Best Personal Loan Options — compare 30+ lenders offering low-interest plans, quick approval, and flexible repayment in the US, UK, Canada & Australia.

Are you exploring personal loan options for 2025 but feel lost in a sea of confusing choices? Whether you’re in the United States, the United Kingdom, Canada, or Australia, the sheer number of lenders and loan products can be overwhelming. You might be facing a mountain of high-interest credit card debt, planning a crucial home renovation, or dealing with an unexpected major expense. The central challenge is identifying a loan that not only offers a low interest rate but also provides the flexibility your life demands. Many potential borrowers are anxious about hidden fees, the lengthy approval processes, and the potential damage to their credit score from applying. This uncertainty can make it difficult to move forward with your financial goals.

This definitive guide promises to demystify the process of finding the best personal loan. We will break down the top personal loan options available, helping you compare rates, terms, and features from leading financial institutions. Imagine a streamlined online application, a quick approval decision, and the funds you need deposited directly into your account, all with a repayment plan that doesn’t strain your budget. By the end of this guide, you will be equipped with the knowledge and confidence to select a personal loan that empowers you to take control of your finances and achieve your objectives.

Top Personal Loan Options for 2025 from Trusted Financial Institutions

As we navigate 2025, the landscape of personal loan options is more diverse and borrower-friendly than ever. Trusted financial institutions, ranging from major international banks and community-focused credit unions to innovative online lenders, are all competing to offer the most attractive packages. This competition is a significant advantage for consumers in Tier One markets like the US, UK, Canada, and Australia. The top personal loan options today are characterized by competitive interest rates, flexible repayment terms, and transparent fee structures. Lenders are leveraging technology to simplify the application process, often providing instant pre-qualification and funding in as little as one business day.

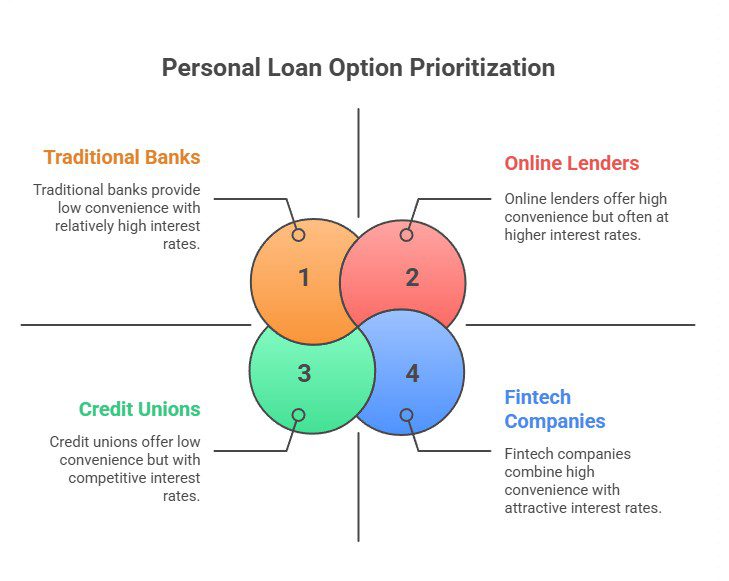

When exploring these options, it’s essential to look at the full picture. A loan from a traditional bank might offer the benefit of in-person service and relationship discounts if you’re an existing customer. A credit union may provide lower interest rates and a more member-focused approach. Meanwhile, online lenders often lead the pack in terms of speed, convenience, and having options for a wider range of credit profiles. The best choice for you will depend on your individual financial situation, your credit history, and how you prioritize factors like interest rates, funding speed, and customer service.

Mini Case Study: Emily’s Strategic Choice

Emily, a project manager in Vancouver, Canada, wanted to consolidate $20,000 in high-interest credit card debt. Her local bank, where she’d been a customer for years, offered her a loan with a 9.5% APR. Before accepting, she decided to compare personal loans online. She found a reputable online lender that pre-qualified her for a five-year loan with a 7.2% APR and no origination fee. The online application took her less than 15 minutes to complete.

Result: By comparing her options, Emily chose the online lender and will save over $1,500 in interest over the life of her loan. This strategic choice allowed her to pay off her debt faster and more affordably.

| Lender Type | Typical APR Range (Good Credit) | Loan Amounts (USD Equivalent) | Key Advantage |

| Online Lenders | 7% – 20% | $2,000 – $100,000 | Speed, convenience, competitive rates |

| Banks | 8% – 22% | $3,000 – $100,000 | In-person service, relationship discounts |

| Credit Unions | 6% – 18% | $1,000 – $50,000 | Lower rates, member-focused service |

Ready to find your best loan option? Start comparing personalized offers now. →

Compare Rates and Terms Across Leading Personal Loan Lenders

Comparing rates and terms is the most critical step in securing the best personal loan. Even a small difference in the Annual Percentage Rate (APR) can translate into hundreds or thousands of dollars saved over the course of your loan. In 2025, the top lenders across the US, UK, Canada, and Australia will provide transparent information that makes this comparison process easier than ever. When you evaluate personal loan options, you should look at more than just the advertised interest rate. The APR is a more comprehensive figure, as it includes the interest rate plus any mandatory fees, such as origination fees, giving you a true side-by-side comparison of the cost of each loan.

