrase combines two major red flags: “guaranteed approval” and “no credit check.” In regulated markets like the US, UK, Canada, and Australia, virtually all licensed lenders are required to perform some form of credit check. It might be a “soft check” that doesn’t harm your score, but a check is necessary for identity verification and risk assessment. A lender advertising “no credit check” and “guaranteed approval” is likely operating outside the law, and may charge illegal interest rates, have hidden fees, or be a scam to get your personal information. It is always safer to work with a transparent lender that performs the necessary checks to lend responsibly.