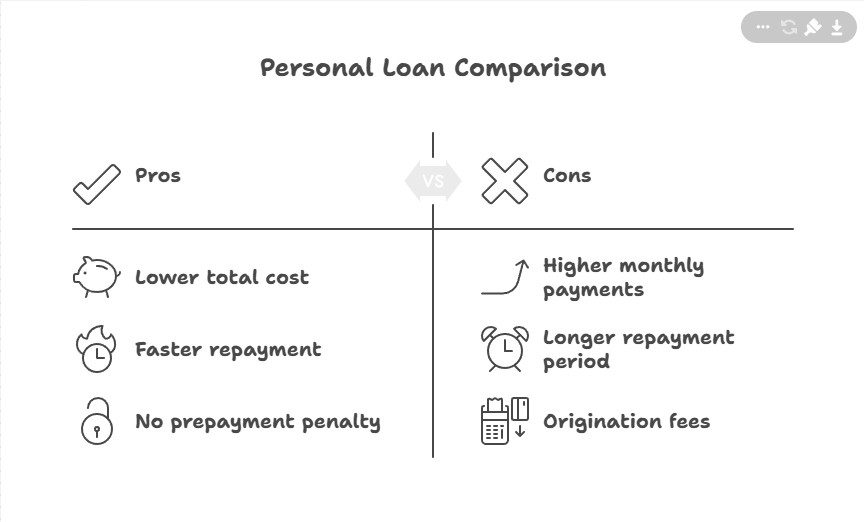

Beyond the APR, carefully consider the loan term—the amount of time you have to repay the loan. Terms typically range from one to seven years. A shorter term will result in higher monthly payments but a lower total interest cost. A longer term will make your monthly payments more affordable, but will lead to paying more in interest over time. The ideal term is one that offers a monthly payment that you can comfortably manage while minimizing the total interest paid. Also, look for borrower-friendly features like no prepayment penalties, which allow you to pay off your loan early without any extra charges.

Mini Case Study: David’s Renovation Loan

David, a homeowner in Sydney, Australia, needed a $30,000 loan for a kitchen renovation. He received two pre-qualified offers:

· Lender A: 8.5% APR with a 5-year term.

· Lender B: 8.9% APR with a 7-year term.

While Lender B’s lower monthly payment was tempting, David used an online loan calculator to compare the total costs. He realized that the shorter term with Lender A, despite a higher monthly payment, would save him nearly $2,800 in total interest.

Takeaway: Always calculate the total cost of a loan, not just the monthly payment. A shorter term can lead to significant savings.

| Feature to Compare | What to Look For | Why It Matters |

| Annual Percentage Rate (APR) | The lowest possible number. | This is the true, all-in cost of your loan. |

| Loan Term | A balance between affordability and total cost. | Determines your monthly payment and how much interest you’ll pay overall. |

| Origination Fee | Lenders that charge 0% or a very low percentage. | This fee is deducted from your loan funds, reducing the amount you receive. |

| Prepayment Penalty | A loan with no penalty. | Gives you the flexibility to pay off your debt early and save on interest. |

| Customer Reviews | Consistently positive feedback. | Provides insight into the lender’s service and reliability. |

Start comparing your personalized rates from top lenders today. →

How Personal Loans Work and What Borrowers Should Expect

Understanding the mechanics of a personal loan is essential before you begin the application process. At its core, a personal loan is a type of installment loan. This means you borrow a fixed amount of money from a lender (a bank, credit union, or online lender) and agree to pay it back in equal monthly installments over a set period, known as the loan term. Most personal loans are unsecured, which means you don’t have to put up any collateral like a car or a house to secure the loan. The lender approves your application based on your creditworthiness.

The interest rate on most personal loans is fixed, which provides stability and predictability. Your monthly payment will not change for the entire life of the loan, making it easy to budget for. When you make a payment, a portion of it goes toward paying down the principal (the amount you borrowed), and the other part goes toward paying the interest. The process begins with an application, where the lender assesses your credit history, income, and other financial details. If approved, you’ll sign a loan agreement outlining all the terms, and the lender will disburse the full loan amount to you in a lump sum, typically via direct deposit into your bank account.

Mini Case Study: Sarah’s First Personal Loan

Sarah, a recent university graduate in the UK, needed to purchase a car for her new job. Unfamiliar with how personal loans worked, she was initially hesitant. She researched the process and found a reputable lender with a clear, educational website. She pre-qualified online, which gave her an idea of her potential rate. After she was approved, the lender sent her a clear loan agreement that detailed her £10,000 loan, her 6.5% fixed APR, her monthly payment of £195, and her 5-year repayment schedule. The funds were in her account in two days.

Result: By understanding the process, Sarah felt confident and in control. The predictable monthly payments allowed her to easily manage her budget while enjoying her new car.

| Loan Stage | What Happens | Borrower’s Role |

| 1. Application | Lender reviews your credit and financial profile. | Provide accurate information and required documents. |

| 2. Approval | Lender approves the loan and presents a formal offer. | Carefully review the loan agreement, APR, and terms. |

| 3. Funding | Lender disburses the loan amount as a lump sum. | Receive the funds in your bank account. |

| 4. Repayment | You make fixed monthly payments over the loan term. | Make on-time payments each month until the loan is paid off. |

Learn more about the personal loan process and see if it’s right for you. →

Benefits of Choosing the Right Personal Loan Option for Your Goals

Selecting the right personal loan option is more than just securing funds; it’s a strategic financial decision that can offer numerous benefits and help you achieve your goals more efficiently. One of the primary advantages is the versatility of the funds. Unlike a mortgage or auto loan, a personal loan can be used for almost any purpose, providing the flexibility to address your most pressing financial needs. Whether you’re consolidating high-interest debt, financing a home renovation, or covering a major expense, a personal loan provides the capital to make it happen.

Another key benefit is the potential for a lower interest rate. If you have a good credit score, you can often secure a personal loan with an APR that is significantly lower than the rates on credit cards. This can save you a substantial amount of money, especially when used for debt consolidation. The fixed monthly payments and a set repayment term also provide structure and predictability. This makes budgeting straightforward and gives you a clear end date for your debt, which can be a powerful motivator. Furthermore, by making on-time payments, you can build a positive payment history, which can help improve your credit score over time.

Mini Case Study: Mark’s Credit Score Boost

Mark, from a city in the US, had a good but not great credit score due to high balances on several credit cards. He took out a personal loan to consolidate his $15,000 in credit card debt. This immediately lowered his credit utilization ratio, which is a major factor in credit scoring models. He then made every single loan payment on time for two years.

Takeaway: After two years, Mark’s credit score had increased by over 60 points. The personal loan not only saved him money on interest but also served as a tool to significantly improve his creditworthiness.

| Benefit | How It Helps You | Ideal For… |

| Lower Interest Rates | Saves you money compared to high-interest credit cards. | Debt consolidation, financing large purchases. |

| Fixed Payments | Provides predictability and simplifies your budget. | Anyone who values financial stability and a clear repayment plan. |

| Versatility of Funds | It can be used for a wide variety of purposes. | Home improvements, medical bills, weddings, and more. |

| Improves Credit Score | On-time payments can boost your credit history. | Borrowers looking to build or improve their credit profile. |

| Fast Funding | Quick access to cash for time-sensitive needs. | Emergencies, unexpected expenses, or time-limited opportunities. |

Unlock the benefits of a personal loan. Explore your options today. →

Flexible Repayment and Low-Interest Loan Options for Every Budget

In today’s lending environment, flexibility is a key feature that borrowers seek, and lenders are responding with a wide range of repayment and low-interest loan options designed to fit nearly any budget. The ability to customize your loan is a significant advantage, allowing you to align your debt repayment with your financial reality. The most fundamental aspect of this flexibility is the choice of the loan term. Lenders across the US, UK, Canada, and Australia typically offer terms ranging from as short as 12 months to as long as 84 months (seven years). This allows you to choose between a higher monthly payment to pay off the loan quickly and save on interest, or a lower monthly payment spread over a longer period to ensure it fits comfortably within your cash flow.

Low-interest personal loan options are primarily available to borrowers with good to excellent credit scores. Lenders reserve their most competitive rates for those who have demonstrated a strong history of responsible borrowing. If you have a high credit score, you should actively shop around, as you are in a strong position to secure a very low APR. However, even if your credit is not perfect, there are still options available. Some lenders specialize in loans for fair credit borrowers, and while the interest rates will be higher, they can still be more affordable than other forms of credit, like payday loans or high-interest credit cards.

Mini Case Study: The Jones’ Family Vacation

The Jones family, from a small town in the UK, wanted to take a once-in-a-lifetime family vacation, but didn’t want to put the £8,000 cost on a credit card. They had good credit and shopped around for a personal loan. They found a credit union that offered them a loan with a 3-year term, which had a manageable monthly payment. They also confirmed the loan had no prepayment penalty. They were able to pay for their trip and, by making a few extra payments over the next couple of years, paid off the loan 8 months early.

Key Tip: Always opt for a loan with no prepayment penalty. It provides the ultimate flexibility to pay down your debt faster if your financial situation allows.

| Feature | Description | How It Helps Your Budget |

| Variable Loan Terms | Choose a repayment period from 1 to 7+ years. | Allows you to select a monthly payment amount that you can afford. |

| Low APR for Good Credit | The best rates are offered to low-risk borrowers. | Minimizes the total cost of borrowing, saving you money. |

| No Prepayment Penalty | No fee for paying the loan off ahead of schedule. | Provides the flexibility to become debt-free sooner. |

| Autopay Discounts | A small rate reduction for setting up automatic payments. | A simple and easy way to save a little extra money on interest. |

Find a loan that fits your budget. Compare flexible options now. →

Using Personal Loans for Debt Consolidation, Renovation, or Major Purchases

Personal loans are a powerful financial tool that can be strategically used to achieve specific goals, with three of the most common being debt consolidation, home renovations, and financing major purchases. Each of these uses can provide significant financial or personal value when approached thoughtfully. Debt consolidation is perhaps the most financially impactful use. If you are juggling multiple credit card balances with high, variable interest rates, a fixed-rate personal loan can be a lifeline. By using the loan to pay off all your credit cards, you are left with a single, predictable monthly payment, often at a much lower interest rate. This can simplify your finances and accelerate your journey out of debt.

Using a personal loan for a home renovation can be a smart investment in your property. Unlike using a credit card, a personal loan typically offers a lower interest rate and a structured repayment plan. Projects like updating a kitchen or bathroom can not only improve your quality of life but also increase the equity and resale value of your home. For major purchases, such as a new appliance, furniture, or even a vehicle, a personal loan can be a more affordable alternative to retailer financing, which can sometimes come with deferred interest pitfalls or high rates.

Mini Case Study: Tom’s New Car

Tom, from a city in Australia, was buying a new car and was offered dealership financing at 9.8% APR. He had excellent credit and decided to check personal loan options from his bank. His bank pre-approved him for a personal loan at 7.5% APR. He took the personal loan, paid for the car in what was effectively a cash transaction, and saved a significant amount on interest.

Takeaway: Always compare a personal loan offer against retailer or dealership financing; it can often be the more affordable option.

| Loan Use | Why It’s a Smart Choice | Key Consideration |

| Debt Consolidation | Simplifies payments and can drastically lower your interest costs. | You must be disciplined and avoid running up new credit card debt. |

| Home Renovation | Can add significant value to your home; structured repayment. | Focus on projects with a high return on investment (ROI). |

| Major Purchase | Often a lower-cost financing option than store credit or dealer loans. | Ensure the purchase is a need or a well-planned want, not an impulse buy. |

| Medical Expenses | Covers unexpected costs with a predictable payment plan. | Check if the medical provider offers a no-interest payment plan first. |

Ready to fund your next big project? Explore personal loan options tailored to your needs. →

Low-Interest and No-Fee Personal Loan Options to Maximize Savings

For the savvy borrower, the ultimate goal is to find a personal loan that combines a low interest rate with minimal fees. These “low-interest, no-fee” personal loan options represent the gold standard in borrowing, as they allow you to maximize your savings and keep the cost of your loan as low as possible. A low interest rate is the most direct way to save money, as it reduces the amount you pay for the privilege of borrowing. These rates are typically reserved for borrowers with very good to excellent credit scores.

Equally important is finding a loan with no fees. The most common fee to watch out for is the origination fee, which can range from 1% to 8% of the loan amount and is deducted from your loan proceeds. A loan with no origination fee means you receive 100% of the money you’re approved for. Additionally, look for loans with no prepayment penalties, which gives you the freedom to pay off your loan early without being charged an extra fee.

Pros and Cons of No-Fee Loans

| Pros | Cons |

| Maximum Savings: You pay less in interest and no extra charges. | Stricter Eligibility: Often requires a very high credit score. |

| Transparency: The APR is the same as the interest rate, making it easy to understand the cost. | Less Common: Not all lenders offer completely fee-free loans. |

| Full Loan Amount: You receive the entire amount you were approved to borrow. | May Have a Slightly Higher Rate: Some lenders may bake the cost into a slightly higher interest rate. |

Expert Insight: “When you see a loan advertised as ‘no-fee,’ it’s a great starting point, but always read the fine print in the loan agreement,” advises a consumer finance advocate. “Confirm that it specifically states there are no origination fees and no prepayment penalties. This transparency is a hallmark of a reputable, borrower-friendly lender.”

Debt Consolidation with Personal Loan Options to Simplify Payments

Debt consolidation is one of the most effective uses for a personal loan. If you are making payments on multiple credit cards, store cards, or other high-interest debts, you know how difficult it can be to keep track of different due dates, interest rates, and minimum payments. A debt consolidation loan simplifies this entire process. You take out a new personal loan and use the funds to pay off all your other outstanding balances. This leaves you with just one lender, one monthly payment, and one interest rate to manage.

The benefits go beyond just simplification. The primary goal of debt consolidation is to secure a new loan with a lower interest rate than the average rate of your existing debts. This can result in significant savings, allowing more of your payment to go toward the principal balance rather than interest charges. This can help you get out of debt months or even years faster. The fixed payment and term of a personal loan also provide a clear path and a definite end date to your debt repayment journey.

| Feature | Before Consolidation | After Consolidation |

| Number of Payments | Multiple | One |

| Interest Rates | High, variable | Lower, fixed |

| Monthly Payments | Variable, unpredictable | Fixed, predictable |

| Debt Payoff Plan | Unclear, often long-term | Clear, with a set end date |

Expert Insight: “The key to successful debt consolidation is discipline,” says a credit counselor. “Taking out the loan is only half the battle. You must commit to not running up new balances on the credit cards you’ve just paid off. Think of the personal loan as a tool to get out of debt, not as a way to free up more credit to spend.”

Home Improvement, Medical, and Emergency Funding Solutions

Personal loans offer a versatile and structured funding solution for a wide range of significant life expenses, including home improvements, medical bills, and unforeseen emergencies. For home improvements, a personal loan provides a lump sum of cash upfront, allowing you to pay contractors and purchase materials without having to drain your savings. It’s an excellent alternative to a home equity loan, especially for smaller projects, as it doesn’t require you to use your home as collateral and generally has a much faster application and funding process.

When faced with unexpected medical bills, a personal loan can provide a way to manage the cost with a predictable monthly payment, often at a lower interest rate than a medical credit card. For emergencies, such as a major car repair or an urgent need to travel, the quick funding time associated with many online personal loans can be a lifesaver. It provides a much more affordable and safer alternative to high-cost options like payday loans.

| Funding Need | Why a Personal Loan is a Good Option | Key Consideration |

| Home Improvement | Fast funding, no collateral required, fixed payments. | Choose projects that add value to your home. |

| Medical Expenses | It can be cheaper than other medical financing options. | First, ask your provider about interest-free payment plans. |

| Emergencies | Quick access to cash for urgent needs. | Compare options even in a hurry to avoid high rates. |

Expert Insight: “For any of these funding needs, it’s crucial to borrow only what is absolutely necessary,” advises a financial planner. “Create a detailed budget for your home improvement project or get an exact total for your medical bills. Over-borrowing just means you’ll be paying interest on money you didn’t need, which defeats the purpose of being financially prudent.”

Eligibility and Credit Requirements for Personal Loan Approval

Securing approval for a personal loan hinges on a lender’s assessment of your ability to repay the debt. While specific requirements vary, lenders across the US, UK, Canada, and Australia evaluate a similar set of criteria. Your credit score is the most critical factor. A higher score signifies a history of responsible financial behavior and a lower risk to the lender, which not only increases your approval odds but also qualifies you for better interest rates. Most lenders look for a score in the “good” to “excellent” range (generally 670 or above in the FICO model).

In addition to your credit score, lenders will verify your income and employment to ensure it is stable and sufficient to cover the new loan payment alongside your existing obligations. They calculate your debt-to-income (DTI) ratio—the percentage of your monthly gross income that goes to debt payments. A lower DTI ratio (ideally below 40%) is highly favorable. You will also typically need to be the age of majority, be a citizen or permanent resident, and have a valid bank account.

| Requirement | Why It’s Important to Lenders | How to Improve It |

| Credit Score | Predicts your likelihood of repaying the loan. | Pay bills on time, reduce credit card balances. |

| Stable Income | Shows you have the means to make monthly payments. | Maintain steady employment. |

| Debt-to-Income (DTI) Ratio | Indicates if you can afford another monthly payment. | Pay down existing debt or increase your income. |

| Credit History | A longer history of responsible credit use is better. | Keep old credit accounts open and in good standing. |

Expert Insight: “If your credit score isn’t where you want it to be, don’t be discouraged,” says a credit expert. “There are lenders who specialize in loans for fair credit borrowers. However, the best long-term strategy is to spend six months to a year actively working on improving your credit before applying for a major loan. The savings from a lower interest rate can be substantial.”

Application Process and Expected Approval Timeline Explained

The personal loan application process in 2025 is more streamlined and user-friendly than ever, especially with online lenders. The process can be broken down into four main stages: pre-qualification, full application, verification, and funding. The entire timeline can range from as little as one business day to about a week.

1. Pre-qualification (5-10 minutes): You provide basic personal and financial information. The lender performs a soft credit check (which doesn’t affect your score) and gives you a preliminary offer, including a potential interest rate and loan amount.

2. Full Application (15-30 minutes): If you decide to proceed, you’ll complete a more detailed application and upload supporting documents, such as proof of income (payslips), proof of address, and a government-issued ID.

3. Verification (A few hours to 2 business days): The lender’s underwriting team verifies the information you provided and performs a hard credit check.

4. Approval & Funding (1-3 business days): Once you receive final approval and electronically sign the loan agreement, the lender will transfer the funds to your bank account.

| Process Stage | Typical Duration | Credit Score Impact |

| Pre-qualification | Under 10 minutes | None (soft inquiry) |

| Application & Verification | 1-2 business days | Yes (hard inquiry) |

| Funding | 1-3 business days | None |

Expert Insight: “To ensure the fastest possible approval timeline, have all your documents digitized and ready to upload before you start the application,” recommends a loan processing manager. “The most common delay we see is applicants having to search for payslips or bank statements. Being prepared can cut the verification time in half.”

Exclusive Member Benefits, Rewards, and Loyalty Discounts from Top Lenders

In a competitive market, many lenders offer exclusive benefits and discounts to attract and retain customers. These perks can add significant value to a personal loan offer, so it’s worth looking beyond just the interest rate. Banks and credit unions are well-known for offering loyalty or relationship discounts. If you have an existing checking or savings account with them, they may offer you a rate reduction (often 0.25% to 0.50%) on a new personal loan. Setting up automatic payments from an account at the same institution can often yield another small discount.

Some online lenders have developed comprehensive membership programs. SoFi, for example, offers its members a wide range of benefits, including free access to financial advisors, career coaching, networking events, and rate discounts on other SoFi products. Other lenders might have rewards programs where on-time payments can earn you points or other perks. When comparing loan options, always inquire about any available discounts or member benefits, as they can enhance the overall value of the loan.

| Benefit Type | Common Providers | How It Saves You Money or Adds Value |

| Relationship Discount | Banks, Credit Unions | Lowers your APR, saving you money on interest. |

| Autopay Discount | Most Lenders | A simple way to get a 0.25% – 0.50% rate reduction. |

| Member Benefits | Some Online Lenders (e.g., SoFi) | Provides valuable services like financial planning at no extra cost. |

| Referral Bonuses | Many Lenders | Earn cash or a statement credit for referring friends and family. |

Expert Insight: “Don’t underestimate the power of a 0.25% relationship discount,” notes a financial advisor. “On a $20,000, five-year loan, that small discount can save you over $100 in interest. It’s always worth asking your primary bank or credit union what they can offer you as a loyal customer before you commit to an outside lender.”

Step-by-Step Guide to Applying for Personal Loan Options Online

Applying for a personal loan online is a straightforward process designed for speed and convenience. Following these steps can help you navigate it smoothly and efficiently.

A Step-by-Step Checklist:

1. Check Your Credit Score: Know where you stand before you apply. This helps you target lenders appropriate for your credit profile.

2. Gather Your Documents: Have digital copies of your recent payslips, bank statements, and a government-issued ID ready to upload.

3. Get Pre-qualified: Use online tools to get rate estimates from 3-5 different lenders. This uses a soft credit check and won’t affect your score.

4. Compare Offers: Carefully review the APR, loan term, and any fees from your pre-qualified offers to choose the best one.

5. Submit the Full Application: Select your chosen lender and complete their formal application. This is where you will consent to a hard credit inquiry.

6. Review and Sign: Once approved, carefully read the final loan agreement. If you agree with the terms, sign it electronically.

7. Receive Your Funds: The lender will deposit the money directly into your bank account, typically within 1-3 business days.

Explore your online loan options and get pre-qualified in minutes. →

Understanding APR and Interest Rate Factors That Affect Loan Costs

The cost of your personal loan is determined by several factors, primarily encapsulated in the Annual Percentage Rate (APR). The APR includes your interest rate plus any fees, like an origination fee. The main factor that determines your rate is your credit score; a higher score means a lower risk for the lender and thus a lower rate for you. Your debt-to-income (DTI) ratio also plays a key role. A lower DTI shows you have ample income to cover your debts, which can also lead to a better rate. The loan term you choose affects the total cost as well; a shorter term means less interest paid over time. Finally, the overall economic climate and central bank rates can influence the baseline rates offered by all lenders.

A Quick Checklist for Understanding Costs:

· Focus on APR: It’s the most accurate measure of the total loan cost.

· Know Your Credit Score: It’s the biggest driver of your interest rate.

· Lower Your DTI: Pay down debt before applying to get a better rate.

· Choose the Shortest Term Possible: This minimizes the total interest you’ll pay.

See what APR you could qualify for today. →

Comparing Lenders and Loan Features for the Best Value

To find the best value in a personal loan, you need to compare more than just the interest rate. A comprehensive comparison involves looking at all the features and terms that a lender offers. Start with the basics: APR, loan term options, and the range of loan amounts available. Then, dig deeper. Does the lender charge an origination fee or a prepayment penalty? The best value often comes from lenders who have eliminated these fees. Consider the lender’s reputation by reading customer reviews. How is their customer service? Finally, look for any extra perks, such as autopay discounts, relationship discounts, or member benefits, which can add significant value over the life of the loan.

A Lender Comparison Checklist:

· Does the APR seem competitive for your credit score?

· Are the loan term options flexible enough for your budget?

· Are there any origination fees or prepayment penalties?

· Does the lender have strong, positive customer reviews?

· Are there any rate discounts (e.g., for autopay) that you can take advantage of?

Start comparing top lenders to find your best value. →

Secured vs. Unsecured Personal Loan Options: What’s Right for You?

Personal loans come in two primary forms: unsecured and secured. An unsecured loan is the most common and is based solely on your creditworthiness. You don’t need to provide any collateral. A secured loan requires you to pledge an asset, like a car or a savings account, as security for the loan. If you fail to repay, the lender can take the asset.

Which is right for you? Use this checklist:

· Do you have good to excellent credit? If yes, an unsecured loan is likely your best and simplest option.

· Do you have fair or bad credit? If yes, a secured loan may be easier to qualify for and could offer you a lower interest rate.

· Are you comfortable risking an asset? If you are considering a secured loan, you must be confident in your ability to make the payments.

· How much do you need to borrow? Lenders may be willing to offer larger loan amounts for a secured loan.

Learn more about secured and unsecured options. →

Prequalification and Credit Score Impact Explained for Borrowers

Prequalification is a crucial, risk-free step in the loan shopping process. It allows you to see what loan rates and terms you are likely to be approved for without affecting your credit score. When you pre-qualify, a lender performs a soft credit inquiry, which is not visible to other lenders and does not lower your score. This is different from a formal application, which triggers a hard credit inquiry. A hard inquiry can cause a small, temporary dip in your credit score. The best strategy is to get pre-qualified with multiple lenders to compare offers, and only submit a full application with the one lender you choose.

A Quick Checklist on Credit Inquiries:

· Always Prequalify First: It’s the smart way to shop around.

· Understand Soft vs. Hard Inquiries: Soft inquiries (prequalification) are harmless; hard inquiries (formal applications) have a small impact.

· Limit Hard Inquiries: Avoid submitting many formal loan applications in a short period.

· Shop Within a “Rate Shopping Window”: Multiple hard inquiries for the same type of loan within a 14-45 day period are often treated as a single inquiry by credit scoring models.

Get your risk-free pre-qualified rates now. →

Common Mistakes to Avoid When Choosing Personal Loan Options

Choosing a personal loan is a significant financial decision, and avoiding common mistakes can save you a lot of money and stress. One of the biggest errors is not shopping around. Accepting the first offer you receive, especially from a pre-approved mailer, can mean missing out on a much lower interest rate elsewhere. Another mistake is focusing only on the monthly payment and ignoring the total loan cost. A long-term loan might have a low payment, but it could cost you thousands more in interest. Also, be sure to read the fine print to avoid being surprised by origination fees or prepayment penalties. Finally, avoid borrowing more than you truly need, as this just adds to your debt burden.

A Checklist of Mistakes to Avoid:

· Don’t skip comparison shopping: Always get quotes from multiple lenders.

· Don’t ignore the APR and total cost: Look beyond the monthly payment.

· Don’t forget to read the fine print: Understand all fees and terms.

· Don’t borrow more than you need: Stick to your budget.

· Don’t apply with a low credit score (if you can wait): Improving your score first can unlock much better offers.

Make a smart borrowing decision. Explore your options today. →

Interest Rates and Fees on Personal Loan Options in the US, UK, and Canada

Across the US, UK, and Canada, personal loan interest rates in 2025 are primarily influenced by the applicant’s credit score and the country’s central bank policies. In the US, a borrower with excellent credit can expect an APR between 7% and 12%. In the UK, rates can be even lower for top-tier applicants, sometimes starting around 5%. In Canada, competitive rates for good credit often fall between 8% and 14%. The most common fee is an origination fee, which is more prevalent in the US market, especially with online lenders catering to fair credit borrowers. It’s less common in the UK and Canada.

Repayment Schedules, Term Flexibility, and Early Payoff Strategies

Most personal loans feature a straightforward monthly repayment schedule. However, term flexibility is a key benefit, with lenders typically offering repayment periods from 24 to 84 months. A smart early payoff strategy is to choose a loan with no prepayment penalty and make bi-weekly payments instead of monthly. By paying half your monthly amount every two weeks, you’ll end up making one extra full payment per year, which can shave months or even years off your loan term and save you a significant amount in interest.

Hidden Costs and Fine Print to Watch for in Loan Agreements

The most important document you will receive is the loan agreement. It’s crucial to read the fine print to watch for hidden costs. Look for the “Truth in Lending Disclosure,” which clearly states the APR, finance charge, and total payments. Scrutinize the section on fees for any mention of late payment fees, insufficient funds (NSF) fees, or, most importantly, prepayment penalties. A reputable lender will be transparent about these costs, but it is your responsibility to read and understand the agreement before you sign.

Customer Reviews and Satisfaction Insights from Real Borrowers

Customer reviews on platforms like Trustpilot or the Better Business Bureau can provide invaluable insights into a lender’s practices. Look for patterns in the reviews. Are customers consistently praising the lender’s easy application process and responsive customer service? Or are there frequent complaints about slow funding, surprise fees, or difficulty reaching a representative? A few negative reviews are normal, but a trend of poor feedback should be a major red flag, even if the interest rate seems attractive.

| Review Platform | Best For | What to Look For |

| Trustpilot | Global online lender reviews | Overall star rating, recent reviews, lender responses. |

| Better Business Bureau | US & Canada lender reviews | Complaint history and resolution patterns. |

| Google Reviews | Local bank/credit union branches | In-person service quality at a specific location. |

Online Tools, Calculators, and Apps for Comparing Personal Loan Options

In 2025, borrowers will have access to a wealth of online tools to help them make informed decisions. Personal loan calculators are essential for estimating your monthly payments and seeing how different loan terms affect the total interest you’ll pay. Loan comparison websites allow you to pre-qualify with multiple lenders at once, making it easy to see your options side-by-side. Many lenders also offer mobile apps that allow you to manage your loan, make payments, and track your progress from your smartphone.

Refinancing and Improving Existing Personal Loan Options for Better Terms

If you’ve had your personal loan for a year or more and your credit score has significantly improved, you may be able to refinance it for better terms. Refinancing involves taking out a new personal loan to pay off your existing one. The goal is to secure a new loan with a lower interest rate, which can lower your monthly payment and save you money. This is a particularly good strategy if interest rates have dropped since you took out your original loan or if your financial situation has improved, making you a less risky borrower.

Mark Reynolds, Finance Advisor (US): ‘How to Calculate Monthly Payments for Personal Loan Options’

US-based Finance Advisor Mark Reynolds explains, “Calculating your potential monthly payment is crucial for budgeting. The formula may seem complex, but online calculators do the work for you instantly. The key inputs are the loan amount, the Annual Percentage Rate (APR), and the loan term in months. A lower APR or a longer term will result in a lower monthly payment. However, I always advise clients to focus on the total interest paid. Use a calculator to find the shortest loan term that still provides a monthly payment you can comfortably afford. This strategy ensures you pay the least amount of interest possible.”

UK Credit Analyst Insight: ‘Tips to Improve Approval Chances in 2025’

A top UK Credit Analyst shares her tips for 2025: “Lenders are focused on responsible lending. To improve your approval chances, first, check your credit reports with all three agencies—Experian, Equifax, and TransUnion—for any errors. Second, ensure you are registered on the electoral roll at your current address; it’s a simple but vital identity check. Finally, reduce your credit utilisation by paying down credit card balances before you apply. A utilisation ratio below 30% demonstrates to lenders that you are not over-reliant on credit and can significantly boost your application’s appeal.”

Canadian Financial Report: ‘Alternatives to Traditional Personal Loan Options Gaining Popularity’

A recent Canadian financial report indicates a growing interest in alternatives to traditional personal loans. Lines of credit, particularly Home Equity Lines of Credit (HELOCs), are popular for homeowners due to their flexibility and low interest rates. For smaller amounts, peer-to-peer (P2P) lending platforms are also gaining traction, connecting individual borrowers directly with investors. The report suggests that while traditional personal loans remain the primary choice for structured, lump-sum financing, Canadians are increasingly exploring these other options for needs that require more flexible access to funds.

Global Lending Resource Center: ‘Guides for Smarter Borrowing Decisions and Risk Management’

The Global Lending Resource Center has released new guides emphasizing smarter borrowing. Their key advice for 2025 is to never borrow for non-essential consumption that you can’t afford. A loan should be a tool to improve your financial position, such as by consolidating higher-interest debt or investing in a home improvement that adds value. For risk management, they recommend creating a budget that includes your new loan payment before you even apply. They also advise building an emergency fund to cover at least three months of expenses, which acts as a buffer and reduces the need for future borrowing.

Financial Expert Insight (Australia): ‘Best Practices for Managing Personal Loan Repayments’

An Australian financial expert advises a proactive approach to managing personal loan repayments. “The best practice is to set up automatic payments to ensure you’re never late, which protects your credit score,” she says. “Beyond that, I recommend using the ‘debt avalanche’ or ‘debt snowball’ method for any extra funds you have. If your personal loan is your highest-interest debt (avalanche), pay extra on it. If you need a motivational win (snowball), pay off a smaller debt first, then roll that payment amount onto your personal loan. Either way, actively paying more than the minimum is key to getting out of debt faster.”

Industry Data 2025: ‘Key Factors Lenders Consider Before Approving Personal Loan Applications’

Industry data from 2025 shows a consistent focus from lenders on four key factors. First is the credit score, which remains the primary indicator of risk. Second is the debt-to-income (DTI) ratio; lenders are increasingly stringent, with a preference for DTI ratios below 43%. Third is the stability of income and employment history; lenders want to see a consistent track record of earnings. Finally, the loan purpose itself can play a role. Lenders often view applications for debt consolidation or home improvement more favorably than those for vacations or luxury goods, as they are seen as more financially responsible uses of funds.

FAQ

Which is the best option for a personal loan in 2025?

The best personal loan option in 2025 depends on your individual needs and credit profile. For borrowers with excellent credit seeking low rates and no fees, online lenders like SoFi and LightStream are often top choices. If you value in-person service and have an existing banking relationship, your local bank or credit union might offer competitive rates and loyalty discounts. Credit unions, in particular, are known for their member-friendly terms and lower interest rates. The best strategy is to get pre-qualified with a mix of these options—at least one online lender, one bank, and one credit union—to compare real offers and choose the one with the most favorable terms for you.

What credit score do I need for a $50,000 personal loan?

To qualify for a large personal loan of $50,000, you will generally need a good to excellent credit score, typically 700 or higher on the FICO scale. Lenders view large, unsecured loans as higher risk, so they reserve these amounts for the most creditworthy applicants. In addition to a high credit score, the lender will also require a stable and substantial income to ensure your debt-to-income (DTI) ratio remains at an acceptable level after taking on the new loan. A lower DTI ratio demonstrates that you can comfortably afford the significant monthly payments associated with a $50,000 loan.

What is the best alternative to a personal loan?

The best alternative to a personal loan depends on your specific situation. If you are a homeowner and need funds for home improvements, a Home Equity Line of Credit (HELOC) can be a great option, often offering a lower interest rate. For managing smaller, ongoing expenses or for short-term borrowing, a 0% introductory APR credit card can be ideal, provided you can pay off the balance before the promotional period ends. Another alternative for those with strong credit is a personal line of credit from a bank, which offers more flexibility to draw and repay funds as needed compared to a lump-sum loan.

Which bank gives a personal loan quickly and easily?

Online lenders are generally the fastest and easiest option for obtaining a personal loan. Companies like LightStream and SoFi have highly streamlined online application processes that can provide an approval decision in minutes and funding in as little as the same business day. Among traditional banks, those with robust online platforms, such as Wells Fargo or Citibank, can also offer a relatively quick process, especially for existing customers. To ensure the fastest experience, have all your necessary financial documents (like payslips and bank statements) in digital format and ready to upload before you start your application.

Personal loan options for bad credit borrowers

Even with bad credit (typically a score below 600), personal loan options are available, though they will come with higher interest rates. Lenders like Avant, OneMain Financial, and Upstart specialize in working with borrowers who have less-than-perfect credit. Another excellent option is to apply at a local credit union, which may be more willing to look beyond just the credit score and consider your overall financial picture as a member. You could also consider a secured personal loan, where you provide collateral like a car or savings account, which can significantly improve your chances of approval and may help you secure a lower rate.

Best personal loan options with low APR and fast funding

The best personal loan options that combine a low APR with fast funding are typically found with online lenders catering to borrowers with excellent credit. LightStream is a top contender, known for its low rates and its “Loan Experience Guarantee,” often providing same-day funding. SoFi is another strong choice, offering competitive APRs, no fees, and funding within a couple of business days, along with extensive member benefits. To access these top-tier options, you will generally need a credit score above 720, a low debt-to-income ratio, and a stable income history.

Capital One personal loan: Eligibility and Rate Information

As of 2025, Capital One is not offering new personal loans. The company has discontinued this product to focus on its core offerings, such as credit cards and auto loans. If you are an existing Capital One personal loan customer, you can continue to manage your account as usual. For those seeking a new personal loan, you will need to explore other lenders. Many reputable banks, credit unions, and online lenders provide excellent personal loan options with competitive rates and terms. It is always recommended to compare several lenders to find the best fit for your financial needs.

Wells Fargo Personal Loan: Features and Application Guide

Wells Fargo offers unsecured personal loans ranging from $3,000 to $100,000 with flexible repayment terms of one to seven years. They feature competitive, fixed interest rates, especially for existing Wells Fargo customers who may qualify for a relationship discount. To apply, you can visit a branch or use their streamlined online application. You will need a good to excellent credit score, proof of a steady income, and a low debt-to-income ratio. The application will require personal information, employment and income details, and the loan amount and purpose. Funding can take a few business days after approval.

SoFi personal loan: Benefits, Rates, and Member Rewards

SoFi is a popular online lender known for its competitive, low-rate personal loans with no fees—no origination fees, no late fees, and no prepayment penalties. They offer loan amounts from $5,000 to $100,000. A key differentiator for SoFi is its extensive member benefits program, which includes complimentary access to financial advisors, career coaching services, and exclusive member events and networking opportunities. These perks add significant value beyond the loan itself. To qualify, you generally need a good credit score (typically 680 or higher) and a strong financial profile.

How to get a personal loan from a bank in the US or UK

To get a personal loan from a bank in the US or UK, start by checking with your current bank, as they may offer loyalty discounts. The general process involves several steps. First, check your credit score and gather necessary documents like proof of income, proof of address, and ID. Most banks now offer online applications, which is the fastest method. You will fill out the application, providing your personal and financial details. The bank will then review your application, perform a credit check, and if you are approved, send you a loan agreement to sign. Funding usually follows within a few business days.

Personal loan companies offering flexible repayment terms

Many personal loan companies now offer flexible repayment terms to accommodate different budgets. Online lenders like SoFi and Marcus by Goldman Sachs are known for their flexibility, often allowing you to choose any loan term within a wide range, for example, from 36 to 84 months. Many credit unions also pride themselves on working with members to find a suitable repayment schedule. Key features of flexibility to look for include a wide range of loan term options, the ability to change your payment due date, and, most importantly, no prepayment penalty, which gives you the freedom to pay off the loan early without any extra cost.

Online personal loan options for instant approval in 2025

In 2025, many online lenders offer “instant approval” or, more accurately, an instant decision on your application. Companies like Upstart and Avant use AI-powered underwriting to provide a decision in minutes. The process involves filling out a short online application. If you meet the initial criteria, you will receive a pre-approval instantly. Note that this is a conditional approval subject to the verification of your information. After you upload your documents and they are verified, you can receive final approval and have funds deposited in your account, often as soon as the next business day. This makes online lenders an excellent option for urgent funding needs.